Special Report: Current pipeline expansion slows; future plans contract

Planned pipeline construction to be completed in 2009 rose more slowly than in 2008, increasing by more than 13% from the previous year, driven by large natural gas transportation projects in both the US and Asia-Pacific but constrained by a drop in planned crude mileage.

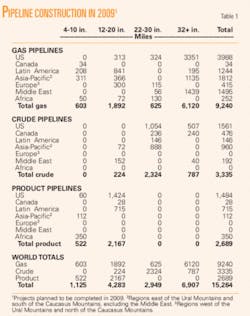

Operators plan to complete installation of more than 15,000 miles in 2009 alone (Table 1), with natural gas construction making up 60.5% (more than 9,200 miles) of the plans, based on reports from the world’s pipeline operating companies and data collected by Oil & Gas Journal.

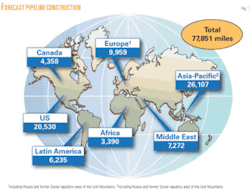

For 2009 and beyond, less mileage is planned in all pipeline categories than had been the case the previous year, as a combination of the global economic crisis and lower commodity prices begin to affect infrastructure development plans..

Global demand for natural gas drove a number of the large pipeline projects set for completion in 2009. Long-term natural gas pipeline plans (2009 and beyond), however, seem to already reflect the slowing in demand forecast since, with fewer plans for pipelines from producing regions such as Canada and the Middle East leading the downward trend.

Fewer crude plans in both the Asia-Pacific and Africa keyed an 18% 2009 slide in miles expected to be completed in that sector from global totals the previous year.

Plans for construction of product pipelines in 2009 rose globally, driven by the continued construction of ethanol pipelines in Brazil and new clean products pipelines in Africa.

As 2008 began, operators had announced plans to build nearly 78,000 miles of crude oil, product, and natural gas pipelines beginning this year and extending into the next decade (Fig. 1), a 9% decrease from data reported last year (OGJ, Feb. 18, 2008, p. 47) in this report. The vast majority (nearly 75%) of these plans is for natural gas pipelines, an increase from the previous year.

Outlook

The downturn in worldwide pipeline construction trends reflects the current economic unrest but run counter to US Energy Information Administration’s energy consumption forecasts, which show continued growth, even if more slowly than predictions from a year ago.

EIA forecast world marketed energy consumption to increase by 50% through 2030 (using a 2005 baseline), a period that encompasses the long-term pipeline construction projections stated here.

Energy demand growth will be strongest, according to mid-year 2008 analysis, among countries outside the Organization for Economic Cooperation and Development. This non-OECD growth will be led by China and India, whose combined energy use will more that double over the projection period to one-quarter of world energy consumption. US demand share will contract during the same period from 22% to 17%.

Fuelling this energy demand growth is projected gross domestic product growth in non-OECD Asia of 5.8%/year through 2030—led by China at 6.4%/year, the highest projected growth rate in the world—compared with 4% worldwide. Each of these levels are flat or slightly lower than EIA projections from a year earlier, reflecting US-led economic uncertainty and ending recent expansion in the projected rate of GDP growth.

Structural issues that have implications for medium to long-term growth in China include the pace of reform affecting inefficient state-owned companies and a banking system carrying a large number of nonperforming loans, according to the EIA. Development of domestic capital markets to help macroeconomic stability and ensure China’s large savings are used efficiently supports medium-term growth projections, according to the EIA.

EIA described the medium-term prospects for India’s economy as positive, as it continues to privatize state enterprises and increasingly adopt free-market policies. EIA projects 5.8%/year demand growth in India 2005-30.

In December 2008, EIA reduced projected US energy consumption in 2030 to 113.35 quadrillion btu from 123.8 quadrillion btu, 10.45 quadrillion btu lower than the previous year’s projection. This 8.4% drop in energy consumption, combined with projected increases in domestic supply, are projected to reduce net liquids imports by 2030 from the 54% projected in 2008 to 41% in the 2009 outlook.2

EIA projects domestic natural gas production in 2030 of 24.28 tcf/year, compared with the 19.9 tcf/year projected a year earlier. The increased production is more than enough to counter the increase in projected consumption also made by EIA. Pegged in 2008 at 23.4 tcf/year by 2030, this year’s projections place 2030 consumption at 25.08 tcf/year, reducing net imports to just 3% vs. the 14% projected in 2008. Unconventional production will make up the bulk of the supply increase.

The 2009 outlook projects the US will be a net pipeline exporter by 2030. Net pipeline imports of natural gas from Canada and Mexico will fall from 2.94 tcf in 2006 to -0.16 tcf in 2030, according to the EIA, which last year pegged 2030 net pipeline imports at 0.5 tcf. EIA once again also sharply reduced the amount of LNG it expects the US to be importing annually in 2030, from 2.9 tcf in its 2008 annual outlook to 0.84 tcf in this year’s publication.

