OGJ Newsletter

MMS issues assessment of hurricane damage

In its final assessment of damage to Gulf Coast oil and gas operations by Hurricanes Gustav and Ike, the US Minerals Management Service said a total of 60 offshore platforms was destroyed.

“Some platforms that had been previously reported as having extensive damage were reassessed and determined to be destroyed,” MMS said. “The destroyed platforms produced 13,657 b/d of oil and 96.5 MMcfd of natural gas, or 1.05% of the oil and 1.3% of the gas produced daily in the Gulf of Mexico.”

MMS estimated 127 of the more than 3,800 oil and gas production platforms in the gulf were exposed to hurricane conditions, with winds greater than 74 mph from Hurricanes Gustav and Ike. Gustav made landfall Sept. 2 in Louisiana, while Ike came ashore Sept. 13 in Galveston, Tex.

In its final assessment, MMS concluded 93 platforms suffered moderate damage from the storms and would take as long as 3 months for repairs. Another 31 platforms had extensive damage that could take as long as 6 months to repair.

Motions filed to repeal CAC’s Egyptian gas verdict

The Cairo Court for Urgent Cases plans to hold a hearing Dec. 15 to consider a motion by the State Judicial Authority to repeal a decision by the Cairo Administrative Court (CAC) to halt Egypt’s exports of natural gas to Israel.

In addition to the court, some 30 individual lawyers have filed six separate motions¿to be reviewed on Dec. 15, 16, 18, and 20¿all aimed at repealing CAC’s Nov. 18 verdict.

The underlying appeal is that CAC’s verdict against the government cannot be sustained, as there is no contractual relationship between the state of Egypt and the state of Israel concerning exportation of natural gas.

Instead, the contract is between the Egyptian General Authority for Petroleum and Eastern Mediterranean Gas, a private energy consortium co-owned by Egyptian businessman Hussein Salem and the Israeli Merhav Group.

The 30 lawyers thus claim that the export of gas does not fall under CAC’s jurisdiction because the agreement is a purely commercial affair.

CAC had ruled that the export of Egyptian gas to Israel cannot be carried out without parliamentary approval and ordered its halt, saying, “National resources belong to current and future generations, and the executive must first get parliament’s approval.”

CAC’s ruling came after opposition groups sued to suspend exports, arguing that the 15-year fixed-price agreement¿rumored to be as low as $1.50/btu¿lacks any mechanism for Egypt to adjust prices to reflect current markets.

Dissatisfaction in Egypt, fueled also by Israeli actions in Palestine, is especially high as gas for December delivery last week closed at $6.53/Mcf on the New York Mercantile Exchange.

The agreement to supply Egyptian gas to Israel was signed in June 2005 by Egyptian oil minister Sameh Fahmi and Israeli infrastructure minister Binyamin Ben Eliezer (OGJ, Oct. 20, 2008, p. 34).

The gas being supplied to Israel goes to Israel Electric Corp., which has estimated that 20% of the electricity produced in Israel over the next decade will be from Egyptian gas.

EU to seek ‘observer status’ on Arctic Council

A communique released Nov. 20 by the European Commission, “The European Union and the Arctic Region,” takes a position on a part of the world the EU calls “in rapid transformation.”

The EU will apply for permanent observer status on the Arctic Council, a high-level intergovernmental forum promoting cooperation among its members¿Canada, Denmark (including Greenland and the Faroes Islands), Finland, Iceland, Norway, the Russian Federation, Sweden, and the US¿and involving indigenous communities.

The commission calls for a “coordinated action” of all stakeholders in order “to protect the Arctic in unison with its population, to promote sustainable use of resources, and contribute to enhanced Arctic multilateral governance.”

It recognizes that exploitation of the Arctic hydrocarbon resources and the opening of new navigation routes can be beneficial, providing it is done “in full respect of the highest environmental standards.”

Describing the Arctic as “a unique region of strategic importance, located in [Europe’s] immediate vicinity,” the commission sets out policy objectives and recommends a series of steps in the fields of research, environment, indigenous peoples, fisheries, hydrocarbons, shipping, legal and political framework, and cooperation with regional organizations.

