Detailed play fairway analysis sheds new light on Nova Scotia offshore

Hamish Wilson

RPS Energy Ltd.

Portsmouth, UK

Matt Luheshi

Leptis E&P Ltd.

Watford, UK

Bernard Colletta

Beicip-Franlab

Paris

For the last decade, the Nova Scotia offshore has been mostly ignored as a potential exploration investment. Although a perennially underexplored region, Nova Scotia is well positioned as a stable and secure opportunity, with positive economic conditions and a fair regulatory regime. What has been missing has been reliable geoscientific information showing where the resource is.

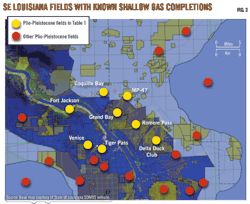

The Play Fairway Analysis (PFA) project has identified rich hydrocarbon potential offshore Nova Scotia with an unrisked, in place yet-to-find of 120 tcf of gas and 8 billion bbl of oil. This potential has diverse characteristics and scales that provide a range of potential investment opportunities. In present day shallow water, there is a substantial opportunity in mostly small-scale traps with potential for both oil and gas. These shallow water plays represent a lower-risk investment with reliable production potential.

The PFA has also identified and mapped very large scale potential traps that could contain gas, condensate, and-or oil in present day deep water. Large scale gas-condensate opportunities exist along the northeastern part of the margin in deep water and, even more interestingly, the prediction of a primarily oil charged play in the southwest of the margin.

These plays in deep water present the potential for resource pools of significant importance that will attract the interest of large oil majors, who have the capability, capacity, and experience to operate in this more complex environment.

Nova Scotia's offshore history

The history of petroleum exploration in Nova Scotia offshore spans more than 50 years.

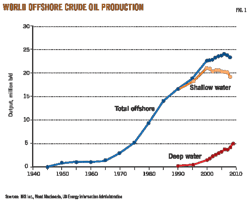

During this period, more than 200 exploration, delineation, and production wells have been drilled with discovered in place reserves of ~2.1 billion bbl of oil equivalent (Figs. 1 and 2). Since 1998, a total of 29 wells have been drilled with only one commercial gas discovery, Deep Panuke in 1998.

The lack of recent exploratory drilling success is reflected in the decline in exploration licenses from a high of 59 in 2002 to only 10 in early 2008, most of which have now been relinquished.

Strategy to attract exploration investment

In 2007, the Nova Scotia Department of Energy commissioned a number of studies to investigate the reasons for the decline in exploration with a view to designing a strategy to rekindle exploration interest in the offshore. These studies concluded that the region has a perception of being a high cost environment associated with high geological risk.

The following year, the government of Nova Scotia committed funding of $18 million to the Offshore Energy Technical Research Association (OETR) to undertake research to support offshore energy development. A large portion of this funded the PFA program, with the goal of using new geoscience to update the understanding of the Nova Scotia offshore and stimulate renewed offshore petroleum exploration activity.

PFA project

In April 2009, the OETR Association awarded the contract to RPS Energy to manage the creation of an industry standard PFA project for offshore Nova Scotia.

The objective of the project was to demonstrate to the industry that there are commercially attractive hydrocarbon opportunities within the Nova Scotia offshore.

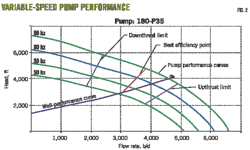

The project recognized that the Halifax research community held a vast amount of knowledge about the province's offshore geology and that it was important to incorporate this knowledge. The project was therefore split into a number of components in which local experts were able to contribute their specific technical expertise into an integrated geoscience analysis (Fig. 3). These subprojects were combined into an integrated play fairway review.

An extensive database was used as the foundation of the project (Fig. 4).

PFA results

The technical story told by the PFA is a tremendously detailed one.

To tell it, there are seven distinct chapters that must be considered. They are:

1. Tectonic evolution.

2. Sequence stratigraphy.

3. Geochemistry.

4. Depositional systems.

5. Petroleum systems modeling.

6. Yet-to-find analysis.

7. Common risk segment mapping.

Tectonic evolution

The tectonic analysis has constructed an integrated 3D model of the crustal structure and evolution of the Nova Scotia continental margin in space and time from rifting to spreading.

