Deepwater crude oil output: How large will the uptick be?

Rafael Sandrea

IPC Petroleum Consultants Inc.

Broken Arrow, Okla.

Ivan Sandrea

Statoil

Oslo

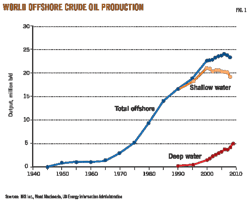

World offshore crude oil production started in the 1940s and has grown from a modest 1 million b/d in the 1960s to nearly 24 million b/d in 2009, representing one third of present world crude oil output.

Indeed offshore production has been the main source of growth for world oil supply in recent years as onshore output has been essentially flat for the last 2 decades.1

Offshore oil production has also been flat since 2002 due mostly to the decline in shallow water (≤400 m) production since 2000. Shallow water accounted for almost the entirety of offshore production until the 1990s, when important deepwater (>400-≤1,500 m) discoveries began going on stream (Fig. 1).

Today shallow water contributes 19 million b/d of crude, about 80% of total offshore output. Through 2009, global offshore has produced a total of 230 billion bbl of crude of which 217 billion bbl corresponds to shallow water fields.

The performance of deep water and ultradeep water (>1,500 m), on the other hand, has been remarkable during the last 15 years.

Deepwater production started in the 1990s, rapidly reaching 1.5 million b/d by 2000, and has since almost tripled to around 4 million b/d today. Ultradeepwater oil production is more recent with beginnings in the US Gulf of Mexico in 2005 and has now grown worldwide to about 1 million b/d, half of which comes from the US gulf.

Both deepwater and ultradeepwater plays are expected to be major contributors to global supply needs in coming decades. Their joint crude oil production of 5 million b/d is already one-fifth of global offshore output, and barely 13 billion bbl of oil have been produced so far.

It should be pointed out that water depth ranges for shallow, deep water, and ultradeep water as defined in this article conform to the IHS Inc. international databases; they better reflect current crossroads in drilling technology discussed later on. Moreover, the term deep water as used hereafter includes ultradeep water--international production and reserves statistics are frequently indistinct.

This article is about the E&P trends of global offshore oil and in particular provides an outlook of crude oil production capacity, with a breakdown for both shallow water and deep water, over the medium term.

Since the foundation of production capacity is reserves, the article also revisits the global offshore oil estimated ultimate recovery (EUR) issue, which can now be better quantified as shallow water has passed the half life of its reserves.

Obviously the recent runaway Macondo well, completed in ultradeep water (1,600 m) in the US gulf, will have a damper effect on future US offshore operations, but the object of this article is to look beyond that event and give a global assessment of deepwater oil production potential in the medium term.

Offshore E&P trends

Offshore has provided nearly 70% of the major oil and gas discoveries worldwide in the last decade, and the US gulf has been the most important deepwater region both in terms of production and investment, representing about one-third of global deepwater spending of around $21 billion in 2009.2

Deepwater oil and gas discoveries have averaged 5.5 billion bbl of oil equivalent/year over the last 5 years with an average discovery size of 150 million bbl vs. 25 million bbl for onshore.3 4 The US gulf has been the driver of US oil production, providing nearly one-third of the 5.3 million b/d of US crude oil output in 2009.

US oil production recorded year-on-year growth in 2009 for the first time since 1991 as the result of a 399,000-b/d increase in output from 2008 of new production largely from five deepwater fields: Tahiti, Dorado, King South, Thunder Hawk, and Atlantis North Flank.

Presently, deepwater fields account for 80% of US gulf oil production. Intensive exploration efforts in the US deepwater gulf have spurred the evolution of many developments in drilling and seismic technologies that have been relevant to exploration successes in other basins around the world.5

The Big 4 deepwater oil producers, Brazil, the US gulf, Angola, and Nigeria, account for three-quarters of current worldwide deepwater production, the remainder coming from 13 other countries.

Fig. 2 sketches the growth of oil and gas production over the last 5 years in the many emerging deepwater provinces that span the globe in addition to the present hot spots of the US gulf, Brazil, and West Africa. Seven new deepwater provinces have started production since 2005. Presently, exploration is also under way in several prospective deepwater basins in countries as diverse as Portugal and Mozambique.

Industry is now also tapping highly geopressured reservoirs in ultradeep water at total well depths approaching 13,000 m, which present many complex technological challenges in seismic, drilling, well design, logging, and reservoir characterization, among many others.

Water depths beyond 1,600 m further exacerbate these problems, in particular making drilling more hazardous while compromising mud and well designs, issues that are currently limiting access to resources in ultradeepwater environments.

