Surging GTL promises lube-market opportunities

Petrobras has analyzed the world's lube-oil production capacity trends from 2000-09, as published by Oil & Gas Journal's annual refinery survey, the current status of world GTL production capacity, and the planned construction of GTL plants during 2010-11 in order to identify future high-quality lube-oil market opportunities derived from GTL technology.

The average lube-oil market size during 2000-09 was about 800,000 b/cd. Market distribution in 2005 was 75% for API Group I, 20% for Group II, and 5% for Groups II+/III/IV. (Table 1 provides definitions for API lube-oil groups.)

High-quality lube oil from Groups II+/III/IV markets is likely to grow to more than 10%, potentially nearing 20% by 2015, depending on the automobile industry demand.1 Global Group I lube-oil production will decline by 1.5-2.5%/year in the next 5 years.2

If global lube-oil production capacity remains steady during the next 5 years and considering these forecasts, we estimate the potential market distribution by 2015 for Group I, Group II, and Groups II+/III/IV will be 61%, 24%, and 15%, respectively. High-quality lube oil market sizes will be about 120,000 b/cd by 2015.

Refineries will continue producing high quality Group II+ and III at a competitive cost through catalytic processes compared with conventional solvent extraction-based technology. In the near future, however, gas-to-liquid results in the most promising technology for market opportunities to manufacture high-quality lube oils by building off of existing catalytic hydrocracking and isomerization processes.

New construction units are under way for about 404,100 b/cd in additional GTL capacity during the coming few years (OGJ Apr. 5, 2010, p. 24). More than 50% of the global GTL capacity will be located in Qatar. Western Europe, Asia Pacific, and North America will continue being the primary high-quality lube oil suppliers.

A commercial scale GTL plant with total capacity of 100,000 b/cd could be designed to produce at least 20,000-25,000 b/cd lube oil, which can provide a large fraction of the worldwide demand for premium lube oils. The technological advances of GTL technology in the last decade will provide new opportunities for developing other emerging technologies, such as biomass-to-liquid or coal-to-liquid.

Countries such as the US, Brazil, China, and some other Western European countries where production of biomass and coal is high can create additional ecologic fuels and specialty product (lube oils, waxes, and olefins) capacities at low capital cost utilizing GTL platform technology.

Production trends

The last 2 decades have seen increasing pressure on the automobile industry to improve energy efficiency, lower SOx, NOx, COx (CO + CO2), and particulates emissions, and lower service intervals and operating costs over the whole life of the engine. New engine design and operating conditions intended to meet these technical and economic requirements have put increasing demands on the performance of lube oils. To help meet these demands, oil refiners have turned to higher quality base-stocks to get lower volatility and impurities, improved viscosity index, and oxidation stability.

The American Petroleum Institute developed the API base-oil groups in order to differentiate the various base-oil qualities in the lube-oil market. Four groups were established, based on saturate hydrocarbon molecules content, sulfur level, and viscosity index (VI) in the lube oil (Table 1).

High-quality lube oils, represented by Groups III and Group IV, contain low-sulfur levels, high-saturate hydrocarbon content, high viscosity index, and low volatility and have excellent oxidation stability properties. Synthetic lube oil (Group IV) contains polyalphaolefins (PAO) or esters as additives in its formulation.

High-quality lube oils are produced by catalytic dewaxing (HCK) and hydroisomerization (HIS) or by combining solvent extraction and catalytic hydrotreating (HDT) and HIS processes of vacuum distillates or waxes (Fig. 1). The appropriate options to produce high-quality lube oils depend on the refinery's crude oil processing flexibility, existing units, and capital-cost tolerance. Generally, catalytic processes make Group III lube-oil production easier than solvent extraction processes.3

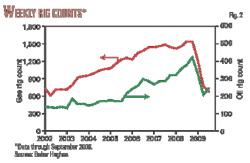

During 2000-05, OGJ annual refining data show, worldwide lube-oil average production capacity remained relatively constant (800,000 b/cd/year) and then decreased in 2008 to 763,000 b/cd due to the global recession. In 2009, world lube-oil production capacity experienced a recovery to previous production capacity near 803,000 b/cd (Fig. 2).

Global vacuum distillation capacity remained relatively constant (26.7 million b/d) during 2000-03 and then grew by about 425,000 b/cd/year to reach a level of 28.6 million b/d by 2007.

