OGJ Newsletter

Saudis foil Al Qaeda terrorist plots, arrest 208

Saudi Arabia said it has preempted a terrorist attack on its oil facilities in the eastern region of the country with the arrest of eight suspects said to be linked to the Al Qaeda terrorist organization.

An Interior Ministry statement said the eight were part of a terrorist cell led by a non-Saudi man, who also was arrested. It said the arrest of the eight pre-empted an imminent attack on an (unnamed) oil installation.

The ministry said the men were arrested as part of a security sweep that netted some 208 suspects either for plotting various terrorist activities in the country or supporting the Al Qaeda network.

One group of 18 suspects, led by an alleged expert in launching missiles, was arrested separately. “They were planning to smuggle eight missiles into the kingdom to carry out terrorist operations,” the ministry said.

In August, Saudi Arabia announced plans to establish a 35,000-person strong special force to protect its oil facilities due to the increasing threats against them by the Al Qaeda network.

In April, Saudi authorities conducted a sweep that netted 172 alleged militants, including pilots authorities said were trained for attacks on oil refineries using civilian airplanes (OGJ Online, Apr. 27, 2007).

There have been several terrorist attacks on the country’s facilities in recent years linked to the Al Qaeda network.

In February 2006, Saudi officials confirmed that a terrorist attack failed to disrupt operation of the Abqaiq crude oil processing facility, which handles as much as two thirds of the country’s production and most of its exports from the Persian Gulf (OGJ Online, Feb. 24, 2006).

In May 2004, Saudi Arabian officials pledged better security in the country after a terrorist attack at its oil and petrochemical hub at Yanbu on the Red Sea, which left 6 dead and as many as 33 wounded (OGJ Online, May 3, 2004).

Petroecuador president named to quell unrest

Ecuador has appointed Navy Rear Admiral Fernando Zurita to head Ecuadoran State Petroleum Enterprise to deal with an emergency situation facing the state-run oil company.

The action was taken partly due to an urgent need to restructure Petroecuador but mainly to quell a public protest that has caused a drop in production at the Auca Sur, Auca Central, and Cononaco oil fields. “The forced interruption affects 47 oil wells, which means a daily loss of approximately $3 million, since they have stopped producing 36,000 b/d of oil, plus the damage done to oil field infrastructure,” said Ecuador’s President Rafael Correa in a statement.

Zurita’s first mission will be to indict “on grounds of sabotage the unpatriotic people who inflicted the damage,” a presidential decree said. The administration said it had not ruled out declaring a state of emergency in Orellana province.

Activists curb Petroecuador’s Auca Sur oil output

Ecuador’s state-owned Petroecuador said it has lost some 5,000 bbl of oil output due to a continuing protest by local villagers that disrupted operations in Dayuma, Orellana Province.

Petroecuador said a set of protesters blocked a bridge on Nov. 25, while other militants forced their way into the Auca Sur station and electric plant, “demanding that operators shut down the entire oil power system, provoking disorder and acts of vandalism.”

On Nov. 26, the company said, more protesters reached the Auca 61D well and used dynamite to disable a hydraulic pump, effectively shutting down the installation.

The villagers are demanding jobs, electricity, and paved roads. But Petroecuador, describing the occupation as a terrorist action, said it had already met the villagers’ demands to improve basic public facilities in the district.

Meanwhile, the firm warned of adverse effects from the protest, saying that “production losses will go on increasing every hour” that the complex remains shut down. Normal daily production at the Auca Sur field is about 176,000 b/d.

In March a blockade by protesters in the Amazon region forced the company to cut oil exports by 36,000 b/d for about a week.

Ecuador produces around 500,000 b/d of oil, making it the fifth-largest producer in South America.

Gas key to climate change, executive says

Natural gas must continue to be a major fuel in Germany’s energy mix if climate change is to be addressed successfully, said Burckhard Bergmann, chairman of E.On Ruhrgas.

It is not enough to focus only on renewable energy to reduce carbon emissions, Bergmann said. Energy efficiency and cost input are also necessary.

“A policy ‘away from gas’ will lead into a blind alley in energy policy,” he said. “If the climate benefits of natural gas are not used, people will be buried by an avalanche of costs.”

Investment in technology and the promotion of renewable energy must both be reflected in relevant legislation, Bergmann added.

