OGJ Newsletter

EU-Russia summit delegates look to next meeting

A summit between Russia and members of the European Union, held Nov. 14 in Nice, France, was seen as an opportunity for EU members to resume negotiations on furthering EU-Russia pacts on economic, energy, and security issues.

Talks occurred despite Russia’s not fully complying with its commitment to fully restore the territorial integrity of Georgia following its August attack on that country. The EU had postponed negotiations when the conflict in Georgia broke out. Negotiations, in fact, had not resumed at the summit but are slated to begin again Dec. 2.

The summit talks mostly were used by delegates for what French President Nicolas Sarkozy referred to as “pan-European security” as well as for smoothing out the many “irritants” that have recently cropped up.

These irritants included Russia’s threat to deploy missiles in Kaliningrad, a Russian enclave between Lithuania and Poland, to counter the US antimissile sytem in countries bordering Russia, Poland, and the Czech Republic.

Also attending the summit with President Sarkozy, who also serves as EU president until yearend, were Russian President Dmitri Medvedev, Commissioner for External Relations and European Neighborhood Policy Benita Ferrero-Waldner, and Trade Commissioner Catherine Ashton.

European security matters would be discussed further at a meeting in mid-2009 within the framework of the Organization for Security and Cooperation in Europe.

House Dems won’t try to restore OCS moratoriums

US House Democratic leaders will not try to reimpose offshore oil and gas leasing moratoriums that expired at the end of September, Majority Leader Steny H. Hoyer (D-Md.) said on Nov. 18.

There probably will be attempts to delineate where leasing will take place, he told an audience at the National Press Club. “I do not believe at this point that there are any proposals being made to reinstate the moratoriums across the board,” Hoyer said.

His remarks came a day after US Senate Energy and Natural Resources Committee Chairman Jeff Bingaman (D-NM) said the US needs an intelligent policy to promote more domestic oil and gas production, both onshore and offshore.

“That production has to be undertaken in an environmentally responsible way, and with recognition that multiple users and stakeholders are involved,” Bingaman said in remarks at the Center for Strategic and International Studies on Nov. 17.

Bingaman suggested that congressional moratoriums on Outer Continental Shelf leasing began in the early 1980s as a reaction to what he described as “a large and ill-conceived offshore leasing effort” by James G. Watt, former US President Ronald Reagan’s first Interior secretary. “I hope that we are smarter and more strategic this time in how we go about dealing with offshore oil and gas resources,” he said.

Bingaman said the next step might be “a serious and expeditious inventory” of OCS energy resources. Congress called for an OCS inventory in the 2005 Energy Policy Act but never provided funding to carry it out, he noted.

“Major energy development projects require a steady strategy and steady investments over the long term, so they need to be based on a stable political consensus that isn’t reversed every few years. That means that our energy decision-making on the [OCS], as well as onshore, needs to be based on the best data we can collect on both the energy and environmental characteristics of potential areas for production. Getting that data on a priority basis will greatly increase the chances that we will make energy supply choices that will be sustainable economically, environmentally, and politically,” Bingaman said.

Responding to Hoyer’s comment, the American Petroleum Institute said that it is the right approach. “Neither Congress nor the next administration should set unreasonable, arbitrary limits on leasing because such restrictions could remove some of the nation’s most promising oil and gas prospects for development, and the industry has proven it can develop these resources in an environmentally safe manner,” it said in a Nov. 18 statement.

In his prepared remarks, Hoyer said the first focus of the next Congress will be to restore US economic health by rebuilding worn-out infrastructure, helping hard-pressed states and demonstrating fiscal responsibility.

IOGCC chair calls for bipartisan efforts

Oklahoma Gov. Brad Henry assumed the chairmanship of the Interstate Oil & Gas Compact Commission by calling upon US lawmakers to work together toward providing policies to ensure stable, sustainable energy supplies.

“It’s more critical now than ever before that we work together in a bipartisan manner,” Henry said in addressing the IOGCC annual meeting Nov. 17 in Santa Fe, NM. He took over as chairman when Alaska Gov. Sarah Palin’s term as IOGCC chair ended. Palin, formerly the Republican vice-presidential candidate, did not attend the meeting.

Henry noted how public clamor about energy dies when oil and gasoline prices decline as they have in recent weeks. But he said energy still needs to be a national priority, and that energy-producing states should help steer the direction of energy policy.

