OGJ Newsletter

FERC issues first ROE order incorporating MLPs

The Federal Energy Regulatory Commission rejected a Kern River Gas Transmission Co. settlement on Jan. 15 in its first return-on-equity (ROE) order under its 2008 policy statement.

The commission found that Kern River’s 12.5% ROE was excessive and would result in unjust and unreasonable rates. It determined that the ROE rate should be 11.55% based on the record established in a paper hearing on ROE established in an April 2008 order.

“The reason for including master limited partnerships [MLPs] in setting a proxy group is to assure an adequate sample for determining a pipeline’s ROE and to obtain consistent regulatory results. The commission’s role is to balance the interests of investors while protecting the ratepayer from excessive rates, and we have done so with this order,” said FERC Chairman Joseph T. Kelliher.

FERC said the latest order also denied a request for rehearing, and rejected a contested settlement filed by Kern River, a subsidiary of MidAmerican Energy Holdings Co.

FERC said the allowed ROE rate was set at the median of a proxy group that included both MLPs and corporations in a pipeline rate proceeding for the first time. Based on its analysis, it said it determined that the ROEs for the five firms selected for the proxy group yielded a range of reasonable returns at 8.8-13%, with an 11.55% median ROE.

FERC directed Kern River to cancel its interim rates filed with the settlement and made effective on Oct. 1, and to make a revised compliance filing using an 11.55% ROE within 45 days of the new order. FERC also directed the interstate natural gas pipeline company to recapture interim refunds at the earliest possible date as required by the settlement.

Midstream JV planned for Marcellus shale

MarkWest Energy Partners LP and NGP Midstream & Resources LP plan to form a natural gas midstream services joint venture in the Marcellus shale.

Terms call for MarkWest to be operator and to own 60% of the JV. MarkWest will contribute $100 million of existing Marcellus assets to the venture.

NGP will invest the next $200 million of capital, which approximates the capital required to finance the project in 2009. Capital funding for 2010-11 will be driven by producer drilling programs.

Finalization of the JV remains subject to customary closing conditions.

MarkWest already provides Marcellus shale midstream services, including gathering and processing services for Range Resources Corp. in southwest Pennsylvania. By yearend, the midstream joint venture is expected to be capable of processing up to 240 MMcfd of gas for Range and other producers.

PNG LNG submits EIS, gathers public input

The ExxonMobil Corp.-led PNG LNG project group has taken another step towards development with the submission this week of its environmental impact statement to Papua New Guinea’s Department of Environment and Conservation.

The 6,000-page tome draws on 26 supporting studies that took just over 18 months to complete. Planning began in April 2007 while field studies and data collection were carried out between November 2007 and July 2008.

The consortium also conducted two public consultation road shows in 2007-08 that each visited 35 villages throughout the proposed 700-km pipeline and infrastructure imprint.

The project venture’s manager Peter Graham says the intention is to mitigate impacts on the environment and on affected communities by planning, building, and operating according to good industry practice as well as adhering to applicable government requirements and international environmental standards.

Following receipt and initial review of the document, the department will conduct a further public consultation road show in the next few months to canvas community feedback. Public release of the EIS is expected next month.

The PNG LNG Project involves construction of a two-train, 6.23 million tonne/year liquefaction plant near Port Moresby, with gas sourced from several fields in the southern highlands.

Interest holders are ExxonMobil with 41.6%, Oil Search 34.1%, Santos 17.7%, and Nippon Oil 4.5%. Landowner interests hold the remaining interests.

PNG’s state-owned Independent Public Business Corp. is using its 17.56% holding in Oil Search to raise $1.68 million (Aus.) to fund the government’s 19.4% of the project which, once applied, will reduce the interest held by the other partners.

