North American LNG exports complicated by alternative markets, investment costs

Biliana Pehlivanova

Global Gas Consultant

New York

At current natural gas prices, North American LNG exports appear extremely attractive. The existence of an alternative market, however, and the size of the required investment add complexity to the prospect.

Soaring demand

The success of shale gas development has changed the face of North America's natural gas industry. From a market heading just 5 years ago towards increased dependency on imports, North America has been transformed into a booming production region now in search of new demand.

A look abroad offers a promising picture: Natural gas demand is soaring in Asia, Latin America, and the Middle East. Much of this growth is being met with LNG. Moreover, buyers around the world are paying much higher prices for LNG than what North American markets offer for domestic gas. This discrepancy has not gone unnoticed, and a line of proposals to build liquefaction in North America has emerged.

Could North America soon become an LNG exporter?

Ten liquefaction plants are currently under consideration (Table 1). Although some projects are more advanced, all are at early stages of development and none has been fully permitted. A US Department of Energy approval for export to all countries of the World Trade Organization has been granted to Sabine Pass, and the Freeport LNG and Lake Charles liquefaction proposals have applied for similar licenses.

These latter two already hold approvals to export to countries that trade with the US under free-trade agreements. All plants would also require approvals from US Federal Energy Regulatory Commission, but none has yet been granted.

At this stage, there is considerable uncertainty about how much North American liquefaction might cost. Preliminary estimates have been announced by Sabine Pass ($6-6.5 billion), Lake Charles ($2-3 billion), Kitimat ($4-4.5 billion), and Freeport ($4 billion), but none has completed a frontend engineering design (FEED) study, a step that is key to evaluating the economic viability of the proposed terminals. Kitimat awarded a FEED study to KBR earlier this year; it is to be completed by yearend.

All three facilities that have filed for US government approvals to export LNG are operating import terminals and have extensive infrastructure—harbors, tankage, and pipeline interconnections—already in place. Thus, their costs should be in a similar range.

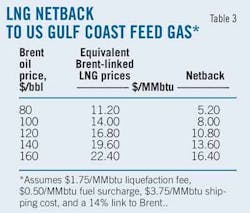

The marketing proposal for Sabine Pass suggests that a fee of $1.75/MMbtu and a 10% fuel surcharge would be sufficient to cover the cost of turning gas into LNG. At current spot freight rates, transport costs would add about $3.75/MMbtu to deliver Sabine Pass gas to Asia and about $1.50/MMbtu to Europe.

This suggests that at $4/MMbtu cost of the feed gas, Gulf Coast LNG would cost about $7.65/MMbtu delivered to Europe and $9.90/MMbtu delivered to Asia (Table 2). European prices, as referenced by the UK National Balancing Point, have averaged $9.24/MMbtu so far this year, and the cost of LNG imports to Japan is $12.91/MMbtu in the first 6 months of the year, according to the Ministry of Finance of Japan.

West Coast advantages

From the perspective of a North American natural gas producer, had the opportunity to export LNG existed at Sabine Pass terminal's proposed fees and current spot freight rates, selling US gas to Japan would have yielded a netback of $7.73/MMbtu in May, compared with an average daily price at Henry Hub of $4.31/MMbtu for the same month.

Compared with those on the US Gulf Coast, US West Coast and Canadian liquefaction proposals benefit from a much shorter voyage to the premium Asian markets. The cost of transport from Oregon and British Columbia, locations with proposed terminals, to Asia is likely to be about $1/MMbtu on the high side—a notable advantage over the roughly $3.75/MMbtu required to ship Gulf Coast LNG to Asia. In addition, these projects would draw on Canadian or Rocky Mountains gas, both of which are generally priced at a discount to the Gulf Coast.

The Canadian proposals rely largely on the growth of Horn River and Montney gas output, as well as construction of a pipeline to bring that gas to the Pacific Coast. Because these producing areas are poorly connected to North American pipeline infrastructure at this time and some drilling sites may be developed only with a netback from premium Asian oil-linked prices, this gas could, in part, be considered stranded, resulting in a lower market value of the feed gas.

