LNG supply, demand weathered 2008-09, will recover in 2010-11

Despite the effects of the economic crisis on world economies and overall energy demand, global LNG trade in 2009 did not fare too badly. Thanks in large part to "markets of last resort" in Northwest Europe and North America, global LNG trade puttered along as sellers were able effectively to "push" unwanted cargoes into these liquid gas markets.

Given the combination of weak LNG demand in Asia with almost 45 million tonnes/year (tpy) of nameplate LNG export capacity entering service in 2009, northwestern European and North American markets were instrumental in balancing the global market by accepting cargoes unwanted elsewhere. The opening of new LNG receiving terminals in Italy and the UK facilitated greater access to these markets, thereby helping the situation.

Consequently, we witnessed dramatic changes in 2009 LNG trade flows compared with the previous year: While Asian LNG imports fell, trade movements improved in the Americas and Europe. The Middle East's entry into the LNG importer's club was also timely in light of the relatively bearish LNG prices in 2009 compared with 2008.

Global LNG trade dynamics will shift again in 2010-11, largely on the back of recovering Asian LNG demand. FACTS Global Energy (FGE) expects Asian LNG imports to improve markedly over the next 2 years, thanks not only to the improved economic outlook but also as volumes under existing contracts ramp up further and new supply contracts take effect.

LNG imports into the Americas will grow during the same period as terminals in the region, especially in the US, continue to absorb flexible LNG not required by some markets in Asia and Europe. The ramp-up of deliveries to such new LNG regasification terminals in the Americas as Brazil, Chile, and the US (see Americas subsection for details) will also result in higher LNG deliveries to the region.

Despite the possibility of lower Spanish LNG imports, Europe as a whole will import more LNG in 2010 compared with last year as such countries as Italy and the UK receive higher amounts of Qatari megatrain volumes. Meanwhile, Spanish and French LNG requirements could come in lower in 2011 compared with 2010 as pipeline gas supply rises. Should this be the case, it will temper incremental LNG imports from the rest of the countries in the region in 2011.

The Middle East is slated to import more LNG in 2010-11 as gas demand for power generation remains robust and new LNG import centers—Dubai is slated to joint Kuwait as the region's next LNG importer—consolidate their demand.

LNG demand

Despite the global economic slowdown, world LNG trade in 2009 rose around 6.5% (or around 11 million tonnes) to more than 180 million tonnes. Weaker Asian LNG imports in 2009 (down nearly 3% compared with 2008) were offset by double-digit growth in LNG imports by Europe and the Americas (Fig. 1) where "markets of last resort" such as the US and, to a lesser extent, the UK helped absorb contracted volumes that were unwanted east of Suez or destination-flexible volumes traditionally sold to the highest bidders, again usually east of Suez.

Strong demand by new, high-value markets in South America and the emergence of LNG demand in the Middle East also made a small contribution to overall LNG import growth, effectively creating a new outlet for sellers to place spare cargoes.

Asia-Pacific

Asia's LNG demand depends very much on so-called "pull factors," such as economic growth, variations in weather patterns, power-sector developments, and government policies towards gas utilization, to name a few. As Asia's economy went into a tailspin—quarterly growth in real gross domestic product continued to contract during much of 2009 (Fig. 2)—as did LNG imports.

For some Asian LNG buyers, the economic crisis resulted in depressed gas demand, which prompted some buyers to invoke downward quantity tolerance (DQT) clauses. DQT allows buyers to defer cargoes in their annual deliver program to a later date in the case of weak demand in their home markets. For some buyers that had new long-term contracts commencing in 2009, the DQT option was even more paramount as supply was ramping up yet demand was contracting.

Overall Asian LNG imports in 2009 fell nearly 3%, or 3.4 million tonnes (Table 1), to 113.6 million tonnes, owing to weak demand in Japan, South Korea, and Taiwan (JKT). These core markets collectively saw LNG imports drop by 6.5 million tonnes. The relatively strong LNG import growth in China and India (+3.1 million tonnes combined) was insufficient to stem the plunge in JKT LNG imports.

