Natural gas pipeline operators' 2010 profits reach record levels

Christopher E. Smith

Pipeline Editor

After sharp declines in 2009, natural gas pipeline operators saw their profits jump nearly 12% to reach on all-time high of more than $5.2 billion. The jump in net income came even as revenues rose a relatively modest 4.4%, reaching nearly $19.8 billion but failing to return to the highs seen in 2007 (Fig. 1).

This development was evident in data submitted by pipeline operators to the US Federal Energy Regulatory Commission and compiled and analyzed by Oil & Gas Journal to create this article, its annual Pipeline Economics special report.

The resulting earnings as a percent of revenue of 26.33% also broke record highs reached in 2008. Oil pipelines, meanwhile, continued their growth in both profits and revenues, which rose 10.9% and 12.3% respectively (Fig. 1).

Natural gas pipeline companies' improved bottom lines came at least in part as a result of slowed capital expenditures, with additions to plant totaling just $5.2 billion (a 67% decrease from 2009). Expenditures on operations and maintenance rose 4.6% to just over $6.6 billion.

Operators also pulled back on new pipeline construction. Proposed newbuild mileage was just 54.5% of 2009's announced build. Planned horsepower additions of 233,400, however, rose roughly 17% from 2009's total.

Overall estimated $/mile pipeline costs slipped 13.25% but remained above $4.4 million. Pipeline labor prices remained the single most expensive per-mile item, despite easing in absolute terms by nearly 14% to roughly $1.95 million/mile.

Higher-cost labor also affected the balance between estimated and actual costs for both pipeline and compressor projects completed in the 12 months ending June 30, 2011. Actual land pipeline costs exceeded projected costs by nearly $1.5 million/mile, with a more than $1 million/mile difference in labor costs leading the way.

Higher than anticipated labor and material costs ran counter to generally softer compressor costs, with projects completed by June 30, 2011, running nearly $150/hp less than had been predicted as land and miscellaneous costs fell.

US pipeline data

At the end of this article, two large tables (beginning on p. 107) offer a variety of data for US oil and gas pipeline companies: revenue, income, volumes transported, miles operated, and investments in physical plants. These data are gathered from annual reports filed with FERC by regulated oil and natural gas pipeline companies for the previous calendar year.

Data is also gathered from periodic filings with FERC by those regulated natural gas pipeline companies seeking FERC approval to expand capacity. OGJ keeps a record of these filings for each 12-month period ending June 30.

Combined, these data enable an analysis of the US regulated interstate pipeline system.

• Annual reports. Companies that, in FERC's determination, are involved in the interstate movement of oil or natural gas for a fee are jurisdictional to FERC, must apply to FERC for approval of transportation rates, and therefore must file a FERC annual report: Form 2 or 2A, respectively, for major or nonmajor natural gas pipelines; Form 6 for oil (crude or product) pipelines.

The distinction between "major" and "nonmajor" is defined by FERC and appears as a note at the end of the table listing all FERC-regulated natural gas pipeline companies for 2010 at the end of this article (p. 111).

The deadline to file these reports each year is Apr. 1. For a variety of reasons, a number of companies miss that deadline and apply for extensions but eventually file an annual report. That deadline and the numerous delayed filings explain why publication of this OGJ report on pipeline economics occurs later in each year. Earlier publication would exclude many companies' information.

• Periodic reports. When a FERC-regulated natural gas pipeline company wants to modify its system, it must apply for a "certificate of public convenience and necessity." This filing must explain in detail the planned construction, justify it, and—except in certain instances—specify what the company estimates construction will cost.

Not all applications are approved. Not all that are approved are built. But, assuming a company receives its certificate and builds its facilities, it must—again, with some exceptions—report back to FERC how its original cost estimates compared with what it actually spent.

OGJ spends the year July 1 to June 30 monitoring these filings, collecting them, and analyzing their numbers.

OGJ's exclusive, annual Pipeline Economics Report began tracking volumes of gas transported for a fee by major interstate pipelines for 1987 (OGJ, Nov. 28, 1988, p. 33) as pipelines moved gradually after 1984 from owning the gas they moved to mostly providing transportation services.

Volumes of natural gas sold by pipelines have been steadily declining, so that, beginning with 2001 data in the 2002 report, the table only lists volumes transported for others.

The company tables also reflect asset consolidation and mergers among companies in their efforts to improve transportation efficiencies and bottom lines.

Reporting changes

The number of companies required to file annual reports with FERC may change from year-to-year, with some companies becoming jurisdictional, others nonjurisdictional, and still others merging or being consolidated out of existence.

Such changes require that care be taken in comparing annual US petroleum and natural gas pipeline statistics.

Institution by FERC of the two-tiered (2 and 2A) classification system for natural gas pipeline companies after 1984 further complicated comparisons (OGJ, Nov. 25, 1985, p. 55).

