SPECIAL REPORT: Global processing capacity flat; US construction pace quickens

Global natural gas production growth in 2007 was flat, with decline in Western Europe and nearly invisible increases in Eastern Europe, the FSU, Africa, and countries of Asia-Pacific (OGJ, Mar. 10, 2008, p. 70).

Global natural gas processing capacity, therefore, had little incentive to increase. In the US, capacity crawled ahead at barely 1% growth and Canada was essentially flat. (Table 1). For the entire world, Middle East processing advanced by slightly more than 2%.

Worldwide, total natural gas processing capacity outside the US and Canada continued to outpace combined capacities in the world’s two largest gas processing countries, a trend that emerged in 2005. For 2007, gas-plant capacities in the US and Canada reached slightly less than 50% of world capacity. That trend was pushed by plants’ capacities in the US advancing by only 1.2%, while Canada’s plants increased capacities by only 0.2%.

Highlights

During 2007, natural gas production increased slightly in all the world’s regions except, as noted, in Western Europe, OGJ numbers show. The US led the growth by producing 2.2% more gas in 2007 than in 2006. But in aggregate, increases among the rest of the world’s regions were smaller than seen between 2004 and 2006 (OGJ, June 18, 2007, p. 50). The marginal advantage in gas processing capacity for regions outside the US and Canada continued in 2007, the third year in a row to show this imbalance.

Canadian NGL production advanced marginally last year, by less than 1%. Combined with production in the US, NGL output from the two countries’ gas plants staged a recovery from a declining trend by reaching 130.4 million gpd, comprising more than 44% of global NGL production last year. For 2006, the figure was 38.7% of world totals; for 2005, slightly more than 33%; for 2004, more than 34%; in 2003, more than 40%; and in 2002, 42%.

Middle East liquids production, however, continued to outrun not only the US but also any other single region. Persian Gulf countries, especially Iran, Saudi Arabia, Qatar, and the UAE have embarked on ambitious projects to produce feedstocks for local and export markets, especially petrochemicals production.

Rolling Mexican data into those for the US and Canada (removing Mexico for the exercise from the Latin America column) reveals that for 2007 North America held:

- Only 51.3% of the world’s capacity, the same as in 2006, down from barely 52% for 2005, from more than 53% for 2004, from 52% in 2003, and off from 54% in 2002.

- 44.4% of the world’s NGL production, from nearly 47% for 2006.

Canadian natural gas production fell off by 123 bcf (2%) from its rebound in 2006. Mexico’s production rose by more than 255 bcf over its 2006 output.

On Jan. 1, 2007, OGJ data show that US gas processing capacity stood at 71 bcfd, up from 70 bcfd for 2006; throughput in 2007 was essentially flat with that for 2006 and 2005, averaging a bit more than 45.5 MMcfd (about 64% utilization); and NGL production, nearly 76,230 gpd, compared with nearly 75,500 gpd for 2006 (Fig. 1).

Fig. 2 shows pricing differentials in the US between LPGthe most widely traded NGL on the world marketand crude oil for the first trading day of each month in 2007. With crude oil prices escalating sharply during the year, the chart nonetheless shows the historically normal relationship between LPG and crude oil continued throughout 2007. (An accompanying article, beginning on p. 58, discusses international trade in LPG.)

null

Sources

Oil & Gas Journal’s exclusive, plant-by-plant, worldwide gas processing survey and its international survey of petroleum-derived sulfur recovery provide industry activity figures.

Canadian data are based on information from Alberta’s Energy and Utilities Board that reflect actual figures for gas that moved through the province’s plants and are reported monthly to the EUB. For 2000 for the first time, OGJ took these data for all of Alberta and compiled annual figures and thereby created a new baseline for data comparisons thenceforth.

(Effective Jan. 1, 2008, the province realigned the EUB into two separate regulatory bodies: the Energy Resources Conservation Board (ERCB) to regulate the oil and gas industry and the Alberta Utilities Commission (AUC) to regulate the utilities industry.)

In addition to EUB figures for Alberta and to operator responses to its annual survey, OGJ has supplemented its Canadian data with information from the British Columbia Ministry of Employment & Investment’s Engineering and Operations Branch and the Saskatchewan Ministry of Energy & Mines.

