Delayed coking schemes are most economical for heavy-oil upgrading

A recent study evaluated different processing schemes to produce synthetic crude oil (SCO) from heavy crudes, such as Canadian oil sands. The price spread between SCO and heavy oil can vary depending on the upgrading scheme-from more than $10/bbl to almost $37/bbl.

The study found that schemes involving delayed coking show the best economics. Hydrogen-addition schemes give a combination of high product rates and good quality. As expected, at higher fuel costs hydrogen generation through gasification of coke or pitch becomes attractive, especially for the lower-SCO value cases.

When planning for capital expenditures on heavy-oil upgrading projects, one must properly account for the product value from the available technologies. The current study evaluates the economics for various schemes to upgrade heavy oils.

Heavy oils

Large reserves of thick, viscous fluid hydrocarbons exist in different locations, such as the Orinoco belt in Venezuela1 and the oil sands of Alberta2. Different methods are used to recover this material from the ground depending on economics, which vary according to the properties of the material, its environment, and ambient conditions.

Different names, such as extra heavy oil, oil sands, or bitumen are used to describe the material. The term heavy oil is used in this article regardless of its source. There are differences between heavy oils, but generally they contain high metals and sulfur and, of course, are difficult to transport either by pipeline or by ship. To transport a heavy oil, operators can heat it to keep it liquid, mix it with water and a surfactant to stabilize it as an emulsion, or blend it with a diluent such as a lighter crude or naphtha. Depending on the situation, these choices can be convenient and acceptable or too expensive and impractical.

Heavy oils have relatively low economic values and are more difficult to process than conventional crudes. Heavy oils, however, can be upgraded with available refining technologies to improve transportability and increase value.

The high resid content of heavy oils makes them suitable for upgrading processes that reduce the relative carbon-to-hydrogen ratio. Carbon rejection, hydrogen addition, or a combination of both can reduce this ratio.

Basic criteria

A producer must know several basic criteria before choosing the appropriate processing configuration. The quantity and quality of the upgraded material, its final destination, and intended use are important in choosing an upgrading scheme.

This study covers various upgrading schemes to process Canadian Athabasca heavy oil with a gravity of 8.6° API and 4.8 wt % sulfur to produce an SCO.

The study covers simple upgrading to high-conversion processes. Some of the processing schemes allow for SCO transport over long distances with little or no diluent.

Other schemes, including high-conversion processes, produce either a full-boiling-range SCO similar to conventional crudes or a “bottomless” SCO in which the residual by-product is either coke or pitch that can be consumed internally to generate hydrogen and electric power.

The SCO can have a high distillate content with good quality gas oil destined for conventional refining units such as catalytic crackers.

Study approach

We used a computerized simulation program, calibrated for heavy oil processing, to develop the processing schemes, including material balances and property predictions as well as the estimated capital costs, based on 2005 US Gulf Coast construction costs.3

In addition to the ability to predict product yields, quality improvements, and the concomitant processing costs, an important consideration in developing the economics is to predict properly the price differential between the primary SCO product and heavy oil feedstock based on quality. We could then develop the net present value (NPV) and internal rate of return (IRR) and compare them on the same basis for all study cases.

SCO price prediction

Although crudes can vary in many different qualities, price analysts have focused on two principal quality differentials-API gravity and sulfur content-to explain intercrude price differentials. To predict price differentials based on quality, we used and adapted data published by the World Bank.4

According to the article, in addition to API and sulfur, the total acid number (TAN) in mg KOH/g can be important on price differentials. The World Bank statistical model shows that the differential between crudes at current North Sea Brent prices will be large for low-quality crudes and that the differentials will widen as the Brent price increases.

The same conclusion and similar results arise if another “marker” or crude such as West Texas Intermediate is used as benchmark in the evaluation.

According to the World Bank report, “Each extra °API gravity (relative to crude) raises the relative crude price $0.007/$ of Brent price, each 1% sulfur lowers the price $0.056/$ of Brent, and each degree of TAN (more than 0.5) lowers the price $0.051/$ of Brent.”

In our study, we used $55/bbl of Brent to calculate a value for the heavy oil feedstock and for each SCO to reflect improved API and sulfur for that case. We calculated the value of the heavy oil feedstock. A feedstock with a gravity of 8.6° API, 4.8 wt % sulfur, and about 3.0 TAN was assigned a value of $23/bbl.

Other prices

Any light hydrocarbon by-products were assigned fuel value and coke, if produced, was given a zero value. Sulfur was assigned a value of $15/short ton. The utilities are based on $7/MMbtu fuel gas and $0.05/kw-hr electricity. We conducted a sensitivity study using higher values of $10/MMbtu and $0.06/kw-hr, respectively.

Processing schemes

We analyzed several alternative configurations to upgrade heavy oil using in-house and published process data.5 A hypothetical 100,000-b/sd plant, consisting of 80,000 b/sd of heavy oil and 20,000 b/sd of diluent naphtha, is used in all cases. Also in all cases, the heavy oil is upgraded to SCO and the naphtha diluent recovered for reuse in the field.

