Global capacity growth slows, but Asian refineries bustle

One bright spot for US refining in 2010 has been the start-up in March of Marathon Oil Corp.'s 180,000-b/d expansion of its Garyville, La., refinery (OGJ Online, Mar. 11, 2010). It brought total crude capacity to 436,000 b/d. Marathon completed the expansion in late 2009. New processing units include a 44,000-b/d coker, a 65,000-b/d reformer, a 70,000-b/d hydrocracker, a 74,000-b/d kerosine hydrotreater, and sulfur and hydrogen plants. Photo from Marathon Oil.

Warren R. True

Chief Technology Editor—LNG/Gas Processing

Leena Koottungal

Survey Editor/News Writer

Crude oil distillation capacity worldwide advanced again in 2010, according to the latest OGJ Refinery Survey, setting a record for the ninth year in a row.

For 2010, OGJ's survey shows total capacity at more than 88.2 million b/cd in 662 refineries, an increase of 1 million b/cd over the figure for 2009 of 87.2 million b/cd for 661 refineries. OGJ's refinery survey for 2008 listed a global capacity of 85.6 million b/cd in 655 refineries.

The 2010 capacity growth, although smaller than for the previous year, is still well ahead of growth for 2008 (300,000 b/cd), 2007 (130,000 b/cd), and 2006 (52,000 b/cd). And the net growth in refineries was slower than in 2009—but it was growth nonetheless and continues the trend started last year, which itself reversed a steady 10-year contraction.

Fig. 1 shows the trend in operating refineries and worldwide capacity.

Asian capacity continued to lead the world, growing by nearly 1.5 million b/cd. Three new refineries started up in 2010, all in bustling Asia-Pacific, as was the case in 2009. North America's capacity remained virtually flat, while Western Europe's contracted as companies closed inefficient plants or otherwise rationalized capacity to meet changing market demands.

Other regions experienced little or no net gain or loss in stated capacity, although activity in the Middle East has been brisk.

Largest refining companies

Table 1 lists the top 25 refining companies that own most worldwide capacity. Table 2 lists companies whose plants total more than 200,000 b/cd of capacity in Asia, the US, and Western Europe. Capacities from Tables 1 and 2 include partial interests in refineries that the companies do not wholly own.

Major changes of positions in Table 1 since Jan. 1, 2010, involve only Chevron; Valero moves down two notches; China National Petroleum Co. and Total each moves down a notch. Chevron's move is based on capacity increases at GS Caltex and Caltex Australia. Valero completed the sale of refineries, as noted later. CNPC moved as a result of Valero's changes, and Total reported decreased capacities. Other refiners remained at the same ranking as they started the year.

Other changes in capacity that appear in Tables 1 and 2 are due to adjustments in declared capacity. In Table 2, Shell exchanged positions with JX Nippon Oil and Indian Oil Co. Ltd. (9 to 6) and Chevron (18 to 15) both moved up in the Asia list; for the US, Valero moved to No. 3 from No. 2 on the strength of closings or sales. ExxonMobil moved up to No. 2; and LyondellBasell switched places with Alon USA; Petroplus in Western Europe dropped to 9 from 6.

Table 3 lists the world's largest refineries with a minimum capacity of 400,000 b/cd. Table 4 lists regional process capabilities as of Jan. 1, 2010.

New crude capacity

Growth in capacity for 2010 has centered almost entirely in Asia and the Middle East, as the regions continued to add new and expand existing refineries to meet anticipated markets in the two regions.

Asia-Pacific

By far most of the world's refining-capacity growth is going on in Asia, with China and India leading the way.

• In China's Yunnan province in September, CNPC began building pipelines and a refinery to transport and process oil and natural gas to be imported from Myanmar beginning in 2013.

CNPC began building the $3.4 billion, 200,000-b/d refinery in Anning City, including a crude distillation unit and 14 other main processing elements. Feedstock for the refinery will come via a new 440,000-b/d oil pipeline from Kyaukryu, a port city on the west coast of Myanmar. Oil for the line will come from China's Middle Eastern and African suppliers.

It extends nearly 500 miles inside Myanmar then enters China at Ruili, in Yunnan province from where it extends more than 1,000 miles to reach Anning.

The pipeline and refinery are to begin operating by 2013 and could produce 7.8 million tpy of oil products for the province and neighboring Guizhou province and the Guangxi Zhuang Autonomous Region (OGJ Online. Sept. 13, 2010).

