The sharp recent rise in well drilling and particularly well stimulation costs has led to the concern that much of the US unconventional gas resource may be becoming uneconomic.

Similar concerns about economic viability have existed since the initial pursuit of this resource, sometimes rightly so. However, by pursuing improvement in the unconventional gas knowledge base and its recovery technology (using industry-government partnerships), in our view, the industry will be able to maintain the economic viability of this large, often marginally productive resource.

Past reservoir characterization methods and traditional means of linking a wellbore to the low-permeability unconventional gas reservoir are no longer sufficient. As such, the discussion of the economic viability of unconventional gas is as much a story of technological advance and the pursuit of efficiency, as introduced in the third (OGJ, Sept. 24, 2007, p. 48) and fourth articles (OGJ, Oct. 1, 2007, p. 46) in this series, as it is a story of costs, financial risks, and wellhead prices.

Even though the overall economic trends for unconventional gas are currently unfavorable, with finding and development costs rising faster than wellhead prices, examples of economic success nonetheless exist.

This fifth article in the series presents a number of examples of how selected companies, with diligent pursuit of knowledge and technology, have converted previously judged uneconomic unconventional gas plays into economically viable prospects. In addition, potential actions can help maintain the future economic viability of US unconventional gas, although several challenges on the horizon could influence the future economics of this resource.

Cost increases

If sharp increases in well drilling and completion costs continue, they will harm the economic viability of unconventional gas.

So far, oil field service companies have been able to increase prices charged for services and products because of increases in natural gas prices and the subsequent boom in unconventional gas development.

For example, rig rates quoted at $12,000/day several years ago are now routinely at $18,000-20,000/day or more. Hydraulic fracturing services and tubulars have had similar, if not higher, increases.

But in our view, the rise in well drilling and completion costs is near its peak because of the expansion in service industry capacity and the reluctance of producers to accept these high, increasing prices. For example:

- The supply of domestic drilling rigs, which accounts for 20-25% of a typical unconventional gas well’s cost, has expanded greatly, with more than 200 land rigs added in 2006 and another nearly 200 land rigs expected in 2007. Several active unconventional gas producers, such as Chesapeake Corp., Southwestern Energy Corp., and Williams Cos., facing a tight, costly rig market, have taken the extraordinary step of contracting for purpose-built rigs and establishing their own drilling companies.

- The supply of high-pressure pumping services for well stimulation and hydraulic fracturing, which account for 30-40% of the well cost, increased by about 25% (about 700,000 hhp) in 2006. With expanded service capacity and several new companies entering this business, pumping service costs may stabilize and possibly decline.

- Following sharp increases in steel prices, the cost of oil field tubulars has stabilized and even shows a slight decline in 2007. Tubulars account for 10-15% of the cost of a typical unconventional gas well.

Nonetheless, these higher drilling rig, pumping service, and tubular costs exert pressure for a relentless pursuit of efficiencies in developing unconventional gas.

Rocky Mountain plays

ARI’s Model for Unconventional Gas Supply (MUGS) provides an up-to-date perspective on the economic viability of 94 distinct US unconventional gas plays. This resource and economic model shows that, using a long-term $6/Mcf NYMEX gas price, 27 of these plays with 260 tcf of recoverable resources are economic, another 21 plays with 140 tcf of recoverable resources are marginally economic, while 46 plays are uneconomic.

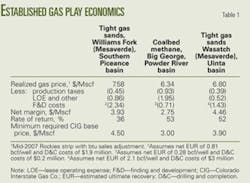

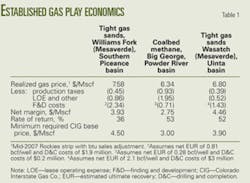

Table 1 provides economics on three traditional Rocky Mountain unconventional gas plays developed from public data provided by Bill Barrett Corp. and other producers.

The Williams Fork (Measaverde) tight gas sands of the Southern Piceance basin now produce almost 1 bcfd. This play provides a 36% rate of return (ROR) to Bill Barrett and requires a $4.50/Mcf gas price at the Colorado Interstate Gas Co. (CIG) hub to be economic.

