SPECIAL REPORT: Interest heats up Southeast Asia discovery, production

Exploration and appraisal drilling in Southeast Asia has continued at high levels through 2006 as oil companies, flush with cash, seek to replace reserves. The high level of license awards in 2005 sustained drilling activity through 2006, and this trend is expected to continue if operators can secure access to drilling rigs.

A number of significant discoveries were made during 2005-06, with Indonesia and Malaysia accounting for more than half of them. About 30 discoveries were made this year, adding potential reserves of 300 million bbl of oil and 10 tcf of gas.

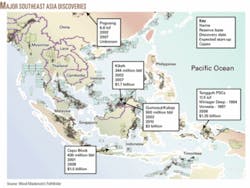

Husky Oil China Ltd.’s deepwater gas discovery off China was the highlight of the year to date, encouraging further licensing and improving industry perceptions of the deepwater area. South Korea’s Daewoo also discovered additional volumes of gas near Shwe field in Myanmar, for which cumulative reserves of 8.6 tcf was certified in 2006.

In addition to exploration success, at least 170 new field developments are expected to come on stream in Southeast Asia by 2012. They will generate about 950,000 b/d of new liquids production and more than 8 bcfd of incremental sales gas (Figs. 1 and 2).

Key developments include the Cepu Block on Java, the Kikeh and Gumusut oil fields off Sabah, supplies to the Tangguh LNG plant in Irian Jaya, and Puguang gas field in China. These five projects together should contribute 390,000 b/d and 2.1 bcfd of new production by yearend 2011.

The countries and sectors included in this review are Brunei, Cambodia, offshore China, Indonesia, Malaysia, the Malaysia-Thailand Joint Development Area (JDA), Myanmar, the Philippines, Thailand, and Vietnam.

Licensing activity

Thirty-one licenses were awarded across the region in the first 10 months of this year. Although significantly lower than the 47 licenses awarded in 2005, this is not a full-year figure, and impending awards in Indonesia could boost the total. High levels of awards were seen in China and the Philippines, with lowest activity in Malaysia and Myanmar (Fig. 3). This is perhaps a reaction to preceding years of high activity, in which most of the attractive acreage was awarded. Eight areas predominated:

- China. Seven awards were made off China through October, continuing the trend from 2005. Six of them are in the South China Sea and followed Husky’s 5 tcf Liwan discovery on its deepwater acreage (OGJ, June 26, 2006, Newsletter). Husky signed an additional deepwater block and two more in shallow water. BG Group PLC has been awarded three deepwater blocks, while Devon Energy Corp. signed the only block outside the South China Sea, expanding its position in the East China Sea.

In addition, Total SA, in partnership with PetroChina, gained an interest in the South Sulige Block in the Ordos basin, a rare example of an onshore China license being awarded to a foreign operator. - Philippines. In the Philippines, seven service contracts (SCs) have been awarded, predominantly to international companies, including a Royal Dutch Shell unit and Nido Petroleum Ltd., Perth. Shell has expanded its Philippines portfolio by signing SC60 in the Northeast Palawan basin.

Two contracts awarded in 2006 were for Area 1 and Area 4, part of the Department of Energy’s second formal licensing round in 2005. Area 1, in the Southwest Palawan basin, increased Nido Petroleum’s Philippines portfolio to eight blocks, while Malaysia’s Ranhill Energy, Kuala Lumpur, was awarded Area 4, in the Sulu Sea.

- Indonesia. Licensing levels have continued downward through October, with only five signings, compared with nine in 2005. However, 41 blocks have been tendered, and the number of awards could increase substantially before yearend.

The much-anticipated results of the 2005 bidding round were announced in June. Only four blocks were awarded, despite seven having attracted bids. The open acreage in the Makassar Straits was popular with international players, and Petronas Carigali, ExxonMobil Corp., Husky, and Marathon Oil Corp. were the successful operators. The blocks are characterized by high exploration risk and high costs, and seven of the 14 blocks failed to attract bids.

Of the 41 blocks offered this year, 20 are under competitive tenders that close in December. The remaining blocks were subject to direct offers and closed on Oct. 11. Only one block failed to attract a bid. ConocoPhillips, Chevron Corp., and ExxonMobil are among the international and local companies believed to have made submissions. With awards expected by yearend, this could mark a minor renaissance in Indonesia licensing activity.

