Talisman, Sasol deepen Montney partnership

Talisman Energy Inc. and Sasol Ltd. of South Africa have expanded their strategic relationship in the Montney shale gas play of Northeast British Columbia.

Sasol has purchased a 50% net working interest in Talisman's Cypress A assets northwest of Fort St. John, BC, for $1.05 billion (Can.). Talisman will operate and manage the Cypress A and Farrell Creek areas as an integrated development project.

Sasol purchased a 50% net interest in Talisman's Farrell Creek Montney properties west of Fort St. John in December 2010. That deal, in which Sasol acquired an estimated 4.8 tcf equivalent of net contingent resource, closed Mar. 1. Talisman said the Farrell Creek and Cypress A assets are similar.

Sasol Chief Executive Pat Davies said, "This additional acquisition of another high-quality natural gas asset will accelerate our upstream growth while also potentially advancing Sasol's already strong gas-to-liquids value proposition utilizing our proprietary technology."

Talisman said the Cypress A transaction represents the sale of 14% or 5.6 tcfe of its remaining estimated 39 tcfe of net contingent resource in the play and 17% or 28,600 net acres of its net Tier 1 acres of land in the Montney shale.

Sasol will pay $260 million (Can.) or 25% of the consideration in cash at closing and will also provide $790 million to fund 75% of Talisman's future capital commitments in the integrated joint venture development area.

The Cypress A transaction is subject to regulatory approvals and is expected to close by the end of this year's third quarter.

Upon closing, Talisman will hold an estimated 34 tcfe of net contingent resource and 139,000 net acres of Tier 1 acreage in the Montney shale play, including Farrell Creek, Greater Cypress, and the Greater Groundbirch area southwest of Fort St. John.

Total to buy stake in Novatek for $4 billion

Total SA announced plans to buy a 12% stake in OAO Novatek, Russia's largest independent gas producer, for $4 billion with plans to boost Total's stake to 19.4% in 3 years. Total also plans to acquire 20% interest in Novatek's northwestern Siberian Yamal LNG project.

The Total-Novatek transaction comes after BP PLC and OAO Rosneft agreed to form a strategic global alliance that includes a stock swap, an Arctic offshore exploration joint venture and research effort, and a refining partnership (OGJ Online, Jan. 17, 2011).

Rosneft and BP plan to form a joint operating company in the next 2 years with a 66.67% and 33.33% participation, respectively.

Total expects to close on its 12% stake in Novatek by April and then plans to appoint a representative to Novatek's board. Through this acquisition, Total will gain access to equity production of 120,000 boe/d and to estimated proved and probable reserves of 1 billion boe.

Terms call for Total's overall holdings in Novatek to increase to 15% within 12 months and to 19.4% within 36 months. Novatek's 2010 production was 750,000 boe/d, including condensates. Total and Novatek already jointly develop Termokarstovoye field through the Terneftegaz joint venture (OGJ Online, June 25, 2009).

Closing on the Yamal LNG partnership is expected by July, Total said. The Yamal LNG project envisions production, treatment, transportation, liquefaction, and shipping of natural gas and NGLs from South Tambey field on the Yamal Peninsula (OGJ, May 10, 2010, Newsletter).

Total lists South Tambey resources at 44 tcf of gas, allowing production of more than 15 million tonnes/year of LNG. After Total acquires its 20%, Novatek will hold 51% of the Yamal LNG project.

Christophe de Margerie, Total chairman and chief executive officer, said, "This agreement adds to the close cooperation built with Gazprom since 2007 on the Shotkman project." Last year Gazprom announced it expects a 3-year gas production delay to 2016 from Shtokman (OGJ Online, Feb. 8, 2010).

De Margerie met with Russia's President Dmitry Medvedev in Moscow on Mar. 2. They discussed Total's activities in Russia. De Margerie signed the Total-Novatek agreement later than same day in the presence of Prime Minister Vladimir Putin.

