Ethanol from wood waste an opportunity for refiners

A recent prefeasibility study explored wood waste-to-ethanol as a significant, ready source of second-generation biofuels, as well as the opportunities for refiners and marketers to participate with pulp and paper mills in these biofuels projects.

The material presented in this article derives from a prefeasibility study recently completed for owners of a pulp and paper mill. These are the major conclusions reached in that study:

- Cellulosic ethanol plants currently being built are technically and economically viable.

- Partial integration of the proposed cellulosic ethanol plant with the pulp and paper mill was technically feasible.

- The proposed integration should offer synergies that would reduce ethanol production costs while providing project owners a valuable new product stream.

- Oil industry participation in projects of this type should offer refiners opportunities for a stable ethanol supply and ethanol price certainty while earning a high return on investment.

- The proposed cellulosic ethanol plant in Southeast US should compete in the growing market for ethanol in the Mid-Atlantic and Northeast US.

The study presented many arguments for considering partial integration of cellulosic ethanol plants with pulp and paper mills, 10 of which are listed in this article:

- Continued increasing demand for ethanol and higher ethanol prices are expected.

- An adequate supply of wood waste exists and can be used for making ethanol.

- Cellulosic ethanol offers advantages over corn ethanol and other second-generation biofuels.

- Viable cellulosic ethanol technologies exist and will shortly be available on a commercial scale.

- Significant synergies exist with partial integration.

- New government support is now becoming available for cellulosic biofuels projects.

- There are inherent advantages in the use of wood waste to produce biofuels.

- Mills now have new opportunities for obtaining a much-needed value stream.

- Leading companies in the paper industry are already undertaking biofuels initiatives.

- The prefeasibility study findings are positive.

This article also presents advantages for oil companies to form joint ventures with paper mills in cellulosic ethanol plant projects. The three main arguments for oil industry participation in cellulosic ethanol plant joint ventures are:

- Investment required to fund cellulosic ethanol plants is significant; pulp and paper mill owners will often need equity partners.

- Petroleum refiners make good affinity partners because they have experience in liquid fuels technologies; refining process operations; and handling, storage, and distribution of fuels.

- Petroleum products marketers make good affinity partners because they have an immediate and ongoing need for ethanol, they have the infrastructure for blending and distributing 10 vol % ethanol (E10) gasoline, and are in a better position to market and distribute more advanced second-generation biofuels, if and when they are produced.

Ethanol mandate

The Energy Independence and Security Act of 2007, Renewable Fuels Standards mandates production of 36 billion gal/year of renewable fuels by 2022.

A recent article (OGJ, Mar. 17, 2008, p. 24) concluded that this mandate would not be met. The article discussed many obstacles that would more than likely “bedevil” attainment of the mandate; it cites, in particular, the 21-billion gal/year of cellulosic biofuels that will be required. It also pointed out that wood waste could be a significant untapped source of second-generation biofuels raw material.

Continued increased demand

Demand for ethanol will continue to increase due to:

- Population and vehicle fleet growth.

- Regulations designed to reduce harmful emissions, including requirements for reformulated gasoline (RFG).

- A shortage in refining capacity to make oxygenates used in RFG.

- Environmental legislation mandating a phaseout of methyl tertiary butyl ether.

- Expected demand for vehicles with dual-fuel capability that could increase demand for more bio-ethanol sold as 85 vol % ethanol (E85) gasoline blends.

Ethanol prices will increase concurrently with rising crude and gasoline prices. Ethanol rack prices are currently averaging $2.33/gal; the 51¢/gal blenders’ credit and hedging is maintaining ethanol’s price parity with gasoline in E10 blends. Even if the 51¢/gal subsidy is phased out, gasoline prices would still increase and ethanol prices would still maintain price parity with gasoline.

Accordingly, with continued increased demand for ethanol and expected higher prices, producers of cellulosic ethanol should be able to sell everything they can produce at prices that well exceed their costs.

Recent studies state that cellulosic ethanol will be cheaper to produce than corn ethanol due in part to the inflationary effect that increased corn ethanol production is having on corn prices, on the lower cost of bio-waste, and on lower cellulosic ethanol processing costs as more commercial-sized plants come on stream.