E.On Ruhrgas has launched Erdgas.On, which will focus on technologies that are environmentally friendly for the gas market. It also will develop the biogas market on a commercial scale and introduce the renewable as a motor fuel.

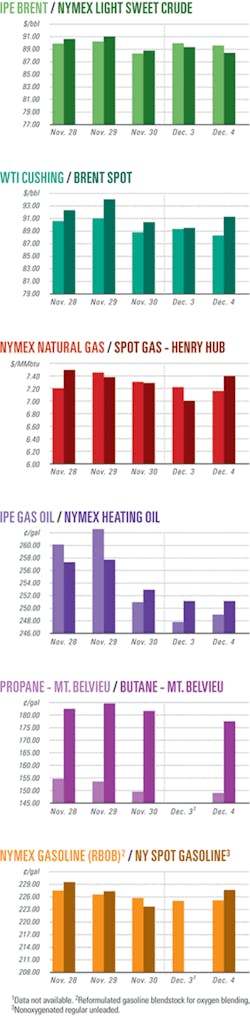

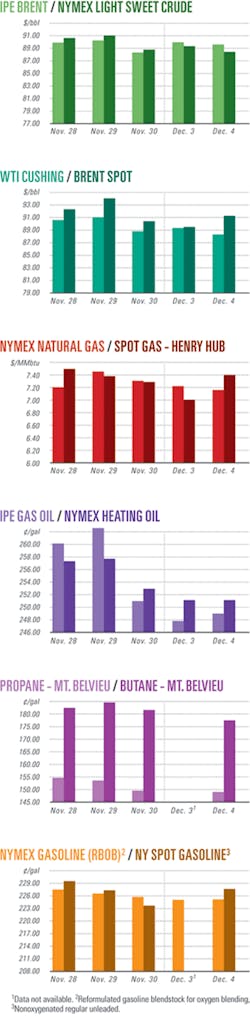

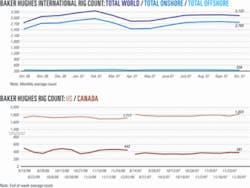

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesApache finds gas with Jade-4 well in Egypt

Apache Corp., Houston, will complete the Jade-4 exploration well in Egypt’s Western Desert as a gas and condensate producer after it flowed 23.8 MMcfd of gas and 2,107 b/d of condensate from the Jurassic Alam El Bueib-3G (AEB) formation.

Apache logged 234 ft of net pay in the AEB, which it described as one of the “most prolific reservoirs” in the greater Khalda concession. Jade-4 is adjacent to the Jade-1x discovery, which logged 217 ft of AEB pay and 66 ft in the Jurassic Upper Safa formation in March (OGJ Online, Apr. 3, 2007). “The discovery was completed as a gas producer from the Upper Safa after a test of 25.6 MMcfd of gas,” Apache said.

It will carry out appraisal and development work next year along the Jade trend and will drill other prospects. After drilling three wells in Jade field along the Matruh Ridge, Apache has found hydrocarbons in four discrete reservoir intervals.

“The Jade-2x well is producing gas and condensate after testing over 20 MMcfd of gas from each of two AEB sands,” Apache said. “In addition, oil pay was identified in another AEB sand behind casing in the Jade-1x and Jade-4.”

G. Steven Farris, Apache president and chief executive officer, said the Jade discovery “was one of several higher-risk, higher-reward exploration prospects we have developed across the 37 million acres we have assembled in [the company’s] core growth regions of Australia, Canada, and Egypt.”

Jade is in the quarter-million-acre Matruh concession in which Apache holds a 100% interest.

Brazil awards five Santos basin blocks to Karoon

Melbourne-based Karoon Gas Australia Ltd. has been awarded five contiguous offshore exploration blocks in the Santos basin off Brazilthe same region as the recent 8 billion bbl Tupi oil discovery (OGJ Online, Nov. 16, 2007).

Karoon said the Brazilian permits are 300 km east-southeast of Tupi and 100 km from producing Caravela and Coral oil and gas fields.

The blocks1037, 1101, 1102, 1165, and 1166will be officially awarded next March when Karoon pays $25 million in nonrefundable signature bonuses and refundable bid bonds.

Karoon has pledged a work program consisting of geological analysis along with the reprocessing and interpretation of existing seismic data. The company must acquire an additional 170-sq-km 3D seismic survey in three of the permits during the first 3 years. In an optional second 3-year term, one well is committed to each block.