- Malaysia. Only two blocks were awarded in Malaysia through November, marking a loss of licensing momentum from 2005, when activity was driven by exploration successes and tenders for the most prospective deepwater acreage. Despite the slowdown, the deepwater trend continued, with Murphy Sabah Oil Co. Ltd. awarded the SB P deepwater block off Sabah in January. The block includes newly demarcated acreage resulting from a partial relinquishment of Murphy’s SB K block.

- Thailand. Only three blocks were officially awarded in 2006, under Thailand’s 19th licensing round, which closed in June. However, at least two more are pending final approval, with authorities considering a total of 22. These awards are anticipated in early 2007.

- Myanmar. Most onshore and shallow-water acreage in Myanmar has been awarded following high levels of licensing activity in 2004-05. A few open blocks remain, and Block M8 was awarded to a consortium led by Zarubezhneft in September. In a bid to further boost activity, the government has offered 18 deepwater blocks, attracting interest from both existing and new players, although no awards have been announced to date. Under terms of the newly offered deepwater licenses, a 2-year technical evaluation period is offered prior to the signing of a full production-sharing contract (PSC).

- Brunei. Onshore Blocks L and M were awarded this year-the first since 2003. The activity planned by the new operators, Loon Energy of Canada, and China Oil, will help offset delays affecting development of Brunei’s disputed offshore acreage.

- Vietnam. Three licenses were awarded this year: Block 122 to Chevron and Petronas Carigali, Block 101-100/04 to Santos Ltd. and Singapore Petroleum Co., and Block 06/94 to Singapore’s Pearl Energy Ltd. and partners in the Nam Con Son basin (OGJ Online, Aug. 1, 2006). This award remains subject to formal governmental approval. A licensing round announced in April should see a similar level of activity maintained through 2007.

Drilling

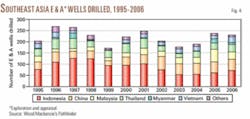

About 230 exploration and appraisal wells were drilled across the region through the end of October, maintaining activity levels from 2005. Year-on-year well counts have increased in Indonesia, Thailand, and Vietnam, with drops in Malaysia and Myanmar. Regionally, however, drilling levels are not far short of the peak levels of the late 1990s and 2001 (Fig. 4).

Drilling activity in Indonesia continues to climb steadily but has a long way to go to regain its historical peaks. Exploration activity is dominated by both local and international companies, of which Energi Mega Persada, China National Petroleum Corp., Santos, and Medco Energi are most prominent. With 20 direct offer block awards pending, drilling activity is expected to continue over the next few years.

In Vietnam, drilling activity has almost doubled from 2005. Continued appraisal efforts in the established Cuu Long and Nam Con Son basins have dominated activity, along with some successful exploration in the Gulf of Tonkin.

While overall drilling levels in Malaysia dropped this year, licensing activity in 2005 led to a high level of exploration drilling, which accounted for over 70% of the wells drilled. With several discoveries during the year, appraisal and continued exploration are likely to encourage drilling activity through 2007.

Key discoveries

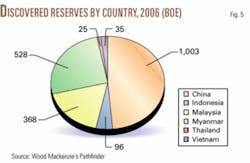

About 30 discoveries were made across Southeast Asia through October, over half of these recorded in Indonesia and Malaysia together (Fig. 5). Exploration efforts remained focused on proved provinces, including the Malay basin, the Gulf of Thailand, Sarawak, Java, Sumatra, and the Bohai Gulf.

Exploration this year has resulted in the addition of about 300 million bbl of oil and 10 tcf of gas reserves. On an oil-equivalent basis, China added the largest volumes, thanks to Husky’s Liwan discovery on Block 29/26. This was the first discovery in China’s deep water, and it improved the prospects in this acreage. Reserves estimates remain provisional and, in the absence of an available rig, further appraisal is unlikely until 2008-09.

Myanmar also increased its reserves significantly with the 3-tcf Mya discovery. Located on Daewoo’s Block A3 off Northwest Myanmar, the field will be developed alongside Shwe and Shwe Phyu fields, with combined reserves estimated at 8.6 tcf.

