Study places CO2 capture cost between $34 and $61/ton

Based on presentation to the Oil Sands and Heavy Oil Technologies Conference, July 14-16, 2009, Calgary.

Technologies in development for capturing CO2 have an estimated cost between $34 and $61/ton of CO2 captured, with specific costs both site and technology specific. Partnerships with enhanced oil and gas production projects, however, or the sale of pure CO2 for industrial and commercial uses can yield values of up to $86/ton of CO2 captured, transported, and sold.

This article will discuss examples of the various CO2 capture technologies. It also discusses different industrial sources and options for industrial use of CO2 as well as the various geological media suitable for sequestration. It will also provide estimates of CO2 pipeline transportation costs at different source-to-sink distances.

The article will conclude with a discussion of the total cost at which captured CO2 can be sold to operators of enhanced oil recovery projects or other industries capable of using it, determining CO2 can be captured and transported up to 100 miles for prices between $1.00 and $3.00/Mcf.

Background

To date CO2 is the largest single contributor to the greenhouse-gas buildup in the atmosphere. The US Energy Information Administration reported the US emitted more than 5.75 billion tons of CO2 in 2008,1 an increase of more than 20% over 1990 emissions (Fig. 1). These factors have prompted a growing concern over greenhouse gas emissions from sources such as power generation, the number one source of CO2 emissions worldwide.2

In order to help meet strict future environmental requirements, existing CCS technologies will be borrowed, enhanced, and reapplied. Sequestration can occur by either directly sequestering the CO2 or treating it as a commodity for a variety of industrial uses. Industrial sources of CO2—the second largest annual source of greenhouse gas at 27%—are subject to capture and use. These CO2 streams have food grade, industrial grade, and sequestration applications.

Capture technologies

As strict environmental, legal, and regulatory requirements are developed, CO2 will need to be captured for sequestration or use in other industrial purposes. Amine absorption is one viable capture technology currently under development.

Aqueous monoethanolamine is a derivative of ammonia often used to treat flue gases. This process directs flue gases escaping from an industrial process through a cool aqueous amine solution, where the CO2 reacts with the amine and forms a rich amine. Heating the rich amine releases the CO2 for cooling and recycling. Drying the CO2 removes the water vapor before compression for transport. Other capture processes under development include:

• Hot and cold methanol.

• Pressure swing absorption.

• Potassium carbonate.

• Membranes.

• Combinations of amine and membranes.

CO2 capture costs depend on the process and the concentration of the CO2 in the flue gas. The Intergovernmental Panel on Climate Change estimated in 2005 capture costs for CO2 at between $34 and $61/tonne.4 This cost includes both capital and operating costs and covers the capture, drying, and compression of CO2.

Industrial sources

The National Carbon Sequestration Database and Geographic Information System (NATCARB) served as the primary source of emission data for source-to-sink analysis. NATCARB is a unified database, funded by the National Energy Technology Laboratory and maintained by the Kansas Geological Survey. It contains several regional databases on carbon sources and sinks. INTEK analyzed these databases to provide unique subsets for analysis.5

The NATCARB database includes source data for industrial CO2 emissions totaling 56.5 tcf/year. Data include utilities, ethanol, gas processing, concrete, steel, refineries, ammonia, and other industrial sources. Potential sources include fossil fuel plants, refineries, cement plants, hydrogen plants, ammonia plants, and ethanol plants. Fig. 2 maps the industrial sources considered in the study.6

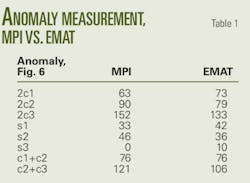

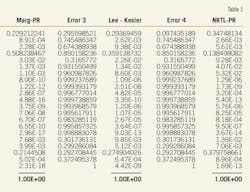

Fossil fuel plants and refineries represent more than 90% of the capturable CO2 emitted. Emissions from ethanol plants will grow steadily in the near future. Data from the Renewable Fuels Assocation supplemented the location and emission data of ethanol plants.7 Capture from these industrial sources can provide up to 25 tcf/year of industrial CO2 (Table 1).8

Capture cost

Capture-cost data came from publicly available data including the Global Energy Technology Strategy Program Report.4 9-11 Capture costs are technology-specific and vary drastically depending on plant type (Table 2). This article uses a cost estimate of between $34 and $61/ton of CO2. These costs will likely decrease over time as the technologies become developed and expand market penetration.

Transportation costs

Truck, barge, ship, and pipelines can all transport CO2. Transport via truck, barge, and ships moves CO2 as a liquid, requiring liquefaction infrastructure and additional activities such as loading and unloading. Associated costs equal $11/ton for liquefaction and $1-11/ton for shipping.