Karoon was one of the successful companies that bid a total $1.5 billion in cash for 117 exploration blocks.

Heritage JV wins exploration license in Pakistan

Pakistan on Nov. 17 granted a petroleum exploration license for Block 3068-2 (Sanjawi) to a joint venture of Heritage Oil & Gas Ltd. 60%, Sprint Energy (Pvt.) Ltd. 30%, and Trakker Energy (Pvt.) Ltd. 10%. Heritage will serve as operator.

Block 3068-2, which lies in Zone-II, covers 2,258 sq km in the Loralai and Kohlu districts of Balochistan. The JV intends to invest $10.1 million in the block to carry out geotechnical studies; acquire, process, and interpret 330 km of 2D seismic data; and drill two exploratory wells during Phase I of the initial 3-year period.

This is Heritage’s first exploration license in Pakistan.

Drilling & Production - Quick TakesStatoilHydro stops Ormen Lange gas production

Natural gas production from Ormen Lange field, the largest gas field in development on the Norwegian Sea’s continental shelf, was stopped because of a gas leak in the export compressors. Ormen Lange, which lies 120 km northwest of Kristiansund, holds 397 billion cu m of proved gas reserves.

Field operator StatoilHydro AS expects production to resume Dec. 2 after it has carried out an inspection and repair work.

Gas from Ormen Lange is transported to the UK via the 600-km southern leg of the Langeled pipeline, which is expected to supply as much as a fifth of the UK’s gas needs at full capacity rates.

The field, expected to supply 70 million cu m/day of gas and 50,000 b/d of condensate at peak rate, will position Norway as the world’s second largest gas exporter after Russia. Gas can also be transported to European markets after it has been processed at the Sleipner hub.

The partners expect to produce gas from 24 subsea wells on the field and Royal Dutch Shell PLC assumed operatorship on Dec. 1.

CNOOC starts up platform in PL 19-3 field

CNOOC Ltd. has brought Platform C on stream in Peng Lai (PL) 19-3 oil field on Block 11/05 in Bohai Bay.

This is the first wellhead platform starting production in the field’s Phase II development.

The facilities in Phase II development include five wellhead platforms, a central processing facility, and a world-class floating production, storage, and offloading vessel with a processing capacity of 190,000 bo/d and the capability to handle 510,000 b/d of total fluids (OGJ Online, Mar. 21, 2007).

PL19-3, the largest oil field off China, is being developed jointly by operator CNOOC 51% and ConocoPhillips China Inc. 49%.

Phase I of PL 19-3 went on stream in December 2002 from a single wellhead platform and a leased FPSO.

Petrobras starts tests at P-52 platform

Petroleo Brasileiro SA (Petrobras) on Nov. 23 began production tests at Platform P-52 in Roncador oil field in the Campos basin 125 km off Brazil.

P-52 is a semisubmersible production unit with a capacity to process 180,000 b/d of oil, to compress 9.3 million cu m/day of gas, and to inject about 300,000 b/d of water into the reservoir (OGJ Online, Nov. 7, 2006). It is installed in 1,800 m of water, a Brazil record.

The platform initially will handle volumes of about 20,000 b/d but is expected to reach its total capacity of 180,000 b/d in mid-2008 when it will be interconnected to 18 production and 11 water injector wells.

The platform’s hull was built in Singapore, and its operating modules were manufactured in Brazil.

Gasification project planned in North Dakota

Great Northern Power Development LP (GNPD), Houston, and Allied Syngas Corp., Wayne, Pa., have developed a $1.4 billion coal gasification project in southwestern North Dakota.

The project, designated South Heart, will use coal in a chemical process to create substitute natural gas.

The South Heart project involves seven British Gas Lurgi gasifiers that will use North Dakota lignite to produce up to 100 MMcfd of pipeline-quality synthetic gas.

Existing pipelines will transport the gas throughout North America, GNPD said.

The BGL technology is owned jointly by Envirotherm and Advantica Ltd., both of which will provide the technology license, process design, and related technical support for the gasification process.

GNPD owns much of the coal reserves that will fuel the project.

Processing - Quick TakesFire shuts down second Saudi refinery

Fire has shut down a Saudi Arabian refinery, according to a statement by Saudi Aramco Lubricating Oil Refining Co. (Luberef). It is the second fire-related accident at an Aramco facility in a month.