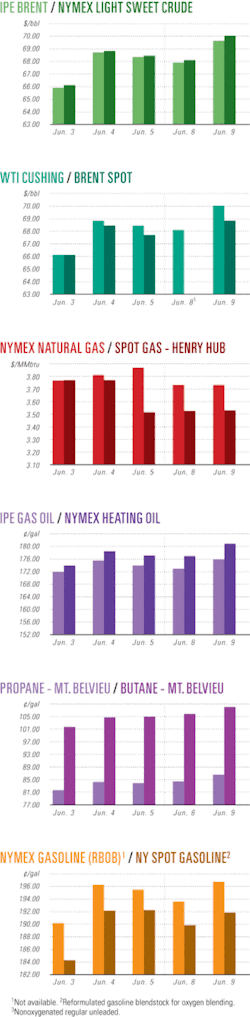

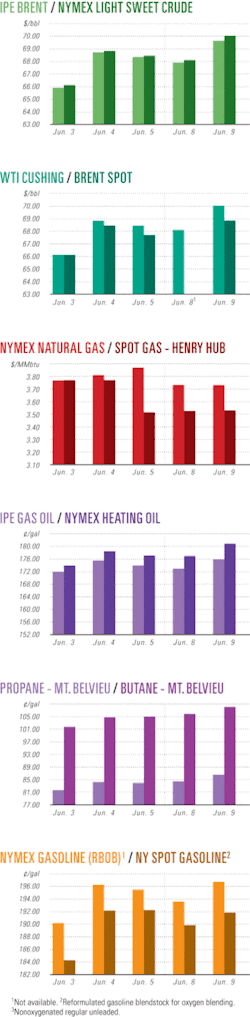

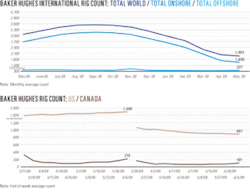

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesEOG sees big volumes from Barnett combo play

EOG Resources Inc., Houston, sees a net recoverable potential of 227-463 million boe from a “combo” play in the Mississippian Barnett shale northwest of Fort Worth along the Red River in Montague and Clay counties, Tex.

Eight EOG horizontal wells and 60 other industry wells have confirmed an economically viable trap 40 miles east-west by 20 miles north-south. EOG holds 250,000 net acres in the area.

EOG defines the area as primarily an oil play with added value from natural gas and natural gas liquids, the company said in a mid-January presentation. It estimates 33 million bbl/sq mile of oil in place and 115 bcf/sq mile of gas in place in eastern Montague County.

The company estimates per well net recovery potential at 75,000 bbl of oil, 34,000 bbl of NGL, and 260 MMcf of gas. A gas processing plant is expected to start up in February 2009, enabling the first major production volumes from the play.

Addax reports oil discovery in Nigeria

Addax Petroleum Corp., Calgary, plans to drill a downdip appraisal well to a two-zone oil discovery on the eastern OML 124 license in Imo state 105 km north of Port Harcourt, Nigeria.

The Njaba-2 well, formerly Okaka, cut four oil-bearing reservoirs that total 289 ft of gross oil column. The two main intervals are 149 ft and 115 ft thick at 990-1,050 m and contain 20-28° gravity oil. The license has facilities for early production.

Addax, with 100% working interest in the license in which Nigerian National Petroleum Corp. is the concessionaire, continued drilling into secondary, lower sections. It plans to test the main reservoirs.

Njaba-2 is OML 124’s first exploration well since the mid-1980s.

Addax produces 6,000 b/d from Ossu and Izombe fields in OML 124.

Repsol YPF hits gas in Algeria’s Sahara Desert

Several natural gas discoveries in Algeria’s Regane and Ahnet basins could prove to be important future resources for Repsol YPF SA.

After drilling exploration well KLS-1, it tested the isolated Kahlouche Sud structure in the North Reggane concession, and gas flowed at 629,000 cu m/day at a depth of 3,720 m through a 32/64-in. choke.

Meanwhile, discovery well OTLH-2, drilled in the M’Sari Akabli concession, flowed on test 249,000 cu m/day of gas at a depth of 1,280 m, and 110,000 cu m/day of gas at 1,340 m; both flowed through 32/64-in. chokes, said RWE Dea AG, a consortium partner. This new independent structure was the first discovery on this block and was in its center.

The wells were drilled in Algeria’s Sahara Desert and proved there is gas flow from the Lower Devonian level.

Repsol YPF said the Reggane basin is a major driver for future growth and its holdings add up to total net reserves of 145 million boe.

The consortium secured exploration rights during the 2002-03 Algerian bidding rounds. During 2005-07, three discoveries were made in Reggane: Sali-1 (SLI-1), Kahlouche-2 (KL-2), and Reggane-6 (RG-6); one exploration well in Upper Ordovician, plus two positive appraisal wells.

Repsol YPF operates the consortium with a 33.75% stake, and RWE Dea has a 22.5% interest. Other partners are Sonatrach with 25% and Edison SPA with 18.75%.

Apache finds three fields in Egypt’s Western Desert

Apache Corp., Houston, reported three field discoveries in Egypt’s Western Desert that tested a total of 80 MMcfd of natural gas and 5,909 b/d of oil and condensate from Jurassic formations.

