OGJ Newsletter

Nigerian militants leave oil-pumping station

Militants in Nigeria have abandoned an oil-pumping station operated by Nigeria Agip Oil Co. (NAOC) after a 2-week siege, freeing nine contract workers and some 20 government soldiers.

A government spokesman said the armed men left the facility in the early hours of Nov. 19 after a truce was brokered by the Bayesla state government.

A senior police officer confirmed that the hostages had been released and the flow station vacated, but he could not say if any ransom was paid to the militants.

Agip’s Tebidaba oil-pumping station in Nigeria’s southern Bayelsa state was overrun and shut down following an attack on Nov. 6 by armed militants, according to company and government officials (OGJ Online, Nov. 6, 2006).

Murkowski releases new pipeline contract report

Alaska Gov. Frank Murkowski on Nov. 16 submitted a 350-page Interim Fiscal Interest Finding (IFIF) report to the Alaskan legislature that provides an economic analysis supporting construction of a natural gas pipeline from the North Slope.

Murkowski, who is leaving office Dec. 4, said he was ready to assist Gov.-elect Sarah Palin and the legislature.

Alaska Department of Revenue Commissioner Bill Corbus prepared the IFIF report, including proposed changes to a draft contract that Murkowski negotiated with North Slope producers. The first draft was released in May (OGJ, June 5, 2006, Newsletter).

The oil companies have not agreed to any of the proposed changes, Murkowski said. The IFIF includes a draft limited liability corporation contract under which the project would be built and operated by a partnership of the state of Alaska and North Slope producers.

“This document represents the future of Alaska,” Murkowski said. “We must transition our oil-based economy to one based on gas production.”

Murkowski declined to say whether he might ask for additional legislative consideration on the pipeline. The Alaska Supreme Court is reviewing an Alaska state district court ruling that Murkowski cannot unilaterally approve the pipeline contract. Murkowski appealed the lower court ruling.

EPA issues subsoil tank containment grant rules

The US Environmental Protection Agency issued the final secondary containment grant guidelines for states on Nov. 16, implementing a key provision of the underground storage tank amendments in the 2005 Energy Policy Act.

Secondary containment provides a barrier between an underground storage tank and the environment by holding leaking petroleum between the barrier and tank so the leak can be detected. EPA, which provides funding to states through grants to regulate underground storage tanks, said it worked with states and regional tank offices to develop the guidelines.

The guidelines provide compliance requirements, detailed definitions and examples for states choosing to implement the secondary containment provision. Owners and operators would not be required to retrofit equipment, but would have to follow the guidelines with replacements or installation of new equipment, the agency said.

EPA said states receiving funds under Subtitle 1 of the Waste Disposal Act must by Feb. 7, 2007, implement either these guidelines or financial responsibility and certification grant guidelines that the agency will issue in the next few months.

The agency is giving states maximum flexibility to establish their own secondary containment requirements by that date because it is only a few months away. For states demonstrating good faith efforts to meet the requirements, EPA said it has the flexibility to continue providing them assistance as they implement their programs.