Only major gas pipelines are required to file miles operated in a given year. The other companies may indicate miles operated but are not specifically required to do so.

For several years after 1984, many non-majors did not describe their systems. But filing descriptions of their systems has become standard, and most provide miles operated.

Reports for 2010 show an increase in FERC-defined major gas pipeline companies: 87 companies of 146 filing for 2010, from 86 of 136 for 2009.

The FERC made an additional change to reporting requirements for 1995 for both crude oil and petroleum products pipelines. Exempt from requirements to prepare and file a Form 6 were those pipelines with operating revenues at or less than $350,000 for each of the 3 preceding calendar years. These companies must now file only an "Annual Cost of Service Based Analysis Schedule," which provides only total annual cost of service, actual operating revenues, and total throughput in both deliveries and barrel-miles.

In 1996 major natural gas pipeline companies were no longer required to report miles of gathering and storage systems separately from transmission. Thus, total miles operated for gas pipelines consist almost entirely of transmission mileage.

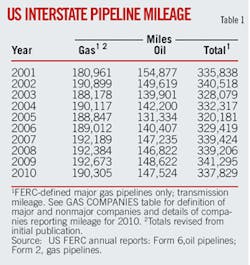

FERC-regulated major natural gas pipeline mileage slipped in 2010 (Table 1) to its lowest level since 2006. Final data show a decrease of 2,368 miles, or 1.25%.

Rankings; activity

Natural gas pipeline companies in 2010 saw operating revenues rise by nearly $837 million, or more than 4% from 2009, reversing a similarly scaled dip from the year before. Net incomes also rose, up roughly $553 million (nearly 12%), to more than eclipse the slips seen a year earlier.

Oil pipelines earnings rose more than $450 million (11%) on the back of a more than $1.2 billion (12.3%) increase in revenues (Table 2). Buoyed by the influx of cash, operators registered more than $6.8 billion in property changes for 2010, nearly double the $3.5 billion seen in 2009.

Crude deliveries for 2010 increased by more than 773 million bbl, or 12%, more than countering a 46.5 million bbl drop in product deliveries.

OGJ uses the FERC annual report data to rank the top 10 pipeline companies in three categories (miles operated, trunkline traffic, and operating income) for oil pipeline companies and three categories (miles operated, gas transported for others, and net income) for natural gas pipeline companies.

Positions in these rankings shift year to year, reflecting normal fluctuations in companies' activities and fortunes. But also, because these companies comprise such a large portion of their respective groups, the listings provide snapshots of overall industry trends and events.

For instance, the growth in gas pipeline earnings was driven by the top 10 companies in the segment, for which combined income climbed more than $600 million. The top 10 companies' share of the segment's total earnings was roughly 50%. Dominion Transmission Inc.'s earnings alone totaled nearly $873 million, or nearly one-third of the Top 10's total earnings, buoyed by a $1.15 billion gain on disposition of property.

Company financial data provide a view of the ongoing condition of the oil and gas pipeline industries.

For all natural gas pipeline companies, for example, net income as a portion of operating revenues rose to 26.33% in 2010, eclipsing the record high set in 2008 (25.78%).

The percentage of income as operating revenues for oil pipelines, however, continued to slide in 2010, hitting 40.84% (the lowest levels seen since 2005) after reaching 42.53% in 2008.

Net income as a portion of gas-plant investment rebounded to 4.18% after having slipped to 3.84% last year, the lowest in at least 15 years.

For oil pipelines, net income as a portion of investment in carrier property in 2010 also rebounded, rising to 9.94% and reversing a drop from the 11.5% reached in 2006. Income as part of investment in carrier property in 2004 stood at 11.4%, having risen steadily toward that level from 6.8% in 1998.

Major and nonmajor natural gas pipelines in 2010 reported an industry gas-plant investment of more than $124.7 billion, the highest level ever, up from almost $121.3 billion in 2009, nearly $105.8 billion in 2008, $95.5 billion in 2007, $88.3 billion in 2006, $84 billion in 2005, more than $83 billion in 2004, nearly $78 billion in 2003, $74.2 billion in 2002, and almost $71 billion in 2001.

Investment in oil pipeline carrier property also continued to rise in 2010, reaching nearly $45.4 billion, after hitting almost $41.6 billion in 2009, $39.1 billion in 2008, almost $35.9 billion in 2007, and rebounding to $32.7 billion in 2006 from the lowest level seen since at least 1997, $29.5 billion in 2005.

OGJ for many years has tracked carrier-property investment by five crude oil pipeline and five products pipeline companies chosen as representative in terms of physical systems and expenditures (Table 3). In 2003, we added the base carrier-property investment to allow for comparisons among the anonymous companies.

