OGJ Newsletter

Study: Tapping off-limit US resources beneficial

Development of US oil and gas resources that Congress has kept off-limits for decades could generate more than $1.7 trillion in government revenues, create thousands of new jobs, and enhance the nation’s energy security by significantly boosting domestic energy production, a new study suggested.

The study by ICF International, which the American Petroleum Institute commissioned, concluded that developing offshore areas covered by congressional moratoriums until recently, along with resources in the Arctic National Wildlife Refuge and a small portion of currently unavailable land in the Rocky Mountains, could increase US crude oil production by as much as 2 million b/d by 2030, offsetting nearly a fifth of the nation’s crude imports.

Natural gas production could increase by 5.34 bcfd, or the equivalent of 61% of the expected gas imports in 2030, the study added. It also estimated that development of all US oil and gas resources on federal lands could exceed $4 trillion over the life of the resources.

US crude production would rise by 36% and natural gas production would increase by 10% if development is permitted in the studied areas of the US Outer Continental Shelf, ANWR, and the Rockies, according to the ICF study. About 160,000 jobs would be created in the process, it indicated.

API Pres. Jack N. Gerard said the study underscores how the oil and gas industry could enhance US energy security and help solve domestic economic problems by increasing US oil and gas production.

“The US oil and gas industry supports more than 6 million jobs, and more drilling for oil and gas will mean more energy for America, more well-paying jobs, and trillions of dollars of much-needed revenues that will help federal, state, and local governments pay for critical services,” he said.

NPRA sees flaws in regulating GHGs under CAA

Attempts to regulate greenhouse gases (GHG) under the Clean Air Act (CAA) would have numerous potentially harmful consequences, the National Petrochemical & Refiners Association told the US Environmental Protection Agency.

“The regulation of GHG under the CAA would constitute EPA’s single largest and potentially most complex assertion of authority over the [US] economy and Americans’ lifestyles,” the trade association warned in a Nov. 25 response to EPA’s July 30 Advanced Notice of Proposed Rulemaking.

“Regulation of GHG under the act would have enormous consequences for every facet of the economy, for industry large and small, as well as for the general population. Indeed, the potential impact on the country to regulate GHG cannot be overstated and makes all prior EPA regulatory efforts pale by comparison,” it maintained.

It said EPA still has much work to do before making a final decision on whether GHG emissions from automobiles cause or contribute to US public health or welfare endangerment. EPA’s analysis “draws most heavily on reports prepared by only a handful of entities, particularly the Intergovernmental Panel on Climate Change, and especially with respect to its analysis of human health and welfare effects,” NPRA said in its filing.

“The agency has an obligation, however, to consider all relevant science on climate change, impacts, and effects on health and welfare. It may not disregard data without justification,” the association said.

NPRA does not believe EPA should proceed with an endangerment finding at this time nor begin a process of subjecting various entities to various CAA provisions in an effort to begin GHG emissions, NPRA Pres. Charles T. Drevna said on Dec. 2.

“The act was not designed to address a global pollutant like [carbon dioxide] and, thus, cannot be used to meaningfully alter its atmospheric concentration. Indeed, EPA’s suggested approaches for applying the CAA’s provisions to GHG sources would impose severe costs on domestic industry, reduce our domestic energy security, and damage the national economy as businesses shift activities overseas to areas where they will not be subject to futile regulation,” he said.

“Discussion of these issues in the ANPR is woefully inadequate, and the public should be given the opportunity to consider them before EPA makes any further decisions under the CAA,” Drevna said.

EU, Egypt sign energy cooperation agreement

The European Commission and Egypt’s Foreign Affairs Minister Ahmed Aboul Gheit, signed a memorandum of understanding Dec. 2 to enhance energy cooperation between Egypt and the European Union. The pact would reinforce energy security for both.

Among five priorities are the establishment of a work program to gradually converge Egypt’s energy markets with the EU’s and the development of energy networks such as the Arab Gas Pipeline, which could transport Egyptian and possibly Iraqi natural gas to European countries.

Other areas covered include market reforms, promotion of renewable energy and energy efficiency, and technological and industry cooperation.

“Egypt is the EU’s sixth largest natural gas supplier and a key transit country between the Middle East, Africa, and the EU,” said EC Commissioner Benita Ferrero-Waldner. “Egypt’s commitment to energy reforms is crucial for the creation of a Euro-Mediterranean energy market.”