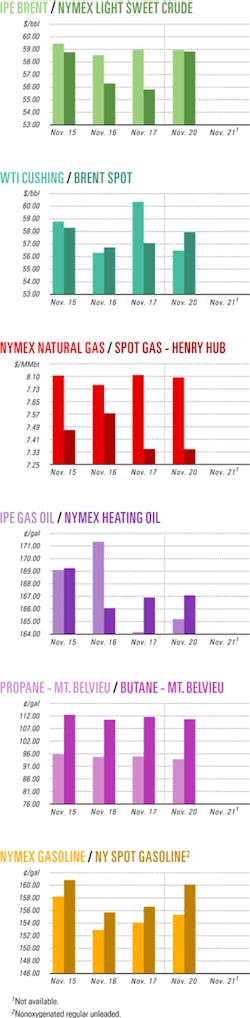

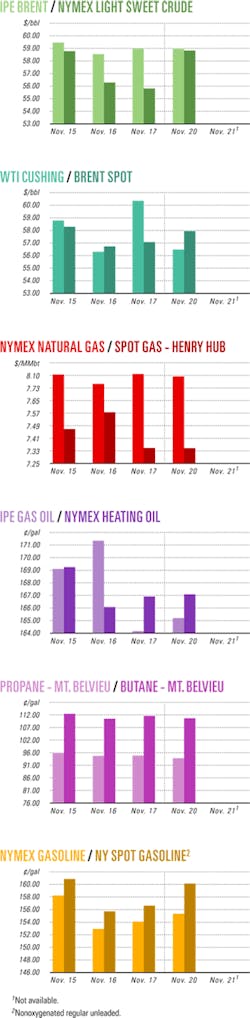

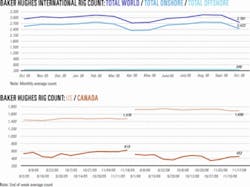

Industry Scoreboardnull

null

Exploration & Development - Quick TakesHusky completes White Rose delineation

Husky Energy Inc., Calgary, has completed the White Rose 2006 delineation program, resulting in an increase of the assessment of White Rose oil field’s recoverable resources by 190 million bbl of oil. The field is in the Jeanne d’Arc basin 350 km east of St. John’s, Newf.

“The results of this delineation program, along with the strong performance of the current development, should allow White Rose to significantly extend its production plateau,” said Chief Executive and Pres. John C.S. Lau.

Contributing to the increase in the assessment of the field’s resources is Husky’s hydrocarbon discovery at the North Amethyst K-15 delineation well in the southwestern section of White Rose. This discovery could contain recoverable resources of 40-100 million bbl of oil, with a likely estimate of 70 million bbl. The K-15 well, drilled to 2,566 m on White Rose Significant Discovery License 1044, revealed a 50-55-m oil column with high reservoir quality in the Aptian-age Ben Nevis Avalon formation. The company is continuing to assess core and fluid samples and wireline log data.

Earlier this year Husky announced results of the O-28 delineation well, which was drilled in the western section of the field. Further review of the well data and geological modeling has resulted in Husky’s upgrading its estimate of recoverable resources in this area to 50-200 million bbl of oil, with a current likely estimate of 120 million bbl. A further delineation well is planned in 2007 to confirm the resource estimates and to assist in future development planning.

The total estimate of about 190 million bbl of recoverable resources from the K-15 and O-28 wells is incremental to the White Rose proven and probable reserves. The two wells are near the SeaRose floating production, storage, and offloading vessel.

Husky is conducting front-end engineering on the White Rose field’s southern extension, which the company expects to develop as a subsea tieback to the SeaRose FPSO. Production from this pool is scheduled for late 2009, pending regulatory approvals. The southern extension reserves are included in the current estimate of White Rose proven and probable reserves. It is anticipated that the K-15 discovery also will be developed through the southern extension development.

The SeaRose FPSO is producing 110,000 b/d of oil from five production wells. A sixth production well is being completed and is expected to come on stream later this month, increasing reservoir production capacity to 125,000 b/d of oil.

Field operator Husky Energy holds a 72.5% interest in the project. Petro-Canada holds the remaining 27.5%.

Vinccler boosting Falcon basin production

PetroFalcon Corp., Carpinteria, Calif., said its PetroCumarebo joint venture with Petroleos de Venezuela SA (PDVSA) looks forward to accelerating activity on the East and West Falcon blocks in northern Venezuela.

PetroFalcon’s Vinccler Venezuela and PDVSA-Corporación Venezolana del Petróleo signed the joint venture conversion agreement on Sept. 29, giving PetroCumarebo rights to the two blocks covering 838,000 acres for 20 years.

Gross production from the two blocks totals 1,200 b/d of oil and 12 MMcfd of gas.

Vinccler Venezuela, with 40% interest, was expanding facilities to handle 20 MMcfd and 1,700 b/d at La Vela field and 30 MMcfd and 5,000 b/d at Cumarebo field.

