SPECIAL REPORT: EU REFINING—3 (Conclusion): Capacity upgrading to cut gasoline exports by 2030

This is the third and final article in a series that presents elements of the European Commission's "Commission Staff Working Paper: On Refining and the Supply of Petroleum Products in the EU."

This background working paper, presenting an overview and analysis of problems facing European refiners, was released at the same time the EC adopted a "Communication 'Energy infrastructure priorities for 2020 and beyond—A Blueprint for an integrated European energy network,'" on Nov. 17, 2010.

In that document, the commission defines EU "priority corridors" for the transportation of electricity, gas, and oil (OGJ Online, Nov. 18, 2010).

The first article in this Oil & Gas Journal series (OGJ, Jan. 3, 2001, p. 90) examined demand issues as they have and will affect European refining. The second article (OGJ, Feb. 7, 2011, p. 96) presented the working paper's views on supply issues and the economic viability of the European refining industry.

This final article presents the effects of future demand developments on European refining by 2030. Following is a summary of those effects:

• EU refining capacity upgrading will lead to significant reductions in exports of (excess supply of) gasoline by 2030, while the import dependence of the EU in gas oil and diesel will continue to increase by 2030.

• Depending on assumptions about the development of the crude diet in Europe 2005-30 and taking into account adopted and implemented EU policies, investments required to upgrade European refining capacities in that period could amount to between €17.8 billion and €29.3 billion, of which between €3.3 and €11.7 billion alone will account for future marine sulfur fuel specification changes to be transposed into EU regulation by the end of 2010. These figures result from a scenario of increasing import dependence in gas oil and diesel.

• It is estimated that the amount of investments that the refining industry in Europe has already committed to spending ("firm projects") 2010-20 is on the order of €13.3 billion.

• In spite of projections of declining demand for fossil fuels, processing intensity in refining will increase as a result of more stringent product specifications, in particular as a result of new IMO changes. One possible consequence is that refinery CO2 emissions will increase 2005-30, by around 6% (and increasing by 12% 2005-20), mainly as a direct result of the needs for hydrogen in refinery units geared towards producing higher proportions of new International Maritime Organization-compliant fuel.

• Significant declines in projected EU demand for transport gasoline by 2030 according to PRIMES (of 20.7% in the Reference scenario) point to the need for gasoline-focused refinery plant restructuring, with necessary capacity reductions by up to a third, depending on the type of unit.

Adopted policies

This section provides a quantitative assessment of the medium-term impacts of expected demand developments in EU petroleum products on the EU refining industry. It presents the results of running the PRIMES 2009 Baseline ("business as usual") and PRIMES 2009 Reference ("policy") scenario petroleum product demand projections on the OURSE refining module of the POLES energy model1 in order to estimate the impacts of evolving demand in terms of:

1. Capacity requirements and capital investment requirements for additional process capacity or upgrade of existing capacity.

2. Production levels.

3. Levels of CO2 emissions.

4. EU import and export levels of petroleum products.

PRIMES projections were also run separately in the Concawe refining model,2 and results have also been reported below, for comparison with OURSE outputs.

The PRIMES 2009 Baseline demand projections result from developments in the assumed absence of new policies beyond those implemented by April 2009. It is not a forecast of likely developments, given that policies will need to develop. Therefore, there is no assumption in the Baseline that national or overall greenhouse gas or renewable energy source (RES) targets are achieved, nor of non-ETS (EU Emission Trading System) targets; CO2 emissions and RES shares are modeling results.

In contrast, the PRIMES Reference scenario reveals the effects of agreed policies, including the achievement of legally binding targets on 20% RES and 20% GHG reduction for 2020. (More details on both the PRIMES 2009 Baseline and Reference scenarios can be found in Annex 3: http://ec.europa.eu/energy/infrastructure/strategy/2020_en.htm.)

The impacts of the PRIMES demand projections are reported with a variation on the assumptions of the refining model with regard to future marine sulfur fuel specifications that are expected to be transposed into EU regulation. The impacts of such changes are reported separately due to the important investments that they will require by EU refining industry if it decides to produce shipping fuel that meets the new specifications.

