Tepco seeking more stable LNG sources

Tokyo Electric Power Co. (Tepco) will not renew long-term agreements to purchase LNG from projects in Alaska and Indonesia when they expire in 2009.

Reports said Tepco is seeking to obtain stable long-term supplies while diversifying its geographical risk. In 2005, Tepco purchased 30% of Japan’s imports of LNG, with more than 6% of those supplies coming from Alaska and Indonesia.

Under existing contracts Tepco receives 920,000 tonnes of Alaska LNG from Phillips Alaska Natural Gas and Marathon Oil, along with an additional 130,000 tonnes of LNG from the Arun facility of Indonesia’s state-run PT Pertamina.

Indonesia had trouble meeting its commitments to Japanese LNG buyers due to demand growth for domestic gas supplies. In Alaska, moreover, there are questions about long-term LNG prospects, given proposals for gas pipelines to feed growing US needs.

Tepco has had other uncertainties over the security of its supplies. In November 2004 the company signed a contract with Sakhalin Energy Investment, operator of the Sakhalin-2 project, to buy 1.5 million tonnes/year of LNG for 22 years from April 2007. Those supplies are now in question due to the sale of a 50% stake in the project to Russia’s OAO Gazprom.

In an apparent effort to begin redressing the situation, Tepco last December concluded a heads of agreement on the purchase of 300,000 tonnes/year of LNG from six sellers of Australia’s North West Shelf LNG from April 2009 to March 2017.

The contract volume is about one fourth of the 1.18 million tonnes/year that Tepco buys from NWS LNG based on a 20-year agreement that will expire at the end of March 2009.

FERC issues final EIS for Mississippi LNG project

US Federal Energy Regulatory Commission staff released a final environmental impact statement favoring Bayou Casotte Energy LLP’s proposed LNG terminal and pipeline on Bayou Casotte adjacent to parent Chevron Corp.’s refinery near Pascagoula, Miss.

FERC said commissioners will take the EIS into consideration when they make a final decision on the project. FERC found the project environmentally acceptable for several reasons:

- The site adjoining Chevron’s refinery would provide “numerous synergies and environmental benefits, including use of existing services for security and safety, minimization of landowner impacts, and use of waste heat from the refinery to accomplish LNG vaporization.”

- Only short lengths of pipeline are needed to tie into an existing natural gas pipeline grid.

- The project would not likely affect threatened or endangered species.

- No residences are near construction areas.

- Bayou Casotte Energy plans to implement a modified version of FERC’s plans and procedures to minimize impacts on soils, wetlands, and bodies of water.

- No noise-sensitive areas are located near the proposed project.

- Before construction could begin, appropriate consultations would be required with the US Army Corps of Engineers, US Environmental Protection Agency, National Oceanic and Atmospheric Administration, State Historic Preservation Office, and Mississippi Department of Environmental Quality.

- Safety features would be incorporated into the design of the terminal and LNG vessels that use it.

- Local pilots and the US Coast Guard would impose operational controls to direct the movement of LNG ships, and security provisions would be put in place to deter possible terrorist attacks.

- The project’s environmental and engineering inspection and mitigation monitoring program would ensure compliance with all mitigation measures, which would be conditions of FERC’s authorization.

McMoRan’s Main Pass Energy Hub project approved

McMoRan Exploration Co. reported it has received approval from the US Maritime Administration for its Main Pass Energy Hub project on Main Pass Block 299 in 210 ft of water off Louisiana in the Gulf of Mexico.

Marad concluded that construction and operation of the MPEH deepwater port would be consistent with national objectives such as energy sufficiency and environmental quality. It also said the project will fill a vital role in meeting national energy requirements for many years and that the port’s offshore deepwater location will help reduce congestion and enhance safety in receiving LNG cargoes to the US.

As approved, the MPEH facility will be able to regasify LNG at a peak rate of 1.6 bcfd, store 28 bcf of gas in salt caverns, and deliver 3.1 bcfd of gas, including gas from storage, to the US.

Unique advantages of the project include use of existing offshore structures, onsite gas cavern storage capabilities, logistical savings associated with the offshore location, and premium markets available from its eastern gulf location.