Plans for a 300,000-b/d refinery on Donghai Island at Zhanjiang in South China's Guangdong Province moved ahead earlier this fall when China's Ministry of Environmental Protection approved the $9 billion project to be jointly owned by Kuwait Petroleum Corp. and Sinopec, according to media reports.

Also part of the project will be a 1-million-tpy ethylene plant and other crude oil and product facilities.

Still to be obtained, however, is formal approval from the Guangdong provincial government's Ministry of Land and Resources. China's National Development and Reform Commission had already approved the project in May.

The project will also include a retail network in Guangdong province and connections to neighboring provinces. Kuwait will supply crude for the refinery. KPC and Sinopec will each hold 50% in the joint venture, with KPC planning to give 20% of its share to potential international partners.

Also in September, China's largest oil company, PetroChina Co. started up its new 200,000-b/d refinery at the port city of Qinzhou in the Guangxi region near Vietnam after an investment of $2.2 billion. The refinery consists of a 70,000-b/d heavy residue catalytic cracker, a 44,000-b/d continuous reforming unit, and a 44,000-b/d hydrocracking unit, according to media reports.

Also in September, PetroChina received NDRC approval to double capacity to 10 million tpy at its refinery in the northern province of Hebei. Production at the expanded plant will start in December 2012, according to company parent CNPC.

PetroChina will also build petrochemical units at the refinery, including a 1-million-tpy ethylene plant. CNPC said the expansion's capacity would make the plant the 14th Chinese refinery with capacity of at least 200,000 b/d.

Work is under way to expand capacity at Essar Oil's refinery at Vadinar in India's Gujarat state to 375,000 b/sd from 300,000 b/sd. Essar Oil is a subsidiary of Essar Energy PLC. With a Nelson complexity of 11.8, the expanded refinery will be one of the world's most complex refineries, says Essar Oil. Photo from Essar Oil.

In September, it appeared Russia's Rosneft and CNPC had resolved a stubborn conflict over crude oil supply to a planned, jointly owned 300,000-b/d refinery and petrochemical complex valued at $3-4 billion in Tianjin. Rosneft will own 49%; CNPC 51%.

Under the agreement, Russia will supply 70% of the planned refinery's feed with the remaining 30% coming from unidentified Asian sources (OGJ Online, Sept. 2, 2010).

Also in September, China National Offshore Oil Co. began commissioning the 20,000-b/d first phase of its 200,000-b/d refinery in Yingkou, Liaoning province, according to press reports. Second-phase construction will take the refinery to full capacity.

In addition, CNOOC plans to build a refinery in Dongying, Shandong province, capable of processing about 200,000 b/d.

In October, the Chinese news outlet People's Online Daily reported that the Xinjiang Uygur Autonomous Region had near-term plans to establish four internationally competitive petroleum refining bases, each with a production capacity of 10 million tpy.

The four refineries will be spread among Dushanzi, Urumqi, Karamay, and Kuqa cities to promote construction of industrial clusters and extend related chains of petroleum and petrochemical industries, said the web site.

Currently, it said, Xinjiang's petroleum refining capacity exceeds about 22 million tpy.

• In India earlier this year, Hindustan Petroleum Corp. Ltd. was upgrading its two refineries to produce high-speed diesel and gasoline to meet Euro 4 emissions standards.

HPCL had let two engineering, procurement, construction, and commissioning contracts to Technip for diesel desulfurization at its 164,000-b/cd Visakh refinery in Andhra Pradesh on India's east coast. Under one contract, Technip will provide a 2.2-million-tpy diesel hydrotreater; the other contract is for a 36,000-tpy hydrogen-generation unit. Among other work at Visakh, HPCL has reported plans for delayed coking.

At its 132,000-b/cd Mumbai refinery, HPCL is installing a 2.2-million-tpy diesel hydrotreater and a 20,000-tpy hydrogen generation unit as well as a 1.4-million-tpy fluid catalytic cracking unit, which will join a 1-million-tpy FCCU already in place. Also at Mumbai, HPCL was reported to be studying adding solvent deasphalting (OGJ Online, Apr. 1, 2010).

Last month, Nagarjuna Oil Corp. said by yearend 2011 it will commission its Cuddalore refinery in Tamil Nadu, about 125 miles south of Chennai on the east coast. Work began on the refinery in 2006.

