SPECIAL REPORT: Global refining capacity increases slightly in 2006

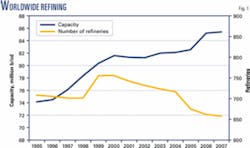

The worldwide refining industry added a slight amount of crude distillation capacity in 2006. For the fifth year in a row, worldwide capacity is at a record high. The number of refineries remained relatively stable.

Last year’s refining report showed a worldwide capacity of slightly more than 85.1 million b/cd in 662 refineries as of Jan. 1, 2006. This year, OGJ’s survey reflects a total capacity of nearly 85.2 million b/cd in 658 refineries, an increase of less than 52,000 b/cd.

The increase is the smallest net gain in refining capacity since 2001, when refining capacity decreased.

Fig. 1 shows the trend in operable refineries and worldwide capacity. The large jump in number of refineries in 1999 was due to improved information from China.

Capacity creep was the main reason for the increases in capacity for the latest survey.

Asia-Pacific showed the largest increase in refining capacity, up 105,000 b/cd or 0.5%, which was also the largest percent increase in capacity.

North America, Eastern Europe, and the Middle East showed smaller changes, increasing 27,000 b/cd, 28,000 b/cd, and 4,300 b/cd, respectively.

US capacity increased more than 146,000 b/cd.

Other regions experienced decreases in capacity. Africa, Western Europe, and South America all lost capacity according to the latest survey numbers, decreasing 18,250 b/cd, 81,500 b/cd, and 8,000 b/cd, respectively.

This year’s survey lists four fewer refineries than last year’s survey due to corrections and reflections of refineries that had shut down in previous years.

New crude capacity

This year’s survey does not list any new refineries. All the increases in refining capacity occurred at existing facilities.

The largest single-facility increase occurred in Formosa Petrochemical Co.’s Mailiao, Taiwan, refinery, which increased capacity by 70,000 b/cd, to 520,000 b/cd from 450,000 b/cd.

In the US, the largest reported capacity increase occurred in Western Refining Inc.’s El Paso refinery. Western reported a 27,000-b/cd increase, growing to 117,000 b/cd in this year’s survey from 90,000 b/cd reported in last year’s survey.

Other major increases in reported capacity occurred in Grupa Lotos SA’s Gdansk, Poland, refinery, which increased to 120,000 b/cd from 90,000 b/cd; Alliance Refining Co. Ltd.’s Map Ta Phut, Thailand, refinery, which rose to 301,000 b/cd from 275,000 b/cd; and ExxonMobil Corp.’s Antwerp, Belgium, refinery, which went to 298,000 b/cd from 275,000 b/cd.

Refinery closures, delistings

Few refinery closures occurred throughout the world in 2006, mainly due to high refining margins that made even the smallest plants profitable.

The only closure reported in this year’s survey is the 2,000 b/cd Norilsk, Russia, refinery. Two other refineries were removed from this year’s survey.

Petro-Canada’s Mississauga, Ont., plant was removed because it feeds no raw crude and produces only lube oil and greases. Removal from the survey, therefore, has no effect on overall crude distillation capacity.

Another refinery in Poland was removed because it has listed zero capacity for the past few years.

Corrections were made to Petroplus International BV’s reported capacity. According to the company’s website, its Antwerp Processing Facility shut down its atmospheric distillation unit in 2003. The company still runs part of the refinery as diesel hydrodesulfurization.

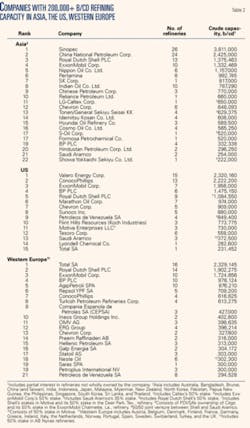

Largest refining companies

Table 1 lists the top 25 refining companies that own the most worldwide capacity. Table 2 lists companies with more than 200,000 b/cd of capacity in Asia, the US, and Western Europe. Capacities from Tables 1 and 2 include partial interests in refineries that the companies do not wholly own.