Total expects to become the first international investor to participate in the Yamal LNG project. Total has done business since 1989 in Russia where it operates Kharyaga field with a 40% interest.

Lukoil eyes Siberian Bazhenov, US shale stake

OAO Lukoil is experimenting with shale oil recovery in Russia and is interested in participating in a US shale play, the company's president said at the IHS-CERA energy conference in Houston last week.

Vagit Alekperov said Lukoil is experimenting in the Jurassic Bazhenov shale in Western Siberia, one of the world's most prolific source rocks (OGJ, May 22, 2000, p. 38).

Alekperov said Lukoil would like to identify a partner and become involved in shale drilling in the US, where a number of non-US companies have taken positions in recent times, in order to transfer drilling and completion technologies to the Bazhenov.

BOEMRE plans workshop on new offshore rules

The US Bureau of Ocean Energy Management, Regulation, and Enforcement will hold a 1-day workshop on Mar. 25 in New Orleans to discuss standards and requirements for exploration and development plans, with an emphasis on new safety requirements which have been implemented in the last 6 months.

The workshop at BOEMRE's Gulf of Mexico regional office will provide information on plan submissions related to E&D plans, worst case discharge calculations, the National Environmental Policy Act, oil spill response plans, and spill response and containment, BOEMRE said.

BOEMRE said the workshop will be open to gulf OCS region stakeholders. There is no registration for the meeting, but seating is limited, it said.

The workshop will be in addition to one which BOEMRE plans to hold on Mar. 15 to discuss new requirements for offshore oil and gas companies to develop and implement new safety and environmental management systems.

Pemex tests Eagle Ford shale gas well

Pemex Exploracion & Production has tested dry gas at the rate of 3 MMcfd from its first exploratory well in the Eagle Ford shale.

The Emergente well, in northern Coahuila state, has 17 frac stages in a 4,500-ft lateral at 2,500 m.

Pemex is still evaluating the unconventional gas well, said Pemex E&P Director General Carlos A. Morales Gil. He said the company believes the formation extends to the south and that it should include liquids to the west.

The Emergente well is about 5 km west of a gas conditioning station in the Burgos basin, Morales Gil said.

Ghana's Owo light oil field extended, renamed

A Tullow Oil PLC group successfully appraised its Owo light oil field discovery off Ghana, and the field has been renamed Enyenra.

The Enyenra-2A appraisal well confirmed a downdip extension of the field discovered by the Owo-1 well in 2010 on the Deepwater Tano block. Enyenra-2A encountered oil and gas-condensate in high-quality stacked sandstone reservoirs.

Located more than 7 km south of the discovery well, Enyenra-2A was drilled to intersect the upper channel in which oil was discovered by the Owo-1 and Owo-1 sidetrack wells and the lower channel where gas-condensate was found in the Owo-1 sidetrack.

Results of drilling, wireline logs, reservoir fluid samples, and pressure data show that Enyenra-2A cut 21 m of oil pay in the upper channel and 11 m of oil pay in the lower channel.

Pressure data from the upper channel indicate Enyenra-2A to be in communication with Owo-1. Pressures in the lower channel suggest communication with the deeper pools in the two Owo wells.

Enyenra-2A also tested a distal portion of a deeper Turonian-age fan where 5 m of gas-condensate sandstones were intersected. An evaluation of the extent and thickness of this new play continues.

The Deepwater Millennium dynamically positioned drillship drilled Enyenra-2A to 13,891 ft total depth in 5,492 ft of water. After logging, the group will suspend the well for future use. The drillship will stay on the block to drill the Tweneboa-4 well.

EPL, Phoenix to explore East Bay moderate depths

Energy Partners Ltd., New Orleans, and Phoenix Exploration Co. LP, Houston, will explore moderate depths below production at the giant East Bay area on South Pass blocks 24, 26, and 27 off Louisiana.