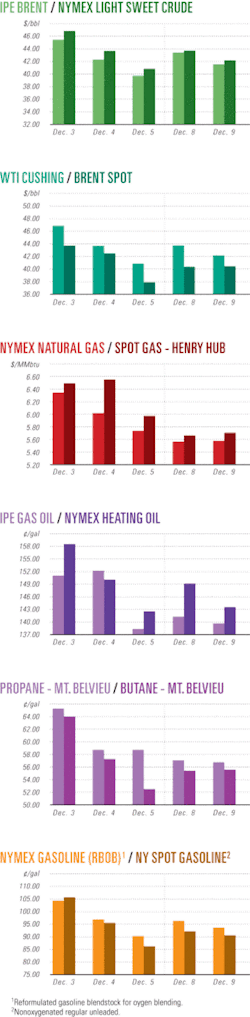

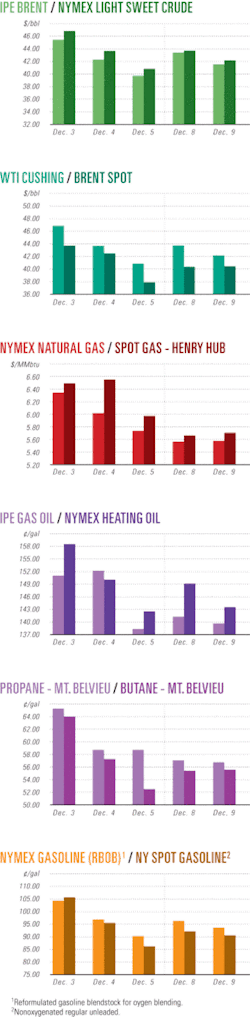

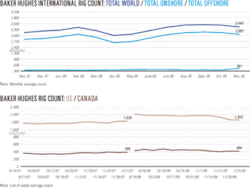

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesShell Australia finds gas with Libra-1 wildcat

The Shell Australia-operated Libra-1 wildcat, which was drilled in Browse basin in Permit AC/P41 off Western Australia, has found natural gas in a series of thick sand packages over a 180-m gross vertical section, according to Melbourne-based partner Nexus Energy Ltd.

Further wireline logging and pressure data is required to confirm reservoir quality, column height, and hydrocarbon composition, Nexus said.

Libra-1 was spudded in early November by Diamond Offshore Drilling Inc.’s Ocean Epoch semisubmersible rig in early November and has reached a depth of 3,918 m.

The well is evaluating the exploration potential surrounding Crux field in the adjoining permit.

Shell holds 65%. Partners are Mitsui with 20% and Nexus with 15%.

New Brunswick gets flowing oil discovery

Corridor Resources Inc., Halifax, NS, plans to appraise an oil discovery 3 km southeast of its McCully gas field in southern New Brunswick.

The South Branch G-36 well flowed clean, 45° gravity oil at the rate of 59 b/d without water through production tubing after 10 days’ clean-up of frac fluid.

Producing interval is the Hiram Brook member of the Mississippian Albert formation at 1,574-1,612 m. The frac job placed 30 tonnes of proppant before being prematurely ended due to a frozen water line, which Corridor said may have reduced the frac’s effectiveness. A pump will be installed for long-term test.

Corridor also ran a frac in Hiram Brook at 1,757-1,840.5 m, resulting in a show of oil and no measurable gas. This interval is considered tight, but another 31 m of potential oil pay previously reported as gas pay in the Upper Hiram Brook have not yet been completed.

TD is 2,642 m, nearly 500 m into the Fredrick Brook shale.

The well is on the southern flank of the Elgin subbasin, where Corridor recently completed a $2.5 million 3D seismic program around the well.

After interpreting the new seismic, the company will drill an offset in early 2009 to G-36, named Caledonia field in recognition of the southern bounding basement rocks of the Caledonia highlands.

Meanwhile, Corridor expects to achieve 2008 yearend production of 35-40 MMscfd of gas from McCully field depending on results of clean-up at the J-47 well and the outcome of a multistage frac at the I-47 horizontal well.

In the Elgin area 20 km east of McCully field, Corridor has drilled Green Road G-41 to 1,118 m and run intermediate casing before deepening to core and run two fracs in the Frederick Brook shale. It is drilling Mapleton N-11 to core a full section of the shale.

Total makes oil find off Congo (Brazzaville)

Total SA tested 3,000 b/d of 18° gravity oil from its Moho Marine Nord-3 appraisal well, which was drilled 80 km off Congo (Brazzaville).

Total said the oil well produced from a 60 m column of good-quality Upper Miocene sands. The well reached 2,300 m TD in 1,030 m of water.