Two significant discoveries were made in Malaysia in 2006. Shell Malaysia and its partners discovered Pisagan field on Block G, off Sabah, which followed successes with the Ubah, Malikai, and Gumusut discoveries in 2004-05. Petronas was also successful with the discovery of PC4 field in unlicensed acreage off Sarawak. Initial oil and gas reserves estimates for these discoveries are 100 million bbl and 1 tcf respectively.

Key developments to 2012

There are a number of key developments that will strongly influence production in the region over the next 5 years:

Cepu block

The onshore Cepu block in eastern Java is estimated to contain over 430 million bbl of oil and 3 tcf of gas, most of it in Banyu Urip field. Development has been delayed by wrangling between ExxonMobil and Pertamina over which company would operate the block. Following the intercession of the Indonesian government, a joint operating agreement (JOA) was signed in March, clearing some of the obstacles to field exploitation.

Fast-track approval of the revised plan of development (POD) had been expected from the regulating body, BP Migas, to further facilitate the development. However, a POD approved in June was returned to ExxonMobil in October for revision with queries about its gas development plans. The initial drilling program had already been delayed to early 2007 from September 2006 because of equipment shortages.

Given the history of this project and despite the JOA, the prospective lack of alignment between the partners could continue to impede progress. Despite this, production from Banyu Urip field could begin by yearend 2008, with production up to 150,000 b/d by 2011.

Tangguh (Irian Jaya)

The two-train Tangguh LNG plant in Irian Jaya, Indonesia, will process gas from three BP-operated PSCs-Wiriagar, Berau, and Muturi-which together represent over 14 tcf of sales gas. Gas sales and purchase agreements totaling 7.65 million tonnes/year have been signed. The reserves were certified in 1998, and by 2005 enough gas had been contracted to allow the project to proceed.

The LNG plant engineering, procurement, and construction contract was awarded in March, and first gas production is expected in fourth-quarter 2008. Although the way forward now appears clear, the project is not yet free of political constraints. In the light of high energy prices, and with large tranches of gas earmarked for export, Indonesia has experienced local shortfalls to domestic and industrial users. In response, the government aims to prioritize supply to domestic consumers and has proposed that a third train at Tangguh could be used to supply Java.

Kikeh (Malaysia)

Murphy-operated Kikeh field, discovered in 2002, is estimated to hold 300-700 million bbl of high-quality oil. It is one of the largest discoveries of the past decade in Southeast Asia and lies in 1,300 m of water off Sabah. Production is expected to begin in early 2008, with a plateau of 120,000 b/d of liquids and 150 MMcfd of gas by 2010.

The exploitation of Kikeh field has its share of challenges. Costs have risen to $1.7 billion, including construction of a gas pipeline to Labuan Island. Unitization issues also remain, given the field’s proximity to Brunei. A fault is understood to separate the main Kikeh field from the satellite Kikeh 5 structure, which lies closer to the disputed maritime boundary with Brunei. It is likely that Kikeh 5 will require unitization before it can be integrated with the main field development.

Gumusut-Kakap (Malaysia)

Gumusut field was discovered in 2003 on Shell-operated Block J. It extends westwards into adjacent Block K and potentially over the disputed marine border with Brunei. Murphy Oil operates Block K on which Kakap field is located. Unitization issues and the ongoing territorial dispute between Brunei and Malaysia likely will complicate this development as well.

The field lies in more than 1,000 m of water. It faces engineering challenges similar to Kikeh’s and could be more costly still. These challenges could slow the development of a discovery that is estimated at a cumulative 500 million bbl of oil reserves. First production could begin in 2010 and reach 83,000 b/d by 2011.

Puguang (onshore China)

The Chinese state company Sinopec discovered Puguang gas field in Sichuan Province in late 2002. Following appraisal drilling, field reserves were increased to 6.6 tcf, making it one of the largest gas fields in China. Sinopec intends to aggressively develop Puguang to produce 390 MMcfd by 2008 and more than 700 MMcfd by 2010.

Gas demand in China, concentrated in the eastern and coastal areas, is expected to rise rapidly over the next decade and accommodate the planned increase in gas production. Plans originally included construction of a pipeline to Jinan, in Shandong Province, but the Chinese government decided in July that the pipeline would supply the Shanghai area. Such decisions illustrate the operator’s inability to control key aspects of the field’s development.

Production outlooks

New Southeast Asia field developments expected to come on stream by 2012 will generate a total of about 950,000 b/d of new liquids production and more than 8 bcfd of incremental sales gas. Malaysia, China, and Indonesia are positioned to lead in output.

