SECOND-HALF 2007: US olefins see improving feed economics, demand

Although the US hurricane season of 2007 was essentially a non-event for the petrochemical and refining industries at large, Hurricane Humberto disrupted operations for a few weeks for ethylene producers in the Beaumont-Port Arthur, Tex., area during mid-September to early October. The important story for second-half 2007 was not Hurricane Humberto, however, but the persistent strength in demand for ethane.

Specifically, feedstock economics for ethane remained favorable and feedstock demand for ethane consistently averaged 47-48% of fresh feed during third-quarter 2007 and 48-51% during fourth-quarter 2007. The persistent strength in ethane demand limited coproducts yields of propylene and aromatics to 85-95% of year-earlier volumes.

Ethylene plant yields of propylene in particular were persistently lower than year-earlier volumes. Refinery-grade propylene sales were also lower than in 2006 and propylene availability was tight throughout second-half 2007.

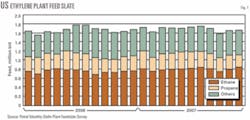

Olefin plant feed slates

Ethylene industry demand for fresh feed averaged 1.68 million b/d during third-quarter 2007; demand was slightly lower in fourth-quarter 2007 and averaged 1.66 million b/d. Demand for LPG feedstocks (ethane, propane, and n-butane) averaged 1.21 million b/d in third-quarter 2007 and declined to 1.15 million b/d in fourth-quarter 2007.

Due to a decline in LPG demand, ethylene producers cracked a somewhat heavier feed slate in fourth-quarter 2007. Specifically, LPG feeds accounted for 69% of total fresh feed in fourth-quarter 2007 vs. 72% of fresh feed in third-quarter 2007.

Typical seasonal factors resulted in lower demand for propane and n-butane, but demand for ethane remained robust during fourth-quarter 2007. Ethane’s share of total fresh feed increased to 49.5% in fourth-quarter 2007 from 47.4% during third-quarter 2007.

Finally, ethane demand only fell below 780,000 b/d in September. Ethane demand was lower in September due only to Hurricane Humberto’s effect on LPG crackers in the Beaumont-Port Arthur area for a few weeks.

Table 1 shows trends in olefin plants’ fresh feed slates.

Based on projected ethylene industry operating rates of 90-92% for first-half 2008, total demand for fresh feedstocks will average 1.65-1.70 million b/d. Total demand for LPG feedstocks will average 1.15-1.20 million b/d during first-quarter 2008 and will increase to 1.20-1.25 million b/d during second-quarter 2008. LPG feedstocks will account for 68-70% of total fresh feed during first-quarter 2008 and 70-72% during second-quarter 2008.

Demand for ethane will remain strong and ethane’s share of fresh feed will average 47-48% during first-half 2008.

Fig. 1 shows historic trends for ethylene feed slates.

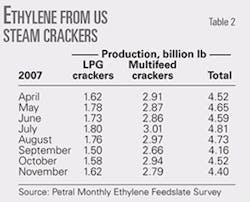

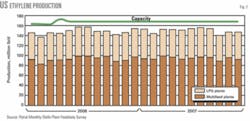

Ethylene production

Ethylene production from fresh feed was 13.70 billion lb in third-quarter 2007 but fell to 13.25-13.35 billion lb in fourth-quarter 2007 (Table 2). Ethylene production from steam crackers during third-quarter 2007 was 63 million lb less than in second-quarter 2007 (less than half a day’s output). Production in fourth-quarter 2007 was 375 million lb less than in third-quarter 2007 (about 2.5 days of output).

Production from LPG plants totaled 5.07 billion lb in third-quarter 2007 and 4.80 billion lb in fourth-quarter 2007. Production in fourth-quarter 2007 was 250-275 million lb less than in third-quarter 2007 (about 5 days of production).

Production from multifeed crackers was 8.63 billion lb in the third quarter but declined to 8.50-8.60 billion lb in fourth-quarter 2007. Production from multifeed crackers during fourth-quarter 2007 was 100-110 million lb less than during third-quarter 2007 (about 1 day of production).