This model underpins an understanding of late rift and early postrift depositional environments and provides a predictive model for salt deposition and the distribution of Early Jurassic source and reservoir rocks. The preexisting interpretation of the rifting calls for an along-strike change in mechanism from magmatic to nonmagmatic driven by the disappearance of the East Coast Magnetic Anomaly (Fig. 5).

A new refraction line acquired in the northeast of offshore Nova Scotia unequivocally shows evidence of an underplated body with Vp/Vs ratios comparable to those observed on the Voring Plateau (Figs. 6 and 7). The landward edge of this body is near vertical and overlain by a basement step coincident with the ECMA and also marking the landward edge of the salt nappes.

The study interpreted the final stage of rifting as essentially "volcanic" in nature and not nonmagmatic; with waning volcanism to the northeast (as indicated by a weakening ECMA). The rifting is associated with subaerial volcanism and a continuous underplated mantle (thinning to the northeast). Therefore, the PFA proposes a magmatic margin along the entire Nova Scotia offshore with no change in rifting mechanism.

Sequence stratigraphy

The PFA commissioned a thorough biostratigraphic review involving experts from Halifax and under the leadership of RPS Energy (Fig. 8).

Six wells were completely repicked and a further 14 reevaluated. The wells were tied to the seismic and an iterative process adopted to date key horizons. Ten sequence boundaries were picked. These have been mapped on the complete set of seismic data.

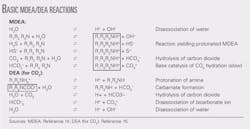

Geochemistry

The existing source rock model is that the Sable oil and gas fields are "locally sourced." However, this model does not explain the existence the hydrocarbon occurrences in the offshore (Fig. 9). Evidence that contradicts the existing source rock model includes:

• The presence of oil fields in the northwestern part of the Sable Delta.

• These oil fields form a line with oil shows in wells to the north of the Sable Delta.

• The oil shows found in piston cores in the deep offshore.

• The extensive evidence of gas (DHIs and gas shows) throughout the margin.

This evidence allows us to postulate a more regional source rock.

Isotope analysis was carried out to link the oils to the source rocks (Fig. 10). Nova Scotia oils are in two populations, one corresponding to the oils in the Sable region and the other from the oils found in the piston cores in the deep offshore. Isotope analysis from the extracts (the green dots) shows a fair correlation between the source rocks penetrated and the oils in the Sable area. The diagram also shows the oils from Morocco and note that one is in the same population as the piston core oils.

The forensic geochemistry evaluation, combined with the revised rifting model, allows us to conclude that there is a regional Lower Jurassic source rock. This probably was initially deposited in a hypersaline environment, in late synrift to early postrift, but transitioned into a restricted marine environment as the basin subsided. For the purposes of modeling, a Pleinsbachian age was assigned to this source rock. The second major source rock is of Tithonian age and probably is the main source for the Sable gas fields with additional contributions from the younger sections.

Depositional systems

The depositional systems story is based on detailed regional sequence mapping and seismic facies characterization.

The isopach maps and well data have been modeled using BEICIP's patented facies modeling package DIONISOS. The model predicts facies distribution in 3D based on paleoslope, water depth, and sediment input, calibrated by the input well data.

The Nova Scotia basin story starts with salt deposition (Fig. 11). The study constrained the distribution of the Lower Jurassic source rock to the salt basins.

The PFA built isopach maps and gross depositional environment maps (GDEs) on each of the sequences starting from the Lower Jurassic. This work allowed understanding and prediction of reservoir distribution in each of the major deltaic systems that characterize the sedimentary section. These Jurassic and Cretaceous delta systems form the main reservoir play fairways (Fig. 12).

The delta systems are clearly shown as is the Mid to Upper Jurassic carbonate bank play. Additional plays are possible in the southwest region where there is potential for early Jurassic oolites and also the presence of sand reservoirs sourced from the Yarmouth arch in the southwest coast of Nova Scotia to the east of the Georges Bank area.

Petroleum systems modeling

The 3D DIONISOS facies model was used as the foundation of the patented Temis petroleum systems model.

The model was calibrated using the 1D well models and the 2D dip line models. Temis was used to predict timing and volume of hydrocarbons generated. The two key source rock horizons are the Lower Jurassic and Tithonian.

Fig. 13 shows the transformation ratio at present day for the Pliensbachian source rock. This shows that the source rock is overmature to the northeast but is generating oil in the southwest.

