OGJ FOCUS:Global ethylene production

Producers added more than 6 million tonnes/year (tpy) of ethylene capacity in 2009, according to the latest Oil & Gas Journal's survey of the global industry. China represented the bulk of the additions, adding more than 4.4 million tpy of capacity.

The global figure for 2009 was large by historical standards but short of the 7 million tpy record set in 2008 after start-up of several new plants in the Middle East (OGJ, July 27, 2009, p. 49). By comparison, capacity growth in 2007 was 2 million tpy and only 245,000 tpy in 2006.

Global ethylene production capacity at Jan. 1, 2010, was more than 132.9 million tpy, up from 126.7 million tpy in 2008, and 119.6 million tpy in the survey for 2007 (OGJ, July 28, 2008, p. 46). The additional capacity represents an increase of nearly 5%.

The survey (see table, p. 39) lists seven new world-scale ethylene production plants with combined capacity of nearly 6.4 million tpy, which started up in 2009 and into 2010.

Fig. 1 shows the cyclical nature of the ethylene industry, a prominent theme as well in the second article in this report (p. 46). Capacities continued the trend set in 2008 of capacity additions racing ahead since the lowest capacity-addition rate in at least 20 years in 2006.

In 2010, nearly 12 million tpy of capacity are slated to start up. The stubborn global recession, however, and a glut in production capacity are likely to trim that level. In 2009, more than 10 million tpy of capacity were slated to start up, but OGJ survey results found less than half that amount—about 3.3 million tpy—actually came on line in the calendar year.

New units

Seven new ethylene plants—opening over a span of 9 months beginning in September 2009—appear in this year's survey, all in China, Saudi Arabia, and Singapore. Also in China, China National Offshore Oil Co.'s existing ethylene plant at Daya Bay, Guangdon, added 150,000 tpy to reach 950,000 tpy.

In September 2009, PetroChina began operations at its $4.4 billion Dushanzi refinery and chemical plant in western Xinjiang region.

The location encompasses about 1.7 sq miles and includes a 10-million-tpy refinery and a 1-million-tpy ethylene production plant. It mainly processes Kazakhstan high-sulfur crude delivered by a Kazakhstan-China pipeline.

In late December 2009, Sinopec started up 1-million-tpy of added ethylene capacity as part of a new 200,000-b/d refinery in Tianjin. The added capacity is a $3 billion joint (50/50) investment with Saudi Basic Industries Corp. and increases capacity at Tianjin to 1.2 million tpy.

The Xinhua News Agency said the complex could supply 5.87 million tpy of oil products, 3.2 million tpy of ethylene, 1.5 million tpy of synthetic rubber and chemical fiber, and 750,000 tpy of LPG.

Sinopec said the Tianjin refinery would become the largest ethylene production base in China and also the largest refining base in northern China. Before expansion, said the agency's reports, the Tianjin refinery had a primary refining capacity of only 5.5 million tpy and ethylene production capacity of 200,000 tpy.

Elsewhere, in Liaoning province in Northeast China in October 2009, Zhenhua Oil started up an ethylene plant at its newly opened 100,000-b/d refinery. Zhenhua Oil is owned by state conglomerate North China Industries Corp. (Norinco) and in turn owns Liaoning Jinhua Chemicals Group, which it acquired in early 2006, to run the new ethylene cracker.

In April 2010, Shell Eastern Petroleum Ltd. started up its new ethylene cracker in Singapore (OGJ Online, Apr. 19, 2010). The cracker complex is part of the Shell Eastern Petrochemicals Complex, which consists of modifications to the existing Bukom refinery and construction of a new world-scale monoethylene glycol plant on Jurong island.

The 800,000-tpy cracker increases Singapore's ethylene capacity by 40%, said a company announcement, while also producing 450,000 tpy of propylene, 230,000 tpy of benzene, and 155,000 tpy of butadiene.

The cracker uses Lummus Technology proprietary ethylene cracking technology, and the butadiene extraction unit uses proprietary technology from BASF/Lummus Technology.

CB&I, Houston, in joint venture with Toyo Engineering Corp., completed the engineering, procurement, and construction of the cracker.

And in May 2010, Qatar Petroleum started up a new ethane cracker at its Ras Laffan industrial site (OGJ Online, May 4, 2010). It feeds the new Qatofin polyethylene plant at Mesaieed started up in November 2009.

According to Total SA, QP's 22.2% partner in the venture through Total Petrochmicals, the Ras Laffan olefin cracker is the largest based on ethane in the world and can produce 1.3 million tpy of ethylene. Also a partner in the project is Chevron Phillips Chemical Co.

Feed for the cracker comes from raw natural gas produced from North field. Produced methane feeds the large LNG plants at Ras Laffan; the separated ethane then flows to the new cracker.