Current pipeline construction plans reflect the landscape described by EIA, with the bulk of US work both this year and looking forward centered on moving new domestic production to market.

OGJ has for more than 50 years tracked applications for gas pipeline construction to what is now called the Federal Energy Regulatory Commission. Applications filed in the 12 months ending June 30, 2008 (the most recent 1-year period surveyed) reflect the expected slowdown in US interstate pipeline construction.

- Nearly 900 miles of pipeline were proposed for land construction and no miles for offshore work. For the earlier 12-month period ending June 30, 2007, 2,032 miles were proposed for land construction.

- FERC applications for new or additional horsepower at the end of June 2008 fell even more sharply, reaching more than 238,500 hp, all onshore, compared with 713,000 hp of new or additional compression applied for a year earlier and 583,000 hp the year before that.

Bases, costs

For 2009 only (Table 1), operators plan to build more than 15,250 miles of oil and gas pipelines worldwide at a cost of nearly $61.5 billion. For 2008 only, companies had planned nearly 13,500 miles at a cost of more than $37.6 billion.

For projects completed after 2009 (Table 2), companies plan to lay more than 62,500 miles of line and spend roughly $225.5 billion. When these companies looked beyond 2008 last year, they anticipated spending more than $201 billion to lay more than 72,000 miles of line.

- Projections for 2009 pipeline mileage reflect only projects likely to be completed by yearend 2009, including construction in progress at the start of the year or set to begin during it.

- Projections for mileage in 2009 and beyond include construction that might begin in 2009 and be completed in 2009 or later.

Also included are some long-term projects judged as probable, even if they will not break ground until after 2009.

US average cost-per-mile for onshore pipeline construction (Table 4, OGJ, Sept. 1, 2008, p. 58) on FERC applications submitted by June 30, 2008, was $3.38 million. There were no offshore applications submitted.

US average cost-per-mile for offshore construction (Table 7, OGJ, Sept. 1, 2008, p. 62) on projects completed in the 12 months ending June 30, 2008, was $15.17 million.

Based on historical analysis and a few exceptions and variations notwithstanding, these projections assume that 90% of all construction will be onshore and 10% offshore and that pipelines 32 in. OD or larger are onshore projects.

Following is a breakdown of projected costs, using these assumptions and OGJ pipeline-cost data:

- Total onshore construction (14,428 miles) for 2009 only will cost almost $48.8 billion:

- —$3.4 billion for 4-10 in.

- —$13 billion for 12-20 in.

- —$9 billion for 22-30 in.

- —$23.4 billion for 32 in. and larger.

- Total offshore construction (836 miles) for 2009 only will cost nearly $12.7 billion:

- —$1.7 billion for 4-10 in.

- —$6.5 billion for 12-20 in.

- —$4.5 billion for 22-30 in.

- Total onshore construction (61,411 miles) for beyond 2009 will cost nearly $208 billion:

- —$1.5 billion for 4-10 in.

- —$14.6 billion for 12-20 in.

- —$19.7 billion for 22-30 in.

- —$172 billion for 32 in. and larger.

- Total offshore construction (1,176 miles) for beyond 2009 will cost nearly $18 billion:

- —$728 million for 4-10 in.

- —$7.3 billion for 12-20 in.

- —$9.8 billion for 22-30 in.

Action

What follows is a quick rundown of some of the major projects in each of the world’s regions.

Pipeline construction projects mirror end users’ energy demands, and much of that demand continues to center on natural gas, with the industry remaining focused on how to get that gas to market as quickly and efficiently as possible. The following sections look at both natural gas and liquids pipelines.

North American gas

BP PLC and ConocoPhillps have joined resources to build a 4-bcfd natural gas pipeline extending from Alaska’s North Slope to market in Canada and the US at an estimated cost of $20 billion. The companies plan to spend $600 million preparing for an open season slated to begin before yearend 2010. After the open season, the companies will file for certification from the US FERC and Canada’s National Energy Board for authorization to move forward with building the project.

The partners must also convince Alaskan authorities that their plan is the best one for developing the state’s gas resources and that it conforms to the Alaskan Gasline Inducement Act (AGIA), under which TransCanada in January 2008 obtained rights to build a North Slope gas pipeline. AGIA requires TransCanada to meet certain requirements that will advance the project in exchange for a license providing up to $500 million in matching funds.

Alaska received five applications for gas pipeline proposals under AGIA from AEnergia LLC, the Alaska Gasline Port Authority, the Alaska Natural Gas Development Authority, Little Sustina Construction Co., and a joint application from TransCanada Alaska Co. LLC and Foothills Pipe Lines Ltd. The state said a proposal submitted by ConocoPhillips did not meet the AGIA’s application criteria. BP and ExxonMobil did not submit applications.