As 2008 began, gas processing capacity outside Canada and the US stood at 112 bcfd, off from 126 bcfd for 2007; throughput outside Canada and the US for 2007 averaged only 77.8 bcfd, off from 80 bcfd in 2006 and more than 81 bcfd for 2005; and NGL production in 2007 outside the US and Canada averaged 163 million gpd, down from 170 million gpd in 2006 and well off 2005 production of more than 201 million gpd.

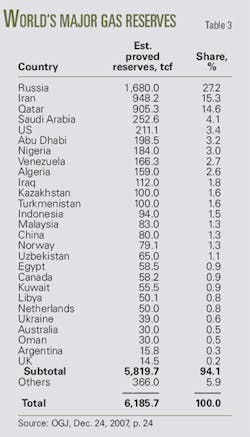

The current state of gas plant construction in the world appears in Table 2, based on OGJ’s worldwide construction surveys. Table 3 ranks the world’s major natural gas reserves by country at the start of 2008; Table 4, the world’s top natural gas producing countries for 2007; and Table 5, the world’s leading NGL producers.

Costs

No gas processorfor that matter, no oil and gas operatorneeded reminding last month that costs for expansions and new buildings were rising at a dizzying pace. But, that’s just what Cambridge, Mass.-based IHS/Cambridge Energy Research Associates did with two reports based on project costs for the preceding 6 months.

Issued simultaneously, the reportsone covering capital costs for building new upstream facilities (OGJOnline.com, May 19, 2008) and one covering capital costs for building downstream facilitieseach cited a 6% rise for the previous 6 months for building facilities. Midstream facilities fall into both categories, with a preponderance in the downstream group.

The upstream index has been tracking costs since 2000; its index of 210 points for early 2008 reflects an overall growth of 210%. That set a record for the years of coverage. The downstream index has been tracking since 2003; its index of 176 points for early 2008 reflects an overall growth of 176% in inception.

For operators, engineering and construction companies, and manufacturers, this is not news; it only makes concrete what all have been seeing in their daily businesses: It’s costing more and more to build anything.

Rising costs for raw materials, especially iron ore needed to produce steel, and transportation, mainly in rising fuel prices, are driving the increases.

“Specialized deepwater equipment that is required for the subsea, particularly umbilicals and control systems, shows the largest increase of any area on the index,” said the announcement. “Continued manufacturing constraints coupled with higher materials and labor costs” led to increases in upstream costs of 12% in the 6 months leading up to May 2008.

Downstream, a “high number of active projects” has driven the latest cost increases, according to CERA’s Jackie Forrest. CERA expects energy projects to “continue to move forward. Despite project delays owing to capital costs and record activity levels,” she said. The inventory of refining projects remains 20-30% higher than recorded in recent years.

Raw materials for steel, such as iron ore, she said have increased 65% just in 2008.

Activity

The relatively flat growth evident in global gas processing over recent years is coming to an end. The following reviews plans for projects announced in the last 15 months or so and reflects a surge of expansion and new buildings not seen in midstream for many years.

North America

In the Peace River Arch area of northeastern British Columbia, Spectra Energy Income Fund will add 30 MMcfd of sour-gas processing capacity to the West Doe plant, bringing the plant’s full processing capability to 53.5 MMcfd. The $41-million project includes 50% ownership in a 58-km, 8 and 10-in. gathering pipeline from the Sundown area in British Columbia. The increased capacity is due on stream in first-quarter 2009. The Sundown gathering pipeline began delivering to the existing West Doe plant this quarter.

In the US Gulf of Mexico in August 2007, Williams was expanding its deepwater gathering and processing infrastructure for production dedicated by units of Shell, Chevron, and BP in the Perdido foldbelt.

Williams has invested about $480 million in its Perdido Norte project, which the company will own and operate. Infrastructure investment, said the company, includes 184 miles of pipeline and expanded gas processing capacity.

The company began pipeline construction in early 2008 with pipelines and additional processing capacity to be ready to receive production by 2010.

Williams’s new infrastructure will originate at floating production the producers will construct in about 8,000 ft of water about 220 miles south of Galveston, Tex.

Great White, Silvertip, and Tobago fields are the sources of initial production. By design, said Williams, its facilities will be able to accommodate future production from other Perdido foldbelt prospects and from potential tie-ins along the new pipeline route.

Design includes 107 miles of natural gas gathering pipeline able to transport about 265 MMcfd of production. The pipeline will extend from producers’ floating production platform to Williams’s existing Seahawk gathering system. This system connects at Brazos Block 538 with a Williams Transco-operated pipeline that moves gas to the company’s Markham, Tex., processing plant.