The East Bay area is nearly all in state waters where the state offers severance tax suspension on wells at 15,000 ft or more of true vertical depth. East Bay, in shallow water 90 miles southeast of New Orleans, is the sixth largest field on the Gulf of Mexico shelf in terms of cumulative production.

Technical teams from both firms will use EPL's 223 sq miles of newly reprocessed seismic data to generate Miocene prospects at 14,000-20,000 ft that can be drilled for $12-20 million.

The companies don't plan to pursue perceived potential in Lower Miocene, Oligocene, and Eocene at costlier ultradeep depths. First drilling could occur in late 2011.

The agreement provides for EPL to farm out acreage at East Bay, with a promoted overriding royalty interest in favor of EPL on interest Phoenix earns in successful prospect areas. EPL retained the right to participate up to a 50% working interest in each prospect area.

EPL said it chose Phoenix over others because of its "expertise and excellent track record exploring similar plays in this region. By leveraging our respective skill-sets, the agreement allows us to more efficiently generate and drill high-impact prospects below our existing shallow productive horizons."

The moderate depths offer "high-potential resources on the Gulf of Mexico shelf for shallow water costs" at compelling risk-reward, EPL said.

Niobrara oil play fans out near Chugwater, Wyo.

The northwest edge of the Denver-Julesburg basin seems in for a round of spirited drilling due to the horizontal Niobrara shale oil play.

Various operators have received permits to drill well over 100 wells in a nonproducing area in northwestern Laramie County, Wyo., between Silo oil field and the Chugwater community.

Prominent operators EOG Resources Inc., Chesapeake Energy Corp., Noble Energy Inc., and Barrett Resources Corp., are joined by private companies on those permits. Drilling has hardly begun.

Recovery Energy Inc., Denver, an independent focused on the Denver basin, will close Mar. 4 on the purchase of 8,060 net acres from Wapiti Oil & Gas LLC for $12.3 million in cash and stock. The deal will give REI 14,400 contiguous gross acres in its Chugwater block.

REI will operate its first well in the second quarter of 2011 as soon as a suitable rig is available. It has signed a joint venture agreement with an undisclosed private independent that will pay 100% of the cost of two horizontal Niobrara wells and carry REI for a 40% working interest in each. REI is seeking a total of four drilling permits.

REI expects to encounter Niobrara, which it believes will have intense natural fracturing, at 8,300 ft true vertical depth, and then drill a 4,500-ft lateral, said Roger A. Parker, chairman and chief executive officer. The first location is in 19n-67w.

REI's block is about 8 miles south of Chugwater and 10 miles northwest of the northwest edge of Silo field, a vertical 1981 Niobrara discovery redeveloped horizontally in the early 1990s.

"There are 122 recently permitted horizontal Niobrara wells within three to four townships around us," Parker said.

REI's team is interested in conventional and unconventional formations in the basin. The company is drilling J sand development wells in Grover field, Weld County, Colo., where it just closed the acquisition of 1,700 acres from private individuals. That deal also included 6,600 net acres in Goshen County, Wyo.

Parker said the company also plans to exploit the Niobrara at Grover, just east of where EOG Resources kicked off the present horizontal Niobrara play with the Jake well in 1-11n-63w (OGJ Online, Apr. 7, 2010).

"The acquisition in the Grover field complements our positions throughout the northern half of the DJ basin giving us significant exposure in what we believe will be both the matrix porosity and naturally fractured areas of the Niobrara shale," Parker said.

Drilling & Production — Quick TakesDOJ task force consolidates Macondo inquiries

The US Department of Justice has formed a task force to maximize resources devoted to the criminal investigation of the Macondo well accident and subsequent Gulf of Mexico crude oil spill, DOJ officials said on Mar. 7.