The heart of the Big George coalbed methane play in the Powder River basin provides a 53% ROR and requires a $3/Mcf gas price at the CIG hub to be economic. Geologically less favorable portions of this coalbed methane play, however, will have less robust economics.

The new Wasatch (Mesaverde) tight gas play in the Uinta basin, outside the Natural Buttes field area, has a 52% ROR and requires a $3.90/Mcf gas price at the CIG hub to be economic. EOG Resources Inc.’s optimization of well completions has helped improve the economic returns from this gas play.

Emerging plays

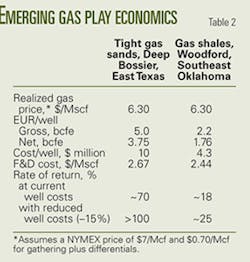

Some emerging unconventional gas plays in the US also exhibit attractive economics (Table 2).

According to Chesapeake Energy Corp., the Deep Bossier tight gas play in East Texas has an average $10 million well cost and a 5 bcf/well (gross) average estimated ultimate recovery (EUR).

At a $6.30/Mcf realized wellhead gas price, the play provides very attractive returns that should improve as drilling costs decline.

The Woodford gas shale in Southeast Oklahoma can provide RORs of 18-25%, assuming a $4.3 million well cost, 2.2 bcf/well gross EUR, and a $6.30/Mcf realized gas price, also according to Chesapeake Energy.

More speculative are the economics for the emerging deep Dakota-Entrada-Navajo tight gas play in the Uinta basin. The initial well costs range from $9 to 10 million for a 15,000-ft well. With expectations of obtaining 5-6 bcf/well EURs, however, the economics appear viable, especially if well costs decline.

The initial discovery well in this play tested at more than 11 MMcfd (gross) in the Dakota, Entrada, and Navajo formations, followed by wells tested at 6-10 MMcfd (gross) in the Navajo formation, supporting a favorable outlook for this new gas play.

Pursuing efficiencies

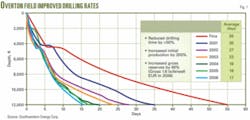

Faced with rising costs, the industry is rigorously pursuing efficiencies and cost reductions in drilling, well completions, and operations. A notable example is the reduction to 17 days in 2006 from 35 days in 2001 for drilling a well in the tight Cotton Valley gas sands at Overton field by Southwestern Energy (Fig. 1). Other unconventional gas producers such as EOG Resources and EnCana Corp. have had similar gains in well drilling efficiencies.

While companies have achieved efficiencies in the past, the rate of efficiency gain has slowed in recent years due to reaching practical limits in what is possible with traditional well drilling methods and rigs.

Drilling, completions

EnCana’s experience illustrates the next phase in the pursuit of efficiency and costs savings in well drilling and completion. As the gains in drilling efficiencies with conventional rigs began to diminish, EnCana contracted for fit-for-purpose rigs and equipment that enabled it to reduce further drilling days for its Rocky Mountain gas prosepcts to about 30 days/well from more than 40 days/well. With experience, EnCana expects additional gains in future years (Fig. 2).

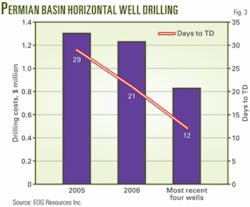

EOG Resources has had similar efficiency improvements in its horizontal wells in the Wolfcamp tight gas sand play in the New Mexico portion of the Permian basin. In this play, average well costs have declined to about $830,000/well for its most recent wells, compared to $1.3 million/well in 2005 (Fig. 3). These wells now take about 20 days to drill, compared with more than 30 days in 2005.

Continuing improvements in horizontal drilling and completion technologies are also key to lowering costs and improving the economic attractiveness of emerging shale plays such as the Fayetteville and Woodford shales.

