SPECIAL REPORT: Markets evolving for oil sands bitumen, synthetic crude

As Canadian oil sands production increases, producers are adopting varied strategies in marketing the bitumen blends and synthetic crude oil (SCO). Some producers seek to minimize capital cost and accept a low price and possible market risk with bitumen production. Others are willing to invest in upgrading or refining of bitumen to add value and perhaps reduce market risk.

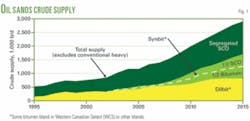

Bitumen produced from oil sands generally is available to the market as a diluted bitumen blend or SCO. The supplies of both diluted bitumen and SCO are increasing and forecasts show this trend continuing (Fig. 1)

Traditional markets have included Canada and the northern tier of the US, but some supplies are starting to move farther south. Some oil sands producers have expressed interest in accessing new markets and several pipeline companies have offered proposals for transportation. Potential new markets include the US Gulf Coast, East Coast, West Coast, and Asia (Fig. 2).

On the other hand, some refiners in the traditional markets have announced plans for facilities to use more oil sands crude, especially diluted bitumen. Through acquisitions and joint ventures, oil sands operators and refiners are working to secure their markets and supplies. Pipeline projects are under way to provide deliveries within these markets.

Historically, producers have diluted bitumen for shipment in pipelines using condensate, in a blend commonly referred to as DilBit. In some cases, they have used SCO as diluent, yielding an SCO blend called SynBit.

Most SCO has been light sweet crude with no vacuum resid, but upgraders also have produced medium-heavy sour SCO. The quality depends on the upgrading technologies employed. The future availability of various crude types will depend on bitumen production and diluent selection as well as upgrading capacity and technology.

Synthetic crude oil

In Alberta, bitumen upgraders produce the SCO, most of which has been light sweet SCO (about 32° gravity and less than 0.2% sulfur) with no vacuum resid. SCO production reached about 800,000 b/d in 2007. This is predominantly from resource-based projects (Suncor Energy Inc., Syncrude Canada Ltd., and Athabasca Oil Sands Project (AOSP) at Scotford), but Husky Energy Inc.’s stand alone upgrader at Lloydminster produced about 53,000 b/d.

Purvin & Gertz estimates that about 600,000 b/d was light sweet SCO with no vacuum resid and 200,000 b/d was medium or heavy SCO with high sulfur content as well as more vacuum gas oil (VGO) or vacuum resid. Forecasts indicate production will rise in the next few years with expansions by Suncor and AOSP and upgrader start-ups at the OPTI/Nexen Long Lake project and the Canadian Natural Resources Ltd. (CNRL) Horizon project.

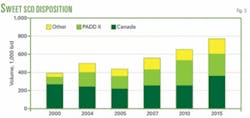

Before the start-up of the AOSP upgrader by Shell Canada Ltd. at Scotford, Canadian refineries around Edmonton and Sarnia processed most of the SCO (Fig. 3). Most have extensive hydroprocessing facilities and use equity crude.

With the AOSP start-up in 2003 and expansions by Suncor and Syncrude, SCO production and exports have risen. Exports fell in 2005 following outages at the upgraders but recovered by 2006.

With growing production, SCO exports likely will rise. Some of the main US importers of SCO have included Sunoco, Marathon Oil Co., and Sinclair Oil Corp. Although US imports of SCO have risen, the SCO price remains strong, and there have been no special projects announced to handle more SCO.

The lack of SCO refining projects could limit SCO demand in the northern tier, so that SCO may need new markets. Movement to more distant markets, however, may weaken the SCO price and provide more incentive to add SCO hydroprocessing facilities at existing refineries within the traditional markets.

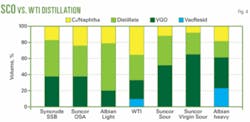

Fig. 4 compares SCO distillations with West Texas Intermediate (WTI). The qualities of SCOs vary, depending on the upgrading technologies and blend strategies used.

Coking followed by hydrotreating produces SCO without vacuum resid. AOSP uses LC-Fining/hydrotreating and produces both Albian Light and Albian Heavy SCO. The Albian Light has less VGO than others. Syncrude and Suncor OSA have a relatively high proportion of VGO that may exceed fluid catalytic cracker (FCC) capacity at some refineries.

The SCOs produced by coking and hydrotreating tend to be fairly aromatic, so that diesel fuel and jet fuel qualities have been poor to marginal, and VGO is fairly refractory for FCC units, limiting conversion. Diesel cetane has improved from as low as 33 to 40 and some newer projects expect to exceed 45. For example, the new OPTI process configuration uses VGO hydrocracking and this is expected to reduce aromaticity.

