OGJ Newsletter

General Interest — Quick Takes

API, NPRA question EPA's proposed ozone limits

Two witnesses from oil industry trade associations separately questioned the US Environmental Protection Agency's plan to significantly toughen ground-level ozone emission limits as they testified at EPA hearings in Houston and Arlington, Va.

EPA's own science does not even support such a move, according to Ted Steichen, a policy advisor at the American Petroleum Institute, and David Friedman, environmental affairs director at the National Petrochemical & Refiners Association.

Neither EPA's review in 2008 nor more recent studies justify lowering the standard based on the health effects of exposure, Friedman continued in his prepared statement at the hearing in Arlington. "The science…during the 2008 review and the latest studies have not changed the earlier conclusion. In fact, in the current reconsideration, EPA indicates that it will rely only on the previous record and not consider any new evidence," he said.

Testifying in Houston, Steichen emphasized progress that has been made improving the nation's air quality in large part through oil and gas industry efforts. More efforts will follow under the existing ozone standards because of pollution controls which are in place or which soon will be implemented, he said.

Cleaner fuels brought to market now and in the future will result in cleaner air for decades to come as cleaner engines are put in place, Friedman said in his prepared statement. "We will see cars and trucks producing significantly lower emissions. In addition, emissions from power plants will be cut in half by 2015. The current National Ambient Air Quality ozone standard is working," he said.

Moving forward with significantly lower ozone limits if there are no demonstrable benefits could unnecessarily increase energy costs, cut jobs, and reduce domestic energy development and energy security, he continued. "These rules represent a stop sign on the road to economic recovery, and will lead to further loss of American manufacturing jobs and increased reliance on imported gasoline and diesel fuel," Friedman warned.

Sabine Neches Waterway reopens after spill

The Sabine Neches Waterway at Port Arthur, Tex., has been reopened to limited tanker traffic while clean-up continues of crude oil spilled after a tanker-barge collision Jan. 23 (OGJ Online, Jan. 26, 2009).

Closure of the waterway caused minor disruption of refinery operations at Port Arthur and nearby Beaumont.

About 462,000 gal of crude entered the water when a barge being pushed by the Dixie Vengeance towing vessel punctured the hull of the 95,660-dwt Eagle Otome tanker.

Cause of the collision remained unclear after the US Coast Guard raised doubts about earlier reports that the tanker had lost power. USCG said three tugs escorted the damaged tanker to the Sunoco Inc. terminal at Beaumont for discharge of the remaining cargo.

"We are doing everything we can to provide much-needed relief to the region's four large refineries," said USCG Capt. J.J. Plunkett, captain of the port and federal on-scene coordinator for the response.

House bill reintroduced to recover royalties

Two US House members reintroduced legislation that they said could recover as much as $54 billion in federal offshore royalty payments that were mistakenly exempt in the late 1990s.

The measure would require producers that hold such leases to renegotiate terms before being able to bid on newly offered tracts. The leases originally were issued without a requirement to pay federal royalties to stimulate Gulf of Mexico deepwater exploration and development. They were erroneously exempted from royalty payments when price thresholds were omitted from 1996 to 2000.

"Instead of oil companies drilling for free on public land, we should be drilling for deficit dollars by fixing this taxpayer rip-off," said Rep. Edward J. Markey (D-Mass.), who chairs the House Select Committee on Energy Independence and Global Warming. "Half of our trade deficit in 2008 was from buying foreign oil, and $54 billion of our national budget deficit could be solved by keeping oil companies honest."

The bill's cosponsor, Rep. Chris Van Hollen (D-Md.), who co-chairs the bipartisan Renewable Energy and Energy Efficiency Caucus, said that the bill would close what he termed a "costly, special interest loophole."

Exploration & Development — Quick Takes

Group signs Halfaya development contract

A group led by PetroChina Co. Ltd. has signed its service contract for development of supergiant Halfaya oil field in Iraq (OGJ, Dec. 21, 2009, Newsletter).

The 20-year contract, with state-owned Missan Oil Co., calls for an increase in production to a plateau of 535,000 b/d from 3,100 b/d at present.