“Apache plans to continue an exploration and appraisal program in 2009 to capitalize on these successes,” said G. Steven Farris, Apache president and chief executive officer.

The Sultan-3x well is an oil field find in the Khalda Offset concession, 7 miles south of Apache’s Imhotep field. The well encountered oil pay in the Jurassic Alam El Buieb (AEB-6) and Safa formations. It test-flowed 5,021 b/d of oil and 11 MMcfd of gas from three commingled intervals in the Safa formation.

The discovery opens up a large area for further exploration and appraisal drilling on Apache-operated acreage south and east of the well. The Egyptian minister of petroleum approved a 20-block development lease, and production is expected to commence in February. Apache has 100% contractor interest in the Khalda Offset concession.

Adam-1x and Maggie-1x discovered gas-condensate fields on the Matruh development lease north of the Sultan discovery. Adam-1x is in the center of the Matruh lease about 3½ miles south of Apache’s Alexandrite field. Wireline logs indicate as much as 102 ft of gas pay in the Jurassic Safa formation. A test of an interval in the Lower Safa produced 28.5 MMcfd of dry gas.

Maggie-1x, 5 miles northeast of Adam-1x, was drilled to test closures at three levels in the AEB and Safa formations. The well logged 27 ft of pay in the Cretaceous Alam El Bueib (AEB-3D) formation and 83 ft of pay in the Jurassic Zahra and Safa formations. Preliminary results of tests of an interval in the Lower Safa formation measured gas at a rate of 40 MMcfd with associated condensate production of 884 b/d. Apache has 100% contractor interest in the Matruh development lease.

More Rajasthan discoveries commercial

India’s government has approved a commerciality declaration for three 2007 gas and oil discoveries by Cairn Energy PLC in Rajasthan, northwestern India.

The declaration covers the Kameshwari West 2, 3, and 6 discoveries and an 822 sq km development area that was part of the northern appraisal area on the RJ-ON-90/1 license (see map, OGJ, Jan. 23, 2006, p. 38).

Cairn Energy noted that the No. 2 and 3 discoveries opened a new play in the Paleocene Barmer Hill-Lower Dharvi Dungar sands on the basin’s western margin.

Kameshwari West-2, some 56 km south of Mangala oil field, cut 18.2 m of net pay in a 40-m gross interval of Lower Dharvi Dungar with a gas-oil contact at 1,127 m true vertical depth subsea and an oil-water contact at 1,147 m TVD ss. It flowed 33° gravity oil with gas.

Kameshwari West-3, just 10.6 km north of Kameshwari West-2, cut up to 16 m of gas pay in tight Lower Dharvi Dungar reservoir rock in a potential column of more than 100 m. TD is 1,499 m measured depth.

Kameshwari West-6, about 22 km northeast of Kameshwari West-3, tested 2.39 MMscfd of gas.

Cairn Energy, operator with 70% interest, and its partner Oil & Natural Gas Corp. with 30% now have 3,111 sq km under long-term contract on the Rajasthan license, of which the Mangala field development plan covers 1,859 sq km and the Bhagyam field development plan covers 430 sq km.

Cairn Energy in December gauged a discovery at Raageshwari East 1/1Z, the first well in its 2008-09 exploration program.

The well cut 10 m of net oil pay in an 81-m gross column of sands in the Eocene Thumbli formation below 1,425 m. It also found 1.4 m of gas pay in the Eocene Akli formation at 1,153 m TVD ss. It stabilized at 500 b/d of 40° gravity oil and 400 Mcfd on a 1-in. choke from a 4-m interval in Upper Thumbli sand.

The companies plan to start production through a new pipeline to the Gujarat coast in late 2009.

Drilling & Production Quick TakesPlatform operations start up off China

Operations have begun on Production Platform B, part of Peng Lai (PL) 19-3 Blocks’ Phase 2 project in China’s Bohai Bay. ConocoPhillips is operator of PL 19-3, which currently is China’s largest offshore oil field. Its partner, China National Offshore Oil Corp. (CNOOC), holds 51% interest in Block PL 19-3, and ConocoPhillips holds the remainder.

Platforms D and E are expected to come on line in 2009 to boost development of the oil field off China’s northeastern coast.

Fluor Corp. assisted in the successful startup of the platform and provided engineering services, including conceptual engineering, front-end engineering and design, and detailed engineering. The company also provided procurement services for three wellhead platforms and construction support in fabrication yards in Shanghai, Tanggu, and Singapore. Engineering and procurement were performed from Fluor’s global execution centers in Houston, Shanghai, and Manila.