To accommodate the new production, Williams also will increase capacity at Markham to more than 500 MMcfd from 300 MMcfd.

Elsewhere on the Gulf Coast at mid-2007, Enterprise Products Partners LP completed expanding NGL and LPG handling capacities at its import-export terminal on the Houston Ship Channel.

The expansion doubles unloading capacity to 480,000 b/d from 240,000 b/d and allows the flexibility to unload product from two vessels simultaneously or two separate products from the same vessel. In addition, the terminal’s maximum loading rate for exports increased 14% to 160,000 b/d from 140,000 b/d.

The nearly $60-million project included expanding capacity on pipelines that connect the terminal to the company’s fractionation and storage at Mont Belvieu, Tex.

To handle the additional volumes, Enterprise had already hiked Mont Belvieu’s capacity to fractionate butanes by 20,000 b/d. It now can separate up to 300,000 b/d of mixed imported and domestic butanes, as well as butanes from isomerization at Mont Belvieu.

Also at Mont Belvieu last year, Enterprise completed installation of its fourth propylene fractionator. The new unit allows the company to increase production of polymer-grade propylene there by 26%, to about 4.8 billion lb/year (73,000 b/d) from 3.8 billion lb/year. With the additional 1 billion lb, said the company, its Mont Belvieu facility accounts for more than 19% of US polymer-grade propylene manufacturing capacity.

Complementing the fractionation facilities is a network of pipelines that gathers product for delivery to Mont Belvieu and transports fractionated products to refiners and petrochemical manufacturers for use as feedstocks, in addition to providing access to storage facilities. As part of the plan to expand the capabilities of these facilities, Enterprise in late 2007 expanded its 48-mile refinery-grade propylene pipeline between Texas City, Tex., and Mont Belvieu to move refinery-grade propylene from the Texas City area. Enterprise also completed connecting a Beaumont-Port Arthur, Tex., refinery to the company’s propylene fractionation and storage at Mont Belvieu via its 66-mile, 8-in. pipeline.

Earlier this year, Enterprise connected the pipeline to a second Beaumont-Port Arthur refinery, adding 50,000 b/d of gathering capacity into Mont Belvieu.

Further ashore late last year, Madisonville Gas Processing LP started up a gas-treatment plant expansion at Madisonville field in Madison County, 100 miles north of Houston, to handle sour gas from the Cretaceous Rodessa formation at 12,000 ft.

The expansion takes up to 50 MMcfd, according to GeoPetro Resources Co., San Francisco. MGP purchased the field’s existing 18-MMcfd treatment plant from Hanover Compression LP in July 2005.

In East Texas, PVR Midstream, a unit of PennVirginia Resource, has just completed the 80-MMcfd Crossroads natural gas processing plant. The plant can operate in high ethane-recovery mode or in ethane-rejection mode and has instrumentation allowing for unattended operation 16 hr/day.

Gas on the Crossroads system will originate from Bethany field, Panola County. PVR expected average gas quality on the system to be 3.1 gal/Mcf (GPM). The Crossroads system delivers residue gas from the plant into the CenterPoint Energy pipeline for sale or transportation to market. Produced NGLs will be delivered into Panola pipeline for transportation to Mont Belvieu for fractionation.

In April, Crosstex Energy LP announced plans to build an $80-million gas plant in the Barnett Shale region of North Texas. The Bear Creek plant, which will be in operation in third-quarter 2009, will have inlet capacity of 200 MMcfd and increase the company’s total processing capacity in the Barnett Shale to 485 MMcfd.

Bear Creek will sit in Hood County, near Crosstex’s other midstream assets. Its construction closely follows completion last year of the Silver Creek plant.

Crosstex currently operates three gas plants in the Barnett Shale with a total capacity of 285 MMcfd: the 50-MMcfd Azle plant in Azle, Tex.; the 50-MMcfd Goforth plant in Parker County; and the 200-MMcfd Silver Creek plant, also in Parker County. Bear Creek will be a sister plant to Silver Creek.

Also last year in North Texas, Enbridge Energy Partners LP expanded natural gas processing capacity through the $93 million project that added 35 MMcfd of capacity at Weatherford Plant II and 40 MMcfd of capacity at Weatherford Plant III. These plants increased Enbridge’s aggregate processing capacity to 1.2 bcfd.