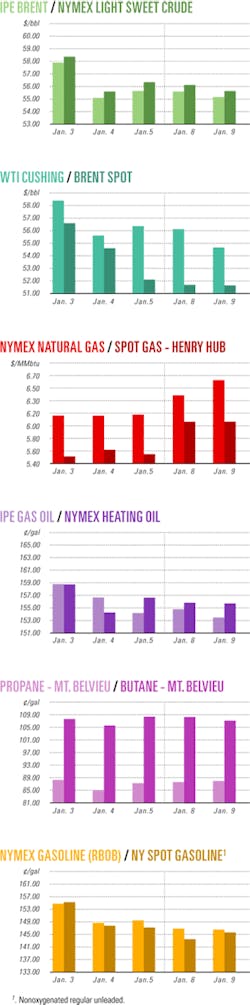

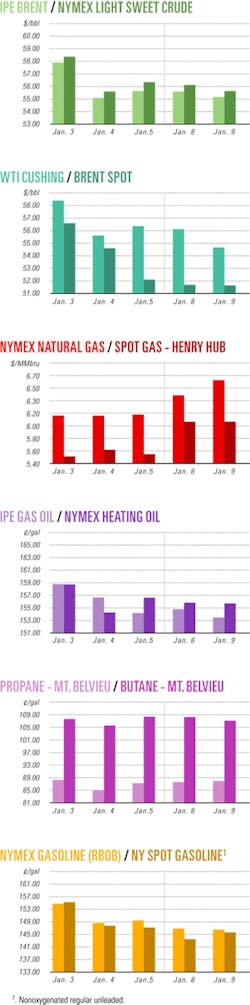

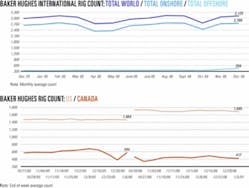

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesApache finds oil, gas in Egypt’s Western Desert

Apache Corp. reported encouraging results from several recent wells drilled in Egypt’s Western Desert.

Its Qasr 34 appraisal well has tested 18.4 MMcfd of gas and 725 b/d of condensate after reaching a TD of 14,000 ft in Jurassic Lower Safa rock. The well extends the Qasr field, 2.5 km to the northwest, adding 2,200 acres to the field, Apache said.

Wireline logs indicate 96 ft of net pay in the upper sand of the Lower Safa at 13,328-13,442 ft. A total of 72 ft of Lower Safa pay at 13,328-13,400 ft was tested through a ¾-in. choke with 2,000 psi of wellhead pressure.

Separately, the Zasr 36 well flowed 2,945 b/d of oil and 2.1 MMcfd of gas. The well was a new Alam El Bueib (AEB) discovery in the field. Apache drilled the well to 12,424 ft in AEB 3G sands and targeted AEB 3D and 3E sands. Log analysis showed 58 ft of net pay in the AEB 3D and 3E sands.

The Hathor Deep 1X well on the Khalda Offset concession tested 12 MMcfd of gas in the AEB 6 formation and 1,237 b/d of oil from the AEB 3D formation. Apache will proceed with developing the Hathor Deep 1X having received approval from state-owned Egyptian General Petroleum Corp. It has installed surface equipment and needs the petroleum minister’s approval before it can begin production.

The Qasr 40 well logged 60 ft of net oil pay in the AEB 3E sands and in secondary pay intervals in the AEB 3A and 3C. The new well is a step-out northwest from the Qasr 31, which currently produces 2,005 b/d.

The Kenz 35 well will be completed in the AEB 3E formation as a gas and condensate producer. Apache said it was drilled 1 km northwest of the nearest producing well in the Kenz field on the Khalda Ridge. Kenz 35 logged 140 ft of AEB net pay as well as 18 ft of net pay in the Upper Bahariya.

Vermilion to drill wildcat off southwest France

Vermilion REP, a subsidiary of Calgary-based Vermilion Resources Ltd. and Vermilion Exploration SAS, is planning to drill an exploration well on the Aquitaine maritime permit which covers a 1,211 sq km area in the northern part of offshore Aquitaine basin in southwest France.

Following 2D and 3D seismic surveys carried out in September and October 2005 at a cost of $6 million, with final processing completed in February 2006, Vermilion is planning an exploratory well in this year’s third quarter at a cost of $25-30 million.

Six large structural leads have been mapped at the primary Lower Cretaceous reservoir target. In addition, a large structural lead has been identified at the Upper Cretaceous-Lower Tertiary level, and a location for the hole is being selected, said Paul Beique, director of investor relations for parent firm Vermilion Energy Trust.

“A well depth of 3,000 m would be sufficient to penetrate the entire Lower Cretaceous sequence,” Beique said, adding that it would take 30-40 days to drill. “The big question,” he said, “is the quality of the reservoir, whether the rock is porous and permeable.”