The oil field development project is 235 km southeast of Tanggu and began in 1999 with conceptual and feasibility engineering. The first phase of the project involved the basic design package for the early production facility, which consisted of a fixed production platform tied to a newly modified and refurbished floating production, storage, and offloading vessel.

The project was executed in two phases. The second phase, carried out simultaneously with the first, included development of what Fluor described as the “world’s largest” floating production, storage, and offloading vessel and five additional fixed production platforms tied to a central fixed riser and utility platform. Workers installed 36 miles of subsea pipeline to interconnect the facilities. Fluor designed the flow lines so early production could be routed to the existing FPSO vessel. After the new FPSO is delivered, the flow lines will be reconnected for permanent installation.

Talisman starts gas production from Rev field

Talisman Energy Norge AS has started natural gas and condensate production from Rev field in the Norwegian North Sea.

The field was expected to start production last July via a subsea 9-km tieback to the Armada platform in the UK North Sea, operated by BG International (CNS) Ltd., for processing and final export to the UK. Rev’s plateau rate will be 100 MMcfd of gas and 6,000 b/d of condensate from two subsea wells. The development plan cost $444 million in 2007 money.

“A third producer, the Rev East well, is expected to be brought on stream later in 2009,” Talisman said. Its share of proved and probable reserves in the field at yearend 2007 was estimated at 26 million boe, with proved reserves of 16 million boe.

Recoverable reserves are estimated at 3.9 billion cu m of gas and 600,000 cu m of condensate.

Talisman has a 70% interest in the field, with Norway’s state-owned Petoro AS holding the remaining 30%.

Nexen’s upgrader turns out sweet crude oil

Nexen Inc.’s Long Lake, Alta., oil sands upgrader has started production.

The upgrader is expected to reach its full design production rate of 60,000 b/d of sweet crude within 12-18 months, Nexen said. As the upgrader ramps up to full capacity, the company expects routine downtime periods as it works through early production stages. Sour crude is upgraded to light sweet crude oil and the asphaltenes are converted to a synthetic fuel gas. This gas is available as a low-cost fuel source and as a source for hydrogen required in the hydrocracker.

The gas will be burned in a cogeneration plant to produce steam for the assisted gravity drainage operations and for electricity to be used on site and sold to the electric grid.

Processing Quick TakesVenezuela denies rift with Brazil over refinery

Venezuela has denied any rift with Brazil over the construction, operation, or supply of the Abreu e Lima refinery in Pernambuco state, a project 60% owned by Petroleo Brasileiro SA (Petrobras) and 40% by Petroleos de Venezuela SA.

Rafael Ramirez, Venezuela’s oil minister, said there has been no conflict with Brazil regarding the refinery project despite earlier statements by Petrobras downstream director Paulo Roberto Costa (OGJ Online, Jan. 22, 2009).

Ramirez, who called Costa’s comments “the opinion of a low-level official,” said Venezuela has not been notified of any changes to the project.

The refinery is expected to start processing 200,000 b/d of oil, half from Venezuela and half from Brazil, by 2010, but Costa had said the two countries have disagreed on the price of the heavy Venezuelan crude that would supply the refinery.

The reports from Venezuela coincided with news Petrobras has authorized Phase 2 in the construction of the Abreu e Lima refinery, calling for construction of the facility’s 150-Mw electric power plant at a cost of $408.2 million.

Meanwhile, dismissing concerns over the global financial crisis, Costa confirmed that the Abreu e Lima refinery is just one of several facilities that Petrobras will bring on stream in the near future.

“I’m happy every time I hear of refinery investments being postponed around the world. I want them all to be postponed. The world will continue to exist,” Costa said. “It is hard to believe the world will be in a recession until 2013. It doesn’t make much sense.”

Costa noted Petrobras doesn’t want to be an exporter of oil, but an exporter of products. “There’s a world diesel shortage,” he said, adding, “It is short-sighted to think there won’t be market for this supply.” Costa also said $2 billion should be added to Petrobras’s investments in refineries, to adapt them for the production of low-sulfur diesel.

Costas named the new refineries as the 230,000 b/d Abreu e Lima facility, the 150,000 b/d Comperj facility, the 600,000 b/d Premium I facility in Maranhao, the 300,000 b/d Premium II facility in Ceara, and the 30,000 b/d unit in Rio Grande do Norte.

