SPECIAL REPORT: Fischer-Tropsch oil-from-coal promising as transport fuel

As crude oil prices rose above $50/bbl last year, interest revived in the use of Fischer-Tropsch (F-T) technology to produce transportation fuels from coal.

Developed during World War II, the F-T process in recent years has moved into commercial-scale use in gas-to-liquids projects around the world.

While application of the technology to coal is economically more challenging than it is for natural gas, its possibility raises hope globally and especially in the US for development of fuel supply from an abundant and secure domestic hydrocarbon resource. As part of modern integration schemes such as those described in this article, indirect liquefaction resolves environmental problems associated with traditional coal combustion.

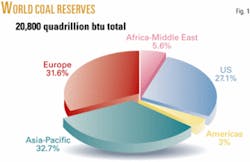

Coal, an extremely large and significant energy resource, has huge potential as a source of clean liquid hydrocarbons for coal-rich nations, including the US, which has more than one-fourth of the world’s coal supply.

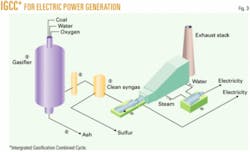

With newer technologies such as integrated gasification combined cycle (IGCC), coal conversion is an environmentally friendly process. Pollutants-mercury, sulfur oxides (SOx), and nitrogen oxide gases (NOx)-are essentially eliminated because coal gasification instead makes hydrogen sulfide and ammonia, which can easily be removed in gas scrubbers. Carbon dioxide, considered a greenhouse gas, can also be captured and sequestered, and can even provide a significant income stream if oil fields are nearby and responsive to CO2 flooding.

This study examines coal conversion to liquid hydrocarbons and electric power generation, using IGCC as the basis for gasification. The syngas is converted to liquid hydrocarbons using F-T technology. There are several scenarios where this commercially proven technology offers attractive economics.

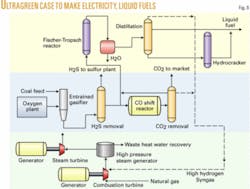

Two significantly different coals were investigated for conversion to liquid hydrocarbons and electric power generation using “green” technology. Furthermore, an “ultragreen” case was developed in which the CO2 emissions are practically eliminated by shifting all of the carbon monoxide to a hydrogen-rich gas before the synthesis gas feed goes to the power plant. The hydrogen-rich gas is then burned in the combustion turbine of the IGCC plant.

The coals studied were a low-sulfur Western subbituminous coal typified by Montana Rosebud and a high-sulfur Eastern coal typified by Illinois No. 6 coal. The Montana Rosebud coal results in the best economics, partly because of its cheaper cost, but more significantly, the CO2 can be utilized in nearby oil fields.

CO2 as a revenue stream to be sold for enhanced oil recovery (EOR) looks likely for Montana coal because of nearby oil fields in the Williston basin. However, the potential revenue stream remains questionable for an eastern plant location, as the location and responsiveness of local oil fields need to be established.

The study found the following return on investment (ROI) scenarios and economics, based on discounted ROI:

- Western coal to liquid transportation fuels, 14% ROI.

- Western coal to electricity via IGCC, 12% ROI.

- Western coal to liquid transportation fuels and electricity, 15% ROI.

- Western coal to liquid transportation fuels and electricity utilizing the ultragreen mode for making electricity, 16% ROI.

- Eastern coal to liquid transportation fuels and electricity, 9% ROI.

- Eastern coal to liquid transportation fuels and electricity utilizing the ultragreen mode for making electricity, 12% ROI.

The technology is commercially proven to make coal an important and significant source of liquid hydrocarbons. Large plants are already operating in South Africa. Coal especially should be part of the US overall alternative energy picture and recognized as on a par with other, more-frequently touted alternative energy sources such as biomass, hydrogen, and wind power.

