OGJ Newsletter

Deutsche Bank: OPEC needs to cut output

With global oil and product inventories high and with demand deteriorating, the Organization of Petroleum Exporting Countries needs to further cut its crude output, according to Deutsche Bank analyst Adam Sieminski.

Despite this, Sieminski writes in a new report that OPEC is unlikely to lower its exports because prices have been rising. For the week ending May 1, US demand for motor gasoline climbed less than 5% from a year earlier, while for the preceding week demand was up 8%, and a month ago it was up over 10% from a year earlier, indicating the onset of a downward trend in the demand growth rate, Sieminski wrote.

Momentum in the demand rate for distillate fuels as reported by the US Energy Information Administration also decreased during the latest reporting week.

Although gasoline inventories, measured in terms of days of forward cover, look relatively normal, oil and gasoline inventories are very full, Sieminski said.

He added that crude prices recently have been driven higher by a combination of rising expectations for a faster economic recovery, increased funds flow into commodities, and higher utilization at US refineries, which were up 2.6% this week to 85.3%—the first rise since January. This rise in utilization shows refineries are gearing up for the US driving season, which begins on May 25.

Sieminski believes that gasoline cracks are holding on tertiary stocking and could come under pressure when that stocking runs its course.

“Eventually, in our view, refiners will have to scale back, and this will force crude oil back to $50/bbl,” Sieminski said.

Deutsche Bank estimates that WTI will average $47/bbl for 2009, rising to average $55/bbl next year.

Meanwhile, the Deutsche Bank US natural gas forecast calls for an average of $4.50/MMbtu this year, rising to $6.50/MMbtu next year.

IOGCC: Alaskans press for gas development

The rest of the world will capitalize on the development of clean natural gas even if the US delays, speakers told the Interstate Oil & Gas Compact Commission on May 12 in Anchorage.

Both the Lower 48 and Alaska gas will be needed in 2018-20, said Mark Myers with the Alaska Department of Natural Resources.

Other countries such as China and Japan that have fewer supply options likely will snap up LNG, Myers said. LNG will go there because it will bring higher value than in North America.

Alaska has 85 tcf of unconventional gas resources on top of its vast conventional endowment, Myers said.

Infrastructure is in place except for the proposed 4.5 bcfd, 48-in. pipeline to northern Alberta, he noted.

Alaska Gov. Sarah Palin said Washington policymakers don’t realize that delaying exploitation of Alaska’s onshore gas and putting off exploration for offshore gas will result in greater greenhouse gas emissions in the interim until more renewable energy sources can be brought into play.

Two Dallas promoters named in SEC complaint

Two Dallas promoters raised $10 million from 300 investors nationwide through fraudulent offers and sales of oil and gas joint venture interests, the US Securities and Exchange Commission charged.

SEC filed a civil injunctive action in US District Court in Dallas alleging that Hartmut T. (Hardy) Rose and James Patrick Reedy acted through Geo Cos. of North America Inc., Geo Natural Resources Inc., and Geo Securities Inc. between August 2003 and August 2005.

SEC’s complaint said the pair made numerous false and misleading representations and omissions in connection with the offers and sales of the interests, including Reedy’s touting Geo’s successful track record when, in reality, the firm had very few wells producing commercial quantities.

It also charged in several instances Rose and Reedy solicited funds from investors to complete wells without disclosing that Geo’s geologists advised against completing them. Finally, the complaint alleged Rose and Reedy sought additional money from investors by falsely portraying prior wells as successful when they were actually dry holes.

It sought permanent injunctions, disgorgement of ill-gotten gains plus prejudgment interest, and civil penalties against the pair. Rose settled the charges by agreeing to pay $58,914 in disgorgement, $22,749.29 of prejudgment interest and a $50,000 penalty, the federal securities agency said. Litigation continues against Reedy, it indicated.