DOJ's criminal division, environment and natural resources division, and the US Attorney's office for eastern Louisiana have been working for several months on separate and simultaneous investigations related to the matter, a spokesman told OGJ. He said that Deputy US Atty. Gen. James Cole decided to establish a single task force after assessing the overlapping cases in an effort to avoid duplication of efforts.

John Buretta, a senior counsel in DOJ's criminal division, will lead the task force under the supervision of Assistant Atty. Gen. Lanny Breuer, who heads that division, the spokesman said.

Seneca sells gulf assets; hits Marcellus output mark

An undisclosed purchaser has agreed to buy the Gulf of Mexico oil and gas producing properties of Seneca Resources Corp., Williamsville, NY, for $70 million, leaving Seneca free to increase focus on its Appalachian and California assets.

Seneca said it hasn't made substantial investments in the gulf properties for several years and that it will invest the proceeds in the Marcellus shale. Closing is set for Apr. 30 retroactive to Jan. 1.

Meanwhile, Seneca said its Marcellus production reached 120 MMcfd on Mar. 7 from 32 operated and 27 nonoperated wells. The company said longer laterals and more frac stages per well have led to higher anticipated estimated ultimate recoveries that will offset the increased service costs.

Seneca said, "We are now anticipating well costs of $5-6.4 million for wells with up to 20 frac stages and lateral lengths reaching over 6,000 ft. Taking these factors into account, we expect to see results continue to improve over time, with some of our best wells achieving EURs of 8 bcf." This implies 20-65% pretax internal rates of return at $4/MMbtu.

With the gulf sale, the exploration and production segment's fiscal 2011 capital spending is expected to be $600-655 million, up from $485-560 million.

PROCESSING — Quick TakesCrude unit, hydrocracker due at Sohar

Expansion of the Sohar refinery in Oman will include installation of a crude unit and hydrocracker (OGJ Online, Mar. 2, 2011).

The refinery, now with a capacity of 116,000 b/d, processes a mixture of Oman Export Blend crude and long resid delivered by pipeline from the 106,000 b/d Mina Al-Fahal refinery near Muscat 266 km to the southeast.

Oman Refineries & Petrochemical Co. let a contract to CB&I for front-end engineering and design and project management for a project at Sohar that will include a 71,500 b/d crude distillation unit, 96,800 b/d vacuum distillation unit, 66,400 hydrocracker, and 42,400 b/d deasphalting unit.

Other units will be for sulfur recovery, sour water stripping, amine regeneration, and isomerization.

Existing Sohar facilities in addition to the distillation tower include a 75,260 b/d resid fluid catalytic cracker and propylene recovery and indirect alkylation units.

Among goals of the project, according to the Oman Refineries web site, are production of 1.5 million tonnes/year of naphtha to feed the reformer at a nearby Aromatics Oman LLC complex and improvement of RFCC feed quality.

Sohar is a port on Oman's northeast coast.

GHG regulations threaten US refining, EPA told

US Environmental Protection Agency regulation of refineries' greenhouse gas (GHG) emissions could drive many US refiners out of business by placing them at a significant disadvantage to foreign gasoline, diesel fuel, and jet fuel suppliers, National Petrochemical & Refiners Association Pres. Charles T. Drevna said on Mar. 4.

"Our nation's petroleum refineries remain one of the last internationally competitive segments of the American manufacturing base," he said in a letter to Gina McCarthy, EPA's assistant administrator for air and radiation, which NPRA submitted to accompany its oral testimony at the agency's listening session on its effort to implement GHG regulations under the Clean Air Act. EPA has said that it formulated the regulations in response to a 2007 US Supreme Court decision saying that it had the authority and obligation to do so.

US refiners process 95% of the gasoline, diesel, jet fuel, heating oil, and lubricants which are used domestically, Drevna continued. "There is no guarantee that the US domestic refining manufacturing base will continue to be in existence two or three decades from now," he said. "Our members'…plants could well go the way of many domestic auto plants, virtually all of our domestic textile miles, and many domestic steel plants."