“Nearly 70% of our nation’s oil comes from foreign sources,” Henry said. “The goal of energy independence is too complex to believe that renewables alone will be the solution.”

Marathon Oil Corp. Chairman and Chief Executive Officer Clarence Cazalot said the world faces an energy transition in learning how to deal with the long-term fundamentals of growing global energy demand in the face of constrained energy supplies.

Cazalot called for the US to develop “a comprehensive, fact-based energy plan integrated with climate change” concerns. “All energy sources are going to become increasingly important components of any energy plan,” Cazalot said. Nonetheless, he said fossil fuels will dominate world energy supplies through 2030.

The energy plan needs to include efficiency and conservation, diversified energy supply, and the development of new technology, he said.

EIA: OPEC production dropped in October

The Organization of Petroleum Exporting Countries produced a total of 32.3 million b/d of crude oil in October, down 100,000 b/d on month, according to the US Energy Information Administration.

EIA estimated OPEC’s production capacity to be 34.24 million b/d and its spare production capacity to be 1.93 million b/d.

It said OPEC’s 12 producers, excluding Iraq and Indonesia, produced 29.13 million b/d in October, and exceeded the organization’s output target of 28.8 million b/d by 330,000 b/d.

Although Angola increased production, Indonesia, Nigeria, Qatar, Saudi Arabia, and Venezuela all saw declines. Production remained steady in Algeria, Ecuador, Iran, Iraq, Kuwait, Libya, and the UAE.

EIA projects that OPEC crude production will drop even further to 31.3 million b/d in first quarter 2009, where it will remain relatively stable through yearend 2009.

In terms of revenues, EIA said OPEC could earn $979 billion of net oil export revenues in 2008, and $595 billion in 2009. EIA did not explain the substantially reduced earnings projection for 2009.

Through October, OPEC has earned an estimated $884 billion in net oil export earnings in 2008, while in 2007 it earned $671 billion in net oil export revenues, a 10% increase over 2006.

Saudi Arabia earned the largest share of these earnings, $194 billion, representing 29% of total OPEC revenues. On a per capita basis, OPEC net oil export earnings increased by 8% over 2006, reaching $1,137.

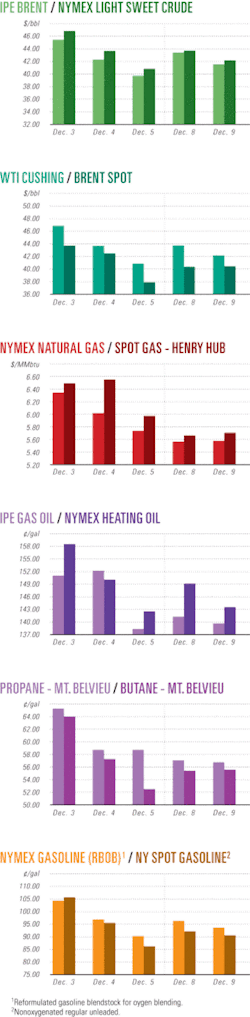

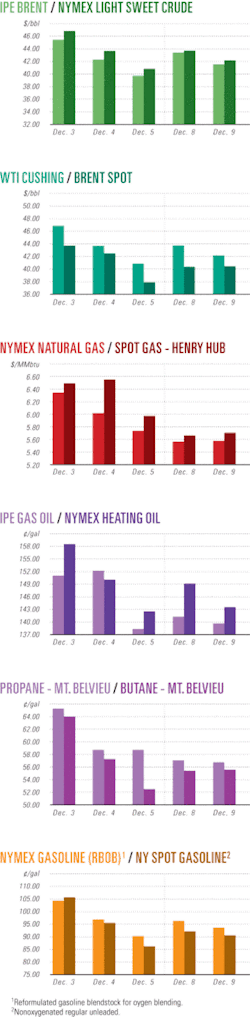

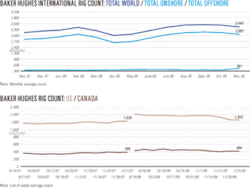

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesExxonMobil signs Black Sea exploration deal

An ExxonMobil Corp. affiliate signed an agreement with Turkey’s state oil company TPAO to explore two large deepwater blocks off Turkey, marking ExxonMobil’s entry into Black Sea exploration.

ExxonMobil Exploration & Production Turkey BV will be operator in the initial exploration phase and earn a 50% interest in the 8,500 sq km Samsun Block and the 21,000 sq km eastern portion of the 3921 Block, which lie in 2,000 m of water. The two blocks are in the Black Sea basin and are separated by a lease held by TPAO and Brazil’s Petroleo Brasileiro SA.