Much of the cost and risk in deepwater and ultradeepwater reservoir development is related to rig/riser cost and the possibility of not being able to reach the desired reservoir target with a hole of sufficient diameter to economically produce the required high capacity (10,000-30,000 b/d) flow stream.6

Recent breakthroughs7 in dual-gradient (Chevron) and riserless (AGR) drilling technology will make ultradeepwater drilling safer, more environmentally friendly, and less expensive. There are also other practical limits to exploration in ultradeepwater horizons. In most parts of the world, 4,000 m of water depth touches the edge of the continental shelf, and there are no more sedimentary rocks to look for.

Offshore oil production potential

Offshore crude oil is of critical importance to the global supply equation.

Production, however, has begun to show signs of leveling off around 23 million b/d (or 8.5 billion bbl/year) following a diminishing trend in both the volumes and size of new discoveries (Fig. 1).

Offshore oil discovered over the 5-year period through 2008 averaged about 6 billion bbl/year and 90 million bbl/play. A single powerful indicator of E&P growth (or lack thereof) is the production/discoveries or P/D ratio,8 a measure of the degree of replacement of produced reserves with new discoveries. A healthy P/D ratio should be 1 or less (P/D ≤1). A ratio of 1 indicates full replacement of produced reserves, while values consistently above this threshold would signal the onset of production decline.

Fig. 3 shows the global P/D trend for onshore and offshore crude oil since the 1930s. The ratio values in the graph correspond to production and discoveries for each decade.

The composite P/D for both onshore and offshore has almost tripled since the 1980s to a current adverse level of 2.6, meaning that worldwide barely one-third of the reserves produced have been replaced with new discoveries during this decade.

The P/D for offshore reached a high of 1.3 in the 1990s but has since dropped below the threshold level of 1, thanks to the timely rapid growth of deep water. Specifically, shallow water has been the laggard, averaging only 286 million bbl/year of crude oil in discoveries and 19 million bbl/play over the last 5 years. As a result, shallow water oil production has declined from an all time high of 21 million b/d in 2000 to 19 million b/d today.

This is to be expected since shallow water oil fields are mature and new discoveries from several underexplored provinces including China and the Caspian Sea have not materialized to the extent of compensating the decline of shallow water US gulf, North Sea, and important Persian Gulf fields.

The bright star of offshore is the new frontier of deep water, which had its dawn in the 1970s in the US gulf. More than 80 basin tests have since been made globally, but the Big 4 oil provinces of US gulf, Brazil, Angola. and Nigeria plus Australia (gas) account for nearly all of the oil and gas reserves discovered to date.

Worldwide, deepwater oil production has grown continuously (Fig. 1) to its present level of 5 million b/d. Production is centered in prolific turbidite sands and carbonates with high porosities (30-35%) and permeabilities (1-2 darcies). Consequently well productivities are high, in the range of 30,000-50,000 b/d.

In the case of the ultradeepwater plays these are obscured (from a seismic quality point of view) by thick (up to 2,000 m) plastic-like layers of salt that further complicate the possibility of drilling horizontal wells.

In spite of the recent successes in Brazil, geological evidence to date suggests that deepwater are plays with limited prospectivity relative to onshore primarily due to the fact that the best quality reservoirs are exclusively associated with turbidites. Brazil's subsalt discoveries, moreover, represent a new major play that is unique to its setting as such reservoirs are not known to have global scale. Assessing the prospectivity of deepwater turbidites is still difficult.

Decline analysis

The main focus of this article is to provide a medium-term outlook of the production capacity of offshore oil and its shallow water and deepwater components.

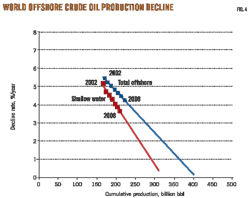

As production is wholly underpinned in reserves, a solid estimate of reserves is a prerequisite to establishing any production outlook; decline analysis9 is the classical approach to EUR.

Fig. 4 illustrates the logistic decline trends of global offshore and shallow water production. The decline trend for shallow water gives an EUR value of 320 billion bbl of which 217 billion bbl or two-thirds have already been produced through 2009. This indicates that shallow water is well past the half-life of its reserves, and therefore its EUR estimate should remain stable and firm within a 90% confidence level.

The decline trend of total offshore oil production is also stable and indicates an EUR of 400 billion bbl. This trend, however, has yet to be influenced by deepwater production, which is still in a very early growth stage (Fig. 1); its cumulative production of 13 billion bbl barely accounts for 5% of the cumulative total offshore production to date of 230 billion bbl.