The five crude oil pipeline companies in 2010 increased their overall investment in carrier property by more than $1.1 billion (roughly 20%). The increase followed one of about the same size in 2009. The increase was once again led by very large investment growth on the part of the largest company, which by rising more than $1.2 billion entirely eclipsed the ups and downs experienced by the other operators.

The five products pipeline companies, by contrast, increased overall investment in carrier property by $282.6 million, or 4.3% down from the $325 million, or 5.2%, increase of 2009. Also unlike the crude oil lines, all companies in the products pipeline group increased investment in 2010.

Investment by the five product pipeline companies in 2010 was more than $6.85 billion, continuing a return to growth started in 2003 when investment of more than $4.7 billion was up from 2002's $4.5 billion level.

Comparisons of data in Table 3 with previous years' must be done with caution: In 2004, a major crude oil pipeline company listed there sold significant assets, making comparisons with previous years' data difficult.

Fig. 2 illustrates the investment split in the crude oil and products pipeline companies.

Construction mixed

Applications to FERC by regulated interstate natural gas pipeline companies to modify certain systems must, except in certain instances, provide estimated costs of these modifications in varying degrees of detail.

Tracking the mileage and compression horsepower applied for and the estimated costs can indicate levels of construction over 2-4 years. OGJ has been doing that since this report began more than 50 years ago.

Tables 4 and 5 show companies' estimates during the period July 1, 2010, to June 30, 2011, for what it will cost to construct a pipeline or install new or additional compression.

These tables cover a variety of locations, pipeline sizes, and compressor-horsepower ratings. Not all projects proposed are approved. And not all projects approved are eventually built.

Applications filed in the 12 months ending June 30, 2011, fell sharply for the second consecutive year.

• More than 286 miles of pipeline were proposed for land construction, and no new offshore work. The land level is down from the roughly 525 miles proposed for construction in 2010, and the 2,180 miles proposed for construction in 2009, which was the highest level since more than 2,700 miles were proposed in 1998.

• New or additional compression proposed by the end of June 2011 measured more than 233,000 hp, up from the 200,000 hp proposed in 2010, but still down substantially from the 664,775 hp proposed in 2009.

Putting the downturn in US gas pipeline construction in perspective, however, Table 4 lists 31 land-pipeline "spreads," or mileage segments, and no marine projects, compared with:

• 8 land and 0 marine projects (OGJ, Nov. 1, 2010, p. 108).

• 21 land and 0 marine projects (OGJ, Sept. 14, 2009, p. 66).

• 19 land and 0 marine projects (OGJ, Sept. 1, 2008, p. 58)

• 25 land and 1 marine project (OGJ, Sept. 3, 2007, p. 51)

• 42 land and 1 marine project (OGJ, Sept. 11, 2006, p. 46).

• 56 land and 4 marine projects (OGJ, Sept. 12, 2005, p. 50).

• 15 land and 0 marine projects (OGJ, Aug. 23, 2004, p. 60).

• 37 land and 3 marine projects (OGJ, Sept. 8, 2003, p. 60).

• 83 land and 3 marine projects (OGJ, Sept. 16, 2002, p. 52).

• 49 land and 2 marine projects (OGJ, Sept. 3, 2001, p. 66).

The drop in mile growth in 2011 at the same time the number of spreads rose sharply shows that most of the projects proposed were small, with none measuring more the 40 miles. This represents the nature of current activity, with much of the work focused on connecting new production sources to existing transmission infrastructure rather than building new large transmission lines, and only some of it falling under FERC jurisdiction.

For the 12 months ending June 30, 2011, the 31 land projects would cost an estimated $1.27 billion, as compared with the just more than $2.67 billion for 8 projects totaling more miles a year earlier.

It is helpful to remember that these statistics cover only FERC-regulated pipelines. Many other pipeline construction projects were announced in the 12 months ending June 30, 2011, but as mentioned earlier, many of these projects involved connecting developing natural gas shale plays such as Eagle Ford and Marcellus to already operating transportation infrastructure.

A report conducted earlier this year on behalf of the Interstate Natural Gas Association of America concluded that the US and Canada will require annual average midstream natural gas investment of $8.2 billion/year, or $205.2 billion (in real 2010 dollars) total, over the nearly 25-year period 2011-35 to accommodate new gas supplies, particularly from the prolific shale gas plays, and growing demand for gas in the power-generation sector. The capital investment requirement includes mainlines, laterals, processing, storage, compression and gathering lines.

These totals included $20 billion of investment in the Marcellus shale region alone.

Against the backdrop, however, estimated $/mile costs for new projects as filed by operators with FERC retreated from the highs seen in 2010. For proposed onshore US gas pipeline projects:

• In 2010-11, the average cost was $4.4 million/mile.

• In 2009-10, the average cost was $5.1 million/mile.