TPAO and ExxonMobil will merge skills and operational abilities during the development and production phases scheduled for completion in 2009. Assignment of the interest to ExxonMobil by TPAO is subject to Turkish government approval.

“ExxonMobil is pleased to team up with TPAO to explore the hydrocarbon potential of these deepwater Black Sea blocks,” said Tim Cejka, president of ExxonMobil E&P. “We look forward to bringing our global deepwater experience to this prospective unexplored area.”

Mehmet Uysal, TPAO president and chief executive officer, said the two companies “have all the tools required” to evaluate and develop a discovery and plan an “aggressive” exploration program.

ExxonMobil affiliates or predecessor companies have been operating in Turkey for more than 100 years. It has a lubes blending plant in Istanbul as well as finished lubricants, aviation fuels, and marine fuels sales throughout the country.

Syrian oil discovery adds new play type

The Yousefieh-1 exploration well near Khurbet East oil field on Block 26 in northeastern Syria discovered an accumulation of 23° gravity oil, said Gulfsands Petroleum PLC and Emerald Energy PLC.

The 50-50 partners were moving appraise the discovery with a well at the north end of Khurbet East field that seeks to establish the oil-water contact and could be used later for water disposal.

Yousefieh-1, 3 km from Khurbet East production facilities, cut 63 m of net oil pay in the target Cretaceous formations and flowed 900 b/d without treatment from the shallowest 19-m interval. Porosity averaged 18.6%. TD is 2,139 m.

While preparing for the natural flow test, the well flowed at the average rate of 1,450 b/d for 3 hr through a 95/64-in. choke on gas lift. Preliminary results indicate good permeability. The entire reservoir was cored.

A smaller workover rig may be brought in to run further tests.

The companies, which identified the new play on 2007 3D seismic, plan to shoot more 3D to identify other prospects and leads nearby.

Meanwhile, cumulative production has exceeded 1 million bbl from Khurbet East field, averaging 11,500 b/d from two vertical and three horizontal wells with minimal reservoir production reduction.

Saudi Aramco cancels Manifa contract

Saudi Arabia’s state-owned Saudi Aramco said it has cancelled a contract awarded in July to Saipem subsidiary Snamprogetti for development of the Manifa oil field.

Aramco, which recently announced plans to review all of its oil development projects, said it would retender the contract and invite Snam to bid again, along with Bechtel Group, Technip, and Foster Wheeler.

Earlier this month, Khaled al-Buraik, an Aramco executive director, said the company’s short-term projects were on track and that the kingdom would reach its target of increasing production capacity to 12.5 million b/d by yearend 2009.

But al-Buraik said that development of the Manifa field, which could have added about 900,000 b/d of capacity by 2011, was under review, as was a project to produce some 1.5 bcfd of gas from the Karan field.

“We are going back to our partners and discussing with them the new economic circumstances,” Buraik said. “We are not talking about delays, we are talking about reviewing” (OGJ Online, Nov. 6, 2008).

With Snam’s Manifa contract cancelled, however, it remains to be seen whether Aramco can maintain its schedule for the field and achieve the additional volumes it wanted by the originally planned date of 2011.

StatoilHydro wins licenses off Newfoundland

Canada has granted StatoilHydro operatorship of one license and a 50% interest in another, both off Newfoundland, under its land sale award announced Nov. 17.

One license is in the Flemish Pass basin, near StatoilHydro’s Mizzen well, which is to be drilled this winter. StatoilHydro will operate the well with a 65% working interest; Husky Energy Inc. will hold 35%. The second license is in the Jeanne d’Arc basin. StatoilHydro will partner equally with operator Petro-Canada on the well.

StatoilHydro is a partner in the Hibernia and Terra Nova fields off Canada, with 5% and 15% working interest respectively, in addition to being a partner in developing the Hebron offshore field.

Sterling makes oil discovery in UK North Sea

Sterling Resources Ltd. will suspend well 210/29a-4 in the UK northern North Sea to evaluate the size and development options of an oil discovery on the Bowstring East prospect.

The Cladhan well encountered an oil column of more than 110 ft, with no observed oil-water contact, in an Upper Jurassic sequence below 9,450 ft. It contained 25 ft of sandstones with log porosity exceeding 20% and showed high oil saturations.