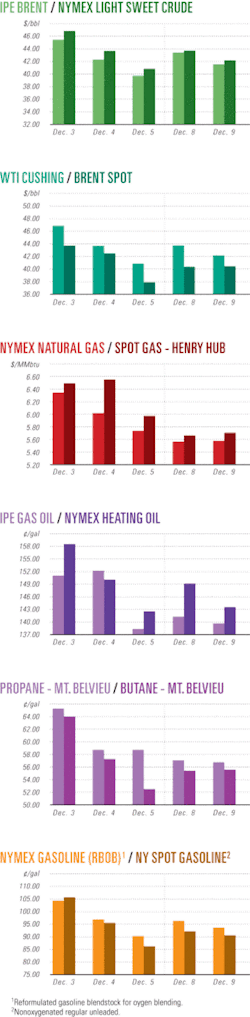

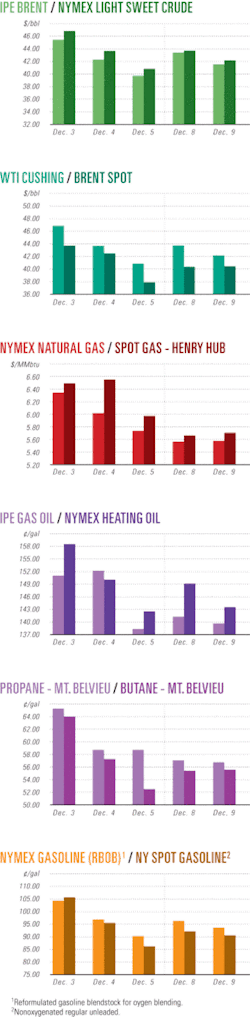

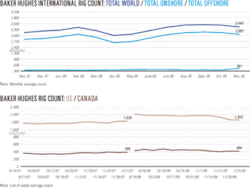

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesPioneer drilling lateral in Eagle Ford shale

Pioneer Natural Resources Inc., Dallas, is drilling the horizontal leg in Cretaceous Eagle Ford shale in an exploratory well in DeWitt County, Tex.

This is about 90 miles east-northeast of where Petrohawk Energy Corp., Houston, gauged an Eagle Ford gas-condensate discovery in LaSalle County (OGJ Online, Oct. 21, 2008).

Petrohawk is completing its second well in LaSalle and is drilling in McMullen County, Pioneer said.

Pioneer has logs through Eagle Ford from the more than 150 wells it has drilled in the Cretaceous Edwards Trend along its 310,000-acre spread from LaSalle to Lavaca counties and chose to horizontally drill the Eagle Ford where it saw the best porosity. Permeability is the question, the company said Dec. 2.

Eagle Ford shale is the source rock for the Cretaceous Austin chalk and Edwards formations, Pioneer noted.

Meanwhile, the company’s Edwards gas production is averaging 85 MMcfd.

Reindeer delays gas project off W. Australia

The Apache Australia-Santos Ltd. joint venture has postponed its Reindeer gas project off Western Australia, citing the poor global economic outlook that has impacted the project’s main customer.

The project included an unmanned wellhead platform and an undersea natural gas pipeline to transport gas 100 km to shore. The proposed onshore plant, at Devil Creek, 65 km south of Karratha, included gas processing facilities for supplying the domestic market in Western Australia. The project was to have come on stream in 2010.

Deferral of Reindeer means that Apache and Santos will have to suspend or terminate engineering and construction contracts. The main contractor is Perth-based Clough Engineering.

However Santos said that work will continue on regulatory approvals to ensure that restarting the project can be timely once gas sales agreements supporting the development are concluded.

Reindeer, which contains an estimated 410-640 petajoules of gas, was found in 1997 on permit WA-209-P.

Apache has a 55% interest and is the operator. Santos holds the remaining 45% interest.

Cabot to hike Pennsylvania Marcellus program

Cabot Oil & Gas Corp., Houston, plans to boost production from Devonian Marcellus shale in northeastern Pennsylvania in the next few weeks from the current 13 MMcfd as it hooks up six vertical and three horizontal wells.

Meanwhile, the company expects to expand to eight rigs in 2009 from the five currently working.

Cabot’s first horizontal Marcellus well came on line at 6.4 MMcfd after a six-stage frac in its 2,000-ft lateral. Measured total depth is 8,925 ft.