The discovery confirms the Tertiary Miocene resource cluster in the northern part of the Moho-Bilondo license, Total said.

Total made the Moho Nord Marine-1 and 2 finds in 2007. The latest well is 1.7 km northwest of Moho Nord Marine-2 and 2.7 km north of Moho Nord Marine-1.

Total started oil production from Phase 1 on the southern part of Moho-Bilondo in April using 14 subsea wells tied back to a floating production unit.

Output, which will gradually increase to a plateau of 90,000 b/d, is exported to the Djeno terminal.

Total E&P Congo holds a 53.5% interest in the license, with Chevron Overseas Congo Ltd. holding 31.5% and Societe Nationale des Petroles du Congo with 15%.

CNPC signs framework agreement with Cuba

China National Petroleum Corp., eyeing competition from a variety of other nations, has signed a framework agreement with Cuba’s state-owned Cubapetroleo SA (Cupet) on expanded cooperation in oil and gas development.

The agreement, signed by CNPC Vice-Pres. Wang Dongjin and Cupet Pres. Fidel Rivero Prieto, involves the provision of engineering and technical services along with related equipment for oil and gas field development.

The agreement with CNPC is the latest in Cuba’s efforts to create interest in the development of its offshore oil reserves, which the Cuban government recently estimated at some 20 billion bbl of oil in its portion of the Gulf of Mexico.

Cuba’s estimate is considerably higher than the recent US Geological Survey’s estimate of up to 9 billion bbl of oil reserves, but Cupet officials claim their data is more reliable.

“We have more data. I’m almost certain that if [the USGS] asks for all the data we have, [its estimate] is going to grow considerably,” Cupet Exploration Manager Rafael Tenreyro Perez said in October.

Tenreyro said Cupet’s estimate was based largely on a comparison with oil production from similar geological structures in the US and Mexican areas of the Gulf of Mexico.

Cuba’s offshore geology is similar to that of Mexico’s giant Cantarell oil field in the Bay of Campeche, Tenreyo said.

Industry observers have cast doubt on the Cubans’ claims, saying they would like to see the findings verified by independent experts. Still, a number of oil companies have expressed interest in exploring Cuban waters.

Last month, Russia’s ambassador to Cuba, Mijail Kamynin, speaking ahead of a visit by Russian President Dmitri Medvedev on Nov. 27, said that Russian oil companies could soon begin exploring for oil off Cuba.

Kamynin, who said Russian oil companies have “concrete projects” for drilling off Cuba, added that Russian firms also would like to help build storage tanks for crude oil, modernize pipelines, and help with Venezuelan efforts to refurbish the Soviet-built Cienfuegos refinery.

In October, Brazil’s Petroleo Brasileiro SA, building on agreements signed with Cuba earlier this year, announced plans to explore Block 37 in the Florida Straits, in 500-1,600 m of water between Havana and Matanzas and 90-95 miles south of Key West, Fla. (OGJ Online, Oct. 31, 2008).

Drilling & Production Quick TakesShell sets record with Perdido completion

Shell Oil Co. has set a world water depth record in drilling and completing a subsea well 9,356 ft below the water’s surface.

The SA001 well was drilled to 16,300 ft TD in Silvertip field at the Perdido regional development project, 200 miles from Houston. Silvertip field is on Alaminos Canyon Block 815 in OCS lease G19409 in the Gulf of Mexico (see map, OGJ, Sept. 8, 2008, p. 35).

The Noble Clyde Boudreaux double-derrick, dual-activity semisubmersible drilled and completed the record well. The semisub used 16 mooring lines on this project.

As an oil well, the Silvertip record is 35% deeper than the previous oil well record of 6,950 ft, also set by Shell in Fourier field in the gulf.

At Perdido, Shell intends to drill an even deeper well in Tobago field at 9,627 ft on Alaminos Canyon Block 859. Shell operates Perdido on behalf of partners Chevron Corp. and BP PLC.

Shell and its partners will drill 35 wells at Perdido¿22 direct vertical access and 13 remote¿in the Great White, Tobago, and Silvertip fields in Alaminos Canyon.

Moored in 8,000 ft of water, the drilling and production facility will be the deepest in the world. Nine polyester mooring lines averaging more than 2 miles in length now hold the spar in place. The floating structure will weigh 50,000 tons and will be nearly as tall as the Eiffel Tower when fully operational.

First production from Perdido is expected in early 2010, with the facility capable of handling 130,000 boe/d.

