Special Report: Economic slump to chill capital spending in 2009

Oil and gas producers—slammed by the worldwide economic downturn, lower oil and gas prices, and tight credit markets—have slashed their 2009 capital budget plans.

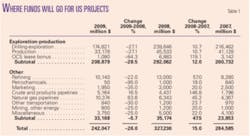

Capital expenditures for oil and gas projects are set to shrink worldwide this year, with outlays in the US especially hard hit.

OGJ’s annual capital spending survey shows that oil and gas industry capital spending in the US will fall 26% this year to $242 billion.

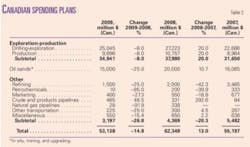

Total Canadian spending will decline 15% to $53 billion (Can.), but spending plans indicate an increase in Mexico. Outside North America, upstream oil and gas capital expenditures will decline from a year ago.

In response to the worldwide economic downturn and resulting drop in oil demand, many small oil and gas producers have slashed their original 2009 capital spending plans.

The larger operators mostly have stayed with their plans, but many of these spending outlooks call for a decline in 2009 outlays from last year’s levels. These companies stand poised to take advantage of lower costs during the slowdown. But with economies in Southeast Asia still growing, there will be no precipitous decline in costs during this downturn.

Earlier this month the Conference Board reported that real gross domestic product in the US is forecast to have declined 5.9% during the first quarter of this year, signaling a deep point in the recession, and that the US may see real GDP decline 2.6% in 2009; this would be the largest decline since 1946.

“The Conference Board projects that growth in the second quarter will stay negative and will be very slow in the third quarter as capital spending will remain low and inventories will not be depleted until year’s end. Overall industrial production is also unlikely to move up before the fall. Even the recovery in the fourth quarter will be held back by these negative trends and increased unemployment, which is typically a lagging indicator,” the Conference Board said.

Companies that invest now will realize savings as costs decline, though. The Centre for Global Energy Studies recently noted in its Monthly Oil Report that oil companies are seeking big cost reductions from service providers, with Total talking about cuts of 20% and BP 40%, according to Thierry Pilenko, CEO of Technip.

“With such big savings on the cards, it is little wonder that investment decisions are being delayed until costs have come down,” CGES said.

US upstream spending

Spending in the US for upstream operations will decline almost 29% this year. This includes outlays for oil and gas exploration, drilling, production, and offshore lease payments to the Minerals Management Service.

This upstream outlook is based in part on OGJ’s annual drilling forecast, which predicted that the total number of US well completions in 2009 would be 43,384 (OGJ, Jan. 19, 2009, p. 35). The 2008 well completion total is estimated at 52,097.

In the wake of soaring worldwide demand for inputs such as labor, drilling rigs, steel, and copper, costs have been reassessed since the last edition of OGJ’s capital spending outlook (OGJ, Apr. 28, 2008, p. 20). This led to upward revisions of 2008 upstream spending figures.

But 2009 drilling and exploration capital expenditures in the US will decline 27% from last year to $174.6 billion.

Low oil and gas prices have slowed drilling and curtailed production in most areas of the US. The American Petroleum Institute this month reported that first–quarter 2009 US oil and gas drilling activity dipped to levels not seen since 2004.

According to API’s latest Quarterly Well Completion Report, an estimated 11,071 oil wells, gas wells, and dry holes were completed in the first quarter of 2009, down 22% from a year earlier and down 35% from last year’s fourth quarter. The estimated number of new exploratory wells fell 11% from first–quarter 2008.

The API statistics show that gas continues to be the primary target for US drilling, with an estimated 5,735 gas wells completed in the first quarter, down 23% from a year earlier. This decline represents the most severe quarterly decline for gas drilling in this decade, API said.

OGJ estimates that outlays for production this year will total $33.2 billion, down from $45.5 billion last year.

