Slump trims forecasts for Canadian oil sands

Expectations are falling for bitumen production from the Canadian oil sands as the international price of crude oil languishes around $40/bbl, far below levels required by new investments in production and upgrading.

While once-stratospheric operating costs have fallen in the major oil-sands producing regions of Alberta, their slide hasn’t matched that of oil prices, which peaked last July above $140/bbl.

Companies have delayed, suspended, or canceled dozens of upgrading and extraction projects (see table). Many of them have announced layoffs. Investment expectations are plunging.

With layoff announcements frequent, the unemployment rate in Alberta is increasing. After several years of booming activity and labor shortage, however, it remains relatively low. The provincial government said the unemployment rate in January rose to a seasonally adjusted 4.4% from 4.1% in December and 3.2% in January 2008. The new figure for Alberta was still well below the average unemployment rate for all of Canada of 7.2%.

The operational slowdown comes as worry grows about the environmental consequences of oil sands production and upgrading, which require more water and energy than conventional production and emit more greenhouse gases (GHG) and, in the case of mining projects, extensive surface disturbance. A major uncertainty for oil sands project operators is the cost of future measures enacted to control GHG emissions.

Last month the Alberta government published a 20-year strategy for oil sands development that it said seeks, among other things, to balance economic growth, environmental values, and land-use concerns of aboriginal peoples. Environmental groups criticized the strategy for lacking details.

Also in February, the Energy Resources Conservation Board and Alberta Environment sought comments on a draft directive that would reduce water use in thermal in situ operations and increase water recycling.

And with rising costs of environmental remediation ever looming, the royalty rate on oil sands production increased at the beginning of the year under Alberta’s “New Royalty Framework,” which was approved while oil prices were high and rising (OGJ, Nov. 5, 2007, p. 34).

Weakening economics

All these trends weaken the economics of an industry crucial to Alberta and increasingly important to the Canadian economy and global oil supply.

Inevitably, the weakening is taking its toll on expected production.

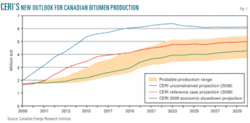

Last month the Canadian Energy Research Institute (CERI) cut forecasts it made only last November for oil sands production through 2030 (OGJ, Feb. 16, 2009, Newsletter; Fig. 1).

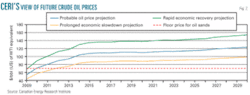

Senior Economist David McColl, author of the outlook, said the new projection uses a CERI database of mining, in situ, and upgrader projects current as of Jan. 25. The forecast assumes the industry requires a West Texas Intermediate crude price above $70/bbl (US) to resume growth. It also assumes construction and operating costs rise in step with the oil price, exceeding the $70/bbl threshold in 2010 (Fig. 2).

The price projections follow forecasts by the US Energy Information Administration, with “rapid economic recovery” and “prolonged economic slowdown” projections reflecting a 25% rise or fall in the price of crude delivered to the US relative to the “probable” projection.

McColl’s study says oil sands projects now in operation should be able to withstand oil prices below $50/bbl for a while.

Lower growth

In its 2008 project, CERI saw potential for oil sands production to exceed 5 million b/d by 2015 and 6 million b/d by 2030 (“unconstrained projection” line in Fig. 1). Its 2008 reference case, however, was lower, projecting output of 3.4 million b/d of bitumen by 2015 and 5 million b/d by 2030.

Its new projection (labeled “2009 economic slowdown” in Fig. 2) assumes the WTI oil price stays below $60/bbl for most of 2009 and credit markets continue to lack liquidity. Economic recovery begins in early 2010, and liquidity returns slowly.

Oil sands production in this scenario stalls until 2013 and shows no major growth until 2015. At first, output growth resumes only for established projects and those with financing in place before the credit collapse of 2008. Many projects will face a period of reassessment and refinancing that might last several years.

The new CERI forecast projects a range of oil sands production: 1.9-2.9 million b/d in 2015, rising to 3.7-5.4 million b/d by 2030.

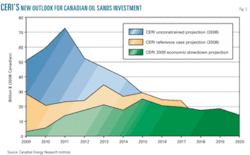

The projection calls for “modest” spending on oil sands, McColl says, “at a level that CERI believes the Canadian economy can easily absorb.”

Labor and equipment availability have combined with the economic slowdown to trim $97 billion (Can.) of expected spending from the 2008 reference case and $241 billion from the “unconstrained projection” case (Fig. 3).

McCall says the oil sands production outlook for 2030 won’t be known with more certainty for “well over a decade.”

He adds: “What is clear to us is that, over the next few years, oil sands production growth will be almost at a standstill, and new capital investment will collapse to levels not seen since before the turn of the century.”

In 2000, he notes, oil sands investment was “just over $4 billion.”

CAPP’s adjustment

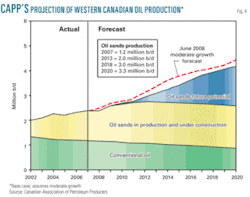

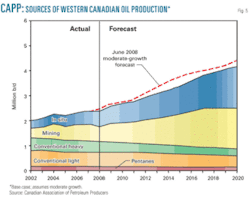

Like CERI, the Canadian Association of Petroleum Producers has trimmed its expectations for oil sands production (OGJ, Jan. 12, 2009, p. 39).

In December, the group updated a June 2008 forecast to reflect announced changes to project schedules, reducing its “moderate-growth” case to show continued but slower growth in total crude oil production for western Canada (Figs. 4, 5).

It now sees minimal production change from the 2008 projection in 2008-12 but as much as 300,000 b/d less in 2012-17.

Deferrals in upgrader projects, it adds, will result in more output of heavier blends and less upgraded, lighter oil.