Japan, global leader in LNG consumption, saw LNG imports in 2009 deteriorate by 6.8% (or –4.7 million tonnes) to 64.6 million tonnes. The global economic slump not only dented industrial sector gas demand but also reduced gas use in the power sector amid lower overall electricity demand. Gas use in the power sector was also weaker due to improved nuclear utilization rates and hydropower output.

On the city-gas front, overall demand was 7.8% lower in 2009, largely on the back of a massive 12.8% drop in industrial gas demand. Industrial end-users are the city-gas sector's largest consumer base.

South Korean LNG imports fell 5.3% (or –1.4 million tonnes) to 25.8 million tonnes in 2009 as sluggish economic conditions depressed gas demand in the power and industrial sectors. Oil's lower per-unit costs compared with natural gas during first-quarter 2009 also played a part in reducing LNG imports, as power and industrial sector end-users favored oil over gas.

With the start of new long-term contracts (1.5 million tpy from Sakhalin II and 2.0 million tpy from Yemen LNG) against a weak gas demand backdrop, Korea Gas Corp. was forced to exercise DQT clauses in 2009. LNG imports only really began to recover in fourth-quarter 2009, thanks to stock building, frigid winter weather, and power-sector gas demand recovery.

Like Japan and South Korea, Taiwan was also hurt by the global economic recession. The country imported an estimated 8.6 million tonnes of LNG in 2009, down 3.7% (-0.3 million tonnes). The sharpest drop in LNG imports occurred in the first half of the year.

The power sector, which accounts for three quarters of the nation's LNG demand, consumed 5.7% less LNG in 2009 vs. 2008 as demand for electricity fell nearly 4%. This in turn was attributed to reduced electricity use by the industrial sector. It is worth noting, however, that the decline in LNG imports was tempered by the strong recovery in LNG demand by the power sector in second-half 2009.

From an LNG demand standpoint, India was one of Asia's few bright lights in 2009. The nation imported 9.1 million tonnes of LNG, an increase of more than 10% compared with 2008. India's improved performance was underpinned by higher spot and short-term deliveries, especially during the first three quarters of 2009. Demand for spot and short-term cargoes during first-half 2009 received a boost from companies that were not allocated gas from Reliance Industries Ltd.'s Krishna-Godavari basin or received insufficient volumes.

The competitiveness of spot LNG prices compared with naphtha prices supported spot and short-term LNG demand. India benefitted from the availability of "reasonably priced" LNG cargoes as a result of the reduction in LNG imports from depressed gas markets in JKT. Moreover, a deluge of additional LNG supply became available in 2009 by such existing projects as Australia's North West Shelf (Train 5 only starting commercial operations in September 2008) as well as by new projects such as Sakhalin II and Qatari megatrains.

Asia's other pillar of strength during 2009 was China. LNG imports spiked 65.8% to 5.5 million tonnes in 2009. This impressive performance was partly due to the ramp-up in CNOOC's contractual volumes with NWS, plus start-up of new long-term deliveries from Indonesia, Malaysia, and Qatar. In addition, China received more spot volumes, which it mainly received from neighboring Asian suppliers as well as the Middle East.

On the supply side, only the Pacific Basin managed to stave off the decline in LNG exports to Asia, supplying roughly 9% (5.8 million tonnes) more LNG to the region in 2009 compared with 2008, underpinned mainly by start-up of commercial operations at Sakhalin II. This further reinforced the Pacific Basin as Asia's dominant supplier of LNG with a 62.5% share in 2009, up from 55.8% in 2008.

The Middle East continued consistent delivery of LNG to Asia-Pacific but saw exports decline by more than 5% (–2.0 million tonnes) in 2009 as some buyers exercised DQT clauses and cut back on spot demand. Nonetheless, the Middle East still accounted for around 31% of Asian LNG trade in 2009.