The SCO quantity and quality depend on the upgrading scheme in each case. The economic calculations for all cases used the common feedstock value but the revenue in each case depends primarily on the value assigned to the SCO.

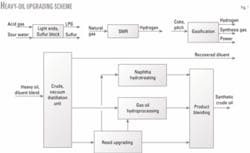

The process flow in all cases involves a crude unit including desalting followed by atmospheric and vacuum distillation. The vacuum bottom material is sent to resid conversion. The combined gas oils from crude unit and resid conversion are further processed.

In addition to the processing units, the economic evaluation considers support facilities, including all utilities and offsites. The alternative processing schemes are divided into two main sections: hydroprocessing and resid upgrading-conversion.

Hydroprocessing

The hydroprocessing section upgrades heavy distillates from the crude unit and partially upgrades material from the resid conversion process to boost the middle distillate content and improve the quality of the SCO blend.

The usual choice is either gas oil hydrotreating (GHT) or gas oil hydrocracking (GHC). Naphtha from resid conversion is also hydroteated, as applicable.

Conversion processes

Resid upgrading technologies that we considered were visbreaking (VBR), solvent deasphalting (SDA), delayed coking (CKR), and resid hydrocracking (RHC) using ebullated-bed technology.

Hydrogen generation

Hydrogen production via steam-methane reforming (SMR) was included in all cases except visbreaking. We also considered gasification of solid coke or liquid pitch for some cases.

Gasification, the noncatalytic partial oxidation of hydrocarbons to synthesis gas (mainly carbon monoxide and hydrogen), can involve the production of hydrogen or hydrogen plus power.6

Generally, SMR is preferred as a hydrogen source, particularly if natural gas is available at low cost.

Gasification is an alternative hydrogen production method and can be an important additional step in resid conversion. It can be an economically attractive application in heavy oil upgrading. It also has some environmental advantages; it allows relatively easy capture of SO2 and CO2 and avoids the creation of coke.

Study cases

We created eight primary upgrading schemes.

Case 1, VBR only

This case visbreaks vacuum resid and blends it with the atmospheric and vacuum distillation gas oils without hydroprocessing. The advantage of this scheme is its low cost, but the improvement in quality is limited.

The SCO may be unstable during storage and shipping because it is a blend of cracked and uncracked material. There is a new technology, however, for visbreaking in the presence of an additive that promises a more stable product at higher severities than conventional visbreaking. This would further reduce the viscosity and possibly produce an SCO with a higher gravity than shown for this case.

Case 2, GHC only

In this scheme, the crude gas oil is hydrocracked and blended with the vacuum bottoms into SCO without resid upgrading. Hydrocracking can produce high-quality distillates from heavier feedstocks and increases the liquid yield at high conversion (by hydrogen addition).

Hydrocracking, however, requires high capital investment and demands high amounts of hydrogen. Generally, GHC can be economically justified when used in conjunction with a resid processing option.

Gasification of a portion of the vacuum resid will produce hydrogen, with the resid balance being blended into SCO. We dropped SMR from this case because it is economically unattractive unless a low-cost natural gas is available. Similarly, gasification to produce hydrogen plus power was also dropped.

Case 3, GHC-VBR

In this case, the crude gas oil is hydrocracked and blended with an untreated visbreaker product. This scheme is an extension of Cases 1 and 2 and combines the advantages of both schemes.

The overall pumping qualities may sufficiently improve to meet pipeline specifications, but there is the same concern and potential for SCO stability in storage and shipping as in Case 1.

Case 4, SDA-GHC

The crude gas oil and deasphalted oil are hydrocracked. Generally, hydrocracking this blend is more difficult and costlier than that of distillate gas oil alone.

The deasphalted oil has a relatively high Conradson carbon and metals, which are detrimental to catalyst. Hydrogen by SMR has marginally attractive economics, but the availability of low-cost natural gas can have an influence on its selection.

We also studied the two extremes for gasifying the SDA pitch. One case gasifies the SDA pitch to produce hydrogen; the pitch balance goes into the SCO. The other case consumes all of the SDA pitch for hydrogen and power production. This significantly reduces SCO production.

An intermediate case, of course, changes the balance between power generation and SCO production.

Case 5, CKR-GHT and Case 6, CKR-GHC

In these cases, the resid is processed in a delayed coker and the coker naphtha is hydrotreated. The coker and crude gas oil blend is either hydrotreated (Case 5) or hydrocracked (Case 6).

In addition to SMR, coke gasification produces hydrogen only and hydrogen plus power. Schemes that involve coking produce a bottomless SCO and give a good balance between capital cost and production. Generally, coking schemes show attractive economic results. Solids handling is required, however.

Case 7, RHC-GHT and Case 8, RHC-GHC

Hydrogen-addition schemes produce high liquid yields with good qualities. The ebullated bed technology partially converts resid and the naphtha is hydrotreated. The RHC and crude gas oil blend is then hydrotreated (Case 7) or hydrocracked (Case 8).

