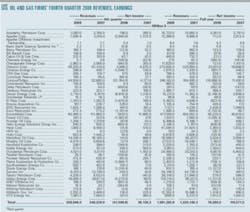

Collectively, a sampling of US and Canadian operators posted dismal results for the fourth quarter of 2008.

In a group of 48 US-based producers and refiners, 26 recorded a net loss for the quarter. The group’s full-year results show that 18 incurred a net loss for 2008.

In the sample of eight companies based in Canada, two reported a quarterly loss. As a group, their combined earnings declined 49% from a year earlier.

Oil and gas prices plunged during the quarter, although operating costs remained high. Some refiners experienced a sharp downturn in earnings as gasoline prices plummeted on weak demand and swelling inventories.

Boosting the fourth-quarter results of some of the operators were net gains on the mark-to-market of hedges and derivatives contracts. Meanwhile, others were hard hit by impairment charges.

A sample of service and supply firms fared much better as a whole for the fourth quarter and the full year. The 21 companies in this group reported a combined 3% increase in 2008 net income compared with 2007, although their combined earnings for the fourth quarter were down from a year earlier. Revenues, however, were up sharply from a year earlier for both the quarter and the year.

Prices, margins

In the final 2008 quarter, the front-month futures contract for West Texas Intermediate on the New York Mercantile Exchange averaged $59.06/bbl.

This compares with $118.22/bbl in third-quarter 2008, and $ 90.50/bbl in the final 2007 quarter.

Gas prices also fell in the 2008 fourth quarter, with the front-month NYMEX contract averaging $6.398/MMbtu, down from $7.392/MMbtu in fourth-quarter 2007.

High product prices suppressed demand during the second half of last year. The average pump price for all formulas of unleaded gasoline in the US reached as high as $4.165/gal in the first week of July 2008, and then dropped to $1.71/gal in the final week of last year. Refinery utilization in the US sank to below 85% in December.

Cash operating margins for refiners on the US Gulf Coast averaged $5.45/bbl in the 2008 fourth quarter. This compares to an average of $8.83/bbl a year earlier, according to Muse, Stancil, & Co.

Integrated companies

The integrated firms in the sample of US-based operators reported weaker results for the recent quarter compared with a year earlier. But for the entire year, revenues and earnings for these companies were generally improved from 2007, benefiting from record oil and gas prices in third-quarter 2008.

These companies’ fourth-quarter earnings were mostly lower due to weaker oil prices and higher operating expenses.

But ConocoPhillips posted a $31.764 billion loss for the fourth quarter due to charges, including a $7.4 billion write-down on the company’s investment in Lukoil. ConocoPhillips also recorded a $25.4 billion impairment of all its E&P segment goodwill, the difference between the purchase price of assets and their net worth.

ExxonMobil reported that its $7.82 billion earnings for the fourth quarter were down as higher downstream margins were partly offset by weaker crude oil prices, higher operating expenses, lower chemical volumes, and the lingering impacts of Gulf Coast hurricanes in the final 2008 quarter.

For the 2008 fourth quarter, ExxonMobil’s revenues were down 28%, and earnings were down 33% from a year earlier. For the year 2008, the company’s revenues climbed 18% from 2007, while net income increased 11% to a record $45.22 billion.

Chevron Corp. recorded a 26% decline in fourth-quarter 2008 revenues but a slight gain in net income for the quarter. Income from the company’s upstream operations declined to $3.15 billion from $4.84 billion a year earlier. Meanwhile, Chevron’s refining, marketing, and transportation income soared to $2.08 billion from $204 million in the fourth quarter of 2007.

“Fourth-quarter earnings for our downstream business improved as the lower cost of crude oil feedstocks used in the refining process helped boost margins on the sale of gasoline and other refined products,” said Chairman and CEO Dave O’Reilly. “Lower quarterly profits for our upstream operations reflected a sharp decline in crude oil prices from a year ago,” O’Reilly said.

Independent operators

Many of the independent oil and gas producers in the sample of US-based companies incurred losses in the 2008 fourth quarter.

Apache Corp. reported a $2.9 billion loss for the recent quarter and a 75% drop in its 2008 net income to $712 million, which includes a $3.6 billion noncash, after-tax reduction in the carrying value of its oil and gas properties stemming from significantly lower commodity prices at yearend 2008.

