US producing, exporting more slurry oil

Based on a presentation to the Platts Bunker & Residual Fuel Oil Conference, New Orleans, June 23-24, 2010.

Slurry oil is a heavy aromatic by-product of a refinery's fluid catalytic cracking unit that forms a small part of global fuel oil supply. Generally, it is mixed into heavy fuel oil as a viscosity cutter. Slurry oil's low API gravity, however, limits how much can be blended.

The US has never been a heavy user of fuel oil and, in fact, produces more slurry oil than it can absorb. US Gulf Coast refiners and traders, in particular, must find outlets for excess slurry oil.

The US carbon black industry has always used slurry oil as feedstock (CBFS), but Asian carbon black companies have now become major customers for US slurry CBFS. Because not all slurry oils meet CBFS specifications, however, traders lately have found it profitable to ship slurry oil to Singapore where it is blended with high API gravity, low-sulfur oil components to meet the high fuel oil demand in Asia.

This article will discuss slurry oil's properties, quantities produced, outlets, and quantities consumed.

Production, properties

Fluid catalytic cracking is a major process refiners use to convert heavy atmospheric gas oils, vacuum gas oils, and sometimes atmospheric resids into more valuable gasoline and middle distillates. A refinery generally keeps its FCCU fully loaded because that unit has a significant effect on refinery profitability.

Along with fuel gas, C3s, and C4s, FCCUs also produce as a by-product a 650o+ F. heavy aromatic oil called "slurry oil" because catalyst fines carried over from the FCC reactor end up there. Because these fines must be allowed to settle out of the oil, some people more correctly call the product "decant oil," while a few use "clarified oil" or "clarified slurry oil." In Japan, some refiners refer to slurry oil as "FBO," for FCC bottom oil.

Slurry oil is the lowest-value stream produced by an FCCU, representing only 3-7 vol % of the total products. A typical 50,000 b/cd FCCU would produce as by-product 2,000 b/cd or 125,000 tonnes/year (tpy) of slurry oil.

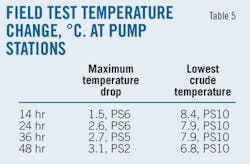

Slurry oil quality will vary according to its crude oil origin, FCC design, and fractionation equipment, among other factors, but the two most important factors affecting quality are catalyst type and conversion level. Sometimes, quality might be varied for marketing reasons by dilution in the FCC fractionator with heavy cycle gas oil. Table 1 shows the typical range of slurry properties.

Slurry oils have low and even negative API gravities, which means they must be offset by lighter oils when blended into a residual fuel pool with a gravity limit. On the other hand, their high density causes slurry oils to have 2-6% more volumetric higher heating value (HHV) than the 6.3 MMbtu/bbl of normal resid.

Slurry oils have very low viscosity at high temperature, which might make them desirable in a resid pool. That low viscosity results from high aromaticity, which is measured by a US Bureau of Mines Correlation Index (BMCI). Slurry oil viscosities at various temperatures cannot be predicted with normal bunker fuel correlations. A 380 cst @ 50o C. (122o F.) bunker fuel would have 150 Saybolt seconds universal (SSU) @ 210o F., but a 380 cst slurry would have only about 90 SSU. Slurry oil blending looks much better when blending to a high-temperature viscosity specification.

Severe FCC feed hydrodesulfurization can reduce the sulfur content of slurry oil to less than 0.5 wt %, but the hydrotreating would result in decreased slurry aromaticity unless conversion is greatly increased. Currently about 40% of the US FCC feed is hydrotreated but mainly at mild conditions so that those slurries contain 0.5-1.5% sulfur (OGJ, Dec. 21, 2009, p. 46; accompanying online survey). Refiners do not desulfurize FCC feed just to lower slurry oil's sulfur content; they have other objectives such as lowering gasoline sulfur, reducing sulfur emissions from catalyst regeneration, improving product yields and quality, or purchasing higher sulfur crude oils.

Ash is a particular problem for slurry, especially those oils that are heavy and viscous needing long residence time to allow for catalyst settling. Obtaining low ash (less than 0.05 wt %) requires such special techniques as heating, chemical additives, filters, electrostatic precipitators, centrifuges, and cyclones. Selection of an attrition-resistant catalyst helps to a great extent, and a few refiners buy higher-priced hard catalysts to alleviate ash problems in slurry oil.

