OGJ Newsletter

General Interest — Quick Takes

Gorgon LNG partners given final approval

The giant Gorgon-Jansz-Io LNG and domestic gas project off Western Australia has been given a final investment green light by the joint venture partners Chevron Corp., ExxonMobil Corp., and Royal Dutch Shell PLC.

In 2009 dollars, the cost of the development is $43 billion (Aus.).

With a total gas resource estimate of 40 tcf, the project will be the largest for resources development in Australia's history.

Preparatory work on the proposed Barrow Island LNG and domestic plant site will begin immediately with full construction timed to begin in February 2010.

Contracts valued at $2 billion (Aus.) have already been let and a further $10 billion (Aus.) worth of contracts will be awarded before yearend.

First LNG deliveries are expected to start in 2014. Domestic gas is slated to come on stream by yearend 2015.

The project comprises two subsea pipelines, one each from subsea wells on the Gorgon and the Jansz-Io fields. The gas will be piped to Barrow Island where three 5 million tonne/year LNG trains will be constructed along with a 300 terajoules/day domestic gas plant. Domestic sales gas will be piped to the mainland to connect with the main Dampier to Bunbury gas trunkline. LNG will be shipped direct to customers overseas from a loading jetty to be built on Barrow.

Carbon dioxide extracted from the project—mostly from Gorgon field—will be geosequestered by injection directly into storage reservoirs 2,000 m beneath the island.

The estimated economic life of the project is presently put at 40 years.

Gorgon field was first discovered by West Australian Petroleum in 1981 while nearby Jansz and Io were found in the 1990s by ExxonMobil and BP PLC, respectively.

Chevron has signed sales agreements with Osaka Gas, Tokyo Gas, and GS Caltex (of South Korea) for a total of more than 4 million tonnes/year of LNG. ExxonMobil has sales agreements with Petronet of India and PetroChina for its share of LNG production. Shell has yet to confirm its supply deals.

Chevron has 50% of the project (47.75% once equity sales are approved to Osaka Gas and Tokyo Gas). ExxonMobil and Shell each have 25%.

BP sees US biofuels consumption climbing

BP PLC expects biofuels will become a larger part of the US motor fuel market, probably displacing more gasoline than diesel, said Katrina Landis, chief executive officer of BP Alternative Energy, at the Offshore Europe Conference.

"Diesel use is growing in the US, following the trend set by Europe, and biodiesel is expected to provide around 8% of the fuel for diesel-powered engines by 2030," Landis said.

During that same period, biofuels are expected to take the place of about 25% of the gasoline market, she said. "US production of biofuels is expected to grow from less than 0.5 million b/d in 2007 to 2.3 million b/d in 2030," she added.

BP has a joint venture with Martek Biosciences Corp. to produce ethanol from sugarcane, and BP is working with DuPont Corp. to produce biobutanol at Saltend, Hull, UK.

In the US, BP has a joint venture with Verenium Corp., Cambridge, Mass., to develop a commercial-scale cellulosic ethanol plant in Highlands County, Fla. Plans call for the plant to produce 36 million gal/year by 2012.

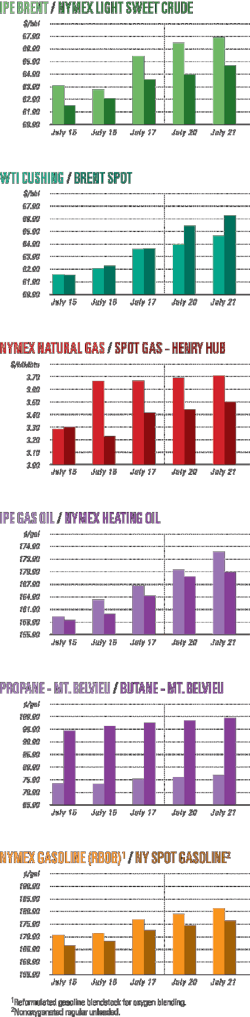

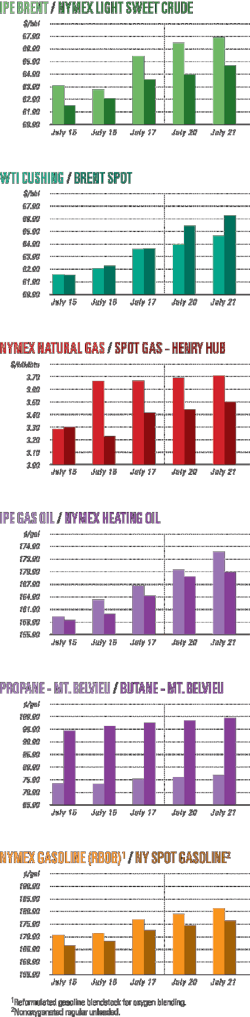

Industry Scoreboard

Exploration & Development — Quick Takes

Libya to invest $10 billion in development

Libya plans to invest 12.1 billion dinars ($9.92 billion) in the development of 24 wells in fields it calls "technically, financially, and economically proven."