The group will receive a remuneration fee of $1.40/bbl when production exceeds 70,000 b/d and must sustain output at the plateau rate for 13 years. The contract provides for cost recovery.

The Iraqi oil ministry said seven wells drilled in Halfaya field have appraised oil in multiple Tertiary and Cretaceous formations since discovery in 1976. Current production is from four wells completed in Cretaceous Mishrif and Nahr Umr zones.

The field is a northwest-southeast trending anticline about 30 km long and 10 km wide. It's 35 km southeast of Amara.

PetroChina has a 37.5% interest in the consortium. Total E&P Iraq and Petronas Carigali Sdn. Bhd. hold 18.75% each. State partner South Oil Co. has a 25% interest.

European unconventional gas attracts firms

The Ukraine unit of EuroGas Inc., New York, acquired three unconventional gas concessions in eastern Ukraine's Donbas basin and increased activities in the Lublin basin that extends from Poland into western Ukraine.

The acquisition brings to five the number of shale gas and coalbed methane concessions held by EuroGas Ukraine Ltd. in eastern Ukraine under a joint activity agreement with Nadra Luganshchiny Ltd.

The five concessions total 512 sq km, and the largest, Marijewvskogo Poligon, covers 251 sq km. Horizontal drilling is to start this year.

Meanwhile, EuroGas GMBH signed a memorandum of understanding to explore for unconventional gas, such as shale and CBM gas, in the Lublin basin where it was the first foreign company to successfully drill a CBM well in the Ukrainian sector in the late 1990s.

Meanwhile, Realm Energy International Corp., Vancouver, BC, said it applied for oil and gas rights in eight undisclosed basins in seven unidentified European countries where it plans to exploit shale gas on more than 1.5 million acres.

Realm Energy, which is collaborating with Halliburton Consulting to apply North American shale gas technology in Europe, is evaluating other undeveloped shale plays and intends to make more applications in early 2010.

Gulfsands to develop Syria's Yousefieh oil field

Gulfsands Petroleum PLC expects to bring Syria's Yousefieh oil field on stream in early April. Gulfsands holds 50% interest and is the operator.

Recently, Syrian authorities granted Gulfsands a 25-year production license and a 10-year extension option. Yousefieh is 3 km east of Khurbet East field.

Production of 23º gravity oil is expected from two wells, Yousefieh 1 and Yousefieh 3, at an initial combined rate of up to 1,000 b/d.

Planning is under way to install permanent down-hole artificial lift equipment in both Yousefieh wells this year.

Yousefieh, on Block 26, was discovered in November 2008 (OGJ, Nov. 24, 2008, Newsletter).

At yearend 2008, Yousefieh was estimated to contain 11 million bbl of proved plus probable reserves. Gulfsands plans to issue a reserves update during the second quarter 2010. Another development well on Yousefieh is planned for 2010. Gulfsands anticipates Yousefieh production will reach about 6,000 b/d by 2012.

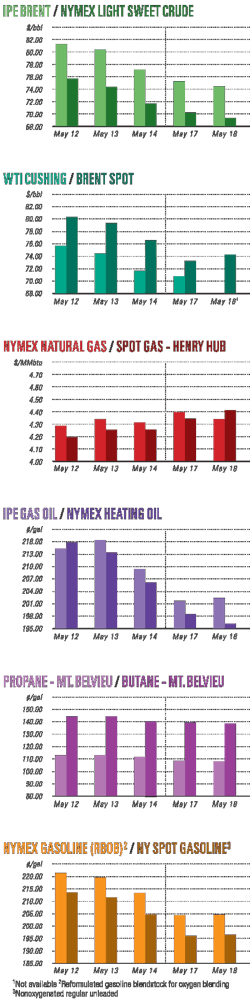

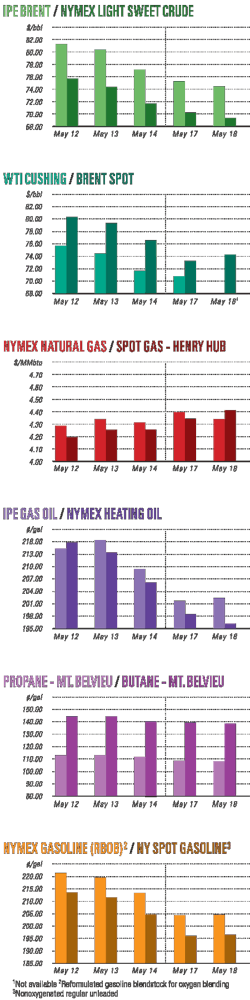

Industry Scoreboard

Drilling & Production — Quick Takes

BP reports work progress on Valhall deck

BP Norge has reported its 11,000-ton BP Valhall redevelopment integrated production and hotel facility deck has left the fabrication hall.

