OGJ Newsletter

Indonesia places domestic gas sales over exports

Indonesian Vice-President Jusuf Kalla, on a state visit to Japan, has reaffirmed the need for his country to prioritize its domestic gas market over exports.

“I have spoken to the Japan Bank for International Cooperation (JBIC) that we will help Japan (meet their gas demand) as long as (the transactions) are under a win-win solution,” Kalla said.

“We need gas for domestic consumption, but we also need to export gas for foreign exchange reserves,” said Kalla who did not detail Indonesia’s plans to export gas to Japan this year.

“We have abundant natural resources. Japan is dependent on us, particularly on energy,” said Kalla, who hinted that Japan, via JBIC, would increase funding to Indonesia if it could secure gas supplies.

Kalla also said, “It is better for Japan to put its money into Indonesia” than to invest it domestically. Kulla explained that, “domestically, Japan will receive interest of only 0.1%, while it will get a 3% return from lending money to us.”

The Indonesian government recently urged gas producers in the country to maintain production or produce more gas to meet rising demand from domestic and overseas markets. Earlier, Indonesia’s acting coordinating minister for the economy Sri Mulyani Indrawati said the government has put higher priority on the domestic market than on exports (OGJ Online, Jan. 25, 2009).

Inpex president upbeat about LNG developments

Inpex Pres. Naoki Kuroda, in an interview with Japan’s Nikkei Business Daily, remains upbeat on his company’s prospects regarding the development of two LNG projects despite the current economic downturn.

Kuroda said Inpex is making a huge investment in LNG at the moment because the lead time for natural resources development is long. “We cannot do anything if we look at only short-term trends.”

He acknowledged that demand for resources is falling amid the economic slowdown but the Japanese firm nevertheless plans to start production in Australia in 2015 and in Indonesia the following year.

“We expect that the economy will have recovered and demand for LNG will have increased by then,” he said, adding: “It’s necessary to continue active investments from medium and long-term perspectives.”

Kuroda noted that Inpex expects its two projects to produce 12-13 million tonnes/year, which accounts for about 20% of domestic demand. “The projects will contribute to a stable energy supply and become a major revenue source for us,” he said.

Referring to the amount of investment for each project—$20 billion in Australia and $11.2 billion in Indonesia—Kuroda said Inpex will “sort out the details of the plants before finalizing the amounts.”

In fact, Kuroda said the actual costs would be lower than the estimates because equipment prices are falling.

“We will also draw up the best combination of loans and bonds to procure funds,” he said, adding: “We can make the projects profitable and keep our finances sound with cautious risk management.”

Kuorda said Inpex has yet to start formal sales negotiations, but large-lot customers are showing strong interest. Since LNG releases less carbon dioxide than oil, it is attracting more demand.

Asked if Royal Dutch Shell Group is interested in participating in the Indonesian project, Kuroda said: “More than 10 companies have expressed interest, though we haven’t entered into tie-up talks with any of them.”

“We have a 100% stake in the project and may consider letting other companies take partial interests,” he said.

However, Kuroda downplayed any talk of a shakeout among resource development companies.

“We have no plans for a merger,” he said. “What’s necessary for growth is to increase our stakes in overseas natural resource projects. We will consider tie-ups with Japanese and foreign competitors on large-scale oil and gas development projects that would be difficult to handle on our own.”

Concluding, Kuroda expressed his company’s goal, saying that, “Inpex has a daily output equivalent to 400,000 bbl of crude oil at present, and we aim to increase that figure to 800,000-to-1 million bbl and join the ranks of the semimajors in the future.”