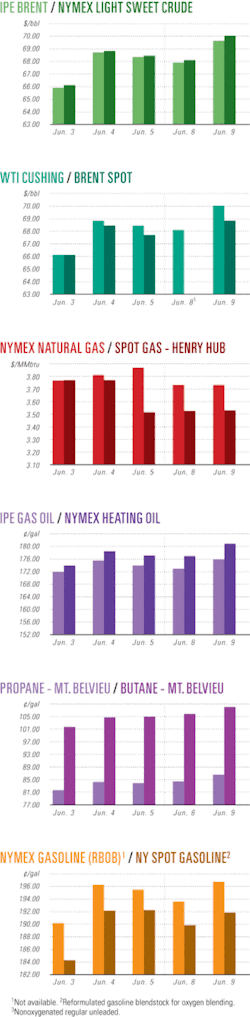

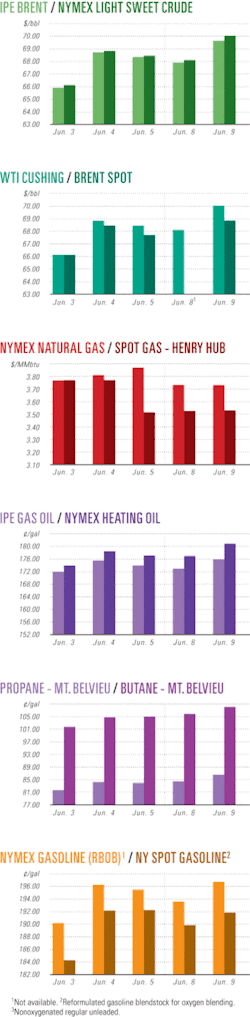

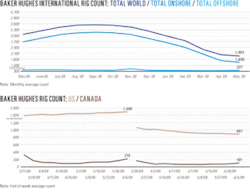

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesTotal has oil find off Congo (Brazzaville)

Total E&P Congo gauged a third deepwater oil discovery in the northern part of the Moho-Bilondo license off Congo (Brazzaville) where it reported two successful exploration wells in 2007.

The Moho Nord Marine-4 well, 75 km offshore in 3,537 ft of water, flowed at the rate of 8,100 b/d on a 52/64-in. choke. It proved a 163-m column of high quality oil in the Albian F formation. TD is 13,907 ft.

Total said the discovery “confirms the existence of significant Albian resources in the northern part of the Moho-Bilondo license, in addition to the already recognized Tertiary and Albian A and B resources.”

Total said this and the Mono Nord Marine-1 and 2 finds in 2007 and the positive delineation well Moho Nord Marine-3 in 2008 “reinforce Total’s confidence in the emergence of a development pole” in the northern part of the license. Preliminary development studies have begun.

The company started production in the Phase 1 development of Moho-Bilondo field in the southern part of the license in April 2008. It is drilling more wells and building production to an expected plateau of 90,000 b/d of oil equivalent from 14 wells in 2010.

License interests are Total E&P Congo 53.5%, Chevron Overseas Congo Ltd. 31.5%, and Soc. Nationale des Petroles du Congo 15%.

Total noted that it has drilled half of all exploration wells in Congo, begun production on 15 fields covering 9 of the 28 existing permits or concessions, and discovered 65% of initial listed reserves in the country.

It is operator with 53% interest at Nkossa field, where work undertaken since 2005 arrested a decline and stabilized production at 50,000 b/d.

In October 2008, Total began developing Libondo, a satellite of Yanga field, where it is operator with 65% interest.

The company continues to explore the Mer Tres Profonde Sud permit, on which it has made five discoveries. Total is operator with 40% interest.

Tullow discovers more oil in Uganda

Tullow Oil PLC said its Nsoga-1 exploration well, which was drilled in the Butiaba region on Block 2 in Uganda, has found “good quality Kasamene-type” oil-bearing reservoirs.

Tullow said the well was drilled 6 km horizontally from the top of the structure, to a total depth of 755 m and has been successfully cored, logged, and sampled.

The total net Kasamene-type reservoir is 43 m thick, of which the top 3 m are oil-bearing at this location. “At the crest of the trap, which is 160 m vertically up-dip, the entire reservoir should be oil filled,” the firm said.

Tullow said in a separate low net-to-gross section, immediately above this Kasamene-type reservoir, “12 m of thin-bedded oil-bearing sands were also encountered and are likely to have deeper oil water contacts based on seismic amplitudes and pressures.”

“This latest result further extends the play and derisks several adjacent prospects located in Blocks 1 and 2, which are scheduled for drilling later in the year,” Tullow said of Nsoga-1, which is the seventh successful test of the Victoria Nile Delta play fairway within the Lake Albert Rift basin.

The well is now being suspended as a future oil producer and on completion of operations the rig will move to test the Awaka prospect with drilling operations scheduled to commence this month.