TransCanada already has NEB authorization for its project.

In Canada, the proposed Mackenzie Valley pipeline would stretch more than 750 miles to transport Mackenzie River Delta gas to Alberta and beyond. Plans call for initial capacity of 1.2 bcfd, expandable to 1.9 bcfd. A combination of regulatory delays and mounting cost estimates has prevented tangible progress on this project. Canada’s Joint Review Panel, examining the environmental and socio-economic impacts of the $16.2-billion (Can.) project, plans to release its report in December 2009.

In addition to the Aboriginal Pipeline Group, other pipeline partners are Imperial Oil Ltd. 34.4%, ConocoPhillips Canada 15.7%, Shell Canada, 11.4%, and ExxonMobil Canada 5.2%

Costs include $7.8 billion for the Mackenzie Valley mainline, $3.5 billion for the gas gathering system, and $4.9 billion for anchor-field development.

Large US natural gas pipeline projects designed to move Midcontinent supplies to market centers continued to progress, with new projects also proposed. The Rockies Express pipeline, running 1,323 miles of 42 in. pipe from Cheyenne, Wyo., and Colorado to Clarington, Ohio, is the largest new US pipeline project undertaken in 20 years. The 1.8 bcfd, $3 billion line has firm commitments in place for 900 MMcfd, including a binding 500 MMcfd by EnCana Corp. and a conditional 400 MMcfd from the Wyoming Natural Gas Pipeline Authority.

Kinder Morgan Energy Partners LP will operate the pipeline and owns two thirds of the project. Sempra Pipelines & Storage holds one third of it. In exchange for capacity commitments, some shippers may exercise options for equity in the project, which could give KMP a minimum of 50% and Sempra 25% after construction.

The pipeline, which KMP expects to be completed by autumn 2009, will be brought on line in three segments.

REX-Entrega, running from Greasewood, Kanda, and Wamsutter to the Cheyenne Hub in Colorado and REX-West, covering the next 710 miles from the Cheyenne Hub in Colorado to Audrain County, Mo., and interconnecting with five other interstate pipelines, are already in service.

The 639-mile REX-East segment from Missouri to Ohio received its draft environmental impact statement in November 2007. In addition to the 42-in pipeline, FERC’s REX-East draft EIS covered the possible environmental impacts of 20 metering stations and 7 new compressor stations, including 2 to be built along REX-West in Wyoming and Nebraska.

FERC noted that the REX-East project would follow existing rights-of-way for more than 59% of its route and would be consistent with or conform to federal resource management plans.

REX-East construction began in summer 2008. Service to Lebanon, Ohio, is scheduled for spring 2009, with full service to Clarington targeted for autumn.

Alliance Pipeline Inc. and Questar Overthrust Pipeline Co. held an open season on their Rockies Alliance Pipeline project in June 2008. Initial support totaled 500,000 dekatherms/day (500 MMcfd) from both Rockies producers and Midwest markets. The pipeline will take delivery of natural gas from Opal, Meeker, and Wamsutter and terminate at Alliance Pipeline delivery points in the Chicago area.

The 875-mile, 42-in. OD pipeline will have capacity of 1.3 bcfd, expandable to 1.8 bcfd with extra compression. The Alliance system connects to the Guardian, Vector, Peoples, Nicor, ANR, NGPL, and Midwestern pipeline systems.

TransCanada proposed a competing Rockies-to-Midwest project, Pathfinder, consisting of 673 miles of 36-in. OD pipe running from Meeker, Colo., to an interconnection with the Northern Border Pipeline Co. system for delivery into the Ventura and Chicago area markets. The pipeline’s initial capacity will be 1.2 bcfd, with an ultimate capacity of 1.6 bcfd.

Ventura is a major connection with Northern Natural Gas, the major pipeline into Minnesota. The Chicago market provides access to numerous pipelines serving Wisconsin, Illinois, Indiana, Michigan, and Ontario.

El Paso Corp. proposed the $3-billion Ruby Pipeline connecting Rockies reserves to western US markets. The pipeline includes 670 miles of 42-in. OD pipe beginning at the Opal hub in Wyoming and terminating at a Malin, Ore., interconnect near California’s northern border. Ruby will have initial capacity between 1.3 and 1.5 bcfd, depending on final customer commitments.

Pipeline rights-of-way will cross four states: Wyoming, Utah, Nevada, and Oregon. El Paso has proposed four compressor stations: one near Opal hub in southwestern Wyoming; one south of Curlew junction, Utah; one at the project mid-point, north of Elko, Nev.; and one in northwestern Nevada.

Pending regulatory approvals, construction could begin in early 2010, with an estimated in-service data of March 2011.

