Gas condensate capacity to increase substantially in Middle East, Asia

Condensate production in the Middle East and Asia will more than double through 2008 and increase by an additional 60% by 2013, according to a new study.

The joint study by FACTs Inc. (www.factsinc.net), Honolulu, and Asia Pacific Energy Consulting, Seattle, “Condensate Outlook-East of Suez 2005,” examines base condensate’s growing role in East of Suez crude and product markets and forecasts supply, demand, and export availabilities for this NGL and the products derived from it.

East of Suez, as defined in the study, includes the Middle Eastern countries Saudi Arabia, Iran, UAE, Qatar, Iraq, Oman, and Yemen, as well as the Asia-Pacific countries India, Pakistan, Bangladesh, Indonesia, Malaysia, Thailand, Brunei, Vietnam, Myanmar, Philippines, China, Eastern Russia, Australia, New Zealand, and Papua New Guinea.

According to Al Troner, one of the study’s authors, the role of condensate splitters will continue to change during the next few years. The Middle East will begin using splitters to maximize the production of transportation fuels. And Asian countries will use them to satisfy a shortage of light-end hydrocarbons.

Condensate

The study defines condensate broadly as an NGL that precipitates out of, or is stripped from, produced natural gas. Unlike LPG, condensate remains a liquid without specialized infrastructure and in many ways can be considered a sweet, light crude equivalent.

Condensate is light (gravity of 50° API or lighter), low (generally less than 0.3%) in sulfur, usually free of metals, and produces a light product outturn, always more than half of which is naphtha.

Gas development

Unlike oil output, condensate production is a by-product of gas development and condensate output is based on gas production volumes.

Since the beginning of the century, gas development in the Middle East and Asia-Pacific has been undergoing a fundamental, structural change, according to the study. Spearheaded by LNG projects, gas development has accelerated enormously in the first half of this decade as output rises to feed LNG and piped-gas sales, gas-to-liquids production, and petrochemical feedstock needs.

This sharp and continuing rise in marketed gas production will continue to boost segregated condensate output, with production expected to more than double through 2008 and rise an additional 60% through 2013.

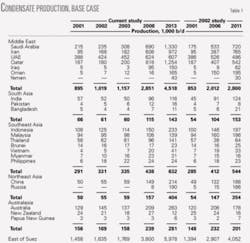

Table 1 shows the increases in condensate production by country. Total condensate production will increase to nearly 6 million b/d in 2013 from 1.77 million b/d in 2003. The increases are substantially more than were forecast in a 2002 study from the same consulting companies.

Table 1 shows that the most substantial increases will occur in the Persian Gulf region, most notably Saudi Arabia, Qatar, and Iran.

Condensate, crude trends

The emergence of large-volume condensate production in East of Suez countries comes at an important juncture in the industry’s development. In recent years, there have been some fundamental shifts in crude balances, trading, and pricing relationships.

According to the study, the more important trends in the oil and gas industry have been:

• High oil prices. Whether one forecasts $30/bbl, or $50/bbl crude through 2010, it is unlikely that prices will drop to $15-20/bbl, at least in the 5-year outlook.

• Crude supply constraints. OPEC’s ability to increase crude output in the short term is limited. Many believe that non-OPEC output is near or at a peak. Gains in crude production will be more gradual and substantial investment will be needed to boost output.

• Widening of the heavy-light and sweet-sour spreads. Premiums have widened significantly in the past 2 years for light-medium crude grades that contain less sulfur vs. heavy, sour crudes. Most see this price difference remaining significant for some time.

• Tightening product specs support spreads. The drive for improved product quality will tend to support the price spreads, as sulfur ceilings are lowered and more light-end products are needed in the market.

• East of Suez markets encounter light-ends squeeze. A crude-products exporter such as Saudi Arabia is encountering increasing difficulty in meeting gasoline demand. Importers such as China are increasingly challenged by the need to produce more gasoline and petrochemical feedstock simultaneously, while improving product quality.

Condensate demand, availability

The sharp rise that is forecast in condensate output will influence each of the trends. Yet much of this ballooning of condensate production will not end up as exports of condensate, thus easing increasing crude availabilities, but will be diverted into specialty-built condensate splitters.

Table 2 shows the outlook for condensate demand in the Middle East and Asia.

According to the study, the East of Suez countries in 2013 will use 4.3 million b/d of condensate, up from 1.3 million b/d in 2003. Importing countries will use 405,000 b/d of condensate, about the same as in 2003. Total demand will therefore be nearly 4.7 million b/d in 2013.

Again, substantial increases in Persian Gulf countries account for most of the additional demand.

Substantial condensate splitter capacity has been commissioned in the Persian Gulf region and much more is slated for start-up by 2008 (Fig. 1).

Fig. 1 shows that operating condensate processing capacity will rise to 1.76 million b/d in 2008 and more than 3 million b/d in 2011, up from 1.23 million b/d in 2004. This will increase the East of Suez’s share of global condensate capacity to more than 70% in 2011 from about 60% in 2004.