Coal-rich US

Although the US has only 2% of global oil reserves, it has 27% of the coal reserves and is frequently referred to as “the Saudi Arabia of coal” (Fig. 1). Table 1 shows the top three coal-rich states and their estimated reserves. Although coal is not the single answer to broadening the US energy portfolio, it certainly is abundant enough to have an important positive impact on fuel supply because the US depends almost entirely on crude oil for its transportation fuels. This reliance, particularly on imported crude oil, has caused problems for the US. Not only does it affect it economically in its balance of trade but, more significantly, contributes to major foreign policy issues between the US and countries that exploit their oil power.

After taking into account process heat and electric power generation, about 2 bbl of liquids/short ton of coal can be produced using a coal gasification process followed by F-T synthesis. Therefore the combined total coal-derived liquids of just the above three states, when based on the more conservative estimated recoverable reserves, is 309.6 billion bbl of oil. If total imported oil is 7.3 million b/d, then these three states could supply all of the US imported oil for around 70 years. If the US relied on coal for all of its oil consumption of 20 million b/d, then it would have enough coal in these three states alone to run the US for 41 years. Obviously coal cannot be the primary source of liquid fuels for the US, but these calculations certainly demonstrate how vast US coal reserves are and that they are positioned to make a significant contribution.

The National Coal Council is pushing for government incentives to help generate some 2.6 million b/d of liquid fuel from coal by 2025. This would satisfy about 10% of the US’s total demand and reduce imported oil by 25%. The coal reserves and the technology are available to meet this goal. Only the economics remain in question

Coal gasification followed by F-T synthesis is proven commercial technology. Sasol Ltd. of South Africa is making about 160,000 b/d of liquid product from its coal reserves, and currently is offering its technology to license.1 While Sasol would charge a licensing fee, it is more interested in an equity position in the licensed projects-as much as 50%.

China is building a coal-to-liquids facility to produce about 200,000 b/d with its own direct liquefaction technology but also wants to use Sasol indirect liquefaction technology for an additional 80,000 b/d.2

Although direct liquefaction processes are more energy-efficient than F-T, they are difficult to run and keep on stream. From the point of reliability, indirect liquefaction wins hands down. China’s direct liquefaction technology will probably cause it problems later, as the coal ash creates huge erosion problems that eat away valves, and staying in donor solvent balance is a real trick.

The need for strategy

In 2003, the US consumed 20 million b/d of crude oil, with about 55% imported from foreign countries. The greatest suppliers of oil and oil products to the US are Canada, Saudi Arabia, Mexico, Venezuela, and Nigeria, in that order.

Several of these areas have experienced instability in recent years. Volatility anywhere in the oil patch drives up the price of crude from all sources. These recent instabilities have underlined the need for the US to develop more domestic resources. Fig. 2 summarizes how US crude oil consumption and production have trended during 1993-2003.

One continuing trend observed is that US crude consumption continues to increase while domestic production decreases.

Current initiatives

Currently the US Department of Energy is focusing its alternative transportation fuel efforts mainly on hydrogen and biomass as measured by the amount of funding allocated in these areas.

All hydrogen generated today is produced from a hydrocarbon source, generally natural gas. It could be made electrolytically, and if hydroelectric or nuclear power were used, it could be classified a green fuel. However, baring the development of surplus cheap nuclear power, an economically viable source of hydrogen is unlikely in the near future. In addition, the infrastructure to distribute hydrogen to fueling locations does not exist. Onboard vehicle storage capabilities would limit the range of any vehicle powered by hydrogen, although some attempts to concentrate it via metal hydrides have met with limited success. Hydrogen as a transportation fuel faces many challenges before it can significantly contribute to the transportation fuel mix.

The most significant biomass fuel in the marketplace today is ethanol produced from corn. US production is 4 billion gal/year. The debate over whether a gallon of ethanol requires more energy to produce than it contains has continued over the last 2 decades.

MIT chemistry professor John Deutch, a former director of energy research, undersecretary of energy in the Jimmy Carter administration, and former director of the Central Intelligence Agency, recently commented in the Wall Street Journal on the “biomass movement:” “Cultivation of corn is highly energy-intensive, and a significant amount of oil and natural gas is used in growing, fertilizing, and harvesting it. Moreover, there is a substantial energy requirement-much of it supplied by diesel or natural gas-for the fermentation and distillation process that converts corn to ethanol. These petroleum inputs must be subtracted when calculating the net amount of oil that is reduced by the use of ethanol in gasoline.