Malaysia

Medium-term production in Malaysia will be dominated by oil projects in deepwater Sabah. Several large oil discoveries-Kikeh, Ubah, Malikai, and Gumusut-are being developed, requiring huge investments and application of development technologies that are new to the area. WoodMac expects about 290,000 b/d of new oil production to be brought on stream by 2012, with Kikeh field accounting for almost 42% of this and Gumusut-Kakap, 36%. These additions should allow Malaysia to slow its oil production decline. Over 1.3 bcfd of new sales gas production will be on stream by 2012.

China

The installation of new infrastructure and processing capacity will facilitate a substantial increase in production from existing Chinese gas fields. This, coupled with new field start-ups, should increase output by over 3.5 bcfd by 2012. Of this, 1.4 bcfd will come from new fields, primarily newly discovered Puguang field.

While Puguang is a giant project, it will not have the singular impact of the key new fields in other countries. This is the result of a simultaneous increase in output from established fields, as well as that from other fields coming on stream.

Indonesia

Developments in Indonesia will add up to 3.5 bcfd of gas production capacity by 2012. This will result from construction of infrastructure and commissioning of the Tangguh LNG plant. Tangguh’s development will maintain Indonesia’s position in the top tier of global LNG producers despite the decline in output from the Arun plant in North Sumatra.

Any spare gas production capacity is expected to supply the overstretched Java market.

Oil production from the Cepu Block will account for more than half of the 320,000 b/d of new oil capacity being brought on stream by 2012. Oil production is in decline, and Indonesia became a net importer in 2004. In these circumstances, it has become highly reliant on this single project to slow the decline.

Other areas

Elsewhere, Thailand remains dominated by gas developments, with new production adding almost 750 MMcfd by 2012.

Vietnam is forecast to see almost 170,000 b/d and 450 MMcfd of production come on stream by 2012. Other Southeast Asian countries are expected to make only a minimal impact on regional production levels.

More to come

In addition to these highlighted projects, there are several large projects waiting in the wings:

- Vietnam. Ca Ngu Vang, Su Tu Vang, and Te Giac Trang oil fields contain a combined 700 million bbl of oil and may all be on stream before the end of the decade. Vietnam’s gas production profile also will increase once Kim Long and Ac Quy fields are brought on stream, although the timescale for their development remains uncertain.

The proposed Cuu Long gas gathering system will provide an opportunity for operators to realize value from previously stranded gas reserves. - Gulf of Thailand. Development of Arthit field will provide most of this area’s near-term gas production growth. Already beset by delays and cost overruns, the field is expected to come on stream in early 2008 and to supply more than 330 MMcfd to the gas-hungry domestic market.

- Offshore Sabah. Large, deepwater fields Ubah and Malikai will follow the development of Kikeh, so they are not expected to come on stream until the next decade.

First oil from Jeruk field off East Java is also not expected before 2010, although high oil prices could encourage these developments to be fast-tracked, subject to the availability of drilling rigs. In addition, the Ganal PSC gas fields, off Kalimantan, and E8 and F13 gas fields, off Sarawak, will be tied into the Bontang and MLNG plants respectively.

The development of Myanmar’s large offshore gas fields awaits a decision on the destination of the gas. Memorandums of understanding have been signed with both China and India, and political machinations seem likely to continue for some time, thereby delaying a final investment decision.

Given the continued enthusiasm for exploration and the potential for new field discoveries, Southeast Asia holds strong prospects for further discoveries and major new developments through the next decade and beyond.

The authors

Hazel Cameron ([email protected]) is a research analyst on Wood Mackenzie’s Southeast Asia upstream team. Her main responsibilities are coauthoring the Southeast Asia Upstream Service, and contributing to consulting assignments across the region. Prior to joining Wood Mackenzie in October 2004, Cameron was a process engineer with ConocoPhillips in Aberdeen. She holds an MEng in chemical engineering from Heriot-Watt University, Edinburgh.

Thomas Young ([email protected]) joined Wood Mackenzie in 2005 as a research analyst on the Southeast Asia upstream team. His responsibilities include contributing to Wood Mackenzie consulting offerings across the region and the continuing updating of sWood Mackenzie research products. Young holds an MRes degree in chemistry from Edinburgh University.