'Flexible factory' steadies unconventional gas work

Enhancing operational flexibility of the factory approach to unconventional-gas drilling programs can help operators lower the risk of inefficient use of capital, which some have encountered with costly results. To achieve such flexibility, operators can establish internal and external triggers allowing them to adjust to unforeseen changes in markets, geology, availability of services and supplies, and other operational challenges.

While the industry has made great progress in terms of reducing development cost and compressing cycle time by standardizing process and technical design, the dramatic collapse of gas prices in 2008 and the subsequent liquidity crisis have forced companies to reexamine development of many assets. The picture is not rosy: Uneconomic land positions and partially finished wells plague the balance sheets of already highly leveraged companies. In addition, subsurface characterization still poses challenges to the productivity of wells in terms of both initial production and ultimate recovery.

Operators need strategies to deal with uncertain conditions driven by geological characteristics, market evolution, or even supply constraints. This article describes how an organization can detect variations to alter the economics of plays promptly and to continuously improve performance.

This new approach departs from the consideration of unconventional plays as a purely statistical exercise. It requires tight integration between various functions throughout the life cycle of a play to support the right decision in nearly real time. This issue is highly relevant for North American operators who are moving into relatively new areas such as the Marcellus and Haynesville shales.

Improving cost and production performance is imperative in the highly volatile North American gas market. For operators considering entering the unconventional gas business overseas, experience from North America can be very valuable.

Unconventional gas lessons

Production of gas from unconventional reservoirs is now a major part of the energy supply in North America. It is also attracting attention and investment in other parts of the world. This success results from progress the industry has made over the past 10 years to unlock the commercial potential of unconventional gas reserves. Drilling techniques, fracturing technology, and improved understanding of subsurface issues have helped companies overcome the challenges of low porosity and heterogeneous formations.

The industry has adopted new business processes capable of handling large numbers of wells. Application of factory-like models is becoming the industry norm to speed up surface and drilling activities of multiyear development programs. Leading companies have been able to reduce development cost by up to 40% and accelerate time to production by 30%.

These improvements are largely the result of standardization of design and development processes. Accelerated permitting, elimination of crew downtime, parallel processing of pad construction and drilling activities, higher rig utilization, and seamless completion and tie-in are examples of near-term benefits companies have been able to capture.

However, the positive results mask a number of negative side effects. As prices collapsed, easy capital dried up, and liquidity constraints highlighted inefficiencies. In the rush to acquire land and launch large development programs, some companies acquired large inventories of uneconomic leases, left many wells uncompleted, or developed underperforming assets due to poorly understood geology. In addition, the uncertainty of the production decline rate and of actual ultimate recovery of unconventional reserves creates uncertainty as to the future profitability of these positions.

Unconventional developments require an investment commitment over a long period of time and over large geographic areas. This requirement exposes companies to volatility, both in the market and in terms of geology, which raises the risk of inefficient use of capital.

Some US-based independent producers have learned the lesson the hard way, realizing that a number of wells were destroying value (mostly due to unseen geological changes). To them, the point has become clear that unconventional plays are not just a statistical game where the objective is to drill as many wells as possible, as cheaply as possible (Fig. 1).

To be sure, unconventional gas is appealing: There is a large supply of it, and the industry is getting better at drilling for it economically. But it can be tricky as subsurface uncertainty and shifting market conditions challenge companies to adjust development plans to avoid making investments that result in value loss.

Need for flexibility

As unconventional plays gained in importance, many companies realized that a new operating model was necessary to effectively execute development campaigns of hundreds, if not thousands of wells. As a result, companies deployed capabilities to enable cross-functional coordination to enable a continuous, efficient flow of activity throughout the end-to-end development process. In addition, they standardized well design to avoid spending unnecessary engineering hours and streamline the interface with suppliers. Typically, the approach followed a pace based on external constraints such as rig availability and deployment of infrastructure (e.g., gathering capacity).

This "factory approach" represented a significant departure from conventional development practices as it forced companies to think in terms of groups of wells and execute the development in a factory-like environment (see table).

The geographic extent of most unconventional plays helps ensure that any location within the core area will be productive at least to some degree. This has led many operators to believe that they can generate a limited number of well designs and simply reapply those designs across the field. Operators further convince themselves of the merits of this approach by choosing not to fully characterize the reservoir and optimize the performance of each individual well, assuming that the efficiencies provided by standardization exceed the costs of analysis and customization.

The major drawback to this approach is its inherent rigidity. When the initial field development plan is created and the investment approved based on pilot results, attention turns to speed and cost of execution. Supplier commitments are made, permits are secured, and the factory model produces completed wells quite efficiently. By the time deviations in production profiles against the initial type curves are noticed, the system is full of wells partially completed, leading to the value destruction shown in Fig. 1.