Luberef said the fire broke out Dec. 1 at one of its refineries south of Jiddah but was put out quickly with no casualties. It did not mention which of its two refineries was closed.

Luberef operates refineries in Jeddah and Yanbu for the production of lubricating base oils. The combined design capacity of Luberef’s two refineries is 550,000 tonnes/year.

In the statement, Luberef Chief Executive Omar Bazuhair said the fire would not affect the company’s supplies, and the refinery would be reopened “within a short period of time after carrying out some tests on the products.”

Bazuhair said the fire started in a storage tank when a malfunctioning cooling fan ignited a propane leak.

In an earlier accident, 28 people were killed and another 10 injured on Nov. 18 when an explosion ignited a fire along the Haradh-‘Uthmaniyah gas pipeline in Saudi Arabia’s Eastern province. Saudi authorities ruled out any terrorist connection with the accident (OGJ Online, Nov. 19, 2007).

In late November, the Saudi government reported that it had preempted a terrorist attack on its oil facilities in the eastern region of the country with the arrest of eight suspects said to be linked to the Al Qaeda terrorist organization (OGJ Online, Nov. 29, 2007).

Luberef was founded in 1976 as a joint venture of Saudi Aramco 70% and ExxonMobil 30%. In early November, Saudi Aramco said Jadwa Investment Co. had reached an agreement to acquire ExxonMobil’s 30% stake in Luberef.

Total, Sonatrach plan Algerian petchem complex

Total SA and Algeria’s Sonatrach have signed a framework agreement to build a $3 billion petrochemical complex with a 1.4 million tonne/year ethane cracker in Arzew, near Oran, by 2012. The signing follows a memorandum of understanding signed in July (OGJ Online, July 19, 2007).

The facility will produce 1.1 million tonnes/year of ethylene, which will be processed into polyethylene (two units with a total capacity of 800,000 tonnes/year) and monoethylene glycol (550,000 tonnes/year). The companies plan to issue technology tenders for the units.

Total will invest over $1.5 billion in the complex, which will export most of its products. Feed gas from fields in southern Algeria will be used at the complex.

Total Chief Executive Christophe de Margerie said the project would expand the company’s petrochemical activities based on world-class facilities. “It signals our entry into Algeria’s petrochemical industry and strengthens the existing partnership between Total and Sonatrach in oil exploration and production.”

Total holds a 51% stake in the joint venture and Sonatrach 49%.

China’s NDRC okays Sinopec, KPC JV

China’s economic planning agency, the National Development and Reform Commission (NDRC), has approved a joint refinery venture project between China Petroleum & Chemical Corp. (Sinopec) and Kuwait Petroleum Corp. (KPC) in southern China’s Guangdong province.

Sinopec last year agreed to establish a $5 billion joint venture refinery with KPC in the Guangdong city of Nansha, with a refining capacity of as much as 15 million tones/year and an ethylene capacity of 1 million tonnes/year.

Sinopec gave no timetable for the project, but once it is online, NDRC has ordered Sinopec to shut down its 200,000 tonne/year capacity ethylene facility operated by Sinopec Guangzhou.

PetroSA mulls major South Africa refinery

Petroleum Oil & Gas Corp. of South Africa (PetroSA) has hired KBR to assess the feasibility of constructing a 200,000 b/d refinery at Coega in Port Elizabeth, South Africa, by 2014-15.

The refinery, entitled Project Mthombo, is expected to cost $6 billion. KBR described the proposal as one “of the largest post-2010 investments in South Africa.”

Under the 6-month prefeasibility study, KBR will examine the economic optimum configuration for the refinery, including crude oil type and costs, required product slate, prices, and specifications, and capital and operating costs. “After the configuration has been approved, Project Mthombo will move on to the feasibility phase, which will define the engineering scope of the refinery,” KBR said.

Project Mthombo is an important strategic element to cut South Africa’s reliance on imported automotive fuels. If successful, it could be expanded to allow for products exports or other growth opportunities and could be integrated with downstream petrochemical opportunities.

Job opportunities for 20,000 South Africans will also be available if the refinery is constructed in one of the most impoverished provinces in the country.

PetroSA said several South Africans would work closely with KBR on the prefeasibility study. KBR is the engineering and construction unit of Halliburton, Houston.