Fig. 14 shows the transformation ratio for the Tithonian. This is in the gas window today and is mainly immature in the southwest. However, note the rim in the Sable area where the source rock is potentially generating liquids.

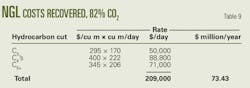

Yet-to-find calculation

The PFA divided the margin into zones to high-grade the prospectivity. Temis then calculated the YTF in each of the zones (Fig. 15).

In simple terms, zones one, three, and five are on the shelf. Zone three contains the Sable producing fields. Zones two, four, and six are in the deep water.

Fig. 16 and Fig. 17 show the results of the YTF calculation. There is a substantial unrisked YTF in place resource for the basin. The ranking of the zones shows a large remaining potential in the gas producing Sable area.

Zone five is of particular interest as the area was explored in the 1970s on poor quality 2D data. There are areas in zone five that are very promising although the wells drilled in the area failed due to lack of closure. Zone five contains sweet spots for both the Missisauga and Mic Mac reservoirs.

It is likely the potential in this area has been missed because of less accurate seismic of the day. With application of modern 3D technology, it is likely that significant pools will be discovered through integration of this revised mapping with high quality imaging.

The deeper water portions of zones one and two are also attractive from a YTF perspective. There are large structures in this region that could contain substantial volumes of hydrocarbons, including significant amounts of oil.

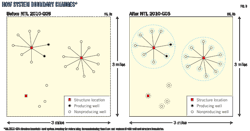

Common risk segment mapping

For each play, the PFA produced common risk segment (CRS) maps on the following features.

The CRS maps identify areas of relative high, medium, and low risk according to a simple traffic light (red, yellow, green) color scheme. Maps were produced on the six factors that constitute an effective petroleum system. These six maps were convolved to produce composite common risk segment (CCRS) maps for each reservoir.

Fig. 18 shows an example of a CCRS product. This is for the Valanginian/Hauterivian Middle Missisauga sequence. This sequence is one of the main producing reservoirs for the Sable area gas fields and is the core high prospectivity area around the fields.

The study identified several undrilled dip closed features in and around the producing fields. The source rock includes both the Tithonian and the Pliensbachian. The presence of a Pliensbachian source opens up the prospectivity to the southwest.

A summary of the plays and their play risks is shown in Table 1 (the zones are those in Fig. 15).

Key PFA findings

There are four important insights arising from the work. Three conclusions address the geological risk, and the fourth conclusion concerns the potential for hydrocarbon volumes.

Source rocks

The PFA has developed a model that allows the potential for a regional Lower Jurassic source rock that extends beyond the Sable subbasin and underlies the whole margin. The presence of this regional source rock is confirmed by isotope and molecular analysis of the oils discovered in piston cores taken along the length of the margin.

Analysis of these oils proves the presence of a distinct separate regional source rock. The presence of oil in the piston cores suggests that the source rock is oil prone in the western half of the Scotian margin. The eastern half is gas dominated as demonstrated by the existing production, although with the potential of an oil rim round the Sable subbasin.

Reservoir rocks

The presence of reservoir rocks in the Sable area is proven. Detailed sequence stratigraphy along with seismic analysis has developed predictive models for four reservoirs that form the main play fairways for the margin:

• Mic Mac Upper Jurassic Delta sequence in the northeast of the margin.

• The Baccaro carbonate bank forms the reservoir for Deep Panuke field. This reservoir extends to the west along the "shelf edge."

• Two Lower Cretaceous Delta sequences are the producing reservoirs in the Sable subbasin. The PFA has developed a model to predict reservoir/seal distribution in the Sable region itself and, with the use of sediment distribution models combined with seismic attributes, can predict reservoir into the deep offshore as well as farther west along the margin

These four play fairways are proven and, with the revised source rock model and derisking approach, offer an opportunity of global significance. In addition to these plays, the PFA has also identified untested reservoirs in the western part of the basin in the area of the oil prone source rock.

Petroleum systems modeling

The 3D petroleum systems model identifies target areas by determining source rock type and maturity at the present day. The following two statements can be made as a result of this modeling:

1. The Lower Jurassic source rock is generating oil today in the southwest part of the margin. In the eastern margin, it is generating gas that could have sourced the Deep Panuke gas reservoir (oil generation occurred before the Deep Panuke reservoirs were sealed).

