OGJ Newsletter

Brazil, Bolivia sign natural gas-price agreement

After months of negotiations, Bolivian President Evo Morales and his Brazilian counterpart Luiz Inácio Lula da Silva have signed a protocol agreement that formalizes an increased price for natural gas that Bolivia exports to Brazil. Brazil agreed to pay $4.20/MMbtu for Bolivian gas. This is an increase from the previous $1.09/MMbtu rate. The agreement refers specifically to gas used by a thermoelectric power plant in Cuiaba, in western Brazil, where 1 million cu m/day of gas is delivered via a 267-km pipeline in which Royal Dutch Shell PLC holds a 38% stake (OGJ Online, Jan. 30, 2007).

Carlos Villegas, Bolivia’s hydrocarbons minister, described the agreements as very encouraging in terms of bilateral relations between the two countries. The agreements point to a mutual commitment to enter a new phase of energy cooperation, he said.

No agreement, however, has been reached concerning Brazil’s imports of 26 million cu m/day-about half of Brazil’s daily gas consumption-through the 3,150-km Bolivia-Brazil gas pipeline. Brazil pays slightly higher than $4/MMbtu on average for this gas. Bolivia wants Brazil to pay about $5/MMbtu for the gas, after reaching a similar agreement with Argentina.

Transneft: Russian elections won’t affect projects

Russian pipeline operator OAO Transneft is committed to implementing its oil projects regardless of any change in Russia’s presidency in the forthcoming elections, Transneft Pres. Simon Vainshtock told OGJ at International Petroleum Week in London.

“Russia has prepared all the necessary grounds for there to be a continuity of energy policy that we currently have. The policy will be maintained and will remain the same,” Vainshtock said.

One major Transneft project is construction of the 4,000-km Eastern Siberia-Pacific Ocean pipeline to export Russian crude to the Asia-Pacific region. Vainshtock said the first phase of the 30 million tonne/year pipeline is on schedule to be commissioned in 2008. “We’ve got guarantees for 100% of the volumes to fill the first stage of the pipeline,” he said.

Russia, Bulgaria, and Greece recently signed a preliminary agreement for the 240-km Burgas-Alexandroupolis oil pipeline proposal to fast-track the establishment of an international company to manage the project. The pipeline, with an initial capacity of 15 million tonnes/year, will skirt the Black Sea, cross Greece and Bulgaria and help reduce crude oil shipments by tankers through the congested Bosphorus and Dardanelles straits.

Vainshtock added that Transneft will support OAO Gazprom’s position not to ratify the Energy Charter Treaty because they are both state energy companies. The international agreement aims to protect foreign energy investments. Russia signed the treaty but refused to ratify it, saying it does not serve Russian interests, because of objections to the Transit Protocol, a related document that facilitates the transit of hydrocarbons.

Russia is negotiating with the European Union to reach a resolution on this document before it will progress with ratification.

Excelerate begins operations of Teesside GasPort

Commercial operations have started at Excelerate Energy’s GasPort in Teesside in northern England, opening the possibility of supplying as much as 600 MMcfd of peak gas directly into the UK national grid system.

GasPort is the world’s first dockside regasification application-a land-based manifold that connects to a high-pressure gas arm on Excelerate’s specially adapted Energy Bridge Regasification Vessel (EBRV), which can regasify LNG onboard.

“The technology platform on which the Teesside GasPort is based has long-term implications for the LNG industry,” said Rob Bryngelson, Excelerate Energy executive vice-president and chief operating officer. “GasPort operations are further enhanced by the ability of Energy Bridge vessels to conduct commercial ship-to-ship transfers with conventional LNG vessels, an ability that aggregates global LNG supplies and markets, shortening travel time and reducing costs.” RWE Trading will market the gas from GasPort to UK customers. Both hope to develop additional LNG infrastructure in other European markets.

OGJ joined senior UK gas industry officials at the inauguration ceremony Feb. 20 in Teesside where the company stressed it has delivered the project in under a year and offers a substantial cost effective solution to LNG regasification needs. GasPort cost £40 million whereas traditional land based regasification terminals are at least £400 million. It was particularly proud of launching GasPort with its first commercial ship-to-ship transfer of 130,000 cu m of LNG, and Excelerate hopes to capitalize on meeting short-term LNG demand (OGJ online, Feb. 16, 2007).