Although it is an extension of the onshore oil-prone Parentis subbasin, and its distance to shore varies at 20-80 km in 50-200 m of water, the 22 exploration wells drilled over time by Esso, Shell, or Elf have never so far yielded commercial results. Esso, which never found a partner to share the development costs, drilled the most recent well, Pegasus, in 1998.

Petroceltic makes gas find in eastern Algeria

Petroceltic International PLC, Dublin, said two wells have confirmed the potential to commercially exploit shallow, laterally extensive hydrocarbon reservoirs on part of the 10,872 sq km Isarene permit in the Illizi basin in eastern Algeria.

The company is reviewing options with respect to appraisal and development.

ISAS-1, the permit’s obligation well, tested 360 Mcfd of wet gas on a 40/64-in. choke at 41 psi stabilized wellhead pressure from Devonian F2 at 851-856 m and 861-865 m. Formation damage was indicated. The well also tested 850 Mcfd of wet gas on a 56/64-in. choke with 36 psi stabilized wellhead pressure from Carboniferous Visean B at 558-564 m.

The well produced small amounts of gas from Ordovician open hole.

About 40 km west, Hassi Tab Tab-2 flowed 12.56 MMcfd of wet gas on a 56/65-in. choke with 590 psi stabilized wellhead pressure from Devonian F2 at 907-921 m and 939.5-943 m. It flowed 2.44 MMcfd of wet gas on a 44/64-in. choke with 231 psi stabilized wellhead pressure from Carboniferous Tournaisian at 677-681 m. And it flowed 440 Mcfd of wet gas on a 32/64-in. choke with 84 psi stabilized wellhead pressure from Carboniferous Visean B at 436.5-441.5 m.

The Devonian F2 flow rate at HTT-2 is one of the highest for this horizon in the basin, said Petroceltic, which holds 75% of the block. Sonatrach holds the other 25%.

Isarene is 120 km south of In Amenas, Algeria’s largest wet gas project. It is just southwest of another permit on which Rosneft has drilled two oil discoveries and one gas-condensate discovery in Ordovician and Devonian F6 reservoirs. And it is less than 15 km from Repsol YPF-operated Tifernine field, where processing facilities have spare capacity (OGJ, May 17, 1993, p. 26).

Well off Vietnam gauges high oil flow rate

A new appraisal well in Te Giac Trang on Block 16-1 off Vietnam has flowed oil at high rates on a drillstem test.

The TGT-5X well, drilled to a TD of 3,405 m, gauged 7,000 b/d, said Thailand’s PTT Exploration & Production PLC, which holds a 28.5% interest in Block 16-1 through subsidiary PTTEP Hoang Long Co.

PTTEP said a second drillstem test, in progress at the time of the report, recorded an initial flow rate of 7,300 b/d.

Drillstem test flows of other appraisal wells on the same structure are 600 b/d from TGT-4X, 9,432 b/d from TGT-1X, and 9,908 b/d from TGT-3X (OGJ Online, Apr. 28, 2006).

Trinidad and Tobago round gets one bidder

The latest bid round for the Trinidad Deep Atlantic Area received only one bid, the fewest since production-sharing contracts were introduced in the 1990s.

Statoil ASA submitted a bid for the TDAA Block 5. The Trinidad and Tobago government promised that it would make a decision within 3 months on Statoil’s bid.

Eleven other oil companies paid for 2D seismic data on deepwater blocks but did not offer any bids.

The eight blocks involved in the bid round were in 1,700-2,500 m of water and adjacent to areas from which most of Trinidad and Tobago’s oil and gas are produced. The area has not been explored.

ONGC strikes gas in Krishna-Godavari basin

India’s government-owned Oil & Natural Gas Corp. (ONGC) said it made a major gas discovery in the Krishna-Godavari basin off India’s eastern coast.

ONGC is the operator with 90% interest in the KG-DWN-98/2 block. Scottish energy firm Cairn India holds 10% interest.

A senior ONGC executive told OGJ that test results for the first well in the KG basin confirmed 30 m of gas pay at 5,300 m below the seabed. The executive said seismic studies indicate 80 m of potential pay at 6,450 m.

ONGC has identified five more drilling locations on the block.

Drilling & Production - Quick TakesBP suspends production at Shah Deniz project

BP PLC has halted gas and condensate production from its first production well at the Shah Deniz project because of a technical fault.