Total holds interests in North field through the Dolphin and Qatargas I and II projects.

Largest producers

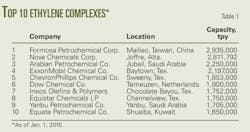

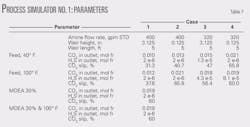

Table 1 shows rankings of the 10 largest ethylene production complexes in the world.

For 2009, Formosa Petrochemical Corp. pushed Nova Chemical Corp.'s 2.8-million-tpy Joffre plant from its top spot on the list.

Formosa Petrochemical reported to OGJ it has increased two of its three units at Mailiao, to 700,000 tpy from 450,000 tpy and to 1.35 million tpy from 900,000. The expansions sent the company's capacity past Nova Chemical by more than 12,000 tpy.

The order remained unchanged among the remainder of the list, even though ChevronPhillips Chemical Co. expanded its Sweeny, Tex., plant by 9,000 tpy.

Regional review

Table 2 ranks ethylene production capacity by region; Table 3 shows changes for individual countries between 2009 and 2010.

Adding more than 4.4 million tpy of ethylene production capacity, China installed the lion's share of new capacity in Asia-Pacific, which—with more than 6.3 million tpy of new or added capacity—in turn led the world in capacity additions, spanning into 2010.

China's activity, along with Singapore's, was detailed previously. Also noted previously, Formosa Petrochemical added 385,000 tpy.

Following Asia-Pacific in added ethylene capacity in 2009 is the Middle East/Africa, led by Saudi Aramco, which started up Phase 1 of its Petro Rabigh petrochemical plant, bringing on stream a 1.5-million-tpy ethylene plant.

On the other hand, Eastern Europe shut 600,000 tpy of capacity; North America, more than 935,000 tpy of ethylene capacity.

In the US last year, Flint Hills Corp. shut down the 360,000-tpy ethylene plant at Odessa, Tex., despite having purchased the plant from Huntsman Corp. with the previous 2 years. As part of the sale, Flint Hills also purchased Huntsman's 635,000-tpy Port Arthur, Tex., ethylene plant and has continued to operate it.

Largest ethylene producers

Table 4 lists the top 10 owners of ethylene capacity worldwide. There was considerable shifting of positions 2009-10. The first column of capacities presents capacities as if a company owned 100% of each plant; the second column reflects the total for actual percentages for each company.

ExxonMobil moved ahead of both Dow Chemical, which had been in first position for some years, and Saudi Basic Industries. Sinopec moved to the No. 5 spot by adding 1 million tpy of ethylene capacity at Tianjin, as mentioned earlier, and bringing on line new 1-million-tpy capacity at Zhenhai.

Total AS made it onto the list, to No. 6, pushing off ChevronPhillips Chemical Co., which for 2008 had clung to No. 10. LyondellBasell moved down two spots to No. 5, Ineos to No. 9, and Formosa Petrochemical to No. 10.

Construction

Table 5 lists ethylene production capacity slated to start up during 2009-13.

For 2009, nearly 11 million tpy of ethylene production capacity was scheduled to come on line, according to responses to OGJ's construction questionnaires. As has been shown, projects in China made up more than 4 million tpy of that.

The latest OGJ construction data show that nearly 12 million tpy of new capacity are slated to come on stream in 2010 (Table 5). But global economic uncertainties and the growing glut of ethylene capacity are almost certain to trim that considerably. (See the accompanying article on p. 53 for a closer look at the ethylene industry's cyclical history and nature.)

As has been predicted for some time by many industry observers, virtually all new capacity will be in the Middle East and Asia-Pacific. Four of the projects listed show capacities of 1 million tpy each or more and comprise 4.5 million tpy.

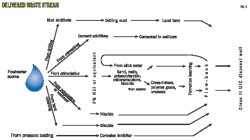

Fig. 2 presents a long-term view of global capacity growth.

Predictions for many years have envisioned growth among Middle East, especially Arabian Gulf, gas producers that plan to supply feedstocks for the equally expanding petrochemical capacities, especially ethylene, in Asia-Pacific. Events in 2009-10 are showing those visions to have been on the mark.

As this article has noted, early 2010 has seen much of the predicted growth come on stream. In April, Sinopec started up its 1-million-tpy ethylene plant at Zhenhai. Plans for 2010 call for at least 2.3 million tpy more for Dushanzi in Zinjiang Province, Maoming in Guangdong, and Ningbo in Zhejiang.

Likewise, India's Oil & Natural Gas Corp. plans to start up 1.1 million tpy at Dahej. And Shell Eastern Petroleum has already begun operations on Bukom Island, Singapore.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com