SMR and gasification of unconverted resid produce hydrogen. The unconverted fractionation bottoms, as an alternative to blending into SCO, can therefore produce hydrogen.

As much as 25% of the resid can be gasified to supply hydrogen for the hydroprocessing units. Accordingly, depending on the method of hydrogen production, the SCO produced can be bottomless or a full-boiling-range similar to conventional sweet crudes.

Except for Case 3, the gas oil hydroprocessing unit (hydrotreating or hydrocracking) is in series with the resid upgrader unit.

Fig. 1 shows the general upgrading scheme for the various processing cases.

Study parameters

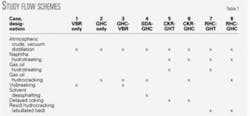

The combination of resid upgrader and gas oil hydroprocessor is the differentiator between the eight main study cases. The variations in these main cases are designated by additional descriptive nomenclature depicting the method to produce hydrogen and power.

Hydrogen production can be from light hydrocarbons, particularly natural gas using SMR. The study also considers the alternative of coke or pitch gasification and converting the synthetic gas to hydrogen (GH2). If power is produced, then we used the designation of GH2+KW.

Table 1 shows the configurations of the main study cases and defines the primary operating units for each case.

Heavy-oil upgrader economics are measured using the discounted cash flow method based on these parameters:

• Design and construction = 3 years.

• Operating period = 12 years.

• Depreciation (straight line) = 10 years.

• Corporate tax rate = 35%.

• Capital spending = 25% in Year 1, 35% in Year 2, and 40% in Year 3.

• Cost escalation during construction = 5%/year.

Economic results

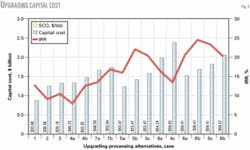

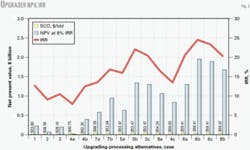

Capital costs are based on mid-2005 US Gulf Coast costs. Capital costs for this study are sufficiently accurate for comparing cases but do not necessarily depict the actual cost of an upgrader, which will depend on the project location. Figs. 2 and 3 depict the economics of upgrading heavy oil for the eight processing schemes and their variations (a total of 16 cases).

Table 2 shows the variables considered in the different cases (x-axis) on Figs. 2 and 3.

null

Findings

The main factors for selecting a heavy oil upgrading scheme are:

• Attractive economics.

• SCO yield based on feed rate.

• SCO value (gravity and sulfur). Other specific criteria, such as gas oil content in the SCO, may also be considered.

• Marketability of excess hydrogen or syngas and power (if produced), especially in a constrained natural gas market.

Heavy oil can be upgraded with schemes involving thermal cracking or deep hydrocracking. The upgrading can occur over a wide range of qualities that is reflected in the price of the SCO. The price spread between the SCO and heavy oil varies depending on the upgrading scheme-more than $10/bbl to almost $37/bbl.

Schemes involving delayed coking show the best economics.

Hydrogen addition schemes give a combination of high product rates and good quality. As expected, at higher fuel costs, hydrogen generation through gasification of coke or pitch becomes attractive, particularly for the lower SCO value cases. ✦

References

1. Mommer, B., “The Value of Extra-Heavy Crude Oil from the Orinoco Belt,” MEES, March 2004.

2. Flint, L., “Bitumen & Very Heavy Crude Upgrading Technology-Long Term R&D opportunities,” LENEF Consulting limited, funded by NRCan and Alberta Energy Research Institute, March 2004.

3. Worley Parsons, multiple sources.

4. Bacon, R., and Tordo, S., “Crude Oil Price Differentials and Differences in Oil Qualities: A Statistical Analyses,” prepared for joint UNDP/World Bank Energy Sector Management Assistance Program (ESMAP), October 2005.

5. “2004 Refining Processes Handbook,” Hydrocarbon Processing, November 2004.

6. Morano, J.J., “Refinery Technology Profiles-GASIFICATION and Supporting Technologies” Prepared for U.S. Department of Energy, National Energy Technology Library, Energy Information Administration, June 2003.

The authors

Dan Vartivarian ([email protected]) is chief process engineer for WorleyParsons, Arcadia, Calif. He has more than 35 years’ experience in the various aspects of petroleum refining. Vartivarian has performed studies for the process industry covering petrochemicals, refining, and heavy oil upgrading. He previously worked for UOPLLC, KBR, Bechtel Corp., and Cenco Refining Co. He holds a BS and MS in engineering from Southern Illionis University.

Helmy Andrawis ([email protected]) is process engineering manager for WorleyParsons, Arcadia, Calif. He has 30 years’ experience in oil and gas, sulfur, and petroleum refining. He spent 20 years with various companies including CF Braun & Co., SF Braun, and B&R Braun, all in Alhambra, Calif. His past 10 years have been with Parsons Corp., Pasadena, Calif., and WorleyParsons. He holds a BS (1975) in chemical engineering from Cairo University. Andrawis is a member of AIChE and a registered professional engineer in California.