Others estimate that ethanol contains plus or minus 25% of the energy required for manufacture. But the energy issue is largely academic, as the economics of ethanol production depend on a government subsidy to make it a viable fuel. The current subsidy is $0.51/gal. The other source of biomass is cellulosic material such as the much-touted switch grass and agricultural by-products like corn stover and straw. However, cellulose must first be converted into sugar and then into ethanol with advanced enzyme technology. Genencor and Novozymes have made some headway. This technology, however, is still in the research and development stage.

Greenhouse emissions

Another important issue faced today is that of greenhouse emissions worldwide, notably CO2. Coal historically has been used to generate electric power, and in the US represents over half of all electric power generation. As stated in C&E News, “The US, like the rest of the world, has a coal problem: There is a lot of it and it is cheap, but it is dirty. Coal-fired power plants are responsible for 60% of US sulfur dioxide emissions, 33% of US mercury emissions, 25% of nitrogen oxide emissions, and more than 33% of the nation’s CO2 emissions.”3

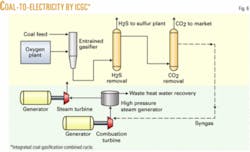

However, it doesn’t have to be that way because IGCC, shown in Fig. 3 for electric power generation, makes coal a very clean fuel with the side benefit of increasing the thermal efficiency from about 33% for conventional coal firing to more than 40% for IGCC. DOE is taking the lead in commercializing IGCC in its Future Gen Project slated for either Illinois or Texas, with two candidate plant sites in each state.

In a typical IGCC plant, coal is first gasified to synthesis gas, hydrogen, and carbon monoxide. The synthesis gas is scrubbed to remove acid gases and mercury. The synthesis gas is then burned in two sets of turbine drivers, first a combustion turbine and then a steam turbine to produce electricity. If the synthesis gas is passed through a water gas shift converter, the CO converts to CO2. The CO2 can also be scrubbed, providing a hydrogen-rich steam to the turbines. This scenario is called “ultragreen” because there would be very little CO2 emitted from the power plant. CO2 cannot currently be eliminated entirely, as some carbon must be left in the feed to the power plant for flame stability.

The increased cost of IGCC over conventional coal firing is 20-25%.4 However, when including the benefits of less air pollution and the ability to conveniently capture carbon dioxide emissions, the price difference is not so obvious. Furthermore, if the federal government enacts CO2 emission controls, they could make conventional coal-fired technology no longer the economic choice. The primary environmental benefit of IGCC is increased energy efficiency and the potential for significantly reduced air pollution. IGCC can be used as a springboard for making liquid hydrocarbons from coal by integrating F-T synthesis with the electric power generation plant.

The run-up in crude prices over the last year to $50-80/bbl has stimulated renewed interest in F-T synthesis. Furthermore, technological improvements in F-T synthesis, such as slurry phase reactors plus tougher environmental standards are pointing to F-T as a promising way to help abundant coal increase its contribution to total energy supply.

In addition to removing other pollutants from power generation, IGCC technology also is capable of capturing CO2 that can be sequestered. DOE is quietly funding CO2 sequestration partnerships around the country, such as the Blue Sky Sequestration Partnership in Montana.

Thus, IGCC technology, combined with CO2 capture, can provide a road to increased domestic crude production, provided the regional oil fields are receptive to CO2 flooding and the CO2 is available in sufficient quantities. CO2 captured from the Great Plains plant in North Dakota, is used in this manner. “Regional” is defined as a radius of 400-500 miles of the plant. CO2 currently is piped from southwest Colorado (Cortez) into the Texas panhandle-a distance of 450 miles. Thus, the CO2 situation today differs considerably from that during the energy crisis of the 1970s and 1980s, when CO2 was simply emitted to the atmosphere. Today CO2 can be a viable product in its own right. Tomorrow, it may be classified as a pollutant, making its capture mandatory.