Excelerate will forge key commercial relationships with industry participants via Excelerate GasNet, a logistical services and trading platform, to deliver LNG supplies to customers in North America, Europe, and elsewhere worldwide.

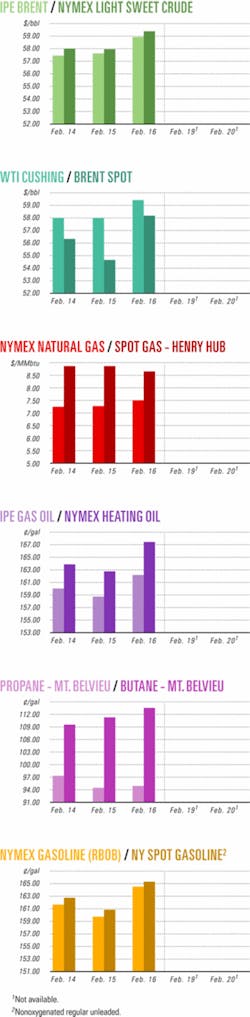

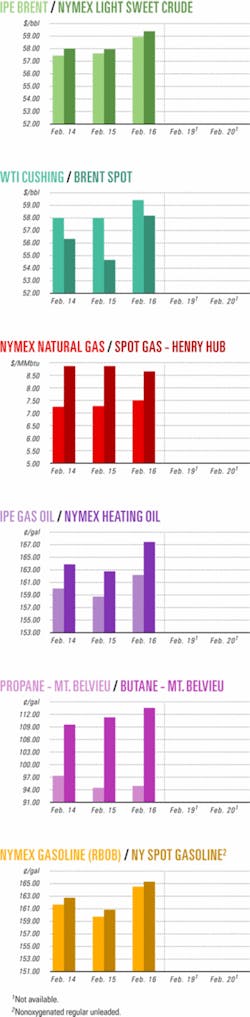

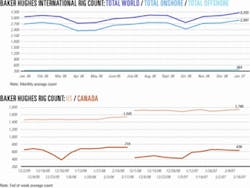

Industry Scoreboardnull

Scoreboard

Due to the holiday in the US, data for this week’s industry Scoreboard are not available.

null

Exploration & Development - Quick TakesBP assesses gas hydrates with ANS well

BP Exploration (Alaska) Inc., in collaboration with the US Department of Energy and the US Geological Survey, has drilled a well on the Alaskan North Slope to assess the potential of gas hydrates as a long-term nonconventional energy source.

The well is 1.4 miles south of the Milne B-pad in Milne Point oil field northwest of BP’s Prudhoe Bay oil field.

Drilled to 3,000 ft, the stratigraphic test well intersected the Sagavanirktok formation on the Mt. Elbert prospect, which was identified by seismic data, well, and reservoir modeling studies.

About 430 ft of 3-in. hydrate cores were collected. The core segments were initially subsampled and analyzed on site due to the time and temperature-dependent data requirements. They will be shipped to Anchorage for temporary storage before being distributed to gas hydrate researchers around the country.

Subsequent data collection and analysis will continue for several months, after which a report will be published, BP said.

The well provided a stratigraphic test of interpreted gas hydrate accumulations from Milne seismic and well data. Core, wireline logs, and wireline downhole testing will help assess gas hydrate-bearing sediment, shallow reservoirs, and fluid properties.

The project resulted in the first significant collection of gas hydrate-bearing cores in Alaska, and the first delineation of a seismically defined gas hydrate prospect in Alaska.

Production tests and other future developments of the Milne test well will be determined jointly with DOE, which funded the estimated $4.6 million drilling cost.

Gulfsands, Emerald spud third well on Syria’s Block 26

The Khurbet East No. 1 exploration well on Block 26 in Syria has been spudded using the Crosco 2000 HP Emsco 602 drilling rig, according to Emerald Energy, a partner in the block. The well, which is expected to reach TD of 3,700 m over the next 100 days, is targeting a fault-bound structural culmination, with closure mapped at several potential reservoir levels, including Cretaceous, Triassic, and Palaeozoic ages.