CSB gives more details about Utah refinery fire

The US Chemical Safety and Hazard Investigation Board provided more details about a Jan. 12 refinery fire near Salt Lake City as its investigators prepared to return to the plant on Jan. 27.

The fire in Tank 105 of the Silver Eagle refinery in Woods Cross seriously burned four workers. The atmospheric storage tank was almost full when a large vapor cloud was released and ignited at about 5:30 p.m. MST, causing a massive flash fire, CSB said on Jan. 26.

CSB said that, on the night of the incident the tank was nearly full, containing about 440,000 gal of what the refinery said was light naphtha. The federal agency said the tank has an interior floating room and has six atmospheric vents on the top sides of its exterior roof.

Investigations Supervisor Don Holmstrom said the CSB team will examine a reported history of releases from the tank and the tank seal’s integrity. “We will also be looking at the operation of the refinery and any recent process changes to determine why highly volatile hydrocarbons were released on Jan. 12,” he said.

Tank 105 was receiving up to three different streams of hydrocarbon liquids from the refinery, including light substances at the time of the incident, he added.

CSB said its investigators were at the refinery for 2 weeks, conducting about 30 interviews of witnesses, gathering samples and evidence, and examining the accident scene. It said the refinery’s staff and management have cooperated with the investigation, and that the CSB team was coordinating with investigators from Utah’s Occupational Safety and Health Administration and the South Davis Metro Fire Agency.

Transportation Quick TakesPipeline would ship Haynesville shale gas

A pipeline company and a producer launched plans to build a 178-mile, 42-in. pipeline in East Texas and Northwest Louisiana to serve the Jurassic Haynesville gas shale play.

Meanwhile, the producer, Chesapeake Energy Corp., Oklahoma City, said the Haynesville has the potential to become the largest producing field in the US.

Chesapeake said its last seven horizontal Haynesville wells averaged 16 MMcfd of gas equivalent on initial production or tests. The two most recent wells tested at more than 22 MMcfd.

The company plans to average 25 rigs in the play in 2009, up from 20 rigs currently.

Energy Transfer Partners LP (ETP), Dallas, and Chesapeake Energy Marketing Inc. plan to lay the Tiger Pipeline from Carthage, Tex., to near Delhi, La. The project will connect to ETP’s dual 42-in. pipeline near Carthage and would connect to at least seven interstate pipelines at various points in Louisiana.

Capacity would be at least 1.25 bcfd initially and could be raised to 2 bcfd based on results of an open season.

Chesapeake, largest gas producer in the US, committed a firm 1 bcfd for 15 years to the project, which is to cost $1-1.2 billion and be in service by mid-2011 pending regulatory approvals.

Separately, Cubic Energy Inc., Dallas, accepted a proposal to participate with 2.8% working interest in Chesapeake’s Clingman Acres-11H horizontal well in Johnson Branch field, Caddo Parish, La. It is to go to Haynesville shale at 17,000 ft measured depth.

Cubic, which is exploiting several geologic formations, has 12 wells producing in its Johnson Branch acreage, and 10 wells producing in its more southern acreage position of Bethany-Longstreet field in DeSoto Parish.

Regency cites Haynesville expansion progress

Regency Energy Partners LP, Dallas, said it has negotiated definitive agreements with shippers for 800 MMcfd or more than 70% of the capacity of its Haynesville gas pipeline expansion project in North Louisiana.

The company’s existing system extends 320 miles from Waskom, Sligo, and Elm Grove fields near Shreveport to connections with interstate and intrastate pipelines near Winnsboro in Franklin Parish.

The agreements are for firm transportation capacity under 10-year contracts and are subject to conditions including final approval by Regency’s board.

Regency said it is in advanced discussions with other shippers who have requested transport volumes that exceed the remaining capacity.

The company also said it has eliminated its obligation for the purchase of 28 miles of 24-in. pipe no longer needed for the revised 1.1 bcfd expansion.

The $650 million revised expansion calls for 128 miles of 36-42-in. pipe and 12,500 hp of compression.

The major milestone for the project is to finalize financing arrangements. Regency is working with GE Energy Financial Services to secure funding. If financing is obtained, the expansion is to be in service by the end of 2009.

Meanwhile, Regency is acquiring rights of way and environmental permits and clearances. A construction contractor is committed to the project, and 98% of the route has been selected and surveyed.

Regency has $230 million of purchase commitments related to the expansion.