The investment will be undertaken by Libya's state-owned National Oil Corp (NOC), its subsidiaries, and current foreign partners, according to an official statement issued after a cabinet meeting.

"No new parties would be allowed to participate in that plan," said the statement, according to the government news agency Jana.

The government's plan calls for boosting production from the Waha-Jalou oil field by 100,000 b/d at a cost of 1.6 billion dinars and increasing output at the Nafoora-Oujlaa-Khleej oil field by 130,000 b/d at a cost of 1.3 billion dinars. No other details were released.

Analyst BMI said Tripoli's move to prioritize contract awards to existing players in the Libyan upstream "may present opportunities" to Italy's Eni SPA, France's Total SA, Spain's Repsol YPF SA, and Austria's OMV AG.

However, the analyst expects "BP and Royal Dutch Shell to avoid making any high-profile new investment deals with Libya in the immediate term" in order to disassociate themselves and the British government from suggestions that oil industry concerns in Libya may have motivated the release of convicted Lockerbie bomber Abdel Baset al-Megrahi on Aug 20.

Last week, US Sen. Charles E. Schumer called on the British government not to bid on or agree to any oil contract with Libya after speculation that Megrahi's release was due to a secret deal between the British and Libyan governments.

"If the British government wants to dispel these disturbing rumors once and for all, agreeing to Libyan oil contracts is not the way to do it," Schumer said. "The Libyans have clearly shown their disdain for the international community by holding a welcome home ceremony for this terrorist, but it's up to the British to show the world that they reject the Libyans' foul actions."

BP nonetheless plans to drill its first Libyan well in the second half of 2010 as part of a $900 million exploration program, according to company spokesman, David Nicholas.

BP signed an accord with NOC in May 2007 during a visit by then-British Prime Minister Tony Blair. The agreement allows BP to explore 21,000 sq miles and in 2007 the company said it planned to drill at least 17 exploration wells.

West of Shetland gas find under appraisal

A group led by DONG Energy AS is considering whether to drill a sidetrack to appraise a gas discovery on the Glenlivet license west of the Shetland Islands off the UK.

The well in the P1195 license encountered the prognosed gas pay in Paleocene sandstone. Cores, logs, and sampling revealed 61 m of net gas pay with excellent reservoir and saturation parameters.

The Transocean Rather deepwater semisubmersible is drilling the well near the Laggan and Tormore gas discoveries, in which DONG Energy holds 20% interest, in the Faroe-Shetland Channel (see map, OGJ, Aug. 20, 2007, p. 38).

DONG Energy operates P1195 with 80% interest. Faroe Petroleum PLC and First Oil Expro Ltd. have 10% each.

DONG Energy was awarded interests in 21 exploration blocks covering 3,600 sq km in the region around the West of Shetlands in November 2008. DONG Energy operates four of the blocks.

Brunei exploratory drilling on tap in 2010

Two groups plan to drill at least four exploration wells onshore Brunei in 2010.

Kulczyk Oil Ventures Inc., Calgary, formerly Loon Energy Inc., offered to buy private Sydney firm Triton Hydrocarbons Pty. Ltd., which has a 36% interest in 744,000-acre Block M that contains undeveloped Belait oil and gas field.

Shareholders of more than 75% of Triton stock accepted the offer. Closing is expected in mid-September.

Tap Oil Ltd., Perth, operates Block M, which is just south of 550,000-acre Block L, in which Kulczyk Oil holds 40% interest (OGJ Online, Sept. 1, 2009).

Tap Oil shot 118 sq km of 3D seismic and 60 line-km of 2D seismic on Block M in the second and third quarters of 2009. It plans to drill two wells in 2010 and a third well by August 2011. Kulczyk Oil noted that four prospects on Block M were categorized as prospective resources because of the lack of discovery wells and production tests.

Once Kulczyk Oil acquires Triton, Brunei National Petroleum Co. Sdn. Bhd. has the right to acquire Kulczyk Oil's interest in Block M.