Oil flow starts from North Duri Area 12 field

PT Chevron Pacific Indonesia reported start of oil production Nov. 14 from Area 12 of Indonesia’s North Duri field, where Chevron produces nearly half the nation’s oil.

Oil production from Area 12 is expected to rise to 34,000 b/d by 2012, Chevron said. Initial production from Area 12 will increase with the application of steamflood technology next year, the company said.

Area 12 represents the latest expansion of Duri field, which is the largest producing field Chevron operates in Indonesia and one of the world’s largest steamflood projects. The field, which was discovered in 1941 on the island of Sumatra, currently produces 200,000 b/d of oil.

Steamflooding, Chevron reported, has more than tripled oil production from Duri field and has resulted in recovery of more than 2 billion bbl of oil.

North West Shelf JV approves oil redevelopment

The Woodside Energy Ltd.-operated North West Shelf joint venture has approved a $1.8 billion (Aus.) redevelopment of Cossack, Wanaea, Lambert, and Hermes oil fields to support production beyond 2020.

The work centers on the purchase and conversion of the SBM-owned Okha floating storage and offloading facility to a floating production, storage, and offloading vessel to replace the on-site Cossack Pioneer FPSO in 2010. The conversion entails addition of topside production facilities to Okha.

The JV also will refurbish the existing riser turret mooring system and selected subsea facilities.

The aim is to produce additional oil from the region by extending the life of the four existing fields¿about 135 km northwest of Karratha off Western Australia in 75-135 m of water¿and adding production from nearby yet-to-be-drilled exploration prospects.

The timetable calls for the facilities to be completed and fully operational by early 2011.

Cossack and Wanaea came on stream in 1995, while Lambert and Hermes were later additions. Total production is just under 400 million bbl.

The JV¿Woodside 33.33%, BHP Billiton 16.67%, BP Developments Australia 16.67%, Chevron Australia 16.67%, and Japan Australia LNG (MIMI) 16.67%¿anticipates that the refurbishment will generate more than 60 million bbl of oil.

Horizon confirms Maari budget increase

Horizon Oil Ltd., Sydney, a minority interest holder in the Maari oil field development off New Zealand’s Taranaki basin, has confirmed another 18% capital expenditure increase for the project, which now stands at $600 million. This latest cost blowout is due primarily to a 3-month delay in the start of development drilling.

At the final investment decision for Maari in late 2005, expected outlays were pegged at $365 million. In April, that figure rose to $508 million. The latest estimate is further, although anticipated, bad news for the development consortium, which is led by OMV of Austria.

Horizon also lowered its expectation of revenue from the project in the initial years following the fall in world oil prices. The company said if the $50-55/bbl prices continue, project returns will likely be about $540 million in the first year and $1.31 billion over 4 years.

Oil production is now expected to begin in February 2009 and to rise to 35,000 b/d by August 2009.

The field has estimated reserves of 68 million boe. The nearby, yet-to-be-drilled Manaia structure has potential for a further 25 million boe.

Interest holders in the Maari mining license (PMP 38160) and the Manaia exploration license (PEP 38413) are OMV 69%, Todd Energy 16%, Horizon 10%, and Cue Energy Resources 5%.

Giant Grand Bay field’s output climbing

Saratoga Resources Inc., Houston, is increasing oil and gas production from giant Grand Bay oil and gas field in Plaquemines Parish, La., and believes that only about one third of the field’s reserve potential has been evaluated.

The company has begun gas production from shallow Pliocene sands with the QQ15 well, completed Nov. 25, producing 1.063 MMcfd of gas and 3 b/d of water on a 19/64-in. choke.

Discovered in 1938, Grand Bay has only three wells drilled deeper than 15,000 ft. The shallow Pliocene gas has never been exploited although it shows up on 3D seismic and well logs.

The field, which has produced from more than 30 stacked sands at 3,000-13,500 ft, averaged 1,200 b/d of oil and 1.3 MMcfd of gas from 60 wells in late 2008, up from 562 b/d and 575 Mcfd in July. Well density is relatively light across the field’s 16,000 net acres.

Saratoga Resources, with 100% working interest in nearly the entire field, owns a 90 sq mile 3D seismic survey. The company believes the field has at least 50 proved developed workover or recompletion opportunities in 37 wellbores and one proved undeveloped drilling opportunity.

