US LNG exports will face stiff competition in medium term

Last year, Cheniere Energy announced the first concrete plans to export US gas as LNG from the Lower 48 from its Sabine Pass LNG terminal in Cameron Parrish, La. Cheniere applied to the US Federal Energy Regulatory Commission for permission to build up to four liquefaction trains with combined capacity of 14 million tonnes/year. Photograph from Cheniere Energy Partners.

Updated from a Barclays Capital commodities research publication Mar. 22, 2011.

James Crandell

Biliana Pehlivanova

Barclays Capital

New York

Michael Zenker

Barclays Capital

San Francisco

Oversupplied North American natural gas markets might see construction of liquefaction that would allow LNG export potentially in 2015. There is a question, however, of whether the world needs another source of LNG supplies.

Global regasification additions will far outpace liquefaction capacity growth 2012-13, suggesting that global LNG markets could tighten if demand materializes behind those terminals. The picture changes 2014-15, however, when liquefaction and regasification growth balance.

This suggests that proposals for North American liquefaction would likely face strong competition, particularly from Australia, and highlights the importance of relative costs of supply.

The earthquake and tsunami that struck Japan in March severely crippled the country's power system, especially its nuclear plants. This is likely to tighten LNG markets globally near term. But with the safety of nuclear power now in question, media have speculated that a broader move away from nuclear generation would support LNG markets for years to come. Some analysts are going so far as to suggest that the nuclear crisis has prompted strength in the back end of the forward Henry Hub natural gas price curve.

It is too early to judge Japan's long-term response to its current challenges, and therefore demand for natural gas, in our view. The prospect for LNG exports out of the US, however, would certainly look more attractive in a tighter longer term LNG market. And as other countries review options for new power supply, natural gas may appear more favorable than it did weeks ago, given the heightened concerns over the safety of nuclear generation.

Increased LNG demand from Japan aside, the indisputable success of shale gas development and the resulting extended period of oversupply in North American natural gas markets has prompted companies that not long ago wanted to import LNG into North America now to consider exporting. North American natural gas prices are among the lowest in the world, both in the cash markets and far out the forward curve.

But does the world need another source of LNG supplies, particularly after the record wave of liquefaction additions in the past 2 years? And can North American exports compete successfully on a cost/price basis against alternative LNG supplies?

Spot trade

Over the past few years, global LNG markets have been transformed. Since 2009, a record number of liquefaction facilities came on line, flooding the market with LNG just as demand dropped under a global economic slowdown. Many of the new liquefaction plants had targeted US destinations but were not bound by traditional long-term take-or-pay contracts to ship to the US.

With the US markets now shunning LNG and given the destination flexibility of the new volumes, global LNG markets embraced a growing spot trade and moved the new supply to markets more in need of gas.

The ability of the world to produce LNG has now outstripped demand for 2 consecutive years. While terminal capacity to import gas has expanded along with growing liquefaction capacity, the demand behind those regas terminals has not kept pace with supply.

Will this trend continue and for how long?

Global gas demand

Global LNG consumption recovered strongly in 2010. The increased use of LNG was underpinned by rapid economic and industrial expansion in many parts of the world, but it was also supported by an exceptionally cold winter and a hot summer in Europe and Asia in 2010.

The return to normal weather trends should create downward pressure on 2011 LNG consumption, but continued economic growth should push aggregate global LNG demand higher. Furthermore, the scheduled start of several new regasification terminals, including in countries new to LNG trade, will facilitate market expansion.

The massive earthquake off Japan shuttered a large number of nuclear power reactors and has pushed the country's LNG demand higher than previously expected. Power demand has recovered in Japan much more quickly than supply. While there is significant uncertainty about the magnitude and duration of nuclear power plant outages, we estimate that replacing the currently idled 13,000 Gw of nuclear capacity would take an incremental 0.8 bcfd of LNG.

