OGJ Newsletter

General Interest - Quick Takes

Iran seeks more gas from Turkmenistan

Iran wants to increase its natural gas imports from Turkmenistan and will accept a higher price, according to Iranian Foreign Minister Manuchehr Motaki.

“Iran wants a considerable enlargement of Turkmen natural gas imports and is ready to make proposals to Turkmenistan,” he told Turkmen President Saparmurat Niyazov by telephone on Feb. 12.

Motaki said Iran accepts a Turkmen bid to increase the gas price. He said an Iranian delegation will soon visit Turkmenistan to sign a contract.

Preliminary negotiations about the suggested increase of the Turkmen gas price from the current $42-60/1,000 cu m were held in Ashgabat on Feb. 3.

According to the Turkmen Oil and Gas Ministry, Turkmenistan delivered 5.8 billion cu m (bcm) of gas to Iran in 2005. Contracts signed last year call for the supply of 8 bcm in 2006. Last month, Iran received about 786 million cu m of Turkmen gas.

Turkmenistan produced 7.03 bcm of gas in January, up 24% over last year, according to the country’s National Statistics and Information Institute. Gas exports grew 28%.

In addition to Iran, contracts signed late last year stipulate the delivery of 30 bcm of Turkmen gas to Russia and 40 bcm to Ukraine in 2006.

Alaskan governor reports gas line status

Alaska hopes to reach agreements with the two remaining Alaska North Slope producers about their participation in a gas pipeline to the Lower 48 states by June, Gov. Frank H. Murkowski said.

State negotiators have been meeting about every 7 days with representatives of BP PLC and ExxonMobil Corp. after reaching an agreement with ConocoPhillips, Murkowski wrote in a report to state legislators on Feb. 9.

“It is expected that the final contract will contain the same terms for all three companies,” he said.

The state will take a 20% equity share in the project, an amount Murkowski said would be commensurate with its royalty and tax interests.

“This will require a multibillion dollar investment by the state and is unprecedented in the US,” he said.

The legislature also is considering tax incentives for investment in oil and gas facilities and exploration that will need to be passed before it adjourns in May, Murkowski said.

“The proposed fiscal contract will need to integrate the oil tax revisions if they are passed to accommodate the producers’ desire for certainty for oil as well as for natural gas,” the governor said.

Assuming agreements are reached with BP and ExxonMobil and approved by the legislature, he said the producer group could then begin to make plans and seek permits.

The project also needs to resolve permitting and right of way issues with Canada, he noted.

Murkowski said “today’s best estimate” is that the Federal Energy Regulatory Commission’s open season would take place in 2007, that construction would commence in 2009 or 2010, and that the pipeline could be in operation by 2014.

Relaxation urged for Chinese price controls

China’s National Development and Reform Commission has submitted a proposal to the central government to relax price controls on oil products under a mechanism that would allow prices to fluctuate according to movements in the cost of crude oil.

The Chinese government has kept prices of oil products below international levels with price caps, squeezing margins for state refiners facing rising crude costs.

BPMigas plans meetings on Cepu development

Indonesia’s oil and gas regulatory body BPMigas planed to meet with state oil company PT Pertamina and ExxonMobil Oil Indonesia Inc. to seek reasons for their failure to file a development plan for the Cepu block.

BPMigas Chairman Kardaya Warnika said the companies had failed to meet a Dec. 31, 2005, deadline for filing a plan.

“If there’s no working proposal, there will be no work done nor production on Cepu,” Kardaya said. “They have to start doing some work on the field this year. That’s what we want.”

Earlier, Indonesia’s State Minister for State Enterprises Sugiharto said he expects delays in production from the Cepu Block in Central Java due to the continued disagreement over which company will operate the block (OGJ Online, Feb. 13, 2006).

Pertamina and ExxonMobil have been in talks about a joint operation agreement after the government decided in June 2005 to award them a contract to develop Cepu jointly. The contract was to have been signed last September.

Pertamina blamed for Indonesia’s fiscal woes

Indonesian Finance Minister Sri Mulyani Indrawati has blamed state-owned PT Pertamina for contributing to the country’s fiscal malaise.

Indrawati said Indonesian state income for 2005 totaled 495.4 trillion rupiah, which was 44.7 trillion rupiah below the target set in the state budget.

She said the country’s economy expanded by 5.8% in 2005, below the target of 6%, and inflation was 17.1%, well above the target of 8%.

Indrawati told legislators that the failure of Pertamina to meet its financial obligations to the government was one of the causes of the shortfall.

