Gulf LNG terminals will see completion 2008-09

Terminal commissioning has been ongoing at two Texas Gulf Coast LNG terminals this month, as the region begins to complete and start up the first wave of new US import capacity.

Freeport LNG Development LP’s Quintana terminal, about 70 miles south of Houston, began receiving its first cool-down shipment from the 138,000-cu m Excelsior on Apr. 15. Cheniere Energy’s Sabine Pass terminal, in Cameron Parish, La., along the Sabine River border near Port Arthur, Tex., received its first cargo for commissioning on Apr. 11 from the 145,000-cu m Celestine River.

Two other terminals in the area will begin commissioning later this year or in first-quarter 2009.

ExxonMobil’s Golden Pass terminal lies across the Sabine River from Cheniere’s facility. And east of Sabine Pass, in Hackberry, La., on the Calcasieu Channel 18 miles from the Gulf of Mexico, Sempra Energy subsidiary Sempra LNG is in the final months of building its Cameron LNG terminal.

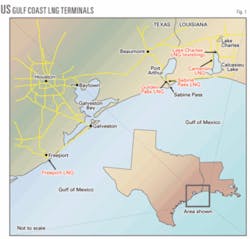

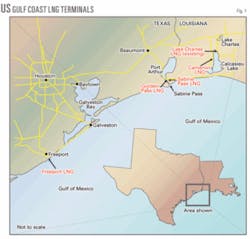

Fig. 1 shows the relative location of each terminal.

Freeport LNG

Start-up at Freeport LNG will occur later this year, according to FLNG Vice-Pres. Bill Henry.

Possibly the first to first to start up among the four under construction, the terminal on Quintana Island just south of Freeport, Tex., will have Phase 1 nominal sendout capacity of 1.5 bcfd with peak capacity of 1.75 bcfd. Phase 2 plans, unapproved as recently as early April, would add 2.25 bcfd of additional sendout capacity.

The terminal began construction in January 2005, the first of the three other LNG terminals in Texas whose construction has also been taking place over the last 2-3 years. It has been built under a “fixed-price, date-certain, turnkey” contract by a consortium consisting of Technip USA Corp., Zachry Construction Corp., and Saipem Technigaz SA.

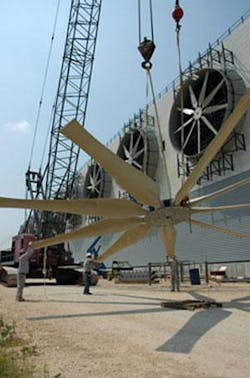

Unlike the four existing US land terminals that use submerged-combustion vaporizationat Everett, Mass.; Cove Point, Md.; Elba Island, Ga.; and Lake Charles, La., Freeport LNG employs an ambient-air system designed to draw heat from the air to regasify the LNG. The process employs towers similar to cooling towers commonly used in many industries, says the company. The towers consist of seven vaporizers with one installed spare employing vertical shell-and-tube exchangers of 250 MMcfd each. The heating medium is glycol and water (Fig. 2)

The technology, says the company, allows Freeport LNG to operate its plant within the Houston-Galveston nonattainment area because the towers emit no NOx. During cooler weather, FLNG converts its vaporization process to heaters similar to those used at other LNG terminals.

Phase 1 has installed two, 160,000-cu m LNG storage tanks (3 bcf equivalent in each tank) and an LNG carrier berth that can accommodate the largest carrier envisioned. Phase 2 would add a third 160,000-cu m tank and separate berthing facilities for a second carrier.

In addition, the company has laid a 9.6-mile, 42-in. pipeline from the terminal to natural gas salt-dome storage at Stratton Ridge (LNG Observer, January-March 2007) where it has contracted for 7 bcf of storage. Three storage tanks in both phases combined with the salt dome storage effectively give the terminal as much as 16 bcf of storage.

The terminal’s first cool-down cargo arrived aboard the LNG regasification vessel (LNGR) Excelsior; the vessel is chartered to Excelerate Energy.

Freeport LNG Development is managed by a general partner owned 50% by Michael S. Smith and 50% by ConocoPhillips. Limited partners with “economic interests,” according to company material, are Michael S. Smith, Cheniere Energy, Dow Chemical Co., and Osaka Gas. Company material says ConocoPhillips has agreed with Freeport LNG for capacity rights of up to 1 bcfd. Dow has also contracted to receive 500 MMcfd.

Sabine Pass

Running close to the construction schedule of Freeport LNG has been Cheniere Energy’s Sabine Pass terminal in Louisiana, near Port Arthur, Tex., along the Sabine River border with Texas. The company held an opening ceremonynot a commissioning, company officials were at pains to sayonly last week.