Another component of US upstream spending is the total of bonus payments that the MMS collects from lease sales for tracts on the Outer Continental Shelf.

The MMS has two lease sales scheduled for this year. One sale for tracts in the Central Gulf of Mexico took place in March and attracted $703 million in high bids. Another lease sale for tracts in the Western Gulf of Mexico is scheduled on Aug. 19.

Based on declining investment and the fact that fewer tracts will be offered in the upcoming sale, OGJ estimates that a total of $1.08 million will be generated by the two 2009 lease sales. Last year MMS conducted four lease sales and received $6.883 million in high bids.

US downstream outlays

Construction of pipelines will cushion the fall in capital spending in all other categories, including transportation, processing, marketing, and LNG. OGJ forecasts that all oil and gas spending excluding upstream projects will decline almost 6% this year.

Capital spending at refineries in the US will fall 22% to $10.14 billion. The decline follows a surge in project spending that took place last year. Fewer new projects are planned to get under way this year, and some projects are being slowed.

In December 2008, Sunoco Inc. reported that it would focus on base maintenance and the completion of major compliance projects in 2009 and 2010, including completing a distillate hydrotreater conversion in Philadelphia.

Through 2008, Sunoco spent $140 million on the Philadelphia ultralow–sulfur diesel project. It plans to spend a further $70 million on it this year.

Some integrated operators have indicated they will reduce capital outlays at their refineries this year, including Marathon Corp., which announced plans to spend almost 35% less at its refineries than last year. Chevron Corp. said it will reduce this year’s capital outlays at refineries to $2 billion from $2.3 billion last year.

ConocoPhillips reported that capital spending at its US refineries in 2009 would total $1.1 billion, down from 2008 outlays of $1.6 billion. The company said this year’s investment is primarily for projects related to sustaining and improving the existing business with a focus on safety, regulatory compliance, reliability, and capital maintenance.

In addition, ConocoPhillips said projects to expand conversion capability and increase clean product yield continue, including funding for a hydrocracker project at its San Francisco refinery. But the company noted that it will slow down some of its refining projects due to economic conditions.

Pipelines, other spending

Expenditures are set to climb this year for crude and products pipelines and for gas pipelines in the US. Construction activity for pipelines, especially new gas systems like the Midcontinent Express Pipeline between Texas and Alabama, will push spending up 44% from last year.

OGJ’s most recent Worldwide Pipeline Construction report identified plans for the construction of nearly 4,000 miles of gas pipelines and just over 3,000 miles of crude and products lines in the US this year (OGJ, Feb. 9, 2009, p. 52).

OGJ forecasts that spending on these gas lines, including compressor stations, will climb 64% this year to $10.37 billion. Spending for crude and products lines in the US will total $5.16 billion, up 17%.

With no major projects taking place this year, capital spending at US petrochemical plants is forecast to plunge to $50 million from $1 billion last year.

Also, a slowdown in LNG project development will suppress spending for import terminals in the US, while cost reductions brought on by the economic recession will drive down marketing and corporate expenditures from last year’s levels.

Spending in Canada

Cost–cutting will affect capital spending for projects in Canada this year as well. Oil sands development outlays will plunge more than conventional E&P spending, and the total of all other capital expenditures in Canada will drop from last year.

Capital expenditures for conventional oil and gas exploration, drilling, and production in Canada will decline 8% to $34.94 billion (Can.), following last year’s 20% jump.

OGJ’s drilling forecast earlier this year called for well completions to fall to 16,360 from last year’s total of 17,802. There were 14,856 well completions in Canada in 2007, according to the Canadian Association of Petroleum Producers (CAPP).

Oil sands capital spending, which includes funds for in–situ extraction, mining, and upgraders, will slump 25% from a year ago to $15 billion (Can.). CAPP reported that oil sands capital expenditures totaled $18 billion (Can.) in 2007, the latest year for which the association has reported such data.