Many refiners "de-ash" with chemical settling aids, which accelerate ash settling in storage. These chemicals are polymeric compounds that adhere to the catalyst surface, causing agglomeration of the fine particles, in order to accelerate separation.

For some time, refiners have found it economical to cat crack increasing quantities of 1,000o+ F. boiling material, and current industry consensus is that about 40% of the industry is cracking some resid. Cracking an unhydrotreated resid might result in a heavier, more viscous slurry oil with low aromaticity and high metals content. When resid is added to an existing FCC, ash separation might be more difficult because the catalyst-removal system must handle a greater volume of more viscous slurry.

There is considerable variation in slurry oil's properties resulting from different product demand in various markets. US Energy Information Administration data show that the US uses little fuel oil due to favorable natural gas and coal availability; hence gasoline constitutes 44% of petroleum products (www.eia.gov). US FCCs operate at high severity in order to maximize gasoline; the result is a very heavy, aromatic decant oil. Due to low fuel-oil production and specific-gravity limits, US refineries cannot blend much decant oil in resid, allowing the excess to be sold for other uses such as carbon black feedstock.

Due to low gasoline and high diesel demand, Asia has installed less cat cracking than the US, while lower severity FCC operation in Asia results in a light, less aromatic decant oil. With a large fuel oil market and low decant oil production, Asia uses most of its decant oil as a viscosity cutter especially for low-sulfur waxy residues (LSWR) available in Singapore. If any decant oil is sold as CBFS, an Asian refiner would have to replace it with a high-priced middle distillate, such as a diesel fraction, to cut resid viscosity.

Europe is in between the extremes of the US and Asia. A good measure of slurry oil's availability to the merchant market is an "FCC factor," which is FCC processing capability as a percentage of crude oil distillation capacity. US FCC processing is 32% of crude capacity vs. 13% in Asia-Pacific and 16% for the European Union where decant oil is not as readily available for carbon black feedstock (OGJ, Dec. 21, 2009, p. 46; accompanying on line survey).

For the past 35 years, European heavy fuel oil consumption, particularly high-sulfur grade, has declined significantly. European refining had been moving toward US type operation, but a strong European diesel market in recent years has forced European refiners to favor hydrocracking rather than cat cracking.

Future regulations requiring low-sulfur gasoline are introducing a subtle difference between the US and Europe regarding FCC operation. FCC gasoline is the largest source of gasoline sulfur and refiners have two choices for removal: post treat the FCC gasoline or pretreat the FCC feed. Most US refiners have chosen posttreatment, but European refiners are hydrotreating the FCC feedstock. When there is an existing FCC, some refiners are mildly hydrocracking the FCC feed to remove sulfur to extremely low levels.

Slurry production

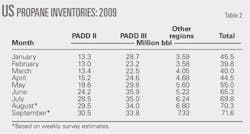

According to the BP Statistical Review of World Energy for 2008, global heavy fuel oil's consumption was about 9.4 million b/cd, or 540 million tonnes. (Note: This analysis used data for 2008, since slurry oil trade in 2009 was extremely abnormal.) Slurry oil production of only 46.5 million tonnes means it is a small part of the global fuel oil market (Table 2).

While global slurry production of 46.5 million tonnes is 9% of its fuel oil consumption, US slurry production amounts to 50% of its resid consumption. This amount could not be accommodated in a gravity-limited resid pool and means the US must burn some slurry, export some, and sell some as carbon black feedstock.

Table 3 summarizes US slurry oil production by region and sulfur level, while Table 4 shows the sulfur distribution for US slurry production. In 2008, the US Gulf Coast accounted for nearly half US slurry production and 19% of world production. It might be noted that West Coast slurry averages 1% sulfur, which is roughly half that for the rest of the US. There are several West Coast oils with as little as 0.2-0.5% sulfur, CTC International data show.

Slurry outlets

There are three distinct major outlets for slurry oil: heavy fuel oil, carbon black feedstock, and refinery processing. (One minor merchant use is wood treating in which some can be used to extend the more expensive creosote.)