Cumarebo field began producing 10 MMcfd and 285 b/d of oil in early August, when the field was tied into PDVSA’s Interconnection Centro Occidente gas pipeline to the Paraguana Peninsula.

PetroCumarebo plans to develop Los Moroches oil and gas field, discovered in 1995 on West Falcon by the previous operator. Vinccler Venezuela also delineated several structural prospects around Cumarebo field on 85 km of 2D seismic data gathered in 2005.

Due to the delay in incorporating the JV, PetroCumarebo will not be able to spend its 2006 capital budget of $40.7 million.

Gentry makes Alberta oil discovery

Gentry Resources Ltd., Calgary, said a well drilled in the Mississippian Pekisko formation within the Princess exploration area of southern Alberta encountered a net pay interval of 12 m within a gross pay column of 40 m.

The discovery well is 8 miles south of Gentry’s existing Tilley-to-West Tide Lake Pekisko oil fairway.

On test, the well flowed for 8 hr at the equivalent of 925 b/d at a flowing pressure of 200 psig. Gentry Resources expects to install a temporary battery by early December, and the well is expected to produce at a restricted initial well allowable rate of 125 b/d.

Two more exploratory wells are to be drilled in December, 15 miles south of the discovery well, to test another possible oil fairway. Five additional exploratory wells on the block are planned for first-quarter 2007.

Lundin signs PSC for two Ethiopian blocks

Swedish independent Lundin Petroleum AB signed a production-sharing contract for Blocks 2 and 6 in southeastern Ethiopia’s Ogaden basin.

The two-block area spans more than 24,000 sq km.

Lundin holds a 100% interest in the PSC area through the exploration period, with the Ethiopian government having an option for a 10% interest following a commercial discovery.

No wells have been drilled on Blocks 2 or 6, but indications of light oil, gas, and condensate have been documented in well tests and surface seeps south and east of the blocks, Lundin said.

Silverstone UK North Sea well finds gas

Silverstone Energy Ltd., a North Sea exploration and production company, struck natural gas with the 49/21-10A Vulcan East exploration well, drilled to 8,125 ft TD in the southern UK North Sea.

The Vulcan East well discovered an accumulation separate from adjacent Vulcan field, said Silverstone, the operator. The discovery is estimated to contain 150-200 bcf of gas in place in a 345-ft column.

Silverstone and partners, ConocoPhillips and BP PLC, are reviewing the well results to determine the viability of bringing the field onto production. Following evaluation of the Permian Rotliegendes sand reservoir, the well was suspended for possible future use as a development well.

Silverstone of Aberdeen was formed 18 months ago as a 50-50 joint venture between private equity fund Lime Rock Partners and Calgary independent Storm Ventures International Inc.

Chile’s Magallanes area gets new gas flow

GeoPark Holdings Ltd., Hamilton, Bermuda, said it has become the first private company to produce oil and gas in southern Chile.

As operator of the 440,000-acre Fell Block, GeoPark is the only oil and gas company operating in Chile other than state Empresa Nacional de Petroleo (ENAP).

GeoPark is producing 5.4 MMcfd of gas and 50 b/d of condensate from single wells in Molino, Ovejero, and Nika fields on the Fell Block in the Austral basin northwest of the Straits of Magellan. It is selling gas to the Methanex methanol plant at Tierra del Fuego, Argentina, and condensate to ENAP.

GeoPark plans to tie in Santiago Norte field in late 2006 and other fields in second quarter 2007.

A workover rig has been cleaning out more wells since September, and a drilling rig is due to arrive in first quarter 2007. A 650 sq km 3D seismic survey is under way on the Fell Block.

GeoPark holds 100% interest in the Fell Block, having acquired the last 10% interest from ENAP earlier this year.

The Fell Block in Chile and GeoPark-operated Cerro Dona Juana, Del Mosquito, Loma Cortaderal blocks in Argentina total more than 700,000 acres.

KMV plans three more gas wells in Oklahoma

Mammoth Energy Group Inc. subsidiary KMV Consulting, Denver, currently drilling five wells in its shallow gas project in Rogers County, Okla., has made arrangements to drill three more wells there.