The sale of CO2 in combination with power generation and the production of liquid transportation fuels from coal is the primary focus of this paper.

Fischer-Tropsch projects

Table 2 lists worldwide coal-based F-T projects that are existing, proposed, or in development. Three F-T plants based on coal are in operation: Sasol I, Sasol II, and Sasol III, all in South Africa. Originally they were developed more for political considerations than for economics. The world community refused to export oil to South Africa because of the government’s apartheid policy. Since apartheid ended, Sasol has licensed its F-T technology mainly for conversion of natural gas to transportation liquids. It most recently began converting gas to synthetic crude at the Oryx plant in Qatar, which in March will begin converting 330 MMcfd of lean gas from Qatar’s vast North gas field into products for global markets.

The recent escalation of crude oil prices has stimulated interest in additional coal-based F-T projects, notably in China and the US. Two commercial projects are moving forward in the US: Rentech Midwest Energy is converting an ammonia plant in Iowa using gas to make F-T liquids from Illinois coal, and WMPI Inc. in Pennsylvania is converting coal tailings to liquid fuels. Most recently, Montana Gov. Brian Schweitzer announced in fall 2006 that DKRW Advanced Fuels LLC will be building a coal-to-liquids plant in Montana producing 22,000 b/d of diesel fuel and about 150 Mw of electricity; completion is expected in 5 years.

Economics

Ultimately, it is economics that drives decisions relative to energy needs and whether coal conversion technologies can compete economically with crude oil. This article uses a case study approach to determine the economics of power generation, transportation fuels, and CO2 from coal. It specifies the commercial process, establishes the material balances, estimates the capital investment, and finally establishes the discounted rate of return on investment. It covers only green (capture of CO2 after gasification) or ultragreen (conversion of CO in the power plant feed to hydrogen-rich gas with water gas shift reactor, followed by CO2 capture) technology where CO2 emissions are captured and sequestered.

The six cases demonstrate the impact of key parameters, such as coal type (Eastern vs. Western), the coproduction of both electricity and liquid transportation fuels, and the use of CO2 for enhanced oil recovery (EOR) in nearby oil fields. All of these cases use only commercial proven technologies.

Four of the cases (1-4) are based on use of Montana Rosebud subbituminous coal, and two cases (5-6) are based on use of Illinois No. 6 bituminous coal:

- Coal to liquid transportation fuels, using F-T synthesis.

- Coal to electric power, using IGCC.

- Coal to both liquid transportation fuels and electric power.

- Ultragreen technology to eliminate essentially all CO2 emissions from the IGCC plant, using hydrogen-rich gas for the combustion turbine.

- Same as Case 3 but substituting high-sulfur, low-moisture Eastern coals feed instead of low-sulfur Western coal.

- Eastern high-sulfur, low-moisture coal with additional shift conversion to run in ultragreen mode with hydrogen-rich gas for combustion turbine

These cases are summarized in Table 3 with the products, investment, and return on investment (ROI). For this analysis, the price of oil was set at $60/bbl (conservatively equivalent to $1.80/gal for zero-sulfur diesel fuel), electricity at $35/Mw-hr, and CO2 at $1/Mscf to establish the cash flow.

The discounted cash flow (DCF) rate of return on investment is very attractive for Cases 1, 3, and 4, all based on using Western subbituminous coal, Montana Rosebud. Cases 5 and 6, based on bituminous Illinois 6 coal, have a lower ROI for two primary reasons. First, the Illinois coal is more expensive at $45/ton vs. $12/ton for Montana coal. Second, the Illinois coal has less moisture and gasifies more efficiently, producing less CO2. Hence there is less CO2 to sell for EOR, and this reduces the ROI in Cases 5 and 6.