Specifically, the variations in fuel specification changes that are modeled here are as follows:

Case A assumes a change in maximum permitted sulfur content in marine fuel for Emission Controlled Areas (ECAs) in the EU (the Baltic Sea, the North Sea, and the English Channel) from 1.5% to 1% by 2010 and then down to 0.1% by 2015; and for the rest of the world, from 4.5% to 3.5% in 2012 and then down to 0.5% from 2020.3

Case B assumes no changes in maximum permitted sulfur content in marine fuel beyond 2012, i.e., ECAs remain at 1% and the rest of the world remains at 3.5%. Note that in comparing a case including future IMO changes to one excluding them, in the latter case the changes to 1% and 3.5%, respectively, for the ECAs and the rest of the world have been taken for granted.

As was explained in Part 2 of this series (OGJ, Feb. 7, 2011, p. 96; "Upgrade investments"), this is because it is generally regarded that such changes will pose no major problems for refiners—blends can simply be modified to redistribute the higher sulfur components—while the real challenge will be the changes to 0.1% sulfur content and 0.5%, respectively, for the ECAs and the rest of the world, as these will likely require conversion of bunker fuels to diesel.4 This will require investment in desulfurization or conversion capacities.

The context for the impacts on the EU refining industry that are reported below in terms of key additional outputs from the OURSE model, is as follows:

• Production of petroleum products: The production levels of EU refineries during 2005-30 will fall by 14%, similar to the projected fall in demand in the PRIMES Reference scenario over that period.5

• Trade flows: Russia will have sufficient refinery capacities in middle distillates during the projection period to continue to supply the EU, while North America will not continue to absorb the excess gasoline the EU is projected to produce; new markets will have to be found.

According to the OURSE model, by 2030 the EU net exports of gasoline will total 19.4 million tonnes of oil equivalent (toe), equivalent to 18% of EU gasoline production for that year, while EU net imports of gas oil and diesel will be 37.7 million toe, equivalent to 15% of EU diesel and gas oil demand in 2030.

In comparison, OURSE numbers for 2005 show that EU net exports of gasoline amounted to 32.4 million toe, equivalent to 21.5% of its gasoline production in 2005, and gas oil and diesel net imports were equivalent to 28.2 million toe, amounting to 9.7% of EU gas oil and diesel demand in that year.6

In short, therefore, the OURSE model projects resulting trade flows for the economically optimal capacity required to satisfy the PRIMES reference demand. Those flows amount to falling gasoline exports and increasing gas oil and diesel imports by 2030 compared with 2005.

A key assumption of the OURSE model regards the evolution of the EU crude diet. Globally, it assumes that by 2030, the API gravity of conventional crude oil will have slowly decreased, while sulfur content should increase slightly. It is expected, however, that this will be balanced by an increasing share of condensates used in refinery production and the availability of upgraded crude oil from extra-heavy oil.

In the case of the EU, the OURSE model assumes relative stability 2005-30, both in terms of the API gravity and sulfur content of refineries' supply because along with an increasing share of condensates is included the assumption of an expected doubling of the share of high medium distillate-yielding crudes.7

Note in addition that the OURSE model treats the EU27, Switzerland, Norway, and Turkey together as forming the region of Europe, broken down into two zones: Z3 (Northern Europe) and Z4 (Southern Europe). Impacts are therefore reported for the EU27 plus these three countries. While it cannot be easily estimated what amount of investments and CO2 emissions are EU27 specific, it is useful to note that the Institut français du pétrole (IFP) simulates EU27 demand into the OURSE model by using topping unit8 capacity proportions.

By that measure, Norway and Switzerland represent 4% of Z3 capacity and Turkey, 12.5% of Z4 capacity.

As Fig. 1 reveals, whether "business as usual" or "policy" targets beyond April 2009 are assumed makes little difference in terms of the demand projections in petroleum products for the EU. The general trends in both cases can be summarized:

• A general fall in the level of consumption of petroleum products.

• The continued gradual erosion of demand for high-sulfur residual inland fuel and marine bunkers (which make up heavy distillates).