CO2 transported via pipeline must be dried and compressed (2,000-3,000 psig), at a combined cost of $10/ton. Transportation costs consist of pipeline tariffs calculated using the following procedure:

• Overlaying maps of industrial sources and candidate fields.

• Calculating average distances between the sources and fields.

• Applying a minimum model-developed pipeline tariff rate for each source.

Fig. 3 shows the distances between four refineries and a large number of candidate fields in the Illinois basin. The tariff used would be for the average distance of 158 miles.

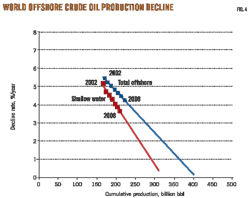

Pipeline cost depends on the distance the CO2 is transported, the capacity of the pipeline, and the compression equipment required. Fig. 4 provides example costs for two pipeline scenarios, with transportation costs ranging from <$8/ton to >$9/ton depending on volume and distance of CO2 transported.

Storage options

After the CO2 has been captured compressed, and transported, it must be sequestered. A company can either directly sequester the CO2 or treat it as a commodity for industrial use (Fig. 5). The CO2's value depends on its level of contamination and the purpose for which it is intended. This section describes key sequestration and value options.

• Depleted oil and gas reservoirs. Carbon dioxide can be injected into depleted or abandoned reservoirs. The National Energy Technology Laboratory conducted a CO2 sequestration pilot test in 2008 at the depleted West Pearl Queen field in New Mexico, injecting 2,100 tons of CO2.12

• Deep saline aquifers. Another sequestration option uses saline aquifers, composed of porous rock containing brine. An extensive impenetrable rock layer caps these aquifers—widespread throughout the US and Canada—allowing trapping of the injected CO2.12

Several aquifers with large storage potential lie in Utah, Wyoming, and Colorado, including the Farnham dome along the southwestern edge of the Uinta basin, the target site of a planned field test of the effectiveness of carbon sequestration in deep saline aquifers

NETL reports injection wells will be drilled in 2009 and CO2 injection will continue through 2012. Up to 1 million tons/year of CO2 will enter the dome during the test phase, followed by several years of monitoring.

An NETL assessment of deep saline formations found a combined storage capacity of between 219 and 1,119 million tons of CO2 in Colorado, Utah, and Wyoming.12 Fig. 6 shows the locations of these saline aquifers.

• Ocean beds. Sequestration of CO2 in the ocean bed is an experimental technology and is not currently in use. Under this option, if sequestration is occurring at up to 1,000 m water depth, it will be transported by pipeline; otherwise, a ship will be required.

• Food and industrial-grade CO2. If a company purifies the CO2 sufficiently, it can be sold as either industrial or food-grade. Preparing CO2 for an industrial or food purpose is more costly than sequestration, however, as it must meet purity standards. Industrial CO2 must be at least 99.5% pure, while the food grade CO2 is required to be 99.9% pure.

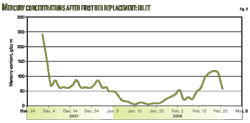

• Enhanced oil recovery. CO2 EOR technology has been profitable in commercial applications for nearly 30 years. As of 2008 there were 100 CO2 EOR projects in the US, with a combined crude oil production of 240,000 b/d. Twenty of these projects started between 2006 and 2008. Fig. 7 illustrates the relationship between the increase in the number of active projects and the increase in production (OGJ, Apr. 21, 2008, p. 42).

There are nearly 2,100 reservoirs in the onshore Lower 48 states that are candidates for CO2 miscible flooding (Fig. 8) and would present a market for produced CO2. Indentifying these potential reservoirs used the following criteria:

1. API gravity >22°.

2. Reservoir pressure greater than the minimum miscibility pressure.

3. Depth >2,500 ft.

4. Oil viscosity <10 cp.

5. Current oil saturation >20% of pore volume.

6. Sandstone or carbonate rock.

• Gas bearing sandstone. CO2 injected into gas bearing sandstone can maintain pressure and produce the methane contained in the reservoir. Gas reservoirs in sandstones have ideal porosity for CO2 injection. Injection is continued until the CO2 breaks through. This process may require installation of additional injection wells and compressors to increase reservoir pressure.

• Gas bearing shale. CO2 maintains reservoir pressure and produces methane through natural fractures in the reservoir. This process continues until CO2 breaks through to the production well.

• Coalbed methane. CO2 can also recover gas from unminable coal seams. Injecting CO2 along with nitrogen into the coal seam allows production of methane and nitrogen, which is then separated. The nitrogen is reinjected into the seam while the methane is treated and sold. A pilot currently testing this process in the San Juan basin in New Mexico12 injects 35,000 tons/year of CO2.