In the Fayetteville shale, for example, Southwestern Energy Co. uses a combination of horizontal wells plus large-volume slick-water fracs to place pressure and proppant deep into the formation. With average $2.3 million well costs, 1.3-1.5 bcf/well EURs, and $6.50/Mcf gas prices, the economics of this play are attractive.

Similarly, in the Woodford shale, Newfield Exploration Co., after drilling mostly vertical wells, is now drilling mostly horizontal wells and completing them with five-stage fracs.

Newfield found that higher frac density translates into higher initial production rates and higher expected EURs. While such wells cost $5-6 million to drill and complete, compared with earlier vertical wells that cost about $2 million, these increased costs appear to be more than offset by higher production rates and ultimate recoveries per well.

Production operations

Companies also are achieving efficiency gains in what are generally considered to be mature unconventional gas plays. In the San Juan basin of New Mexico, which has been producing from both coal seams and tight gas sands for many years, several companies are pursuing strategies to maximize the potential of this mature, gas-rich basin.

For example, to offset its declining production in this basin, Williams established a cross-functional team to develop strategies to maximize production from its more than 800 wells operating in the basin. By investing $15 million into an effort to reduce line pressures, install new pumping units and compressors, change tubing size, and perform well workovers, the company increased production by about 20% and lowered lease operating costs.

Water treatment, disposal

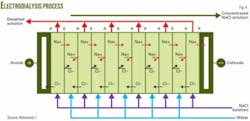

Water treatment and disposal can constitute a major cost for producing coalbed methane, particularly in environmentally sensitive basins. In addition to using evaporation ponds and reverse osmosis, companies have examined such promising water treatment options as electrodialysis, an electrically driven membrane filtration process in which desalted water is separated from a concentrated saline solution (Fig. 4).

With the process, a company then can dispose of the desalted water at the surface and reinject the saline water.

GTI has operated an electrodialysis pilot in the Wind River basin in Wyoming for several years, showing that the process is technically feasible. It also has conducted a test in the Powder River basin showing CBM produced water could be treated for about $0.15/bbl.1

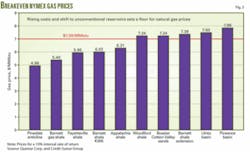

Finding, development costs

In the US, the cost to find and develop all gas resources, including unconventional gas, has risen considerably during the last 5 years. These rising costs, along with the continuing shift of US gas production to unconventional gas, has lead some, like the Credit Suisse Group, to believe that unconventional gas will set the floor for future natural gas prices (Fig. 5). In our view, however, the domestic natural gas price will be set by many factors, including world oil prices and LNG imports. As such, if domestic unconventional gas is to compete for investment capital and remain economically attractive, efforts to reduce finding and development costs must continue.

Barriers, opportunities

Unconventional gas development faces potential barriers, such as land use and environmental concerns, access to federal lands, and prudent management of produced water. At the same time, these barriers provide opportunities for innovative, forward-thinking firms.

Access and land-use policies on federal lands continue to pose formidable constraints on unconventional gas development. For example, for the remaining unconventional gas resource not yet developed in the Lower 48 states, about 15% is inaccessible, while another 64% is accessible but only under conditions more restrictive than standard lease terms.2

Some firms, however, are working collaboratively with government agencies to develop innovative “win-win” strategies to address seasonal restrictions in exchange for enacting more environmentally friendly drilling practices. For example, Questar Corp., a Rocky Mountain-based natural gas production and pipeline company, faced heavy restrictions on its lease in the Pinedale anticline of Wyoming. In response, the firm used information gathered through an extensive outreach program with local organizations and government officials to develop a plan whereby it could perform year-round drilling on previously seasonally restricted portions of its lease.

In exchange for the exception, the firm proposed to make investments that would reduce its environmental footprint, such as directionally drilling multiple wells from a single well pad and piping gas to central compression facilities instead of using tanker trucks.