Operating rates for LPG crackers averaged 93% of nameplate capacity (21.6 billion lb/year) during third-quarter 2007 but declined to 89% during fourth-quarter 2007. Multifeed crackers operated at 89% of nameplate capacity (39.2 billion lb/year) during third-quarter 2007 and at 85-87% during fourth-quarter 2007.

Operating rates for the overall industry averaged 90.2% during third-quarter 2007 but slipped to 87% during fourth-quarter 2007. Turnarounds and Humberto’s disruptions accounted for the decline in operating rates.

Flint Hills Resources LLC completed its acquisition of the ethylene plant at Port Arthur from Huntsman Corp. during third quarter. This plant resumed operations in October 2007 after being out of service following a fire in late April 2006. This ethylene plant, a multifeed cracker with 1.55-billion lb/year nameplate capacity, boosted the industry’s nameplate ethylene production capacity to about 62 billion lb/year.

Fig. 2 shows trends in ethylene production.

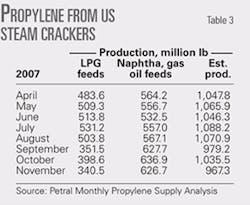

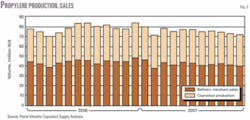

US propylene production

Propylene production from steam crackers was 3.14 billion lb in third-quarter 2007, which was 19 million lb less than in second-quarter 2007 (less than 1 day of production). Coproduct propylene production during third-quarter 2007, however, was 370 million lb less than year-earlier volumes (11 days of production). Propylene production declined during the fourth quarter and totaled only 3.0 billion lb, which was 100-110 million lb less than during third-quarter 2007 (about 3 days of production).

Propylene production from LPG feeds was 1.39 billion lb in third-quarter 2007 and was 120 million lb less than production in second-quarter 2007. Propylene production from LPG feeds slipped to 1.1 billion lb during fourth-quarter 2007almost 300 million lb less than during third-quarter 2007.

During fourth-quarter 2007, ethane cracking remained strong while propane and n-butane cracking declined. The sustained strength in feedstock demand for ethane was the most significant factor resulting in the 20% decline in coproduct propylene yields from LPG feeds during fourth quarter.

Propylene production from naphthas, condensates, and gas oils totaled 1.75 billion lb in third-quarter 2007 and was 98 million lb more than during second-quarter 2007. Coproduct yields of propylene from heavy feeds increased to 1.93 billion lb during fourth-quarter 2007, which was 179 million lb more than in third-quarter 2007.

Unless ethylene industry operating rates are significantly higher in first-half 2008 vs. second-half 2007, coproduct yields of propylene will continue to average 0.95-1.10 billion lb/month.

Table 3 shows trends in coproduct propylene production from LPG and multifeed plants.

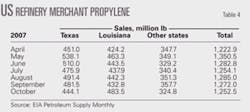

Refinery propylene supply

Normally, refinery propylene production reaches its annual peak during third quarter. Refinery-grade propylene production during third-quarter 2007, however, was less than expected.

Refinery propylene sales were 3.8 billion lb during third-quarter 2007 (Table 4). Production was 45 million lb less than in second-quarter 2007 and 260 million lb less than year-earlier volumes (nearly 6 days of production). Refinery propylene sales slipped to 3.70-3.75 billion lb during fourth-quarter 2007.

Production in fourth quarter was 100-150 million lb less than in third quarter and 440 million lb less than year-earlier volumes (nearly 10 days of production).

The cumulative year-to-year decline in refinery propylene sales during second-half 2007 totaled 700 million lb. The year-to-year decline in refinery propylene sales reinforced weak coproduct propylene yields and kept total propylene supply tight during second-half 2007. The year-to-year decline in refinery propylene sales and coproduct propylene yields totaled 1.29 billion lb during second-half 2007.

Based on the expected decline in refinery operating rates during first-quarter 2008, refinery-grade propylene sales will decline to 3.60-3.65 billion lb, but sales will increase to 3.75-3.90 billion lb during second-quarter 2008.

Fig. 3 shows trends in coproduct and refinery merchant propylene sales.

