SPECIAL REPORT: LNG questions loom amid wave of project completions

Each recent year has brought global LNG capacities to levels only dreamed of 10 years ago. That will be no less true for 2008.

The difference this year, however, will be that many of the projects set in motion 3-5 years ago will be coming on line or nearing completion as the wave of projects from the first half of this decade crests.

But closely following that wave are clouds of problems that have begun to obscure the future, ultimate success of LNG in transforming natural gas trade into a fully global enterprise.

Capacities, projects

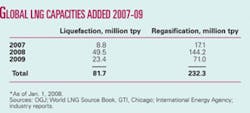

The accompanying table summarizes global LNG production and regasification capacities added in 2007-09.

Most of the liquefaction capacity in those 3 years will come online in 2008, mostly in the Middle East as several projects in Qatarat least 39 million tonnes/year (tpy)are finally completed. Qatar Petroleum Co. announced in early 2007 that it was freezing plans to finish current projects and to evaluate reservoir conditions in and production from its North field, the world’s largest nonassociated gas field.

Long-awaited production will start from Russia’s Sakhalin, Indonesia, and Nigeria as well as from Australia and Yemen.

By the same token, most of the new regasification capacity in 2007-09 will come on this year. In the US, more than 65 million tpy of import capacity is set to openall but 3 million tpy on the Gulf Coastwith additional North American capacity set to open in Mexico and Canada pushing that continental capacity to nearly 90 million tpy.

Europe will add nearly 26 million tpy of import capacity, mostly in the UK but also in France and Italy, if current construction meets targets.

Asia will similarly add 26 million tpy in 2008spread among India, China, and Koreawith another nearly 19 million tpy due online in 2009.

Last year saw a dearth of announcements for new liquefaction capacity but ended with a minor flourish in December as Chevron Corp. announced investors in Angola LNG had agreed to move the project to construction.

Cabinda Gulf Oil Co. Ltd., a wholly owned subsidiary of Chevron, holds a 36.4% interest in Angola LNG Ltd., which has entered into an investment contract with the Angolan government and the country’s state oil company Sonangol to develop the project. Other Angola LNG shareholders are Sonangol (36.4%) and BP PLC and Total (13.6% each).

The project plans to move offshore Angolan gas to a liquefaction plant to be built in the Soyo region, Zaire Province. The plant will be able to handle 1 bcfd of associated gas and produce 5.2 million tpy of LNG and related gas liquids. The project will also supply up to 125 MMcfd of gas to Sonangol for domestic use in Angola.

First LNG from the project is set for early 2012 and will be delivered to Gulf LNG’s Clean Energy regas terminal, planned for Mississippi’s Gulf Coast.

Also receiving the green light last year, after considerable delays and doubts, and starting construction was Woodside Energy Ltd.’s Pluto LNG project, involving an investment of more than $5 billion (Aus).

The project includes development of Pluto gas field, off northwest Western Australia, and construction of an onshore LNG plant in the Pilbara region of Western Australia.

Pluto field, discovered in 2007 with early reserves estimated at 3.5 tcf, lies about 100 km off northwest Western Australia and about 180 km from the Burrup Peninsula. The gas, according to Woodside, is relatively dry with small amounts of condensate and low levels of carbon dioxide.

Pluto’s first target for its 5-7 million tpy of LNG is Asia with possible eventual supplies aimed at North America, especially if any locale on the US West Coast ever approves a terminal.

The first phase will build a 4.8 million tpy train with first gas expected in 2010. Woodside Energy said feasibility work has begun on the second train.

Industry issues

These two projects made headlines last year in part because of longstanding industry concerns about the slow pace of growth in global liquefaction capacity. The table makes clear the growing gap between liquefaction and regasification capacity.

By far the largest factor in the slow growth of production capacity has been the explosive increase in materials costs and the shortage of skilled and trained labor to build and manage projects.

Cambridge Energy Research Associates has estimated that, since 2002, upstream capital costs as part of an LNG project have risen by 80%. That reflects industry observations that capital costs of annual capacity in an LNG project rose to more than $600/tonne in 2006 from $200/tonne in 2002.

Fueling this growth has been surging Chinese demand for all industrial raw materials, pushed by double-digit annual gross domestic product growth over the last 5 years. The effect has had every major industrial project in the world, especially energy projects, scrambling for sufficient materials and skilled labor.

Aggravating these shortages in materials and people, in the view of some observers, is the double-edged sword of natural gas prices.

Elevated gas prices since the mid-1990s have in part spawned the resurgence of LNG as a transportation mode. But in markets where prices have hit particularly high levels, they have driven energy demand towards competing fuels, especially coal, even with expensive cleanup technologies.

Some project developers, therefore, have been reluctant to invest massive capital and extensive time if natural gas demand is not more certain.

Complicating this dilemma are the differing behaviors of the world’s three major LNG markets: Asia, the historical leader, broadly indexes LNG prices to crude oil; the US pegs them to the Henry Hub gas price; and Western Europe has several pricing centers with little uniformityand therefore predictabilityamong the several nations.

Finally, an unexpected consequence of the flow of wealth to formerly developing nations is that their domestic gas demand is rising and threatens to siphon off gas initially intended for international trade, thus tightening global supplies.

By yearend 2008, some of these issues may be sorted out as growth of industry’s capacities crests and leads to several years of consolidation before the next wave begins in 2013-14.