OGJ Newsletter

GPA09: Gas recovery coming sooner, not later

Rapidly declining US natural gas rig counts and prices are setting the stage for a recovery in both sooner rather than later. That was the message of Gregory A. Dodd, vice-president for natural gas marketing and supply at Devon Energy Corp. in remarks made Mar. 10 to the 88th Annual Convention of the Gas Processors Association in San Antonio.

Dodd sees signs of this eventuality in the rapid pace that gas rigs are being laid down or otherwise pulled away from US gas plays, especially shale areas. He also said many wells are being completed but not yet tied into gathering and transmission infrastructure.

The coming recovery is evident in the accelerating rate of production decline, the increased use of natural gas in electric power generation as falling prices make it more of the fuel of choice, and the inevitable US economic recovery. Devon, said Dodd, is “getting ready for a turnaround” by, in part, increasing its 2009 capital budget over 2008.

Natural gas, Dodd said, is “not the fuel of the future but the fuel of today.” Companies need to be prepared for recovery by reducing debt and reorganizing management structures to speed decision making.

They also need to shorten response times for rig mobilization once recovery begins and be actively influencing policy making, especially at the federal level. Currently, said Dodd, the story of natural gas is not getting told in Washington, DC.

LNG will play a critical role, he said, in meeting demand in the recovery, as it will take US production companies 6 months from the time rigs are called back to work and increased production from that new work.

M&A activity rises among UK-based oil, gas firms

Mergers and acquisitions among UK-listed oil and gas companies soared by more than 70% in the last year, according to law firm Freshfields Bruckhaus Deringer LLP. The rise could indicate larger players’ desire to acquire smaller operators, now struggling to access capital.

Oil prices dropping more than 60% since the peak of $147/bbl in July 2008 diminished the value of oil and gas firms, and opened cheaper deals for those who are cash rich enough to weather the downturn.

FBD said the level of M&A activity in the UK rose despite the slowdown in pace of global M&A deals. The value of these transactions involving London Stock Exchange-listed companies leapt by 183% to £2.1 billion in 2008. In volume terms they rose to 52 deals, representing a rise of 73%.

“Somewhat against the grain of what we have seen in UK and global M&A as a whole, activity levels within the oil and gas sector involving London-listed companies in particular have been decidedly busier and look set to become even more intense throughout 2009,” said Simon Marchant, a corporate partner at FBD and head of the firm’s energy and natural resources group.

In 2008, the industry’s global M&A deals increased by more than 51% on the previous year. However, they fell by 18% in value terms to £146 billion.

Last August, Jarpeno Ltd., the investment vehicle of India’s Oil & Natural Gas Corp., bought Imperial Energy Corp. PLC for $2.6 billion—the largest deal in the UK.

China ‘stocking up’ on world oil, analysts say

China is taking advantage of the worldwide recession to stock up on foreign oil, last month offering some $43 billion in loans to foreign oil companies in Brazil, Venezuela, and Russia to secure future oil supplies.

The flurry of deals comes despite the global recession and a worldwide decline in oil demand, according to a report by Radio Free Asia, which said that China views those conditions as “an opportunity” rather than a reason to cut back on its investment plans.

Philip Andrews-Speed, an energy expert at Scotland’s University of Dundee, said China is still not putting its trust in the market, but that its latest overseas deals suggest a new approach.

“The balance between the government and the companies has changed, so the government now is in the lead, providing these loans in return for oil,” Andrews-Speed said. “It’s the same set of objectives but with a different set of cards in the hand.”

Andrews-Speed sees China’s new strategy as more beneficial for oil development because the state-owned oil companies of Russia, Brazil, and Venezuela all face funding problems in a declining market.

“These are state companies that don’t have enough money to develop new reserves as fast as they want to. Thus the Chinese loans will allow them to move ahead faster and produce additional oil earlier than we would have expected,” he said.

Experts told RFA that China’s oil loans are a sign of both opportunism and confidence that its economy will recover from the worldwide recession soon.

In January, China’s oil imports fell 8% to their lowest level in 14 months, the General Administration of Customs reported. But the government appears to be investing for the longer term.

“Putting aside the current economic crisis, we’re looking for China’s oil imports to double in only a very few years,” said Andrews-Speed. “So, if you don’t trust the market, you’ll be doing more of these deals, and now is a very good time to be doing these deals.”