Case 3 using Montana coal is a direct comparison to Case 5 using Illinois coal and the ROI drops to 9% with Illinois coal from 15% with the Montana coal, while Case 6 is a direct comparison to Case 4, and the return drops similarly to 12% from 16%. Although it is easy to justify the CO2 revenue stream for Montana coal because there are nearby oil fields that will benefit from EOR, it is less clear whether the same scenario could be found in the state of Illinois.5 Consequently, the return on Cases 5 and 6 for Illinois 6 coal might actually be lower if there is no market for the CO2 produced and producers must simply sequester it and inject it into the ground.

Case analyses

Case 1. Developing liquid transportation fuels from Western coal using F-T synthesis has several commercial advantages:

- It uses cheap Western coal.

- It employs a once-through F-T synthesis operation.

- CO2 is sold for EOR in nearby oil fields.

There also are environmental advantages for this scenario:

- All CO2 is captured.

- Sulfur, nitrogen, and mercury are captured in the gas cleanup following gasification.

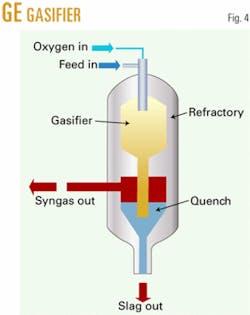

Montana subbituminous coal is gasified by slurrying in water and then fed with oxygen into an entrained flow gasifier such as the GE gasifier, previously known as the Texaco gasifier (Fig. 4). The gas composition leaving the gasifier includes CO, hydrogen (H), CO2, water (H2O), ammonia, and acid gases (H2S and COS) and small amounts of methane. For syngas generation, an entrained flow gasifier, like the GE version or Destec gasification process (formerly Dow’s; now ConocoPhillips’s), is preferred because it operates at high temperature and makes very little methane.

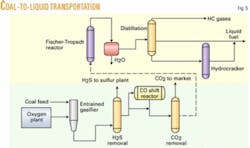

In this process, illustrated by Fig. 5, the water is condensed out, and acid gases, including CO2, COS, and H2S are removed separately with a gas scrubbing system such as Selexol. The hydrogen-carbon monoxide ratio is then adjusted by flowing part of the scrubbed gas through a CO shift converter to get a 2.1 ratio of H2 to CO. The syngas is then fed into an F-T reactor using a “once-through” flow through, rather than recycling the unconverted syngas and methane due to the high single pass conversion (greater than 90%) that is achieved. A once-through operation eliminates the need for separation equipment and compressors, reducing the capital investment. The unconverted syngas and light ends are burned for plant fuel.

The hydrocarbon yield structure6 is based on an F-T fixed bed reactor with a cobalt catalyst. The reaction products include a broad spectrum of hydrocarbons ranging from light gases to middle distillates, and finally waxes and water according to the following F-T chemical reaction:

Sasol’s Qatar facility has a more advanced slurry phase reactor. However, the yield structure from that reactor design is not available. Presumably, it is better than fixed-bed yields, and thus these reported liquid yields could be conservative. The reaction products include a broad spectrum of products ranging from light gases to middle distillates, and finally waxes, and water.

Water is separated from the hydrocarbon products in a condenser, and the hydrocarbons are then distilled in a fractionation column. Light gases leave overhead, middle distillates exit the middle of the fractionator, and the heavy waxes leave in the bottoms stream. The waxes are sent to a hydrocracker to reduce the high molecular weight hydrocarbons to light and middle distillate. The distillate produced has zero sulfur and a very high cetane number.

The CO2 stream is available for sale to oil production facilities. If that is not an option, it can be sequestered for injection into the ground. A recent DOE study by Advanced Resources International shows a strong potential for CO2 flooding in the Williston basin of Montana.5 Lookout Butte and Elk basin are two such areas being considered.

Case 2. This illustrates the generation of electric power using IGCC as the basis for gasification. The primary commercial advantage is that IGCC has a higher thermal efficiency than direct coal burning.

There also are several environmental advantages:

- CO2 from coal gasification is captured.

- All sulfur and nitrogen from coal are captured.

- Some NOx is emitted from the combustion turbine.