During 2007-08 vacuum distillation capacity remained constant and then increased to 29 million b/d in 2009 (Fig. 3).

Lube-oil production capacity, HCK, FCC, and thermal operations processes represent about 3.0%, 17.0%, 51.3%, and 28.8%, respectively, of total world vacuum distillation capacity (Fig. 4). These proportions remained relatively constant during 2000-09 (per OGJ annual refining surveys).

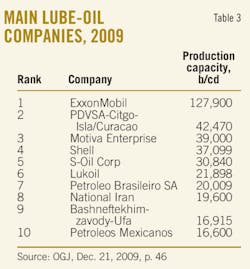

Tables 2 and 3, respectively, list the top 10 world lube-oil producing countries and companies and their respective 2009 production capacities and distribution. These countries contain about 67% of the global lube-oil production capacity (OGJ, Dec. 21, 2009, p. 46). The US contains about 25% of global lube-oil capacity and ExxonMobil is the largest lube-oil producing company in the world (16% of the world lube-oil production capacity).

Future demand

The average lube-oil market size during 2000-09 was about 800,000 b/cd. Market distribution in 2005 was 75% Group I, 20% Group II, 4% Groups II+/III, and 1% Group IV (Fig. 5).

High-quality lube oil from Groups II+/III/IV markets will grow to more than 10%, potentially nearing 20% by 2015, depending on the automobile industry demand.1 Global Group I lube-oil production will likely decline by 1.5-2.5%/year in the next 5 years.2

If world lube-oil production capacity remains steady during the next 5 years and considering the above forecasts, we estimate the potential market distribution by 2015 for Group I, Group II, and Groups II+/III/IV will be 61%, 24%, and 15%, respectively. High-quality lube oil market sizes will be about 120,000 b/cd by 2015 (Fig. 6).

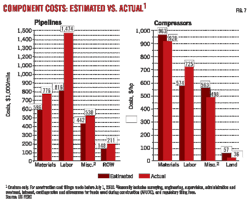

World lube-oil supply represents about 89% of global lube-oil production capacity.4 5 During 2000-09, the average lube-oil supply was about 712,000 b/cd/year (528,000 b/d Group I, 136,000 b/d Group II, 41,000 b/d Group III, and 7,000 b/d Group IV). Western Europe, North America, and Asia Pacific are the primary high-quality lube oil suppliers. North America supplies about 75% of global Group II/II+, while Group I oil base is supplied by all geographic regions (Fig. 7).

Market opportunities

Although much of the current interest in GTL is on producing high-quality middle distillate fuels and naphtha for petrochemical uses, it has also gained interest due to its ability to generate high-quality specialty products, including lubricant base oil, waxes, and olefins.

GTL fuel and specialty product markets are rapidly developing. This technology is also being viewed as a platform for development of biomass-to-liquid and coal-to-liquids products with identical chemical properties and compositions.6

Lube oils produced through the Fischer Tropsch process show the following attributes (Table 4):1 7 8

• Viscosity index ranging from 140 to 155 as compared with Group IV-PAO that have a VI in the range of 120-140 for the same viscosity grades.

• NOACK volatilities (ASTM D-5800) below 10 wt %, that is significantly lower than Group II/II+ and III base oils.

• Pour point of GTL base oils is, however, much closer to that of a Group III. This can be addressed by the use of pour point depressant additives. Advantageously, GTL base oils are reported to have excellent responsiveness to methacrylate-based pour point depressants.

• GTL base oils have no detectable levels of sulfur, nitrogen, or aromatics compounds. They have very narrow hydrocarbon distribution and have excellent oxidation stability and biodegradability characteristics.

In addition to high quality, GTL base oils also have very favorable manufacturing economics. Some studies indicated that the manufacturing costs for GTL delivered in the mature markets are comparable with that of Group I, II, and II+.1 7 Even more importantly, the economics for GTL are more favorable than that of high-VI Group III.

GTL base oil competes with Group III and Group IV-PAO in automotive lubricants markets. The performance advantages of GTL base oil over Group III will likely be found in several key aspects:7 8

• Superiority of its lower volatility over that of Group III.

• Low formulation cost to capture market share from Group III and Group IV-PAO.

• GTL base oil provides environmentally friendly solutions to the industrial lubricants market due to its biodegradability and its absence of sulfur, nitrogen, and aromatics compounds.