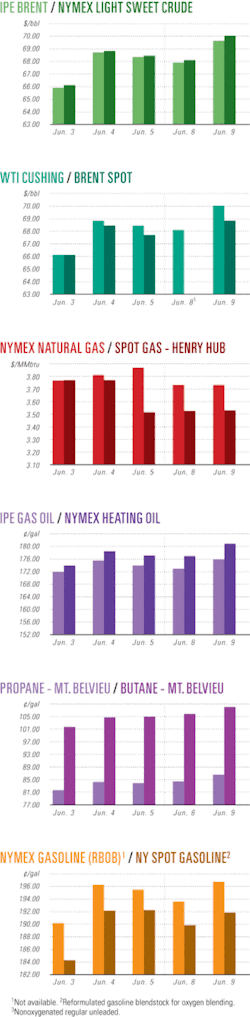

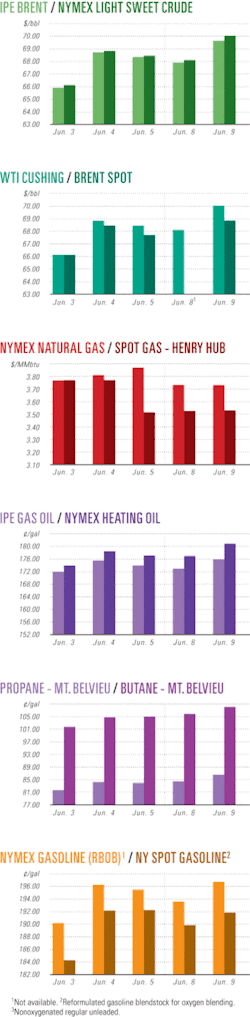

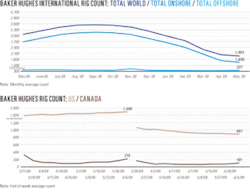

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesBrazil reports oil, gas finds in Potiguar basin

Brazil’s Petroleo Brasileiro SA (Petrobras) told the country’s hydrocarbons regulator Agencia Nacional do Petroleo (ANP) that it found traces of oil in test wells drilled at two exploration blocks in the Potiguar basin.

ANP said the discoveries were made at well 3-BRSA-695RN on Block POT-T-520, and at well 3-BRSA-700DRN on Block BT-POT-8, both off Brazil’s Rio Grande do Norte state.

Petrobras, which reported the finds on Feb. 3, holds 100% stakes in both blocks.

The announcement coincided with earlier reports by ANP that Galp Energia and Petrobras also discovered signs of oil and gas in the Potiguar basin as well as the Sergipe-Alagoas basin.

ANP Feb. 2 said that Galp Energia found traces of hydrocarbons in onshore well 1-GALP-26RN on Potiguar’s POT-T-354 Block in addition to signs of oil and gas in an onshore well on Sergipe-Alagoas’ SEAL-T-412 Block. Galp operates both blocks with a 50% stake, while Petrobras holds the remaining 50%.

Last month, Petrobras and its partner Starfish Oil & Gas SA declared a natural gas find at Well 1-STAR-BRN on Block POT-T-794 onshore, also in the Potiguar basin.

Moosebar shale test drilling in British Columbia

Canada Energy Partners Inc., Vancouver, BC, spudded a horizontal exploration well to Lower Cretaceous Moosebar shale in northeast British Columbia.

The wellsite, near Hudson’s Hope west of Dawson Creek, was chosen near the site of an unstimulated natural gas flow that occurred from the Moosebar shale during the drilling of a deeper well for coalbed methane in the Lower Cretaceous Gething formation (OGJ Online, Jan. 5, 2009). Canada Energy is drilling the well, expected to take 2 weeks, in a joint venture with GeoMet Inc., Houston. It is the first horizontal well to target the Moosebar shale on Canada Energy’s 50,000-acre Peace River project. Under the joint venture agreement, Canada Energy is operator of the Moosebar shale rights.

In addition to the 50% working interest it already owns, Canada Energy has the right or option to earn an aggregate 75-87.5% interest in the Moosebar shale rights under the acreage subject to certain drilling obligations and elections by the joint venture partner.

BLM sale proceeds; eight tracts deferred

US Interior Secretary Ken Salazar on Feb. 2 ordered the Bureau of Land Management to remove eight tracts from a Feb. 3 oil and gas lease sale after Wyoming Gov. Dave Freudenthal expressed concerns about them.

Salazar said his decision was a response to Freudenthal’s Feb. 2 letter to BLM Wyoming State Director Don Simpson concerning three parcels near Shoshone National Forest and five parcels adjacent to the Jack Morrow Hills Coordinated Activity Plan boundary.

The lease sale of 137 remaining parcels totaling 163,526.4 acres proceeded as planned, raising nearly $2.4 million from the sale of leasing rights and from rental fees on 112 parcels totaling 121,706.36 acres, BLM’s Wyoming state office said on Feb. 3.

It said that 74.43% of the total acres and 81.75% of the total parcels offered were sold. Bids totaling nearly $2.2 million ranged from the federally mandated minimum of $2/acre to a high bid of $230/acre on one tract.

Successful bidders also pay a one-time administrative fee of $140/parcel and yearly rental of $1.50/acre for the first 5 years and $2/acre for the remaining 5 years of the 10-year leases, said the Wyoming BLM office.

It said its next oil and gas lease sale is scheduled for Apr. 7.