Nations Southeast Asia Ltd., Calgary, operator of Block L, shot 350 sq km of 3D seismic in the southwest part of the block earlier this year near adjacent Seria oil field, which had produced more than 1 billion bbl of oil by 1991.

Nations plans to drill two exploration wells starting in the first quarter of 2010 on Block L, where the last well, Jerudong-11, was drilled in 1986, Kulczyk Oil said.

Brunei Shell Petroleum Co. announced a large dry, sweet gas discovery in three formations just offshore at Bubut, less than 1 km from the Block L boundary (OGJ Online, Nov. 15, 2007).

Kulczyk Oil noted that Triton also owns 35% of Mauritania International Petroleum Inc., which holds 100% interest in four contiguous exploration blocks off Mauritania.

Triton also owns 50% of Triton Petroleum Pte. Ltd., or Triton Singapore, which owns a 20% beneficial interest in a production-sharing agreement that covers Syria's Block 9, where Kulczyk Oil plans to shoot a large 3D seismic survey by June 2010. Triton Singapore will be led by the current management of Triton, who are pursuing development opportunities in southern Iraq.

Drilling & Production — Quick Takes

Pan Orient to buy Indonesian interests from Fuel-X

Pan Orient Energy Corp., Calgary, agreed to buy Indonesian interests held by Fuel-X International Inc. of Alberta, which was placed in receivership in September 2007.

The main interest is a 30% nonoperated interest in the 2,285 sq km Tungkal production-sharing contract in South Sumatra. The other interest is a $5 million receivable payable upon first commercial gas delivery from Ruby gas field in the Sebuku PSC off East Kalimantan (OGJ Online, May 2, 2007). Development was approved in mid-2008.

The purchase price, $7.5 million (Can.) in Pan Orient stock, will be adjusted for revenue, expenses, and capital outlays related to the 30% participating interest in the Tungkal PSC from Aug. 31 to the closing date, and these adjustments will be paid largely in cash.

The Tungkal PSC has several discoveries, including Mengoepeah South in 2007, the discovery well encountering 70 m of net oil pay and testing at a combined rate of more than 2,000 b/d of oil above 1,200 m true vertical depth. Gross production is 800 b/d, of which 240 b/d is net to the Fuel-X interest.

Indonesia approved a revised Mengoepeah development plan in April that includes up to 10 development wells and the workover of existing wells. Development drilling is under way and anticipated to be completed by yearend with a target of gross production of 2,000-3,000 b/d, or 600-900 b/d net to the Fuel-X interest.

One high impact exploration well is to spud in the fourth quarter and be completed by yearend. Tungkal is next to the Pan Orient-operated Batu Gajah PSC, where seismic is being shot and a multiwell exploration drilling program is to start in the first half of 2010.

Volund field off Norway starts producing

Marathon Petroleum Co. (Norway) LLC started production from Volund field on Block 24/9 in the Norwegian North Sea.

The field consists of three subsea-completed wells tied back 8 km to the Alvheim floating, production, storage, and offloading vessel. Water depth at Volund is 120-130 m.

Volund is the second tieback to the Marathon-operated FPSO. The StatoilHydro-operated Vilje field began producing to the FPSO from two subsea-completed wells in August 2008 (OGJ, Aug. 11, 2008, Newsletter).

Marathon says current oil production to the Alvheim FPSO is about 140,000 bo/d, or about 20,000 b/d more than the nameplate capacity. The first Volund well, therefore, will function as a swing producer until a natural decline starts in the Alvheim fields, likely by the middle of 2010, the company says.

Marathon expects Volund to reach a peak oil production of about 25,000 b/d, the timing of which is subject to available processing capacity on the FPSO.

Operator Marathon holds a 65% interest in Volund, while its partner, Lundin Norway AS, holds the remaining 35%

Production from Alvheim started in June 2008 (OGJ, June 16, 2008, Newsletter). Operator Marathon holds a 65% interest in the Alvheim field and the FPSO. Partners in Alvheim are ConocoPhillips Skandinavia AS 20% and Lundin Norway AS 15%.

Interest owners in Vilje are operator Statoil 28.85%, Marathon 46.9%, and Total E&P Norge AS 24.24%.

Talisman farms into Papua New Guinea permits

Talisman Energy Inc., Calgary, signed a $60 million deal with Horizon Oil Ltd., Sydney, to farm into Horizon's gas and condensate interests in the western province of Papua New Guinea.

Talisman will acquire 50% interest in retention lease PRL 4 that contains the Stanley gas-condensate discovery and a 50% interest in PRL 5 that contains the Elevala and Ketu gas discoveries.