Condensate splitter capacity will increase in Asia-Pacific as well, in part because of the ability of splitters to produce significant volumes of petrochemical feedstocks as well as gasoline.

In the Persian Gulf, Saudi Arabia and Iran are hoping to use splitting capacity to help meet rapidly increasing domestic demand for transportation fuels, both gasoline and diesel. Condensate splitters will constitute a large proportion of base refinery additions through 2008. In 2009-10, conventional grassroot refineries will start up.

In importing countries, Thailand’s substantial splitter capacity will be paralleled by a buildup in new splitting units in Indonesia, China, and India.

Table 3 shows the expansions in existing condensate splitter capacity and new construction expected through 2010.

Click here to view Splitter Capacity Expansions Table 3 in PDF.

Table 3 shows that, according to the study, Qatar Petroleum is considering adding a new 60,000-b/d splitter in Ras Laffan as a joint venture with either Royal Dutch Shell PLC or ConocoPhillips.

The National Iranian Oil Co. (NIOC) is actually planning three splitters, but the study authors believe it unlikely that the company will meet its ambitious start-up dates of 2006 and 2008.

According to the study, splitters in Saudi Arabia are 200,000 b/d each and integrated with refineries and olefins plants. The splitters will concentrate on producing transportation fuels for domestic markets. Capacity of 400,000 b/d is already committed, with 400,000 b/d pending.

A series of paradoxes arise from the current construction plans. Although segregated condensate output in East of Suez countries rises more than 2 million b/d for the 2003-08 period and again from 2008-13, segregated condensate available for exports increases far more slowly-less than 800,000 b/d in each of these periods (Table 4).

Table 4 shows that most exports will come from Middle Eastern countries, which are building the most capacity. Total exports will rise to more than 2 million b/d in 2013 from 556,000 b/d in 2003.

Exports from Persian Gulf countries will increase to 1.57 million b/d in 2013 from 346,000 b/d in 2003.

Segregated condensate will contribute only modestly to total refinery feedstock supply.

Splitter paradox

According to the study, proponents of condensate splitters often characterize these facilities as absorbing condensate. In fact, they simply transform a light, sweet crude equivalent feedstock into products, with naphtha almost always accounting for more than half of total volume outturn.

Splitters do not absorb condensate, i.e., the condensate does not vanish. Rather, they transform condensate into light and middle distillate products.

This leads to another interesting market trend, according to the study. Splitters reduce the absolute volume of condensate available for exports as segregated condensate and therefore support the price of condensate sales overall.

This tends to firm condensate prices for traditional Asian importers such as Japan, South Korea, Taiwan, Singapore, and Thailand. Naphtha production, however, mostly dictates the base value of condensate.

Middle Eastern splitters, for the most part, will focus on creating gasoline and diesel and continue to export large (and growing) volumes of mainly paraffinic naphtha. Any incremental paraffinic naphtha that East Asian petrochemical buyers cannot readily absorb will weaken naphtha prices directly and indirectly soften prices for all condensate.

The equation then is whether condensate prices will be supported more by the absorption of segregated condensate by splitters, or weakened by the large and growing volumes of splitter-derived paraffinic naphtha that Saudi Arabia, Iran, Qatar, and Abu Dhabi will push into Asia-Pacific petrochemical feedstock markets.

Even a splitter operation focusing on gasoline output, such as Saudi Aramco’s program, produces large volumes of paraffinic naphtha, which cannot be easily absorbed by the domestic petchem market.

Thailand, China

According to the study, the future of condensate and naphtha prices will depend highly on how importing countries, such as Thailand currently or China in the future, approach the looming light-ends squeeze for their markets.

Thailand already operates substantial splitting capacity, and by 2010 condensate should account for roughly a quarter of the country’s refining and petrochemical feedstock use.

In Thailand, gasoline demand growth has been unstable whereas petrochemical naphtha demand has increased substantially. Petrochemical naphtha demand has more than doubled since 2000, increasing to about 164,000 b/d in 2005.

Table 5 shows a forecast for condensate use in Thailand.

Table 6 shows the forecast for China condensate demand.

China is the giant shadow looming in the medium-term. Beijing has overtaken Tokyo as the region’s largest gasoline consumer. Its petrochemical sector is growing at a breakneck pace and cannot be supplied feedstock solely from refinery-derived naphtha. In addition, gasoline specs are tightening.

The study says that China will emerge as the next large-scale condensate market in Asia-Pacific, with substantial impact on regional naphtha balances.

Naphtha demand growth will match the phenomenal gasoline demand growth through 2010. As a percentage of total demand, gasoline plus naphtha will grow to 28% in 2010 from 25% in 2000.

To satisfy this demand growth, the first splitters are starting to be built in China and Chinese companies are building splitters in Iran and Algeria.