‘Design-build’ method useful for refinery project execution

Refiners can execute many projects at a lower cost and in less time using a “design-build” approach that bypasses the front-end engineering and design (FEED) package.

Refinery managers should take a fresh look at how they evaluate and execute new projects due to dramatic increases in operating margins and asset values of refining companies. The current economic environment requires refiners to rethink the traditional approach of evaluating and executing projects.

Refiners should expend much more effort in the initial stages of project development to ensure they select the best project for execution. Those projects selected for execution should either strategically fit the refiner’s core business or meet a higher selection standard than the customary standard used for projects that are a strategic fit.

We believe current industry practices regarding development and execution of projects rose from leaner times and are no longer the “blueprint” for future projects.

Background

During the past 20 years, refiners have approached projects, for the most part, in a singular manner. Refinery or corporate staffs defined the basic process facilities to be added. They then contracted with an engineering firm to develop a FEED package from which bids were obtained from engineering, procurement, and construction (EPC) contractors. A definitive cost estimate was then prepared and the project was either approved, canceled, or placed on hold.

In most cases in which the project went forward, the refiner used a rather extensive project-controls mechanism to track project cost even when lump sum, turnkey (LSTK) contracts were in place with the EPC contractors.

The significant time and engineering resources used to ensure that the project was executed according to the FEED package and within the predicted cost was deemed necessary due to the economic environment during the 1990s.

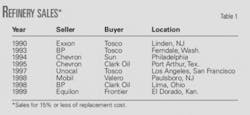

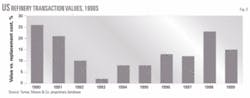

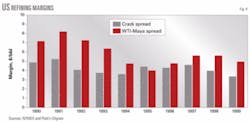

In the 1990s, refined product supply exceeded demand, which led to underutilized refinery capacity (Fig. 1) and relatively low volumes of long-haul imports (Fig. 2) from export refineries not specifically targeted for the US. Refining margins were narrow during this period. Wall Street held a dim view of the refining business and many integrated companies were selling their domestic refineries for cents on the dollar (Table 1).

The percentage of a refinery’s replacement cost to the seller of an existing facility was extremely low (Fig. 3); therefore, any new capital expended on refineries instantly depreciated by as much as 70-90%.

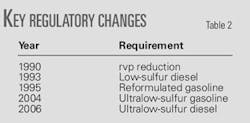

Most capital projects executed during this period were to satisfy regulatory changes to specifications for gasoline and diesel (Table 2).

The primary economic projects were geared toward substituting of heavier, sour feedstocks for lighter crude oils. The driving force behind these projects was the attractive heavy-light cost spread, which frequently exceeded the crack spread (Fig. 4), and the belief that having the cheapest feedstock was the key to remaining competitive. Almost all of these projects involved delayed coking capacity, but only a few significantly increased clean fuels production.

The remainder of refinery projects executed during the 1990s involved a slew of minor debottlenecking efforts implemented in-house that collectively became known as capacity creep. For most of these projects, forces other than broad refining economics defined the general refinery configuration. Regulatory-driven projects usually required hydrotreating units or other universally accepted approaches for compliance.

Because refinery capital was in short supply, there was little need or emphasis for company staffs thoroughly to evaluate multiple technology options and refinery configurations in search of maximizing refinery profitability. Minimizing capital spending was generally the company’s primary goal.

Furthermore, due to Wall Street’s increased scrutiny of industry performance, achieving the budgeted capital cost for these projects became as or more important than whether the budgeted cost was reasonable and if additional spending could further enhance refinery performance. It was logical, therefore, for refining companies to focus on the execution phase of these projects, especially maintaining tight control of spending.

New ‘Golden Age’

The refining environment of the past few years is dramatically different from the period that gave rise to the FEED-package-driven approach. Since 2005, refining margins have been robust; recent crack spreads of $10-14/bbl are much higher than in the past.

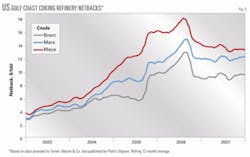

Additionally, refining netback margins for light crude far exceed the additional margin associated with substitution of heavy, sour feedstocks (Fig. 5) that spawned the numerous delayed-coking projects during the 1990s. Furthermore, fair market values for existing refineries have risen significantly and now approach full replacement cost (Fig. 6).

In the current economic environment, capital improvements for increasing capacity or improving yield structure of existing refineries will contribute additional income, and will increase the facility’s value by a near-equivalent amount. Another indication of this turnaround is a reduction in refinery sales by integrated oil companies.

Although none can predict how long this new era will last, we believe there are many indicators that it will not be short-lived:

- Demand for clean fuels in the US exceeds the current supply and modest growth in demand appears to exceed likely capacity additions. Capacity creep may have run its course. Even though distillation capacity continues to rise slowly, utilization appears to have peaked (Fig. 7) and has actually declined a bit.

- Capacity creep will play an insignificant role in future capacity gains. Most easy and inexpensive debottlenecking projects have already been implemented. Furthermore, US Environmental Protection Agency and Justice Department initiatives to pursue legal action against refiners for expanding process units without formal permitting have dampened enthusiasm for these types of projects.