GTL projects

Some economic analysis has indicated that cost escalations have caused the cancelation or postponement of a number of GTL construction or expansion plans until improvement occurs in financial and product demand. Two projects planned in Qatar involving ConocoPhillips with Qatar Petroleum and with Marathon partnerships were put on hold in 2006.

In early 2007, ExxonMobil and Qatar Petroleum announced cancellation of the proposed 154,000-b/cd Palm GTL project. Chevron Nigeria and Nigerian National Petroleum Co, however, announced that they expect GTL capacity to be expanded to 120,000 b/cd during the coming few years.

At a global level, GTL is still an emerging industry with a limited number of commercially operative plants. Existing GTL plants in operation are in South Africa (160,000 b/cd Sasol, 22,500 b/cd PetroSA), Qatar (34,000 b/cd Sasol-Qatar Petroleum Oryx), and Malaysia (12,500 b/cd Shell).

GTL capacity was set to increase to more than 500,000 b/cd by 2015.1 2 More than 50% of the global GTL capacity will be in Qatar. New construction units are under way for about 404,100 b/cd in GTL additional capacity (OGJ, Apr. 5, 2010, p. 24).

GTL projects have received attention in Qatar over the last several years. Pearl GTL project will use Shell´s GTL technology to convert 1.6 bcfd of natural gas into high-quality gas oil, high-specification lubricant base oils, and chemical feedstock. The company will use its leading brand, technology, global supply chain, and marketing to maximize the value of these products in the global market.

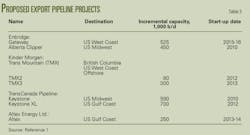

Major construction at Pearl GTL is to be completed by the end of 2010 and into 2011 (Table 5). ExxonMobil's Qatar project announced to produce 80,000 b/cd diesel fuel and 30,000 b/cd GTL lube oil by 2011.2 9

A large-scale commercial GTL plant will likely have a small impact on the fuel market but could have a large impact on base-stock markets. According to our estimation, by 2015 the high-quality lube oil market sizes will be about 120,000 b/cd. A commercial scale GTL plant having a total capacity of 100,000 b/cd could be designed to produce at least 20,000-25,000 b/cd lube oil which can provide large fraction of the worldwide demand for premium lube oils.1 10

The technological advances of GTL technology in the last decade will provide new opportunities for developing other emerging technologies, such as biomass-to-liquid or coal-to-liquid. Countries such as the US, Brazil, China, and some other Western European countries where the production of biomass and coal is high can create additional ecologic fuels and specialty products (lube oils, waxes, and olefins) capacities at low capital cost utilizing GTL platform technology.

References

1. Rahmim, Iran Isaac, "GTL and CTL Commercialization: Status and Impact on Global and Regional Product Markets," AICHE Spring National Meeting, 7th Tropical Conference on Natural Gas Utilization, Houston, Apr. 24, 2007.

2. Regan, Tony, "The future is gas—How GTL Technology Becomes the Reality that Replaces Oil," TRI-ZEN International to Institute of South East Asian Studies, June 7, 2005, www.trizeninternational.com/presentations.

3. McGaffrey, David S., Andre, J.P., and Tabak, S.A., "Process Options for Producing Higher Quality Basestocks," 3rd Intl, Sym. Fuels & Lubricants, ISFL-2002, New Delhi, Oct 7-9, 2002.

4. Downey, William R., "Impact of GTL Technology on the Future of the Lube business," UEIL World Congress, Rome, Oct. 27-28, 2005.

5. Marques de Oliveira, Ranato, "Lubricant Market in South America," www.atiel.org.

6. Glenn, Thomas F., "A US Market Space Analysis of GTL Lubricants," NPRA Lubricant & Waxes Meeting, Houston, Nov. 8-9, 2001.

7. Rahmim, Iran Isaac, "GTL, CTL finding roles in global energy supply," OGJ, Mar. 24, 2008, p. 22.

8. Baker, Charles L., "Next Generation of Base Oils From GTL Processes," Outlook for the East of Suez Lubricant and Baseoils Conference, Apr. 6-7, 2005, Dubai.

9. Jamieson, Aileen, and McManus, Gordon, "GTL production will partially ease regional diesel, naphtha imbalances," OGJ, Mar. 19, 2007, p. 49.

10. Rahmim, Iran Isaac, "The effect of GTL commercialization on fuel and specialty product market," OGJ, Mar. 14, 2005, p. 18.

The Authors

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com