Petrohawk’s Haynesville output hits 160 MMcfd

Petrohawk Energy Corp., Houston, is producing a gross 160 MMcfd of gas equivalent (MMcfed) from 16 operated Jurassic Haynesville shale wells in North Louisiana.

The company’s budget is $690 million for Haynesville drilling in 2009, when it expects to average 12 rigs and complete 75-80 gross wells. Petrohawk is targeting laterals of 4,300-4,600 ft with as many as 15 frac stages spaced 325 ft apart to improve drainage and minimize the number of wells. While laterals at its first four completions averaged 3,339 ft with 10 frac stages, the last 12 completions averaged 3,958 ft and 12 stages except one well that had mechanical problems and only six frac stages.

The four wells turned to sales most recently are:

- Mack Hogan-4, in 3-16n-11w, Bossier Parish, initial rate of 13.4 MMcfed on a 24/64-in. choke with 6,350 psi flowing casing pressure.

- Osborne 8-3H, 8-16n-11w, Bossier, 18.8 MMcfed, 24/64-in. choke, 6,800 psi FCP.

- Roos A-5, 3-16n-11w, Bossier, 15.1 MMcfed, 24/64-in. choke, 6,100 psi FCP.

- Griffith 11-1, 11-13n-14w, DeSoto, 23.3 MMcfed, 28/64-in., 7,550 psi FCP. Griffith is a long southwest step-out.

Two wells, Sample 4-1 and R.E. Smith Jr. 32-1, had mechanical problems and lower than average production rates.

Of the 16 operated wells on production, 11 have been on production 30 days or more and averaged 15.2 MMcfed in their first 30 days. Eight have been on production 60 days or more and averaged 13.2 MMcfed in the first 60 days. The four wells on line more than 90 days have averaged 8.8 MMcfed in the first 90 days.

All operated wells to date have been produced utilizing similar production practices. Petrohawk will conduct a pilot program on certain wells in 2009 by altering practices to restrict production by using smaller chokes. It will monitor these wells for effects on decline rate and mechanical operation.

Gazprom to explore Algeria’s El Assel license

Gazprom Netherlands BV has secured from Sonatrach the rights to explore the onshore El Assel concession in the Berkine basin in Algeria. Gazprom will have a 49% stake.

“According to provisional estimates, the recoverable oil reserves of the said area amount to some 30 million tons. El Assel includes three blocks covering a total of 3,083 sq km,” Gazprom said.

This, the company’s first project in Algeria, underpins its strategy to build a presence in Africa.

In 2006 Gazprom and Sonatrach pledged to cooperate under a memorandum of understanding in Algeria, Russia, and overseas on exploration, production, transportation, and asset swaps.

Algeria’s proved natural gas reserves total 4.58 trillion cu m, with the majority of these in the central and eastern areas of the country. Its proved oil reserves amount to 1.58 billion tonnes.

Drilling & Production Quick TakesEncore presses Bakken-Sanish drilling, refracs

Encore Acquisition Co., Fort Worth, plans to drill 9 operated and 19 nonoperated wells in 2009 in the Williston basin Bakken play, where it holds 300,000 net acres.

Encore participated in completions in 2008 with Continental Resources Inc., Newfield Exploration Co., Brigham Exploration Corp., and XTO Energy Inc.

Encore has drilled 13 operated Middle Bakken wells and 6 operated Three Forks/Sanish wells to date. Average initial rates were 380 boe/d from the Middle Bakken and 524 boe/d from the Three Forks/Sanish.

One goal is to reduce average well cost to $4 million from $5 million, the company said Feb. 3.

Encore also plans four refracs in the Cherry and Bear Creek project areas of North Dakota. Several wells in Elm Coulee field in Montana sustained higher production after refrac, the company said. The 2008 refracs averaged 85 boe/d of incremental production and 80,000 boe of incremental reserves for an estimated $500,000/well.

Refracs are applied 9-18 months after initial production, and other operators are starting refrac programs, Encore said.

Processing Quick TakesLindsey refinery workers near job offers victory

Workers participating in an unofficial strike at Total UK Ltd.’s Lindsey refinery in England have been told there will be 102 jobs made available for British workers if they end their protest about the employment of foreign workers.

Union representatives will present the offer for staff to vote on Feb. 5 and if accepted will end the week-long dispute that gained sympathy walkouts at refineries and electric power stations all over the country.

This is a revised proposal after workers rejected a deal where only 60 jobs out of the 200 available would have been created for British employees. Total, the unions, and Acas, the employment mediation service, have been in talks for 3 days to resolve the issue that has been discussed in parliament and that triggered debates on xenophobia and antiprotectionism.