At this point, it is unclear how much of the West Coast projects' shipping and feed gas cost advantage will be offset by potentially higher capital costs. By our estimate, the preliminary announcement for a $4-4.5 billion cost to develop Kitimat, including the cost of building a pipeline to connect the production area with the jetty, would result in a $3.00-3.75/MMbtu liquefaction fee. This would be $1.25-2.00/MMbtu more expensive than the proposed fee for Sabine Pass, but a difference of this magnitude would be completely offset by a $2.25/MMbtu lower cost of shipping, for sales to Asia.

North American LNG originating in the US Gulf coast would be much cheaper if exported to European destinations. European gas prices are, however, generally lower than Asian LNG import costs.

Long-term LNG contracts are typically linked to oil—either the average price paid for crude oil in Japan (Japan Crude Cocktail; JCC) or more recently also Brent. (JCC and Brent track each other closely with a 1-month lag.) Pricing formulas could look similar to this:

14% • JCC (or Brent) + $0.85

for a given range of JCC, with the slope and coefficients changing in favor of the producer, if JCC prices were to drop below a certain level, and in favor of the consumer, should JCC prices spike above a given limit.

Oil-linked LNG has appreciated dramatically over the past decade, along with buoyant oil prices, and selling North American gas at oil-linked prices currently looks very appealing for North American gas producers and overseas consumers alike. But the disconnect between oil and gas prices has not always been so large, and the same netback may not have looked attractive in the past.

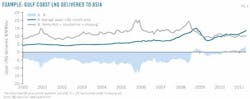

In fact, selling US LNG to Japan at the average price it has paid for its LNG imports would have yielded lower netbacks than Henry Hub prices for most of the past 10 years (Fig. 1). Indeed, the swing in netbacks to US gas producers from selling LNG at oil-linked prices can be quite large.

Table 3 illustrates a range of possibilities given different Brent levels.

Some argue that the low and stable gas prices of the past 2 years, along with the proven ability of shale gas to deliver production growth, has prompted foreign LNG consumers to consider buying US LNG at a price linked to Henry Hub. This would effectively lock in a premium to Henry Hub prices for the North American producer and offer a lower-priced alternative to the consumer.

Indeed, from a buyer's perspective, in today's price environment, Henry Hub-linked prices are appealing. As Fig. 1 illustrates, however, that has not always been the case, and risks remain that the relationship between oil-linked LNG prices and Henry Hub-linked prices may shift.

Unique perspective

Most liquefaction plants around the world monetize a stranded-gas resource: meaning, there is no market value for the feedstock. As a result, the cost of the feed gas is predictable and generally low, although the cost of constructing liquefaction plants in remote locations can be quite high.

In contrast, gas produced in North America is hardly stranded, and the existence of a deep and liquid forward market adds a new type of uncertainty to liquefaction economics: a fluctuating cost of feed gas if it is obtained on the open market. Alternatively, if a North American producer could commit resources to a liquefaction project, that producer would have to be willing to forgo the opportunity to sell the gas to the domestic markets and may still consider the alternative domestic value of the gas.

Whether a long-term North American LNG supply contract is linked to Henry Hub or Brent/JCC, the existence of an alternative value for the feed gas means that somewhere along the supply chain, the volatility of the spread between oil and gas prices would likely pose a risk.

One important difference between global LNG and North American gas markets is buyer sentiment towards security of supply. In North America, gas is domestically produced and supply is rarely interrupted, with a large and liquidly traded market and extensive storage infrastructure readily available to make up for any unforeseen delivery disruptions.

This is not the case for some of the largest consumers of LNG, however. Japan and South Korea, which together imported 47% of the world's LNG in 2010, have no alternative access to gas and limited storage. Similar situations exist in several other LNG importing countries. In this context, stability and security of LNG supply are key.

Understandably, buyers with no alternative supply options focus more on the security of supply than on catching an opportunity to arbitrage regional prices. In this context, an LNG price that is linked to oil at a smaller percentage might be more appealing than a Henry Hub-linked one.

Forward prices suggest that the market is pricing in an erosion of the premium of oil prices relative to North American gas (Fig. 2). The forward price curve for Brent oil is in backwardation—that is, prices farther out on the curve are lower than those of nearer months. In contrast, the NYMEX natural gas curve is upward sloping.

Together, the Brent and NYMEX forward curves point to a shrinking advantage of North American LNG exports linked to Henry Hub compared with traditionally priced LNG, at least as these two curves currently trade. Note that movements in the forward prices for gas and oil are not necessarily related. In fact, North American natural gas prices have lost their fundamental connection with crude oil as oversupply has settled in.