Marcellus drilling totals 18 wells, 4 of them horizontal. The 2009 program calls for 16 vertical and 7 horizontal wells. Four vertical and 3 horizontal wells remain to be drilled in 2008.

Typical costs are $1.3-1.5 million for a vertical well and $2.6-2.9 million for a horizontal well. Average footage is 7,200 vertically and 2,200 ft laterally.

The company has laid 10 miles of pipeline and started up one compressor with a second unit standing by as produced volumes warrant.

Haynesville gas flows as high as 28 MMcfd

Three operators reported new horizontal completions in Jurassic Haynesville shale at rates as high as 28.2 MMcfd of gas.

The three companies, Petrohawk Energy Corp. of Houston and Comstock Resources Inc. and EXCO Resources Inc. of the Dallas area, plan much more activity in the Haynesville in East Texas and Northwest Louisiana.

Petrohawk reported the 28.2 MMcfd rate at its Sample 9-1 in 9-14n-11w, Red River Parish, La., about 12 miles south of Elm Grove gas field. The rate came on a 30/64-in. choke with 7,100 psi flowing casing pressure.

Petrohawk’s Brown 17-4 in 17-16n-11w, Bossier Parish, gauged 23.4 MMcfd on a 26/64-in. choke with 7,700 psi FCP. And its Goodwin 9-5 in 9-16n-11w, Bossier Parish, made 21.1 MMcfd on a 26/64-in. choke with 6,750 psi FCP. The company plans to complete five more Haynesville shale wells by yearend 2009.

Initial flow rate is 9 MMcfd at Comstock’s BSMC LA 7-1H well in Toledo Bend North field, De Soto Parish. The flow came from a 4,300-ft lateral at 11,750 ft true vertical depth after a 10-stage frac.

Comstock is running another 10-stage frac at its Collins LA 15-1H well in Logansport field, also in De Soto. It has a 4,200-ft leg at 11,350 ft. The company has a 22% interest in the Gamble 24-1H well at Logansport, drilled to 11,800 ft TVD with a 3,950-ft lateral.

Comstock has drilled the vertical portion of two other Haynesville wells. Bogue A-6H in Waskom field in Harrison County is to get a 4,000-ft lateral, and Green 13H in Blocker field in Harrison County is to get a 3,700-ft lateral. Comstock is drilling vertically at Headrick 1H and Hart 1H in Logansport and Moneyham 7H in Longwood field. Each is due a 4,000-ft leg.

EXCO said its first Haynesville horizontal well, Oden 30H6 in De Soto Parish, averaged 22.5 MMcfd on a 26/64-in. choke with 7,800 psi FCP. It has a 4,481-ft lateral at 12,304 ft TVD.

EXCO has two operated horizontal wells, one vertical well, and two outside-operated horizontal wells in the play and plans to drill 25 or more horizontal Haynesville wells in 2009.

Busy 2009 seen in western Newfoundland

Vulcan Minerals Inc., St. John’s, expects a busy year in several exploration plays in Newfoundland and Labrador in 2009.

Vulcan plans to drill a 3,600-m exploration well, Robinson-1, onshore in the Bay St. George basin that would be the basin’s deepest well ever. It is on a seismically defined structure with several prospective reservoirs.

A drill pad is being built for the well, which is the culmination of several years of seismic work and shallow drilling. Vulcan’s 50% working interest is to be carried fully by Investcan Energy Corp.

Vulcan plans to drill two other onshore wells 1,500-2,500 m deep onshore in the basin and is reviewing the prospect for completing two 150-m core holes at Flat Bay to sample for natural fracture systems.

Leprechaun Resources Ltd., private Alberta company, has become operator of three onshore permits at Parsons Pond, western Newfoundland, in which Vulcan holds 7.39-18.57% interests. Leprechaun is raising funds. The Parsons Pond area covers 100,000 acres of Cambrian-Ordovician platformal rocks in an area of numerous oil seeps, and seismically defined drill targets occur as deep as 4,000 m, Vulcan noted.

Vulcan owns 19% of the stock of NWest Energy Inc., which holds 100% working interest in 1.6 million acres off western Newfoundland. The blocks cover a Cambrian-Ordovician-Silurian platform and foreland basin rocks with petroleum potential. NWest is shooting seismic and seeking partners for drilling.

Meanwhile, Vulcan and Investcan plan to explore 584,466-acre License 1107 off Labrador. The license offsets two undeveloped gas discoveries and has several seismic leads. Investcan’s interest is 50%.