Ruby was a competing proposal to Spectra Energy’s 1-bcfd Bronco Pipeline, also designed to deliver Rockies gas to Malin. Spectra held an open season on the $3-billion project in January 2008, with plans to put the line in service during 2011, but has since cancelled the project. The company is still evaluating other opportunities to move Rockies gas west.

Williams Gas Pipeline Co. and Trans-Canada PipeLines USA Ltd.’s proposed Sunstone Pipeline project was a third contender through this corridor, but the companies are reevaluating the scope and timing of the project and have temporarily suspended field work, including survey activities.

North American crude

Canadian oil sands development has slowed as oil prices plunged and the economy spiraled. Even so, this supply’s proximity to US demand has helped make export lines for Canadian crude a large portion of the work to be completed in the US for 2009.

TransCanada Corp. received permitting from the US Department of State in March 2008 to begin construction of border crossing facilities for its 2,148-mile Keystone oil pipeline project, which will transport oil from Canada to the US Midwest. ConocoPhillips is TransCanada’s partner in the project.

In addition to 1,379 miles of new-build US line, Keystone includes additions to existing Canadian pipelines and mainline flow reversals. It is expected to start up in late 2009 with the capacity to deliver 435,000 b/d of crude oil from Hardisty, Alta., to the US at Wood River and Patoka, Ill.

TransCanada plans to expand Keystone’s capacity to 590,000 b/d and extend the line to Cushing, Okla., starting in 2010. The project has secured firm long-term contracts totaling 495,000 b/d for an average of 18 years.

TransCanada announced plans in July 2008 for the Keystone Gulf Coast Expansion Project (Keystone XL), providing additional capacity of 500,000 b/d from western Canada to the US Gulf Coast by 2012. The expansion would boost the system’s total capacity to 1.1-million b/d at a total capital cost of about $12.2 billion. Keystone XL has secured additional firm, long-term contracts for 380,000 b/d for an average of 17 years from shippers.

Keystone XL includes 1,980 miles of 36-in. OD line starting in Hardisty, Alta., and extending to a delivery point near existing terminals in Port Arthur, Tex. (Fig. 2). Subject to shipper support, Keystone XL will include an additional 50-mile lateral to Houston. Additional pumping could boost the combined Keystone system’s throughput to 1.5 million b/d. TransCanada anticipates beginning construction in 2010, pending regulatory approvals, and intends to start the line in 2012

Enbridge Energy Partners LP plans its own pipeline expansion to deliver 450,000 b/d of crude oil to the US. Following on the heels of the Southern Access/Southern Lights expansion, Enbridge intends to build the Alberta Clipper crude pipeline between Hardisty, Alta., and Superior, Wis. This 1,000-mile line is expected to be in service by mid-2010. Initial capacity can be expanded to as much as 800,000 b/d.

Enbridge Inc. and ExxonMobil Pipeline Co. have tabled their own proposed pipeline system to transport crude from Patoka to the Texas Gulf Coast for the time being. The Texas Access Pipeline would have transported crude oil sourced from the Canadian oil sands region in Alberta and the upper US Midwest to refiners in Nederland and Houston, Tex.

Altex Energy is pursuing a completely newbuild 36-in. pipeline running directly from northern Alberta to the US Gulf Coast. The line’s initial capacity will be 425,000 b/d, but the company says expansion to 1 million b/d is possible as demand warrants (OGJ, Nov. 3, 2008, p. 60).

Enbridge has renewed plans to build the Northern Gateway Pipeline to transport 525,000 b/d of oil sands crude from near Edmonton, Alta. to a tanker terminal in British Columbia for shipment to China, other parts of Asia, and California. Enbridge is likely to submit pipeline plans to the NEB in 2009.

Northern Gateway includes a 1,170-km, 36-in. OD pipeline to move oil to the west and a parallel 20-in. OD pipeline for shipping 193,000 b/d of condensate from the coast east to Alberta refineries. Enbridge put the project on hold in December 2006 to focus on completing its Southern Access/Southern Lights project. Each line’s capacity is largely subscribed.

North American products

Colonial Pipeline Co. is proposing an additional pipeline from Jackson, La., to Austell, Ga., running alongside the two current main lines to the extent possible. The 460-mile Project ExCEL, prompted by announced Gulf Coast refinery expansions, represents a more than $2 billion investment.

Colonial is currently conducting permitting, with environmental analyses to follow once the route is finalized. The company hopes to begin construction in 2010, targeting a 2012 completion date.

Kinder Morgan Energy Partners LP is continuing to develop its $400 million expansion of the 550-mile CALNEV pipeline. This involves construction of a 16-in. pipeline from Colton, Calif., to Las Vegas, Nev., and will increase the system’s capacity to 200,000 b/d, transporting products for the military at Nellis Air Force Base. A further capacity increase to more than 300,000 b/d is possible with the addition of pump stations.