- Reformulated gasoline and ultralow-sulfur fuels requirements have added significant new complexity to refinery operation and undoubtedly contributed to the decline in distillation capacity utilization.

To supply rising demand adequately and consistently, US refiners have imported more gasoline and distillate (Fig. 8) and have increased dependence on long-haul imports. Demand for gasoline and diesel will continue to grow (Fig. 9), which will extend the favorable refining environment created by the domestic supply shortfall.

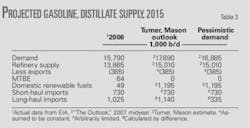

Although imports may ultimately decline, long-haul imports will not disappear in the foreseeable future even with the effect of recently enacted corporate average fuel economy (CAFE) and renewable fuels legislation, and a pessimistic view of demand (Table 3).

New project approach

US refiners need to add significant production capacity and the options for doing so appear infinite. Indeed, a few large expansions of existing refineriesMarathon’s Garyville, Ill., expansion, for exampleare in progress.

All of the announced likely expansions will not balance refinery supply and demand short of a reversal of the rather modest, but consistent, growth in gasoline and distillate demand in the US. Refiners therefore face developing and executing their own best combination of economic-driven projects for existing facilities.

Unlike the 1970s, however, which was the last time this type of environment existed, refining companies no longer have large home office and local technical staffs adequately to explore their various options. Additionally, most of the “veterans” from this prior era have left the industry via retirement or downsizing. Furthermore, controlling capital costs will no longer be the only focus during execution of future projects.

The current economic environment dictates that refiners devote more attention and more resources, including outside parties such as consultants and EPC contractors, to screening the many opportunities and selecting the best mix of projects that can maximize earnings and asset value. One important element is the whether a project under consideration is consistent with the company’s strategic interests.

Identification and prioritization of all available options, including those options that are commercial, are important. Finally, given the attractive refining margins currently available, getting the selected project on stream more quickly can be more valuable than reducing the amount of capital used in an excessive project definition and for spending controls.

Strategic importance

Projects that fall outside a refiner’s core business, even if they appear to add value, should be carefully considered relative to competing options that may be a better fit. Although the lack of strategic value should not disqualify a good project, it should force the project to meet a high standard for approval, including a thorough, and possibly independent, assessment of any overlooked or rejected alternatives.

Perhaps no better example of the importance of strategic fit is the major addition by a nonfuels, inland refinery that occurred in the early 1990s. The refinery staff was determined to add processing units to convert certain salable by-products into transportation fuels. The staff considered these streams to be undervalued by its current customers.

The proposed project cost about five times the fair market value of the existing refinery and it did not enhance the refinery’s non-fuels core business. In addition, the project team adopted a narrow “Case A” vs. “Case B” evaluation methodology that did not consider different commercial options nor the acquisition of another regional refinery (two would have been available) that would have cost much less than the project and provided the opportunity to expand the refinery’s core business product slate in a cost-effective manner.

A few years after the project was completed, the refinery closed. It has since been restarted by a different company after being purchased for a minor sum. The facilities added in this project, however, remain idle with no firm plan in place to restart them.

A similar mistake was narrowly avoided by a US Gulf Coast refinery that was considering an expensive desulfurization project in response to pending low-sulfur-diesel regulations. The project would cost about one to two times the refinery’s fair market value.

Although the projected economic benefit was reasonable, it was based on a predicted price differential for a new product (low-sulfur diesel) relative to the price for high sulfur off-road diesel and heating oil. The project team evidently ignored the fact that the refinery was pipeline connected to the primary common carrier serving the Northeast heating oil market and that production of on-road diesel was not required at the team’s location.

The project was canceled, a decision that was correct in hindsight because the predicted price differential needed for an economic return on investment never materialized and the refinery had no problem selling its entire distillate production as high-sulfur material.

The ‘best’ options

Many refinery projects executed during the past 20 years were either regulatory compliance-driven or were heavy oil substitution projects centered on delayed-coking additions. In most cases, the project-development stage consisted of little more than licensor evaluations followed by some refinery optimization.

Regulations or, as for heavy oil projects, a universally accepted approach dictated the basic conceptual design to be used. Local and corporate technical staffs had little need, and were therefore never challenged, to evaluate multiple refinery configurations and process technologies.

The current economic environment requires a thorough review of the numerous routes for converting a broad range of available feedstocks into additional clean fuels. Refinery technical staffs have limited experience with this degree of conceptual review and generally lack the broad knowledge necessary to identify, evaluate, and accurately select and prioritize all of the potential options available for adding the most value to their refining companies.

A diverse group, including consultants and EPC companies familiar with issues such as construction cost and constructability, is needed during the project development phase to ensure that all options are identified, their economics accurately quantified, and that the best are selected for execution.

A recent strategic review conducted by a large single refinery company that serves US Gulf Coast and East Cost markets shows how to implement this approach. The company enlisted the assistance of our staff and a well-known engineering company, both of which had knowledge of the refinery and a history of working with the company’s staff.