Processing Quick TakesPDVSA: Ecuadorian refinery still ‘on track’

Venezuela’s state-owned Petroleos de Venezuela SA (PDVSA), contradicting earlier remarks by a senior company official, has no plans to change its schedule for the construction of a refinery in Ecuador.

The statement, issued by the Ecuadorian oil and mines ministry, followed a meeting between Ecuadorian oil minister Derlis Palacios and Venezuelan energy and oil minister Rafael Ramirez, who confirmed his country’s commitment to execute the project.

Work on the joint-stock Refineria del Pacifico, held 51% by Ecuador’s state-owned Petroecuador and 49% by PDVSA, is scheduled to start in 2010, and operations are expected to begin by 2013.

The Ecuadorian statement followed media reports concerning a revision of the projected investments of PDVSA abroad due to the fall of international oil prices. The media reports specifically mentioned the refinery project in Ecuador and another one in Nicaragua.

Elogio Del Pino, a PDVSA vice-president, told the Venezuelan newspaper El Nacional, in comments published on Nov. 29, that PDVSA would reevaluate funding for some international projects, while its investment in the domestic oil industry would remain unchanged.

“The idea is to maintain investment in the country, because our idea is to have between 300,000 and 400,000 b/d (of oil) of potential so that when the rebound in oil prices comes…we can then open up that production,” Del Pino told El Nacional.

“International investments like the refineries in Ecuador and Nicaragua are under evaluation,” Del Pino said, adding that, “We’re asking to look for financing” to help pay for the 300,000 b/d refinery in Ecuador and the 150,000 b/d facility in Nicaragua.

Nicaraguan officials issued no comment concerning Del Pino’s remarks about the planned facility in their country. But his statement about the need for additional financing was in line with earlier remarks by officials involved in the Ecuadorian project.

In September, reports said that PDVSA and Petroecuador would jointly finance just under one third of the estimated $6-10 billion cost of the Ecuadorian refinery, expecting that the outstanding amount would be financed by other countries.

Carlos Albuja, head of Petroecuador unit Petroindustrial, said the two state firms would “finance 30% of the cost,” adding, “Countries such as England and China, among others, are interested in financing the remainder.” Since then, a memorandum of understanding has been forged between Iran and Ecuador for the revamp and modernization of Ecuador’s refineries. Under the MOU, a refinery will be constructed, to be cofinanced by Iran, Ecuador, and Venezuela (OGJ Online, Sept. 22, 2008).

Transportation Quick TakesShell to supply PetroChina with LNG

Shell Eastern LNG has agreed to sell as much as 2 million tonnes/year of LNG to PetroChina International under a 20-year supply agreement.

Shell said LNG supplies will come from various company projects, including Western Australia’s Gorgon gas project, in which it holds 25% interest.

Shell did not outline when deliveries of supplies would begin or detail any other projects that might provide supplies.

The current agreement builds on one signed in November 2007 under which Shell was to supply 1 million tonnes/year of LNG to PetroChina, which is building three regasification facilities on China’s Pacific seaboard: one in Jiangsu province, one in Dalian city, and a third in Tangshen city.

According to analyst BMI, PetroChina’s decision to double the volume under the final contract demonstrates the Chinese firm’s confidence in ongoing strong demand for LNG in China.

In addition, the analyst said, the increased supply may reflect PetroChina’s desire to source more long-term LNG supply contracts from Asia Pacific as a less risky strategy than boosting LNG imports from the Middle East, “particularly as the upsurge in piracy increases transit risks and shipping costs along the route.”

Earlier this month, China and Myanmar signed an agreement for the supply of gas that also came amid growing concerns about the safety of shipping through the Malacca Strait, especially following the rise of hijackings and attacks on oil tankers by Somali pirates operating in and around the Gulf of Aden (OGJ Online, Nov. 20, 2008).

Woodside lets contract for Pluto LNG project

Woodside Petroleum Ltd. has awarded service contracts totalling $5.2 million (Aus.) to Finnish consulting and engineering firm Poyry for the Pluto LNG project off Western Australia.

The awards cover the concept phase of different development options for the proposed second LNG train for Pluto.

Poyry says the long tie-back from the offshore field to the plant on the Burrup Peninsula means that flow assurance studies for Pluto are vital to ensure there is an acceptable fluid flow under all operating conditions.

The studies in the contract include an evaluation of the thermal and hydraulic performance of the Pluto production system from the undersea reservoir through 27 km of subsea flowlines to the production platform and then along 180 km of subsea trunkline to the onshore Burrup plant.