The new pipeline will parallel existing utility corridors between Colton and Las Vegas. Following its completion, the existing 14-in. line will be transferred to commercial jet fuel service for McCarran International Airport and any future airports planned in Las Vegas, with the 8-in. pipeline that currently serves the airport purged and held for future service.

Start-up of the line is scheduled for late 2009 or early 2010.

Holly Corp. and Sinclair Transportation Co. plan to jointly build a products pipeline extending from Wood Cross, Utah, refineries to a terminal north of Las Vegas. The UNEV Pipeline project includes construction of associated terminal facilities in Cedar City, Utah, and northern Las Vegas.

The US Bureau of Land Management issued a draft environmental impact statement in December 2008.

The 400 mile, 12-in. line will cost about $300 million and have an initial capacity of 62,000 b/d, expandable to 120,000 b/d. It will serve refineries and shippers along its route and interconnect to the Pioneer Pipeline.

The system is slated for completion by the end of this year.

Latin America

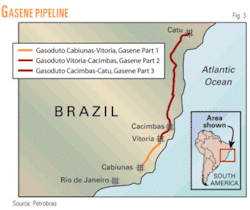

Brazil’s 862-mile Southeast-Northeast Interconnection Gas Pipeline (GASENE) will connect the existing southeastern gas system to the northeastern gas system, creating a common gas market and allowing gas imports at Bahia. GASENE connects Cabiúnas terminal in Rio de Janeiro state to Catu, Bahia (Fig. 3). It will create a common gas market in Brazil and allow gas import from Bahia.

Construction on the final 605-mile stretch of the pipeline, between Cacimbas and Catu started in May 2008. The 28-in. OD pipe, using one compressor station, is scheduled to enter service in 2010. Sinopec is building the pipeline, financed by China Development Bank.

Petrobras signed an accord with the Goias state government to build the country’s first new ethanol pipeline, a 12-in. OD, 975-km line to transport 12 million cu m/year. The pipeline will run from Goias to a refinery in Paulinia, near Sao Paulo. Japan’s Mitsui and Brazil’s Camargo Correa are also participating in the project, dubbed Projetos de Transporte de Alcool (PMCC). Petrobras plans to have the line in service by 2010.

Plans call for a future leg between Paulinia and Guararema, stretching from there to coastal terminals in Sao Sebastiao, Sao Paulo, and Ilha D’Agua, Rio de Janeiro.

Petrobras also said it would sign a cooperation agreement with two Brazilian states for a second 12-in. ethanol pipeline. Petrobras and the states of Mato Grosso do Sul and Parana plan to develop viability studies for the pipeline, which would cover 528 km, linking Campo Grande in western Brazil to the port of Paranagua in southern Brazil.

Peru’s Ministry of Energy reports that work is progressing on Camisea II, a gas export project featuring a 253-mile, 34-in. natural gas pipeline connecting Camisea Block 56 to a liquefaction plant being built on the coast 106 miles south of Lima. Peru LNG (Hunt Oil Co., 50%; SK Energy Co. Ltd., 30%; Repsol YPF, 20%) expects the project to enter service in 2010.

Asia-Pacific

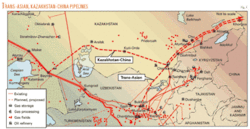

PetroChina has begun building its second West-East Pipeline (WEPP II) and expects to bring it into service during 2010. The pipeline is part of the larger Asian Gas Pipeline, running from Turkmenistan to eastern China. The Chinese section covers 3,400 miles, connecting Xinjiang province to Guangzhou and Shanghai. The development also calls for 1,240 miles of branch lines. WEPP II will carry 30 billion cu m/year from Central Asia to consuming centers in China.

The Chinese section of WEPP II will use 1.1 million tonnes of X80 42-in. OD welded pipe and 3.2 million tonnes of X80 18-in. OD spiral pipe.

Construction began on the Turkmen section in August 2007. About 117 miles will be laid in Turkmenistan, 329 miles through Uzbekistan and 803 miles through Kazakhstan. Service to the Chinese border is slated for 2012 (Fig. 4).

CNPC is also seeking 800,000 tonnes of steel for WEPP III, set to begin construction in 2010 or after completion of WEPP II. The pipeline will run 3,728 miles from Altai to Bohai Bay.

A planned 1,480 km pipeline running from western Kazakhstan to western China would carry 10 billion cu m/year once complete. The 1,040-mm OD pipeline, running from Beyneu to Chimkent (Fig. 4) has been in the works since 2005 and was originally proposed to carry as much as 40 billion cu m/year between Atyrau and Alashankou. Economic concerns and delays in developing Kazakhstan’s reserves dictated the route and capacity changes (OGJ, Jan. 5, 2009, p.58).