The main deck will measure 100 m in length, 47 m in width, and 50 m in height. It is expected that the structures' main deck, weather deck module, flare boom, and first and second bridges will leave the Heerema Zwijndrecht location in May or June for its final destination off Norway. Once completed, the topsides will weigh more than 13,000 tons, excluding power-from-shore module and living quarters.

Heerema Zwijndrecht was awarded the fabrication and integration contract in March 2007 for the topsides with the 350-ton flare-boom structure of which fabrication started in November 2007. It also received the award for the fabrication of the 2,000-ton weather deck module on June 23, 2009.

Contracts let for Brazil's first TLWP

The Papa Terra Joint Venture has let contracts for construction and installation of the P-61 tension-leg wellhead platform (TLWP) in the deepwater oil field for which it recently revived development off Brazil (OGJ, Feb. 1, 2010, Newsletter).

The TLWP, to be installed in 3,900 ft of water 70 miles offshore in the southern Campos basin, will be the first facility of its kind off Brazil. It will produce 14-17° gravity crude into a floating production, storage, and offloading vessel with production capacity of 140,000 b/d.

Partners Petroleo Brasileiro SA (Petrobras), operator, and Chevron Corp. had suspended Papa Terra development in early 2009 because of business conditions.

J. Ray McDermott SA reported the contract award as part of a larger project covering design, engineering, construction, transportation, installation, and a 3-year limited operations contract let to FloaTEC Singapore Pte. Ltd., a venture of Keppel FELS Ltd., J.Ray, and FloaTEC LLC.

Construction of the TLWP will occur at the yard of a Keppel FELS subsidiary at Angra dos Reis, Brazil. The FloaTEC Singapore joint venture will supply risers, well systems, and tendon components. J.Ray will install the unit and provide topsides engineering and procurement services. Completion is due by mid-2013.

Guara pilot production FPSO chartered

Petroleo Brasileiro SA (Petrobras) along with partners BG Group and Repsol YPF SA signed a letter of intent with the Schahin Group and Modec Inc. for a 20-year charter and operation of a floating production, storage, and offloading vessel that will be used for the Guara pilot production.

Guara is a presalt oil discovery in the Santos basin on Block BM-S-9 off Brazil.

The FPSO will have 65% Brazilian content and be capable of handling 120,000 bo/d and 5 million cu m/day of gas. Conversion work on the hull will take place outside of Brazil while several modules will be integrated in Brazil.

Petrobras expects Guara to go on stream in late 2012.

Flow tests, limited by equipment capacity, on the Guara presalt discovery well 1-SPS-55 (1-BRSA-594), in 2,141 m of water, produced at about 7,000 bo/d and Petrobras estimates that the well initially could produce at about 50,000 bo/d (OGJ, Sept. 14, 2009, Newsletter). Petrobras believes that the area contains about 1.1-2 billion bbl of recoverable 30° gravity oil.

Operator Petrobras holds a 45% interest in the block. The remaining interest is held by BG 30% and Repsol YPF 25%.

Tullow plans Ugandan oil production this year

Tullow Oil PLC plans to begin oil production from its Uganda fields this year, starting at 500-1,000 b/d and rising to 10,000 b/d next year before reaching 150,000 b/d in 2015.

Initial production at midyear will not be "economically significant, but it is a great step forward for Ugandans to know that their oil is being used for industrial use," said Tullow Chief Operations Officer Paul McDade.

"We would like to produce oil on a test basis to see how the oil wells behave and how the crude can be transported by truck since it is waxy. We will have to heat the oil to keep it flowing," said McDade. The oil will be produced from Block 2, which is 100% owned by Tullow.