The British workers complained about discrimination after Total contracted Italian firm Irem SPA to build a diesel hydrodesulfurization unit (OGJ Online, Jan. 30, 2009). Total insisted that it has not and will not discriminate against British companies and workers.

Irem was using Italian and Portuguese employees and had provided a floating hotel as accommodation for them. According to the deal, none of them will lose their jobs.

Derek Simpson, joint secretary for Unite union, said: “The problem is not workers from other European countries working in the UK, nor is it about foreign contractors winning contracts in the UK. The problem is that employers are excluding UK workers from even applying for work on these contracts.”

The issue of contracting foreign workers for major projects in the UK has led the Construction and Engineering Association to recommend that companies first always consider whether there are competent local workers. According to the guidelines published Feb. 4, if there are, non-UK contractors should consider any applications.

British Prime Minister Gordon Brown described them as “the common sense way of dealing in practical terms with the difficulties we face.”

The controversy’s political dimension is acute because the UK will require at least 60% of its power stations to be replaced, according to Unite’s estimates. It is keen to see that British employees have a sizeable amount of work.

There also been have different responses from the ruling Labor party. John Mann, a Labor Member of Parliament, congratulated unions for “exposing this exploitation and the absence of equal opportunities to apply for all jobs.” He called for primarily British labor to build new power stations. In contrast, Peter Mandelson, the business secretary, has warned that stopping foreign competition from participating in local industries would turn the recession into depression.

Brown’s phrase ‘British jobs for British workers,’ which was used in 2007, has been a rallying cry for the strikers as fears about job losses intensify during the recession. During the Prime Minister’s Question Time in parliament, Brown defended the remark despite accusations by David Cameron, leader of the Conservative party, of a grave error of judgment and pandering to protectionist fears.

Midor awards contract for coking unit

Middle East Oil Refinery has awarded a €43 million engineering, procurement, and construction contract to Technip for the expansion of the delayed coking unit at its refinery in Alexandria, Egypt.

The unit, which will have 30,000 b/d production capacity and will be based on ConocoPhillips’s technology, is scheduled for completion by third quarter 2010.

California refinery temporarily shutting down

Big West LLC said its Flying J subsidiary, which filed for reorganizational bankruptcy last year, temporarily is shutting down its Bakersfield, Calif., refinery for lack of cash with which to buy oil.

Flying J, which is based in Ogden, Utah, filed for Chapter 11 bankruptcy on Dec. 22. The refinery, which has a 65,000 b/cd capacity, supplies diesel and gasoline to California. The closure will not affect Flying J’s refinery in Salt Lake City, Utah, the company said. The Salt Lake refinery has a 30,000 b/cd capacity.

“For now, we will be winding down refining operations at the facility,” Fred Greener, Big West executive vice-president, said of the Bakersfield refinery in a Jan. 28 news release. “We hope that this suspension will be short lived, and are working very hard to find a solution that will allow resumption of the operations. We cannot predict when that might occur.”

He said Big West contacted the United Steelworkers Local 219 to begin discussions about the future of its contract with union employees at the Bakersfield refinery.

Total budgets Donges refinery upgrades

Total SA has earmarked €120 million for the scheduled 5-year turnaround of its 229,700 b/d Donges refinery near Saint Nazaire on the Loire estuary. Donges is the group’s second largest refinery in France. Work will be carried out between Feb. 22 and Apr. 20, with 200 companies engaged on site.

Half the units will be shut down during the 2-month turnaround, but the refinery’s spokesperson told OGJ that products have been stored, and customers will be fully provided with all products during the down time.

The change of convection and radiation equipment of the three atmospheric distillation furnaces will involve the largest expenditure, €20 million. A further €60 million will provide a new amine unit for gas desulfurization, a new torch, construction of double lining for the troughs bordering the Loire River, and a laboratory.

In addition, €10 million will be spent for a thorough evaluation of the 30,000 km of pipes at the refinery.

Transportation Quick TakesPutin says ESPO may have parallel gas line

Russian Prime Minister Vladimir Putin said a natural gas pipeline might be laid alongside the Eastern Siberia-Pacific Ocean (ESPO) oil pipeline and would carry gas toward China and the Pacific Ocean.

“The project for the first section of the ESPO [oil] pipeline system is in its final phase,” Putin said, adding, “In the long term, a gas pipe may be laid in the direction of the Pacific Ocean and China parallel to the oil pipeline.” Russia’s state-owned pipeline monopoly OAO Transeft plans to commission the first section of the ESPO oil line in December. The section, with a throughput capacity of 30 million tonnes/year, will extend from Taishet in East Siberia to Skovorodino near the border with China.