The Caspian nations are not the only countries actively pursuing export projects to China, with much of the crude mileage planned in the Asia Pacific region for 2009 consisting of the Eastern Siberia-Pacific Ocean crude line running from Russia to Japan and China.

The first stage of the 4,700-km project includes construction of a 2,400-km oil pipeline from Taishet to Skovorodino near the Chinese border and of a rail oil terminal at Perevoznaya Bay at a combined cost of $7.9 billion. The second stage, depending on development of Eastern Siberian oil fields, involves construction of a pipeline link between Skovorodino and Perevoznaya on Russia’s Pacific Coast.

China looks to import as much as 30 million tonnes/year of crude if a pipeline spur is built from Skovorodino to Daquing.

Russia and China suspended talks on construction of the proposed spur in November 2008, reversing a memorandum of understanding signed the previous month by Russian Prime Minister Vladimir Putin and his Chinese counterpart Premier Wen Jiabao.

Under terms of that MOU, China was to grant $15 billion in loans to Russia’s OAO Rosneft and $10 billion to Transneft for construction of the pipeline spur and for the supply of 15 million tonnes/year of oil over 20 years.

The branch pipeline was planned to extend some 70 km from Skovorodino in Siberia to the Chinese border and was to supply the oil hub of Daqing in northern China.

The long-awaited agreement about construction of the spur coincided with an announcement by Russian Deputy Prime Minister Igor Sechin that the Chinese government would provide Russian oil firms with “considerable” loans in return for increased oil supplies (OGJ Online, Oct. 29, 2008).

China subsequently made demands Russia found objectionable, in particular higher interest rates on the loans owing to a freeze in lending following the global financial crisis. Supplies along the Skovorodino-Perevoznaya route would total 50 million tonnes/year, the bulk of which would be exported to Japan, but hinge entirely on the combination of continued development of the other Siberian fields and Russia’s continued desire to export to Japan.

Gas Authority of India (GAIL) plans to complete construction of a 48-in. OD, 3,500-km pipeline system connecting existing terminals to the 1,600-Mw Pragati Phase III powerplant in Bawana, near Delhi by January 2010. The system will include compressors installed at Vijaipur and Jhabua. GAIL has also been authorized to construct pipelines between Chainsa and Hissar, Kochi and Bangalore, and Dabhol and Bangalore.

Myanmar awarded China the right to manage planned pipelines that will transport crude oil and natural gas from the Bay of Bengal across Myanmar to Kunming in southwestern China.

China National Petroleum Corp. will acquire a 50.9% stake in the firm that will build and operate the pipelines, while Myanmar players, including state-run Myanmar Oil & Gas Enterprise, will hold 49.1%.

Under the agreement, Myanmar and China will jointly construct two pipelines, one to transport oil carried by tanker from the Middle East and the other to carry gas obtained from Myanmar’s A-1 and A-3 blocks offshore.

A gas collection terminal and a port for oil tankers will be constructed on an island near Kyaukpyu on the Bay of Bengal in western Myanmar.

The pipelines will extend from Mandalay in central Myanmar; through Lashio in the Myanmar state of Shan and Muse, a town bordering the Chinese province of Yunnan. It will terminate in Kunming. In addition to Yunnan, analysts said, other areas will benefit from the pipelines: Chongqing municipality, Guangxi Zhuang autonomous region, Sichuan province, and Guizhou province in southwest China.

Total estimated project costs amount to $1.5 billion for the oil pipeline and $1.04 billion for the gas pipeline.

Yunnan will start construction in first-half 2009 as part of its plan to spend some $10.55 billion on energy projects next year, according to Mi Dongsheng, head of the province’s Provincial Development and Reform Commission.

The new pipelines will give China better access to Myanmar’s resources and will speed deliveries and improve China’s energy security by bypassing the congested Malacca Strait, which currently ships most of China’s imported crude oil.

Europe

Work started in early December 2005 on the Russian onshore section of the Nord Stream pipeline in Babayevo. This 56-in. segment will stretch 917 km to the Baltic Sea coast near Vyborg, linking existing gas pipelines from Siberia to the NEGP project. Seven compressor stations will provide the necessary pressure. The pipeline will cross the Baltic, making landfall near Greifswald, Germany. This section will be 1,200 km long with a 48-in. OD.

The full system is scheduled to start operations in 2011 at a capacity of 27.5 billion cu m/year. The project includes building a second, parallel pipeline, doubling capacity to about 55 billion cu m/year. This second pipeline is planned to come on stream in 2012.