On Feb. 6, the Indonesian government announced that the country produced 955,000 b/d of oil and condensate in 2005, missing its targeted output for the year by 120,000 b/d.

The same day, Cyril Noerhadi, finance director of Indonesian oil and gas company PT Medco Energi Internasional, said the country is unlikely to raise its planned output to 1.3 million b/d of crude by 2009 due to the lack of exploration and development (OGJ Online, Feb. 6, 2006). ✦

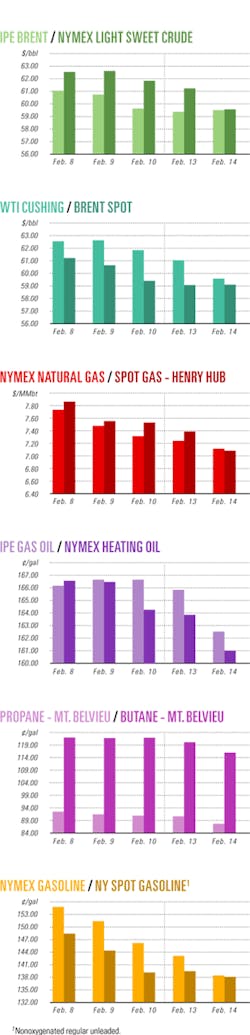

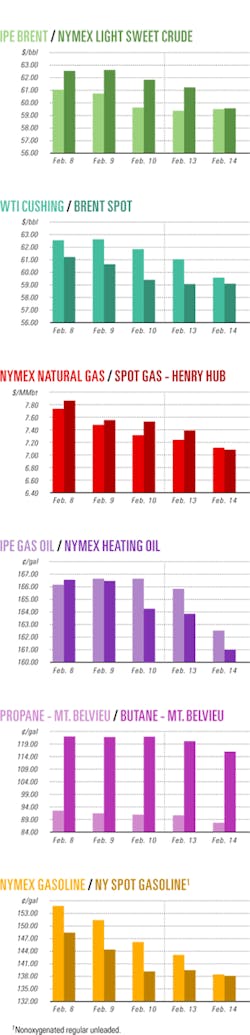

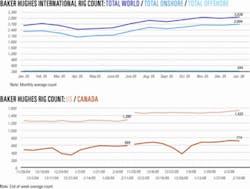

Industry Scoreboard

null

null

null

Exploration & Development - Quick Takes

Total has new oil strike on block off Angola

Total E&P Angola and state-owned Sonangol EP have made another oil discovery on Block 32 off Angola.

Mostarda-1, drilled in 1,758 m of water, tested 5,347 b/d of 30° gravity oil from one interval. The discovery lies in the eastern section of the block 14 km south of the 2004 Canela-1 discovery and 15 km southeast of the 2005 Gengibre-1 strike.

Complementary technical studies are under way to evaluate the potential of the Mostarda-1 discovery and its possible development with the other Block 32 discoveries.

MMS issues final notice for OCS Sale 198

The US Minerals Management Service has issued the final notice for Central Gulf of Mexico Outer Continental Shelf Lease Sale 198 scheduled Mar. 15 in New Orleans.

The sale offers 4,040 blocks covering 21.3 million acres 3-210 miles off Louisiana, Mississippi, and Alabama in 4-3,400 m of water. MMS estimates the proposed lease sale could result in the production of 276-654 million bbl of oil and 1.59-3.3 tcf of natural gas (OGJ Online, Nov. 28, 2005).

Pakistan grants three blocks to OGDC

Pakistan has granted three onshore petroleum exploration licenses to state-owned Oil & Gas Development Co. Ltd. for Blocks 2769-14 (Tegani) in Zone III, 2769-15 (Thal) in Zone III, and 2567-11 (Tano Beg) in Zone II.

Tagani is in Shikarpur, Jacobabad, and Sukkur districts; Thal in Khairpur, Sukkur, and Ghotki districts of Sindh Province; and Thano Beg in Lasbella, Dadu, and Karachi districts of Balochistan and Sindh provinces. A minimum firm investment of more than $ 24.1 million will be made in the three blocks.

Development due Colombian heavy oil field

Meta Petroleum Ltd., jointly owned by US investment company Elliott Advisors and Synergy Group of Brazil, plans to increase production to 100,000 b/d of upgraded crude oil from 9,000 b/d by advancing development of Rubiales heavy oil field in the Llanos basin of central Colombia (OGJ Online, July 23, 2002).