After record intrabasin trade in 2008, Atlantic Basin LNG (accounting for 12% of Asian LNG imports in 2008) deliveries to Asia were down sharply in 2009 as demand, especially from JKT, for spot volumes, dried up. Moreover, with geographical proximity in their favor, new Asian supplies essentially crowded out sellers of Atlantic Basin cargoes looking to place shipments into Asia. As a result, we saw greater volumes of Atlantic Basin LNG being shipped to their original markets west of Suez in 2009. Nonetheless, the Atlantic Basin continued to supply around 6.2% of Asian LNG imports in 2009.

Europe

European LNG imports surged by 23.5% (9.8 million tonnes) to more than 51.0 million tonnes in 2009. The region's stellar performance is due to higher LNG deliveries to Northwest Europe, specifically Belgium and the UK, although Italy showed a healthy demand growth also. Only Spain, the largest LNG consumer in Europe, and Greece fell into the red.

Northern Europe proved to be a veritable sink for LNG volumes in 2009, with the UK heading the list of willing buyers. Besides the commencement of new LNG import terminals in the UK (South Hook and Dragon LNG) and Italy (Adriatic LNG), LNG sellers were eager to place "unwanted" cargoes by Asian buyers into more liquid markets such as the UK and the US (see next subsection for details). The competitiveness of UK gas prices relative to US levels, especially during first-half 2009, also helped to pull away cargoes from the US and into the UK.

The majority of other Northwest European countries witnessed positive growth in LNG imports. This was in part driven by the disruption in pipeline gas supplies owing to the Russia-Ukraine gas dispute (OGJ Online, Apr. 22, 2010). Turkey and France for instance bolstered purchases of spot cargoes—Turkey received its first Omani cargo in January 2009—noticeably in first-quarter 2009.

In 2009, Belgian LNG imports more than doubled mainly due to the ramp-up in long-term contractual volumes from Qatar. Relatively ample pipeline gas supplies and attractive spot prices offered by buyers outside of Belgium, however, motivated the reexport of several cargoes in second-half 2009. One of the cargoes was delivered to Kuwait in 2009—interestingly, originally from Qatar—while one of two cargoes delivered in 2010 was purchased by CNOOC.

One of Europe's poorest performers in 2009 was Spain. After a solid import performance in 2008, Spanish LNG demand fell by more than 7% to less than 20.0 million tonnes in 2009, in line with a more than 10% plunge in domestic gas demand. Domestic gas demand in 2009 deteriorated on the back of a marked decline in gas consumption by both the power sector as well as by the conventional gas market as the economy contracted due to the financial crisis.

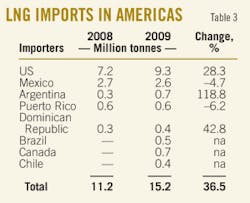

Americas

LNG imports in the Americas rose by more than 35% in 2009 compared with 2008 (Table 3). This was attributable to the ramp-up of deliveries to new South American terminals, as well as increased LNG deliveries to the US, despite robust domestic gas production there. US LNG imports in 2009 were 28.3% higher on the year. Weak demand for Atlantic Basin LNG cargoes from Asian buyers motivated flows back to the US.

Argentine LNG imports more than doubled in 2009 amid strong gas demand during the Southern Hemisphere's winter season when hydroelectricity generation was at a seasonal low. The Americas also saw higher LNG inflows owing to the introduction of new LNG terminals from first-time importers like Brazil (0.5 million tonnes), Canada (0.7 million tonnes), and Chile (0.4 million tonnes).

• Brazil joined the growing list of global LNG importer in January 2009, when Petrobras Transporte SA (Transpetro) received its maiden cargo at the offshore Pecém receiving terminal. Petrobras' second floating storage and regasification unit (FSRU), located at Guanabara Bay (Rio de Janeiro), regasified its first cargo in March 2009 (OGJ, Apr. 13, 2009. p. 42).

• Chile's Quintero LNG regasification terminal received its maiden LNG cargo from BG in July 2009. BG has a 21-year sale and purchase agreement to supply up to 1.7 million tpy to the terminal. BG has a 40% stake in GNL Quintero SA, the joint venture that owns the terminal (OGJ, July 20, 2009, p. 35).