Transportation - Quick TakesUK’s Milford Haven gas pipeline commissioned

UK pipeline operator National Grid PLC has commissioned the final section of the Milford Haven-Tirley pipeline, which will deliver gas from the Milford Haven LNG terminal into the national transmission system at Tirley in Gloucestershire.

Gas transport along the 316 km pipeline will start by mid-December. National Grid completed the project in 3 years.

The Milford Haven-to-Aberdulais pipeline was commissioned last month, and the section from Brecon to Tirley also has been tested and filled with gas.

Opening the valve energy minister Malcolm Wicks said: “National Grid’s new pipeline will be able to carry 20% or more of the UK’s gas needs once imports into Milford Haven start next year, and it will also help to secure Wales’ energy supply for many years.” In the past, Wales’s gas has been piped through England and Scotland. “Now for the first time, Wales is at the front end of the UK’s gas supply system,” said Wicks.

Gazprom, Eni sign South Stream pipeline deal

Russia’s OAO Gazprom and Eni SPA of Italy signed an agreement to build the projected 560-mile South Stream gas pipeline under the Black Sea and through Bulgaria.

The agreement, seen by both sides as a strategic development in the supply of energy to Europe, was signed as part of Italian Prime Minister Romano Prodi’s visit to Russia for talks with President Vladimir Putin.

“Russia and Europe are interdependent. Europe needs Russia and Russian needs Europe,” said Prodi, who added, “We need to move as quickly as possible toward a strategic partnership.”

“The South Stream project is of strategic importance for Europe’s energy security,” Putin said. “It is being implemented based on principles of transparency and taking into account interests of energy suppliers and consumers,” he said. Officials from Gazprom and Eni signed the agreement to establish 50:50 joint venture to develop a marketing and feasibility study for the pipeline.

On completion, the $10 billion line eventually could distribute gas to northern and southern Europe, with an estimated annual capacity of 30 billion cu m. “The new pipeline system, which complies with the strictest technological and environmental criteria, will significantly improve the security of supply of the whole of Europe,” Eni CEO Paolo Scaroni said.

Gasunie joins Nord Stream, BBL consortiums

JSC Gazprom has formally accepted NV Nederlandse Gasunie into the consortium that plans to build the 27.5 billion cu m/year Nord Stream pipeline to deliver Russian gas to Europe starting in 2010.

Gasunie also will join the partners that developed the Dutch Balgzand Bacton Line (BBL), which started operations last year and sends gas from the Netherlands to the UK. The deal builds on a memorandum of understanding signed last October in which Gasunie expressed an interest in cooperating on Nord Stream and BBL.

Under an umbrella agreement signed Nov. 6 by both companies, Gasunie will acquire a 9% share in Nord Stream AG, with consortium members Wintershall AG and E.On Ruhrgas AG reducing their interests by 4.5% each. Gazprom also will have an option to acquire a 9% interest in BBL Co. When the deal is executed, shareholdings in Nord Stream will be Gazprom with 51% share, Wintershall and E.On Ruhrgas with 20% each, and Gasunie 9%.

According to the agreement, Gazprom also will gain access to transport capacity within Gasunie’s network, which has an annual throughput of about 100 billion cu m. The Netherlands’ position as a gas hub for northwest Europe is of particular interest to Gazprom.

The revised shareholdings in BBL Co., if Gazprom utilizes its option, will be Gasunie will keep 51%, E.On Ruhrgas and Fluxys 20% each, and Gazprom 9%. Gazprom Chairman of the Management Committee Alexei Miller and Gasunie Chief Executive Marcel Kramer said the new partnership would enable delivery of secure gas supplies to Europe, particularly as domestic production is falling and gas demand increasing.

Cosco Busan detained in US following spill

Audet & Partners LLP, attorneys who earlier filed a class action lawsuit representing the fisherman, boat operators, and other alleged victims of the Nov. 7 oil spill into San Francisco Bay, have obtained a court order authorizing the “arrest” of the Cosco Busan to keep the vessel from leaving the country.

“Under well-established maritime law, in these circumstances, it is appropriate to make sure the vessel involved in the oil spill does not leave the jurisdiction of the United States,” said William M. Audet of Audet & Partners.

The US District Court issued an order Nov. 20 granting the plaintiff attorneys’ request to arrest movement of the Cosco Busan.