Ethylene economics, prices

Feedstock prices, coproduct values, and ethylene plant yields determine ethylene production costs. We maintain direct contact with the olefin industry and track historic trends in spot prices for ethylene and propylene. We use a variety of sources to track trends in feedstock prices.

Some ethylene plants have the necessary process units to convert all coproducts into high-purity streams. Some ethylene plants, however, do not have the capability to upgrade mixed or crude streams of various coproducts and sell some or all their coproducts at discounted prices. We evaluate ethylene production costs in this article based on all coproducts valued at spot prices.

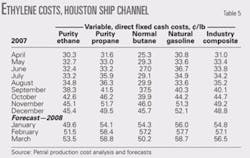

Ethylene production costs

Production costs for ethylene in the Houston Ship Channel (based on full spot prices for all coproducts) increased to 45-47¢/lb in December 2007 for propane and natural gasoline, which was 8-12¢/lb higher than in September. Average production costs for fourth quarter ranged from 44-45¢/lb for propane and natural gasoline to a low of 41¢/lb for purity ethane. In response to these economic incentives, ethylene producers maintained an ethane-rich feed slate during fourth-quarter 2007.

During third-quarter 2007, spot prices for ethane increased 13.3%, but spot prices for natural gasoline increased only 1.7%. Spot prices for propane increased 8.2%. Despite the increase in spot prices, ethane remained significantly less expensive than propane and was competitive with natural gasoline and similar light naphthas.

Spot prices for all feedstocks were sharply higher during fourth-quarter 2007. Spot prices for ethane were 27.1% higher than in third-quarter 2007. In contrast to almost flat prices in the third quarter, however, spot prices for natural gasoline increased 19.7% during fourth-quarter 2007. Spot prices for propane were 23% higher in fourth-quarter 2007.

Spot prices for all major coproducts also increased during second half but spot prices for polymer-grade propylene were only 13.2% higher in fourth-quarter 2007 than in third-quarter 2007. Counter to the trend in feedstock prices, spot prices for benzene and toluene declined during fourth-quarter 2007. Spot benzene prices were 2.2% lower in fourth-quarter 2007 vs. third-quarter 2007. Spot prices for toluene were 5.3% lower in fourth-quarter 2007.

Because prices for all major ethylene coproducts lagged rising feedstock prices, variable production costs based on propane and natural gasoline increased much more than for ethane during fourth-quarter 2007. Specifically, variable production costs for natural gasoline were 41% greater in fourth-quarter 2007 than in third quarter.

Similarly, variable production costs for propane were 33% higher in fourth-quarter 2007. Variable production costs for ethane increased only 28% during fourth-quarter 2007.

Table 5 shows trends in ethylene production costs.

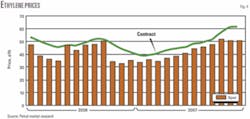

Ethylene prices, profit margins

Contract prices for ethylene averaged 50.2¢/lb in third-quarter 2007, which were 5.5¢/lb more than in second-quarter 2007. Contract prices increased to 52.5¢/lb in September from 48.5¢/lb in July. Contract prices jumped more sharply during fourth-quarter 2007 and averaged 60.2¢/lb, which were 10¢/lb higher than the third-quarter average.

Even though contract prices in November and December were 15.5¢/lb higher than in June, the increases just barely covered increases in production costs.

Margins based on contract prices and a feed slate of ethane, propane, and n-butane averaged 17-18¢/lb during third-quarter 2007 and 18-19¢/lb during fourth-quarter 2007. More importantly, margins based on production costs for light naphthas fell to 15-16¢/lb during fourth-quarter 2007 from 17-20¢/lb during third-quarter 2007.

During third-quarter 2007, spot prices for ethylene fluctuated within a range of 44 to 48¢/lb and averaged 46¢/lb, which was 5.2¢/lb more than in second-quarter 2007.

The increase in spot ethylene prices during third-quarter 2007 was sufficient to expand margins. Margins based on spot prices and average variable production costs increased to 12-16¢/lb during third quarter for purity ethane and light naphthas.