Shell farms into Sicilian offshore licenses

Northern Petroleum UK Ltd. has brought in as a partner Shell Italia Exploration & Production SPA for its licenses off Sicily under a farmout agreement.

Shell will acquire a 55% interest in GR17-NP, GR18-NP, GR19-NP, and a 70% stake in GR20-NP, GR21-NP, GR22-NP licenses.

Shell has agreed to pay €1.9 million for Northern Petroleum’s back-costs and various seismic work. Northern will serve as operator during the initial seismic phase, and Shell will serve as operator once drilling starts.

The assets are estimated to hold unaudited, combined, and unrisked prospective resources of 1.9 billion bbl of recoverable oil.

Derek Musgrove, Northern Petroleum managing director, said, “Shell will bring to the project Italian thrust belt and production experience, in addition to its international major project and deepwater expertise. In 2003, we perceived the potential of the thrust belt play in the Sicily Channel ahead of the new climate of gas oil prices and have been progressing these licences for several years. The area under licence in the Sicily Channel is 4,367 sq km and if drilling is successful it could open up a new Western European hydrocarbon province.”

Drilling & Production Quick TakesMontana BLM okays Bowdoin gas field plan

A decision to drill new and replacement wells at a rate equal to the retirement of no longer productive wells will keep the Bowdoin natural gas field active for another 35-50 years, the US Bureau of Land Management said on Dec. 5.

BLM officials in Montana announced a finding of no significant impact as they approved a proposed alternative with additional mitigation for the project by Fidelity Exploration & Production Co. and five other producers who want to drill within one of Montana’s oldest gas fields.

They said that the field, which has been active from the 1930s and has about 1,450 wells, generally straddles the line between Phillips and Valley counties south from the Canadian border to US Highway 2.

“Production from some wells that were drilled in the 1940s would be restored by drilling new replacement wells from the original drilling pads. In other instances, areas within the field that were previously passed over would be tapped to increase productivity,” said Donato Judice, supervisor in BLM’s Great Falls office.

Approved project components include up to 635 wells on individual sites; construction of new access roads and associated facilities, upgrading and use of existing roads; disposal of produced water with evaporation ponds at each well site; use of solar, wind, and gas-fired engines as external power sources, and installation of electric power lines on a site-specific, case-by-case basis, and use of remote electrical devices to measure temperature, pressure, and well flow at each wellsite, the decision said.

Fidelity E&P is a division of MDU Resources Group Inc. of Bismarck, ND, a holding company which also operates oil and gas pipelines and electric and gas utilities from Minnesota to Oregon and Washington.

StatoilHydro tables Canadian bitumen upgrader

Norway’s StatoilHydro has dropped plans to develop a $16 billion (Can.) bitumen upgrader in Alberta because of soaring costs, poor global economic conditions, and a lack of legislative clarity.

The announcement joins a growing list of major energy infrastructure proposals that operators are delaying or canceling as economic conditions deteriorate and oil prices fall. Royal Dutch Shell PLC has postponed a planned expansion of the Athabasca Oil Sands Project and the 100,000 b/d Carmon Creek oil sands project, near Peace River in northwest Alberta. Petro-Canada also warned last month that it could cancel its proposed upgrader following a 50% leap in costs for its massive Fort Hills project that could exceed $28 billion (Can.).

In May, StatoilHydro’s project was initially delayed for 2 years to 2016. The upgrader was going to process bitumen into synthetic crude from its 257,000 acres of oil sands leases that were bought last year for $2.2 billion (Can.) to diversify from mature North Sea assets. During the first phase the capacity would be 80,000 b/d and this was expected to cost $4 billion (Can.). Later expansion would boost capacity to to 243,000 b/d.

However, StatoilHydro said it would continue to monitor the cost and price environment and reassess downstream options. “This decision does not impact the upstream part of the company’s oil sands venture. The production from the project will be marketed as unprocessed bitumen,” the company added.

It will continue with its 10,000 b/d Leismer steam-assisted gravity drainage project that is slated to start up in late 2010. Flint Energy Services Ltd. has been contracted to construct the facility 160 km south of Fort McMurray, Alta., under a $41 million contract (OGJ Online, Nov. 19, 2008).

Processing Quick TakesSonangol lets contract for Lobito refinery

Sonangol EP has awarded an engineering, procurement, and construction management services-site development contract to KBR for the 200,000 b/d Lobito refinery in Angola, about 373 miles south of Luanda.