Meta has let a contract to Mustang Engineering for front-end engineering design and cost estimate services for a heavy oil upgrader complex at Rubiales.

The project includes the design of crude oil production and stabilization facilities, raw crude desalting and diluent recovery, and two parallel heavy crude conversion units.

Mustang also will design the offsite and utility systems to support the upgrading complex and facilities for a planned pipeline. It and parent John W. Wood Group’s Colombian sister company Energéticos will perform the work.

The 12.5º gravity crude produced at present is transported by truck for sale as asphalt and fuel oil in Bogota, Cali, Medillin, and Cartagena. Tuskar Resources PLC of Dublin discovered the field in 1989. When Meta Petroleum bought development rights in 2002, output was 700 b/d from 10 wells. The field now has 35 wells.

German Efromovich, head of Synergy Group, last year said further Rubiales development would require drilling of 600 wells.

In an interview published in the May-June issue of state-owned Ecopetrol’s Carta Petrolera, Efromovich said the field has 3 billion bbl of heavy crude in place.

The development he envisions would cost nearly $1 billion- $300 million for the drilling and $700 million for infrastructure, including the upgrader and a pipeline of undetermined size to Casanare. He expects the drilling to be complete by 2008. Production then would be 50,000 b/d and would rise to 100,000 b/d by 2010.

Rubiales wells are shallow, requiring about 9 days to drill, Efromovich said, adding that the drilling program would involve four or five rigs.

Lundin spuds Oudna production well off Tunisia

Lundin Petroleum AB, Stockholm, has spudded the Oudna oil production well in as much as 300 m of water on its Hammamet Grand Fonds license off northeast Tunisia.

The Pride Venezuela semisubmersible will drill, test, and complete the production well and an injection well.

The Oudna 1 discovery well tested 7,000 b/d of 41º gravity crude oil from Miocene Lower Birsa sands at 1,600 m.

Oudna production is expected to start in late 2006 at a rate of 20,000 b/d from two Birsa intervals (OGJ Online, July 3, 2003).

Oudna development involves the relocation and modification of the Ikdam floating production, storage, and offloading vessel, currently in mature Isis oil field (see map, OGJ, July 18, 2005, p. 32).

Isis production will be shut in during the second quarter. The Ikdam FPSO then will be released for upgrade and reclassification before redeployment in Oudna field. ✦

Drilling & Production - Quick Takes

India’s Oil & Natural Gas Corp. Ltd. (ONGC) has awarded five 3-year contracts to Transocean Inc. for jack ups to drill off India.

Three of the contracts-for the Ron Tappmeyer, Randolph Yost, and Trident XII jack ups already under contract to ONGC-will begin when those contracts expire in November.

An existing ONGC contract for the Trident II jack up will expire in May, when the jack up will undergo maintenance for 120 days then begin service under the new contract.

The fifth contract, for the J.T. Angel jack up currently operating off Indonesia, is expected to begin following completion of a contract with EMP Kangean Ltd. this month, an estimated 100 days out of service for maintenance, and a 6-month project in Indonesia.

Revenue from the contracts is expected to total about $805 million, Transocean said.

Repairs shut down two fields off Norway

Statoil ASA on Feb. 8 shut down production of 20 million cu m/day of gas and about 60,000 b/d of condensate on the Kvitebjørn platform in the Norwegian North Sea to repair flare knockout drum plates. It also increased its estimates of original Kvitebjørn reserves by about 50% to 81 billion cu m of gas and 205 million bbl of condensate, saying the reservoir holds more hydrocarbons than had been assumed.

The company planned to shut down production of 3 million cu m/day of gas and 140,000 b/d of oil on the Heidrun platform in the Norwegian Sea on Feb. 15. Repairs at each facility were expected to be complete within a few days, the company said.

The precautionary actions follow determination that a gas leak on the Visund platform Jan. 19 was caused by a loose metal plate on the flare knockout drum, which is the same type that exists on the other platforms. A specialist team decided that shut-down of the Sleipner B platform in the Norwegian North Sea, which has similar plates, was unnecessary.

Statoil to use Odfjell semi in Norwegian Sea

Statoil has signed a 2.35 billion kroner ($350 million) draft deal with Odfjell Drilling AS for drilling by the Deepsea Bergen semisubmersible in the Halten-Nordland area of the Norwegian Sea.

The rig is to be delivered in the second quarter of 2008 and will be used for development drilling and exploration near Heidrun, Norne, and Aasgard oil and gas fields. The agreement, subject to approval by the production licensees, is for 3 years.