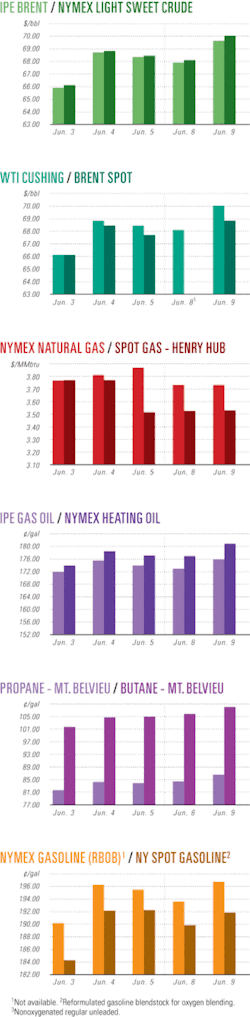

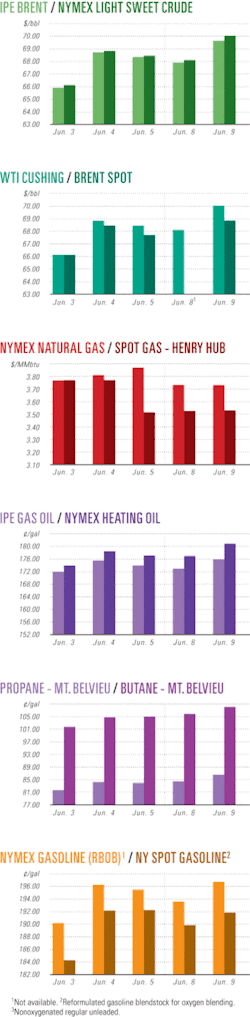

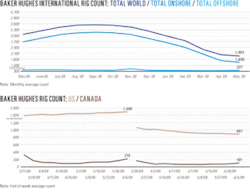

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesChesapeake shuts in gas, may idle more rigs

Chesapeake Energy Corp., Oklahoma City, shut-in 7% of its operated natural gas and oil production due to low Midcontinent wellhead prices and is considering a further 10% reduction in drilling in 2009 if prices stay low the next few months.

The volumes shut in at least through March are 200 MMcfd of gas and 6,000 b/d of oil.

Chesapeake, however, said it “believes conditions are developing that will support higher prices for natural gas and oil later this year and in 2010.”

Chesapeake said it was taking the action to protect shareholder and royalty owner values with Midcontinent gas prices at most major interstate delivery points at $2.70/MMbtu, a price at which most gas production is unprofitable.

Chesapeake said, “We believe low wellhead prices combined with constrained capital availability will likely cause US drilling activity to decline well beyond the 40% drop already seen since August 2008. As a result, US natural gas production will begin to dramatically decline before the end of 2009 and consequently natural gas markets will regain better supply-demand balance by the end of 2009, if not sooner.”

The company said its attractive hedges and cash availability provide it with the operational and financial flexibility to shut in production in periods of unusually low prices, such as the current market.

A 10% reduction in rigs, if implemented, would be in addition to a drop to 110 rigs from the 158 it operated in August 2008.

Petrobank slows Bakken work in Saskatchewan

Petrobank Energy & Resources Ltd., Calgary, said it is the largest Bakken producer in Canada.

The company built the production of its Canadian business unit to an average of 22,274 boe/d in the 2008 fourth quarter compared with 17,775 boe/d for all of 2008, mainly on strong Bakken results. The unit’s production was estimated at 22,000 boe/d in February 2009.

Operating in the Williston basin generally east and northeast of Weyburn, Sask., Petrobank is running two rigs in the Bakken. It reduced its activity as commodity prices declined from an average of eight rigs in 2008 and as many as 10 rigs.

The company drilled 161 net wells in 2008 with a 99.4% success rate and compressed the time from spud to on production to 35 days. It plans to drill 40 wells in 2009 at current prices and as many as 120 if prices improve.

The company’s recent efforts to further improve Bakken production have focused on increasing the intensity of fracs by several means.

It is increasing the number of staged fracs from 8 to 11 in its 1,400-m laterals for a 38% increase in frac intensity per square mile. It is doubling the number of wells per square mile with shorter 600 to 700-m laterals and 8 fracs in each leg for a 200% increase in frac intensity.