Members of the refinery’s technical staff and representatives from the two outside companies formed a review team to develop what might be best described as a 5-year capital plan for the refinery. The team identified and screened more than two dozen options for increasing the company’s profitability. Several potential refinery configurations involved technologies whose details were unfamiliar to the company’s staff.

We then selected the most interesting options for more detailed evaluation. Surprisingly, the company’s original presumption of a major crude oil expansion was only marginally attractive and given a low priority for execution. The review team correctly identified a cost-effective expansion of an existing delayed coker to be the highest value-added project for the facility and the one project that could be implemented in the shortest possible time.

Although the crude expansion remains a possibility, it is unlikely it will move forward until the delayed coker expansion is complete. It is unlikely that the company could have satisfactorily performed such an extensive review and developed a recommendation so different from their original presumption without the participation of outside parties.

Project execution

After the best project is selected, there are many approaches to executing design and construction. The current industry standard approach is to select an engineering company to prepare a FEED package from which bids are obtained from various EPC contractors. Companies are reluctant to deviate from this approach.

The FEED package approach can hinder a project as much as it can help. By relying on the FEED package for the basis of bids, the refiner has eliminated from competition any knowledge, expertise, and creativity available from the EPC contractor. In addition, extra implementation time and cost are required relative to a “design-build” approach where a limited bid basis is provided from which EPC contractors submit LSTK bids that achieve the refiner’s goals but may not use identical designs.

Refinery projects that are essentially the same can vary significantly in cost depending on the refining company and EPC contractor involved. We witnessed the construction of two CCR reformers with the same licensor and of reasonably similar size for two different companies by somewhat similar LSTK EPC contractors. In fact, the successful bidder for one unit was a close runner-up for the other.

The costs for these units, both being built in US Gulf Coast refineries during the same time period, were significantly different. The unit built using the FEED package approach cost about $3,500/bbl of capacity. The other slightly smaller unit was competitively bid with the design-build approach and cost about $2,000/bbl.

Refiners using the design-build approach for LSTK construction usually rely upon the EPC contractor’s standard specifications, albeit with some minor modifications for specific refiner circumstances. Refiners also cede a certain degree of project control when following the LSTK route in return for reduced price risk.

Individual refiner specifications and the desire to control every aspect of the EPC process, however, tend to inflate project cost. This added cost returns little incremental benefit.

During a recent project in which we helped develop and execute a refinery expansion involving a new vacuum distillation unit and a new ultralow-sulfur distillate hydrotreater, we used the design-build approach to achieve a much more cost-effective project. We first developed the project in January 2005 and presented it to the company the following month.

Because of the relative quick pretax payout estimated for the project (slightly less than 2 years), the company approved our plan to obtain LSTK bids for the two major process units in a “fast track” manner via the design-build approach. We screened five potential EPC contractors and requested bids from the top three candidates in May 2005.

Unlike the FEED package approach, which would have cost more than $1 million and consumed 12 weeks, two of the three bidders agreed to submit LSTK bids at the same time at no cost to the refiner. The third bidder, who also agreed to the desired time frame, did negotiate a small “loser’s fee” in the event their proposal was not selected.

Interestingly, none of the three EPC bidders chose to use the same fractionation scheme for the full-range distillate hydrotreater, nor did any propose the same diameter for the vacuum tower. The cost from each bidder also varied significantly for essentially identical units. We jointly reviewed the bids with the refiner, and the winning bid was accepted in late August 2005.

The fast-track approach was invaluable because the refiner obtained a LSTK price immediately before the economic disruption caused by Hurricanes Katrina and Rita. The project, which also included a reformer expansion, hydrocracker fractionation additions, and related infrastructure, was successfully completed in January 2008 for less than $6,000/bbl of added refinery capacity. Projects such as the one being implemented at Marathon-Garyville are reported to cost about $15,000-20,000/bbl.

The fast-track approach created no significant cost overruns or large change orders. The largest overrun was associated with the fractionation addition to the hydrocracker, which was not fast tracked, and became exposed to escalation associated with the post Katrina-Rita period.

Overall, the entire project cost was 15% more than the original feasibility-stage cost estimate. The cost for the two grassroots units covered in the original LSTK contracts, including change orders, additional contractor charges, and force majeure items, was less than 10% more than the feasibility study estimate and well below the amount of the runner-up bidder’s proposed cost.

The estimated pretax payout using 2007 actual prices calculates to be less than 1 year.

Based on a presentation to the 2008 National Petrochemical & Refiners Association Annual Meeting, San Diego, Mar. 9-11, 2008.

The author

James W. Jones ([email protected]) is a senior vice-president with Turner, Mason & Co. He leads assignments that involve refinery process technology selection and design, independent engineer services, strategic capital investment studies, project management, and petroleum economics. Jones joined the firm in 1994 after 18 years with La Gloria Oil & Gas Co., where he held numerous positions at their Tyler, Tex., refinery, including 8 years as operations manager. He holds a BS (1976) in chemical engineering from the University of Texas and an MBA (1980) from the University of Texas, Tyler. Jones is a licensed professional engineer in Texas and is a member of AIChE.