• In 2008-09, the average cost was $3.7 million/mile.

• In 2007-08, the average cost was $3.4 million/mile.

• In 2006-07, the average cost was $2.8 million/mile.

• For 2005-06, the average cost was $1.95 million/mile.

Cost components

Variations over time in the four major categories of pipeline construction costs—material, labor, miscellaneous, and right-of-way (ROW)—can also suggest trends within each group.

Materials can include line pipe, pipe coating, and cathodic protection.

"Miscellaneous" costs generally cover surveying, engineering, supervision, contingencies, telecommunications equipment, freight, taxes, allowances for funds used during construction (AFUDC), administration and overheads, and regulatory filing fees.

ROW costs include obtaining rights-of-way and allowing for damages.

For the 31 land spreads filed for in 2010-11, costs-per-mile projections for both material and labor, typically the two most expensive categories, eased while miscellaneous and ROW charges firmed. Miscellaneous charges actually passed material to become the second most expensive costs category:

• Material—$642,594/mile, down from $1,580,483/mile for 2009-10.

• Labor—$1,957,215/mile, down from $2,273,151/mile for 2009-10.

• Miscellaneous—$1,562,722/mile, up from $1,040,598/mile for 2009-10.

• ROW and damages—$258,127/mile, up from $201,641/mile for 2009-10.

The dramatic drop in material costs was prompted by the prevalence of smaller-diameter projects in the 2011 totals. Estimated material costs for the roughly 44.5 miles of 42-in. OD projects proposed came in at $1,542,328/mile. The rise in miscellaneous costs was driven by companies increasing the amount set aside for contingencies in their estimates.

Table 4 lists proposed pipelines in order of increasing size (OD) and increasing lengths within each size.

The average cost-per-mile for the projects rarely shows clear-cut trends related to either length or geographic area. In general, however, the cost-per-mile within a given diameter decreases as the number of miles rises. Lines built nearer populated areas also tend to have higher unit costs.

In addition, road, highway, river, or channel crossings and marshy or rocky terrain each strongly affect pipeline construction costs.

Fig. 3, derived from Table 4, shows the major cost-component splits for pipeline construction costs.

Labor costs were relatively flat as a portion of land construction costs, remaining the single most expensive category. Labor's portion of estimated costs for land pipelines eased slightly to 44.27% from 44.61% in 2010, 37.95% in 2009, 39.76% in 2008, and 37.93% in 2007. Material costs for land pipelines saw their share of total costs plunge to 14.54% as compared with 31.01% in 2010, 35.19% in 2009, 30.93% in 2008, and 36.44% in 2007.

Fig. 4 plots a 10-year comparison of land-construction unit costs for the two major components, material and labor.

Fig. 5 shows the cost split for land compressor stations based on data in Table 5.

Table 6 lists 10 years of unit land-construction costs for natural gas pipeline with diameters ranging from 8 to 36 in. The table's data consist of estimated costs filed under CP dockets with FERC, the same data shown in Tables 4 and 5.

Table 6 shows that the average cost per mile for any given diameter may fluctuate year to year as projects' costs are affected by geographic location, terrain, population density, or other factors.

Completed projects' costs

In most instances, a natural gas pipeline company must file with FERC what it has actually spent on an approved and built project. This filing must occur within 6 months after the pipeline's successful hydrostatic testing or the compressor's being put in service.

Fig. 6 shows 10 years of estimated vs. actual costs on cost-per-mile bases for project totals.

Tables 7 and 8 show actual costs for pipeline and compressor projects reported to FERC during the 12 months ending June 30, 2011. Fig. 7, for the same period, depicts how total actual costs ($/mile) for each category compare with estimated costs.

Actual labor costs for pipeline construction were more than $600,000/mile higher than estimated costs for the same projects. Overall actual costs were 62.6% higher than projected costs for the 12 months ending June 30, 2011, with the price of labor running 122% higher than had been anticipated.

Some of these projects may have been proposed and even approved much earlier than the 1-year survey period. Others may have been filed for, approved, and built during the survey period.

If a project was reported in construction spreads in its initial filing, that's how projects are broken out in Table 4. Completed projects' cost data, however, are typically reported to FERC for an entire filing, usually but not always separating pipeline from compressor-station (or metering site) costs and lumping various diameters together.

The 12 months ending June 30, 2011, saw nearly 240,000 hp of new or additional compression completed, roughly flat from the year before.

Horsepower additions were concentrated in the Gulf Coast, and Mountain West regions.

In contrast to pipelines actual compression costs ran $124/hp lower than estimates, with softening in other cost components balancing increases in materials and labor (Table 8). Actual $/hp costs also eased nearly 4.6% from 2010. OGJ

Click here to download the PDF of the "Oil Pipelines Companies".

Click here to download the PDF of the "Gas Pipelines Companies".

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com