It is also doubling the number of locations per square mile, with each well having two 600 to 700-m laterals from a single vertical well bore and each leg receiving 8 staged fracs, representing a 400% increase in frac intensity.

Facilities at Viewfield, Creelman, and Freestone, Sask., have been connected to the main Midale gas processing plant with 100 km of new pipeline to capture gas and gas liquids produced with the Bakken’s light oil. Together they are conserving more than 6.5 MMcfd plus NGL. Two more gathering facilities are to be built in 2010 as drilling spreads north.

Petrobank grew its land base in 2008 to 270 gross (236 net) square miles.

Since acquiring Peerless Energy Inc. in January 2008, Petrobank has developed an innovative way to reenter old producing Peerless trilateral wells and perform multistage fracs in the two outside horizontal legs. Results exceeded expectations.

Bakken player focuses on cutting costs

With rig activity down more than 40% from the peak in late 2008, Encore Acquisition Co., Fort Worth, is focused on reducing costs, high-grading acreage, and continuing a highly successful refrac program.

The company, which has drilled 24 wells in several areas of its 307,900 acres in the Bakken play, estimates 3.75 billion bbl of oil in place on its holdings. Initial potential rates averaged 411 b/d.

Low recovery of 1.9% of the oil in place per well based on 300,000 bbl/well presents opportunities for downspacing, improved drilling and completion techniques, and possibly even enhanced recovery once oil prices recovery, the company said Mar. 3.

Encore saw its costs per 640-acre Bakken single-lateral well climb to $5.2 million in 2008 from $4.5 million in 2007. It has a goal of reducing the average to $4 million this year. It is already seeing 8-10% cost savings compared with 2008 wells and needs another 14% reduction to reach the $4 million goal.

Casing costs, which doubled in 2008, are starting to decline. Stimulation costs have dropped 40% since mid-2008, and other costs are 15% lower.

Encore wants to cut $1 million from the cost of 1,280-acre Bakken wells that averaged $6.5 million last year.

The company has drilled 12 operated Middle Bakken wells that averaged 380 boe/d in the first 7 days on production and 7 Sanish wells that averaged 487 boe/d. Gas-oil ratio is assumed to be 1,000 scf/st-tk bbl.

Refracs, initiated 9-18 months after the initial completion, are returning 80,000 bbl of incremental reserves at a cost of $500,000. Multiple refracs may be possible at many wells.

Encore, producing 3,000 boe/d from the play, has a $73 million budget for 2009 that includes $12 million for land acquisition. It has an interest in 530 identified locations in five areas. Economics are marginal at $50/bbl and $5/Mcf at $5 million/well and 250,000-300,000 bbl recovery.

Bakken and Sanish appear to be in communication in some areas where they are separated by less than 20 ft but may be separate along the Nesson anticline where they are 50-75 ft apart, Encore said.

New Guinea Energy to fast-track PNG oil appraisal

New Guinea Energy Ltd., Sydney, intends to fast-track the drilling of its Panakawa oil prospect on the PPL267 onshore permit in the Papua New Guinea forelands.

The company has just completed a seismic survey in the wholly owned permit over an area containing an oil seep discovered in 2006.

The seismic data has delineated a fault-closed structure with 16.5 sq km of potential areal closure that the company’s reservoir engineers suggest could contain around 187 million bbl of oil in the Cretaceous Toro sandstone reservoir.

The oil found flowing naturally to surface in 2006 at an estimated rate of 5 b/d had an API gravity of 35° rather than the traditional 55° oil found in the PNG highlands. The company has spent $7 million (Aus.) over the last 3 years evaluating the region, and it plans to begin a drilling program in late 2009.

The Panakawa prospect is located just 1 km from the Panakawa logging and veneer timber plant wharf on the navigable Fly River which is used to export products direct to international markets via ships and barges. New Guinea Energy will be able to deliver the rig and equipment directly from barges to the drill site without the use of helicopters—a boon for logistics of the operation.

Target depth of the reservoirs is a relatively shallow 2,500 m.

Drilling & Production Quick TakesCoastal Energy starts Songkhla oil production

Coastal Energy Co. has begun production from a mobile offshore production unit (MOPU) in Songkhla field in the Gulf of Thailand following delays caused by poor weather in January.

