Special Report: Worldwide Gas Processing: NGL production from US shale plays grows

The future growth of NGL production in the US depends largely on the continued exploitation of hydrocarbons found in shale and other unconventional resource plays. NGL production from conventional oil and gas formations has been in steady decline for several years, and NGL production from crude oil refineries will likely see only limited growth in the US.

Commercial development of shale plays via directional drilling and hydraulic fracturing began in the Barnett shale in Central Texas and was then adapted to other shale plays, as well as other types of unconventional resources. The amount of NGLs contained in the extracted hydrocarbons varies among the plays and even within many shale formations.

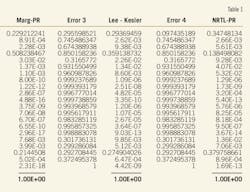

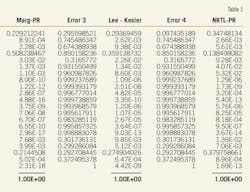

The Barnett shale contains significant NGLs and was already a major source of NGLs by 2005. In contrast, the Haynesville shale in Louisiana contains almost no NGLs. Even though natural gas production from the Haynesville may have surpassed production from the Barnett shale, the Barnett remains the preeminent shale for production of NGLs. The accompanying figure shows historical and projected NGL production from the Barnett shale and several other important shale plays.

US natural gas production has increased over the past year while natural gas prices have remained low. Producers have looked to NGLs to provide a boost in profitability, and drilling has tended to migrate from formations with low liquids content to plays with a high concentration of NGLs and heavier liquids. Consequently, the dry Fayetteville shale in Arkansas has seen reduced drilling, while wet or oily plays such as the Eagle Ford in South Texas are a hive of activity. Within plays that vary in liquids content, the wetter areas are being preferentially drilled.

As shown in the figure, some of the more important shale plays for NGLs include the Barnett, Eagle Ford, Woodford, Marcellus, and Bakken. The Barnett is currently producing the most NGLs, but the Eagle Ford is growing more quickly and will likely equal the Barnett’s NGL production by 2014.

The Eagle Ford has an oil region, a wet-gas region, and a dry-gas region, but nearly all drilling activity is currently concentrated in the portions with liquids. The Eagle Ford is benefitting from intense infrastructure development, including a new mixed NGL (Y-grade) pipeline to the fractionation center at Mont Belvieu.

The Woodford shale in southern Oklahoma was the second major wet-gas shale play to be developed (after Barnett) and also has good access to NGL fractionation at Mont Belvieu via the Arbuckle Y-grade pipeline, whose capacity will be expanded to 240,000 b/d in first-half 2012 through the addition of new pump stations.

Drilling in the Marcellus shale is most active in the wet-gas regions of southwestern Pennsylvania and northern West Virginia. Unlike the Barnett, Woodford, and Eagle Ford shales, the Marcellus shale is far from any existing, large-scale NGL infrastructure. Gathering, processing, and fractionation are being built within the region, but there is no nearby market for ethane.

A large number of projects have been proposed to move ethane out of the Marcellus to more lucrative markets, but no more than two or three of these projects are likely to be built, and none is likely to be operating fully until near the end of Purvin & Gertz’s forecast period. Thus, while recovery of propane and heavier NGLs will ramp up with regional wet-gas production, ethane recovery will likely make a step change when the first infrastructure project is complete.

The Bakken shale is primarily an oil play in North Dakota but also stretches into Montana and Canada. Oil production in the Bakken is growing dramatically, and very rich associated gas is being produced with it. The Bakken shale is likewise far from major NGL infrastructure and petrochemical plants, and pipelines have been proposed to ship ethane to Alberta and Y-grade to Bushton, Kan.

Other plays are being actively drilled and will also contribute NGLs within the forecast period. Several shale plays are very active in the Permian basin of West Texas and eastern New Mexico. These plays include the Avalon, Bone Spring, and Wolfcamp shales. The Anadarko basin in western Oklahoma and Texas Panhandle contains several oily plays including the Granite Wash, Cleveland, and Mississippian plays. In the Denver-Julesburg and Powder River basins of Colorado and Wyoming, the Niobrara and Frontier shales are being developed.

Companies have amassed acreage for other wet shale plays that are likely to produce NGLs beyond the forecast period. Two examples are the Utica shale in eastern Ohio and the Collingwood shale in Michigan.

There is still a great deal of uncertainty regarding the amount of NGLs that can be recovered from the shale plays in the US. Outstanding questions include the consistency of the liquid composition across the plays, the extent of the plays, the role of infrastructure, the commercial environment, and the impact of advances in technology. The potential for government regulation of essential technologies such as hydraulic fracturing is an ongoing threat to the industry. Purvin & Gertz believes that NGL production has a bright future in the US.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com