Thus, expectations for the future value of the oil-gas differential are driven by the fundamental outlook for each individual set of market fundamentals.

Complexity, cost loom

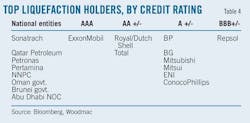

Our analysis, therefore, suggests that North American LNG can be competitive in the global market. Yet, while attractive economics are a necessary precondition for construction of any liquefaction, they are only one of the considerations necessary to make a proposal viable. The sheer complexity, size, and lifespan of the investment dictate several additional requirements, including technical expertise, a large balance sheet, a solid credit rating, and a long history of stable operations. All of these are necessary to appeal to buyers who are as often concerned about security of supply as about price.

Liquefaction projects are highly capital intensive and necessitate solid financial backing before construction can begin. To secure sufficient cash flows, the vast majority of liquefaction projects are contracted fully over their lifetimes—usually a 20-25 year term.

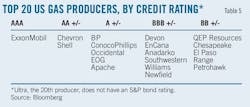

To illustrate the notional value of such a project, a 1-bcfd contract with a 20-year term with a delivered price of $10/MMbtu represents a notional commitment of more than $65 billion, assuming a 90% utilization rate. This is greater than the market capitalization of 14 of the top 20 North American gas producers. Healthy credit and a large balance sheet would clearly be key to participating in such a project.

Of course, high capital costs of liquefaction are not unique to North America. In fact, projects that monetize stranded gas must also include an upstream cost component, which makes them significantly more capital-intensive. For this reason, barriers to entry are high, and as a result, few companies are actively involved in liquefaction. And, those typically have large balance sheets or are nationally backed entities (Table 4).

This suggests that certain types of companies are better positioned to participate in a North American liquefaction terminal. International oil companies have large balance sheets, solid credit ratings, and extensive experience in building liquefaction. Some have upstream shale assets in North America.

Although IOCs are arguably best positioned to develop North American liquefaction projects, they typically have the option either to commit capital towards a North American project or to develop stranded gas elsewhere. For these companies, forgoing the North American LNG export option still preserves the ability to grow production in North America and sell their gas at domestic market prices. Developing a stranded asset would provide revenues that are incremental to income from selling North American gas domestically.

Independent North American gas producers stand to benefit the most from construction of North American liquefaction. Not surprisingly, many independent producers have expressed strong support for the announced projects, and some have taken equity stakes.

Many of them, however, would have difficulties with long-term supply commitments, given their more limited balance sheets and relatively low credit ratings. Although some independent North American gas producers have credit ratings comparable to those of the top 20 liquefaction capacity holders (A or better by Standard & Poor's rating), most fall into a lower credit rating category (Table 5).

Importantly, producers committing production to LNG exports would have to forgo the option to sell their gas on the US market, which in the case of oil-linked LNG sales would leave them exposed to fluctuations in the spread between oil and North American gas prices. This exposure could of course be hedged. In fact, producers typically hedge a significant part of their production in the forward market.

Hedging programs, however, generally go only 2-3 years out; a 20-year hedging program would pose considerable problems. Nevertheless, North American producers could provide supply to an LNG project while not necessarily acting as sponsors of the facility.

Because of the size and scale of an LNG project, a North American plant could face the fewest difficulties if developed in an integrated fashion, in which an established LNG consumer takes an equity stake in the mineral resource base and either sponsors a liquefaction project or contracts for firm capacity for the project's lifetime. Integrating a liquefaction project would eliminate exposure to volatile oil and gas prices because the consumer would also be the owner of the resource and therefore pay for feed gas at cost, rather than at market prices.

In fact, the joint-venture activity that has poured capital into the North American gas industry since 2008 has given several overseas entities access to North American shale gas, many of which are consumers of LNG. These also tend to be larger companies with the balance sheets able to shoulder the large capital investments. Indeed, recent joint-venture participants have openly discussed the potential development of their North American reserves for LNG exports.

Several of the proposed North American liquefaction projects are aiming to take final investment decisions in 2012. Their success will depend on the ability of developers to secure long-term off-take agreements, access to capital, and regulatory permits. Development of these projects is likely to require involvement of large, credit-worthy entities with a long history of stable operations.

The authorMore Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com