• Fuel oil. Some slurry might be used as refinery fuel but much is blended into the resid pool as a viscosity cutter. In recent years, Platts has lowered the API gravity specification for US Gulf Coast 1% sulfur resid to meet a change in purchasing specifications by Florida Power & Light, which buys nearly all the available 1% grade.

Not all the US slurry can be accommodated in the resid pool, especially those oils that are very heavy and contain a lot of sulfur. Many of these oils are sold neat, for use by certain utilities with some being exported by traders. A considerable amount is exported to Jamaica where it is used as fuel during the processing of bauxite into alumina. Some of the slurry fuel in the Gulf Coast market comes down the Mississippi by barge from Midwest refineries.

• Carbon black feedstock. After fuel, carbon black manufacture is the next major slurry oil market. More than 90% of carbon black is used to reinforce and extend the elastomers in tires and other manufactured rubber goods.1 Tires account for around 70% of demand with carbon black being 25% of the tire weight.

Oil-furnace black, the most dominant type of carbon black, is produced by the controlled thermal decomposition and to some extent partial combustion of heavy aromatic oils. An auxiliary fuel (natural gas, LPG, fuel oil, or even carbon black oil) is completely burned with preheated excess air blown into the combustion chamber. Preheated CBO is atomized into the hot gases that provide the heat necessary to vaporize almost instantaneously and crack the aromatic oil into elemental carbon and hydrogen inside a specially-designed, refractory-lined reaction section.

A portion of the oil reacts with unused oxygen and provides heat to maintain reactor temperature for further carbon formation. After the carbon agglomerates into particles, direct water sprays quench the carbon aerosol to about 540o C., stopping all chemical reactions. The carbon black is separated through filters, then pelletized for handling and shipping.

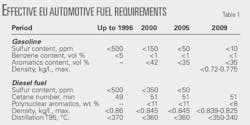

CTC International's data show that in the US, nearly 100% of the CBFS is slurry oil, but in Europe and North Asia significant quantities of two other feedstocks dominate—coal tar and ethylene tar. US refiners not only provide slurry oil feedstock to the domestic carbon black industry but also supply most of the CBFS used in South Asia—India, Thailand, Indonesia, and Malaysia. In Asian refineries, low-severity cat cracking produces poor CBFS, and the strong resid market makes that slurry more valuable to the refiner. Table 5 presents the typical properties required of slurry oils used as CBFS.

• Refinery processing. Besides fuel oil blending, there are a few other refinery uses for slurry oil with the most notable being needle coke feedstock (NCFS). This is a highly-structured, low-metals, low-sulfur delayed coke used to manufacture electrodes especially for producing steel. This coke has a needle-like, crystalline structure rather than the sponge-like appearance of regular delayed coke.

Needle coke needs a highly aromatic, low-sulfur feedstock. Due to a 0.5% sulfur restriction, the ConocoPhillips needle coke plant at Lake Charles, La., operates a slurry oil hydrotreater to lower sulfur content. As mentioned, because the US West Coast has lower-sulfur slurries, some is regularly exported to Japan as NCFS, while at times a little might be shipped to a Gulf Coast needle coke producer.

Other refinery processes consume a little slurry oil. Many refiners add about 5-10% slurry to their delayed coker feeds to prevent formation of shot coke. A few refiners put slurry into their residual hydrocrackers. Shell Canada Ltd.'s Athabasca oil sands upgrader project needs slurry oil for its hydrocracker and even must import from US refiners because not enough is available in Alberta. Slurry oil can be used as feedstock to make an impregnating pitch that fills the pores in baked electrodes before final graphitization.

Because hydrotreated FCC feed has a low concentration of coke precursors, an existing FCC unit would operate poorly due to conditions imposed by the FCC heat balance. Some refiners might inject decant oil as "torch oil" into the FCC regenerator for optimum operation by increasing the regenerator temperature.

Slurry consumption

Table 6 shows global slurry oil consumption. The US is a large exporter of CBFS and slurry fuel, which reduces availability, but the US is still the top slurry consumer. Due to large imports, Asia is the top burner of slurry as fuel and the second largest consumer.

Table 7 summarizes US slurry consumption by region; it's no surprise that the Gulf Coast dominates the slurry market.

Reference

1. Carbon Black World Data Book, Notch Consulting Group, 2008 Edition, p. 88.

The author

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com