• An initial increase in demand for middle distillates (including gas oil, heating oil, kerosine, and jet fuel) followed by an eventual and overall fall, mainly resulting from a decrease in road diesel demand due to regulation to restrict CO2 emissions from cars becoming effective9 as the automobile fleet is gradually renewed and due also to the spill over effects from more efficient car engines to those of trucks (truck diesel consumption stabilizes 2020-30).

• A continued fall in demand for gasoline (included in light distillates, along with naphtha). Note that the PRIMES demand projections do not assume a change in the current taxation regime in the EU, which differentiates between diesel and gasoline in favor of the former.

It is important to note that in both scenarios, the proportion of middle distillates in total demand increases quite significantly 2005-10, after which it remains fairly stable.

Effects on investments

According to the OURSE model, the impacts of the Reference scenario in terms of the investments required to upgrade EU+3 refining capacities amount to €17.8 billion 2005-30, of which €3.3 billion account for IMO changes.10

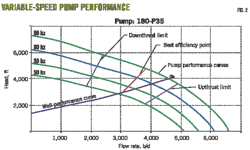

This results primarily from investments in extra gas oil hydrodesulfurization units that will be in short supply on the basis of both the Baseline and Reference scenarios' projections. Fig. 2 shows the volumes that will be needed to meet demand in the Reference scenario, although there is little difference between the two scenarios. (Baseline demand will require slightly more investments in all of the same types of units, excepting cokers.11)

Note that the new IMO regulations will require 14.3 million tonnes/year of extra capacity by 2030 (the difference between Case A and Case B in Fig. 3), mainly in terms of extra hydrocracking12 units (amounting to 6.6 million tpy), hydrodesulfurization of residuals (amounting to 5.4 million tpy), and hydrotreating of vacuum gas oil13 (4.2 million tpy).

Thus, the levels of investments required in order to supply initially rising (but over the whole period, falling) levels of middle distillates are considerable, and even with such investments, imports are likely to rise further. One variation that has been undertaken on the OURSE model runs of the PRIMES Reference demand projections is with regard to crude oil supply projections.

As has been highlighted, the OURSE model projections assume a balanced crude diet 2005-30 in Europe, which along with an increasing share of condensates relies on a doubling of the share of high medium distillate yielding crudes. Simply keeping the share of such crudes constant during that period (with the consequence of an important increase in the overall sulfur content) in the OURSE model, however, results in total investments 2005-30 of €29.7 billion of which €9.3 billion alone account for IMO changes.

Running the PRIMES Reference scenario projections on the Concawe model while keeping trade levels 2005-30 constant would require €29.2 billion of investments in that period, of which €13.3 billion would have to be spent due to the new IMO changes. The same demand projections combined imports of gas oil and diesel 2005-20 to 40 million tpy from 20 million tpy (and staying at that level every year thereafter to 2030) will, however, require total investments of €25.8 billion 2005-30, of which IMO changes alone amount to €11.7 billion.

Concawe estimates that the amount of investments that the refining industry in Europe has already committed to spending (or what it calls "firm projects") 2010-20 is on the order of €13.3 billion. Note in addition that according to the Concawe model results, cumulative refining investments 2005-20 are higher than for 2005-30, a reflection of falling demand in petroleum products according to the PRIMES demand projections. This highlights a particular dilemma faced by refiners of investing early in capacity that will only be partially utilized later in the non too-distant future.

Utilization of refining units

According to OURSE model results, in terms of changes in refining capacity from 2005 levels by 2030 (Fig. 4), whether or not new IMO regulations are assumed, similar reductions in the use of simple refining capacity can be expected to occur, while similar increases in the use of cokers and hydrodesulfurization units should result. In addition, assuming IMO changes will require a large increase in the use of residual hydrodesulfurization and some 22% increase in the use of hydrocracking units.

Note again that there is very little difference between the PRIMES Baseline and Reference cases in terms of the demand projections in petroleum products for the EU.