McDade said Tullow plans to invest $300-400 million in the initial phase, rising to $5 billion to reach the 150,000 b/d level. He said initial production will be used for local industry and power generation.

In addition to Block 2, Tullow has a 50% stake in Block 1 and in Block 3A. Tullow Uganda Ltd. recently entered into an agreement with Heritage Oil & Gas Ltd. and Heritage Oil PLC to purchase their entire interest in Blocks 1 and 3A (OGJ Online, Jan. 28, 2010)

Anticipating its takeover of the Heritage blocks, Tullow is considering farm outs. According to McDade, the two companies that Tullow prefers to work with are China National Offshore Oil Corp. and Total SA. "The Chinese are best in building refineries, and they move fast. CNOOC has just built a big refinery in China [that] can refine the same quality of oil as in Uganda. They built it in a period of 2 years."

Tullow recently announced plans to sell more than 80 million shares, equivalent to 10% of the outstanding equity in the company, to accelerate plans to develop huge oil discoveries in the Lake Albert Rift basin. Tullow Chief Financial Officer Ian Springett said the cash would also be used to help to buy out Heritage Oil's stake.

Production rising at Mangala field in India

Oil production from Mangala field in Rajasthan, India, has reached 20,000 b/d from five wells as work progresses to expand capacity of a processing terminal, reports Cairn Energy PLC.

The field, part of a complex that includes nearby Bhagyam and Aishwariya fields, started up last August and averaged 15,430 b/d in fourth quarter 2009 (OGJ, Sept. 7, 2009, Newsletter).

A 30,000-b/d train is on line at the Mangala Processing Terminal (MPT), which eventually will have four trains with total capacity of 205,000 b/d and room for expansion. Approved plateau production for the complex is 175,000 b/d.

Start-up of two more trains will expand MPT capacity to 125,000 b/d by the end of June.

Production now moves by truck to the Gujarat coast for shipment in heated tankers to refineries operated by Reliance Industries Ltd. and Mangalore Refining & Petrochemicals Ltd.

Cairn India is commissioning a 590-km, 32-in. insulated pipeline between the MPT and Salaya, near RIL's 660,000-b/d and 580,000-b/d refineries at Jamnagar, heated to keep the crude oil temperature above 65° C.

At Mangala, the company has drilled 45 producing wells, of which 33 have been completed in the Paleocene Fatehgarh formation and are producing or awaiting start-up. Three of the wells are horizontal. The company has been operating two rigs and a completion unit in the Mangala development area and soon will add a third rig.

Cairn also has drilled eight wells in Raageshwari Deep gas field, production from which combines with Mangala associated gas to fuel steam turbine generators at the MPT and heaters for the crude pipeline. The company said one Raageshwari well, Raag-14, tested gas at a field-high rate of 15.7 MMscfd after a hydraulic frac.

Construction is complete on the Raageshwari gas terminal, about 80 km south-southeast of the MPT, and facilities 20 km southeast of the MPT to produce water for secondary recovery.

Cairn has a pilot project testing enhanced recovery with polymer and alkaline-surfactant-polymer injection, which the company estimates might boost recovery from the Mangala complex by 300 million bbl.

Processing — Quick Takes

Sunoco shuts refinery, sells PP business

Sunoco Inc. has made permanent its closure of the 150,000-b/d Eagle Point refinery at Westville, NJ, and is selling its polypropylene business to Braskem SA.

The company idled the refinery, which is interconnected with its refineries at Philadelphia and Marcus Hook, Pa., last November (OGJ Online, Oct. 6, 2009).

It said it has permanently shut down the refinery, citing "continuing weak demand for refined products and unfavorable market conditions."

Product storage and handling operations will continue at Eagle Point. Sunoco is considering options for the site, including biofuels production.

The company said it expects to report a loss for the first quarter of 2010 of $185-195 million.

Braskem, Sao Paulo, Brazil, will pay $350 million cash for Sunoco's PP plants in Marcus Hook; La Porte, Tex.; and Neal, W.Va. The plants can produce a combined 2.1 billion lb/year of the polymer.

Braskem also will acquire Sunoco's Research and Technology Center in Pittsburgh.