Significant changes from last year involve BP PLC, ConocoPhillips, Formosa, Petroleos de Venezuela SA, Saudi Aramco, Petroleos Mexicanos (Pemex), and Petroplus.

On Dec. 16, 2005, Ineos completed the purchase of two refineries from BP’s subsidiary, Innovene. Ineos acquired the 195,700-b/cd Grangemouth, Scotland, refinery and the 207,100-b/cd Lavera, France, refinery.

Ineos reportedly acquired the Innovene business from BP for $9 billion. The sale and subsequent loss of refining capacity moved BP down to the fourth largest refiner. Overall, the company reported almost 400,000 b/cd less refining capacity than last year.

ConocoPhillips, on the other hand, added sufficient capacity to become the fifth largest refiner in the world, up from eighth largest last year. The deal was completed too late in 2005 to include it in last year’s survey.

On Feb. 28, 2006, ConocoPhillips announced that it had completed a deal, announced in November 2005, to purchase the Wilhelmshaven, Germany, refinery from UK-based Louis Dreyfus Refining & Marketing Ltd. The addition of the 268,000-b/cd refinery increased significantly the company’s capacity outside the US.

On Aug. 16, 2006, Lyondell Chemical Co. acquired Citgo Petroleum Corp.’s 41.25% interest in Lyondell-Citgo Refining LP for $2.1 billion, including the refining company’s debt. The 282,600-b/cd refinery in Houston processes very heavy high-sulfur crude.

PDVSA, parent company of Citgo, lost a net 114,000 b/cd of refining capacity. The company fell to seventh largest global refiner.

Lyondell’s acquisition allowed it to meet the minimum 200,000-b/cd requirement for inclusion in Table 2. It is the fourteenth largest refiner in the US.

On Nov. 23, 2005, Aramco Overseas Co., a subsidiary of Saudi Aramco, and Motor Oil Holdings SA, announced that Motor Oil had completed the acquisition of remaining interest in the 100,000-b/cd Corinth refinery in Greece. Previously, the refinery was owned 50/50 by the two companies. For the year, Saudi Aramco decreased refining capacity by 48,000 b/cd.

Pemex also decreased refining capacity in 2006. Last year’s survey indicated the company had 1.85 million b/cd of refining capacity, which fell to 1.7 million b/cd in 2006. The loss, however, was not enough to move it in Table 1 in relation to other companies.

One deal that was not included in Table 1 last year was Total AS’s trading of refining capacity with Royal Dutch Shell PLC. On July 12, 2005, Total acquired Shell’s 20% stake in the 89,000-b/cd Raffineria di Roma in return for Total’s 18% interest in the 79,800-b/cd Compagnie Rhénane de Raffinage refinery in France.

Table 2 shows this change-both refiners have ownership stakes in fewer refineries this year.

Newcomers to Table 2 this year include Lyondell in the US and Ineos in Western Europe, both due to deals previously mentioned.

In other deals, Petroleo Brasiliero SA acquired a 50% interest in the 100,000-b/cd Pasadena Refinery System Inc. The refinery was previously 100% owned by Astra Oil Trading NV. Petrobras paid $370 million in the deal.

Petroplus announced on June 1, 2006, that it acquired the Belgian Refining Corp. including the 115,000-b/cd refinery in Antwerp. The acquisition increases Petroplus’s total refining capacity to 300,000 b/cd.

The company also announced that it intends to buy ExxonMobil’s Ingolstadt, Germany, refinery. The deal for the 106,000-b/cd refinery is to close in early 2007 and will be reflected in next year’s survey.

On Oct. 19, 2006, Harvest Energy Trust announced that it closed on the acquisition of North Atlantic Refining Ltd. and related businesses for $1.6 billion (Can.). North Atlantic operates the 109,250-b/cd refinery in Come By Chance, Newf.

