West Texas Overthrust outlook expands with 3D

SandRidge Energy Inc., Oklahoma City, expects to be operating 20 rigs in the West Texas Overthrust by the end of 2008, down from 27 rigs in early November and a third quarter average of 34.

The company has halved its planned 2009 capital budget from the $2 billion previously anticipated. It is also selling its East Texas assets.

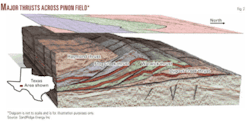

SandRidge continues to exploit and expand Pinon field using 3D seismic and well control to identify new reservoirs in the three primary thrusts: Dugout Creek, Warwick, and Frog Creek. More than 600 wells have been drilled at Pinon since the 1980s.

The company still doesn’t know how large Pinon field will become.

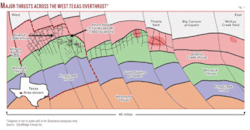

WTO thrusts

Pinon and other fields associated with the thrusts are spread across Pecos and Terrell counties 20 miles north of Sanderson, Tex. (Figs. 1 and 2).

SandRidge holds more than 650,000 net acres in the area and has acquired virtually all of the leases in the WTO.

The 5.1 tcf of net proved, possible, and probable reserves identified in the 72,000-acre Pinon field are almost exclusively in the Dugout Creek and Warwick thrusts.

The Frog Creek thrust is the most recent of the three thrusts discovered in the Pinon field to have commercial production, SandRidge said. SandRidge hasn’t booked reserves from Frog Creek and hasn’t yet drilled the Haymond thrust.

The Frog Creek thrust provides drilling opportunities in the Caballos chert at 3,500-5,500 ft. The thrust as interpreted from 3D data appears to be similar in size to the Dugout Creek and Warwick thrusts.

“We have started to drill wells targeting specifically the Frog Creek Caballos and have very encouraging results,” SandRidge said. “We are in the process of mapping this thrust with geological information from the few penetrations we have and tying into 3D seismic data to high-grade locations as we prepare to drill more Frog Creek Caballos wells in 2009.”

Recent production tests from Frog Creek analyzed methane with less than 3% carbon dioxide. The company believes the Frog Creek thrust may contain substantial quantities of reserves that can be developed at or below current Pinon finding costs.

“Until we had our first interpretation of our proprietary 3D seismic over the Pinon field in July (2008), we did not even realize that the Frog Creek or Haymond thrusts existed,” SandRidge said in late October. “This realization has increased the potential for continued expansion of the Pinon field and across the West Texas Overthrust.”

Drilling and seismic

SandRidge drilled 76 wells and completed and placed on production 60 gross wells in the WTO in the quarter ended Sept. 30, when it owned and operated 612 gross wells.

The vast majority of the production growth the past 2 years has occurred in the Dugout Creek thrust. The Warwick thrust is the field’s most prolific producer.

SandRidge shot 265 sq miles of 3D seismic data in the third quarter of 2008, bringing the total shot to date to 1,115 sq miles. The company expects to have 1,250 sq miles of the planned 1,500 sq mile 3D shoot completed by the end of 2008.

SandRidge believes it can use 3D seismic and well control data to highgrade its drilling locations in the multiple thrusts in Pinon field and continue to deliver drilling finding costs below $1.70/Mcf.

The most prolific reservoir at Pinon is the Warwick Caballos chert high CO2 reservoir at 6,000-8,000 ft with average estimated ultimate recovery of 7 bcf/well of total gas based on 125 wells drilled.

The Warwick thrust “is one of the keys to the future of our company as it represents the best reservoir for capital spend of any large scale play that I am aware of,” said Tom L. Ward, chairman, chief executive officer, and president of SandRidge.

The company is nearly down at the Big Canyon 1-21-1A exploration well 30 miles east of Pinon field. Drilling at 15,400 ft and believed to have entered the Warwick thrust, it has had encouraging shows. Results are expected by the end of 2008.

Two other wells on the South Sabino prospect produced sweet gas at initial rates below 500 Mcfd, but this production is “not from the overthrusted chert that we have found in the Big Canyon well,” SandRidge said. “The presence of sweet gas outside Pinon field is important to our goal of finding additional Pinon fields on our more than 650,000 acres in the WTO.”

Gas processing

Production from the Warwick Caballos reservoir is limited to 150 MMcfd of inlet high CO2 gas processing capacity of the company’s legacy plants.

SandRidge is expanding the capacity of existing plants and is building the Century plant in a joint venture with Occidental Petroleum Corp. funding construction and operating the facility for 30 years. The project allows SandRidge to capture and accelerate development of a net 1.6 tcf of methane from high-CO2 gas.

Century is designed to have 800 MMcfd of processing capacity. The first phase is to start up in the second quarter of 2010, and the second phase is to start in the second quarter of 2011.

Given the current limited availability of CO2 treating capacity, the risk of finding gas containing CO2 at levels above pipeline specifications limits the company’s ability to aggressively develop the Warwick thrust.

The company continues to find relatively sweet gas in the Warwick thrust on the east side, but even transition wells with low amounts of CO2 are not able to maximize production due to the lack of processing capacity.