The $4.5 billion project, in the Azerbaijan sector of the Caspian Sea, has encountered some unexpected problems with gas pressures in the well, the company said. Shah Deniz came on stream in mid-December and was shut down just before the end of that month.

“We hope to bring the project back on as soon as possible,” a BP spokesman said, but declined to give a specific time frame.

Shah Deniz holds 25-35 tcf of gas and in Stage 1 is expected to produce 8.6 billion cu m/year of gas and 37,000 b/d of condensate, which will be shipped to Ceyhan, Turkey, for processing (OGJ, Aug. 21, 2000, p. 68).

Gas will be exported to Azerbaijan, Georgia, and Turkey via the $1.3 billion, 700 MMcfd South Caucasian Pipeline. The line, also operated by BP, extends 430 miles from Baku to Tbilisi, Georgia, and Erzurum in eastern Turkey, paralleling the Baku-Tbilisi-Ceyhan oil pipeline.

UK Buzzard oil-gas field starts production

Buzzard oil and gas field in the UK Central North Sea has come on stream and will bring an additional 200,000 b/d of oil to international markets later this year and 60 MMcfd of gas.

Buzzard, which is operated by Nexen Petroleum UK Ltd., has reserves of more than 500 million boe and the potential to deliver about 10% of the UK’s annual forecast oil demand at peak rates. It is the largest North Sea discovery to be developed in more than a decade.

Buzzard production will be processed through a 12,000-tonne production deck (OGJ Online, June 29, 2006). So far nine production and five injection wells have been drilled. Buzzard will be developed with 27 production wells and 11 water injection wells.

Buzzard lies in 317 ft of water about 100 km northeast of Aberdeen in the Outer Moray Firth. Oil is exported through an 18-in. pipeline to the Forties Pipeline System for processing at the BP Kinneil plant. Gas from Buzzard will be exported through a 10-in. pipeline on the UK Frigg pipeline to the St. Fergus gas terminal.

Dave Thomas, an oil analyst at Citigroup, told OGJ that the $2.9 billion invested to develop the field was “very competitive” bearing in mind rising industry costs. “However, there is still the question on how BG Group will deal with handling high sulfur levels in Buzzard oil,” he added. Installing an amine unit offshore to strip sulfur from the oil could cost an additional estimated $200-300 million.

A BG Group spokesman told OGJ that the sulfur was contained in some parts of the reservoir and production would go ahead as planned.

Shell lets contracts for deepwater ESP systems

Units of Royal Dutch Shell PLC have awarded contracts to Centrilift, Claremore, Okla., to provide electrical submersible pumping (ESP) systems in deepwater seabed production-boosting systems for projects in the Gulf of Mexico and off Brazil.

It will be gulf’s first ESP system using seabed vertical booster stations, said Centrilift, a division of Baker Hughes Inc.

Shell Offshore Inc.’s Perdido development will include five enhanced run life ESP vertical booster stations. Centrilift will supply the ESP equipment, provide engineering design, qualification, and testing services. Each installation will include a liquid-gas separator to maximize ESP performance.

The vertical booster stations will handle production from Great White, Silvertip, and Tobago satellite fields tied back to the Perdido spar, moored in 8,000 ft of water (OGJ, Nov. 27, 2006, Newsletter).

The booster stations will be under the spar and tied to the platform via top tensioned risers. First production is expected in 2010.

Processing - Quick TakesIndonesia to expand refineries’ capabilities

Indonesia’s state-run PT Pertamina and Japan’s Mitsui & Co. plan to establish a joint venture to build a $1 billion gasoline cracker at the Cilacap refinery on Java.

Pertamina processing director Suroso Atmomartoyo said the new unit would have a capacity of 40,000-50,000 b/d. He said Pertamina plans to start construction by 2008 at the latest and expects operations to begin in 2010.

The Cilacap refinery has two crude distillation units with respective capacities of 118,000 b/d and 230,000 b/d. The facility also has a 29,000 b/d gasoline-making reforming unit and a 50,000 b/d visbreaker.

Last December Pertamina Pres. Ari Soemarno said Indonesia wanted to make the Cilicap refinery more economic and competitive as part of a general strategy to develop the country’s refining capacity, especially after suffering gasoline shortages in mid-2005.

He said Pertamina aims to double the country’s crude output to 300,000 b/d within 4 years and to modernize several of its biggest refineries, inviting overseas partners to join $18 billion of projects aimed at boosting crude oil production and fuel refining.