In 2005, the Wyoming Bureau of Land Management approved the plan, giving Questar rights to drill year-round, including through the previously restricted winter months. Questar reports that these modifications will eliminate the need for an extra 89 well pads and 25,000 annual tanker truck trips.3

An increasingly visible and contentious issue is coalbed methane (CBM) produced water management. An in-depth US Department of Energy study demonstrated that the cost to treat produced water from coalbed methane operations could impact severely the economics of recovering natural gas.4

Depending on the regulatory requirements and management options used, capital costs for CBM-produced water management could range from as little as $1,500 to as much as $72,300/well.

In response to the barriers posed by managing produced water, Anadarko Petroleum Corp. implemented an innovative solution that creates synergies between its CBM and oil production investments.

The firm has recently completed a 48 mile, 24-in. Powder River basin pipeline to transport 400,000-450,000 bw/d produced from its CBM wells to the Madison aquifer at Salt Creek.

This pipeline will reduce greatly the water handling expenses for Anadarko, and establish a predictable cost structure for future water handling costs, reducing the risk in existing and future CBM development projects in the region.

Additionally, the water injected into this reservoir will provide an affordable source of water for enhanced oil recovery at the firm’s nearby oil fields. Companies had depleted this low-cost Salt Creek reservoir water source through past waterflood and EOR activity.

Another example of turning a barrier into an opportunity is to use coal seams for value-added CO2 storage. Coals are often near large point sources of CO2 emissions, especially power plants. In addition, the injection of CO2 into coal seams can enhance the recovery of methane (enhanced coal bed methane, or ECBM) from coal seams, although the technology is still relatively new.

Nonetheless, ARI analyses have shown that CO2-ECBM can be economic with today’s gas prices across a broad range of geologic environments, although substantial research and demonstration projects are still needed to push its application.

Economic viability

The economic viability of US unconventional gas resources remains in a precarious balance. Though drilling and completion costs are likely to level off and be partially offset by advances in technology, the economic viability of unconventional gas is at the mercy of service, raw material, and environmental management costs, all of which are increasing.

To remain a viable source of energy into the future, the unconventional gas industry as a whole will need to continue to build on the successes mentioned in this article by promoting greater cooperation between industry and government, by accelerating the pace of technological progress, and by tirelessly promoting efficiency and innovation in its field applications.

References

- Hayes, et al., “Electrodialysis Treatment Of Coal Bed Methane Produced Water: Engineering Issues And Cost Projections,” 13th Annual International Petroleum Environmental Conference, San Antonio, Oct. 17-20, 2006.

- Scientific Inventory of Onshore Federal Lands’ Oil and Gas Resources and the Extent and Nature of Restrictions or Impediments to Their Development, Phase II Cumulative Inventory, US Department of Interior, Agriculture and Energy, BLM/WO/GI-03/002+3100/REV06, 2006.

- Charles E. Greenhawt testimony prepared for the committee on Natural Resources hearing Access Denied: The Growing Conflict Between Fishing, Hunting, and Energy Development on Federal Lands, Mar. 27, 2007.

- “Powder River Basin Coalbed Methane Development And Produced Water Management Study,” US DOE, Office of Fossil Energy and National Energy Technology Laboratory, Strategic Center for Natural Gas, DOE/NETL-2003/1184, November 2002, http://www.fe.doe.gov/programs/oilgas/ publications/coalbed_methane/PowderRiverBasin2.pdf.

The authors

Michael L. Godec is vice-president of Advanced Resources International. He has more than 20 years of experience in the oil and gas industry and his areas of expertise include energy policy and market analysis, oil and natural gas forecasting, and environmental impact assessments. Previously, he was a senior vice-president at ICF Consulting. Godec has a BS in chemical engineering from the University of Colorado and a MS in technology and human affairs from Washington University in St. Louis.

Tyler Van Leeuwen is a research assistant with Advanced Resources International. He previously worked as an international consultant. Van Leeuwen has a BA in economics from Washington and Lee University.

Vello A. Kuuskraa’s photo and biographical information appeared in Part 1 of this series (OGJ, Sept. 3, 2007, p. 35).