The 6-million-tpy unit, estimated to cost about $157 million, will start processing crude oil in December 2011 and reach full commissioning by March 2012, said a company official.

NOC has contracted with BP PLC for crude oil that will be processed at the refinery. BP will also be responsible for exporting 25% of fuel produced there with the remainder serving domestic markets. The plant will produce Euro IV and Euro V auto fuels, LPG, and bitumen.

Nagarjuna Fertilizer holds 51% in the project, while Tata Petrodyne, a unit of Tata Group, holds 30%. The Tamil Nadu government holds 5%, Uhde of Germany 4%, and Cuddalore Port 10%.

In June, Mangalore Refinery & Petrochemicals Ltd. let a €25-million contract to Technip for work associated with an expansion of MRPL's Mangalore, India, refinery, according to the Paris-based company. MRPL is a unit of Oil & Natural Gas Corp. Ltd., which owns 71.62% of the company.

Technip described its work as part of a third phase of expansion that would push crude capacity to 300,000 b/d. The company is providing design, engineering, supply, and installation of fired heaters for crude distillation, vacuum distillation, delayed coking, and petrochemical FCCUs.

In February, MRPL had announced an expansion of the refinery's nameplate capacity, to 236,000 b/d from 194,000 b/d. It said it had been operating the plant, which has two hydrocrackers and two continuous catalytic reformers, at 115-130% of capacity for 4 years (OGJ Online, June 8, 2010).

And in August, Essar Energy, Mumbai, said an expansion and upgrade of its 300,000-b/sd refinery at Vadinar, India, was on schedule except for two of nine processing units, including a delayed coker. The expansion was to take total throughput capacity to 375,000 b/sd and is due on line by March 2011.

Last month, Essar Oil announced further plans to expand the refinery to 415,000 b/d by September 2012. The company will revamp six units: fluid catalytic cracking, diesel hydrodesulfurization, sour water stripping, diesel hydrotreating, vacuum gas oil hydrotreating, and delayed coking (OGJ Online, Nov. 10, 2010).

In addition to crude and vacuum distillation, the refinery's main units are FCC, continuous catalytic reforming, diesel hydrodesulfurization, and naphtha hydrotreating. The plant began commercial operation in May 2008.

Vadinar, near Jamnagar on India's west coast, is also where Reliance India Ltd. completed a refinery next to an existing plant that brought total capacity to 1.24 million b/d (OGJ Online, Aug. 20, 2010).

• In neighboring Bangladesh in August a Saudi investment group announced it had joined a Bangladeshi industrial conglomerate to invest nearly $1 billion to expand Bangladesh's only refinery, according to area media reports.

Marasel Co. of Saudi Arabia and Beximco of Bangladesh set up a joint venture to fund a trebling of capacity at the 33,000-b/d Eastern Refinery Ltd. plant at the port of Chittagong. Bangladesh Petroleum Corp. had solicited interest in the project, which would include installation of single-point mooring and a pipeline. The refinery fills about 40% of the country's demand for oil products (OGJ Online, Aug. 31, 2010).

In addition to crude and vacuum distillation capacity, OGJ refinery data show the refinery has capacities for visbreaking (10,000 b/d), catalytic reforming (1,800 b/d), mild cat hydrocracking for distillate upgrading (1,200 b/d), and catalytic hydrotreating for reformer feed (2,000 b/d).

In August, the Vietnamese government announced it had approved plans to raise capacity at the Dung Quat refinery to 200,000 b/d from 148,000 b/sd. Vietnam's only refinery began operating in February 2009 owned by state company Petrovietnam through Binh Son Refining & Petrochemical Co. Ltd (OGJ Online, Aug. 13, 2010).

Malaysia's Petronas is studying whether to expand and upgrade Train 1 at its Malacca refinery to produce higher quality fuels and meet rising domestic demand after recently expanding plant capacity to 290,000 b/d, according to media reports earlier this fall.

Upgrades will allow the state-owned company to process more sour crude there, as the country's sweet crude production declines. The study will determine capacity and investment costs and is to be completed in first-quarter 2011.

Train 1 currently has design capacity of 100,000 b/d but operates at 120,000 b/d and processes only locally produced sweet crude. Earlier this year, Petronas started up a new 50,000-b/d hydrocracker at Malacca, which raised overall refining capacity at Train 2 to 170,000 b/d.

Petronas owns 53% of the refinery, while ConocoPhillips owns the remaining 47%.