Talisman paid $30 million in cash and an additional $8 million to be drawn down at any time and applied to Horizon's share of capital expenditure on the permits. The remaining $22 million will be drawn down after Papua New Guinea approves the working interest transfers.

Talisman's entry comes immediately after Horizon's recent announcement that it terminated its earlier $55 million deal with P3 Global Energy after P3 failed to make the required payments.

Horizon's short to medium-term plan for development of its Papua New Guinea assets involves production of 140 MMcfd of gas from two wells, and extraction from that gas of an initial 4,000 b/d of condensate, and potentially 40 tonnes/day of LPG before reinjecting the dry gas until a gas market develops in the region.

Horizon says the Stanley gas resource likely would be used for electric power generation to supply local domestic and industrial customers while the larger Elevala and Ketu gas resource would rely on export by pipeline or as a liquid via a small LNG facility.

The deal also adds to Talisman's recently acquired assets in western Papua New Guinea via its takeover of British company Rift Oil PLC earlier this year. Rift holds two permits, one of which contains the Puk Puk and Douglas gas discoveries.

Processing — Quick Takes

Pemex refineries due low-sulfur fuel units

Pemex Refining let engineering, procurement, and construction (EPC) contracts worth $638 million to ICA Fluor for low-sulfur gasoline projects at two refineries in Mexico.

In addition to the EPC work, ICA Fluor will test and start up catalytic gasoline desulfurization plants, amine regeneration units, offsites, and utilities at the 275,000-b/cd refinery in Cadereyta, Nuevo Leon, and the 185,000-b/cd refinery in Ciudad Madero, Tamaulipas.

The Cadereyta project involves a 42,500-b/d catalytic distillation train. The Madero project involves two 20,000-b/d catalytic distillation plants.

ICA Fluor is a joint venture of Empresas ICA SAB de CV and Fluor Corp. Pemex Refining is a subsidiary of state-owned Petroleos Mexicanos.

Irving Oil to upgrade St. John refinery

Irving Oil will spend $220 million to upgrade its 250,000-b/d refinery at St. John, NB.

The privately held company said it will spend $170 million to upgrade the resid FCCU and a gasoline desulfurization unit.

When installed in 1998 with capacity of 70,000 b/d, the resid FCCU was the largest such unit in the world.

The refinery has another FCCU fed by vacuum gas oil. Total FCC capacity is 95,000 b/d (OGJ, Dec. 22, 2008, p. 48).

The refinery also has 35,000 b/d of catalytic reforming, 34,000 b/d of hydrocracking, and 92,000 b/d of hydrotreating capacity.

In addition to the FCCU and gasoline desulfurization work, the 60-day project will include general maintenance on other processing units to reduce flaring and fugitive emissions.

Agreement supports more Marcellus processing

A natural gas processing agreement announced Sept. 15 will underpin a new 120-MMcfd gas plant in the Marcellus shale gas play.

MarkWest Liberty Midstream & Resources LLC, a partnership between MarkWest Energy Partners LP and the Midstream & Resources Funds, announced it had reached agreement with Chesapeake Appalachia LLC, a subsidiary of Chesapeake Energy Corp., and Statoil Natural Gas LLC, a wholly owned subsidiary of StatoilHydro, to process gas at MarkWest Liberty's new Majorsville processing plant in the panhandle of West Virginia.

This agreement is in addition to one MarkWest Liberty executed earlier this year with Range Resources to process gas at the Majorsville plant. All agreements include "significant acreage dedications and other commitments," according to MarkWest's announcement. The Majorsville plant is to be completed in mid-2010.

With its infrastructure in Marshall and Wetzel counties in West Virginia, NiSource Gas Transmission & Storage's affiliate Columbia Gas Transmission will gather the rich gas produced by Chesapeake and Statoil. Per arrangements by MarkWest and Columbia announced in August 2008 (OGJ Online, Oct. 24, 2008), Columbia will deliver the gas to MarkWest's Majorsville processing plant, which is planned to be adjacent Columbia`s existing Majorsville compressor station.

NGLs produced at the Majorsville plant will move via pipeline to MarkWest's Houston, Pa., processing complex (OGJ Online, Apr. 9, 2009). MarkWest Liberty plans a 37,000-b/d fractionation plant at the Houston complex, as well as transportation, storage, and marketing infrastructure, to sell the NGLs into markets in the US Northeast.

The company currently operates a 22,000-b/d fractionation, storage, and marketing facility near Portsmouth, Ohio.

