Volatile VLCC rates lead tanker rebound

Tanker market earnings for the half-year ended March 2008 firmed by 14.1%, from the previous 6 months. Temporary increases in demand (driven by market trading) and decreases in supply (conversions) drove the increase in earnings. Clarkson Research Services Ltd. detailed the reasons behind these market movements and forecast future market directions in its Spring 2008 “Shipping Review and Outlook: A Half-Yearly Review of the Shipping Market.”

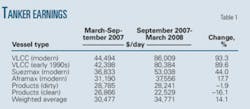

According to Clarkson data, the tanker market, consisting of both modern and early-1990s very large crude carriers (VLCCs), modern Suezmax, modern Aframax, and both dirty and clean products carriers, averaged $34,771/day in earnings from September 2007 to March 2008, a 14.1% increase from the $30,477/day seen March-September 2007.

A 93.3% increase in VLCC earnings, to $86,009/day, led the upward momentum, with clean-product tankers being the only segment experiencing more than a marginal drop in earnings from the previous 6 months, falling 16.1% to $22,529/day (Table 1).

Perhaps the most striking feature, according to Clarkson, was the speed with which VLCC rates increased in October-December 2007, peaking at more than $230,000/day for modern vessels, as compared to $25,000/day for spot VLCCs in October 2007 (OGJ, Feb. 4, 2008, p. 64).

Even with the easing in rates off those highs, Clarkson said, high scrap prices and phaseout requirements, combined with continued trade growth, offer the possibility of earning strength continuing, at least in the short term.

The oil tanker fleet grew to reach 385.9 million dwt by yearend 2007, an increase of 6.2%, with another 4.4% increase forecast for 2008. The active tanker fleet for vessels of more than 10,000 dwt increased by 147 ships over the 6 months ending Mar. 1, 2008; 187 vessels delivered against 21 vessels scrapped. With the current order book standing at 41% of the fleet (in deadweight), Clarkson sees a possibility that the fleet could become oversupplied.

This article details some of the other findings in a few of the numerous vessel categories covered twice each year by Clarkson in its Shipping Market Outlooks.

Market outlook

A combination of the usual seasonal surge in oil liftinglater than usual in 2007and the sudden exodus of single-hull tankers for conversion fueled strength in the tanker market, according to Clarkson. Clarkson said that spot earnings improved across all the major sectors, the average Suezmax spot rate increasing 269%.

Crude tankers of all categories gained ground against 10-year average spot rates over the 6 months. The spot rate for 30,000-dwt clean product tankers also increased to $22,520/day from $17,765/day in the preceding 6 months. Rates for a 1-year time-charter of the same vessel type, however, slipped 4%, to $22,000/day, according to Clarkson.

Ship values continued to increase, with the value of 5-year old VLCCs reaching $140 million from $130 million in September 2007.

Clarkson notes that conversions of single-hull tankers have helped offset deliveries of new vessels, at least in the larger sizes, but that underlying demand remains sluggish, predicting the fleet will grow by 4.4% during 2008. This growth could add to supply pressures if conversions falter, according to Clarkson.

VLCC

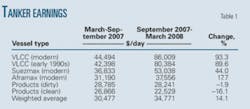

By Mar. 1, 2008, the VLCC fleet totaled 146.8 million dwt, down from 148.4 million dwt 6 months earlier due to conversion of single-hulled tankers to floating, production, storage, and offloading vessels and very large ore carriers. The fleet will total 147.1 million dwt by yearend 2008, as conversions continue to keep pace with deliveries, even as scrapping remains low (Fig. 1). Increased deliveries in 2009 will expand it to 158.7 million dwt.

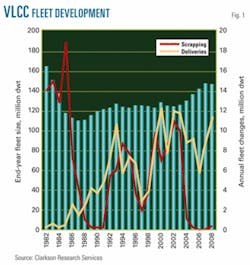

Clarkson described the VLCC sector as volatile for the 6 months ending Mar. 1, 2008, with spot earnings for a 1990s-build vessel starting at a 4-year low before reaching record highs in December. For the entire 6 months, spot earnings averaged $77,713/day, compared with $50,126/day for the same period 1 year earlier. This coincided with relatively flat fleet growth and a continued increase in asset values (Table 2).

By contrast, weakness continued in the time charter market, with 1-year rates for modern tonnage dropping to $43,317/day between September 2007 and March 2008 compared with $49,563/day for the same period a year earlier. Clarkson notes, however, that rates picked up as the spot market improved, ascribing the fall instead to the strength of 2006-07 market.