The absence of vacuum resid in SCO can limit operations in conventional, crude, and vacuum units due to heat integration, tray loading etc., so that companies generally run SCO with other crudes. Of course, refineries with cokers or asphalt production cannot use bottomless crude except perhaps to fill other process units.

As mentioned, the AOSP produces Albian Heavy SCO that contains unconventional LC Finer bottoms. Suncor produces a variety of sour SCOs with varying amounts of VGO, vacuum resid from bitumen, and cracked components.

BA Energy Inc. is planning to use its proprietary deasphalting and pyrolysis processes to produce a cracked, sour SCO. Ivanhoe Energy Inc. recently announced plans to develop an in situ and upgrading project using its proprietary HTL cracking process that would produce a cracked, sour SCO. Others have considered deasphalting to avoid diluent, thus producing a heavy sour crude.

As more refiners in the US Midwest add facilities to process heavy bitumen blends, they will have less interest in using a bottomless SCO. Thus, the potential capacity for light SCO in this traditional market may fall over time.

New markets may become interested in light SCO. The US Gulf Coast and East Coast already use light SCO from Sincor in Venezuela. The large US Gulf Coast market could absorb Canadian SCO if delivered at the right price, but the cost of delivery to the Gulf Coast may reduce the netback price of SCO.

The US East Coast refineries import light sweet crudes primarily. Most do not have cokers but have relatively large FCC capacity, so that they may be good candidates to use SCO (Fig. 5). Fig. 5 shows large FCC/hydrocracking capacity in California. This, however, is associated with coking, so that light SCO without bottoms is less suitable.

Refineries in Japan use light sweet and light sour crudes. Japan is concerned about competition for Middle East crude. The refineries have very little coking capacity and their FCC capacity is small compared with North America. They may also be candidates for SCO although SCO with less VGO might be of greater interest.

As noted, a potentially significant market for SCO is diluent use in SynBit that typically contains about 50% bitumen and 50% SCO. If there were a large demand for SCO as diluent, this would reduce the supply of segregated SCO and strengthen the price. On the other hand, if companies imported more condensate and naphtha for diluent, this would reduce the demand for SCO as diluent and leave more segregated SCO with a weaker price.

Bitumen blends

Upgrading provides a market outlet for bitumen. Within Alberta, most of the upgrading occurs as part of integrated resource projects. To date all the mining projects have upgraders although the AOSP upgrader is not onsite. The OPTI/Nexen Long Lake project will integrate in situ production with upgrading.

In 2007, resource upgraders produced about 650,000 b/d of SCO. Companies have plans for expansions of existing projects. The new Fort Hills upgrader project, led by Petro Canada, will be in the Fort Saskatchewan area, although Total E&P Canada Ltd. and StatoilHydro Canada Ltd. have delayed plans for their upgraders. Husky cancelled its standalone upgrader at Lloydminster and development has slowed for the standalone upgraders planned by BA Energy and North West Upgrading Inc.

In 2007, in situ sites produced about 500,000 b/d of nonupgraded bitumen. Most of the bitumen growth will be from in situ projects although mining projects could produce and sell bitumen if the extraction process can meet bs&w specifications.

Without upgrading, companies must dilute bitumen with lighter petroleum to meet pipeline specifications for density and viscosity. Condensate historically provided most of the diluent, although companies have used SCO and other light streams. Some DilBits such as Cold Lake, Peace River, and Wabasca go directly to market.

Since 2005, companies have blended some of the DilBit and all of the SynBit with conventional heavy crudes into Western Canadian Select (WCS). DilBits, WCS, and conventional heavy crudes compete in the market.

As bitumen production grows, producers will need more diluent. Producers already use nearly all the Canadian condensate as diluent, so that future diluents are likely to be imported condensate and SCO. Some naphtha also may be recycled from Midwest refineries. The future supply of bitumen blend will depend on bitumen production, upgrading capacity, and the source and type of diluent used.

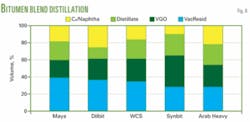

Bitumen blend qualities vary due to the bitumen quality as well as the quality and ratio of diluent in the blends. Fig. 6 compares distillations.

DilBit with about 25% condensate contains around 36% vacuum resid. SynBit with about 50% SCO contains about 28% vacuum resid and about 36% VGO. Refineries need large cokers to process DilBit and large FCC units to process SynBit. The uncertainty of diluent sourcing and the impact on bitumen blend quality make planning for new refinery projects difficult. The sulfur distribution varies due to diluent blending. Some of the bitumen blends from Athabasca and Peace River have high total acid numbers (TAN), so that refiners may require special metallurgy to process these blends.