The Khurbet East prospect is about 12 km southwest of the Souedieh oil field and 12 km south of the Roumelan oil field.

The Block 26 partners, Emerald Energy and Gulfsands Petroleum (operator), have exploration rights in all reservoir levels of Khurbet East. Each company has a 50% stake in the block.

Gulfsands said that in the event of an oil or gas discovery at Khurbet East, production would be tied back to existing facilities about 12 km away near Roumelan field.

This is the third well in the partners’ drilling program for Block 26, and they will drill their fourth well starting in July.

Norway extends Goliat oil license in Barents Sea

Norway’s Oil and Energy Minister Odd Roger Enoksen will grant the Goliat license partners additional acreage to explore in the Barents Sea, after studies suggest the oil reservoir could expand into an area not covered by the original license.

Goliat partners are Eni SPA 65%, Statoil ASA 20%, and DNO ASA 15%. Eni Norge AS submitted the extension application on behalf of the licensees in PL 229, and the partners will drill an extra exploration well to assess the extent of the resources.

Enoksen said this new acreage will be included in Goliat’s development plan scheduled for 2008. The Goliat license covers 5 blocks with an area of 1,010 sq km.

Goliat is one of the most significant future field developments on the Norwegian continental shelf, Enoksen said recently. The license is 50 km southeast of Snøhvit field and 85 km northwest of Hammerfest.

In a separate development, the Norwegian government has offered 13 new blocks in the Barents Sea to interested applicants under its Awards in Predefined Areas 2007 (APA 2007) licensing round.

Companies must submit their applications by Sept. 28 and can apply for all blocks or parts of blocks that have not been allocated under a license. The Norwegian Petroleum Directorate said these were the first blocks on offer in the Barents Sea since APA 2004, and it plans to announce the winners by late this year or early in 2008.

Statoil to drill Snøhvit appraisal well

Statoil ASA and its partners have decided to drill an appraisal well in the Snøhvit field to aid in determining whether to continue with the Barent’s Sea project.

The appraisal well will provide further data on the recoverable oil reserves and better map gas reserves in the western part of the field’s structure, the company said.

Several development options have been under consideration, including a potential coordination with the Goliat oil find development, operated by Eni SPA. The coordination with Goliat was studied earlier with a negative result, Statoil said.

Drilling of the appraisal well is dependent on available rig capacity in the area.

Statoil is operator for development and operation of Snøhvit with a 33.53% share. Other partners are Petoro SA 30%, Total E&P 18.40%, Gaz de France 12%, Amerada Hess Norge 3.26%, and RWE Dea Norge 2.81%.

Heritage Oil to test deeper zones in Ugandan well

Heritage Oil Corp. plans a production test of deep intervals in the Kingfisher-1A deviated exploration well on Block 3A in Uganda. Three intervals, with a total thickness of 44 m, are to be tested at depths of 2,260-2,367 m.

The upper zone of the Kingfisher-1 well, at a depth of 1,783 m, was tested successfully in November 2006, flowing at a stabilized rate of 4,120 b/d through a fixed 1-in. choke at a wellhead pressure of 221 psi. The reservoir had permeability of over 2,000 md.

The 30° gravity oil was sweet with a low gas-oil ratio and some associated wax (OGJ Online, Nov. 7, 2006).

Kingfisher-1A was drilled to 3,195 m. Wireline logs and formation pressure testing indicated hydrocarbons over the planned test intervals, the thickest of which is 21 m.

The production test is scheduled to start by Feb. 25 and is expected to take as long as 3 weeks.

Heritage operates Block 3A, holding 50% interest, and Tullow Oil holds 50% interest.

Total’s Egina field to be stand-alone development

Total SA said Egina oil field, which holds several promising discoveries, may be suitable for stand-alone development. The field is on Total-operated license 130, about 150 km off Nigeria.