CO2 emissions

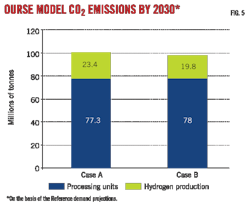

Whether or not IMO changes are assumed in the OURSE model makes little difference in terms of CO2 emissions from EU+3 refineries by 2030, which are projected to emit around 100 million tonnes of CO2 (Fig. 5). This compares with 118.5 million tonnes of CO2 in 2005,14 the fall in emissions resulting from falling production of petroleum products.

Note however that in both cases, a growing proportion of the CO2 emissions will come from the needs for hydrogen in refineries (hydrocracking units use hydrogen to upgrade heavier fractions into lighter products while hydrodesulfurization units use hydrogen to chemically remove the sulfur), so that by 2030, 20% of all CO2 emissions from EU refineries will come from hydrogen production, compared with only 14% in 2005.

Specifically, CO2 emissions due to the IMO changes amount to 3.3 million tonnes of CO2 in the Reference case, essentially as a result of the extra emissions from hydrogen use.

Changing the crude-supply assumptions towards an increase in the sulfur content of the EU crude diet (by keeping the proportion of high middle distillate-yielding crudes, as explained previously) would, however, result in a level of CO2 emissions of 110.3 million tonnes in 2030, 5.6 million tonnes as a direct result of new IMO changes.

In contrast, the Concawe refining model's results reveal that in spite of declining market demand for fossil fuels, processing intensity in refining increases as a result of more stringent product specifications, particularly in the case including IMO changes, and consequently that refinery CO2 emissions will increase somewhat 2005-30, by around 6% (and increasing by 12% 2005-20). OGJ

Notes

1. The POLES (Prospective Outlook for the Long-term Energy System) model simulates the energy demand and supply for 32 countries and 18 world regions. Further details on the OURSE refining module of POLES can be found in an annex to the Working Paper (http://ec.europa.eu/energy/infrastructure/strategy/2020_en.htm).

2. Concawe is the oil companies' European association for environment, health and safety in refining and distribution. The Concawe EU refining model simulates the EU (including Switzerland and Norway) refining system. More information on the model can be found on the internet site of the association (www.concawe.be).

3. The Concawe EU refining model makes the same assumptions as OURSE with regard to the timing and nature of the fuel specification changes in the ECAs, while for the rest of the world it assumes that the change to 3.5% from 4.5% already occurs in 2010.

4. Current technology cannot achieve reductions in the sulfur content of residues to 0.1% unless a very low sulfur feed is used. Even if it were possible, it is questionable whether refiners would not prefer to focus instead on converting residual fuel to lighter, more valuable fuels, and decide to stop supplying the bunker market altogether.

5. The Concawe model's supply growth projections reveal an 11% drop in the 2005-30 period.

6. The Concawe European refining model is run with fixed imports and exports outside the EU and therefore keeps the trade situation constant over time. The sensitivity of the model to trade flows was, however, tested by changing the assumptions made with respect to the volumes of exports and imports to reflect the trade situation projected by the OURSE model.

7. The Concawe model assumes no change in crude mix over time.

8. Topping refining is the simplest configuration of refining and a part of the distillation process. It thus involves no treating or conversion.

9. The CO2 from automobile regulations included in the PRIMES Baseline and Reference scenarios require strong reductions in the average fuel consumption of new cars. Binding targets are 130 g/km by 2010 and 115 g/km by 2020. (It should be noted that the regulation contains a provisional goal of 95 g/km for 2020.)

10. Note that the differences between demand projections under the Baseline scenario and the Reference scenario are not significant enough to make any notable difference in terms of investments according to the OURSE model outputs.

11. Delayed coking units are a type of deep conversion unit, which are the most sophisticated refining units. Cokers crack residual oil hydrocarbon molecules into coker gas oil and petroleum coke.

12. The process whereby hydrocarbon molecules of petroleum are mainly broken into jet fuel and diesel oil components by the addition of hydrogen under high pressure in the presence of a catalyst.

13. Hydrotreating of vacuum gas oil is a process that removes sulfur and nitrogen from vacuum gas oil, which is the product recovered from vacuum distillation.

14. IFP estimations of EU refineries' CO2 emissions. In comparison to 118.5 million tonnes of CO2 emitted in 2005. Note that this does not include emissions related to petrochemical activities.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com