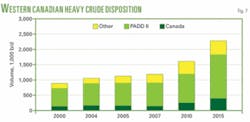

By far the largest market for Canadian heavy crudes has been the US Petroleum Administration for Defense District II (PADD II), including refineries near Minneapolis and Chicago and more recently Wood River, Ill. (Fig. 7). Other markets include Western Canada, Ontario, Montana, and California. Following completion of pipeline reversals in early 2006, Canadian heavy crude has been moving to Cushing and the US Gulf Coast.

Many refiners in the traditional market have large coking capacity (Fig. 8). With wide light-heavy crude price differentials and an expectation of more heavy crude supply, some refiners have announced plans to increase coking capacity at their refineries to use considerably more bitumen blends.

Some of the larger projects include WRB Refining (a ConocoPhillips-EnCana Corp. joint venture) at Wood River, BP PLC at Whiting, Ind., and Marathon at Detroit. Husky, a heavy oil producer, also purchased the Lima, Ohio, refinery and formed a joint venture with BP for the Toledo, Ohio, refinery.

These projects could add considerable capacity for heavy crude, so that the amount available for new markets will depend on Midwest refinery projects and bitumen production increases.

Potential new markets for bitumen blends include the US Gulf Coast, California, and Asia. The large Gulf Coast refining market uses more than 2.5 million b/d of heavy crude and companies have plans for more upgrading, but they also have concerns about heavy crude supplies from Venezuela and Mexico. To meet future demand, several pipeline proposals plan to deliver Canadian crudes to the Gulf Coast from Alberta via Chicago or Cushing.

California has experienced a decline in production of its heavy crude exceeding 100,000 b/d in 5 years, but imports have increased by more than 200,000 b/d, mostly from Latin America. Proposed pipeline expansions and new pipeline projects proposed from Alberta to the British Columbia coast would allow Canadian exports to California or Asia.

Bitumen blends are heavier than most crudes used in Northeast Asia. If Chinese companies participate in future oil sands production, however, they may also add heavy crude processing at their refineries.

Greenhouse gases

Oil sands crude faces a threat from the US market due to its greenhouse gas (GHG) footprint. The 2007 US Energy Independence and Security Act appears to restrict use of oil sands crudes by federal agencies that includes the US military. “Alternative or synthetic fuels including fuel produced from non-conventional petroleum resources” are restricted if the life cycle GHG emissions exceed those from using conventional fuels. The issue has had debate and lobbying and even short-term waivers, but uncertainty remains. Resolution ultimately may depend on the outcome of the 2008 US federal election. This may provide an impetus for a Canadian west coast pipeline to supply Asia.

California proposes to reduce GHG emissions after accounting for life-cycle generation including the upstream production. This would likely affect oil sands crude imports although they would compete with California heavy crudes produced with steam. Because California would use carbon trading, the penalties are uncertain. Several other states have adopted the California program but the US Environmental Protection Agency has disallowed the proposal. This issue is now in court, adding to the uncertainty.

Production of oil sands is energy intensive. Canada and Alberta also are moving to reduce GHGs long-term. Bitumen produced by in situ methods requires fuel for steam. Oil sands mining and extraction requires fuel for steam and power. Upgrading requires fuel and hydrogen feedstock.

The upgrading process falls between production and refining and is optional, so that GHG policies may inhibit upgrading in Alberta. On the other hand, some are promoting carbon capture and storage (CCS) for Alberta and this may reduce the GHG footprint. It may even allow or encourage gasification of coke or heavy oil for hydrogen and syngas because this would concentrate the CO2 by-product.

Future needs

The expected growth in bitumen and SCO production will require growth in markets either through expansion of traditional markets or access to new markets, as well as more pipeline capacity.

The availability of different crude types will depend on several factors. These include oil sands production, diluent sources and types, and upgrading capacity and technology.

Companies are modifying refineries in the traditional markets to handle more bitumen blends. The need for new markets will depend on the growth in bitumen supply. The US Gulf Coast market is of interest due to its large size and complexity. Other potential markets include the East Coast, West Coast, and Asia.

Refineries in the traditional markets do not appear to be planning for more SCO. If oil sands upgrading develops as forecast, companies will need access to new markets and pipelines.

The selection of markets and transportation costs will affect future prices of oil sands crudes.

The author

Thomas H. Wise ([email protected]) is a vice-president at Purvin & Gertz Inc. in Calgary. He has more than 27 years of consulting experience with refining and oil sands economics and market analysis, ranging from petroleum products to heavy crude oil. His work has involved strategic planning, competitive analysis, and business development for the petroleum upstream and downstream, as well as pipelines. He previously worked for Imperial Oil Ltd. and then Associated Kellogg in Canada. Wise has a degree in chemical engineering from Queen’s University at Kingston, Canada, and is a registered professional engineer.