This constraint precludes the use of decline analysis for an independent estimate of the deepwater EUR. The present offshore EUR of 400 billion bbl would imply, by difference, an EUR for deep water of 80 billion bbl (400 minus 320) which, for reasons discussed previously, would evidently be short.

Crude oil proved reserves discovered in deep water to date have been reported as around 100 billion bbl, roughly 30 billion bbl each in the US gulf, Brazil, and West Africa. Likewise, estimates of undiscovered resources are in the range of 80-100 billion bbl, a figure that has remained unchanged for quite some time.

Offshore outlook through 2030

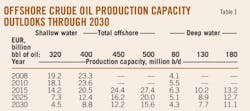

The production capacity outlook for shallow water can now be determined by the logistic model, based on its established EUR.

In regard to total offshore, however, because of uncertainty surrounding its final EUR, three scenarios were selected: 400, 450, and 500 billion bbl which could reasonably be achievable in the medium term; an outlook was determined for each of these three cases. The outlook options for deep water are obtained by the difference between the established shallow water outlook and that of each of the three scenarios for total offshore.

Table 1 summarizes the crude oil outlooks through 2030 for total offshore, shallow water, and deep water. For example, by 2015 shallow water production capacity is expected to decline to 14.2 million b/d, 5 million b/d off its 2008 value. Based on the present EUR value of 400 billion bbl for total offshore, its production capacity would also decline to 20.5 million b/d by 2015 from its current level of 23.3 million b/d. In contrast, deepwater production capacity would grow to 6.3 million b/d by 2015, up from its present level of 5 million b/d.

In the second scenario, which assumes total offshore EUR would grow to 450 billion bbl, deepwater and total offshore production capacities would increase to 10.2 million b/d and 24.4 million b/d, respectively, by 2015. Shallow water production capacity remains the same 14.2 million b/d as for the first scenario since its decline trend does not change.

Essentially all growth in total offshore reserves is attributed to the deepwater provinces.

The third scenario, with an assumed total offshore EUR of 500 billion bbl, generates high-end estimates of production capacities, 13.2 million b/d for deep water and 27.4 million b/d for total offshore, by 2015. In essence this scenario implies that in the medium term about 100 billion bbl of new deepwater reserves would be added to the existing offshore pool.

This scenario would be similar to the latest outlook trends of IHS CERA, Wood Mackenzie, and Centre for Global Energy Studies.

Closing remarks

Offshore crude oil production has been essentially flat, about 23 million b/d since 2002, due mostly to the decline in shallow water production since 2000 and in spite of the sustained production growth of deep water which has tripled to 5 million b/d from its 2000 level of 1.5 million b/d.

The P/D ratio for global offshore oil had reached an adverse level of 1.3 in the 1990s but has since decreased below the critical level of 1, thanks to the rapid development of deep water.

The decline model was used to establish reliable crude oil production capacity outlooks for total offshore, shallow water, and deep water over the medium term.

The model indicates that for the most likely scenario, discovery of 50 billion bbl of new reserves, total offshore and deepwater production capacities would increase to 24.4 million b/d and 10.2 million b/d, respectively, by 2015; shallow water would decline to 14.2 million b/d by the same year. In order to accomplish these goals, many step-changing technological challenges lie ahead in deep water, but the industry thrives on these.

Regarding the after-effects of Macondo, the hope is that solutions will be put in place expeditiously so industry can return to normalcy as soon as possible.

References

1. Sandrea, I., and Sandrea, R., "Global Offshore Oil—Growth expected in global offshore crude oil supplies," OGJ, Mar. 5, 2007 (Part 1), and Mar. 12, 2007 (Part 2).

2. "Exploration after Macondo," Wood Mackenzie Exploration Service Insights, July 2010.

3. Chakhmakchev, Alex, and Rushworth, Peter, "Global overview of offshore oil & gas operations for 2005-2009," Offshore, May 2010.

4. "IHS CERA: Production capacity in deepwater has tripled," Petroleum, August 2010.

5. Dribus, John R., Jackson, Martin P.A., and Kapoor, Jerry, "The prize beneath the salt," Schlumberger Oil Review, Autumn 2008.

6. "Offshore technology roadmap for the ultra deepwater Gulf of Mexico," US Department of Energy, November 2000.

7. Redden, Jim, "Dual-gradient drilling promises to change the face of deepwater," Offshore, May 2010.

8. Sandrea, Rafael, "Oil, gas supply trends point to tight spots, higher prices," OGJ, Nov. 23, 2009.

9. Sandrea, Rafael, "An in-depth view of future world oil & gas supply—A production capacity model," Penn Energy Research, 2010.

The authors

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com