What is the alternative? Revert to the conventional approach, in which each well is optimized to make sure the location is thoroughly analyzed and well design is adjusted to the location? This would bring development activity to a crawl and increase costs.

Clearly, the solution lies between these two extremes. Industry leaders are now gradually deploying continuous improvement capabilities to adjust, when needed, the efficient but rigid factory model. In short, unconventional plays call for a "flexible-factory" model, capable of sustaining low unit development costs and rapid cycle time while making course corrections (e.g., change of well design, spacing, pace, etc.) when geology or market conditions change.

The flexible factory has three building blocks: 1) definition of triggers for course corrections, 2) deploying continuous design improvement capabilities, and 3) operating with a rolling planning horizon.

Course corrections

The multiple years needed to develop unconventional assets make it almost certain that factors supporting the initial investment decision will change during the development. In that context, operators need to adopt triggers that prompt changes in design, drilling plans, or capital deployment strategy. These triggers are a combination of internal and external factors. Internal triggers may include changes to the pace of project execution, empirical data that support use of a different type of completion, well production data that support an increased density of infill wells, or the interpretation of data that support additional stages of fracturing. External triggers may include changes in rig or contractor availability, material shortages, long-term contracts, or other changes in the supply chain or market conditions.

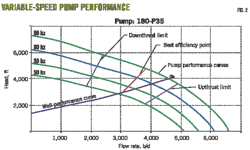

Not all external and internal factors have the same impact on performance of an unconventional play. Similarly, different plays will have different types of uncertainty and therefore different triggers. It therefore is critical to understand the key factors impacting the economics of a given asset in order to define a set of fit-for-purpose triggers (Fig. 2).

It also is critical to understand sensitivities to each parameter and how the sensitivities change over time. The ranges chosen in the sensitivity analysis should be linked to the historical ranges within the type of asset for the operator and analogous operators in the area. Once this is done in the initial phases of the development it should be updated periodically. In doing so, the operator is better positioned to anticipate impactful events that require a shift in development strategy.

Monitoring these key parameters requires various approaches, depending on the availability of information. For example, the parameters related to reserve estimation and actual production volume typically require a blend of modeling to understand subsurface characteristics and ongoing empirical data such as seismic, logging, and production volume to calibrate the model and integrate new information.

Supply chain cost evolution will demand regular monitoring of market pricing to test the competitiveness of current contracts. Market indicators are typically more straightforward to monitor as spot pricing and futures are in the public domain.

Continuous improvement

The response to a trigger is typically cross-functional. A severe deviation in initial production or observed decline rates should trigger a geology review as a natural fracture or unseen formation characteristic can challenge the original production prediction (both up and down). Does it mean that the frac design needs to be optimized? Is the well spacing adequate? Is this a zone worth developing?

Clearly, input from various functions is needed: reservoir engineering to update models, development team for well design, supply chain for impacts on logistics and activity forecast, business planning for cash flow considerations, operations for production volumes. Too often, these decisions are made in organizational silos, with minimal understanding of the implications to other parts of the organization (e.g., change in well spacing requires rework in pad design; change in activity impacts supply chain forecasts). Other typical pitfalls include the lack of a structured process (it is done ad-hoc or differently every time), lack of follow-through (having the meeting but not using the information), and inability to identify trends (no way to look back on previous after-action review results).

Effective management of the triggers requires a set of continuous design improvement capabilities. First, organizations need to establish a structured process to break functional silos and routinize the process by which the organization looks at trends and identifies actions.

Second, in order to be effective, the continuous improvement process needs to ensure proper follow-through takes place. This might involve rewarding people on the basis of an asset's overall performance and moving away from pure individual performance, as some of the actions might hurt some parts of the business for the greater good; for example, changing the well design to maximize production to the detriment of the surface facility group, which will have to rework some of the locations. Another solution might be to create a single point of accountability in charge of tracking actions and measuring impact.

Third, the information necessary to monitor trends needs to be available in the proper format. This can be addressed through the deployment of either dedicated manpower or technology, though the many examples of failed knowledge management programs suggest that relying solely on technology is risky. Better solutions will utilize some kind of technology platform to capture standard outputs and make these searchable. Such an approach can range from simple filing systems managed by someone who maintains a level of knowledge over time to sophisticated systems that utilize a search engine.

Rolling horizons

The positive gains from continuous design improvement will be muted if operators adopt a rigid development planning approach, which prevents organizations from making the necessary course corrections detected by trigger events.