And in Indonesia last summer, state-owned PT Pertamina and Kuwait Petroleum Corp. announced plans to invest $9 billion in a joint venture 300,000-b/d refinery in Balongan, West Java (OGJ Online, July 30, 2010).

And in May, State Oil Co. of Azerbaijan announced plans to build an oil and gas processing and petrochemical complex some 45-50 km south of Baku at Sangachal, where the Caspian's main oil and gas pipelines reach shore, to be completed 2018-20 (OGJ Online, May 21, 2010).

SOCAR plans call for a 40-billion cu m gas processing plant, a 300,000-b/d refinery, as well as chemical, petrochemical, and power plants.

Technip SA and Foster Wheeler Ltd. were conducting the feasibility study of the complex as well as SOCAR's existing downstream, including the Baku Oil Refinery and the Oil Refinery Azneftyag, both in Baku. In first-quarter 2010, the two refineries produced more than 1.24 million tonnes of oil products compared with about 1.12 million tonnes in first-quarter 2009.

Middle East, Africa

Last summer, member countries of the Organization of Petroleum Exporting Countries made it known they would be investing heavily in downstream over the next few years despite uncertainties in the global economy.

OPEC General Secretary Salem Al Badri said that members would invest around $40 billion in refining capacity expansions, according to the regional publication Gulf Times.

In 2009, he said, about 30 projects brought on line 1.5 million b/d in net crude oil and liquids capacity in OPEC countries. Over the next 5 years, some 140 projects would add about 12 million b/d of crude and liquids capacity representing an investment of about $160 million.

An example would be Saudi Aramco's plans, announced in January of this year, to build and finance the $10 billion Jazan refinery with capacity of 250,000-400,000 b/d (OGJ Online, Jan. 20, 2010).

King Abdullah bin Abdul Aziz al-Saud approved the project in 2006 as part of wider development plans for the southern province, but bidding had been delayed as the country tried to generate interest in the project among companies outside the country.

But disappointment dogged another Aramco project when in April ConocoPhillips withdrew from its venture with Saudi Aramco to build a 400,000-b/d export refinery at Yanbu City, on Saudi Arabia's Red Sea coast (OGJ Online, Apr. 21, 2010).

The partners suspended work on the project during the 2008 economic crash but reinstated it in mid-2009. ConocoPhillips had said in late 2009 that it was trimming its downstream business and that it would make a decision about the Yanbu project this year (OGJ, Nov. 16, 2009, p. 68).

In response to the withdrawal of ConocoPhillips, Aramco said it was "evaluating options to progress the Yanbu project."

That evaluation evidently convinced the company to proceed with the project, for in July it signed contracts with several local and international contractors for detailed engineering, procurement, and construction of the planned refinery. Red Sea Refining Co., newly incorporated since ConocoPhillips's pullout, is now responsible for execution and operation of the project.

The grassroots, full-conversion refinery in Yanbu Industrial City will process Arabian Heavy crude and produce 90,000 b/d of gasoline, 263,000 b/d of ultralow-sulfur diesel, 6,300 tonnes/day of coke, and 1,200 tonnes/day of sulfur. It will use existing Aramco facilities to receive oil and export refined products and will include refinery process units, utilities and interconnecting piping, associated feedstock and refined product storage, as well as off site facilities to support refinery operations, according to a company statement at the time (OGJ Online, July 28, 2010).

Earlier in the year, Saudi Aramco Shell Refinery Co. completed a project to increase production of ULSD at its 305,000-b/d refinery at Jubail. The 50-50 joint venture of Saudi Aramco and Shell built a high-pressure diesel hydrodesulfurization unit and revamped two crude units and an existing diesel HDS unit.

The Sasref hydrocracking refinery yields mainly middle distillates from Arabian Light crude. The new and revamped facilities began producing 100,000 b/d of diesel with less than 10 ppm sulfur. The project also included in-line blending and amine treatment (OGJ Online, Mar. 17, 2010).

Elsewhere, Iran in October reported it had concluded an agreement with an unnamed Malaysian firm to construct a £3 billion (about $4.8 billion) oil refinery in Gachsaran in Kohgiluyeh and Boyer-Ahmad province in southwestern Iran capable of producing 12,000 b/d of gasoline and diesel oil.