In addition to the Cilicap refinery development, Pertamina plans to build a cracker at its Balikpapan refinery, and it is conducting talks with SK Corp. of South Korea to expand capacity of the 125,000 b/d Dumai refinery on Sumatra Island to 160,000 b/d.

Hydrogen plant due Polish refinery

PKN Orlen SA let an engineering, procurement, and construction management contract to Technip for a hydrogen plant at its 376,500 b/cd refinery in Plock, Poland.

The €50 million lump-sum contract covers licensing, design, and supply of equipment and materials; construction management and supervision; and start-up services and training.

The hydrogen plant, scheduled to be operational in first quarter 2009, will have a capacity of 5 tonnes/hr. The hydrogen produced will be used in the refinery to produce diesel oil in compliance with the European norms.

Kufpec joins GTL project in Papua New Guinea

Kuwait Foreign Petroleum Exploration Co. has signed a joint development agreement with Syntroleum Corp. for participation in the development of a 50,000 b/d gas-to-liquids plant in Papua New Guinea.

PNG Prime Minister Michael Somare gave the proposal formal support following submission of a feasibility study.

The facility will produce sulfur-free diesel fuel and other petroleum products. Syntroleum said the project has been granted priority in PNG’s effort to establish a commercial gas industry.

The company plans to progress financing and to begin placing major construction and fabrication contracts.

Transportation - Quick TakesChubu-Toho JV to expand LNG terminals

Japan’s Chubu Electric Power Co. and Toho Gas Co. plan to expand their LNG facilities by constructing two natural gas pipelines and further developing the jointly owned Chita LNG import terminal in Aichi prefecture.

To maintain a steady LNG supply for Japan, especially from Qatar, Chubu and Toho will build the pipelines to connect Chita terminal to Chubu’s Kawagoe thermal power plant and to Toho’s regasification plant. The pipelines are scheduled for completion in 2013.

The Chita terminal, one of the largest in Japan, receives about 6.5 million tonnes/year of LNG in about 110 tankers. By 2009, the JV plans to refit and expand the terminal to receive tankers that can carry 200,000 cu m of LNG. Chita currently receives vessels with capacities of as much as 170,000 cu m of LNG.

Hirotaka Iwase, spokesman for Chubu Electric, said more suppliers are using larger-scaled vessels, and the ability to accept the new ships will contribute to securing a stable LNG supply.

In addition to the changes at Chita, Chubu Electric has separate plans to refit by 2010 another LNG terminal near the Kawagoe thermal power plant to accept tankers that can carry as much as 200,000 cu m of LNG.

LNG supplies could come primarily from Qatar Liquefied Gas Co. (Qatargas), which has been a main supplier to Chubu since December 1996 when its first LNG cargo departed Ras Laffan and was delivered to the Kawagoe terminal.

In June, Qatargas said that by 2010 it would add more than 50 tankers, each capable of carrying more than 200,000 cu m of LNG to markets in Asia, the US, and Europe.

GDF seeks partners for LNG terminal expansion

To cope with LNG growth in France and Europe, Gaz de France has issued an invitation to new players to participate in development of new regasification capacity at its Montoir-de-Bretagne terminal on the Atlantic coast.

Capacity enhancement would occur in two stages:

- An initial addition of 2.5 billion cu m, scheduled for commissioning in 2011, will bring current delivery capacity to 12.5 billion cu m/year.

- In the second stage, construction of a fourth large-capacity LNG tank and the additional boosting of regasification and emission facilities would add an additional 4 billion cu m/year, increasing capacity to 16.5 billion cu m/year from 2014 onwards.

The extension will be built on the basis of long-term ship-or-pay contracts.

On stream since 1980, the Montoir-de-Bretagne terminal can handle LNG carriers with a capacity of up to 200,000 cu m. It currently receives LNG from Algeria, Nigeria, and Egypt and has a storage capacity of 360,000 cu m.

GDF sees the development of LNG imports worldwide reaching 300 billion cu m of gas (in gaseous state) by 2010, up from 176 billion cu m in 2005.

US terminal sees two LNG tankers at once

In mid-December 2006 two LNG tankers were at Southern LNG’s Elba Island regasification terminal near Savannah, Ga. This is the first time a US LNG import terminal has had two LNG tankers simultaneously. Docked at the Elba Island terminal North Dock was the 138,000 cu m British Trader while the 127,500 cu m Edouard LD was moored at the facility’s South Dock. Photo from El Paso Corp.

null