Once the Century plant starts up in 2010, the company intends to implement a more aggressive drilling program and accelerate production and reserves growth from the Warwick thrust.

“We believe that there are additional reservoirs containing high CO2 gas that can be developed once this plant is full, but that’s a bit too far out for us to discuss in detail at this point,” SandRidge said.

“If we only keep our existing production flat from 2009 through 2011, we will grow our production from our current 305 MMcfd to about 525 MMcfd by yearend 2011 with just the addition of the Century plant.”

HungaryThe drilling pad is being prepared for a deep, high-pressure high-temperature well in the Kiskunhalas trough on the Tompa block in southeastern Hungary near the border with Serbia.

Toreador Resources Corp., Dallas, has a 25% working interest, and a joint venture partner is funding the well, expected to spud in December and take 70-90 days to drill.

The well is expected to test an 1,800-m section of overpressured sands, shales, and conglomerates below a 1,400-m shale cap. The unconventional deep gas play in Carpathian gas sands was discovered in the 1980s.

Delta Hydrocarbons, a private European energy fund, is earning a 75% working interest in any unconventional gas resources in Toreador’s Tompa exploration block by funding the first well.

IraqAddax Petroleum Corp., Calgary, tested 470 b/d of 23° gravity oil from the fractured Eocene Pila Spi formation at 1,000 m at the No. 11 appraisal well in Taq Taq field in Iraq.

The flow test was from a 52-m gross oil column on a ½-in. choke, and Addax expects the rate to be increased substantially with artificial lift. It looks to develop this part of the field to supply local demand in Kurdistan.

Two secondary targets, the Tertiary Khurmala and Sinjar formations, were confirmed as water bearing.

Taq Taq appraisal continues with the TT-10 well, which targets the previously tested Cretaceous Shiranish, Kometan, and Qamcheuqa reservoirs as deep as 2,500 m. The rig will then move to drill the Kewa Chirmila exploration well on the license.

New ZealandAustralian Worldwide Exploration, Sydney, took a farmout from Global Resource Holdings LLLP, Denver, to partly fund a planned 3,100 line-km 2D seismic survey on PEP 38451 in the deepwater Taranaki basin off New Zealand.

The Pacific Titan vessel is to shoot 1,000 km with 6-km streamers over Global’s southern third of the 8.1 million acre permit and later about 2,000 km in the northern part of the permit with high-resolution, long offset 10-km streamers to infill existing data.

Once the AWE farmout is complete, interest in the permit will be Global operator with 50%, Hyundai Hysco, Seoul, 30%, and AWE and Randall C. Thompson LLC 10% each.

AWE has the option to increase its equity in the southern part of the permit to 40% by funding 70% of the drilling of one exploration well, which option must be exercised by April 2010, following the acquisition, processing, and interpretation of the new seismic.

AWE plans extensive seismic shooting five permits in preparation for its $300 million (Aus.), six to seven-well drilling campaign.

Saharawi RepublicSaharawi Arab Democratic Republic (Western Sahara) extended the date of its second licensing round to Mar. 31, 2009.

The republic is offering three onshore and six Atlantic blocks in the underexplored Aaiun and Tindouf basins that total 48 million acres in as much as 3,600 m of water. One Tindouf block appears to have potential for Silurian shale gas. The round is extended due to the global financial crisis and recent plunge in oil prices.

Eight companies that acquired nine licenses in the first bid round in early 2006 are evaluating prospects.

TurkeyToreador Resources Corp., Dallas, completed shooting and is processing a 1,000 line-km 2D seismic survey in shallow waters of the Sea of Marmara off Turkey in the Thrace basin.

Toreador is operator of the permits with 50% working interest. Thrace Basin Natural Gas Turkiye Corp. and Pinnacle Turkey Inc. each have 25% working interest in the joint venture.

LouisianaMeridian Resource Corp., Houston, plans to hook up by the end of the year a well in Weeks Island field in Iberia Parish, La., that tested at as much as 685 b/d of oil. The Weeks Bay-15 well was sidetracked to 8,900 ft measured depth and logged 43 ft of overall oil pay in Miocene sand. The flow rate was gauged on a 13/64-in. choke with 1,175 psi flowing tubing pressure.

Meridian Resource, which owns 92% working interest in the No. 15 well, is sidetracking the Goodrich-Cocke-3 well in which it owns 63% working interest and is targeting Miocene sands at 7,500 ft.

PennsylvaniaSeneca Resources Corp., Buffalo, NY, bid successfully on 24,000 acres on four large blocks in the Devonian Marcellus shale trend in Pennsylvania.

The leases, in Lycoming and Tioga counties, Pa., have 10-year primary terms and are incremental to the 425,000 acres high-graded in this play.

Meanwhile, Seneca and EOG Resources Inc. modified the terms of their Marcellus shale joint venture to require EOG to select all prospect acreage by March 2009. The change will more quickly free up the nonselected acreage and allow Seneca to evaluate, explore, and develop the remaining lands independently or with other partners.