Spot prices for ethylene increased to 50-52¢/lb in fourth quarter but margins based on average variable production costs did not keep pace with the steady increases in feedstock prices. Margins for purity ethane were in the range of 8-12¢/lb during fourth-quarter 2007 and averaged about 10¢/lb, which was 4¢/lb less than in third-quarter 2007.

The squeeze on margins for light naphthas and natural gasoline was more severe. Margins fell to 4-5¢/lb during November and December, and averaged about 7¢/lb in fourth-quarter 2007, which was 7-8¢/lb less than during third-quarter 2007.

Figs. 4 and 5 show historic trends in ethylene prices (spot and net transaction prices) and profit margins based on composite production costs.

Octane value, propylene price

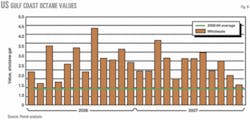

We determine octane’s incremental value using the differential between unleaded premium and unleaded regular gasoline prices divided by the difference in octane (87 octane for unleaded regular gasoline and 93 octane for unleaded premium gasoline).

Octane values are a primary economic influence on spot prices for refinery-grade propylene and toluene. Trends in spot prices for these two products tend to influence prices for other coproducts.

Incremental octane values were at their peak for 2007 during third quarter and averaged 2.52¢/octane-gal vs. 2.25¢/octane-gal during second-quarter 2007. Octane values weakened during the fourth quarter and averaged 1.75¢/octane-gal. In December, octane values averaged only 1.1¢/octane-gal vs. 2.5¢/octane-gal in October.

The trend of weakening octane values was a significant factor that led to declining spot prices for toluene and benzene during fourth-quarter 2007. Weakening octane values had no effect on trends in propylene prices, however. Instead, spot prices for unleaded regular gasoline were 18¢/gal higher in fourth-quarter 2007 than in third quarter.

Spot alkylate prices track unleaded regular gasoline prices rather than declining octane values and are an important influence on refinery-grade propylene prices.

Fig. 6 shows historic trends in incremental octane values on the US Gulf Coast.

Refinery, polymer-grade C3=

Prices for all grades of propylene move in tandem with each other, and differentials between grades are generally constant within a narrow range. The premium for polymer-grade propylene covers operating costs and profit margins for the various merchant propane-propylene splitters in Texas and Louisiana.

Spot prices for refinery-grade propylene were nearly constant during third-quarter 2007 and averaged 46.9¢/lb, only 0.7¢/lb more than in second-quarter 2007. Refinery-grade propylene inventories, however, as reported by the US Energy Information Administration in “This Week in Petroleum,” declined to 390 million lb at the end of September from 448 million lb at the end of June.

Inventories of refinery-grade propylene continued to decline during the fourth quarter and fell to a low of only 265 million lb at the end of November. At this level, refinery-grade propylene inventories represented only 6 days of production vs. 10 days of production at the end of June. At the end of February, refinery-grade propylene inventories were 18 days of production.

Prices responded to tightening supply during fourth-quarter 2007 and jumped to 55-57¢/lb in November and December from 46-47¢/lb in September. Prices for refinery-grade propylene were only 7¢/lb higher than spot alkylate prices in third-quarter 2007, but the refinery-grade propylene premium widened to 11-15¢/lb during fourth-quarter 2007.

The surge in refinery-grade propylene prices during fourth-quarter 2007 helped to push prices for polymer-grade propylene sharply higher as well. Contract prices for polymer-grade propylene averaged 52.3¢/lb in third quarter, only 0.9¢/lb more than in second-quarter 2007.

While total propylene supplies continued to tighten and inventories of refinery-grade propylene fell sharply, contract prices for polymer-grade propylene increased sharply during fourth-quarter 2007. Contract prices for December settled at 62¢/lb, which were 7.75¢/lb more than in October and 10.75¢/lb more than in June.

Differentials between polymer-grade and refinery-grade propylene widened to 3.5¢/lb in third-quarter 2007 and 4.0¢/lb in fourth-quarter 2007 from 2.2¢/lb in second-quarter 2007. Trends in pricing differentials between polymer-grade and refinery-grade propylene were consistent with tightening availability for both grades.

Because nearly all of the refinery-grade propylene supply is upgraded to polymer-grade quality by merchant propane-propylene splitters, the widening differentials indicated that polymer-grade propylene experienced the brunt of the overall supply squeeze during second-half 2007.