A joint venture of Gazprom (51%), Wintershall AG (20%), E.ON Ruhrgas AG (20%), and NV Nederlandse Gasunie (9%) is building the pipeline. For the two-leg option, the total cost for the offshore project will amount to more than €5 billion, with Gazprom investing an additional €1.3 billion in the onshore section. Russia began production at the 825.2 billion cu m Yuzhno Russkoye oil and gas condensate field in December 2007. Gas from this field will be shipped through Nord Stream once it is completed.

Gazprom and Eni SPA agreed in December 2007 to build the 560-mile South Stream gas pipeline under the Black Sea and through Bulgaria. Bulgaria and Russia reached agreement in January 2008. On completion, the $10-billion line could distribute gas to northern and southern Europe, with an estimated capacity of 30 billion cu m/year. Participants plan to deliver first gas through South Stream by 2013.

Gazprom Vice-President Alexander Medvedev said in December 2008 that work on both Nord Stream and South Stream would continue despite the financial and economic crises.

Plans to export Algerian gas via Italy also progressed. Galsi SPA and Snam Rete Gas SPA signed a memorandum of understanding in November 2007 to construct the Italian section of the planned 8 billion cu m/year Galsi natural gas pipeline, which will deliver Algerian gas to Italy via Sardinia.

Gasli shareholders are Sonatrach, Edison SPA, Enel SPA, Hera Trading, Regione Sardegna, and Wintershall AG.

The project envisions four pipeline segments: 640 km onshore between Hassi R’mel gas field in Algeria and El Kala on the Algerian coast; 310 km between El Kala and Cagliari on Sardinia in water as deep as 2,850 m; 300 km between Cagliari and Olbia on the northern Sardinian coast; and 220 km between Olbia and Pescaia, southeast of Florence, in water as deep as 900 m.

Sonatrach will deliver 3 billion cu m/year into the system, Enel, 2 billion cu m/year, and Hera Trading, 1 billion cu m/year.

Work on the line was under way in January 2009, with Snam Rete Gas CEO Carlo Malacarne having said in October 2008 the line would enter service in 2012-2013

Austria’s OMV AG continues to advance the 56-in. Nabucco pipeline, which will bring some combination of Central Asian, Caspian, and Middle Eastern gas to the Baumgarten hub in Austria near the Slovakian border at a rate of 31 billion cu m/year, before moving it on to Western Europe. The $6.5-billion pipeline, spanning 3,300 km, is expected to be completed by 2013.

Feasibility studies have led to a two-stage construction plan. The first phase, starting next year calls for 2,000 km of pipe between Ankara, Turkey, and Baumgarten, allowing 8 billion cu m/year of gas from the existing Turkish pipeline network to be transported through the line by 2012. Second-stage construction would begin in 2012 and build eastward from Ankara to the Iranian and Georgian borders (Fig. 2).

The US supports construction of Nabucco, citing the need to move gas into Europe though economically viable and secure routes.

To deliver gas from Bovanenkovo field—projected production 115 billion cu m/year—Russia is building a multi-line gas transmission system connecting the Yamal Peninsula and central Russia. Construction calls for 1,420-mm OD pipes designed to work at higher pressures than existing Russian lines.

Total pipeline length will exceed 2,400 km, consisting of the Bovanenkovo-Ukhta pipeline (1,100 km, 140 billion cu m/year) and the Ukhta-Torzhok gas pipeline (1,300 km, 81.5 billion cu m/year).

Gazprom began building the 72 km subsea section of the Bovanenkovo-Uktha line, crossing Baidarate Bay, in August 2008. Construction of the main trunkline began in December 2008.

Middle East

Iran, Pakistan, and India continued discussions toward building the long-contemplated gas export line from Iran to India during 2008. The $7 billion project would transport as much as 2.2 bcfd of natural gas from the South Pars field in the Persian Gulf through 2,100 km of 56-in. OD line. (Iran, 1,100 km; Pakistan, 750 km; India, 250 km). Pakistan’s share of gas from the pipeline would be 1.05 bcfd. If India does not participate, Pakistan would take the entire volume.

Natural gas pricing agreements were once reached between Iran and Pakistan, but India’s status remains uncertain and as of December 2008 pricing disputes had reemerged between Iran and Pakistan. In addition to difficulties reaching economic terms, India is under US pressure to not participate in the project and has security concerns regarding having such a major energy artery running through Pakistan.

Pakistan says it will require $1 billion to build underground storage for gas to be imported from Iran and Turkmenistan, according to the country’s petroleum ministry and the Asian Development Bank in a joint study with Sui Northern Gas Pipeline Ltd. (SNGPL) and Sui Southern Gas Co. Ltd. (SSGCL).

Four stages of the 56-in. OD Iranian Gas Trunkline (IGAT) system are still under development. IGAT VI will transfer gas produced by South Pars phases 6-10 from Asalouyeh across 492 km to Khuzestan province for consumption and injection. Construction is expected to be complete in 2009.