• Canada's Canaport LNG started importing LNG in June 2009, when it received its first cargo from Trinidad and Tobago (OGJ, July 6, 2009, p. 33). Repsol, which owns 75% of Canaport LNG and controls 100% of its throughput capacity, has relied heavily on its destination-flexible Trinidadian LNG purchases to fill the terminal, although some of Repsol's Qatari purchases have found their way to Canada, too.

Middle East

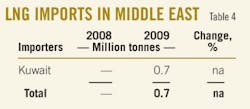

After decades of being an LNG export province, the Middle East entered the LNG import scene in 2009 with start-up of Kuwaiti LNG imports (Table 4). Kuwait unloaded its first LNG cargo in August 2009, which was the start of a string of cargoes imported to meet the country's peak summer electricity demand.

A total of 11 cargoes was unloaded at the Mina Al-Ahmadi GasPort terminal, an Energy Bridge Regasification Vessel hired from Excelerate Energy and moored alongside a jetty to receive LNG via ship-to-ship transfer, for a total of 0.7 million tonnes for the year.

LNG supply

Unlike in 2008 when demand for Atlantic Basin LNG was strong and represented the sole supply growth region, 2009 was fraught with LNG production hiccups that reduced output. In 2009, LNG trade from the Pacific Basin and the Middle East was higher by nearly 10% and 17% (Fig. 3), respectively, as new liquefaction trains came on line.

In the Pacific Basin, among mature LNG producers, only Australia managed to buck the negative growth trend (thanks to ramped-up production from NWS Train 5). Other sellers experienced marginal declines in LNG trade.

The solid gain of nearly 8 million tonnes from Australia and Russia's Sakhalin II in 2009 was more than enough to arrest the combined 1.5-million-tonne decline by Alaska, Brunei, Indonesia, and Malaysia. The feed-gas problems confronting Indonesian (Arun and Bontang LNG plants) and Alaskan LNG projects were offset in 2009 by weakened LNG demand in Asia.

The combination of anemic LNG demand in JKT and the start of new long-term contracts motivated JKT to exercise DQT clauses and caused some sellers of Pacific Basin LNG to send unwanted cargoes to Europe. The Pacific Basin remained Asia's largest LNG supplier, capturing more than 60% of Asia's total imports.

The Middle East exported about 17% more LNG globally in 2009 compared with 2008, underpinned by start-up of new LNG trains in Qatar and Yemen. Qatargas II started the world's first 7.8-million-tpy megatrain in May 2009 (Train 4) and followed with a second megatrain (Train 5) in third-quarter 2009 (OGJ Online, Apr. 6, 2009). Meanwhile, RasGas III completed its first megatrain (Train 6) in July 2009 (OGJ, Aug. 17, 2009, p. 10).

Yemen LNG finally started production at one of its two 3.35-million-tpy trains in mid-October 2009 after a long delay, almost 10 months longer than originally planned. While Middle East LNG exports to Asia fell in 2009, European LNG imports from the Middle East (the bulk of which originated from Qatar) more than doubled in 2009. The start of new LNG import terminals such as South Hook in the UK and Adriatic LNG in Italy, both partially owned by Qatar Petroleum, provided new outlets for Qatari LNG.

In addition, most of the Omani LNG, which was previously diverted from the Spanish market to Asia in 2008 (at a time when Asian LNG demand was strong), either returned to its original market in Spain or was shipped to Turkey and Kuwait in 2009. Turkey imported its first Omani cargo following the Russia-Ukraine gas dispute, which disrupted pipeline gas imports and raised dependence on LNG.

Kuwait's maiden Omani cargo was part of a string of LNG cargoes secured from Shell to meet Kuwait's peak summer electricity needs. Apart from deliveries to South Korea under a long-term contract, limited appetite for spot cargoes by other Asian buyers saw Yemeni LNG being sent to higher priced markets in Spain and Mexico by Total AS, another long-term contract holder that was originally intended for the US market.

Atlantic Basin LNG trade fell 4.4% in 2009, led by Nigeria, Egypt, and Algeria. These three countries were confronted with either feed-gas or pipeline-related problems or both, which lowered LNG production. Fortunately, supply interruptions in 2009 were less disruptive because the world's economic downturn tempered LNG demand in key Asian and European markets.

