New tool determines reserves of mature oil and gas fields

There are many reasons—economic, preaudits, strategic planning for enhanced recovery, among others—that call for the size or ultimate reserves of an oil or gas field to be estimated.

Fundamentally, there are three ways to estimate reserves, and two of these—volumetric and material balance—require sensitive geologic and engineering data at the reservoir level that are highly proprietary to the operators.

A field may consist of several reservoirs, varying from about three in Saudi Arabia to 15 in Venezuela, grouped in the same geological structure, each of which has to be evaluated individually for its reserves and then summed together for the field total.

The only method of directly estimating reserves for the entire field is decline analysis. Although this methodology only requires knowledge of the field’s production history, this information is also proprietary and therefore sparsely available.

The huge share of mature fields, which the IEA estimates the figure at half of the total oil fields, calls for an agile method for estimating reserves. This article develops a model that would provide an estimate of reserves based only on the peak production rate of an oil or gas field. Some unexpected physical variations in the behavior of oil and gas fields are brought to light.

The world’s fields

Oil has been produced worldwide for well over a century, and more than 40,000 oil fields have been discovered.1 2 3

Of the known discovered reserves of these fields, estimated at 2.4 trillion bbl—94% are concentrated in fewer than 1,500 major fields defined as those with more than 100 million bbl of ultimate reserves.

For the US, the tally exceeds 30,000 oil fields, of which roughly 300 are majors with 80% of total US reserves. The North Sea has 265 oil fields of which 90 are majors that account for 80% of total reserves. Saudi Arabia has 96 oil fields.

Worldwide, the top 100 oil fields account for 50% of current production and 65% of reserves.

More than 90% of the world’s oil fields are classified as small and hold just 3% of reserves. A small oil field is defined as one with less than 25 million bbl of reserves.

The tally of gas fields discovered is not as straightforward as for oil because gas comes from multiple sources: fields of nonassociated gas only, fields with both nonassociated gas and oil reservoirs with associated gas, unconventional (coalbed methane and shale gas) ‘fields,’ and gas associated with all oil fields.

Associated gas accounts for a significant 16% of total output; this percentage varies considerably from about 10% in Russia to 25% in the US to almost 100% in Saudi Arabia, Venezuela, and elsewhere.

With the exception of the US, gas production and reserves statistics do not differentiate source details. Estimates of the global number of nonassociated gas fields are in the range of 28,000. There are about 365 giant nonassociated gas fields compared with 370 giant oil fields.

Giant gas fields account for roughly 75% of the total ultimate reserves discovered of 13.8 quadrillion cu ft (qcf) or 2.3 trillion bbl of oil equivalent; giant oil fields account for a similar percentage.

A giant oil or gas field is defined here as one with reserves of more than 500 million boe—that is, roughly 3.5 tcf of gas. More than 90% of the world’s gas fields are classified as small and hold 12% of total reserves. A small gas field is defined here as one with less than 0.25 tcf of reserves.

The tally of US gas fields is around 24,000, of which roughly 300 are major fields with reserves greater than 1 tcf.

In 2000-08 on average worldwide 214 oil fields and 58 gas fields have been discovered annually. The average size of these fields is 28 million bbl and 1.7 tcf, respectively.

Three producing countries—the US, Russia, and Saudi Arabia—together hold 600 billion bbl of ultimate reserves or one quarter of the total oil reserves discovered globally to date. They have all passed their peak production,4 and it is estimated that 80% of their oil production today comes from mature fields, or fields that have passed their peak.

Time to peak varies with the size of the field (Equation 4). It would normally occur as early as 2 years after production start-up in a field with 100 million bbl of reserves or as late as 28 years in a 100 billion bbl field akin to Saudi Arabia’s Ghawar. Real time to peak is usually longer, however, as conservation, economics, and policy considerations alter the field’s natural production profile.

The model

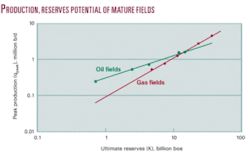

In earlier articles,5 6 the following power relationship between peak production and field size was firmly established with real data from both oil and gas fields:

null

where q is the field peak production rate and K its ultimate recoverable reserves; a and b are constants specific to oil or gas fields. The power relationship is derived from the familiar logistic production decline model.

The algorithm for oil fields is:

null

with a correlation coefficient (r2) of 0.996. The units for qpeak and K are thousands of barrels a day (kb/d) and billion barrels of oil (Bbo), respectively.

For gas fields, the corresponding algorithm is:

null

with a correlation coefficient (r2) of 0.994. For the purpose of this analysis, the units for q and K are in oil equivalent, kboe/d and Bboe, respectively. The original field units in cubic feet (cf) were converted to boe using a factor of 6,000 cf/bbl.