IGAT VII will move South Pars 9-10 gas from Asalouyeh 878 km to Hormozgan province and the Shar-Khoon refinery. Part of the gas will be shipped onward to Sistan and Baluchistan provinces, with some also potentially used for export. Completion is expected 2010-2011.

IGAT VIII, scheduled for completion in 2009, will transport South Pars gas across 1,050 km from Asalouyeh to the Parsian gas plant and Tehran.

IGAT IX, slated for 2011 completion and also termed the Europe Gas Export Line, will move South Pars 9-10 gas 1,863 km from Asalouyeh to the Turkish border. Construction on the stretch from Asalouyeh to Bidbolyand was completed as of June 2008.

Iran expressed interest later in 2008 in finding an international partner on a build-own-operate basis for the balance of IGAT IX, which could link with either the proposed Trans-Adriatic pipeline or the proposed Nabucco pipeline for exports further west.

Iran is also building a 2,163-km ethylene pipeline from Asalouyeh in southern Iran to the country’s northwestern provinces. The pipeline will transport ethylene to meet the feed requirements of new petrochemical complexes in Gachsaran, Khoramabad, Kermanshah, Sanandaj, and Mahabad.

Construction of the pipeline began in 2003 and is targeted for completion in 2009-10. The West Ethylene Pipeline was initially to transport 1.5 million tonnes for 1,500 km to feed five planned petrochemical complexes. The Iranian Parliament, however, instructed the Petroleum Ministry to build five more complexes in the cities of Andimeshk, Dehdasht, Hamedan, Kermanshah, and Miyandoab as a means to boost production in the less-developed parts of the country. The pipeline’s length, therefore, was extended to 2,163 km and capacity increased to 2.8 million tonnes.

An eleventh plant was added to the plan in June 2008 with construction of the pipeline roughly 50% complete at that time, raising doubts that the balance will be completed on schedule.

Olefin plants in Asalouyeh and the Bandar Imam special economic petrochemical zone in Mahshahr City will supply the ethylene; one set for completion in 2010 and the other in 2013.

Bakhtar Petrochemical Co., which is constructing the pipeline, is a private joint stock holding company.

Africa

Nigeria, Algeria, and Niger hope to start gas exports via the proposed 18-25 billion cu m/year Trans-Sahara gas pipeline in 2015. Once built, the 4,300-km line would transport gas from the Niger Delta in southern Nigeria through Niger and into Algeria and Europe. Cost estimates for the project are $13 billion.

According to the feasibility report published by engineering company Penspen Consulting, TSGP would consist of a 48-56-in. pipeline from Nigeria to Algeria’s Mediterranean coast at Beni Saf and subsea pipelines of 20-in. between Beni Saf and Spain.

Europe expects to import 500 billion cu m of gas in 2020. Europe’s Energy Commissioner Andris Pielbags cautiously welcomes the pipeline, stressing the need for Europe to diversify gas suppliers and enhance security of supply. Pielbags, however, said it was important to determine the availability of proved gas reserves, the feasibility of the project, its economic viability, and geopolitical developments in the region.

Nigeria’s export plans are ambitious, particularly as it is trying to boost the use of domestic gas for electric power generation, but the country has expressed its continued commitment to the project as recently as January 2009.

Nigeria and Russia have held talks regarding the latter’s involvement in the project, which both countries appear to desire. India’s GAIL has also voiced interest in participating in the project.

South Africa’s New Multi-Products Pipeline (NMPP) project will move diesel, gasoline, and jet fuel from an import terminal in Durban roughly 525 km northwest to the inland Gauteng region. Transnet Ltd. received the final environmental impact report for NMPP in November 2008, with the report submitted at the same time to the Department of Environmental Affairs and Tourism for a decision.

NMPP will include as many as 10 pump stations, with 4 planned at start-up and others added as needed to meet demand. The 24-in. OD pipeline will supplement the existing 12-in. Durban-Johannesburg Pipeline (DJP), completed in 1965 and already operating at capacity.

Should final approval be granted early in 2009, Transnet plans commissioning for late 2010.

Algeria’s Sonatrach plans to build a 585-km natural gas pipeline, GK3, from Hassi R’mel to an LNG terminal at Skikda. The 48-in. OD pipeline would run 275 km from Hassi R’mel to Chaiba and then 310 km from Chaiba to Skikda. Gas from the line would go into power generation and the planned Galsi pipeline in addition to being used for LNG at Skikda. Sonatrach intends to complete the pipeline in 2010.

Sonatrach also plans to complete the 532-km GR4 pipeline from Rhourde Nouss field near the Libyan border to Hassi R’mel in 2010.

References

- International Energy Outlook 2008, US Energy Information Administration, June 2008.

- Annual Energy Outlook 2009 Early Release, US EIA, Dec. 17, 2008.