The second section of the ESPO, which is scheduled to be completed by yearend 2013 or the beginning of 2014, will extend from Skovorodino to the port of Kozmino on Russia’s Pacific coast.

Russia’s transport Minister Igor Levitin said last month construction of the export terminal in Kozmino, as well as the port’s approach railways, will be completed in 2010.

On completion of the ESPO’s first section, up to 15 million tonnes of oil will be delivered by railway to the port of Kozmino for further shipment to Asia Pacific states, including Japan. An additional 50 million tonnes of crude will reach the port of Kozmino on completion of the ESPO’s second section.

Meanwhile, Russia’s subsoil use agency Rosnedra has set a starting bid price of $50.3 million at an auction for the rights to the East Talakan field in Eastern Siberia.

Russia’s Vedomosti business daily reported that Surgutneftegaz, which is developing the adjacent Talakan field, is likely to get the rights to East Talakan, although Gazprom is also a leading candidate. The paper reported that East Talakan field holds proved and probable reserves of 9.9 million bbl of oil, 22.9 billion cu m of gas, and 0.2 million tonnes of gas condensate.

According to analyst BMI, future development of oil from the East Talakan field “is likely to contribute to planned throughput for the ESPO line.” This year, BMI said, Surgutneftegaz is expecting to boost initial Talakan production to 40,000 b/d, with output expected to reach 120,000 b/d by 2015.

Tokyo Gas to build fourth LNG terminal in Japan

Tokyo Gas Co., which currently operates three LNG regasification terminals in Japan, has selected the coastal city of Hitachi in Ibaraki prefecture as the site for its fourth facility, the firm’s first in 20 years.

Tokyo Gas, which operates two LNG receiving facilities in the Yokohama area and one in Sodegaura, will spend some 100 billion yen on the Hitachi facility, which will include docks for tankers, storage tanks, and regasification equipment.

The new terminal is scheduled to start operations in 2017-18, but the firm released no information on its size or its sources of supply.

Generally, the new terminal is expected to help meet the long-term growth in demand from industry as Tokyo Gas’ industrial gas sales have been rising at an average of 7%/year since 2003-04 and now account for about 40% of all its gas sales.

More precisely, the decision—announced by Tokyo Gas president Mitsunori Torihara—follows earlier efforts by the firm to increase its supply of gas to the Hitachi region.

In 2007, Tokyo Gas said it would supply Hitachi Ltd.’s power station in the city with natural gas from July through a new satellite LNG terminal in Ibaraki prefecture—a move aimed at expanding the company’s natural gas user base to include areas that lack gas pipelines. A Tokyo Gas spokesman said the firm would deliver LNG to the satellite terminal by truck from its main Sodegaura LNG terminal in adjacent Chiba prefecture before regasifying the LNG and selling it in Hitachi.

Tokyo Gas plans to provide 50,000 tonnes/year of gas to the power station and expects to double the volume by developing new customers in the area, the spokesman said.

The Ibaraki satellite terminal, which has a 2,400-kl tank and three 7.5-tonne/hr regasification units, is the company’s second satellite LNG terminal—the first was also built in Ibaraki prefecture in April 2006, with two 400-kl tanks.

This week’s announcement of the new regasification terminal at Hitachi comes despite figures announced by Tokyo Gas this month showing a slight dip in its recent sales of natural gas.

Total gas sales volume by Tokyo Gas for December 2008 came to about 1.169 billion cu m, down 112.08 million cu m from the same period last year.

Sales of residential gas totaled 326.9 million cu m, down 8.7% from December 2007 due to fewer counted days and higher temperatures, which caused a heating and boiling water demand decrease.

Commercial, public, and medical use volumes totaled 210.3 million cu m, down 7.4% from last year due to fewer counted days and higher temperature days from that of the previous year, which caused heating demand decrease.

Although industrial use represents a larger percentage of Tokyo Gas’ sales, recent demand totaled about 442.95 million cu m, down 11.5% from last year as existing customers use less.

Volumes for wholesale supply to other gas companies totaled 189.3 million cu m, down 3.5% from last year. Wholesale gas suppliers sold less to high-volume customers.

On a cumulative basis, Tokyo Gas said, gas volumes from April through December 2008 totaled 986.2 million cu m, a decrease of 0.1% vs. the same period in 2007.