Alon USA Energy Inc. announced on Aug. 7, 2006, that it had acquired Paramount Petroleum Corp. Alon paid $314 million cash and $150 in assumed net debt with excess working capital of $50 million. Included in the acquisition is the 52,000-b/cd refinery in Paramount, Calif.

In March 2006, Holly Corp. announced that it had sold its 10,000-b/cd refinery in Great Falls, Mont., to Connacher Oil & Gas Ltd. for $55 million in cash and 1 million shares of Connacher stock.

Not mentioned in last year’s report was the fact that Suncor Energy purchased Valero Energy Corp.’s 28,000-b/cd Denver refinery. The purchase price was $30 million plus working capital in a deal that was completed on June 1, 2005. The refinery is next to Suncor’s existing 92,000-b/cd refinery, which it acquired in 2003.

Other changes in capacity that appear in Tables 1 and 2 are due to adjustments in declared capacity.

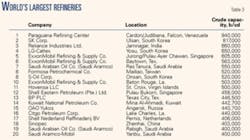

Largest refineries

Table 3 lists the world’s largest refineries with a minimum capacity of 400,000 b/cd.

One refinery moved up the list due to an expansion. As previously mentioned, Formosa’s refinery increased capacity to 520,000 b/cd, which moved it up four spots in Table 3 from last year.

ExxonMobil reported increased capacity in its Baton Rouge refinery-to 503,000 b/cd from 501,000 b/cd in last year’s survey. The Hovensa LLC refinery also reported a slight gain in capacity, to 500,000 b/cd from 495,000 b/cd. The two refineries, however, lost a spot in Table 3 due to Formosa moving up.

The only other change in Table 3 is Shell Nederland Raffinaderij BV revising downward its capacity, to 406,000 b/cd from 416,000 b/cd reported in last year’s survey.

Regional crude capacities

Table 4 lists regional process capabilities as of Jan. 1, 2006. As previously mentioned, the largest increase in crude capacity occurred in Asia.

Asia growth was due to large capacity increases in Taiwan and Thailand, and smaller increases in Australia and Japan. For North America, a 146,000-b/cd gain in capacity in the US was offset by a 144,000-b/cd loss in Mexico.

The other regions were flat or had small increases.

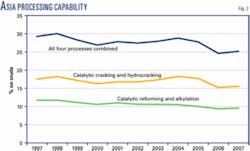

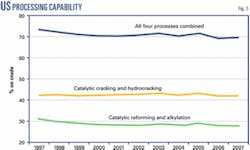

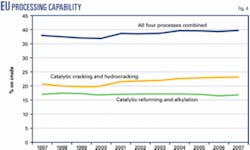

Processing capabilities

Figs. 2-4 show the processing capabilities of Asia, the European Union (EU), and the US for the past 10 years. Processing capabilities are defined as conversion capacity (catalytic cracking and hydrocracking) and fuels producing processes (catalytic reforming and alkylation) divided by crude distillation capacity (% on crude).

null

null

Countries in the EU include Belgium, Denmark, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal, Spain, and the UK.

OGJ subscribers can now download, free of charge, the text version of the OGJ Worldwide Refining Report 2006 tables from www.ogjonline.com by clicking on the Resource Center tab, then the Surveys and OGJ Subscriber Surveys links. This link also features the previous editions of this report as well as a collection of other OGJ Surveys from previous years. Subscribers and nonsubscribers may purchase Excel spreadsheets of the survey data by sending an email to [email protected] or calling (800) 752-9764. For further information, please email [email protected], or call Leena Koottungal, OGJ Survey Editor (713) 963-6239.

Click here to download the Worldwide Refining Survey Legend.

Click here to download the Worldwide Refining Survey.

Click here to download the Worldwide Refineries-Capacity Survey.

Click here to download the US Refineries-State Capacity Survey.