The wells will be drilled in the next few months on acreage KMV leased in May when it took over and began expanding the gas project. KMV recently secured an additional 1,476 acres, doubling the acreage under lease to 2,551 net acres.

The three wells planned would put KMV’s total well count at 18 producing wells, with five more scheduled by yearend. The area has a 100% success rate reported on over 300 wells, due largely to a blanket Excello shale-coalbed methane seam that covers the area.

On the recently acquired acreage, Mammoth’s Chief Executive Christopher Miller said eight oil wells can be recompleted to produce gas and brought on line for about half the cost to drill and complete a well.

“Of the next 15 wells we plan to drill, about half of them fall into this category. Therefore, we hope to have about 30 wells producing by the end of the first quarter 2007,” Miller said.

KMV retains a 49.5% net revenue interest in the 18 gas wells, having sold 33% of its working interest to Allied Energy Group Inc., Bowling Green, Ky., for $1.5 million.

MOL to explore two blocks in Pakistan

MOL Pakistan Oil and Gas BV, a subsidiary of Hungary’s MOL Group, will explore the Margalla and Margalla North blocks under concession agreements with the Pakistani government.

The blocks are in Punjab, North West Frontier Province (NWFP), and Islamabad. The Margalla Block covers 1,387 sq km and the Margalla North Block, 1,562 sq km.

MOL will conduct environmental and geological and geophysical studies; acquire, process, and interpret 2D seismic data; reprocess existing seismic data; and drill exploratory wells based on the results of the data.

It has made several gas and condensate discoveries on the Tal Block in NWFP (OGJ Online, Sept. 8, 2006).

Drilling & Production - Quick TakesShell lets EPC contract for Perdido project

Shell Offshore Inc. has let an engineering, procurement, and construction (EPC) contract to Technip for a production spar hull and mooring system for the Perdido hub project 200 miles south of Freeport, Tex., in the Gulf of Mexico.

The contract covers spar hull and mooring system design and fabrication, load out onto a transportation vessel, transportation and quayside delivery at a Gulf of Mexico yard, and design of the steel catenary risers, top tension risers, and umbilicals. The contract value was not disclosed.

Technip’s operations and engineering center in Houston will provide the overall project management, and the global engineering for the hull and mooring system, as well as engineering and procurement support for the riser tensioner system. The detailed hull design and fabrication will be carried out by Technip’s yard in Pori, Finland.

Shell will operate the hub, called Perdido Regional Host, with a 35% interest. Other interests are Chevron Corp., 37.5%, and BP PLC, 27.5%. The facility will be capable of handling 130,000 boe/d, and it is expected to come on line “around the turn of the decade,” Shell said. It will handle production from Great White, Tobago, and Silvertip fields.

Shell plans to moor the regional direct-vertical-access spar in a record water depth of 8,000 ft of water. The common processing hub, on Alaminos Canyon Block 857 near the Great White discovery, will have a drilling and completion rig and will gather, process, and transport production from wet trees as far away as 30 miles. Pipelines from the facility will connect to undisclosed locations in Texas (OGJ, Nov. 6, 2006, Newsletter).

Denser fracs improve Woodford gas flows

Gas flow rates are much improved at the more recent horizontal wells with higher frac densities in the Woodford shale play in the Arkoma basin of southeastern Oklahoma, said Newfield Exploration Co., Houston.

Newfield, which has production data from 29 horizontal Woodford wells, said initial gross production averages nearly 6 MMcfd from the eight horizontal wells it has tested that were treated with the higher frac densities.

Two of the eight wells, which have laterals of 1,600-3,500 ft, had initial production of 10 MMcfd, and two others flowed 7 MMcfd of gas. Fracs at the eight wells involved three to seven stages.

The company’s gross production from the play has grown to nearly 80 MMcfd from 25 MMcfd at this time in 2005.

MarkWest Energy Partners LP, Denver, and Newfield plan to place in service more than 50 miles of large-diameter pipe in early December to complete the low and high-pressure backbone of the planned 400-mile, four-county gathering system (see map, OGJ, Oct. 9, 2006, p. 31). This is more than 3 months ahead of schedule.