Winter, spring 2008 outlook

During third quarter, US crude inventories declined nearly 40 million bbl. Despite the decline, crude inventories were 17 million bbl more than the average for 2004-06 and were 40 million bbl more than the average for 2002-04. Demand for crude (refinery crude inputs) averaged about 600,000 b/d less during third-quarter 2007 than year-earlier volumes.

From a purely statistical perspective, these supply-demand considerations would normally send a neutral or bearish signal to crude buyers. West Texas Intermediate prices, however, surged to $97.58/bbl during the third week of November from $70.29/bbl during the third week of August, an increase of $27.29 or 38.8%. About two-thirds of this rally in WTI prices occurred during a 7-week period from early October to mid-November.

Crude buyers and traders clearly viewed the seemingly bearish fundamentals from a radically different perspective. Despite improvement in US crude availability, global supply-demand balances remain tight with little spare production capacity available to offset any supply disruptions.

The economic outlook for olefin producers for first-half 2008 began with prices for two important crude benchmarks (WTI and Brent) flirting with the $100/bbl barrier. Acknowledging that EIA and other sources remain focused on “seemingly bearish fundamental considerations,” our crude price forecast focuses on evidence that the bullish trend remains intact.

First, crude buyers reacted very bullishly in October to Turkey’s decision to send troops into northern Iraq following attacks by Kurdish rebels. Until October, northern Iraq was relatively stable and had experienced relatively few disruptions, which have been commonplace in southern Iraq for the past few years.

Furthermore, escalation of tensions between Turkey and the Kurdish rebels increases the risk of disruption of crude supplies that flow through Turkey from the Caspian Sea. Tensions between the US and Iran remain high. The Bush administration, however, moved to defuse some of the tension with its most recent National Intelligence Estimate that declared that Iran was not attempting to build nuclear weapons capability.

The various threats to the flow of crude from the Middle East will remain a significant consideration for crude buyers and traders during first-half 2008.

Finally, refiners will complete their late winter turnarounds and maintenance work by mid to late April and refinery crude demand in the US will increase 0.75-1.00 million b/d during May and June. Crude buyers and traders will anticipate this typical seasonal swing.

To accommodate the increase in US crude demand, buyers have to boost imports to 9.8-10.2 million b/d during second-quarter 2008 from 9.3-9.5 million b/d during first-quarter 2008. These seasonal swings in crude demand are bullish considerations for crude prices beginning in March and probably earlier.

Forecasts for ethylene production costs for first-half 2008 are based on WTI prices in the range of $100-110/bbl for first-quarter 2008 and $105-115/bbl during second-quarter 2008. Based on a strong seasonal increase in unleaded regular gasoline-WTI pricing differentials, regular gasoline prices in the US Gulf Coast will increase to $2.90-3.00/gal.

These forecasts set the economic basis for feedstock prices including light naphthas and propane. Ethane prices will also tend to track the general increase in feedstock prices during first-half 2008.

Ethylene production costs (full cash costs) will be 50-54¢/lb for purity ethane, 54-58¢/lb for propane, and 55-60¢/lb for natural gasoline. Rising costs will push spot and contract ethylene prices higher during first-half 2008. By April or May 2008, spot ethylene prices will increase to 65-70¢/lb and contract prices will increase to 70-75¢/lb.

The author

Daniel L. Lippe ([email protected]) is president of Petral-Worldwide Inc., Houston. He founded Petral Consulting Co. in 1988 and cofounded Petral Worldwide in 1993. He has expertise in economic analysis of a broad spectrum of petroleum products including crude oil and refined products, natural gas, natural gas liquids, other ethylene feedstocks, and primary petrochemicals. Lippe began his professional career in 1974 with Diamond Shamrock Chemical Co., moved into professional consulting in 1979, and has served petroleum, midstream, and petrochemical industry clients since that time. He holds a BS (1974) in chemical engineering from Texas A&M University and an MBA (1981) from Houston Baptist University. He is an active member of the Gas Processors Association, serving on the NGL Market Information Committee and currently serving as vice-chairman of the committee.