Segmenting the field development plan into various phases creates natural points where design changes can be introduced based on learning from previous phases. A number of factors drive the definition of the optimum duration of one segment. For example, the level of subsurface homogeneity (or lack thereof) of a section of the play, the accuracy of the initial production estimates versus actual results, commodity pricing trends, and the lead-time required to properly plan for the supply logistics impact the definition of the optimum phase duration.

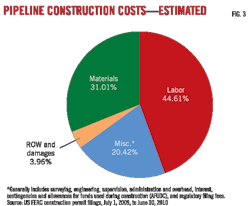

Fig. 3 illustrates how the various phases of a completed field development stack up over time.

This phased approach has a number of benefits. First, it naturally prevents design flaws from propagating throughout the field and levels workloads among various functional groups, making resource planning and allocation easier. It also accommodates variations (being subsurface, market, or supply-driven), and provides transparency of the impact of late changes in plans or designs. In addition, when continuous design improvement becomes a business objective, professionals come up with very creative ideas (such as modular and mobile separation capacity that better matches real decline curves). The result will be a better understanding of the subsurface, an optimized design of wells and facility equipment, lower overall development cost, and an optimum rate of drilling.

The combination of these various building blocks creates an integrated system where the pace of the flexible factory and the technical design are adjusted via a feedback loop to optimize overall performance (Fig. 4).

The flexible factory should be construed as reactive (i.e., act only when a trigger is activated). With a good trigger-monitoring approach and the capabilities to execute it in place, a strategy to continually reduce uncertainty and the sensitivity of the factors under the control of an operator (e.g., subsurface uncertainty, cost) should be implemented. This strategy requires a constant monitoring of performance to identify areas where the operator can impact the parameters over which it has some measure of influence.

Implementation hurdles

The flexible-factory approach challenges entrenched approaches, mostly inherited from the traditional oil exploration and production mindset: Projects are handled via a stage-gate process where reduction of project uncertainty below a given acceptable level triggers commitment to capital and initiates large-scale construction activity. In contrast, the execution of an unconventional play requires constant adjustment to the initial assumptions and course corrections in both technical decisions and capital allocations.

As a result, continuous cross-functional collaboration (i.e., subsurface, development, operations, regulatory, supply chain, finance, and commercial) is imperative. This requires a different set of decision-making processes. For example, an unconventional player realized that the budgeting process, which was historically based on an annual cycle, was no longer adequate. A quarterly cycle was more appropriate to provide the flexibility to adjust the deployment of capital and minimize the investment risks.

Similarly, the flexible-factory model requires a constant feedback loop from the operation to the subsurface and development functions. To make the system work, the cross-functional coordination and performance target-setting need to be linked with the performance of the asset (in terms of both production and cost). In some cases, operators adopt organizational models that align functions with a given asset and implement common key performance indicators to encourage cross-functional cooperation.

Other implementation hurdles typically challenge companies throughout the implementation of a flexible factory. Making investment decisions under uncertain conditions, balancing use of empirical data with scientific subsurface investigative techniques, realizing that ensuring material and manpower are available at the right time and the right place with minimum wastes from permitting to well tie-in all are examples of change-management challenges companies typically face when implementing a flexible factory.

Fundamentally, work practices need to change, including how long-term bets are made, how people interact with each other, and the tools they use to make real-time decisions. This is achieved via a journey where the benefits of the new model become apparent, first on a small scale (e.g., pilot for a given asset) and then scaled up across multiple assets. The model has proven to be very effective in multiple cases. Companies considering implementing a flexible-factory model can clearly benefit from the experiences of peers who have already undertaken the journey.

Reaching the baseline

As projects progress, operators can expect wells to improve over time in terms of cost and production profile until they stabilize at a optimized level. Through careful application of flexible-factory principles, operators can reach that baseline much more quickly, generating great value for the project.

For example, in most development programs where an effort is made to continuously improve, a reduction of 20-50% in break-even price has been observed. For an operator entering new areas such as the Haynesville or Marcellus shale, capturing the learning curve quickly will be a key competitive advantage.

As discussed in a recent Schlumberger Business Consulting publication, Managing Through the Volatile North American Gas Market, being a low-cost natural gas producer is the hallmark of leading unconventional operators in North America. In that context, adopting a flexible-factory model is a natural step for unconventional players. This approach to unconventional plays has strong implications for North American producers as well as for companies entering the fray overseas.

In North America, it is a matter of being able to manage extreme market volatility in a cash-constrained environment. Globally, it is an opportunity to fully leverage the industry lessons learned to avoid the same pitfalls.

The authors

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com