The field is producing 11,000 b/d from the Songkhla A-01 and A-03 wells. Coastal Energy used a MOPU different from the originally contracted unit, which had been damaged by the weather. Production from the Songkhla A-07 exploration well is scheduled for mid-March and will be tied in.

Randy Bartley, president and chief executive officer of Coastal Energy said, “The Songkhla wells’ production rates are exceeding our original estimates. Our combined onshore and offshore production is now [about] 12,800 boe/d. We currently plan to build our liquidity position and commence another phase of drilling later in 2009. However, we have no related capital expenditures committed at this time.”

Last December Coastal Energy successfully completed two wells on Block G5/43, which ensured an average oil production of 9,000 b/d from Songkhla field (OGJ Online, Dec. 31, 2008).

Coastal Energy, the sole operator of the block, said it has identified numerous undrilled prospects along the northwest margin of the Songkhla basin.

Total starts production from Nigeria’s Akpo field

Total Upstream Nigeria Ltd. (Tupni) has brought on stream deepwater Akpo gas condensate field in Nigeria a month ahead of schedule. It expects to reach plateau levels this summer.

Akpo’s production will be ramped up to 175,000 b/d of condensate and 320 MMscfd of gas from 44 wells (22 producers, 20 water injectors, and 2 gas injectors), 22 of which have already been drilled. Output is being delivered through a 100,000-tonne dry weight floating production, storage, and offloading vessel. The FPSO has a capacity of 185,000 b/d and can store up to 2 million bbl of stabilized liquid hydrocarbons.

The gas, which will go to the Amenam hub, will be used in the domestic market and at the Nigeria LNG plant on Bonny Island. Gas and condensate is delivered to a single-point mooring oil terminal 2 km away. The subsea infrastructures transporting the hydrocarbon effluents consist of 110 km of high-pressure, high-temperature subsea flowlines connected by steel catenary risers to the FPSO.

Akpo is a strategically important field underpinning Total’s growth strategy as it would harness gas that would otherwise be flared. It “has been designed as a hybrid development capable of handling up to 530 MMscfd of high-pressure gas, out of which 185 MMscfd will be reinjected into the reservoir to maximize hydrocarbon recovery, and 320 MMscfd will be exported by pipeline,” said Total.

Akpo, on OML 130, has estimated proved and probable reserves of 620 millions bbl of condensate and more than 1 tcf of gas. Condensate is 50°. The field, discovered in 2000, is 200 km off Nigeria in 1,200-1,400 m of water.

Pemex awards drilling, rig contracts

Mexico’s Petroleos Mexicanos, aiming to boost production at aging fields, has awarded a $687 million oil well drilling contract to a consortium led by Schlumberger.

The group, which includes Dowell Schlumberger de Mexico, OFS Servicios, and Drillers Technology de Mexico, will begin drilling 500 wells in the Chicontepec field in April. The contract runs through June 2012.

Pemex hopes to boost output from Chicontepec to 600,000 b/d from 30,000 b/d, with spending plans for the area pegged at more than $2.3 billion this year.

Meanwhile, Diamond Offshore Drilling Inc. said it will start two rig contracts with Pemex in 2009. In late July, the 300-ft Ocean Summit jack up rig will leave the US Gulf of Mexico to start a 476-day contract in Mexico, while Diamond also extended a contract for the Ocean Nugget.

The existing contract, due to expire this month, will last from April through June 2011 following the extension agreement.

Processing Quick TakesChina approves new Guangdong refinery project

China’s National Development and Reform Commission has approved China National Petroleum Corp.’s plans to construct a 10-million-tonne/year refinery at Jieyang in southern Guangdong province.

The approval is the latest effort by the government to boost China’s refining capacity in the wake of severe shortages over the past several years throughout the country, but especially in its southern regions.

“The refinery will help CNPC better tap the rising demand for petrochemical products in the Pearl River Delta region,” said Cai Enming, an executive with China Petroleum and Chemical Association.

Although China’s other two main oil companies, Sinopec and CNOOC, already have refineries in Guangdong, the facility marks a new departure for CNPC as most of its existing refineries are located in China’s northeastern and northwestern regions.

Cai underlined the need for CNPC to operate a refinery closer to the market it serves, saying that, “The cost would be too high for CNPC to transport its products from these [northern] refineries to Guangdong.”

Chinese media reported that the project would likely refine heavy oil imported from Venezuela.