- Mercury from coal is captured.

This case is similar to Case 1 but now no liquid hydrocarbons are made, and instead all of the scrubbed syngas is directed to a power generation cycle (Fig. 6). The coal input is reduced in half because it is necessary to make only 525 Mw of power, as this is a typical size electric power generating facility for IGCC. Because the hydrogen-carbon monoxide ratio is no longer important, the CO shift converter can be eliminated from the process scheme.

More specifically, the unshifted syngas is fed into a combustion turbine that drives one set of electric generators. The hot combustion gas leaving the combustion turbine is then directed into a waste heat boiler to generate superheated steam. This steam is fed into a second set of steam turbines to generate more electricity. This coupling of the gas and steam turbines results in a higher thermal efficiency compared with conventional coal firing. More specifically, the thermal efficiency of IGCC is greater than 40%, whereas direct coal firing is around 33%.

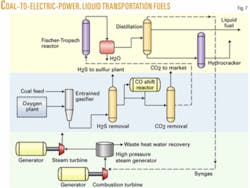

Case 3. Case 3 is conversion of coal to both liquid transportation fuels and electric power. There are a number of commercial advantages to this process:

- Unconverted syngas from the F-T reactor can be burned in the combustion turbine.

- The process can make both liquid fuels and electricity.

- There is higher thermal efficiency from IGCC.

In addition, it has many environmental advantages:

- All CO2 is captured from the gasification section, but CO2 is emitted from the combustion turbine.

- All sulfur and nitrogen from the coal are captured.

- A small amount of NOx is emitted from the combustion turbine.

- Mercury in coal is captured.

Case 3 is a combination of Case 1 and Case 2 using the same amount of Montana coal as Case 1 but splitting the syngas production into two parts, roughly half for electric power generation, and the other half for production of F-T liquids. The primary coupling of the two processes is with the light gases leaving the F-T section of the plant being fed to the electric power section. Referring to Fig. 7 for Case 3, the process flows have been described previously for the separate parts of the combined process, so no further discussion is necessary here.

Case 4. In Case 4, ultragreen technology eliminates most CO2, using hydrogen-rich gas in combustion turbines. This process has five major commercial advantages:

- It produces the highest ROI.

- Unconverted syngas can be burned in the combustion turbine.

- Both liquid fuels and electricity can be made.

- Higher thermal efficiency is derived from IGCC.

- Combustion turbine burns a hydrogen-rich gas, so little CO2 is emitted.

There also are a number of environmental advantages of this method:

- CO2 emissions are extremely low.

- All sulfur and nitrogen from the coal are captured.

- A small amount of NOx is emitted from the combustion turbine.

- Mercury in coal is captured.

This case is quite similar to Case 3, but now almost all of the syngas is shifted to make a hydrogen-rich stream for the combustion turbine (Fig. 8). A slip stream is taken before the shift converter A hydrogen-rich stream leaving the CO2 scrubber is blended with this slip stream to achieve the required 2.1 to1 hydrogen-carbon monoxide ratio. The combined stream is then fed to the F-T section of the plant.

Combustion turbines need to be specifically modified to handle hydrogen-rich fuel. Flame stability is a problem and can be partially solved by adding methane to the fuel so that it stabilizes the flame.

General Electric, a major gas turbine maker, has worked with this flame stability problem and claims to have it reasonably solved.7 Obviously this is critical to making the ultragreen case a commercial reality.

Case 5. This illustrates the use of high-sulfur, low-moisture Eastern coal instead of Western coal but has the same flow as Fig. 7. It has two major commercial advantages: It is near major liquid fuel markets, and it enables the use of high-sulfur Eastern coal, as all sulfur is captured.

It has more environmental advantages:

- All CO2 is captured from the gasification section, but a small amount is emitted from the combustion turbine due to CO burning.

- All sulfur and nitrogen from the coal are captured.

- A small amount of NOx is emitted from the combustion turbine.

- Mercury in coal is captured.