Financial details were not disclosed.

The EPC award follows KBR’s front-end engineering and design contract granted in November. KBR will start its new assignment immediately on the grassroots refinery, which will process heavy crudes and reduce Angola’s product imports.

KBR’s EPC work also includes construction of a heavy haul road to transport materials and equipment to the refinery, as well as a marine facility that will be used to import and export both raw and finished hydrocarbon products.

PetroSA lets contract for South African refinery

PetroSA has let a feasibility and front-end engineering and design contract to KBR for its 400,000 b/d refinery in the Coega industrial development zone outside Port Elizabeth, South Africa. The value of the contract was not disclosed.

The award builds on the prefeasibility study that KBR carried out for Project Mthombo earlier this year (OGJ Online, Nov. 11, 2008).

KBR will start the work in December, and operations at the $11 billion refinery, which will be Africa’s largest, are expected to start in 2014.

Feasibility studies will be completed in September 2009, and a final investment decision is scheduled for late 2010.

The refinery is of strategic importance to South Africa as national demand for refined fuels has outstripped the nation’s refining capacity. Diesel consumption is forecast to grow at 6% and petrol at 2%/year during 2009-20.

Sipho Mkhize, PetroSA’s president and chief executive, said that if there were no investment in refining capacity, South Africa would have to import 10 billion l. of fuel/year by 2015¿equivalent to 20% of the national requirement.

“Importing this much refined fuel will have a negative impact on the country’s foreign exchange reserves and makes national supply very vulnerable to external factors,” Mkhize added.

KBR will work with PetroSA to outline a competitive supplier development program to stimulate economic growth, jobs, and skills development in the eastern Cape under the industry liquid fuels charter.

Transportation Quick TakesFirms charged in Buncefield storage depot fire

Total UK Ltd., Hertfordshire Oil Storage Ltd. (HOSL), British Pipeline Agency Ltd. (BPA), TAV Engineering Ltd., and Motherwell Control Systems 2003 Ltd. will be criminally prosecuted for the December 2005 Buncefield oil storage depot fire in Hertfordshire, UK.

The companies must appear in court on Jan. 23, 2009.

The companies face the proceedings after the Health and Safety Executive and the Environment Agency investigated and published its reports.

The agencies are jointly responsible for regulating nonnuclear hazardous industrial sites in the UK.

During the incident there were a number of explosions, and 43 people were injured.

Total is being accused of failing to ensure the health, safety, and welfare of its employees, failing to protect persons not in its employment, and polluting groundwater near the plant.

Total said it had sought legal advice and would consider its position once all the relevant papers have been served.

HOSL is facing two charges: failing to prevent a major accident and limit its consequences to persons and the environment, and polluting groundwater.

Hundreds of businesses, insurance companies, and local residents are seeking a total of ¿700 million in damages from Total and HOSL in a separate civil lawsuit.

BPA was charged with failing to take all necessary measures to prevent major accidents, and pollution groundwater.

TAV Engineering and Motherwell are being prosecuted for failing to protect the health and safety of people not in their employment.

In 2006, investigators said 300 tons of gasoline had escaped from a tank, but they were unable to identify the reason behind the ignition at the depot, 40 km north of London.

The UK minister for health and safety said in response to the investigation’s recommendations that planning for emergencies was improving as was the effectiveness of emergency responses at major hazard sites. There also has been careful planning to maintain the resilience of the UK’s fuel supply.

Kirkuk-Ceyhan line resumes flow after repairs

Iraq resumed sending some 430,000 b/d of crude oil through its pipeline to Turkey on Dec. 4 after flow was shut down on Dec. 1 due to technical problems.

“Oil is flowing at around 18,000 bbl/hr,” reported a shipping agent, following the 2-day halt said by Turkish officials to have been caused by an unidentified technical fault on a section of pipeline in Iraq.

The line had begun carrying oil earlier on Dec. 1 after the completion of repairs to damage caused by an explosion and fire on Nov. 21 in Turkey’s southeastern province of Mardin.

The Kurdistan Workers Party (PKK) rebel group claimed responsibility for the Nov. 21 bomb attack, which triggered the large fire that stopped flow along the Kirkuk-Ceyhan line.

Turkish authorities confirmed that the blast appeared to be caused by sabotage, although they said an investigation was ongoing (OGJ Online, Dec. 1, 2008).