Later in the year out in West Texas, Enterprise completed its new Hobbs NGL fractionator in Gaines County (OGJ, June 18, 2007, p. 50). The plant can separate up to 75,000 b/d of ethane, propane, isobutane, normal butane, and natural gasoline.

Located at the interconnection of Mid-America Pipeline and Seminole Pipeline systems, the fractionator can supply the NGL hub at Mont Belvieu. The Hobbs fractionator will also be able to export to northern Mexico through existing pipelines.

Out west in Wyoming last year, in a joint venture with TEPPCO Partners LP, Enterprise completed the first part of a two-phase expansion of the Jonah natural gas gathering system that serves Jonah and Pinedale fields in the Greater Green River basin of southwestern Wyoming (OGJ, May 5, 2008, p. 74). The additional compression increased system capacity to 2 bcfd and will reach 2.3 bcfd following completion of the second phase this summer. In anticipation of the additional volumes, Enterprise built a new cryogenic processing plant at Opal, Wyo.

Elsewhere in the Piceance basin, Enterprise in October completed the first phase of its Meeker cryogenic natural gas processing plant in northeastern Colorado; second phase will be completed in third-quarter 2008 (OGJ Online, May 21, 2008).

The new Hobbs fractionator in West Texas can accommodate NGLs recovered by Meeker, which will move south along the Rocky Mountain segment of the MAPL system. To handle the increased volume demands, the company has expanded this portion of the MAPL system to provide 50,000 b/d more capacity for NGLs. In all, Enterprise says it has dedicated more than $1.9 billion over 2 years for projects and acquisitions as part of its Rockies program.

Phase I of Enterprise’s Meeker processing complex is designed to process up to 750 MMcfd of natural gas and be able to extract as much as 35,000 b/d of NGLs. Phase II, which will double capacity of the facility to 1.5 bcfd and 70,000 b/d of NGLs, will begin operations this summer.

In Wyoming in February 2008, Enterprise Products Partners LP started up its 750-MMcfd Pioneer natural gas processing plant in Sublette County, Wyo., processing gas from the Jonah gathering system and extracting about 25,000 b/d of NGLs.

The company has maintained operations of the adjacent silica gel processing plant as a backup to provide producers with additional assurance of the company’s processing capability at Pioneer.

That capability was tested in late March by a fire that shut down Pioneer for several weeks; natural gas was diverted to the silica gel plant during the period. Enterprise was able to restart Pioneer on Apr. 24. Processing at that time reached nearly 560 MMcfd with extraction of about 20,000 b/d of NGLs.

Also late last year in the Piceance basin in northwest Colorado, an Enterprise affiliate signed a long-term contract with Marathon Oil Co. to provide a range of midstream services, including natural gas gathering, compression, treating, and processing, for Marathon’s natural gas production.

Under the contract, Enterprise Gas Processing LLC built about 50 miles of new gathering lines to connect Marathon’s multiwell drilling sites, production from which is to peak at about 180 MMcfd, to Enterprise Partnership’s 48-mile, 36-in. Piceance Creek gathering system. From there, the natural gas moves to the Meeker processing complex, described earlier, the first phase of which was placed in service in fourth-quarter 2007.

Also in late 2007 and in Utah, Anadarko Petroleum Corp.’s midstream unit started up the 250-MMcfd Chapeta gas processing plant west of Bonanza in giant Natural Buttes gas field in Uintah County. A lateral now transports liquids that the new refrigeration plant extracts from the field’s gas to the Mapco NGL pipeline in western Colorado for shipment to Mont Belvieu for fractionation.

Anadarko has diverted to the Chapeta plant about 200 MMcfd from the Uinta basin that was being delivered into various dewpoint-control plants operated by others. The company is currently expanding Chapeta to 500 MMcfd with a planned start-up for first-quarter 2009. Upon completion, the plant could be further expanded to 750 MMcfd.

Processed gas from Chapeta moves through the 400-MMcfd Kanda lateral, operated by El Paso Western Pipelines and owned by Wyoming Interstate Co., to the Colorado Interstate Gas mainline for transport out of the Rockies, Anadarko said.

Europe and elsewhere

In mid-2007, Phoenix Park Gas Processor Ltd. hired Black & Veatch to build a new butanes fractionator at the company’s Port Lisas natural gas processing and NGL fractionation site in Trinidad.

Upon completion, the fractionator will produce 3,500 b/d of isobutane, which will flow to a nearby 165,000-b/d refinery for use in a new alkylation unit to enhance gasoline production. The butanes fractionator project is set to start up later this summer.