In Africa, a new refinery is planned for Tema in Ghana. The $1.8 billion, 12,000-b/d plant is to augment the country's refinery capacity at the 45,000-b/d Tema oil refinery, Current Ghana demand is pegged at about 65,000 b/d, according to government figures.

Ghana joined oil producing countries when commercial oil production began at Jubilee fields, off Cape Three Points earlier this fall.

And other media in the region reported last month that Uganda in 2012 will start building a $4.6 billion refinery in the northwestern Hoima district and complete it in 2015. Uganda will build the refinery with private industry, said Bloomberg.

Uganda is to become an oil producer next year when Tullow Oil PLC begins producing from the Kasamene field.

Refinery closures, sales

It will surprise no observer of global refining that, among highly industrialized nations, mainly the US, capacities shrank this year.

In August, Western Refining Inc. announced it was suspending operations at its 70,000-b/d Yorktown refinery in York County, Va., citing the "poor outlook for East Coast refining margins." The company continues to operate the Yorktown products terminal and storage.

The refinery had FCC and coking units in addition to distillate and naphtha hydrotreating, reforming, and LPG polymerization units.

In September, the company announced completion of the process, saying it would consider restarting it if the "refining economics on the East Coast improve" (OGJ Online, Sept. 13, 2010).

Earlier in the year, citing "continuing weak demand for refined products and unfavorable market conditions," Sunoco Inc. made permanent its closure of the 150,000-b/d Eagle Point refinery at Westville, NJ, and sold its polypropylene business to Braskem SA. The company had idled the refinery, which is connected with its refineries at Philadelphia and Marcus Hook, Pa., in November 2009 (OGJ Online, Oct. 6, 2009).

Also in August, ExxonMobil Corp. announced its Chalmette, La., refinery, operated in 50-50 joint venture with Venezuela's national oil company PDVSA, would shut down three units: a distillate hydrocracker, a gasoline reformer, and a coker. Refinery capacity was not to be affected. Closing the three secondary units in a reconfiguration was planned to save $8-9 million/month, according to Reuters.

OGJ's refinery data (www.ogj.com) has the plant's capacity as 189,000 b/d and its current throughput at about 159,000 b/d.

In Canada, earlier this year, Shell Canada Products halted operation of its 130,000-b/d Montreal East refinery and began converting it into a terminal for gasoline, diesel, and aviation fuel. In a press statement Shell said the refinery "no longer fits with Shell's long-term strategy." The company opened the refinery in March 1933 as a 5,000-b/d topping plant (OGJ Online, Jan. 14, 2010).

Refinery closings and capacity reductions have also hit Europe.

In July, ConocoPhillips cancelled plans to upgrade its 260,000-b/d refinery at Wilhelmshaven, Germany. The company had planned to add a coker, hydrocracker, and hydrogen units (OGJ, Dec. 21, 2009, p. 46).

And in Switzerland in October, Petroplus Holdings AG, Zug, began to shut down of its 60,000-b/d Cressier refinery in Neuchatel. The company attributed the action to the labor strike at the port of Fos Sur Mer, France, which it said was disrupting the supply of crude to the Cressier refinery. Reopening the plant would depend on market conditions following the end of the strike, said the company.

Petroplus operates six refineries in Europe with combined throughput capacity of 752,000 b/d. It had also begun to close its 84,800-b/d refinery at Reichstett, France (OGJ Online, Oct. 21, 2010). The company's other refineries are in the UK, Belgium, Germany, and France.

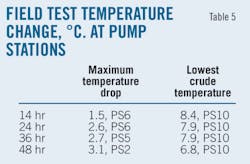

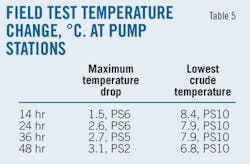

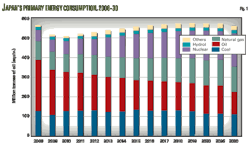

The other center for capacity reduction has been Japan, where refining overcapacity has been estimated at 1 million b/d.

In April, Idemitsu Kosan Co. announced plans to cut 100,000 b/d of crude capacity by March 2014. The firm said its 3-year program from fiscal 2010 calls for reducing its combined capacity at four Japanese refineries to 540,000 b/d from 640,000 b/d.

Idemitsu's decision followed continued reduction in Japan's oil consumption over several years due to more energy-efficient technologies and a shift to cleaner-burning natural gas.