In his testimony, Howard J. Feldman, the American Petroleum Institute's regulatory and scientific affairs director, said API also opposes EPA's GHG regulatory effort, but backs completion of its new source performance standards under the Subpart Ja rulemaking relative to flares.

Refiners already have strong incentives to be more efficient because energy is their second largest cost, less efficient plants have closed as the number of US refineries has dropped by 50% in recent decades, and refiners already have installed cogeneration where appropriate, he noted.

"The refining industry already faces a blizzard of EPA regulations that threaten US operations and jobs," Feldman said. "We're not sure where this and other regulations fit into [US President Barack Obama's] regulatory review directive."

TRANSPORTATION — Quick TakesKitimat LNG partners award FEED contract

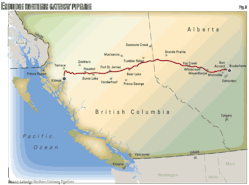

Partners in Canada's Kitimat LNG project let a contract to KBR for front-end engineering and design of the planned LNG export facility on British Columbia's west coast.

Kitimat LNG owners Apache Canada Ltd. and EOG Resources Canada Inc., which let the contract to KBR, plan to build the facility with initial capacity of 5 million tpy on Haisla First Nation land at Bish Cove 400 miles north of Vancouver.

Apache Canada is the managing partner of KM LNG Operating General Partnership, which owns 51% of the Kitimat LNG facility and is the facility operator. EOG Canada, through subsidiaries, owns 49%.

Kitimat LNG Pres. Janine McArdle said, "This is another important milestone for Kitimat LNG, taking us a significant step closer in being able to export LNG to Asia-Pacific markets as soon as 2015."

Last month, Kitimat LNG Partners agreed to buy the remaining 50% interest in Pacific Trails Pipeline LP, thus securing full ownership of the infrastructure to transport natural gas from production areas to Kitimat LNG (OGJ Online, Feb. 9, 2011). The 36-in., 287-mile buried pipeline will carry natural gas to Kitimat from Summit Lake in Northeast British Columbia.

Apache Canada and EOG Canada are in marketing discussions with potential Asia-Pacific LNG customers. The partners expect to have firm sales commitments in place by the time a final investment decision is made near yearend.

Kitimat LNG's application for a 20-year export license is pending with Canada's National Energy Board. A hearing is set for June 7.

Enterprise to buy Permian carbon dioxide line

Enterprise Products Partners LP purchased a 39-mile carbon dioxide pipeline from Trinity Pipeline LP that Enterprise will convert to crude oil service. The 8-in. OD pipeline, extending from Reeves County, Tex., to Lea County, NM, will be capable of shipping an estimated 54,000 b/d to the Basin Pipeline.

Converting the pipeline to oil service and linking to Basin will expand takeaway capacity in the Permian basin's Bone Spring-Avalon play, allowing shippers access to Enterprise's network, including storage facilities at Midland, Tex., and Cushing, Okla. Enterprise will build a central delivery point and associated infrastructure for receiving truck deliveries of crude oil for loading onto the converted line. Construction of the new facilities and conversion of the pipeline to crude oil service is expected to be completed by yearend.

The Bone Spring-Avalon play is characterized by an interval of shale, sandstone, and limestone up to 2,000 ft thick. Prospective production has been identified in multiple horizons on more than 2 million acres throughout Eddy and Lea counties in New Mexico and Reeves, Loving, Ward, and Culberson counties in Texas. Enterprise estimates 120,000 b/d crude oil production and 500 MMcfd gas production as possible from the play by 2018, based on 400 wells drilled/year. There are currently 30 rigs operating in the play, Enterprise said.

Energen Resources Corp, Birmingham, Ala., expanded its Bone Spring-Avalon acreage by 17,000 net acres in January and plans to drill at least 14 wells in the play during 2011 (OGJ Online, Jan. 7, 2011).

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com