The terminal sits at the widest point on the Sabine River Navigation Channel, 3.7 nautical miles from open water and 23 nautical miles from the outer buoy. The channel is maintained at 40 ft deep and not subject to tidal limitations, says the company. The terminal’s two berths are recessed far enough so that no part of the LNG vessel will protrude into the open waterway while docked, says company material.

Phase 1 of terminal construction, nearing completion, has built 10.1 bcf of LNG storage in three tanks, each with an LNG capacity of 160,000 cu m and a maximum continuous regasification rate of 2.6 bcfd, the largest of any US terminal. Vaporization will take place in 16 high-pressure submerged combustion vaporizers (SCVs; Fig. 3). Takeaway is provided by a 16-mile, 42-in. pipeline.

At the opening ceremony last week, company officials celebrated the end of construction of Phase 1. The 145,000-cu m Celestine River was in berth, having arrived on Apr. 11 with a cargo from Nigeria LNG to begin commissioning of the terminal. The vessel is owned and operated by Kawasaki Kisen Kaisha Ltd.

A company spokesperson said two or three more cargoes, from suppliers she declined to name, will be necessary to complete the cool-down process. Commercial operations are likely to start in May or early June, again with no supply sources named by the company.

Phase 2, already well under way, will add 1.4 bcfd with three more 160,000-cu m single-containment tanks, 16 ambient-air vaporizers, each with a high-pressure sendout pump, 8 more SCVs, also aided by a high-pressure sendout pump, and two 30-in. take-away pipelines to metering sites.

Phase 2 will be built in stages. The first stage is adding fourth and fifth storage tanks and more vaporizers that will bring the maximum continuous regasification rate up to 4.0 bcfd with a peak sendout capacity of 4.3 bcfd. Future stages of Phase 2 may add a sixth storage tank and related facilities to bring the total LNG storage volume to 20.2 bcf.

2009 completions

Also under construction is ExxonMobil’s Golden Pass terminal, across the Sabine River in Texas from Cheniere’s terminal and about 10 miles south of Port Arthur in Jefferson County. At the end of April, said ExxonMobil, the first phase of terminal construction is about 50% complete and will be fully completed by mid-2009. The second phase of the terminal will be completed in 2010.

At the end of two construction phases, Golden Pass LNG plans to import LNG to move about 2 bcfd (2.7 bcfd peak) to Texas and US markets. The project includes dock and unloading facilities for double-hulled LNG carriers; five full-containment 155,000-cu m LNG tanks; 10 shell-and-tube heat transfer fluid heat exchangers (5 in Phase 1 and 5 in Phase 2) for vaporization; and associated pipelines.

The initial filing with the US Federal Energy Regulatory Commission listed:

- A 77.8-mile, 36-in. mainline (the Golden Pass LNG pipeline) from the terminal to an interconnection with a Transco mainline near Starks, La.

- A 42.8-mile, 36-in. loop beside the mainline from the terminal to an interconnection with Texoma pipeline in Orange County, Tex.

- A 1.8-mile, 24-in. lateral from the mainline in Jefferson County, Tex., to industrial customers in Beaumont-Port Arthur, including ExxonMobil’s Beaumont refinery.

Golden Pass’s dedicated slip, berths, and unloading facilities will accommodate two LNG carriers of 125,000-250,000 cu m and tugboat operations, says the company’s initial FERC filing. The berths will also consist of four 16-in. unloading arms and on 16-in. vapor-return arm.

Golden Pass LNG LLC, owner of the terminal, is 70% owned by an affiliate of Qatar Petroleum, with affiliates of ExxonMobil and ConocoPhillips each owning a share in the balance of the interest in the terminal. LNG for Golden Pass will be supplied primarily from RasGas 3, Trains 6 and 7, and Qatargas 3.

East of the Sabine Pass area, in Hackberry, La., 18 miles north of the gulf and on the Calcasieu Channel, Sempra Energy subsidiary Sempra LNG is building the Cameron LNG terminal (Fig. 4).

With total investment, according to Sempra, of about $750 million, the terminal will have 1.5 bcfd of initial sendout capacity with room for expansion up to 2.65 bcfd. The terminal is installing NGL recovery to allow it to meet btu-content specifications of receiving pipelines.

Construction began in 2005, with completion expected late this year. Start-up is planned for first-quarter 2009, said a company spokesperson, but had no details on commissioning cargoes, vessels, or sources.

The location consists of three 160,000-cu m full-containment LNG storage tanks; the planned 1.15-bcfd second phase will add another tank. Vaporizing will take place in 12 SCVs, each sized for 150 MMcfd.

Another Sempra Energy unit, Sempra Pipelines & Storage, has built a 35.4-mile, 36-in. sendout pipeline to connect with major interstate systems north of the terminal.