Plains Exploration & Production Co. incurred a similar noncash impairment charge on its oil and gas properties, which resulted in losses for the recent quarter and for 2008.

Exco Resources Inc. recorded a net loss in the recent quarter and for the year. The company said these results were impacted by a $2.8 billion pretax ($1.7 billion after-tax) ceiling-test write-down, partially offset by $484 million pretax ($290 million after-tax) mark-to-market gain on derivatives, and a $540 million income tax valuation allowance.

Anadarko Petroleum Corp. is among the E&P companies that posted positive net income for both the full year and for the fourth quarter of 2008. Anadarko reported fourth-quarter 2008 net income of $786 million. Of this, $750 million after tax was due to gains on derivatives and divestitures minus impairments and other adjustments.

Refiners

The refiners in the sample of US companies posted varied results for the fourth quarter and for the year. Holly Corp. and Tesoro Petroleum each recorded positive net income for the final 2008 quarter, but Valero Energy Corp. reported a loss for the 3-month period. Full-year results revealed a loss for Holly and Valero and $278 million in earnings for Tesoro.

Tesoro reported that earnings climbed to $97 million in fourth-quarter 2008 from a $40 million loss a year earlier, even though revenues declined 34%. The San Antonio-based refiner’s expenses for the recent quarter were down 37% from a year earlier, due partly to the write-off of a $91 million receivable for which collection was deemed unlikely.

Tesoro Petroleum reported that its fourth quarter segment operating income of $204 million was $196 million higher than in the fourth quarter of 2007, primarily due to higher gross margins, especially in the Hawaii and California regions, and improved results from its retail segment. The increase in segment operating income was partially offset by lower throughput rates.

Tesoro’s gross refining margin increased to $12.47/bbl from $8.28/bbl in the fourth quarter of 2007. Margin realization improved as a result of efforts to increase crude flexibility and distillate production, the company said.

Valero’s $3.278 billion loss in the fourth quarter brought the company’s loss for the year to $1.131 billion. Excluding a $4.1 billion noncash loss from the impairment of goodwill would put Valero’s fourth-quarter 2008 net income at $732 million and full-year 2008 net income at $2.9 billion.

Holly Corp. reported that the principal factor contributing to its increase in fourth-quarter 2008 net income was an increase in refined product margins, partially offset by a decrease in sulfur credit sales of $15 million. Overall refinery gross margins were $12.01/bbl for the quarter, a 22% increase from the fourth quarter of 2007.

Canadian firms

Most of the companies in a sample of eight producers and pipeline companies based in Canada posted positive net income for the fourth quarter and for 2008. Four of these firms posted a slide in earnings from fourth-quarter 2007, while two incurred a loss for the recent quarter.

Although its revenues in the quarter climbed 39%, Suncor Energy Inc. reported a $215 million (Can.) fourth-quarter 2008 loss vs. $1 billion (Can.) in earnings a year earlier. The company said the decline was due primarily to major decreases in commodity prices in the 2008 fourth quarter.

“This negatively impacted both our sales revenues and the value of our inventories. In addition, we had higher operating expenses in our oil sands business. These impacts were partially offset by mark-to-market gains on our crude oil hedges,” the company said.

Service, supply companies

The collective net income for a sample of service, supply, and engineering firms was down 12% for the final 2008 quarter despite a 20% jump in revenues from a year earlier. Higher expenses and taxes weighed on some of the firms’ results.

Baker Hughes Inc. announced that its net income for fourth-quarter 2008 was $432 million compared with $401 million a year earlier. Net income for the year 2008 was $1.64 billion, up from $1.51 billion in 2007.

Chad C. Deaton, Baker Hughes chairman, president, and chief executive officer, said the company’s fourth-quarter results were particularly strong in the Western Hemisphere despite the global economic slowdown and eroding commodity prices.

“In North America, service-intensive horizontal drilling remained strong, and our completion and production business posted solid results. Revenue increases in Brazil and Colombia led a strong quarter in Latin America. In the Europe-Africa-Russia-Caspian region, weakening of local currencies against the US dollar, a declining Russian market, as well as weather and project-related delays in the North Sea and Nigeria impacted our results. Sequentially, Middle East-Asia Pacific region revenue increases were led by strong results from Saudi Arabia, Indonesia, and Egypt,” Deaton said.