The Egina-1 discovery well, drilled in December 2003, and the Egina-2, drilled in October 2004, revealed the presence of a new structure. After reprocessing existing seismic data, Total launched an appraisal program to size the Egina discovery.

The Egina-3 (September 2006), Egina-4 (November 2006), and Egina-5 (January 2007) wells, drilled in about 1,500 m of water, encountered 60-80 m of oil in Miocene sands. They confirmed the possibility for a stand-alone development of the field.

Tests of the Egina-5 well suggest the well’s production potential could reach 12,000 b/d.

Egina-1 lies 20 km from Akpo gas-condensate field, which is scheduled to start production in late 2008 and quickly peak at 225,000 boe/d, 80% condensate. Akpo was discovered in 2000.

Drilling & Production - Quick TakesFCP to produce from Algeria’s MLE field in 2009

First Calgary Petroleums Ltd. (FCP) will produce 200 MMcfd of gas from MLE oil and gas field in Algeria’s Berkine basin and will build infrastructure with Sonatrach by late 2009 under a $1.3 billion development plan.

MLE, which has 230 million boe of reserves, will send gas to a new gas plant, field gathering system, and facilities designed to process 230 MMcfd of raw gas on a gross basis along with associated natural gas liquids and oil. There are proposals to increase the plant’s capacity to as much as 400 MMcfd.

MLE’s production plateau of 200 MMcfd is over an initial 10 years, and it will produce 21,000 b/d of oil, condensate, and LPG. Sonatrach will market the gas.

MLE is on the eastern part of Block 405b. The block will be developed in stages to exploit oil and gas discoveries west of MLE field after the companies finish appraisals and determine their commerciality.

The joint venture will construct dry gas and liquids pipelines from Block 405b to a tie-in point on the national pipeline grid about 140-km west of the block, said FCP. “In addition, an oil pipeline is planned to be built to a tie-in point on an existing oil pipeline in the Berkine basin (PKO).”

FCP will provide 75% of the $1.3 billion costs, and Sonatrach, will provide 25%.

BP to boost CBM production in San Juan basin

BP PLC reported it plans to invest as much as $2.4 billion over the next 13 years to boost by more than 20% its 425 MMcfd share of coalbed methane gas production in the San Juan basin of southwestern Colorado.

BP said it will drill more than 700 wells from existing well pads in the basin. It has already acquired regulatory infill approval and associated field infrastructure.

CBM constitutes 10% of gas production in the US. The San Juan basin project is a major initiative for BP that is part of a 10-year, $45 billion oil and gas exploration and production program in the US that includes major investments in the deepwater Gulf of Mexico, Alaska, and the Lower 48 states.

PTTEP starts gas, condensate output from Shams

Thailand’s PTT Exploration & Production PCL (PTTEP), operator of Oman’s Block 44, has begun production of natural gas and condensate in its Shams (Sun) field, about 300 km west of Muscat.

Production from the field, which is part of Block 44, is averaging 50 MMscfd of gas and 4,000 b/d of condensate.

Gas from the field will be sold to Oman’s oil and gas ministry in accord with a gas sales agreement concluded on Apr. 27, 2005, while condensate will be exported to PTT PCL, PTTEP’s parent company in Thailand.

PTTEP became operator with 100% interest in Block 44 following an exploration and production-sharing agreement signed with Oman’s oil and gas ministry on July 21, 2002.

PTTEP lets contract for Arthit field development

PTTEP has awarded Technip a contract for the detailed engineering of four generic wellhead platforms with associated subsea pipelines and tie-ins.

The platforms will be installed in the Arthit natural gas field in 80 m of water in the Gulf of Thailand, and tied to existing wellhead platforms.

The contract covers engineering services, which are to be completed in May, as well as the preparation of purchase requisitions for all long-lead items.

Technip said its operations and engineering center in Bangkok will execute the contract with pipeline engineering support from the Technip operations and engineering center in Kuala Lumpur.

In January, PTTEP said it expected the offshore Arthit gas field to start production in first quarter 2008 with an initial capacity of 330 MMcfd of gas.

JV ramps up gas production from Phu Horm field

A group led by Hess Corp. has ramped up natural gas production to 100 MMcfd from Phu Horm field, Thailand’s second onshore producing gas field.