2. The main source rocks for the Sable subbasin fields are the Upper Jurassic Tithonian sequence and are in the gas window today. The basin shallows at the margins and, in the shallow region of the basin, the source rock is in the oil window. Therefore, there is the potential for an oil rim round the Sable delta. Evidence for this is provided by the Cohasset and Penopscott oil discoveries and oil shows in wells to the northeast of Sable. This is a credible oil play that exists in shallow water and is underexplored.

Yet-to-find and prospect sizes

The confident identification of two source rocks enables an assessment of the volumes of hydrocarbons generated. The modeling work indicates an unrisked yet-to-find of 120 tcf of gas and 8 billion bbl of oil. The volumes of generated hydrocarbons are substantial and sufficient to fill the several large structures that can be seen on the seismic data.

Exploration sweet spots

The CCRS mapping exercise has highlighted the following prospective areas that represent the premier opportunities in the region.

A. Mature and shelf exploration.

The Sable subbasin has significant remaining YTF. The Upper Jurassic and Lower Cretaceous deltas are prospective in this region. There are a number of relatively small, undrilled dip closed features that are close to the existing infrastructure.

The main Sable plays extend to the east of the Sable subbasin and extend to the Nova Scotia/Newfoundland boundary. The area is underexplored with most of the wells drilled in the 1970s on poor quality 2D data.

The Baccaro carbonate bank and clastics also form attractive plays to the west of Sable where they would be sourced by the oil prone Pleinsbachian source rock.

B. Deepwater and frontier exploration.

The PFA has identified the exciting possibility of an oil play in deep water in the southwest of the margin. The area is underlain by the postulated Lower Jurassic source rock that is in the oil window today. Reservoirs are provided by Lower Cretaceous turbidite sand that are seen on the seismic and are predicted by facies modeling.

The deep water of the Sable Delta and to the northeast is more gas prone but contains significant undrilled features. The PFA developed models to derisk the reservoir in this area. The presence of a noncommercial gas discovery (Annapolis) shows that the play works.

The PFA has demonstrated that there is significant remaining potential in the Nova Scotia offshore that warrants the attention of the industry. Reprocessing existing seismic and utilizing new geoscience has led to a dramatic improvement in the quality of data and presents a more accurate picture of a significant and varied hydrocarbon opportunity.

More information about the Nova Scotia offshore is available at the web site (www.novascotiaoffshore.com).

Acknowledgments

The authors acknowledge Sandy MacMullin of the Nova Scotia Department of Energy who is the main driver behind this project. We also acknowledge the financial support of the project sponsors, OETR. The project team at BEICIP provided much of the technical work included in this article. Critical technical support from David Roberts and Janice Weston was invaluable. The project received very important input and support from several geoscientists at the CNSOPB, Geological Survey of Canada, Dalhousie University, and St. Mary's University.

The authors

Hamish Wilson was overall program director for the Nova Scotia Play Fairway Analysis. He joined BP in 1978 as a geologist and worked in the North Sea, Alaska, and Southeast Asia before becoming project manager of corporate database development. He left BP in 1989 and later formed Paras, a consulting company specializing in information systems and exploration performance. RPS Energy acquired Paras in 2008. His expertise is in exploration strategy and performance and using play analysis to underpin exploration technical analysis. He graduated with a geology degree from Edinburgh University and has an MBA from International Management Development.

Matt Luheshi is a consultant specializing in play fairway analysis and exploration strategy. He joined BP in 1979 and retired in 2004. Following a period in BP's technology department, he became a senior explorer gaining wide international experience. His roles included project management and subsurface team leadership, and he has gained extensive experience working with international and national oil companies. He has a PhD in physics from Manchester University.

Bernard Colletta joined the Beicip-Franlab consultancy in 2008 where he is presently director of exploration projects. He started his career as a research associate at the regional office of the University of Mexico, in Sonora, where he taught structural geology and plate tectonics. He joined the IFP research institute in 1983, where he acquired a deep knowledge in seismic interpretation and petroleum systems, both in rift and thrust environments. He is also a specialist in physical analog models for geological structures and developed the IFP structural experimental laboratory. During 7 years, he managed a research team of 130 persons as the head of the geology-geochemistry-geophysics division in IFP. He obtained a PhD in applied geology at Grenoble University.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com