Foster Wheeler to study Ugandan refinery

The Ugandan government has let contract to Foster Wheeler AG's Global Engineering & Construction Group for a feasibility study of a 150,000-b/d refinery, which would be Uganda's first.

The Ministry of Energy and Minerals Development last year disclosed plans to study a 50,000-b/d refinery, saying production from recent Ugandan discoveries might reach 100,000 b/d (OGJ, Aug. 10, 2009, Newsletter). The country produces no crude oil at present.

The Foster Wheeler study will cover location and configuration of a refinery and options for oil-field development, crude transportation, and evaluation of alternatives to refinery construction such as pipeline export. Completion is due in midyear.

QP awards NGL control system contract

Qatar Petroleum has let a contract to Cegelec of Paris to replace, over the next 18 months the turbine and compressor control system for two NGL production trains in Mesaieed, Qatar.

Under the $15 million contract, an integrated GE-Mark VI system will replace the existing pneumatic control system for Trains 1 and 2, the Cegelec announcement said. In addition, the existing fire-protection system will be replaced with a water-mist system interfaced with the new control system.

This contract follows an earlier $40 million turnkey contract awarded to Cegelec to design and build a blast-proof control building at the QAPCO petrochemical complex, also in Mesaieed.

Cegelec has also provided technical assistance and commissioning for Phase 2 of the common water-cooling system in Ras Laffan, where the end customer was QP.

Transportation — Quick Takes

Golar, PTTEP cancel FLNG project off Australia

Golar LNG Energy, Bermuda, and Thailand's PTTEP have cancelled their heads of agreement and joint study agreement signed last year to develop a floating LNG (FLNG) project off northwest Australia.

At the same time, the two companies also announced termination of a memorandum of understanding for the global cooperation to identify and develop other FLNG projects.

The Australian part of the agreement to enter into front-end engineering and design studies for the FLNG project on a 50-50 basis was signed in July 2009.

The plan was to develop stranded gas reserves in the Timor Sea originally found by BHP Petroleum Ltd. in the 1980s and then bought by Coogee Resources before PTTEP took over Coogee in late 2008. The main gas fields are Cash, Maple, Biliara, Tahbilk, Pathaway, and Montara.

The companies have not revealed a reason for the split, but Golar LNG says it will continue to pursue FLNG projects that fit its financial objectives and technical capabilities. The company added it still believes highly cost-efficient approaches to gas development based on FLNG are the key to substantial additional growth opportunities.

Alaska Pipeline Project files for open season

The Alaska Pipeline Project (APP) filed its plan with the US Federal Energy Regulatory Commission for approval to conduct its open season on a potential pipeline to move natural gas from the Alaskan North Slope to Alberta and on to the US. Members of the public can provide comment through the month of February. Pending approval, APP will finalize its open season and provide it to potential shippers at the end of April for assessment through July.

Two options will be submitted for shipper assessment in the open season. The first option is a 1,700-mile pipeline from ANS to Alberta, from where the gas could be delivered on existing pipeline systems to the US. The second option would transport gas 800 miles from ANS to Valdez, Alas., where it would be converted to LNG in a facility to be built by others and then delivered by ship to North American and other international markets.

Both options would allow off-take by Alaskan customers. Both also would include a gas treatment plant and a 58-mile pipeline from Point Thomson fields to the plant and main transmission line.

The results of the open season will determine the preferred development option. The open season process initiated with FERC applies to the US portion of the project. A separate but coordinated open season will occur for the Canadian portion of the project.

Updated cost estimates for the project are $32-41 billion for the ANS-to-Alberta option, and $20-26 billion for the Valdez option. Both options have an expected in-service date of 2020 and would provide capacity of either 4.5 bcfd (Alberta) or 3 bcfd (Valdez).

The project is a joint effort among TransCanada Corp. and ExxonMobil Corp. under the Alaska Gasline Inducement Act. ExxonMobil reaffirmed its commitment to this project, despite recent North American unconventional gas acquisitions, earlier this week (OGJ Online, Jan. 25, 2009).

Denali—a consortium of BP PLC and ConocoPhillips—will submit its open season package to FERC in April.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com