The reports follow an announcement by CNPC on Feb. 13 that it has started a new research program that aims to lighten heavy crude oil, enabling it to build several refineries able to process such Venezuelan oil (OGJ Online, Feb. 20, 2009).

Pertamina renews Balikpapan refinery upgrade

Indonesia’s state-owned PT Pertamina, renewing interest in an earlier plan, has signed a memorandum of understanding with Dubai-based Star Petro Energy (ETA Group) and Japan’s Itochu Corp. to upgrade the country’s 260,000 b/d refinery at Balikpapan in East Kalimantan.

“By signing the memorandum of commitment, Pertamina and those companies will hold further talks on upgrading Balikpapan refinery,” company spokesman Anang Noor said of the signing, which took place at the World Islamic Economic Forum in Jakarta.

“Cooperating with world-class companies is important in our efforts to improve ourselves as soon as possible in order to increase the performance of our refineries,” said Karen Agustiawan, Pertamina president director.

She expressed hope that negotiations with ETA Group and Itochu would be concluded soon so that the project could be started on time.

State Enterprise Minister Sofyan Djalil, who said that negotiations with the two firms are continuing, estimated the venture as worth up to $1.7 billion. “It is still a tentative figure,” he said, adding, “We still have to explore the actual price.”

Sofyan said cooperation with the two firms should result in the improved performance of the refinery in Balikpapan, especially its processing of residual materials.

So far 30% of the total volume of oil processed by the refinery becomes residue which was sold very cheaply, Sofyan said, expressing hope that the refinery upgrade would enable 100% higher priced products.

Pertamina has previously said it wanted to boost capacity at the Balikpapan refinery, which has two crude distillation units with respective capacities of 200,000 b/d and 60,000 b/d.

Pertamina said it wanted to increase total capacity to 280,000 b/d, switch from sweet crude to cheaper sour crude, and add a 50,000 b/d cracking unit to process heavy residue into gasoline and petrochemical products.

Transportation Quick TakesAlaska outlines intrastate gas pipeline plan

An intrastate natural gas pipeline that extends from Alaska’s North Slope (ANS) to the Cook Inlet area could cost $4 billion and be in service as early as 2015, according to state-appointed project manager Harry Noah. The line would provide gas to meet Alaskan space heating and industrial demand.

The 800-mile, 24-in. OD pipeline would use two compressor stations and deliver about 500 MMcfd. Alaska sees the line as a complement to an eventual trans-Alaska gas pipeline delivering supplies to the Lower 48.

Two proposals for a natural gas pipeline from ANS into Canada have advanced to the detailed planning and project development stage, the US Federal Energy Regulatory Commission told Congress on Feb. 20. “At this point in project development, both Denali and TC Alaska are now fully working towards obtaining quality information to conduct their respective open seasons to obtain shippers for their pipeline,” FERC said in its seventh report to federal lawmakers on the project (OGJ, Mar. 2, 2009, p. 27).

Noah named a number of tasks to be completed on the in-state line by June 2011, including guaranteeing a gas supply, obtaining commitments from purchaser, establishing tariffs, obtaining permits, and turning the project over to a builder-operator. He also said the project would build on work completed by Enstar and the Alaska Natural Gas Development Authority.

Oman Shipping commissions product tanker

Oman’s state-owned Oman Shipping Co., as part of a larger plan aimed at boosting its refined and oil transport capabilities, has commissioned the LR2 Haima product tanker built by Japan’s Mitsui Engineering & Shipbuilding.

The 245-m long, 42-m wide vessel, which boasts navigational equipment enabling it to operate in a variety of climatic conditions, can transport as much as 110,000 tonnes of oil products and will become the 18th ship in the OSC fleet.

The LR2 Haima is the second ship of its kind to be taken by Oman, following December’s delivery of the LR2 Liwa. The vessel represents the latest move by OSC to step up its ability to carry oil and products.

In mid-December, OSC and Emirates for Trade Agencies (ETA) signed in Dubai an agreement to establish a 50-50 joint venture to own three 300,000-tonne crude oil tankers.

The Omani-Emirates agreement followed an announcement by OSC in September that it planned to raise $4 billion by the end of 2008, aiming to add 15-20 product tankers to its fleet, in addition to the order for 10 vessels it announced in February.

The 10 vessels are due for delivery between November 2011 and April 2012.