Clarkson sees upwards support for spot prices remaining in place for the balance of 2008, as the lack of fleet growth faces continued demand.

Suezmax

On Mar. 1, 2008, the Suezmax fleet totaled 54.8 million dwt, flat for the 6 months as conversions matched 1.3 million dwt of deliveries. A heavy delivery schedule, particularly in 2009, will see the fleet reach 62.4 million dwt by yearend, according to Clarkson.

Spot earnings for the 6 months ending Mar. 1, 2007, averaged $46,322/day, down only slightly from a year before despite reaching highs of more than $112,000 day at year-end 2007. Time-charter rates for 1 year on a modern vessel dropped 9.7% from the end of 2007, while 3-year rates fell 4.3% to $22,000/day.

Clarkson expects spot rates in the Suezmax sector to remain steady in the short term, bolstered by robust demand. In the medium term, however, rates may come under pressure as potential vessel oversupply emerges. The 2010 single-hull phase-out, however, could reduce the risk of oversupply, according to Clarkson.

Aframax

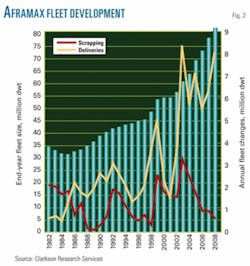

On Mar. 1, 2008, the Aframax fleet had increased to 76.9 million dwt. A heavy delivery schedule, only partially offset by demolitions and conversions, will grow the fleet to 83.1 million dwt by the end of 2008, according to Clarkson (Fig. 2).

Aframax earnings rose to $35,420/day during the 6 months ending Mar. 1, 2008, but were still down 17% from the year-earlier period. Time charter rates also slipped 12% from a year earlier, reaching $21,833/day for a 1-year term.

Clarkson sees the 40%-of-fleet order book in the Aframax sector as leading to the same potential medium-term oversupply of vessels expected in VLCC and Suezmax vessels, but notes that the 2010 phaseout of single-hulled vessels could provide some counteracting upward pressure in the future.

Products

Clarkson reports softer earnings in the products market during the 6 months ending Mar. 1, 2008. Spot earnings for clean-product tankers averaged $22,189/day, down from $27,961/day for the previous 6 months and $24,979/day for the year-earlier period. Clarkson ascribed the fall in earnings to a combination of charterers holding their positions and large product inventories, particularly of US gasoline, limiting immediate demand.

On Mar. 1, 2008, the 10,000-60,000 dwt product tanker market stood at 84.6 million dwt. With more than 10 million dwt/year expected to be delivered during the next 2 years and limited scrapping and conversions, Clarkson expects the fleet to reach 105.7 million dwt by the end of 2009.

Over the longer term, Clarkson expects tonne-mile growth to be stronger than in 2008, as both expansion of refinery capacity in the Far East and fleet expansion slow.

Chemical

Mar. 1, 2008, saw mixed spot freight rate movement from end-2007, according to Clarkson. Rates for 5,000 tonnes Rotterdam-Houston fell 7.3%, with Houston to Rotterdam for 5,000 tonnes rising 7.8%.

Persian Gulf-Mediterranean rates showed the sharpest increase, rising 25% (15,000 tonnes). Despite strength along some routes, however, Clarkson saw the entire segment as weakened by a softer dollar and elevated operating costs, particularly for crewing and bunkers.

As with the other tanker segments, Clarkson sees future fleet development in chemicals as hinging on the market’s ability to absorb a large orderbook (15.6 million dwt as of Mar. 2008), tempering this somewhat with expectation of a buoyant biofuels markets and expanded Middle East production.

LNG

Clarkson described the LNG segment as ready to accelerate, citing a number of final approvals in both liquefaction plants and receiving terminals expected over the next 12 months. In the first 2 months of 2008, six vessels totaling 1.15 million cu m were delivered to the fleet, the smallest measuring 147,200 cu m, creating a short-term capacity overhang and depressing charter rates accordingly. In total, 56 vessels are scheduled for delivery in the last 10 months of 2008, 44 in 2009, and 19 in 2010.

Prospects for major growth longer term, according to Clarkson, continue to depend on the success of Russian and Iranian development plans. Output at Shtokman could increase from an initial 2013 capacity of 23.7 billion cu m/year to 71 billion cu m/year in 2020, says Clarkson, also citing three large-scale projects in Iran.

A combination of project delays and on-schedule vessel delivery could, however, extend the current rate softness forward, according to Clarkson.