Effectively, such an increase of Japanese consumption relative to our previous estimate would bring the global LNG market into balance. In our latest Global Gas Explorer (Jan. 12, 2011), we pegged global LNG demand growth at about 1.5 bcfd in 2011, compared with 2010, which would fall short of the supply growth potential.

Our projection for global demand growth, taking into account the probable increased need in Japan, now stands at 2.3 bcfd, broadly in line with the 2.4 bcfd of LNG production growth that we expect to see in 2011. Thus, we believe that Japan alone will cause supply and demand growth in 2011 to roughly balance.

From a longer term perspective, global gas demand has been rising steeply over the past 2 decades. It increased by 60% from 1990 to 2010, growing by a compounded growth rate of 2.4%/year. If this pace of demand growth persists in the next 2 decades, global gas consumption could rise to nearly 490 bcfd by 2030 from about 300 bcfd in 2010. This is partly driven by the embrace of gas in power generation around the world and also by the penetration of gas into new residential and commercial markets.

LNG infrastructure

One way to consider the longer term outlook for global LNG supply and demand is to compare announced plans for the additions of liquefaction and regasification terminals. Liquefaction terminals facilitate growing volumes as they would not be built without a plan to supply the market, especially given the very high capital cost. As well, regasification capacity limits consumption in many parts of the world, meaning incremental additions to capacity should facilitate more demand. There are countries that have idle regasifcation capacity, such as those in North America, or countries that have surplus regasification capacity for reliability reasons (e.g., Japan). But in several other locations, regas terminal capacity limits the consumption of gas. Ultimately, relative tightening in balances depends both on additions of regas capacity and utilization rates.

Liquefaction

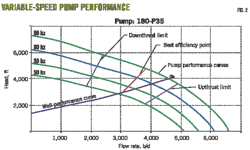

On the liquefaction side, the last of the Qatari megatrain additions will hit the market in 2011, and liquefaction capacity growth will slow sharply in the following 2 years (Fig. 1). The next major wave of liquefaction capacity additions is set to start in 2014 with the scheduled completion of Australia's Queensland Curtis, Fisherman's Landing, and Gorgon projects, as well as Papua New Guinea's PNG LNG and Indonesia's Donggi Senoro offshore project. This wave of supply growth could stretch across 3 years (Fig. 2).

Australian projects are in the lead with 10.7 bcfd of planned liquefaction capacity additions 2014-16 (Fig. 3). We have not included liquefaction project proposals targeting later start-up dates due to the uncertainty of their commissioning times. In total, projects currently on the horizon 2012-15 amount to 7.4 bcfd. Note that these numbers exclude North American liquefaction proposals; this is not a reflection of our view on the likelihood of their construction but rather because we are trying to answer the question of whether there is a need for North American LNG.

The LNG industry is notorious for liquefaction plant delays, and it is unlikely that all liquefaction projects come to fruition as planned. In fact, several of the listed plants still have significant challenges to overcome before there can be more certainty on their start-up times. Thus, the simple math of tallying the plants currently under construction and planned carries the risk of overestimating the actual growth of supply.

Note that while the plants that have already secured final investment decisions (FID) have already contracted much of the supply under long-term agreements, most of those targeting FID within 2 years are still searching for buyers. These plants are the likely competition that North American liquefaction proposals would face in securing long-term offtake contracts with a target date in the 2015-16 time frame.

Regasification

Yet, even a generous estimate of future liquefaction capacity additions falls far short of regasification expansion plans 2012-13, as global regasification capacity is slated to grow by a cumulative 6.5 bcfd, while liquefaction grows by 1.7 bcfd (Fig. 1). The majority of this regasification growth should come from Asia (Fig. 4), with 4.1 bcfd of capacity planned, proposed, or under consideration in the region.

Europe could see the second largest growth of as much as 2.0 bcfd. Numerous regasification terminals have been announced for later years, with total regasification additions of 12.7 bcfd between 2012 and 2015. The fate of many of these facilities, however, carries a high degree of uncertainty.