For instance, Nigeria's largest LNG market, Spain, witnessed a severe decline in gas demand that resulted in 34% less Nigerian LNG imports. Meanwhile, Asian LNG imports from Nigeria dropped by more than half in 2009 compared with 2008. Only the Americas saw growth in Nigerian LNG imports in 2009, thanks largely to increased imports by Mexico.

Trinidadian LNG exports rose 14.1% in 2009 compared with 2008, due partly to increased deliveries to the UK following start-up of BG's majority-owned Dragon LNG in second-half 2009 (OGJ Online, Sept. 2, 2009). Start-up of new regasification terminals in the Americas—Brazil, Canada, and Chile—and Kuwait in the Middle East also offered sellers of Trinidadian cargoes new outlets for their LNG.

Algerian LNG trade was down nearly 5% in 2009 amid supply problems that originated from a pipeline leak that reduced feed-gas deliveries to Arzew. As such, FGE gathers that Algerian LNG production was down some 20% in earlier months of 2009. Trade data support this: We observed a double-digit drop in Algerian LNG imports during first-quarter 2009. Improvements in LNG trade were subsequently observed for ensuing quarters of 2009.

Unlike Algeria, which saw reduced LNG production due to pipeline problems that limited feed gas to the liquefaction plant, Egypt's Damietta LNG train is understood to be producing less than nameplate capacity as a result of feed-gas diversions to the hungry domestic market. This caused Egyptian LNG exports to suffer in 2009.

Norway's Snøhvit LNG project, which has been fraught with production hiccups since its 2007 start-up, made strides in addressing equipment failures and managed to produce more LNG in 2009 compared with 2008. Unlike in 2008, however, all of its cargoes were delivered to markets west of Suez.

Remainder 2010; 2011

FGE forecasts global LNG trade to continue growing in 2010 and 2011, underpinned by several key developments.

On the supply side, besides several new LNG trains entering service in 2010-11, we suspect that Atlantic Basin LNG output will recover as production hiccups are resolved. As in previous years, trade will remain mostly regional with intrabasin traffic being dictated by the strength of recovery in Asian LNG demand.

On the demand side, the global economy will recover in 2010-11, which should be conducive to a recovery in Asian LNG demand. Such organizations as the International Monetary Fund forecast in July 2010 that global output will expand by more than 4% in 2010 and 2011 after a 0.6% contraction in 2009. Nonetheless, we remain cautiously optimistic about the global growth prospects in light of the recent economic crisis in Europe and its possible negative contagion effect on world output and trade.

Demand

Asian LNG imports will rebound strongly in 2010, growing by more than 7%, after a dismal LNG import year in 2009. China and India will import greater amounts of LNG in 2010 and 2011 after a relatively solid import year in 2009. Meanwhile, the pace of recovery in JKT LNG imports will vary, with South Korea making the most strides in 2010. Taiwan will outperform Japan and South Korea in 2011.

Although Japanese LNG imports are set to pick up in 2010 (+0.4%) and improve further in 2011 (+2.3%), it could take 4 years before LNG imports recover to precrisis levels. Nuclear utilization rates in Japan will improve in 2010 and 2011 as Tokyo Electric Power Co. slowly restarts shut-in nuclear units at its Kashiwazaki-Kariwa power plant, which was hit by an earthquake in 2007.

While this will likely temper demand for thermal fuels including LNG for power generation, an uptick in industrial sector gas demand will support the recovery in Japanese LNG imports. Even though Japanese industrial sector gas demand rebounded quite nicely during first-half 2010, it still fell short of 2008 levels (first 6 months and before the economic crisis), suggesting that there is still room for recovery.

Meanwhile, the rebound in Taiwanese and South Korean LNG demand will be more pronounced in 2010 and 2011 relative to Japan. FGE forecasts a more than 13% recovery in South Korean LNG imports in 2010 and for LNG imports to grow by 2-3% in 2011. Similarly, Taiwan will see higher LNG import growth in 2010 (+10.1%) following weak imports in 2009. For 2011, Taiwanese LNG imports will climb 4.2%.