The well, drilled on Block 210/29a, is in license P1064. Transocean’s 704 semisubmersible rig targeted a seismic amplitude-driven Upper Jurassic anomaly down-dip and eastward of the East Shetland platform. The well was in 535 ft of water and reached a total measured depth of 9,735 ft.

“Although the well will not be flow-tested, an extensive pressure test measurement program and the collection of oil samples through a modular formation tester logging tool, suggest good reservoir mobility and therefore promising productive potential,” Sterling said.

David Findlater, Sterling’s vice-president for exploration, said, “This wildcat well has met all expectations and confirmed the presence of a hydrocarbon bearing stratigraphic trap. Our immediate plan is to integrate the well results with the seismic data and to determine the size of the oil accumulation before submitting our appraisal strategy.”

Sterling secured the acreage in 2003 under the Promote Licensing Round in the 21st UK Offshore Round.

Sterling, which has a 39.9% interest, has partners in the license: Revus Energy (UK North Sea) Ltd. 33.5%, Encore Petroleum Ltd. 16.6%, and Dyas (UK) Ltd. 10%.

Wintershall gets license on Block 4N off Qatar

Qatar has granted Wintershall AG an offshore exploration license for Block 4N (Khuff), close to North field. The exploration and production-sharing agreement has a 25-year term.

The acreage, which has gas potential, is 544 sq km and in 70 m of water.

Wintershall, as sole operator, will reprocess seismic data and shoot additional seismic over the next 2 years and plans to drill two exploration wells by 2010.

“Depending on the results of the intensive exploration campaign, Wintershall would develop a discovery through further drilling, and subsequently produce natural gas and condensate,” Wintershall said.

It was granted operatorship of offshore Block 11 in Qatar in 2000 and Block 3 last year. It also plans to shoot seismic surveys and drill two exploration wells by 2010 on Block 3.

Drilling & Production Quick TakesFort Hills Energy defers oil sands project decision

Officials of Fort Hills Energy LP said they will defer until 2009 a final investment decision on a bitumen upgrader and will focus instead on developing the mine and bitumen production facilities of that integrated oil sands project near Fort McMurray, Alta.

A decision will be made later whether to proceed with an upgrader to be located 300 miles south in Sturgeon County east of Edmonton.

“We’re giving ourselves some breathing room on the project schedule, so we can take advantage of a softening market to reduce costs,” said Ron A. Brenneman, president and chief executive officer of Petro-Canada. “Given cost pressures, lower crude oil prices, and uncertainty in the financial markets, it’s important to scale our efforts to focus on the mine first.”

The partnership will use the extra time to evaluate cost reductions, efficiencies, and the overall project schedule. It remains committed to retaining the oil sands leases and is in discussions with the Alberta government on lease terms.

The partnership consists of Petro-Canada with 60% working interest, UTS Energy Corp. 20%, and Teck Cominco Ltd. 20%. Petro-Canada Oil Sands Inc., a unit of Petro-Canada, is operator.

Chevron starts oil production from Blind Faith field

Chevron Corp. reported oil production started from its Blind Faith field in the deepwater Gulf of Mexico.

Initial production is 30,000 b/d of oil and 30 MMcfd of natural gas. Daily production is expected to ramp up to 65,000 b/d of oil and 55 MMcfd of gas in 3 months.

Blind Faith, Chevron’s deepest offshore production, is in 6,500 ft of water and lies 160 miles southeast of New Orleans. It has subsea systems in 7,000 ft of water in Mississippi Canyon Blocks 695 and 696.

The Blind Faith discovery well was drilled in June 2001. Chevron owns 75% interest and operates Blind Faith, having acquired its stake from BP PLC (OGJ, Nov. 24, 2003, p. 46). Anadarko Petroleum Corp. holds 25% interest in the project.

StatoilHydro lets Leismer oil sands contract

StatoilHydro Canada Ltd. has let a $41 million construction contract to Flint Energy Services Ltd. to develop its Leismer Oilsands demonstration project, 160 km south of Fort McMurray, Alta.

The company will construct the central plant’s mechanical components for the new steam-assisted gravity drainage facilities. The processing facility will have the capacity to produce from oil sands 10,000 b/d of bitumen from 22 horizontal well pairs–one for injection, the other for extraction–linked to four well pads.

Production, planned for late 2009-early 2010, is expected to increase to more than 200,000 b/d by 2020 from an initial 20,000 b/d in 2012 from all of StatoilHydro’s oil sands leases.