Although we have a fair degree of confidence in start-up of projects planned for 2011, our view on plants scheduled to come on line past 2012 is much less firm. Regasification plants generally have shorter lead times than liquefaction projects, and there are risks that the capacity additions that are currently planned could increase further. Also note that lead times are particularly short for the start-up of floating storage and regasification units (FSRUs), a growing number of which are being placed into operation around the world.

Although regasification terminals are unlikely to be fully utilized, as is customary for the LNG supply chain, they will nevertheless provide substantial growth potential for consumption. In 2010, global regasification capacity amounted to 77.2 bcfd, while global consumption was roughly 30 bcfd, yielding an approximate utilization rate of 39%.

The vast majority of underutilized regasification capacity, however, is concentrated in the US (lack of need for the supply) and Japan (spare capacity for seasonality and reliability), where utilization rates have averaged 10% and 38%, respectively, in the past 2 years. Excluding the US and Japan, global regasification capacity utilization rates have averaged 40% in 2009 and 51% in 2010. Note that this level of utilization is relatively high, given the seasonality of LNG consumption. In addition, regasification capacity would tend to exceed average needs so as to provide an added safety that additional LNG can be received in times of peak demand.

While the utilization of each new regasification facility will reflect the local supply/demand balances of each country, on average we expect regasification terminals coming on line outside the US and Japan to have greater utilization rates. At 51% utilization of existing regasification facilities (outside Japan and the US), there is further room for consumption growth from those plants. In addition, we believe strong Japanese LNG demand as a result of lower nuclear power output is likely to continue supporting LNG consumption in the next few years.

LNG balance

In summary, current plans for regasification terminal additions far outpace the planned liquefaction capacity additions 2012-13, suggesting that global LNG markets could tighten significantly, assuming regasification terminals create more demand. Fig. 5 illustrates global liquefaction capacity as a percent of regasification capacity (excluding US regasification terminals). Key uncertainty to this time frame will be European supply/demand balances and in particular Europe's ability to swing natural gas supply between pipeline gas and LNG. North American-fed liquefaction, of course, would not be available in this time frame.

The picture looks different 2014-15, when liquefaction and regasification capacity growth is set to be more in balance. This suggests that barring delays in the start-up of currently planned liquefaction facilities or a jump in the utilization of the regasification terminals, the proposals for North American liquefaction projects would coincide with a relatively balanced market and would face competition from alternative supplies.

In this context, North American-sourced LNG would critically depend on their economics, in particular as they compare with Australian projects, which make up the overwhelming majority of upcoming LNG supplies.

We note that longer term prospects for LNG supply and demand are subject to numerous uncertainties. Competition with alternative fuels in power generation, the price of LNG relative to crude oil and coal, domestic natural gas production trends, and the availability of pipeline gas imports are only a few of the factors that could swing balances. More stringent emissions regulations, a growing penetration of natural gas-fueled vehicles, a rapid uptake of electric vehicles that drives gas-fired power demand higher, and a host of other macroeconomic factors all pose further uncertainties to the consumption of LNG.

While a detailed discussion of all these topics is beyond the present scope of this article, we outline below the key risks to supply/demand balances in the longer run:

• Lower LNG prices would continue to encourage displacement of alternative fuels with natural gas in power generation. This trend has been particularly evident in the established LNG consuming markets—South Korea and Japan, both of which have increasingly shifted power generation away from petroleum products toward natural gas. In Europe and North America, natural gas is far cheaper than petroleum products and is competing with coal for power generation.

• Lower LNG prices would continue to encourage spot LNG use in favor of crude oil-linked pipeline gas in Europe. Growing demand and declining local production means that western European consuming countries will be increasingly short gas. The need for imports could be met via LNG or pipelines.