Crescent lets contract for two Mubarak wells

Crescent Petroleum Co. Inc. has let a contract to Indonesian drilling company PT Apexindo Pratama Duta to drill two wells in Mubarak oil and gas field off Sharjah.

The Apexindo Raniworo jack up will drill the wells in 75 days at a cost of $5.2 million/well. The rig will start work after completing a 2-year contract with Statoil off Iran.

Apexindo, a unit of oil and gas firm PT Medco Energi Internasional, operates nine land rigs and five offshore rigs.

Anadarko raises Haley tight gas output

Anadarko Petroleum Corp. said its gross production from the Haley area of West Texas averaged 121 MMcfd of gas equivalent in the last quarter of 2005.

Annual 2005 gross production was 106 MMcfd.

The company holds 145,000 net acres of leases and fee minerals, up 33% from the third quarter of 2005. The area is in Loving, Ward, and Winkler counties (OGJ Online, Feb. 4, 2005).

Anadarko said the University 20-29 No. 1 well appears to have extended the productive limits 5 miles to the south, while the Ludeman 22-1 was a 7-mile north step-out.

Rowan Cos. Inc. is to bring in four new rigs in the first half of 2006, contributing to the drilling of 36 wells planned in 2006. At least four wells will be in new areas or extend limits.

Anadarko completed 16 of 18 wells drilled at Haley in 2005 and suspended two for mechanical issues.

The Haley area of the Delaware basin produces from Pennsylvanian Morrow, Atoka, and Strawn and Permian Wolfcamp. Morrow, deepest of the four, is at 15,000-17,500 ft.

BHP Billiton lets O&M contract for Neptune

BHP Billiton Petroleum (Americans) Inc. let a $4 million contract to John Wood Group PLC to develop a maintenance management system, operating manuals, and start-up procedures for the deepwater Neptune project on Atwater Valley Block 618 in the Gulf of Mexico (OGJ, Apr. 26, 2004, Newsletter). BHP Billiton is developing the field with seven subsea wells tied back to a tension-leg platform with design production capacities of 50,000 b/d of oil and 50 MMcfd of gas. It expects production to start in 2007.

Casino gas field on stream off Victoria

(Correction Casino field was misidentified as the second Santos Ltd.-operated gas field to come on stream following the Mutineer-Exeter fields off northwestern Australia (OGJ, Feb. 20, 2006, Newsletter). Mutineer-Exeter are oil fields.)

Production has begun from Casino gas field operated by Santos Ltd. in the offshore Otway basin of western Victoria, Australia (see map, OGJ, Oct. 24, 2005, p. 51).

Delivery of first gas from the field was made to TRUenergy’s Iona onshore processing plant near Port Campbell via subsea pipeline. From there it will be sent to South Australia and Australia’s eastern seaboard. TRUenergy (formerly TXU) has an initial 12-year contract to take up to 420 petajoules of Casino gas as well as from future developments nearby, which include the same group’s recently discovered Henry field (OGJ Online, Aug. 3, 2005).

Casino is the second Santos-operated gas field in Australia to come on stream in the last 9 months following the Mutineer-Exeter field off northwestern Australia (OGJ Online, Mar. 31, 2005).

Both developments produced first gas well ahead of schedule. In Casino’s case, first gas comes just over 3 years after discovery.

Casino is on permit Vic/P44 about 30 km offshore in 70 m of water. The field has been developed via subsea wellheads and a subsea pipeline. ✦

Processing - Quick Takes

Fire shuts down Total’s Dunkirk refinery

A fire which broke out Feb. 10 at the electric power station of Total SA’s Dunkirk refinery cut off the plant’s entire electric system and forced a shutdown of the 160,000 b/d facility. The fire was quickly extinguished.

Total is not certain when the refinery could be restarted, a Total spokeswoman told OGJ. Total has five other refineries in France and sufficient stocks to meet demand.

Daya Bay petrochemical complex starts up

A joint venture of China National Offshore Oil Corp. (CNOOC) and Shell Petrochemicals Co. Ltd. (SPC) produced on-specification ethylene and propylene on Jan. 29 at the new petrochemicals complex at Daya Bay in Huizhou, Guangdong Province, China.

The Daya Bay plant is expected to produce 2.3 million tonnes/year of products primarily for Guangdong and other high-consumption areas of China’s southeast coastal economic zones. Central to the complex is a condensate or naphtha cracker producing 800,000 tonnes/year of ethylene and 430,000 tonnes/year of propylene.