In the Middle East, the Ebla gas project in Syria, being developed by Petro-Canada Palmyra BV, will include multiple well sites, flowlines, a gas gathering station, an 88 MMscfd gas-treatment plant, and an 88-km, 16-in. trunkline.

Upon completion by August 2010, development will include two fields, Ash Shaer and Cherrife, in central Syria, northwest of Palmyra. The new gas-treatment plant will sit next to another plant already under construction for the Syrian Gas Corp. as part of the SMAG project. Some utilities and services will be shared between the two plants.

At the field, the gas gathering station will separate water for reinjection, and the gas will be dehydrated for pipeline transportation to the treatment plant.

The plant will extract LPG from the feed gas for road tanker transport and produce export-specification sales gas and condensate using a turboexpander and liquids fractionation process.

Five gas well sites and three oil well sites are initially planned for Ash Shaer field with one gas well site planed for Cherrife field.

In the Persian Gulf, Bahrain National Gas Co. last year hired Foster Wheeler Ltd. to conduct a pre-front end engineering design for revamp and expansion of the Banagas LPG plant in Bahrain. The expansion will accommodate gas throughput up to 530 MMscfd by 2020. Design for the expanded plant will include high-yield LPG recovery units.

Also last year, Saudi Aramco hired Foster Wheeler for FEED and program management services for the Karan onshore gas processing facilities at Khursaniyah. The facilities will process 1 bcfd of gas from Karan offshore gas field, which is being developed to come on stream in 2011.

The new onshore facilities will deliver sales gas to meet growing Saudi demand. In addition, a small portion of the sales gas will be used for plant fuel and 640 tonnes/day of sulfur will be produced. Facilities will consist of gas processing trains for acid-gas removal, dehydration, and sulfur recovery, and substations and all associated utilities and infrastructure.

The project is part of the kingdom’s Master Gas System to provide fuel and feedstock to its petrochemical industries.

In Africa, Dana Gas PJSC’s Bahraini affiliate Danagaz Bahrain is building and will own and operate by late 2009 the Gulf of Suez gas liquids plant in Egypt. The 150-MMcfd plant, to be built near Ras Shukheir on the western shore of the gulf, will produce 120,000 tonnes/year of propane and butane.

Egyptian General Petroleum Corp. will supply gas for the plant under a long-term supply contract. The plant will recover 99% of the propane in the gas stream and 100% of the butane, said the company.

The composition of the feed gas will permit production of 110,000 tonnes/year of exportable international specification propane, which will represent about 90% of the total NGL product from the plant. The butane produced, about 10,000 tonnes/year, will be sold on long-term contracts to help meet Egypt’s domestic requirements.

Danagaz Bahrain is owned 66% by Dana Gas and 34% by Bahraini partners (OGJ Online, July 23, 2007).

Sulfur production

A seemingly inexorable slide in worldwide refining and natural gas processing’s production of petroleum-derived sulfur continued in 2007, to 82.7 million tonnes/day from 84.2 million tpd in 2006, and from slightly less than 85 million tpd in 2005. Capacity increased slightly to 178.8 million tpd, from 178.5 million tpd in 2006, and from slightly more than 178 million tpd in 2005.

Canada and the US continued to dominate last year with 46.9% of processing capacity, exactly even with its share for 2006, a slip from 47% in 2005. The two countries’ share of actual production rose in 2007, to 49.7% from 48.6% in 2006 and 49% for 2005.

In 2007, Canada produced barely more than 23.2 million tpd, down from 23.3 million tpd in 2006 and 23.4 million tpd in 2005. US production in 2007 advanced, to 17.8 million tpd from more than 17.6 million tpd in 2006 but down from more than 18.5 tpd in 2005.

Canada continued to account for less than 24% of the overall total capacity, level with 2006, and more than 28% of production last year, ahead of 27.6% for 2006 and 27.5% in 2005.

OGJ subscribers can download, free of charge, the 2008 Worldwide Gas Processing Survey and the 2008 World Sulfur Production Survey tables or at www.ogjonline.com: Click on Resource Center, Surveys, OGJ Subscriber Surveys, then Worldwide Gas Processing, and choose from the list below June 23, 2008. To purchase spreadsheets of the survey data, please go to http://www.ogj.com/resourcecenter/orc_survey.cfm or email [email protected].