Once the backbone is completed, Newfield will have the ability to produce from any part of its 125,000 net acre position.

The 2007 plan calls for the drilling of 150 horizontal wells. Permitted spacing of 640 acres would allow nearly all of the company’s current acreage to be held by production by the end of 2007 based on the anticipated drilling rate as activity ramps up to 20 rigs from 11 operated rigs at present.

Antrim secures drilling rig for UK North Sea

Antrim Energy Inc., Calgary, has secured a semisubmersible rig to drill three Causeway appraisal-development wells next year on UK North Sea Block 211/22a.

Antrim, the operator and owner of 65.5% interest in the block, hired AGR Peak Well Management (Peak) to conduct the drilling program. Peak earlier had managed the drilling on East Causeway.

Antrim will spud the first appraisal-development well in May 2007, about 2 miles southwest of the East Causeway discovery. The company expects to drill to 11,500 ft and to appraise the Middle Jurassic Brent Group of sandstones, specifically the Tarbert, Ness, and Etive formations.

The drilling program follows Antrim’s East Causeway discovery 211/23d-17z, which flowed on final test at multiple stabilized rates of up to 7,500 b/d of light, sweet oil (OGJ, Aug. 18, 2006, Newsletter).

The test rate did not include the 8,100 b/d of oil flow rate previously recorded from the Ness formation in the suspended 211/23b-11 well in an eastern fault compartment.

Kuwait planning gas production by 2008

Kuwait, which in March announced the discovery of 35 tcf of free natural gas and a large quantity of light oil in what it called its “northern oil fields,” plans to start commercial production of gas late next year or early January 2008, according to Farouk al-Zanki, head of state-owned Kuwait Oil Co. (KOC).

At an oil and gas conference in Kuwait City, al-Zanki said the firm expects an initial output of 180 MMcfd, which it would increase to 600 MMcfd by 2011 and to 1 bcfd by 2014-15.

Al-Zanki said KOC would have a provisional plan for natural gas development by the end of November or in early December.

He said the company is searching for more gas in five exploration sites in the same region, which he did not name. It needs gas for its desalination plants and for a planned large refinery.

Al-Zanki also repeated an earlier commitment to increase Kuwait’s oil production capacity to 3 million b/d by 2010, to 3.5 million b/d by 2015, and 4 million b/d by 2020 from the current 2.6 million b/d.

In January, Kuwait said it also planned to start exploration for natural gas in what it called undisputed parts of offshore Dorra field, which Iran also claims. At the time, Kuwait’s energy ministry undersecretary Issa al-Oun told the Al-Siyassah newspaper: “Talks with Iran are continuing over the continental shelf. But, we have decided to...start exploration in the undisputed part.”

Oun said Kuwait would soon invite bids for seismic surveys of part of Dorra field and other Kuwaiti offshore fields. He said he did not expect Iran to object to the measure.

Processing - Quick TakesBP lets $3 billion Whiting refinery work

BP Products North America Inc. has awarded Fluor Corp. several major packages, valued at a combined $3 billion, for upgrades to increase Canadian heavy oil processing capacity at its 399,000 b/cd Whiting refinery in northwest Indiana.

The work scope includes the overall integrated program management and construction management; plus the independent engineering, procurement, and fabrication of three major work packages, including a revamped crude distillation unit, a gas oil hydrotreater, and support infrastructure facilities.

The front-end engineering design, the initial award valued at $300 million, is under way.

The project will increase capacity for coking, hydrogen production, hydrotreating, and sulfur recovery. Construction is expected to start in 2007 and be completed by 2011 (OGJ Online, Sept. 25, 2006, Newsletter).

North West picks CLG for proposed upgrader

North West Upgrading Inc., Calgary, has selected the technology of Chevron Lummus Global LLC (CLG) for a 77,000 b/d hydrocraking unit at North West’s proposed heavy oil upgrader facility in Sturgeon County, Alta.