Gas demand in both countries will recover fully and surpass 2008 levels in 2010, led by gains in the power sector amid favorable LNG per-unit generation costs compared with fuel oil and stronger electricity demand in general as the economy recovers. The industrial sector will also play a key role in South Korea and Taiwan's LNG demand revival. In South Korea, expansion of city gas demand will also boost LNG imports in 2010 and 2011.

FGE predicts LNG imports in China to spike by more than 65% and 45% in 2010 and 2011, respectively. Indeed, China could surpass India in LNG imports by 2011, as Indian LNG imports themselves are likely to grow at a much slower rate of around 1% and less than 10% during the same period.

China's appetite for LNG stems from the inability of domestic gas production and Turkmenistan to keep abreast of China's strong gas demand, which is led by the power and industrial sectors. Incremental LNG supply will be largely met by ramp-up in long-term contractual volumes in 2010—Tangguh, MLNG Tiga, Qatargas II—and start-up of PetroChina's contract with Qatargas IV in 2011. Meanwhile, China will start up three new LNG regasification terminals: in Liaoning/Dalian, Jiangsu/Rudong, and Shenzhen in 2011.

In India, incremental gas demand across all consuming sectors is likely to outstrip increased domestic gas supplies. This will ensure the increased reliance on LNG to meet India's gas needs. Apart from ramp-up in Qatari LNG contractual volumes and a short-term contract with Repsol, India may resort to importing more spot cargoes in second-half 2010, assuming infrastructure bottlenecks are resolved and spot LNG prices are competitive.

We saw how gas-demand requirements coupled with favorable pricing motivated a buyer to procure a spot cargo for less than $5/MMbtu for an April 2010 delivery and less than $5.50/MMbtu for a cargo delivered in June 2010.

Overall European LNG imports could expand, albeit at a slow rate of roughly 5% in 2010 and could turn negative in 2011, pulled down mainly by sluggish Spanish LNG demand. Although gas demand in Spain, the largest European LNG importer, is recovering, the expected modest increase in 2010-11 gas demand will likely be met by higher pipeline gas imports when the Medgaz pipeline starts up sometime in fourth-quarter 2010. Moreover, the Spanish government's aim towards paring domestic coal inventory will likely depress gas-fired power generation, thereby further reducing the need for LNG.

In other key European markets such as the UK and Italy, LNG deliveries will increase in 2010 and 2011. While some conventional Qatari megatrains were closed for maintenance during the shoulder months of 2010, the ramp-up in Qatari megatrains that started production in 2009, along with start-up of new megatrains in 2010 and 2011, will likely ensure that European terminals such as UK's South Hook and Italy's Adriatic LNG continue to receive a healthy amount of LNG.

The Americas will import more LNG in 2010 (up by possibly more than 30%) and 2011 (higher by more than 20%). The US will likely remain a key outlet for Atlantic Basin and Qatari LNG, especially when the partially QP-owned Golden Pass receiving terminal along Sabine Pass on the Texas coast comes on line this summer or early fall and if demand elsewhere does not recover or pick up as strongly.

Also, should the price differential between UK prices at the National Balancing Point and US Henry Hub narrow and turn negative, this may increase further deliveries to the US.

So far this year, the US Atlantic Basin experienced its first hurricane of the season in June, the first June Atlantic Basin Hurricane (in the US) since 1995. This was followed by a weaker tropical storm, Bonnie, in July 2010. While both events seem to have had little impact on US gas prices, there is a pretty strong likelihood that prices could move higher in the nearer term as the US enters into the "peak" months of the hurricane season.

The US Climate Prediction Center in its latest outlook (August 2010) forecasts robust activity for the remainder of this year's Atlantic hurricane season: Of the additional 12-17 named storms, 7-11 are likely to become hurricanes with 4-6 developing into major hurricanes. In contrast, last year's hurricane season was below-normal.

The latest (August 2010) official US LNG import forecast by the US Energy Information Administration for 2010 and 2011 is about 10.3 million tonnes (down from a June 2010 estimate of 11.6 million tonnes) and 10.9 million tonnes (some 1.9 million tonnes lower than its June 2010 estimate), respectively.