The downturn was documented by Japan's Ministry of Economy, Trade, and Industry, which had foreseen a decline in the country's overall oil demand of 4.2% in the fiscal year started Apr. 1, 2010, after a drop of 4.6% the previous year.

In October, Reuters reported refiner JX Holdings Inc. was considering closing its Negishi refinery by business year 2020-21. JX had already said crude refining capacity at the Yokohama-based refinery would fall to 270,000 b/d after it scrapped a 70,000-b/d No. 2 crude distillation unit at the end of October.

Overall, JX planned to complete a reduction of 400,000 b/d in crude refining capacity by the end of the month in the face of declines in domestic oil demand and cut an additional 200,000 b/d by March 2014. By 2020, it plans to cut refining capacity to 1 million b/d.

Refineries have also been changing owners in predictable markets.

In October, Marathon Petroleum Co. agreed to sell its 74,000-b/d St. Paul Park, Minn., refinery, associated terminals, and other downstream assets in Minnesota to private Washington, DC-based equity firm Acon Investments LLC along with TPG Capital LP for $900 million (OGJ Online, Oct. 6, 2010).

Acon and TPG formed Northern Tier Energy LLC to operate the assets as a standalone company. Marathon, Acon, and TPG first announced signing a letter of intent in May (OGJ Online, May 19, 2010). Closing on the sale was anticipated by yearend 2010.

The St. Paul Park refinery has 27,100 b/d of FCC capacity and 18,500 b/d of semiregenerative catalytic reforming capacity.

In July, Murphy Oil Corp. announced plans to leave refining by selling its three refineries and to concentrate on exploration and production and US retailing. It said it would offer the refineries for sale, anticipating closing the transaction in first-quarter 2011 (OGJ Online, July 23, 2010).

Murphy's refinery locations and capacities are Meraux, La, 125,000 b/cd; Superior, Wisc., 33,250 b/cd; and Milford Haven, Wales, 106,000 b/cd. The company is also selling its UK retail system.

Earlier in the year, Petroplus Holdings agreed to buy Valero Energy's idle refinery at Delaware City and to resume refining operations after performing "major" maintenance work over the following 9 months.

Valero closed the refinery, capacity of which Petroplus reported as 190,000 b/d, in 2009 after failing to find a buyer (OGJ Online, Nov. 20, 2009). Through subsidiaries, Petroplus was to have paid $170 million for the refinery and related assets and $50 million for an affiliated, 218-Mw power plant.

The refinery has fluid coking, fluid catalytic cracking, hydrocracking, continuous catalytic reforming, alkylation, and hydrotreating.

In September, Valero Energy Corp. agreed to sell its 185,000-b/d refinery at Paulsboro, NJ, to PBF Holding Co. LLC, a wholly owned subsidiary of PBF Energy Co. LLC, for $360 million plus the value of net working capital and inventories, then estimated to be $275 million.

The transaction is expected to close this quarter, contingent upon regulatory and other customary approvals.

In Europe in August, Royal Dutch Shell PLC agreed to sell its 90,000-b/d Heide refinery in Germany to family investment firm Klesch & Co.

Royal Dutch Shell said the deal included local infrastructure and businesses and is part of its plan to reduce global refining capacity by 15%. The refinery's processing capacities are visbreaking (15,000 b/d), cyclic catalytic reforming (18,000 b/d), catalytic hydrocracking for distillate upgrading (16,000 b/d), and catalytic hydrotreating for pretreatment of cat reformer feed (25,000 b/d).

In October, Shell announced plans to sell a majority of its refining and marketing businesses in Finland and Sweden to Finnish company Keele Oy for $640 million in cash as part of a "strategic refocusing" of refining activities by the company.

Keele Oy is the major shareholder of St1 Holding Oy, whose businesses include fuel retail networks in Finland, Sweden, Norway, and Poland. The sale includes Shell's retail business, including 340 service stations in Sweden, 225 in Finland and its commercial road transport in both markets.

The Finland assets are primarily oil products retail and marketing businesses that include 58 unmanned refueling stations for commercial road transport. Also included is Shell's 87,000-b/d Gothenburg refinery. Shell's bulk-fuels business in both markets and the Shell marine business in Sweden are also included in the sale.

In South America in May, Petrobras Energia SA agreed to sell its 37,600-b/d refinery in San Lorenzo, Argentina, to Oil Combustibles SA for $110 million. The refinery has vacuum distillation capacity of 16,000 b/d and thermal capacity of 3,500 b/d.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com