Tullow has interests in three licenses in the Lake Albert Rift basin in Uganda. Tullow operates Block 2 with a 100% interest and has a 50% interest in Blocks 1 and 3A, which are operated by Heritage Oil 50%.

MMS, NPD sign cooperative exploration agreement

The US Minerals Management Service signed a memorandum of understanding with the Norwegian Petroleum Directorate, MMS announced on May 6.

The agreement’s objectives are to establish and build relationships; promote cooperative resource management activities in exploration and production; promote the sharing of scientific and technical information, exploration, and production strategies as well as technical solutions; and conduct cooperative research studies, MMS and NPD officials said.

MMS acting director Walter D. Cruickshank and NPD director general Bente Nyland signed the MOU. They said the agreement will adhere to applicable US and Norwegian laws.

It complements an existing MOU between MMS and Norway’s Petroleum Safety Authority, Cruickshank noted.

Drilling & Production Quick TakesReliance starts gas production from Dhirubhai finds

Reliance Industries Ltd. (RIL) started natural gas production from the Dhirubhai 1 and 3 discoveries on the KG-D6 block off India in early April.

This was a major discovery for India because it provided an increase in domestic energy supplies that raised questions whether the nation’s energy import plans make sense. At peak production, the KG-D6 facility is expected to produce 550,000 boe/d. It was brought into production 61/2 years from discovery.

The block is in the Krishna Godavari basin in the Bay of Bengal. The gas is received at the Gadimoga onshore facility and delivered to the East West pipeline. Wells, are connected by flow lines and production risers to a control and riser platform and are tied back to the terminal about 60 km from the gas fields—one of the longest tie backs in the world.

“At the seabed, equipment equivalent to over 110,000 tonnes of steel weight and over 2,400 line-km of flowlines and umbilicals have been installed to construct a deepwater production system. Subsea installations were carried out by remotely operated vehicles at sea bed depths ranging from 600-1,200 m, well beyond diver depths,” said RIL.

This was a challenging project because of the harsh weather apart from a window of 4 months every year. Other difficulties included supply chain challenges and manpower shortages against tight schedules.

RIL will sell gas produced from its KG-D6 block off east India to several companies for power generation under a gas sales and purchase agreement (GSPA).

Buyers will take 11 million standard cu m/day of gas at 11 different power stations for 5 years, which will be delivered through the East-West pipeline owned by Reliance Gas Transportation Infrastructure Ltd.(RGTIL) and other pipelines.

RIL expects to sign GSPAs with other power companies shortly, which is anticipated to increase the contracted quantity of gas for the power sector to 18 million standard cu m/day.

The power companies also signed a gas transportation agreement (GTA) with RGTIL.

PMS Prasad, RIL president and chief executive officer of petroleum, said the expected supply of 18 million standard cu m/day of gas to the power sector would largely eliminate their gas supply deficit and would result in generation of 4,000 Mw of power, providing welcome relief in many parts of the country.

Telemark, Clipper Corridor development advances

Development of the ATP Oil & Gas Corp.-operated Telemark and Clipper Corridor discoveries in the deepwater Gulf of Mexico advanced with the awarding by Bluewater Industries Inc. of two lumpsum contracts to Technip.

Bluewater is managing the two development projects. ATP owns 100% of Telemark, and 55% of Clipper Corridor.

Telemark lies on Atwater Valley Block 63 in 4,450 ft of water and will be tied back to ATP’s Titan Mini DOC deep-draft floating drilling and production platform scheduled for installation in midyear in Mirage and Morgus fields on Mississippi Canyon blocks 941 and 942, respectively.

The Telemark contract to Technip includes the design and manufacturing of one high-pressure, 2-mile long flexible riser, engineering for installation and welding of one 13-mile oil and gas production flowline, installation of the flowline and associated riser with an option to install an umbilical, fabrication and installation of subsea structures and a jumper, and precommissioning work.

Clipper Corridor lies on Green Canyon Block 299 in 3,460 ft of water and will be tied back to the Front Runner spar, operated by Murphy Oil Corp., on Green Canyon Block 338.

The Clipper Corridor contract covers design and manufacture of two 11/2-mile high-pressure flexible risers; engineering for the installation and welding of one 151/2-mile pipe-in-pipe oil production flowline and one 151/2-mile gas line; installation of the flowlines, risers, and umbilical; fabrication and installation of four subsea structures and associated jumpers and flying leads; and precommissioning work.