The increase followed an initial run starting on Nov. 30, 2006, when the field, which lies in the northeastern province of Udon Thani, produced 60 MMcfd of gas (OGJ Online, Dec. 6, 2006).

Consortium officials said the production increase is in response to demand from an electric power plant and to make up for the decline in gas output from Nam Phong, the depleting gas field just north of Phu Horm.

Production from Nam Phong, operated by ExxonMobil Corp., has fallen to about 30 MMcfd now though it is expected to go on producing over the next decade, albeit at the declining rates.

The combined production from Phu Horm and Nam Phong has enabled the Electricity Generating Authority of Thailand to run at its full capacity of 720 Mw.

Phu Horm’s current production comes from three wells. The consortium plans to drill three more wells this year, comprising two development wells and one appraisal well, in the 232-sq-km concession block.

Hess and Apico LLC each hold 35% interest in the Phu Horm concession; other consortium members are PTT Exploration & Production PCL 20%, and ExxonMobil E&P Khorat Inc. 10%.

Processing - Quick TakesBorouge lets contract for ethylene cracker

Plastics company Borouge has signed a $1.3 billion lump-sum, turnkey contract with Germany’s Linde Group for the construction of an ethylene cracker-part of a major expansion project at Borouge’s production facility in Ruwais, Abu Dhabi.

The 1.5 million tonne/year cracker will triple production capacity at the facility to 2 million tpy of polyolefins. The Borouge project also will include a 752,000 tpy olefins conversion unit, two 800,000 tpy Borstar polypropylene plants, and a 540,000 tpy Borstar enhanced polyethylene plant. Preliminary work is under way and completion is scheduled for 2010.

CPC refinery to add resid desulfurization

Chinese Petroleum Corp. (CPC) will use Chevron Lummus Global (CLG) technology for a resid desulfurization unit at its 200,000 b/cd Taoyuan refinery in Taiwan.

The 70,000 b/sd plant, for which basic design is complete, is scheduled to come on stream in 2010.

CPC’s 300,000 b/cd Talin refinery in Kaouhsiung has two CLG resid desulfurization units in operation.

CLG is a 50-50 joint venture of Chevron USA Inc. and ABB Lummus Global.

Transportation - Quick TakesMinnCan oil pipeline project gets PUC approval

Minnesota Pipe Line Co. (MPL), Rosemount, Minn., received approval from the Minnesota Public Utilities Commission to construct its $300 million MinnCan pipeline project (OGJ Online, Jan. 4, 2006). It will expand MPL’s system, which is at capacity, to transport crude from oil sands reserves in Alberta and Saskatchewan to Minnesota over the next decade.

The MinnCan project consists of a 304-mile, 24-in. oil pipeline from Clearbrook, in northwestern Minnesota, to refineries in Minneapolis and St. Paul.

Construction, expected to take 8 months, will begin this summer. The pipeline, which will have a design capacity of 60,000-165,000 b/d, should be fully operational in 2008.

The system will originate at the existing interconnection between MPL’s pipeline system and Enbridge Energy’s pipeline system at Clearbrook in Clearwater County. It will pass through 13 counties, with the northernmost 119 miles constructed along existing MPL pipeline right-of-way, except for a 7-mile greenfield route around Staples, Minn. Near Cushing, in Morrison County, the route will diverge from the existing pipeline corridor and extend for 176 miles generally west and south of the Twin Cities metropolitan area.

The project terminates at the Flint Hills Resources refinery at Rosemount in Dakota County. The terminus will provide a direct interconnection with the refinery and with the Marathon Petroleum Co. St. Paul Park refinery through existing pipeline facilities.

Two pump stations are planned, one at the Clearbrook station and another at a midpoint pump station in Morrison County near Upsala. MPL Co. is owned by Marathon Pipe Line LLC, Flint Hills Resources, and TROF Inc.