Transportation — Quick Takes

Regency expands Haynesville takeaway capacity

Regency Energy Partners LP, Alinda Capital Partners LLC, and GE Energy Financial Services announced plans to construct a $47 million pipeline extension of the Haynesville Expansion Project (HEP) in North Louisiana to increase capacity on the Regency Intrastate Gas System (RIGS). The extension, called the Red River Lateral, will add 100,000 MMbtu/day of capacity to the current project, bringing the total capacity to about 1.2 bcfd. Regency described the Red River Lateral as the first of several opportunities to extend the HEP.

The lateral will add 12.5 miles of 36-in. pipe to the HEP, reaching further southwest to the west side of the Red River into Red River Parish, La. All the incremental capacity on the Red River Lateral has been contracted and 75,000 MMbtu/day of additional capacity on the Haynesville Expansion has been contracted as well. The expansion's 1.2 bcfd of capacity is fully subscribed with the exception of incremental space held back for operational flexibility.

Construction of the expansion project—including the Red River Lateral—is on schedule to meet a planned in-service date of Dec. 31, according to Regency. The 46 miles of 36-in. pipeline used is now being commissioned. Construction continues on 75 miles of 42-in. pipeline. Regency plans to begin construction of the Red River Lateral later this month.

The lateral will be funded by each of the partners of the RIGS joint venture in accordance with their ownership percentages. Regency has a 43% general partnership interest in the joint venture, while Alinda, and an affiliate of GE Energy Financial Services, have a 50% and a 7% general partnership interest, respectively. The companies formed the joint venture late first-quarter (OGJ Online, Apr. 1, 2009).

The expansions are underwritten by firm transportation agreements with 10-year terms, and roughly 85% of projected revenues will come from reservation fees.

China, Japan committed to PNG LNG project

Papua New Guinea's Public Enterprises Minister Arthur Somare completed a "positively satisfying and successful" visit to Japan and China in connection with the PNG LNG project.

"Asian governments contracting for long-term purchases of [LNG] wanted assurance that the PNG LNG project has the support of the PNG government," Somare told local media on his return.

"The Chinese and Japanese governments believe that the strong commitment of the PNG government is necessary to ensure smooth progress of the PNG LNG project," Somare said, adding that they are concerned about the role these imports would play in their respective economies over the next 30 years.

"We have been able to satisfy both governments on this score and to hold highly satisfactory meetings with prospective LNG customers that are in advanced sales negotiations with the project operator, ExxonMobil," Somare said.

Somare travelled to Japan and China as a special envoy of Prime Minister Michael Somare, accompanied by four members of Parliament Anthony Nene, Martin Aini, Jimmy Miringtoro, and Francis Potape.

In Beijing, the delegation held talks with Zhang Ping, who heads China's National Development Reform Commission, the supreme government body that sanctions all international business transactions conducted by China's state-owned corporations, including Sinopec.

Enterprise enters Eagle Ford shale agreement

Enterprise Products Partners LP entered into a long-term agreement to provide natural gas transportation and processing services on dedicated acreage owned by one of the largest and most active producers developing the Eagle Ford shale. The agreement covers more than 150,000 acres in the play.

Enterprise declined to name the producer but has publicly identified Anadarko Petroleum Corp., Petrohawk Energy Corp., ConocoPhillips, and Apache Corp., among others, as potential partners for its midstream services. Anadarko holds 350,000 acres in the Eagle Ford shale. Petrohawk's holdings in the play reached 210,000 acres in August. ConocoPhillips holds 300,000 acres, and Apache 400,000.

Stretching from the Mexico border along the Gulf Coast to near Louisiana, the Eagle Ford shale covers more than 10 million acres in Texas and lies beneath or near Enterprise's assets in the region. Enterprise said the proximity would require it make only modest capital expenditures to begin providing the transportation and processing services required under the agreement.

The bulk of the modifications to Enterprise's existing system would consist of filling gaps in its current gas gathering system, the company said. Enterprise would not comment regarding either the expected pipeline mileage required or the timeframe over which the work would be completed.

Enterprise completed expansion of two of its seven South Texas processing plants during first-quarter, increasing its processing capacity in the region to more than 1.5 bcfd, and said these expansions will largely address any capacity needs brought about by the new agreement. Enterprise increased capacity at the Shilling plant in Webb County, Tex., to 110 MMcfd from 60 MMcfd and expanded capacity at its Thompsonville natural gas processing plant in Jim Hogg County, Tex. to 330 MMcfd from 300 MMcfd (OGJ Newsletter, Mar. 23, 2009).