The upgrader, which will use CLG’s LC-FINING technology, will have a total capacity of 231,000 b/d of blended feedstock, including 150,000 b/d of crude bitumen. It will produce light, low-sulfur products and diluent.

The project, for which regulatory approval is expected by mid-2007, is to be built in three phases. The first phase is scheduled to come on stream in early 2010, with a capacity of 50,000 b/d of bitumen at a cost of more than $2.4 billion (Can.). All three phases are to be concluded by 2015.

CLG will provide an engineering package that includes a reactor design package, follow-up technical support during detailed engineering design, training prior to start-up, ICR catalysts and start-up support during the commissioning of the upgrader.

CLG is a 50-50 joint venture of Chevron USA Inc. and ABB Lummus Global.

GAIL JV to build petrochemical plant in Assam

India’s state-owned GAIL India Ltd. is the lead promoter of a $1.2 billion integrated petrochemical complex in India to be built in Lepetkata district in Dibrugarh, Assam.

The complex will contain a gas separation plant, hydrocracker unit, and downstream polymer and integrated offsite utilities and plants. It will have a capacity of 220,000 tonnes/year of ethylene and 60,000 tonnes/year of propylene.

GAIL will hold 70% equity in the project, and the remaining 30% will be shared among three other partners: Oil India Ltd. (OIL), Numaligarh Refinery Ltd. (NRL), and the Assam state government.

The project will be completed in 60 months from the date of financial closure. The Assam state government has selected the site, and participants have obtained necessary environmental clearance.

OIL will provide 6 million standard cu m/day of gas as feedstock for the complex, and Oil & Natural Gas Corp. will provide 1.35 million standard cu m/day until Mar. 31, 2012, and reduce it to 1 million standard cu m/day thereafter. The complex also will utilize 160,000 tonnes/year of petrochemical-grade naphtha from NRL.

Transportation - Quick TakesGas-purchase agreements advance Galsi line

New gas-purchase agreements by five Italian energy companies have given a push to plans for a third gas pipeline between North Africa and Europe.

The companies, Enel, Edison, Hera, Ascopiave, and Worldenergy, have agreed to import a total of 6 billion cu m/year of gas from Algeria via the proposed pipeline connecting Algeria with Italy by way of Sardinia.

Sonatrach of Algeria, Enel, and Wintershall of Germany formed a venture to study feasibility of the pipeline in December 2001 (OGJ, Jan. 7, 2002, Newsletter). Other companies have joined the venture, now called Galsi.

The project envisions four pipeline segments: 640 km onshore between Hassi R’mel gas field in Algeria and El Kala on the Algerian coast; 310 km between El Kala and Cagliari on Sardinia in water as deep as 1,950 m; 300 km between Cagliari and Olbia on the northern Sardinian coast; and 220 km between Olbia and Pescaia, southeast of Florence, in water as deep as 900 m.

Sonatrach says the Galsi pipeline will have a capacity of 8 billion cu m/year, and it projects start-up at the end of 2009.

Gaz de France launches large LNG vessel

Gaz de France has launched the 154,500-cu-m Provalys LNG carrier, one of the world’s largest, at Montoir-de-Bretagne.

The 190 m by 43.5 m vessel is equipped to load LNG in arctic conditions.

Gaz de France is both owner and charterer. It now operates 11 LNG vessels and has two under construction at Chantiers de l’Atlantique: one with 74,000 cu m of capacity due for delivery by yearend and another with 154,000 cu m of capacity due in early 2007.

MISC orders four Aframax tankers from Tsuneishi

Malaysian International Shipping Corp. (MISC) subsidiary AET Inc. Ltd. has placed a $260 million order with Japan’s Tsuneishi Corp. for four 107,500 dwt Aframax tankers.

The first of the tankers will be delivered in 2009, and the three remaining units will be delivered in 2010, said MISC.

MISC also said it took delivery of its eighth very large crude carrier (300,397 dwt) from Japan’s Universal Shipbuilding Corp. on Oct. 31 at a cost of $65 million.