Europe's pipeline import capacity is set to rise significantly over the next 2 years. If spot LNG prices are below the oil-linked pipeline gas, the European markets quickly increase LNG imports (and vice versa). In effect, this dynamic has already proven to be a balancing tool for the global LNG market over the past 2 years, with Europe reducing pipeline imports in favor of purchasing cheaper spot LNG.

• Domestic gas production growth will have a major effect on the long-term need for LNG. While local production trends determine import needs for most LNG consumers, domestic production trends for India and China in particular carry the largest significance for global LNG demand.

China is on track to become the largest importer of natural gas in the world over the next few decades, with a seemingly boundless potential for demand growth, paced by both the availability of supply and pipeline infrastructure development. Thus, Chinese imports, and their effect on the global LNG market, will depend not only on domestic production, but also on the build-out of distribution pipeline networks.

Currently, China produces about 8.8 bcfd of natural gas, with an average growth of 0.8 bcfd/year over the past 5 years (Fig. 6). The International Energy Agency expects Chinese imports (both pipeline and LNG) to grow to 7.7 bcfd in 2020 and over 19.3 bcfd in 2035 from only 0.5 bcfd in 2008. We note that while Chinese gas-demand growth potential is nearly infinite in the medium term, it is price-sensitive. Chinese consumers will be cost conscious, and LNG imports will have to be priced competitively vs. pipeline gas (likely prices with a link to oil or as a netback equivalent to exporting to Europe) and domestic production in order to reach its maximum growth potential.

India's gas markets are growing rapidly as well and the country's LNG imports will be another key determinant of longer term supply/demand balances. Commissioning of giant Krishna-Godavari D6 field in 2009 (OGJ Online, May 5, 2009) has resulted in a 68% surge in domestic gas production in the past 2 years (Fig. 7). Explorations in blocks awarded under the New Exploration Licensing Policy (NELP) suggest that production growth should remain robust in the medium term.

Currently, India depends on imports for about 24% of its gas demand. The country lacks pipeline connections with other nations, and imports come entirely in the form of LNG with the first regasification facility coming on line in 2004. Prospects for importing pipeline gas are slim for the foreseeable future, thus any increase in import demand will be predominantly met by LNG.

Several LNG import terminals are planned over the coming years to add to the two import terminals currently, and India has already been quite active in signing sales agreement for future imports. India imported 1.2 bcfd of LNG in 2009 and has 1.6 bcfd of LNG contracted in long-term agreements as of 2014. Given current regasification capacity and facilities under construction, this represents about one third of capacity available by that time.

Similarly to Chinese use, Indian gas consumption is constrained by the availability of supply, and we expect LNG terminals to have a high rate of utilization even if domestic production grows at a robust pace. Global LNG prices will also play an important role, however, as some consumption sectors have a limited ability to absorb high prices. In particular, while gas-fired generation is able to compete with coal-fired generation, producers of fertilizer depend on international urea prices as well as government subsidies.

• Finally, shale gas development around the world could dampen LNG consumption. Following the success of shale in North America, several countries are looking to tap into their own shale gas reserves. One key question in particular is whether the rush to tap into what appears to be large shale gas resources could significantly lower China's gas import needs.

The government's goals call for shale gas production to rise to 0.3-0.5 bcfd by 2015 and 1.5-3.0 bcfd by 2020. While reaching this level is not unrealistic, given China's estimated reserves, development of Chinese shales poses some unique challenges. If shale gas development in China follows the pace of US shale growth while pipeline transportation and distribution infrastructure expansions lag, it could indeed greatly reduce the need for imports.

Given current official plans and the constraints to growing Chinese shale gas, however, we believe the effect of shale gas on Chinese LNG imports would be limited to about 1 bcfd over the next decade. South Africa, Argentina, Mexico, India, Poland, and Romania are only a few of the other countries where oil and gas production companies are starting to explore for shale gas. These exploration and development efforts are in very early stages and it is difficult to predict their results at this time. A worldwide success of shale gas development, however, could threaten LNG import needs.

The authors

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com