The CNOOC and SPC units agreed in 2002 to proceed with the joint construction of the $4.3 billion world-scale petrochemical complex (OGJ Online, Nov. 6, 2002). ✦

Transportation - Quick Takes

Russia nixes East Siberia pipeline route

Russia’s environmental safety supervisory body has rejected proposals for the designated route of an oil pipeline from eastern Siberia to the Pacific Ocean.

The Federal Service for Ecological, Technological, and Nuclear Supervision, or Rostekhnadzor, said Feb. 3 that the proposals “don’t correspond to the demands of the federal law ‘On Ecological Expertise,’ insofar as they formulated vaguely...and are insufficiently justified.”

The statement appears to be a blow for Russia’s state-owned pipeline operator OAO Transneft, which had wanted to avoid the higher costs of building the terminal nearer the port of Nakhodka on Russia’s Pacific Coast.

Cost concerns also contributed to a shortening of the planned pipeline route that would have taken it to a point within 1 km of Lake Baikal, a United Nations Educational, Scientific, and Cultural Organization world heritage site and home to 20% of the world’s fresh water.

Under Transneft’s proposal, the pipeline route would run from the town of Tayshet in Siberia’s Irkutsk region through Skovorodino in the Amur region to the port of Perevoznaya in the Primorye region on the Pacific coast.

Last October, Russian Prime Minister Mikhail Fradkov-in an effort to speed up implementation of the Eastern Siberia-Pacific Ocean pipeline project-directed relevant ministries and departments to prepare a detailed proposal by Nov. 10 (OGJ Online, Oct. 24, 2005).

The decision may also adversely affect Japan and China, which have been lobbying the Russian government separately to construct a pipeline to the East aimed at delivering supplies from eastern Siberia and reducing their dependency on Middle East reserves.

Last November, Japanese Prime Minister Junichiro Koizumi and Russian President Vladimir Putin agreed to the construction of a two-stage pipeline aimed at delivering crude oil produced in eastern Siberia to the Pacific region (OGJ, Nov. 28, 2005, p. 24).

Kalimantan-Java gas line nets five bids

Indonesia’s oil and gas regulatory body BPH Migas has reported five bids for the construction of a 1,219-km natural gas pipeline connecting East Kalimantan with Central Java.

The bidders include PT Bakrie Bros., state gas distributor PT Perusahaan Gas Negara, PT Barata Indonesia, PT Bumi Karsa Lini Nusa, and PT Alfa Karisma.

BPH Migas Chairman Tubagus Haryono said the winning bidder will be announced in May.

The Kalimantan-Java pipeline is intended to be part of the Integrated Indonesian Gas Pipeline project, a 3,588-km network that will move gas from fields in East Kalimantan, South Sumatra, Riau, and East Java to Java and Sumatra.

Darwin LNG begins Bayu-Undan shipments

ConocoPhillips’s Darwin LNG plant at Wickham Point, Australia, on Feb. 2 was loading its first cargo from Bayu-Undan gas field in the Timor Sea into the Japanese LNG carrier Kotowaka Maru.

Plans call for the delivery of three collective spot cargoes of LNG to Tokyo Electric and Tokyo Gas before commencement of contract sales. TE and TG will together buy 3 million tonnes/year over 17 years.

To satisfy this contract, an LNG carrier will berth at Wickham Point every 7-10 days.

The $2 billion (Aus.), 3.4 million tonne/year shore liquefaction plant, completed late last year, is not expected to begin contract sales until Mar. 1.

ConocoPhillips has approval to produce as much as 10 million tonnes/year and is currently seeking additional gas supplies and markets to justify a second and perhaps third LNG train.

Petrobras plans 975-km ethanol pipeline

Petroleo Brasileiro SA (Petrobras) has signed an accord with the Goias state government to build a $226 million, 975-km pipeline to transport 4 billion l./year ethanol, according to Petrobras Pres. Sergio Gabrielli.

It will be Brazil’s first ethanol pipeline. At present, tanker trucks move the product.

Gabrielli said the pipeline will run from Goias to a refinery in Paulinia, near Sao Paulo.

“We are the only country in the world that has the technology to build an ethanol pipeline,” he said.

Brazil is the world’s largest producer of ethanol and plans to increase exports, now limited by the need to supply local markets. Current and prospective customers include Venezuela, Nigeria, China, South Korea, India, and the US.

The US charges a tariff on ethanol to offset a tax credit for US producers of fuel ethanol made from grain. Brazil is expected to take this matter up with the World Trade Organization. ✦