Supply of wood waste

Most of the 50 pulp and paper mills in the US use wood waste to supplement natural gas or coal used to fuel their boilers. They could easily divert this wood waste to make a high-value product such as ethanol. Many of these mills have local access to abundant untapped sources of wood waste that could be used to produce cellulosic biofuels.

These mills also have the infrastructure needed for on site preprocessing, storage, and handling of wood waste. All are in a position to provide supplies of wood chips and wood waste that a cellulosic ethanol plant may need, assuming the cellulosic ethanol plant is situated near each mill.

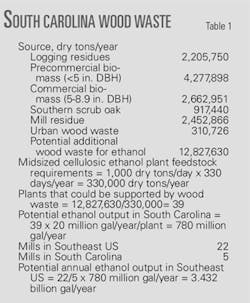

Based on a recent study of woodland areas of a typical pulp and paper producing state in the US Southeast, we determined that significant amounts of cellulosic waste could be recovered each year from forest residues left behind by logging operations and from wastes deposited in urban landfills

The study suggested that, if all of these forestry wastes, mill wastes, and cellulosic wastes taken to landfills were recovered as a new source of feedstock for cellulosic ethanol plants, there would be enough additional wood waste in the US Southeast to support 172 new 20-million-gal/year ethanol plants. These could produce 3.432 billion gal/year of cellulosic ethanol (Table 1). This is quite an untapped potential.

Cellulosic ethanol advantages

Cellulosic ethanol will be needed in the next few years to supplement corn ethanol.

Unlike other renewable biofuels such as methanol, butanol, and di-methyl ether (DME), cellulosic ethanol already has a ready market as a blending ingredient in E10 gasoline.

What’s wrong with corn ethanol?

According to US Department of Energy projections, the US cannot rely only on corn ethanol or ethanol imports. Although corn ethanol satisfies 99% of current ethanol demand, projected increases in corn ethanol will not be enough to meet projected US biofuels needs.

In 10 years, corn ethanol will meet only 62.5% of these needs; in 15 years, only 41.7%. The remainder will have to come from imports and cellulosic biofuels.

Ethanol imports, however, cannot satisfy the shortfall either. Ethanol imports primarily consist of sugar-based ethanol from Brazil. Due to the fragmentation of Brazilian ethanol producers and sugar growers, however, it is already more difficult and costly to increase these imports. Clearly, there will be a significant need for cellulosic ethanol produced in the US. The DOE expects that, in 15 years, 16 billion gal/year of cellulosic ethanol will be needed.

Another problem with corn ethanol is that it is quickly becoming uneconomic. Corn prices will continue to increase, which will have a widespread inflationary effect on corn ethanol; corn already accounts for 55% of the cost of producing corn ethanol. At best, producing ethanol from corn is only marginally energy efficient.

Conversely, studies show that cellulosic ethanol costs 25% less to produce than corn ethanol, cellulosic ethanol plants offer higher energy gains, and most biowaste feedstocks are 50% cheaper than corn.

In addition, corn ethanol is becoming politically unsustainable. Inefficiencies in conversion of corn to fuel have already upset other markets. The widespread use of corn to produce ethanol has pushed up food prices and ethanol subsidies have again become a political issue. Furthermore, processes used to produce corn ethanol consume significant amounts of water and, in many water short corn-producing areas, new corn ethanol plants are no longer welcome because the public views them as having an adverse environmental impact.

Why not produce other advanced biofuels?

Cellulosic ethanol has two primary advantages over other advanced cellulosic biofuels such as methanol, butanol, and DME.

First, there is an immediate and growing market for ethanol; increased demand for E10 will continue with rising demand for gasoline. Second, no additional investment is needed for marketing or distributioneven though other biofuels have higher carbon content and produce more power than ethanol, they will require capital investment in separate storage, transportation, and delivery infrastructure.

In addition, added investment will be required for supporting marketing efforts needed to obtain consumer acceptance of advanced cellulosic biofuels. Additional investment will be needed for making engine modifications and for subsidies to keep advanced cellulosic biofuels prices competitive with E10 gasoline. More importantly, there is an increasing short-term demand for E10.

Are there better profit opportunities in making cellulosic ethanol?

Production and sale of cellulosic ethanol offers great potential profit opportunities. Ethanol prices are high and are rising because they track gasoline prices and not prices paid for feedstock or cost of producing ethanol. The margins ethanol producers are earning are therefore reduced by the prices paid for corn by food and animal-feed producers.