Results

Five oil fields and six gas fields covering a spectrum of oil provinces were used to establish the correlations shown in the figure on p. 33.

The ultimate reserves of each field were determined by production decline analysis—considered the standard; the peak production rates are actual field values. The basic data are summarized in the table.

For the oil fields, the mean deviation between the reserves obtained by the model algorithm (Equation 2) and the decline standard was 5.3%. For the gas fields, the mean deviation was 3.3% for the values estimated with Equation 3.

Contrary to intuitive expectation that the trend lines for oil and gas fields would be parallel, it turns out that they intersect each other at about K = 10 Bboe or 60 tcf. This indicates that the production potential of the vast majority (99%) of gas fields—those smaller than 60 tcf—is lower than that of oil fields of comparable size.

On the other hand, the production potential of supergiant gas fields—those larger than 60 tcf—is much higher than that of oil fields of equivalent size. The dissimilarity in the slopes of the two correlations is apparently not due to reservoir lithology. This premise was tested using a mix of carbonate and sandstone oil and gas fields.

The model was applied to a diverse set of 17 oil and gas fields from around the globe for which reliable data on size and field peak production rate are available. The table summarizes the recoverable reserves values obtained using Equations 2 and 3, which are compared with the standard values.

Deviation averages 4.6% for the oil fields and 3.3% for the gas fields. It is extraordinary that the ultimate reserves of an oil or gas field can be estimated with a reliability of 95% based on a single parameter—its peak production rate.

The model was then used to estimate the ultimate reserves of Ghawar, a number that has been elusive with approximations ranging from 75 billion to 95 billion bbl.

According to the recent IEA Outlook, Ghawar peaked at 5.588 million b/d 29 years after production start-up in 1951. These two facts can now be used to obtain a fresh estimate of its reserves. Equation 2 indicates that Ghawar’s reserves are about 110 billion bbl. This value can now be used to check its time to peak using the following algorithm:4

null

The calculated value of 28 years is evidently a good match with the known field peak time of 29 years. The units of t and K are years and billion barrels of oil, respectively.

The model algorithm depends on a single factor—field peak rate. While this simplicity enhances its versatility, it also limits its applicability in fields subject to practices or conditions that compromise the attainment of the field’s natural peak rate, such as, conservation, capacity caps on production and pipeline facilities, and policy considerations.

The latter affects many important fields in the Persian Gulf. Ghawar was an exception. It peaked prior to its first major shut-in in 1981-82.

Snorre field in the North Sea is a good example of the effect of production caps. When the field was first appraised, estimates of its oil reserves were 1.4 billion bbl. These reserves have a production potential of 367,000 b/d according to Equation 2.

Snorre development plans called for installing an initial production capacity of 186,000 b/d with subsequent upgrades to 245,000 b/d and 360,000 b/d. The latter expansion was never realized.

The field went on production in 1992 and evidently could never produce beyond 245,000 b/d; decline began after 2003. A glimpse of its production history would show that the field ‘peaked’ at 245,000 b/d which, according to the model—Equation 2—would indicate reserves of 730 million bbl or roughly half of its real value.

Finally, it should be pointed out that the model is applicable only to single fields and not to a cluster of several fields like, for instance, the Cantarell complex; grouping distorts the production profile.

In regard to gas fields, it was difficult to obtain data for major fields other than those used in the correlation; auspiciously, the resulting correlation is first rate in that four of the six fields used show no deviation between the estimated reserves and the standard decline values (see table). In fact, for fields with reserves less than 30 tcf—this covers 99% of all gas fields—the model algorithm, Equation 3, reduces to a simple linear expression:

null

with units of tcf and bcfd, respectively. This algorithm can also be used inversely to estimate the production capacity of newly discovered reserves.

Final comments

A model was developed to provide a quick estimate of the reserves of mature oil and gas fields based on a single parameter—the peak production rate of the field.

The model provides estimates with a 95% confidence level and is applicable to individual fields which were produced without any operational limitations that ultimately repress their true peak rate.

The method is particularly useful because it obviates the need for decline analysis, which requires the complete production history of the field and may not be always available.

For the majority of gas fields, those smaller than 30 tcf, a simple rule-of-thumb applies: the size of the field is 10 times its peak production rate. Conversely, for newly discovered gas fields: the production potential of the field is one tenth of its reserves.

References

- World Energy Outlook, International Energy Agency, 2008.

- Largest US oil and gas fields, Energy Information Administration, August 1993.

- Ivanhoe, L.F., and Leckie, G.C., “Global oil, gas fields, sizes tallied, analyzed,” OGJ, Feb. 15, 1993, p. 78.

- Sandrea, R., “An In-Depth View of Future World Oil & Gas Supply—A Quantitative Model,” OGJ Online Research Center, January 2009 (http://www.pennenergy.com/index/resourcecenter/reports/new_future_global.html).