This is the first lease to be developed.

Processing Quick TakesSaipem scoops €1.3 billion Algerian LPG contract

Sonatrach has let a €1.3 billion contract to Saipem SPA to develop an LPG processing facility at the Hassi Messaoud oil and gas complex in central Algeria, about 900 km southeast of Algiers.

Sonatrach signed a lump-sum, turnkey contract with Saipem covering engineering, procurement, and construction of three LPG production trains with a total capacity of 8 million cu m/day.

The work will be completed by first-half 2012.

Supergiant Hassi Messaoud is the basin’s and the country’s largest oil field, with estimated ultimate recovery of 9 billion bbl of 43° gravity oil. It produces from a 900-ft oil column in a Cambrian sandstone reservoir at a depth of 11,000 ft in a 1,300 sq km productive area.

Ecopetrol lets Colombia refinery upgrade contract

Ecopetrol SA has awarded contracts for front-end engineering and design and project management consultancy to Foster Wheeler USA Corp. and Process Consultants Inc., part of its Global Engineering & Construction Group, for the Barrancabermeja refinery upgrade project in Colombia.

The project will increase refining capacity to 300,000 b/sd from 250,000 b/sd, add heavy crude processing capability, and provide a processing configuration to meet the projected 2013 Colombian clean fuels product specifications.

The scope includes the following new units: a crude unit, delayed coker, hydrocracker unit, coker naphtha hydrotreating unit, hydrogen unit, sour water strippers, amine regeneration unit, and sulfur recovery unit, plus associated utilities and offsite units.

The project also will include revamps to the diesel hydrotreater, gasoline hydrotreater, and dismantling of two existing atmospheric and vacuum distillation units. In addition, the contract includes the procurement of long-lead items.

Transportation Quick TakesAGL starts work on salt-dome gas storage cavern

AGL Resources’ Golden Triangle Storage has started construction of a 12-bcf working gas capacity salt dome natural gas storage facility at Spindletop in Beaumont, Tex.

About 7.5 miles of dual 24-in. OD pipelines and 1.5 miles of single 24-in. line will connect the facility to six interstate and intrastate transmission pipelines: Florida Gas Transmission (downstream of Station 6), Texas Eastern Transmission, Centana Pipeline, Energy Tranfer Co.’s Texoma line, Kinder Morgan Texas, and ExxonMobil’s Golden Pass Pipeline. The storage site will be able to receive onshore, offshore, and LNG deliveries.

The project will offer 600 MMcfd of deliverable capacity and 300 MMcfd of injection capacity, serving local petrochemical facilities and the Houston Ship Channel through the intrastate pipelines as well as markets in the Northeast, Mid-Atlantic, and Southeast via the interstate lines.

Golden Triangle says the first storage cavern will be ready for operation in 2010 or early 2011, with the second cavern following roughly 2 years later. Capacity can be expanded to as much as 28 bcf. The company expects a third 6-bcf cavern to be added shortly after completion of the second. Five brine-disposal caverns are also being drilled on Golden Triangle’s site.

Shanghai receives first spot cargo of Petronas LNG

Shanghai Gas Group Co. (SGG), majority owned by Shenergy Group, has received its first spot cargo of LNG from Malaysia’s Petronas.

SGG said a 20,000 cu m LNG carrier from Malaysia arrived at Shanghai’s 120,000 cu m capacity Wuhaogou terminal Nov. 15. The terminal, the smaller of the two LNG terminals being developed in Shanghai, receives only spot cargoes.

In October, Shenergy Group completed construction of two 50,000 cu m LNG steel storage tanks at the Wuhaogou terminal after 2 years of construction. The tanks were scheduled to start receiving LNG supplies from Malaysia beginning in mid-November.

Petronas subsidiary Malaysia LNG Tiga Sdn. Bhd. is scheduled to supply Shanghai’s other regasification facility, which is comprised of three 165,000 cu m LNG storage tanks. It is a joint venture project of Shenergy Group and China National Offshore Oil Corp.

The Malaysian firm will begin LNG deliveries in February 2009 under a 25-year contract. First-phase receiving capacity will be 3 million tonnes/year building to 3.03 million tonnes/year of LNG in 2012. The terminal will enter a trial run in April and will come online in July.

The Chinese joint venture company also aims to construct an additional 3 million tonnes of LNG receiving capacity for its second phase by 2015, depending on the future gas market.