In contrast, cellulosic ethanol margins will be higher and less volatile than corn ethanol margins. First, cellulosic ethanol yields are improving due to technology advancements. Second, the revenues for biowastes converted into cellulosic ethanol are substantially higher than revenues from converting the same biowaste into fuel, fertilizer, or animal feed.

Cellulosic ethanol margins could still vary, depending on the cost of the biowaste used, the ethanol yield from various biowastes, and the process used to convert biowaste into ethanol.

Viable technologies exist

Cellulosic ethanol technologies have advanced to the point where many are nearing commercial viability and are available through a few existing technology providers. Two basic technologies are effective in converting cellulosic material into renewable liquid transportation fuels.

The first is “two-staged thermal with gasification”; the other is “two-staged concentrated acid hydrolysis.” There are many variants for each technology.

In the two-stage thermal with gasification process, devolatization of the wood waste occurs with controlled high temperature and pressure in a partial steam-reforming gasifier. Syngas is then catalytically converted into alcohols in distillation towers, using the entire waste stream to produce a high yield of biofuels, little waste, and low levels of greenhouse gases. This process also has a favorable (3:1) energy-balance ratio.

The two-stage concentrated acid hydrolysis process is designed specifically to convert cellulosic feedstock into ethanol. One version of this process was perfected on a commercial scale and is patented under the name Arkenol. This process can separate cellulosic wastes into sugar-bearing and nonsugar-bearing components to extract the sugars and obtain ethanol using fermentation.

The Arkenol process is most efficient when the cellulose content of the cellulosic material is at least 75%, allowing for a high recovery of the sugar-bearing cellulose and hemicellulose components, leaving behind less nonsugar-bearing lignin. This technology is proven and has been used in making ethanol from municipal solid waste, agricultural waste, and, on a limited scale, wood waste. Better enzymes are now being developed to improve the sugar fermentation process and increase ethanol yield.

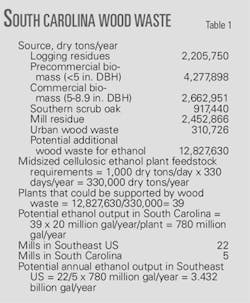

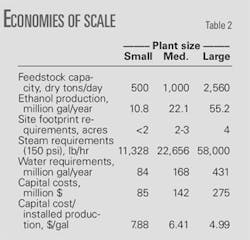

In addition, there appears to be significant economies of scale associated with Arkenol processes (Table 2). Our feasibility study findings showed that the most economical partially integrated Arkenol plant would be medium sized because the feedstock requirement could be met using 100% wood waste (Table 3).

Partial-integration synergies

Our prefeasibility study showed that partial integration could reduce the direct cost of producing ethanol by about 8¢/gal. These direct cost savings are attributable to:

- Using the mill’s infrastructure to procure pulping wood and wood waste, to preprocess it into chips, and to store and handle it before processing.

- Using the mill’s procurement department to obtain and an additional wood waste stream at a lower cost.

- Using an ethanol plant site that was provided to plant operators on a rent-free basis by the mills’ owners.

- Obtaining environmental permitting through the mill owners at no cost.

- Using other mill infrastructure, such as storage areas for liquid and dry bulk, rail sidings, and port access, at no cost.

- Accessing and using mill waste-treatment facilities without cost.

- Low-cost electric power provided from the mill’s cogeneration facilities.

- Using the mill’s excess steam at no cost.

The partial-integration scheme required mill owners to provide a limited up-front investment of about $1 million, and ongoing partial integration support at a low cost or no cost for at least 5 years. This partial-integration support was worth $2.1 million/year for a midsized plant and was capitalized over 5 years, giving mill owners a 27% equity interest in the project.

The prefeasibility study indicated that a value stream from a mid-sized plant would substantially supplement mill earnings, allowing mill owners to recover $2/year for every $1 invested (Table 3).

New government support

The DOE’s Renewable Fuels Loan Guarantee Program offers low-cost federal loans, coguaranteed by DOE, to developers of cellulosic ethanol plants. Eligible borrowers can borrow up to $250 million for each qualified “Renewable Fuel Facility.”

