Orders for production floaters spiked in second-half 2006, according to International Maritime Associates Inc.’s 4-month update of worldwide floating production systems. IMA found that since July the industry has placed orders for 20 production floaters, which will add almost 9% to the future inventory.

IMA’s project inventory includes floating production, storage, offloading (FPSO) vessels, production semisubmersibles, spars, and tension-leg platforms (TLPs).

Its report provides details for production and storage floaters in service, profiles known floater projects in the planning pipeline, analyzes market share of key players in the floater sector, and examines developments taking place that impact the future floater market.

Its series of reports began in the mid 1990s.

Inventory

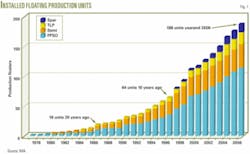

IMA’s latest report says that industry had 188 production floaters in service or available at yearend 2006. This amount is almost triple the number of units operating 10 years ago and more than 10 times the number 20 years ago (Fig. 1).

The current inventory consists of 115 FPSOs, 39 production semis, 20 TLPs, and 14 spars.

These units are on fields primarily off West Africa, Northern Europe, US Gulf Coast, Brazil, Southeast Asia, China, Australia, and New Zealand.

Besides the production units, the industry has installed 70 floating storage vessels, without production capability, primarily in Southeast Asia, West Africa, and the North Sea.

Order backlog

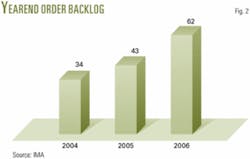

The report says the industry had 62 units on order at yearend 2006 for delivery during the next 2 years. This is much higher than the backlog at the same time in previous years (Fig. 2).

The current backlog consists of 47 FPSOs, 9 production semis, 2 TLPs, and 4 spars.

According to Jim McCaul, head of IMA, “this is by far the highest order backlog of floaters in the 30-year history of floating production systems.” He added that “the number of floaters now on order is about the same as the total number in operation 10 years ago.”

McCaul sees the market for floating production units in the foreseeable future to continue to be strong. He has identified 108 projects currently in the bidding, design, or planning stage that potentially require floating production or storage systems.

McCaul said, “if all these projects materialized, they would generate a requirement for 88 production floaters, 15 floating storage units, and 7 floating regasification facilities.”

In terms of water depth, 25 of the 108 projects in the planning pipeline are in ultradeep water, deeper than 1,500 m. Another 28 are in water depth of 1,000-1,500 m, while the remaining projects are in water less than 1,000 m deep.

The report says seven operators account for 56 of the 108 projects in the planning pipeline. Petroleo Brasileiro SA (Petrobras) has the most with 16 projects, followed by Chevron Corp. with 11, Total SA and Royal Dutch Shell PLC with 7 each, BP PLC with 6, ConocoPhillips with 5, and BHP Billiton Ltd. and Eni SPA with 4 each.

Fabrication facilities

The IMA report says that the number of facilities for fabricating or converting floating production and storage systems also has increased. Currently 34 facilities worldwide, up from 31 in July and 20 from 2 years ago, fabricate or convert floaters.

These facilities do work covered by major fabrication or integration contracts but not work done by subsuppliers and engineering, which is done at many other locations.

The report says Asia continues to have the most construction activity for production and storage floaters, with 16 units currently being built.

FPSO construction is strong in China, with a focus on midsize production units, both ship-shape and cylindrical. Korea continues to fabricate mostly top end, purpose-built production units. Singapore remains the major center for conversion of tankers to FPSOs, according to the report.