Technip’s operating center in Houston will execute these contracts, with riser fabrication in Le Trait, France, and flowline welding in Mobile, Ala.

Technip says offshore installation is scheduled for late 2009 to early 2010 for the Telemark project and for second quarter 2010 for the Clipper Corridor project, using the Deep Blue, Technip’s deepwater pipelay vessel.

Technip will use also its Deep Pioneer deepwater construction vessel on the Telemark project.

Kurdistan plans Taq Taq oil exports

Addax Petroleum Corp., Calgary, has received notification from the Kurdistan Regional Government of plans to export crude oil from Taq Taq field in northern Iraq.

Addax and Genel Energy International Ltd., partners in Taq Taq Operating Co., submitted a field development plan in March envisioning peak production of as much as 180,000 b/d (OGJ Online, Mar. 18, 2009).

The government has requested that the companies prepare to carry oil by truck from the field to the Khurmala export station about June 1. At Khurmala, oil will enter Iraq’s export pipeline transiting Turkey with a terminal at Ceyhan on the Mediterranean.

The joint venture currently is expanding Taq Taq production capacity to 70,000 b/d from its present level of as much as 40,000 b/d. Full field development will require construction of a pipeline.

The State Oil Marketing Organization will sell the oil. Taq Taq Operating works under a production-sharing contract.

Anadarko agrees to pay penalty for oil spills

Anadarko Petroleum Corp. and two of its units will pay $1.05 million in fines and upgrade their spill-prevention plans as part of a settlement for oil spills in Wyoming, according to US government agencies.

The US Department of Justice and the Environmental Protection Agency said Anadarko and units Howell Corp. and Howell Petroleum Corp. also will spend more than $8 million to implement plans to resolve violations of the Clean Water Act.

According to the consent decree, filed in US District Court in Cheyenne, Wyo., Anadarko and its Howell units will pay the fine and also will upgrade and implement appropriate spill-prevention plans and develop and implement facility response plans.

DOJ and EPA said the consent decree also requires the three companies to implement “a multiphased integrity and mitigation plan that incorporates inspection, monitoring, testing, data collection, and failure analysis activities.”

According to a complaint filed at the same time as the consent decree, Anadarko and the two other firms allegedly discharged harmful quantities of oil from its facility in Wyoming on more than 35 occasions between Jan. 26, 2003, and Oct. 19, 2008.

The complaint alleges that more than 31,300 bbl of oily water and oil were released during the spills and resulted in an observable film, sheen or discoloration on the surface of the impacted water or shoreline.

The spills occurred on oil production fields in Park, Johnson, and Natrona counties and resulted in the pollutants being discharged into the tributaries or drainages of Silver Tip Creek and Salt Creek, which are tributaries to the Clarks Fork and Powder rivers, respectively.

Processing Quick TakesPlant pulls helium from stranded Kansas gas

IACX Energy, Dallas, has started up what may be the world’s smallest helium purification plant near Otis in Rush County in western Kansas.

Eight of the producers connected a gathering system formerly operated by a Oneok Inc. affiliate are selling low-btu gas to the plant, which has the capacity to extract 15-30 Mcfd of helium.

IACX polishes the helium to 95% purity, compresses it to 2,800 psi, stores it in tube trailers for transport, and sells it on fixed, take-or-pay contracts. The government-set helium price is $62.25/Mcf.

IACX also operates three nitrogen rejection units with 3 MMcfd of total inlet capacity on the site that brings the 800-btu raw gas up to pipeline quality. It vents the nitrogen. The first nitrogen unit came on in September 2008.

The company uses pressure swing adsorption, a molecular sieve process that works through activated carbon at low pressure and low volume. A chiller extracts natural gas liquids from the formerly stranded gas.

Gas produced from the Permian Chase Group and Cambro-Ordovician Arbuckle formations as deep as 3,000 ft in Reichel field and nearby fields 22 miles northwest of Great Bend contains 1.5% to 2% helium.

Many historical sales points for helium-rich gas are being closed or curtailed by gas purchasers, and helium production is on a sharp downward trend, IACX said. The company operates other nitrogen units in Kansas, Texas, Oklahoma, and Nebraska.

Transportation Quick TakesQSN gas line starts flow in Australia

A natural gas link between Queensland, South Australia, and New South Wales has finally been completed with the opening this week of two new lines and compression facilities in Queensland.