The project must however also use “new or significantly improved technology,” and the project design must be “validated through operation of a continuous process pilot facility with annual output of at least 50,000 gal of ethanol (or other advanced biofuels).”

Assuming that the mill owner and other equity partners in a joint venture could qualify as eligible borrowers, a project involving the partial integration of a pulp and paper mill to a cellulosic ethanol plant would qualify for DOE loan guarantees, because such a project would offer a significant improvement in technology.

Those participating in partially integrated ethanol plants are eligible for Section 126 grants. These grants are available to project contractors for equipment used in gathering, preprocessing, and transporting biomass to cellulosic ethanol plants. The grant should help offset added costs of obtaining forest residue and other wood wastes that are often too costly to gather, separate, clean, and grind for delivery to the mill as an auxiliary boiler fuel. With such grants, such wood waste could be specifically obtained as an economic feedstock.

Advantages of wood waste

The best immediately available feedstock for producing cellulosic ethanol is wood waste and wood chips, not municipal solid waste (MSW) or agricultural waste. MSW has its own set of problemsone is the assumption that cellulosic ethanol plants can obtain MSW from landfill operators at no cost.

Cellulosic ethanol plant operators often have to pay for presorting and preprocessing before the MSW can be used as a feedstock. Furthermore, the cellulosic content of MSW is not always uniform, nor are continuous supplies guaranteed, which could create operating problems.

Likewise, although agriwaste is a good source of cellulosic material, it also has problems. First, outside of the Corn Belt, only a few cellulosic ethanol plants are being designed to use these materials because collection, storage, and preprocessing is costly.

Agriwastes are more costly if they have to be gathered and transported over long distances to an ethanol plant. There is a lack of infrastructure for efficiently collecting and processing large quantities of wheat straw, switch grass, and rice straw, so that they can be efficiently transported in sufficient quantities to cellulosic ethanol plants. Furthermore, much of this agriwaste is now used in farming as a natural fertilizer, or as an animal feed, making its availability sometimes limited and more expensive.

Conversely, there is an abundant supply of wood waste to exploit; pulp and paper mills are already set up to acquire additional supplies of wood waste. These waste materials are logging residue, such as treetops, thinnings (precommercial biomass), as well as sawmill and lumberyard wastes; they can supply “resident” cellulosic ethanol plants with their cellulosic feedstock requirements (Table 1).

Because they represent materials that mills do not currently use, their acquisition should not push up prices mills pay for their wood basket.

New value stream

Participation in cellulosic ethanol projects by the US paper industry may be critical to survival of many of their pulp and paper mills, particularly those that face direct competition from paper product imports. This has increased the volatility and erosion of profit margins earned by many US pulp and paper manufacturers.

There are only a few ways to stop this erosion. Mill owners must keep their pulping and paper manufacturing processes going because it is much more costly to shut down than it is to build up inventories, or liquidate excess inventory at discounts. Mills that shut down also run the risk of losing reliable supplies of pulpwood and they may have to buy their way back into the wood supply chain when supplies are again needed.

Curtailment in pulping and papermaking is not a good short-term option. Increasing pulping and paper-making capacity to meet short-term pulp and paper demand will not work either, because this is a longer-term option.

Our prefeasibility study showed that earnings and cash flows that a mill can earn by participating in a resident cellulosic ethanol plant, would go a long way to offset erosion in profit margins in cyclical downturns and will significantly improve profits when margins from mill operations are at sustainable levels (Table 3).

Paper company initiatives

Many major paper companies have initiated programs to make biofuels from wood waste. Several paper companies are developing the capability to make cellulosic ethanol and view such participation as an immediate business opportunity. They are willing to bet that available technology is commercially viable.

There are some who are taking a longer-term view and are not starting cellulosic ethanol projects. Instead, they are investing in research and development, often in joint-venture partnerships with major energy companies, to develop technologies to make a wide range of advanced biofuels.

There are other mill owners that are still taking a wait-and-see approach because they are uncertain if they have mills that could host resident biofuels plants. And there are those that are still uncertain as to the future of biofuels and their ability to participate successfully in producing and marketing biofuels.

Prefeasibility study findings

We conducted our prefeasibility study at the request of a struggling pulp and paper mill. The mill manager was specifically interested in determining whether significant additional cash flows could be generated through partial integration of the mill to a resident cellulosic ethanol plant. The prefeasibility study findings identified significant additional cash flows.