EIA's projection is a function of higher supply and the inability of still weak markets in absorbing the incremental LNG coming on line, essentially acting as a "secondary" market after satisfying LNG needs in higher priced markets in Asia and Europe. Meanwhile, EIA believes that domestic gas production will continue to expand in 2010 but may contract in 2011.

The start-up of new LNG regasification terminals in Chile and Mexico may help increase the Americas' share of global LNG imports. The 1.4-million-tpy Chilean LNG receiving terminal at Mejillones, owned by GDF Suez and copper producer Codelco, started commercial operations in May 2010 (OGJ, Apr. 5, 2010, p. 24). Meanwhile, the Manzanillo LNG terminal in Mexico may receive its first cargo in late 2011.

Middle Eastern LNG deliveries will likely grow substantially in 2010 and 2011. Kuwait secured around 30 cargoes from two suppliers—Shell and Vitol—to meet increased electricity demand during the peak summer season. Moreover, Kuwait Petroleum Co. could bring in more cargoes, procured on a spot basis, if demand warrants it.

Dubai is set to become the second Middle Eastern country to bring in LNG. The reconfigured vessel Golar Freeze, which was delivered to Dubai Supply Authority in May 2010, will act as Dubai's LNG floating storage and regasification unit.

Supply

Global LNG supply in 2010 will benefit from ramp-up in production at the eight new LNG trains (combined nameplate capacity of 44 million tonnes) that entered service in 2009. Besides the three Qatari megatrains, the Middle East added Yemen LNG to its list of LNG exporters in 2009.

Meanwhile, Asia-Pacific introduced four new LNG trains—two from Russia's Sakhalin II and a pair of equally sized-trains from Indonesia's Tangguh LNG project. The Tangguh LNG project is likely to reach full production by yearend. BP earlier in February 2010 indicated that about 100 cargoes will be shipped in 2010.

New LNG train additions in 2010 and 2011 will come from Asia, the Middle East, and for the first time South America. The dearth of final investment decisions in the Atlantic Basin essentially means that only Angola LNG will come on line from the Atlantic Basin in 2012.

A total of six new liquefaction trains with a combined nameplate capacity of 36 million tonnes—three quarters coming from the Middle East—is likely to be added in 2010 and 2011. The Middle East saw start-up of RasGas III (Train 7) and Yemen LNG's second train in first-quarter 2010 and second-quarter 2010, respectively (OGJ, Apr. 5, 2010, p. 24). Yemen LNG is aiming for an average 95% availability and average production of 85% of capacity for 2010.

Meanwhile, given the relatively bearish gas prices (compared with 2008), Qatargas has shown little urgency to complete construction at its two remaining megatrains. Qatargas is reportedly looking to start LNG production in fourth-quarter 2010.

Peru LNG became the third LNG project to start operations in 2010 (OGJ, June 21, 2010, p. 12). It is the second liquefaction plant to be built on the Americas' Pacific Coast after the aging Kenai LNG plant in Alaska some 40 years earlier. The 4.45-million-tpy project was inaugurated in June 2010 and delivered its first LNG cargo, aboard the Barcelona Knutsen, to the Sempra Energy's Costa Azul LNG receiving terminal in Ensenada (Baja California) on June 24, 2010. In the meantime, the project could ship several spot cargoes while waiting to start long-term deliveries to the delayed Manzanillo terminal.

Australia's Pluto LNG, the world's fastest upstream discovery to LNG construction project, is to start LNG production in 2011. The project was 91% complete at the end of June 2010.

Atlantic Basin projects Nigeria LNG and Norway's Snohvit LNG project will see improvements in LNG production this year and in 2011. Efforts are under way to increase feed gas to Nigeria's Soku gas processing plant and to bring production back to full capacity. Nigerian LNG production suffered immensely in 2009 amid feed-gas problems with intermittent closures at Soku due to pipeline damage caused by condensate theft. The plant is capable of producing around 1.1 bcfd at full capacity.

The authors

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com