Case 5, using Illinois 6 coal, is very similar to Case 3, using Montana Rosebud coal. A comparison of the properties (proximate analysis) of the two coals is shown in Table 4.

The two major differences between the coals are in the moisture and sulfur content. Specifically, the Rosebud coal is characterized by low sulfur and high moisture. The higher moisture content of the Rosebud hurts the overall thermal efficiency of gasification, particularly for a GE gasifier, where the coal is slurried in water. Slurry solids concentration for Illinois coal is typically 65% coal or higher, while Montana coal slurry concentrations are in the range of 45% solids.

For cases 5 and 3, the cold gas thermal efficiency for Illinois 6 coal was 79%, while the Montana Rosebud ran 67%. Presumably most of this loss was due to the higher water content in the slurry feed, which must be vaporized before the reaction will take place. This results in more carbon in the coal being converted to CO2 rather than CO to generate the necessary heat of vaporization.

If CO2 can be sold, the higher production of it is an economic credit rather than a debit. The revenue from CO2 sales can actually exceed the revenue from liquid fuels production. The CO2 revenue stream is one of the key reasons the Montana coal (Case 3) has an ROI of 15% while that of the Illinois coal (Case 5) is 9%.

The CO2 stream will be smaller in this Case 5 due to the increased cold gasifier efficiency as discussed. The sulfur will be higher due to the Illinois No. 6 coal’s containing about five times as much sulfur.

Case 6. This is the ultragreen mode for converting Illinois 6 coal to electricity and liquid fuels. Its commercial advantages are that it is close to major liquid fuel markets, and it allows high-sulfur Eastern coal to be used, as all sulfur is captured.

There are four major environmental advantages:

- It has extremely low CO2 emissions.

- All sulfur and nitrogen from the coal are captured.

- A small amount of NOx is emitted from the combustion turbine.

- Mercury in coal is captured.

The process flow sheet for this case is identical to the ultragreen case using Montana coal in Case 4 (Fig. 8). Recalling that almost all of the CO in the syngas is shifted to hydrogen, this process requires a larger CO shift converter, which results in $37 million more in capital investment for the bigger shift converter.

The amount of CO2 produced from lower-moisture Illinois 6 coal is smaller due to the higher efficiency of the gasification step. Less water in the gasifier results in higher cold gas efficiency, and less CO2 produced. CO2 production for this case is 297 MMscfd compared with 387 MMscfd for the Montana ultragreen case. ROI is 12%, or 3% higher than Case 5 using standard syngas in the combustion turbine.

Even though an additional $37 million is required for the larger shift converter, a higher ROI justifies the additional cost to operate in the ultragreen mode if the CO2 can be sold for EOR.

Future challenges

If crude oil prices drop back to the $40-50/bbl level, then indirect liquefaction of coal will no longer be economically attractive, particularly with the operating risks associated with this technology and the huge capital investment required.

Providing assurances and incentives for private industry to build and operate one of these coal plants is critical to moving ahead. The technology is essentially proven by the plants operating in South Africa by Sasol but the risk of investing large amounts of money and then having the product values drop is a nagging worry.

The price of crude has fluctuated since its discovery in the 19th Century, and it is reasonable to assume these fluctuations will continue. Thus if a plant is built, its economic outlook will vary with the price of crude.

This has been the experience of the Great Plains coal-to-synthetic natural gas plant in Beulah, ND, which was built in the oil crisis of the 1970s and 1980s.

After the plant was built, the price of natural gas fell. Large quantities of gas became available, and no other coal-to-methane gasification plants have been built in the US.8

Action recommended

Given world politics, however, it seems prudent for countries with large coal reserves to move forward with commercialization of this technology. Governments of such countries, including the US, should promote the technology in several ways:

- Organize a consortium of oil, coal, and power companies to design, build, and operate these plants. Production of electricity and CO2 for EOR will cushion the economic downside when crude prices drop.

- Begin or continue loan guarantees for synfuels plants-80% in the US.