We expected favorable study results for the proposed project because:

- The mill was near a port with rail access and close to abundant untapped supplies of wood waste.

- The proposed resident plant was strategically located to serve Petroleum Administration for Defense District (PADD) 1 markets.

- The mill site was big enough to accommodate the ethanol plant.

- Mill owners agreed to provide timely environmental permitting.

- Mill engineers validated the fact that there was enough excess boiler capacity to supply steam to the ethanol plant at a low cost.

- Mill owners agreed to provide the ethanol plant with waste treatment, water, and cogenerated power needs at little or no cost.

Furthermore, the mill’s wood-procurement department confirmed that they could deliver at least 1,000 dry tons/day of preprocessed wood waste to the ethanol plant at a low cost, while providing storage and handling. Mill owners were also willing to consider a $1 million investment in infrastructure upgrades to provide partial-integration support during a 5-year period valued at $10.4 million, in return for 27% equity in the ethanol plant.

Mill owners were also willing to coguarantee ethanol plant debt, or provide direct debt financing, if needed. The major conclusion of the prefeasibility study was that the proposed resident cellulosic ethanol plant would be economically viable based on expectations that ethanol prices would be high enough, the demand for ethanol strong enough, and the costs in making ethanol low enough to assure high earnings, cash flows, and return on invested capital (Table 3).

Oil industry participation

A medium (1,000 dry tons/day) cellulosic ethanol plant based on Arkenol technology can produce 22.1 million gal/year of ethanol and costs about $142 million, or $6.41/gal. Assuming 70% debt financing, $42.5 million in equity financing is needed.

If the mill agreed to acquire 27% of the equity in the project for $11.5 million, given the proposed partial-integration scheme used in the study, only $1.1 million is left as a direct investment and the rest is contributed as the value for partial-integration support during the first 5 years.

In this case, the host mill would have to seek a partner willing to contribute the remaining $31 million for a 73% interest in the plant. Most mills are not in a position to make large cash investments in facilities that are not part of their core business (Tables 2 and 3).

Clearly, if the partial-integration approach to developing cellulosic biofuels plants is exploited to its fullest, many affinity investors in cellulosic ethanol plants will be needed. In particular, refiners and marketers should make good affinity investors because they have experience in liquid fuels technologies and in refining process operations. Their personnel already possess the skills needed to operate processes similar to those used for cellulosic ethanol.

Refinery workers are trained in quality-control procedures and in storage, transportation, and blending operations. With respect to producing advanced cellulosic biofuels, the technology is similar to those in petroleum refining, and that knowledge can be used if cellulosic ethanol plants are to be upgraded to produce synthetic motor fuels such as DME.

Refined products marketers that are not refiners would also make ideal affinity investors because they have an immediate and ongoing need for ethanol and have the infrastructure for blending and distributing E10 gasoline. They are often in a better position to market and distribute more advanced second-generation biofuels, if and when they are produced.

When refiners and marketers partner with owners of a pulp and paper mill in projects of this type, the combined attributes of these partners reduces each participant’s equity requirements, increases return on investment potential, and spreads project risk.

Such partnerships can also be profitable. In our prefeasibility study, we determined that the direct cost to produce ethanol was less than $1/gal and that after-tax income could be more than 50¢/gal. The project would also generate more than $24 million/year in cash flow on a revenue stream of $50 million.

The affinity investor’s 73% share of cash flow is more than $18 million/year, resulting in an average return on its $31 million equity of 58%/year. Participating in such a project could benefit refiners and marketers of ethanol blends. And resale of other second-generation biofuels may offer even more promising returns (Table 3).

The author

Tim Sklar ([email protected]) is president of Sklar & Associates, Murrells Inlet, SC, a consulting firm specializing in biofuels project development. He has experience in business turnarounds and operational management and restructuring for PriceWaterhouseCoopers and KPMG. Sklar also served as CFO for GFC Inc. He has held positions in the federal government as research director. His energy project experience includes petroleum refineries, power plants, power distribution systems, hybrid remote power generation systems, integrated oil seed crushing-biodiesel processing plants, and integrated pulp mill-cellulosic ethanol processing plants.He holds a BS in accounting and a BA in english from Temple University, Philadelphia.