- Sandrea, R., “Estimating new field production potential could assist in quantifying supply trends,” OGJ, May 22, 2006, p. 30.

- Sandrea, R., “Equation aids early estimation of gas field production potential,” OGJ, Feb. 9, 2009, p. 34.

The author

Rafael Sandrea ([email protected]) is president of IPC Petroleum Consultants Inc., a Tulsa international petroleum consulting firm. Sandrea was president and chief executive officer of ITS Servicios Tecnicos, a Caracas engineering company he founded in 1974. He has a BSc from the University of Tulsa and a PhD in petroleum engineering from Penn State University.

AustraliaThe board of Blue Energy Ltd., Perth, approved development of coalbed methane from Jurassic Walloon coal measures on ATP 854P in Queensland.

Two Blue Energy wells, Cerulean-1 and 2, intersected gas in Permian Bandanna coals in ATP 854P.

The company plans to drill three wells in the second quarter of 2009 and at least one pilot later in the year leading to gas certification in the first quarter of 2010. The program targets an initial 300 PJ potentially present in the permit.

Nigeria-Sao Tome JDZAddax Petroleum Corp., Calgary, let a contract to Transocean for the drilling of four wells in the Nigeria-Sao Tome Joint Development Zone starting in the fourth quarter of 2009.

The Deepwater Pathfinder drillship is to start by drilling the Kina prospect in Block 4, subject to Joint Development Authority approval (see map, OGJ, Sept. 8, 2003, p. 38).

Addax Petroleum operates Block 4 and also has interests in JDZ blocks 1, 2, and 3, operated by Chevron, Sinopec, and Anadarko, respectively.

Addax Petroleum also operates OPL 291 off Nigeria.

CaliforniaDaybreak Oil & Gas Inc., Spokane, Wash., said its fourth well in an exploration program around the flanks of giant Mount Poso oil field in the southeastern San Joaquin basin cut 26 ft of oil pay in Oligocene Vedder at 2,200 ft.

The Bear-1 well, in 13-26s-27e, Kern County, went to TD 3,261 ft and is to be completed. The Sunday-1 well, in 19-26s-28e, Kern County, is pumping 50 b/d of oil and likely will be offset.

Olancha-1, in 29-27s-28e, plugged at TD 3,990 ft, is a candidate for reentry pending 3D seismic reinterpretation, and Piute-1, in 33-27s-28e, was plugged at 3,856 ft.

Daybreak said the Sunday and Bear wells have set up several development locations. Drilling of the four wells will result in the company earning a 25% interest in 3,000 acres held by Chevron USA Inc. in the East Slopes Project acreage in Kern and Tulare counties.

Chevron earned a 50% working interest in 19,000 acres contributed by Daybreak and its partners by funding the 35 sq miles of 3D seismic in late 2007.

New MexicoSun River Energy Inc., Wheat Ridge, Colo., let a contract to Thomasson Partner Associates Inc., Denver, to coordinate all evaluation and exploration activity leading to drillsite selection on Sun River’s 112,000 acres in Colfax County, northeast New Mexico.

The 9-month project timeline includes gathering data, assessing area potential, secondary data gathering, prospect ranking, targeting 2D seismic, 3D seismic if warranted, and drillsite definition.

The area has potential for multiple pay zones and natural gas in structural accumulations and may have potential in Lower Pennsylvanian black shales in an “elevator basin” setting, similar to the ongoing play in Guadalupe and San Miguel counties, NM (see map, OGJ, Feb. 23, 2009, p. 32).

OklahomaRed Fork Energy Ltd., Perth, is preparing to build a compression facility to produce shallow, biogenic gas from Mississippian-Devonian Woodford shale in northeastern Oklahoma.

Four wells have been drilled and cased near Tullahassee in Wagoner County to the shale at 550 ft. The Chidester 1-3 and Dorsey 2-5 wells cut about 50 ft of prospective shale and tested at rates of 100 Mcfd of gas from 10 ft of stimulated zone. Red Fork has drilled a water disposal well.

The company believes it could sustain delivery of 300 Mcfd/well if it stimulated several intervals and that its 50,000-acre lease position has room for more than 600 wells.

WyomingDouble Eagle Petroleum Co., Casper, Wyo., set a $10-20 million budget for 2009 to enhance gas production from existing Atlantic Rim wells and drill development wells at Pinedale anticline and the Waltman area of the Wind River basin, all in Wyoming.

Double Eagle drilled 24 producing wells and 6 injectors at the operated Atlantic Rim Catalina Unit. Five wells were online at yearend 2008, one was dry, and 18 are to be available for production by the end of March.

The company participated in drilling 65 wells at the nonoperated Sun Dog and Doty Mountain units at Atlantic Rim to be hooked up in the first half of 2009 and 24 wells at Pinedale to start producing this year.