- Provide a price support for the product from the plant, perhaps guaranteeing to purchase the entire liquid product at a set price. This guarantee would not be that significant for the initial plants as they would only produce 5,000-10,000 b/d of liquid fuels.

- Offer tax credits to corporations that build and operate green and ultragreen coal plants that make either liquid fuels or electricity.

- Streamline environmental permitting so that construction can proceed in a timely manner.

The potential of coal is a resource base that can reduce such countries’ dependence on foreign oil. The US, in particular, has sufficient coal reserves to reduce oil imports, which are becoming a political liability. Converting coal to liquids via gasification followed by F-T (indirect liquefaction) is advisable for the following reasons:

- The technology is commercially demonstrated; there are several commercial plants in operation around the world today.

- The potential for an environmentally green process is exceptional.

- Integration with other technologies such as IGCC and EOR is significant.

- The CO2 produced is a potentially important revenue stream in any coal gasification plant. Its value depends on nearby oil fields that are suited to EOR by CO2 injection. Considerable work has been done to determine that many oil fields are suitable for EOR using CO2 flooding. These same studies need to be carried out on other oil fields.

If the CO2 can be sold, then shifting the synthesis gas power plant feed to a high concentration of hydrogen is economically attractive despite the increased capital investment for a larger shift converter.

The economics of gasification to coproduce power, transportation liquids, and CO2 favors Western subbituminous coal over Eastern coal in the US. Western subbituminous coal produces more CO2/ton of coal gasified while producing less transportation liquid.

Using existing technology, such as IGCC, countries can produce coal as a very clean energy source for both electric power generation and liquid fuels production. Greenhouse gas emissions are almost completely eliminated with CO2 capture and sequestering.

Coproduction of both electricity and liquid transportation fuels from coal seems to generate the highest ROI. In this study, the potential for coal has been clearly demonstrated. It is time to move ahead in developing transportation fuels from this domestic energy resource base. It broadens energy resources for liquid hydrocarbons and exploits a huge resource in an environmentally friendly way.

References

- Barta, Patrick, “South Africa has a way to get more oil: Make it from coal,” Wall Street Journal, Aug. 16, 2006.

- Deutch, John, “Biomass movement,” Wall Street Journal, May 10, 2006.

- Johnson, Jeff, “Getting to ‘clean coal,’” C&E News, Feb. 23, 2004.

- Moore, Taylor, “Coal-based technology at the crossroads,” EPRI Journal, Summer 2005.

- Basin-oriented strategies for CO2 enhanced oil recovery-Williston basin, Advanced Resources International, February 2006.

- Probstein, R.F., Hicks, R.E., “Synthetic fuels,” McGraw-Hill Book Co., 1982, p. 172.

- Todd, D.M., Battista, R. A., “Demonstrated applicability of hydrogen fuel for gas turbines,” GE Power Systems.

- “Pioneering gasification plants,” US DOE, (http://www.fe.doe.gov/programs/powersystems/gasification/gasificationpioneer.html).

The authors

Ken K. Robinson ([email protected]) is president of Mega-Carbon Co. He has several years of industrial experience working at such companies as Monsanto, Amoco, and Argonne National Laboratory where he held positions such as director of coal utilization; research associate; manager, technical university relations; and associate director, technology transfer. Robinson has published 20 articles and holds 9 patents. He is coinventor of the Robinson-Mahoney spinning basket reactor and, with Ralph Bertolacini, the Amocat coal liquefaction catalysts used at the H-Coal pilot plant in Catlettsburg, Ky. At Monsanto, Robinson was a member of the development team for the homogeneously catalyzed acetic acid process that was commercialized worldwide.

David F. Tatterson is currently involved in businesses development for Mega-Carbon Co. He has 33 years of experience within the petroleum, alternative energy, and activated carbon industries. His expertise includes hydrocarbon process development, product development, marketing, marketing research, and business development. In the marketing area, he has extensive experience in global markets, including China, Russia, Mexico, Brazil, Turkey, Azerbaijan, and India. Tatterson holds 8 US patents and has published a number of technical and marketing papers.