Epic Energy built the 180-km, 400-mm high-pressure gas line, known as the Queensland-South Australia-New South Wales (QSN) line, which will transport gas from the Wallumbilla gas hub in eastern Queensland through the company’s Southwest Queensland line to connect with the Moomba-Adelaide and Moomba-Sydney lines.

A second, 113-km, 400-mm line, commissioned by AGL Energy, will transport gas from a point about 81/2 km east of Miles near the Condamine electric power station in central-eastern Queensland to the Wallumbilla hub.

Epic has increased the flow capacity of its Southwest Queensland line with construction of a midline compressor facility, while AGL designed and built a Wallumbilla compressor station to enable gas from AGL’s Berwyndale coalseam methane field to enter the high pressure Southwest Queensland line.

Completion of all this work means there is an interconnected eastern Australian pipeline network that will provide a level of security of gas supply to customers in New South Wales and South Australia.

ExxonMobil signs Gorgon LNG deal

ExxonMobil Corp., one of three joint venture partners in the proposed development of the Gorgon-Jansz gas fields, agreed to sell some of its LNG production to Petronet LNG of India.

ExxonMobil will supply 1.5 million tonnes/year of LNG to the Indian company for 20 years. This represents 10% of the three-train project’s total planned capacity of 15 million tonnes/year of LNG.

ExxonMobil has a 25% share in the project and its production. ExxonMobil and Petronet will work to conclude a sale and purchase deal in June.

Petronet intends to ship its LNG from the proposed Barrrow Island plant to a new receiving terminal in the port city of Kochi, which will have a total capacity of 2.5 million tonnes/year of LNG. The terminal is scheduled to begin operations in 2011.

This is the latest move to develop the Gorgon-Jansz project, the most recent being the conditional environmental approval by the Western Australian EPA last week for a third LNG train to be added to the development plans on Barrow Island.

TransCanada wins Mexico gas pipeline contract

TransCanada will build, own, and operate the 310-km Guadalajara Pipeline, extending from an LNG regasification plant being built near Manzanillo on Mexico’s Pacific Coast to Guadalajara. The 30-in. OD pipeline will have capacity to ship 500 MMcfd of natural gas, with a targeted in-service date of 2011.

Mexico’s state-owned electric power utility Comision Federal de Electricidad (CFE) has a 25-year contract for all gas shipped through the line, which will be used to serve power generation load in both Manzanillo and Guadalajara as well as connecting to an existing Petroleos Mexicanos (Pemex) line near Guadalajara. Peruvian LNG will supply most of the gas for the pipeline.

The pipeline’s 2011 in-service target coincides with the planned 2011 startup of the Manzanillo LNG terminal. Mexico already has two LNG regasification plants in operation—at Altamira on the Gulf of Mexico and Ensenada on the Pacific Coast—part of Ministry of Energy plans to increase LNG imports to 1.99 bcfd by 2017 from January 2009 levels of 503 MMcfd (OGJ Online, Jan. 7, 2009).

TransCanada owns and operates the 130-km Tamazunchale Pipeline in central Mexico and in the 1990s built the 700-km Mayakan Pipeline and the 214-km El Bajio pipelines. It has since sold these pipelines.

The Guadalajara Pipeline will cost an estimated $320 million.

Skanled partners place gas line plans on hold

The Skanled partners have suspended the pipeline project that was to deliver Norwegian gas to Sweden and Denmark because of the global economic uncertainty and increased commercial risk.

The pipeline was scheduled to start operations in 2012 and Gassco AS, the leader of the consortium, said it was unclear on what future gas demand would be.

“Despite strong efforts by many stakeholders to succeed with the project, it is Gassco’s view that the current economic environment and also subsequent uncertainties related to timing of new field developments on the Norwegian Continental Shelf, have weakened the basis for the project,” said Thor Otto Lohne, Gassco executive vice-president.

“The project might be relaunched if the commercial conditions become more favorable in the future,” Lohne said.

It has been difficult for the partners to secure gas volumes to underpin the project as the shippers have not been able to reach the gas sales agreements. They planned to submit installation and operation plans to the authorities in April.

Skanled, which will cost an estimated 10 billion kroner, was interdependent on receiving terminals in Norway, Sweden, and Denmark. The pipeline’s capacity was 24 million standard cu m/day (OGJ Online, Jan. 17, 2009).