Canadian Natural Resources Ltd. reported that competition for resources during 2005–08 drove up costs for the first phase of its Horizon oil sands project 43% above the original estimate. Global demand for workers, steel, and copper surged along with oil prices during the project.

Marathon has announced that it will cut its 2009 oil sands spending to $887 million from 2008 outlays of $1 billion. The company said the year–on–year decrease reflects not only a stronger US dollar but also the expectation that nonessential projects will be deferred.

As in the US, midstream and downstream spending in Canada will decline as a whole by 27% from last year. Construction of crude and products pipelines will be the only growth area in this category in 2009.

Refining spending is set to decline 25% to $1.5 billion (Can.). Petrochemical outlays will drop 95% to just $10 million (Can.).

Late last year, Petro–Canada announced that its 2009 capital budget included about $560 million (Can.) for its downstream business, with the majority allocated for new growth project funding. This was to be directed toward the 25,000 b/d delayed coker at the company’s Montreal refinery and additional reliability items associated with its Edmonton refinery conversion project. These plans were made before Petro–Canada’s agreement to merge with Suncor Energy was finalized (OGJ Online, Mar. 24, 2009).

In announcing the merger, Petro–Canada and Suncor said they expect to achieve annual operating expenditure reductions of $300 million (Can.) from efficiencies in overlapping operations, streamlining business practices, and improved logistics. They also expect to achieve annual capital efficiencies of $1 billion (Can.) through the elimination of redundant spending and targeting capital budgets to high–return, near–term projects.

With plans for about 500 miles of construction, spending this year for crude and products pipelines will climb 47%. But plans call for only about 34 miles of new gas pipelines in Canada, dropping such spending to $28 million (Can.) for the year.

Spending elsewhere

Capital spending outside the US and Canada this year also will slow, though to a much less extent.

In Mexico, Pemex announced that its 2009 capital budget includes a 15% total increase. The plan calls for 84% of the new nearly 186 billion peso budget to be allocated for exploration and production, and 12% is to be spent on refining projects. The remainder is set for petrochemicals and other expenditures.

Upstream spending outside North America is forecast to decline 6% from a year ago, according to the most recent Barclays Capital Original E&P Spending Survey, released Dec. 19, 2008.

The Barclays survey said Russian companies, after several years of world–leading spending growth, are now showing some of the largest cuts in 2009 E&P outlays.

Lukoil has reported that its 2009 capital budget will fall 40% but also said that a drop in costs and ruble devaluation will leave its investment effectively unchanged from last year.

Meanwhile, some US–based companies have also released details of their capital budget plans outside North America.

ConocoPhillips reported that in Europe, Asia, Africa, and the Middle East, its E&P capital program this year will be about $5.1 billion.

This funding will go to coalbed methane projects in Australia, the continued development of both Bohai Bay in China and Gumusut oil field off Malaysia, Ekofisk oil field in the North Sea, Shah gas field in Abu Dhabi, and Kashagan oil field in the Caspian Sea, among other projects, ConocoPhillips said.

ConocoPhillips’s non–US refining and marketing spending plan was $600 million, with a focus on projects related to reliability, safety, and the environment, plus an upgrade project at its Wilhelmshaven, Germany, refinery.

In November 2008, ConocoPhillips and Saudi Aramco halted until the second quarter of this year the bidding for construction of a 400,000 b/d export refinery at Yanbu, Saudi Arabia, citing uncertainties in the financial and contracting markets.

Some large LNG liquefaction and regasification projects are currently under construction. In Chile, the Quintero LNG regasification terminal will be completed this year. A handful of terminals are in the planning and construction phases in China. And at Ras Laffan, Qatar, three phases of QatarGas liquefaction remain under construction.

In Western Australia, Woodside Energy’s Pluto LNG project will pipe gas in a 180 km 36–in. line from Pluto and Xena fields to the new liquefaction facility at Burrup, with a total cost of $12 billion (Aus.).