UK approves National Grid to build major line

National Grid, operator of the UK’s gas network, will build a 196-km, 1,220-mm natural gas pipeline from Felindre, near Swansea in west England to Tirley in Gloucestershire, subject to strict UK environmental conditions. The pipeline is an important component in delivering gas from two proposed LNG regasification terminals in Milford Haven, Wales, which are expected to provide 20% of the UK’s gas needs when completed.

National Grid will start line construction in late February or early March. Work should be completed in October. Contractors Nacap Land & Marine Joint Venture will construct a 90-km line section from Felindre to Brecon, and Murphy Pipelines Ltd. will install the 106-km section from Brecon to Tirley.

Local environmental groups had protested the pipeline route, particularly the Brecon Beacons National Park Authority (BBNPA), which objected to a 25.7-km section through the park. Local residents also cited concerns that tourists may be dissuaded from coming because of the pipeline’s impact.

In announcing approval for the line, Energy Minister Lord Truscott said, “I also have to be mindful of the importance of this project to our national energy needs. As the UK’s own reserves of gas decline, there is a need for new infrastructure to connect new sources of imported gas to our homes and industries.”

The 4.4 million tonne/year Dragon LNG and the 7 million tonne/year South Hook LNG terminals are under construction in Milford Haven. Dragon is expected to start operations by yearend and South Hook by first quarter 2008.

A BBNPA spokeswoman told OGJ it was disappointed by the UK Department for Trade and Industry’s decision to permit National Grid to forge ahead with the pipeline. Now 33.7 km of the pipeline will go through the park. She said BBNPA will appoint two officers to monitor construction and ensure that minimum environmental damage occurs. Under special circumstances, these officers could stop work if they find breaches of environmental regulations.

Equatorial Guinea LNG seeks Zafiro gas as feed

Equatorial Guinea LNG (EG LNG) is looking to use gas from Zafiro oil field, operated by ExxonMobil Corp., as possible feed gas for its liquefaction plant, said Steve Ollerearnshaw, EG LNG managing director, at the International Petroleum Week conference in London Feb. 16.

Currently 150 MMcfd of gas from Zafiro field is flared. EG LNG is in discussions with ExxonMobil to see whether it would be feasible to bring gas for its proposed second LNG train, Ollerearnshaw said. “It would need a pipeline and compression to make it work,” he added. Zafiro, which produces more than 270,000 b/d, is the biggest oil field in Equatorial Guinea.

EG LNG has contracted Bechtel Corp. to investigate the feasibility of adding a second 4.4 million tonne/year train. The work is scheduled for completion by the end of the first quarter, and EG LNG shareholders are expected to make a final investment decision by late 2007 or early 2008.

Ollerearnshaw said discussions are under way among Nigeria, Cameroon, and Equatorial Guinea to explore providing gas to EG LNG.

“We believe there is a very sound economic basis for Train 2 at EG LNG,” he added, “and we see a long-term potential for up to 20 million tonnes in Equatorial Guinea.”

EG LNG will join the club of Atlantic Basin LNG suppliers later, with first LNG production from its initial 3.4 million tonnes/year train due in the summer. Gas for the plant will come from Alba field. BG Group is expected to deliver the volumes to the Lake Charles, La., regasification terminal in the US, but Ollerearnshaw said that BG Group has destination flexibility in its contract.

EG LNG is situated on Bioko Island in Equatorial Guinea (OGJ, Sept. 4, 2006, Newsletter)

Chevron’s Casotte LNG terminal gets FERC OK

Chevron Corp. has received approval from the US Federal Energy Regulatory Commission to build the Casotte Landing regasification facility next to the company’s 325,000 b/cd Pascagoula refinery in Jackson County, Miss.

The proposed project would process LNG for distribution to Mississippi, Florida, and the US Northeast. The facility would have a nominal processing capacity of 1.3 bcfd of gas.

Chevron also has reserved 1 bcfd of regasification capacity at Cheniere’s Sabine Pass LNG receiving terminal in southwestern Louisiana. Construction at this facility is about 55% complete and the terminal is scheduled to start operations in second quarter 2008. Chevron’s commitment begins mid-2009.

Both the Sabine Pass capacity and the Casotte Landing facility can be integrated into Chevron’s US Gulf Coast pipeline, storage, and terminal infrastructure.