Fig. 9,13 shows numerous unmineable coal seams in Utah, Wyoming, and Colorado near the oil shale deposits of the Green River basin. The National Energy Technology Laboratory estimates the storage capacity of coal seams in these three states at 21,283-22,142 million tons of CO2.12

• Gas storage. CO2 produced during oil shale development can also assist natural gas storage. Gas storage reservoirs provide support for seasonally driven natural gas demand: Gas is injected when demand is low and withdrawn when it's high. Since gas storage reservoirs use the pressure of the stored gas, a fraction of the natural gas cannot be withdrawn. Injected carbon dioxide can replace this base gas.

EOR application

As previously mentioned, about 2,100 reservoirs are candidates for CO2 EOR. Many of these projects are economically viable with current or higher oil prices but are limited by the availability of CO2. Widespread capture of industrial CO2 for EOR could increase the available volume from 3 bcfd from natural sources to nearly 70 bcfd from natural and industrial sources.

A steady source of CO2 in the US at prices of $1.00-3.00/Mcf could help produce more than 200 CO2 EOR projects with incremental production of nearly 1 million b/d. These projects would also provide the opportunity to sequester nearly 5 bcfd CO2. Over 25 years, this could result in the production of more than 5.5 billion bbl of oil and the sequestration of nearly 30 tcf of CO2 (Fig. 10).

Fig. 11 shows incremental oil production from additional CO2 projects through 2030. More than an additional 800,000 b/d incremental production could be realized, while sequestering nearly 5 bcfd CO2. CO2 sequestered is the difference between CO2 injected and CO2 produced. This assumes CO2 from cheaper sources such as hydrogen and ammonia plants becomes available in 2015. Additional CO2 from refineries and power plants becoming available after 2021 causes the two-hump shape of the CO2 curve.

Costs, benefits

The total cost of carbon capture and storage includes the cost of capture, the cost of transportation, and the cost of either sequestering the CO2 or the value that can be realized through its sale. Sequestration costs range from $1/ton to $45/ton, depending on the geologic media.

The cost of sequestering CO2 in depleted oil and gas reservoirs and brine aquifers ranges from $1 to $11/ton depending on reservoir or aquifer depth. The additional technical difficulties of ocean bed sequestration raise its cost to $8-45/ton. These costs include transportation of the CO2.

The value of CO2 sold for commercial or industrial use depends on the purpose of the CO2. Values for industrial and food grade CO2 can range between $55 and $132/ton. Values of CO2 for enhanced oil or gas recovery can range between $40 and $117/ton. Fig. 12 shows sequestration costs and values.

Fig. 12 also provides the final costs and values of CO2 inclusive of capture and transportation. The capture costs are applied to all sequestration and value options. Food grade and industrial grade CO2 also require liquefaction and transportation. Cost data for CO2 used for enhanced oil and gas recovery or gas storage do not include transportation. The operator of the reservoir typically pays these costs.

The final cost of sequestration, including capture is $43-117/ton of CO2, depending on the sequestration technology applied. Food-grade, industrial grade, and other value options are profitable, valued between $5 and $45/ton of CO2 captured and sold. Costs do not reflect monitoring, liability, or other costs required by future regulations.

Acknowledgments

The authors thank the staff of INTEK Inc. for their efforts in preparing the manuscript and analysis, including Christopher Dean, Emily Knaus, and Jeffrey Stone.

References

1. http://eia.doe.gov.

2. The National Petroleum Council, Reference Report #36: "Capturing the Gains from Carbon Capture," July 18, 2007.

3. UOP, "Amine Guard FS Process," 2000.

4. Metz, Bert, Davidson, Ogunlade, deConinck, Heleen, Loos, Manuela, and Meyer, editors, "Special Report on Carbon Dioxide Capture and Storage," Intergovernmental Panel on Climate Change (IPCC), 2005.

5. http://www.natcarb.org and INTEK, Inc., 2009.

6. http://www.natcarb.org and INTEK Inc., 2007.

8. INTEK Inc., 2007.

9. Dooley, J.J., Dahowski, R.T., Davidson, C.L., Wise, M.A., Gupta, N., Kim, S.H., and Malone, E.L., "Carbon Dioxide Capture and Geologic Storage," Global Energy Technology Strategy Program, April 2006.

10. "The Cost of Carbon Dioxide Capture and Storage in Geological Formations," NETL/DOE, March 2005.

11. Dooley, J.J., Dahowski, R.T., Davidson, C.L., Wise, M.A., Gupta, N., Kim, S.H., and Malone, E.L., "Carbon Dioxide Capture and Geologic Storage," Global Energy Technology Strategy Program, April 2006.

12. Carbon Sequestration Atlas of the United States and Canada, Second Edition, National Energy Technology Laboratory, 2008.

The authors

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles